|

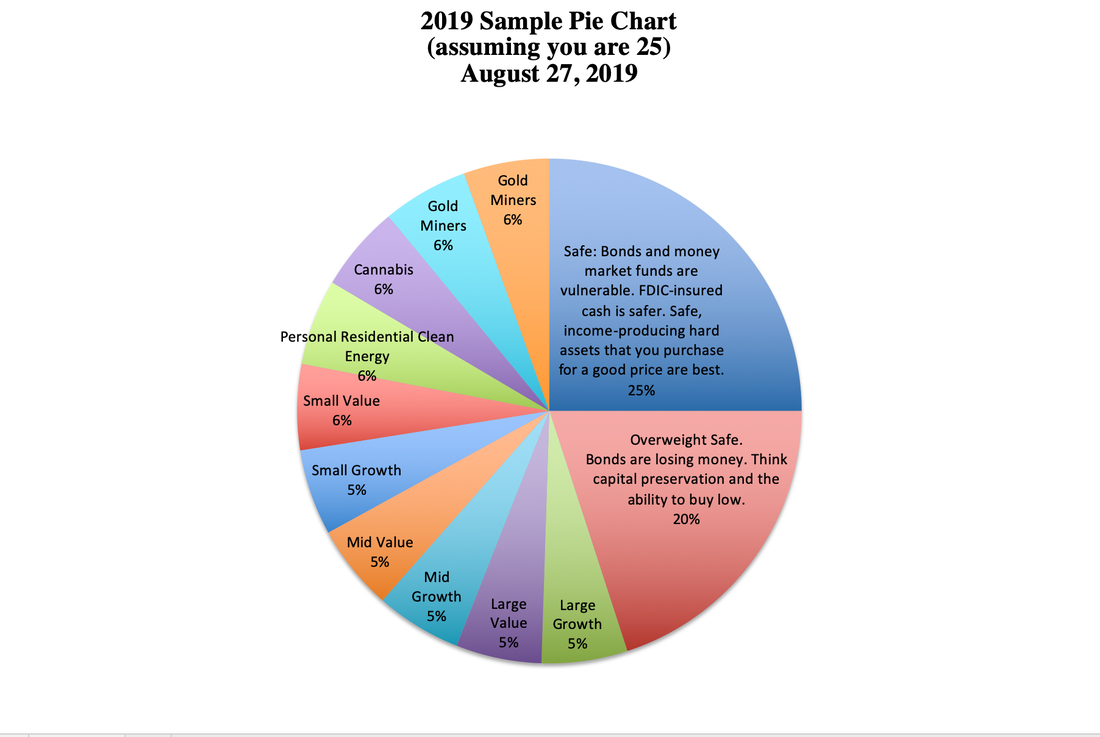

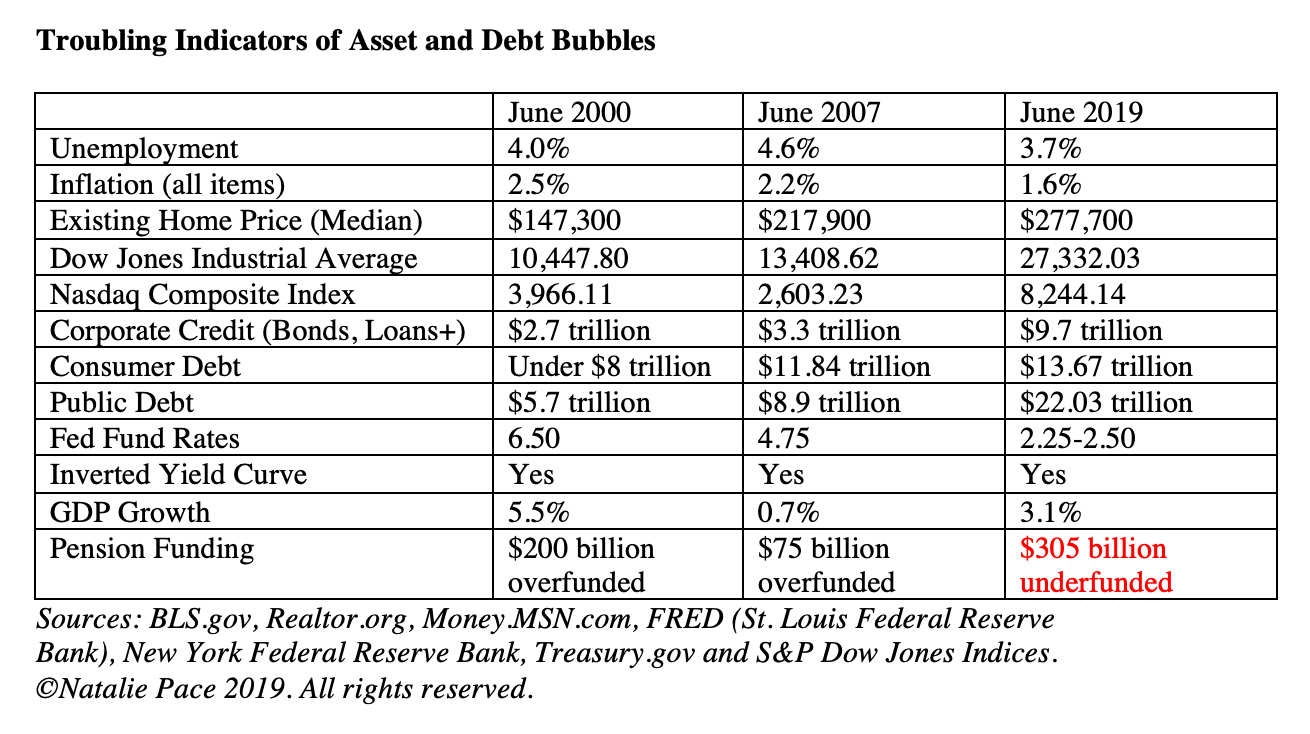

Gold has been in a rally for the last year. Since 2018, gold mining ETFs have almost doubled. Two of our hot slices are gold miners, so this is a great way to add performance to your portfolio. It’s also a reminder of how important annual rebalancing is. If you were annually rebalancing and you’ve had gold miners as hots since 2016, you’ve actually been able to double your money twice. Adding Heat to Your Investments A diversified portfolio has 10 funds, small, medium, large value, growth, and four hot slices. The hots are there to bring the heat. So, this is where you can invest in something that you think is emerging, and have a time-proven gauge of just how much you should be betting on this new industry, country or trend (like cryptocurrency). In investing, it’s never a good idea to be all in or all out on something. Hail Mary investments are similar to the Hail Mary football pass. When it works, it is epic – mythic even. Most of the time, however, you’re putting yourself at great risk for an interception – for the opposing team to score on your desperation. In investing, trying to score big often results in a buy high, sell low strategy. That is the case because investors who jump all in are often doing so because of a hot tip or a headline. By the time you hear about something, chances are the price is already too high. (In the worst-case scenario, it’s a pump and dump scheme, which happens far too often today.) When something falls completely out of favor and nobody’s talking about it, that’s a good time to be buying low. Of course, it won’t be on your radar if you’re used to acting on hot tips and headlines, so you’ll miss the true opportunity – unless you’re doing your homework and understand how to analyze beyond what you are reading in a marketing email or article. And that brings me to the importance of Annual Rebalancing. Annual rebalancing is an easy way to do exactly what you’re supposed to do in your nest egg. If you have your nest egg properly diversified and are able to mark it up an easy to understand pie chart, then your annual rebalancing allows you to buy low and sell high on auto pilot. When you are just looking at gains and losses on a summary page of your account, you’re actually tempted to do the opposite – the losing strategy of selling low and buying high. Here’s how it works. Annual Rebalancing is a Buy Low Sell High Plan on Auto-Pilot 1. Know What You Own. Mock up what you currently have into an easy to understand pie chart. Put all your large-cap growth funds and stocks in one slice, all your large cup values in one slice, all your mid-cap value into one slice, and the same for your mid-cap growth and small cap growth and value. Then put in the value of your four hot industries. You should then have 10 “at-risk” slices of your nest egg. If you have pages and pages and pages of holdings, and it’s not easy to mark them up into an easy to understand pie chart, that’s a red flag. Most people with those dozens of pages of holdings actually only have large-cap growth and large-cap value. They are not properly diversified – typically far overweighted in these two assets – and missing small and mid caps, hots. There is typically not enough safe, and what is safe is at risk of losing money. I’ve been doing second opinions on nest eggs for the past year, and I’ve discovered that even on the safe side many people are holding a lot more risk than they realize. I’ll discuss that later on in this blog. 2. Know What a Diversified, Time-Proven Plan Looks Like. Once you know what you own and have marked it up into an easy to understand pie chart, mark up a sample pie chart based upon your age and market conditions. (If you need help with this, email info @ NataliePace.com or call 310-430-2397. Also view the sample pie chart directly below.) If you are worried about it being the 11th year of the bull market, and are concerned about reports that the world economy is going to weaken this year, then just overweight a little safe. What’s the right answer on how much you should add safe? You could overweight anywhere between 0 to 20% safe. I find overweighting or underweighting based upon market conditions to be a far better tool than risk tolerance. The reason for that is very similar to why you don’t go all in or all out on any asset. The chances that you get it wrong are high. Risk tolerance measures your emotions. However, your emotions are a terrible investment tool. When the markets are super high and everybody is partying like it’s 1999, you’re tempted to buy high. That’s always a bad idea. When the markets tank, and everybody has lost half of their assets, which is what happened in the last two recessions, then most people are tempted to sell low because they’re worried that everything is going to go to hell in a handbasket. That’s a buy high, sell low plan, in other words, a losing strategy. 3. Get Hot. If you think that cryptocurrency is hot, or cannabis, technology, clean energy, gold or some country in South America, simply add that hot industry to one of your four hot slices. This adds performance to your portfolio when you’re right, and limits your losses when you are wrong. 4. Annual Rebalancing. And here is where annual rebalancing comes in. Each year, mark up what you have, You’ll notice that some of your at-risk slices have gotten fatter and some have gotten thinner. The fat slices have made a lot of gains. Trimming them back to the right size is selling high. The thin slices need to get beefed up a little bit. A slice has gotten thinner because the price is lower. So, when you buy more, you’re buying low. This simple strategy would have saved your nest egg from the Great Recession and the Dot Com Recession. It also would have allowed you to make even more gains on gold. 5. Gold Miner ETFs Have Doubled in the Last Few Months. RING, the iShares MSCI Global Gold Miners ETF, was trading at $23.79 on August 26, 2019. On September 14, 2018, you could have purchased that fund for $13.33. The current gold rally actually began in 2016. On January 26, 2016, you could have purchased RING for $10/share. And here is where annual rebalancing could have really enhanced your gains in the gold miners. By August of 2016, RING was at $26/share. So, if you were rebalancing 1-3 times a year (which is a good strategy), then when you noticed that your one or two slices of gold were now four slices, that’s your signal to sell high and trim back to the exposure that you want. You could have captured your double gains in August 2016, and then purchased more at a lower price in in December 2016 or September 2018. Here again, you would be in a position to consider capturing gains. Also note that the hot industry on my sample pie chart is gold miners specifically, not just the price of gold. The reason for that is that, at the time, gold prices were down about 38% from the all-time high. Gold miners were down 75%. So, the upside potential for gains was far greater in the gold miner stocks – which has proven to be the case. While gold miners have doubled this year, gold prices are up 19.7%. 6. Each Year What’s Hot (and What’s Safe) Can Change, so in addition to doing your annual rebalancing and trimming back your slices of small, medium, large, value and growth, you’re going to be evaluating what is hot and what is safe. So, for instance, if gold is an asset that typically goes up when stocks go down, and goes up if the dollar weakens, and both stocks and the dollar are very high right now, then you might predict that weakness in those assets, which is predicted to start later this year, might extend the gold rally. In that case, you wouldn’t sell off your gold slices and replace them with another asset. In fact, if your one slice of gold has doubled, you might consider keeping two slices of gold at this time. Cannabis is the fastest growing industry on Wall Street. There’s nothing that comes close. Look at these gains in revenue growth on the stock report card below. The problem with cannabis is that the industry is very, very volatile. Tilray is the poster child of that. Tilray is currently trading under $30 a share. In September 2018, it was trading at $300 per share. So, you have to play this industry more like a trader than a nest egg slice. Another challenge for cannabis is that the industry is so new that there are not any established cannabis funds. You’re not going to be able to find a Black Rock or Invesco or Goldman Sachs ETF. So you are going to have to create your own mini fund of individual stocks. When you combine the volatility of individual stocks with the volatility of cannabis, then you’re really going to have to babysit your holdings. You’ll need to cherry pick the great companies from the laggards. (There are even still some penny pot stock scams lurking in the shadows.) You’ll need to buy low and sell high, rather than just wait for your 1-3 times per year rebalancing moment. Limit orders can help you to do this. (This is something that I teach in my Investor Educational Retreats and Stock Master Class.) 7. What’s Safe? For anyone over the age of 40, the biggest slice of your pie will be the safe side. It will actually be more difficult to stay buoyant in the next recession because bonds are what saved the day in 2000 and 2008. This time, interest rates are starting out too low for bonds to be of much help. So, you need to understand what’s safe in today’s world. Bonds lost money last year and are more vulnerable than you might be aware of. Over 50% of the investment grade companies are at the lowest rung, just above junk status. Also, most bond funds can have up to 20% junk bonds in them. Money market funds have liquidity fees and redemption gates. Annuities are the only investment product I know where you lose money the minute you purchase them. Also there are no guarantees for annuities. They are not FDIC insured. So, if the insurance company that is holding your insurance or annuity gets into trouble, like AIG and many insurance companies did before we bailed them out in 2008, your future is at risk. Insurance companies typically do poorly in market downturns because they invest heavily in stocks. The Bottom Line Getting hot is a performance enhancer for your nest egg in any market. Being properly diversified is critically important in all markets, both Bull and Bear. Annual rebalancing is by low sell high on auto pilot for your nest egg, and is the single most important factor for protecting your assets and increasing your performance. Proper diversification, getting hot and knowing what is safe in a world where bonds and stocks lost money in 2018 is important to do right now – before the next downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. The 2nd estimate of the 2nd quarter GDP growth will be released this Thursday, August 29, 2019 at 8:30 am ET. The advance estimates were very weak at 2.1% -- compared to the 1st quarter growth of 3.1%. Many economists are predicting an even weaker 2nd half of 2019, for an annual GDP growth gain of just 2.1% on the year. If you'd like to learn stock picking strategies from a #1 stock picker, join Natalie Pace in one of her investor educational retreats. (See links below.) Click to access a link to Natalie Pace's bio. Other Blogs of Interest The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. We’ve had a series of Initial Public Offerings lately that would have been better labeled as Insider Liquidity Events. We Work is another in a long series of these, which makes 2019 IPOs look a lot like 2000 all over again. The revenue growth of the We Company is amazing. Sales doubled in 2018 over 2017 and look on track to do that again in 2019. That is as long as the economy doesn’t start weakening (which it is predicted to do). The cash burn and net losses are eyepopping, at $1.9 billion in 2018 and $905 million in the first six months of 2019. Some of the success stories are inspiring, like the fact that Bird Co. launched out of a WeWork shop in Santa Monica, California. Karlie Kloss’ Coding Camp partners with WeWork to inspire teen girls to enter the technology industry. So, the company is indeed bringing a culture and community to office space in a way that companies like Boston Properties and other commercial REITs haven’t. However, the business model itself is troubling. The We Company isn’t a real estate company. In fact, WeWork’s co-founder and CEO buys real estate and leases it back to The We Company. The We Company enters into long-term lease contracts (15-years or more) with Adam Neumann (and others), but banks its own business upon short-term commitments from small and mid-size businesses. This becomes even more troubling when you consider the amount of credit card debt that is held by Americans, many of who are launching their hobby on a dream with high-interest debt. Consumer credit card debt in the U.S. is $870 million. Small companies in the U.S. are so rife with cash negative operations that Charles Schwab’s Chief Investment Strategist Liz Ann Sonders has an underweight on this area of the marketplace. WeWork promotes CEO Adam Neumann as a guru celebrity, in the same way that Apple and Facebook have capitalized upon in the past. Founder CEOs like Jobs and Zuckerberg cement the promise that visionary disrupters are best left unencumbered and highly empowered to lead the company to greatness. However, opportunist founders, like Marc Pincus and Eric Lefkofsky, who cashed out hundreds of millions before the Zynga and Groupon IPOs (respectively) give the idea a black eye. Which type of founder/CEO is Adam Neumann? Although the We Company S-1 filing claims that “the last time Adam sold any shares was October of 2017,” there has been a lot of borrowing against shares to purchase real estate, some of which is then leased back to The We Company. The Wall Street Journal reported on July 18, 2019 that Adam Neumann has cashed out $700 million in stock and loans pre-IPO. If this is true, then Neumann has cashed out far more than Pincus or Lefkofsky before him. (The We Company did not respond to an email requesting additional information on The Wall Street Journal claims.) As you can see in the chart below, companies that launch IPOs while their business is still cash negative haven’t been faring very well on Wall Street. Companies that launch their IPOs once the business is profitable fare far better. Beyond Meat is the exception of a company that was cash negative, but has had an amazing run-up this year, post IPO. With the sole exception of Zoom Video this year (and Google in 2004), the other eight IPOs listed above were cash negative when the company went public. Uber reported a 2nd quarter 2019 net loss of $5.2 billion. The We Company (WeWork) has been cash negative at least since 2016 (the earliest date reported on its IPO filing). The losses in 2018 were $1.9 billion, with $905 million lost so far in the first half of 2019. It’s easy to see the correlation between profitability and IPO success in the above charts.Here is how WeWorks fares compared to Google, when lining up management, business model, first mover advantage, disruption, etc. Click The We Company IPO joins a long list of companies trying to turn paper profits into cash on your dime, now, while the stock markets are still nice and high. (It’s difficult to launch an IPO during a recession.) Although the company’s mission/vision is touchy-feely new-agey (the annual summer camp featured Deepak Chopra), the age-old idea of a beneficent dictator appears to be more in play. Neumann holds all of the voting power, has cashed in big-time on a cash-negative company and doesn’t have enough experienced executives in the C-suite to pivot into profitability when the economic storms hit and venture capital becomes more difficult to access. Additionally, the We Company is grossly overvalued compared to its competitor IWC Plc (based out of London), which is currently profitable and paying dividends. So, the long and short of an investment in WE at this time is that it really doesn’t add up (IMHO). If you'd like to learn stock picking strategies from a #1 stock picker, join Natalie Pace in one of her investor educational retreats. (See links below.) Click to access a link to Natalie Pace's bio. Other Blogs of Interest The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Last October 2018, a few cannabis stocks had been beaten up. However, the growth was astonishing, and Canada had just legalized marijuana for recreational use. So, I included Cronos on my hot funds list in my nest egg pie charts. Within just a few months, by March 2019, Cronos had doubled. At that time, it was a good time to take profits, so I blogged about the rather lofty prices in cannabis. The industry was still strong in revenue growth. It was just a valuation thing. Now, cannabis is again beaten up, with Tilray, Cronos, Aphria, Aurora, MedMen and other reputable publicly traded companies trading at 52-week lows. Cannabis investing can be a bum trip if you buy high, hold too long or don’t do the work to separate the great companies from the scams. So, below are a few tips to ensure that your cannabis adventures are a delight, without the dreaded hangover. Keeping Cannabis Investing a High (Not a Hangover) 1. The growth is real 2. CBD is ubiquitous 3. The execs and board are A list 4. The share price volatility is sobering 5. There are still some stock scams out there. 6. Not every company is great quality and not all will thrive. 7. Which company is the best investment? 8. What’s your best strategy in this volatile market place? And here is a little more THC on each point. Keeping Cannabis Investing a High (Not a Hangover) 1. The growth is real. Check out the Stock Report Card below. There is no other industry showing revenue growth of 100-1000% year over year. Even Tesla, a super-hot market disrupter, was only at 59% revenue growth year over year in the last quarter. 2. CBD is ubiquitous. The 2018 Farm Bill decriminalized hemp, cannabis and products that are low in THC. 33 states have legalized medicinal marijuana. Recreational marijuana is now legal in 11 U.S. states and Washington DC. (See map above.) A recent poll by the Pew Research Center found that 62% of Americans, including 74% of millennials, said they supported legalizing marijuana. Cannabis is legal in Canada and Uruguay, which is why so many publicly traded cannabis companies are based out of Canada and were listed on the Toronto Stock Exchange before going public in the U.S. The next big move, other than having more states legalize recreational cannabis, will be when the FDA approves the use of CBD in food and nutritional products. Currently, CBD is not legal in “interstate commerce.” When this happens, new investors to the space could get a bit giddy. 3. The executives and board are A list. Not all companies are equal. Some are run by retail executives, like Green Growth Brands. Others, like Aphria, have a natural food guru at the helm. Still others are owned in large part by big tobacco or alcohol, including Cronos and Canopy Growth. Incidentally, Irwin Simon, the former founder and CEO of Hain Celestial who is now running Aphria, averted a hostile takeover bid from Green Growth Brands. Green Growth will have to pay Aphria $88 million for the unwanted courtship. Tilray enjoys a very strong international advisory board, including Governor Howard Dean, the former vice chancellor of Germany and government officials in Portugal, Australia, New Zealand and Canada. Acreage Holdings boasts the endorsement of former Speaker of the House John Boehner, and a date-card takeover invitation from Canopy Growth (once marijuana is legal nationwide in the U.S.). Medmen’s board includes former LA Mayor Antonio Villaraigosa. Charlotte’s Web executive team is strong, with Deanie Elsner, the former president of U.S. snacks division at Kellogg in the CEO seat and a former Coca-Cola VP as the Chief Growth officer. However, the Charlotte’s Web board of directors isn’t as well-diversified as the other cannabis companies. The 6-person board includes two founders, four finance executives and one marketing specialist. 4. The share price volatility is sobering. Due to the massive growth and tremendous upside potential, it’s tempting to just hang on, even when your company has doubled or more in share price. However, as 2019 has proven, a better strategy could be to capture gains, and wait for another opportunity to buy low – i.e. trading around the core. If you leave a little of your investment on the table, then you’re able to shoot the moon, should that occur. And if you’ve captured your gains, you’re in a great seat to buy low, if the share price corrects again. The reason for the volatility is three-fold. First, it is happening because many of these companies soar to overpriced heights, and become too expensive. Second, hedge funds and experienced traders like capitalizing on volatile industries. Also, since 2019 is the late stage of the economic cycle, weakness in the overall market can affect everything, including this hot industry. 5. There are still some stock scams out there. There are still penny pot stock scams that are preying on unsuspecting investors. So, you must know the company and who’s running it before you click the buy button. Do not just trust the promises you receive in a marketing brochure, in an email or in a social media campaign. 6. Not every company is great quality and not all will thrive. At some point, there will be more differentiation by product. Which offers the nicest experience? Which are non-GMO or sustainably grown and harvested? Which company will be the first to infuse CBD or cannabis into an adult beverage or Point of Sale product? Which company will become the Coca-Cola of cannabis? 7. Which company is the best investment? In a rapid-paced marketplace like this, a competitive edge of 1% can snowball into a market share of over 100-fold. So, today’s rock star could be tomorrow’s has-been. This is an industry and an investment that you’ll have to babysit. Stay in touch with what’s going on with the FDA, which states and countries are legalizing and new products that are coming to market. 8. What’s your best strategy in this volatile market place? If you’re not willing to apply a trader’s strategy, you might not have a great experience with your dabble into cannabis. Anyone who jumped at Tilray for $300/share is pretty sobered up with a share price of $31/share. And even though the revenue growth of this hot industry is likely to continue to be astonishing, as more and more states and countries loosen their cannabis, CBD and hemp policies, we still have to deal with the fact that the stock market itself could go down. The GDP growth numbers are widely predicted to weaken this year worldwide, including in the U.S. and Canada. The highs and hangovers of cannabis are largely because this is a very new industry in terms of legality, but a very old industry in terms of product. Pot has been around for decades. It’s now partially legal, so companies are able to book their revenue (instead of laundering it through fake businesses). Some of the old gangsters are running the companies, and others are now cultivating the product as the experts. The simple truth is cannabis and CBD are here to stay. It’s only a question of when your state or country gets on board. And it is the fastest growing industry in terms of revenue growth on Wall Street. Nothing comes close. Full Disclosure: I have positions in a few of the companies listed in the above Stock Report Card. If you're interested in learning the strategies I developed, which earned me the ranking of #1 stock picker above over 830 A-list pundits, then join me at an upcoming Investor Educational Retreat. Visit my home page at NataliePace.com, click on one of the flyers below or call 310-430-2397 or email info @ NataliePace.com for additional information. Other Blogs of Interest Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. I’m often asked today if the economy this time around could ever have the devastating downturns that we have seen in the last two recessions – when the losses were more than 55%. Take a look at the chart below, and you’ll see that the financial indicators this time around are more troubling than they were in 2000 or 2008. I discuss this more in depth in my blogs “A Check Up on the Economy,” “The Weakening Economy” and more. (See the end of this blog for a list of recent blogs). So, the short answer is that, sadly, “Yes. Today’s economy could have losses like we suffered in 2000-2002 and 2008.” In fact, with today’s policy impotence, the downturn could be longer lasting and more severe. And, with the expansion of wealth in the upper 1% and the squeeze and debt-load of the Middle Class, this is all happening on the backs of the Average American. So, what can you do about it? You’ll do well to start adopting the money strategies of the 1%, many of which are outlined below. Wisdom is the cure. Recession Proof Your Life with Strategies of the 1%. Home.

Retirement

Budget

Income

Debt

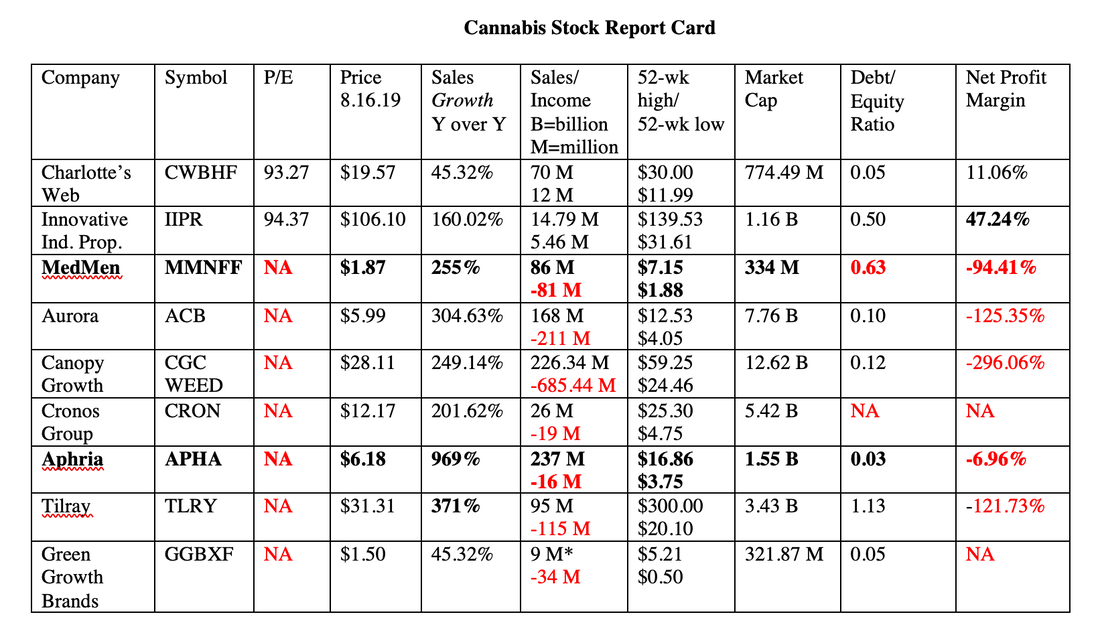

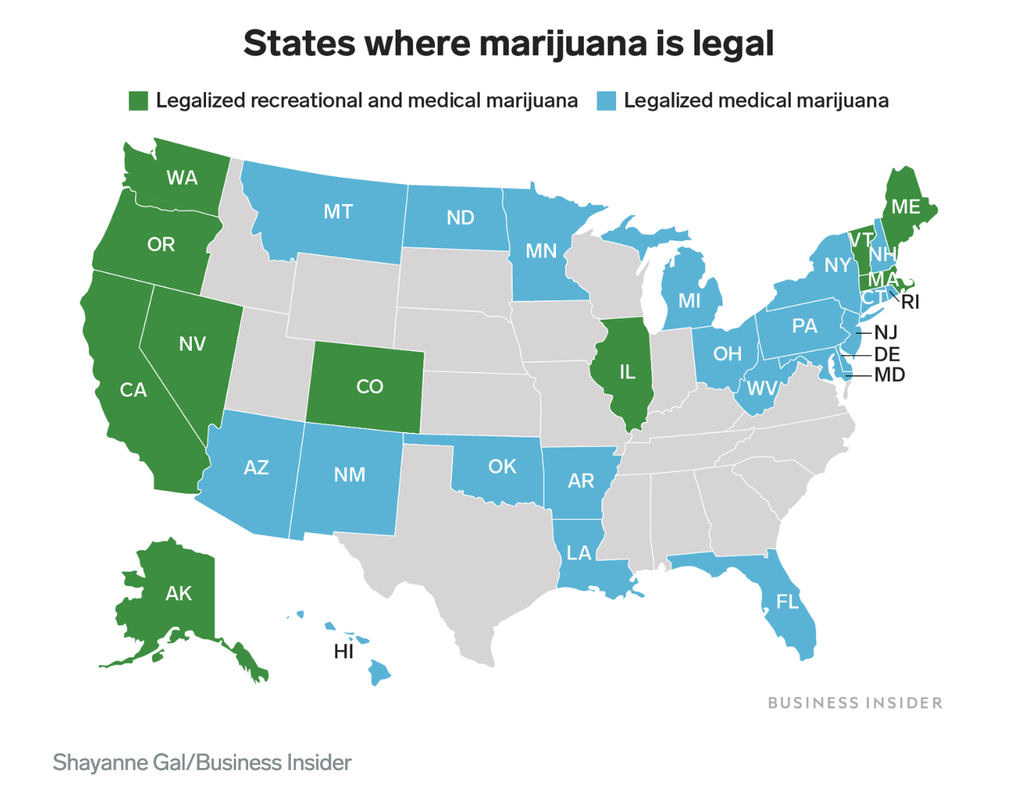

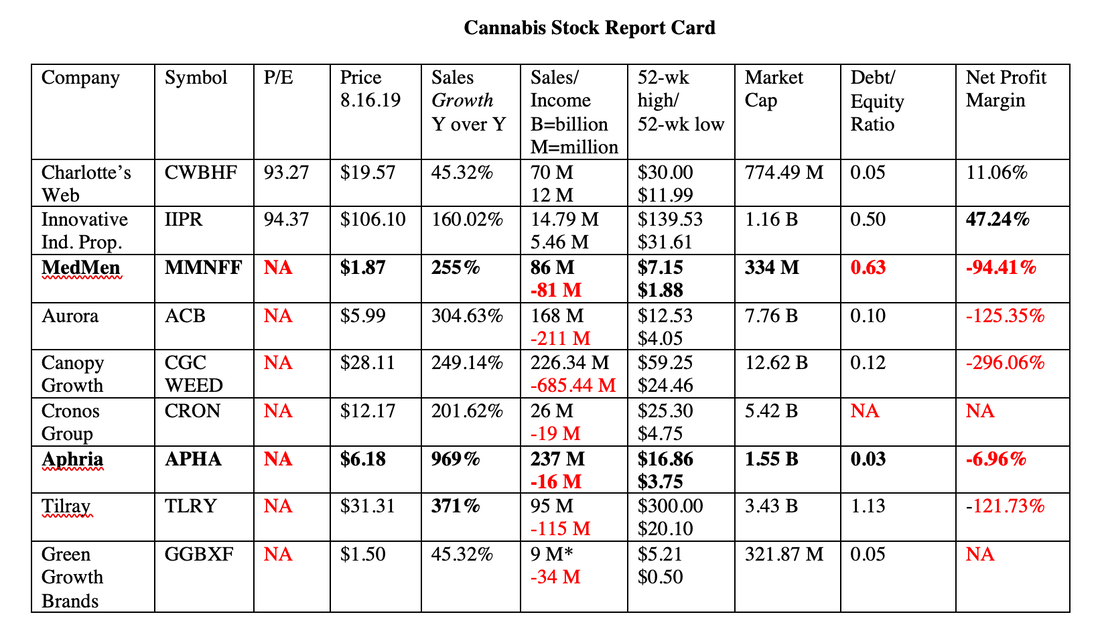

Family

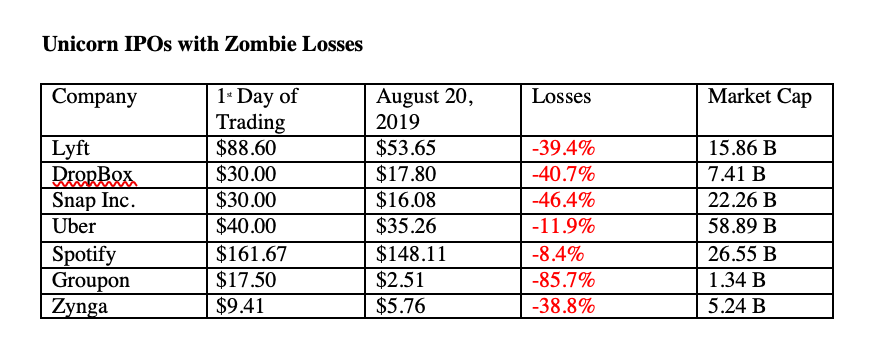

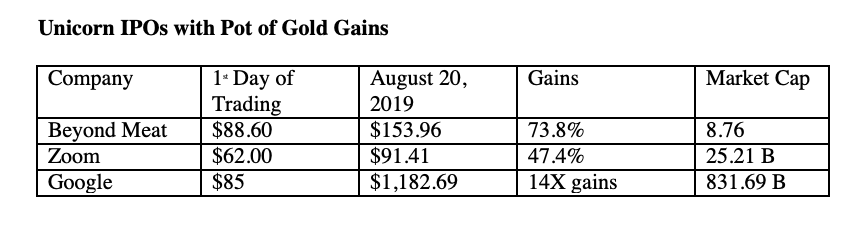

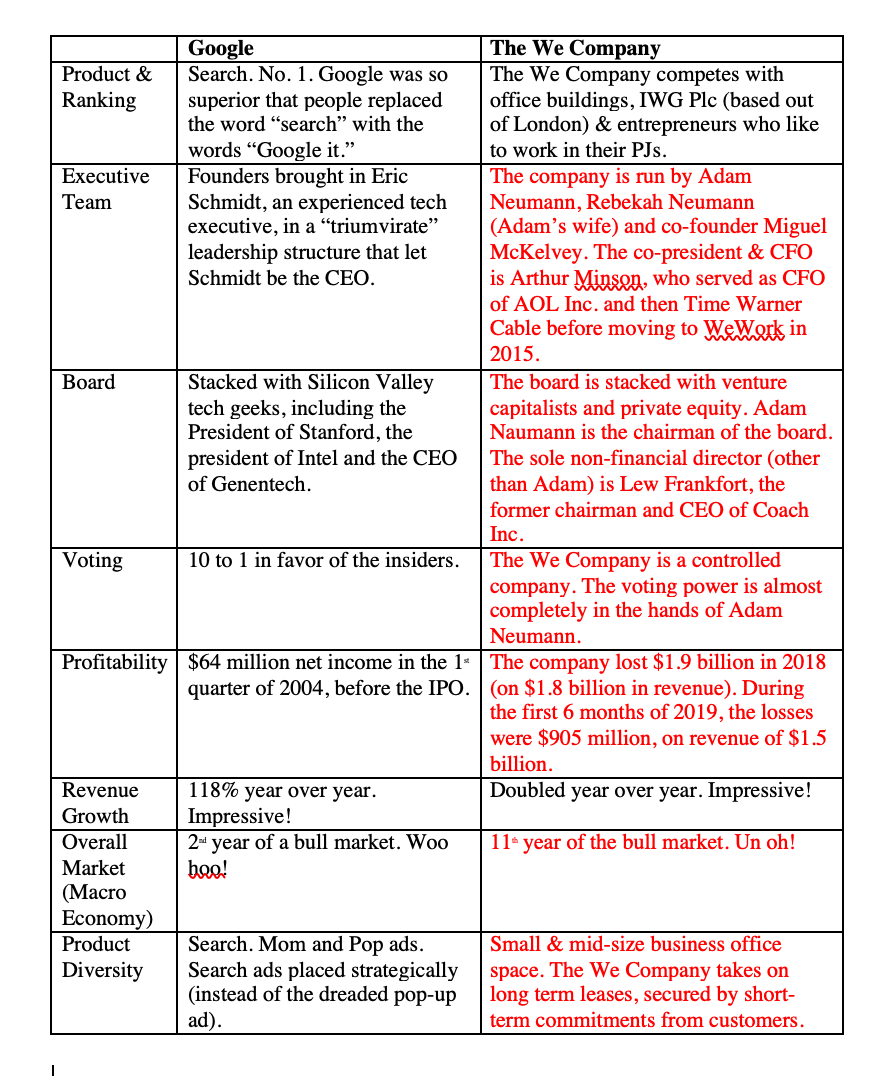

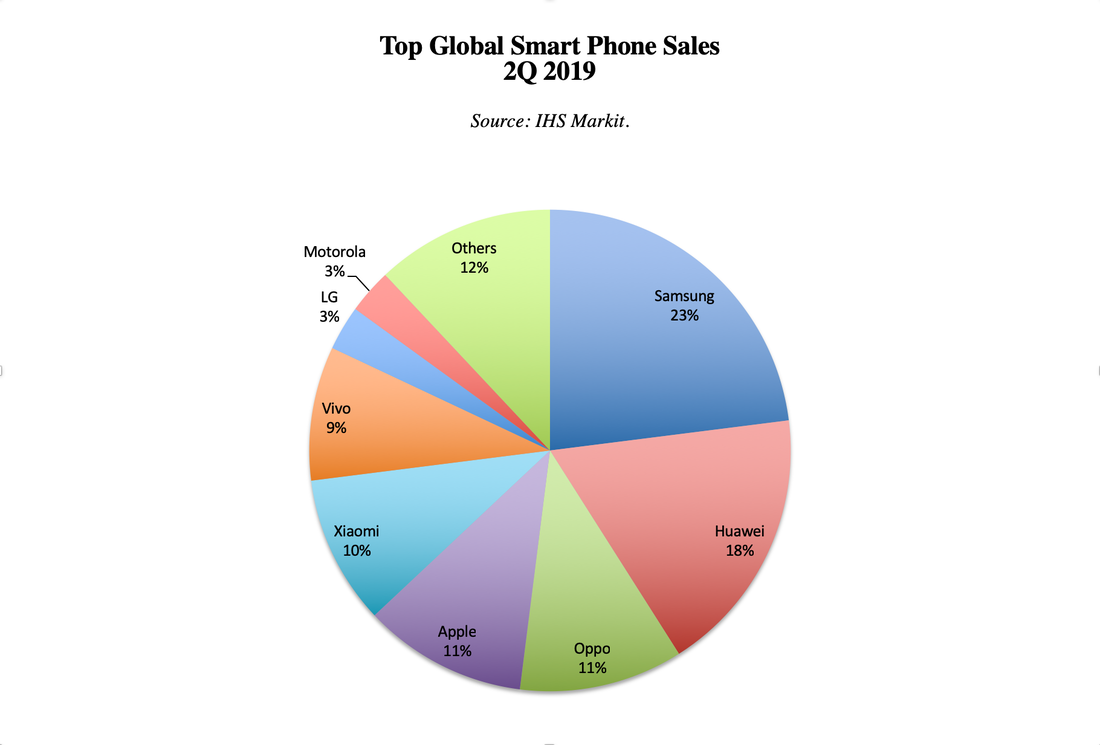

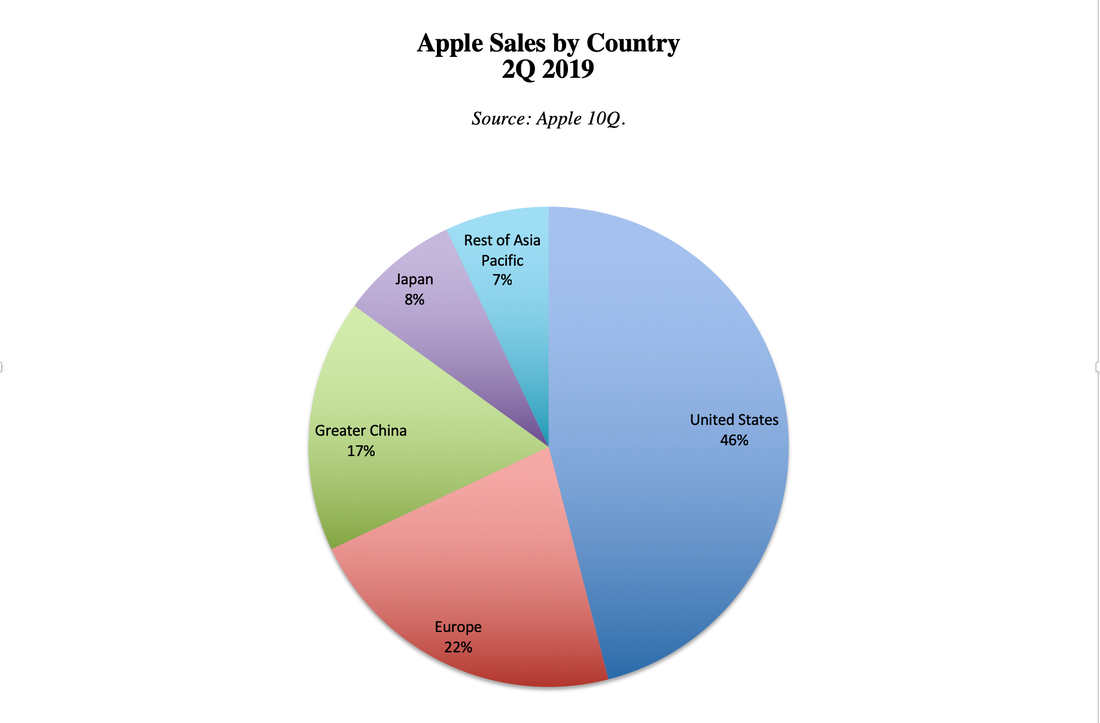

These are all strategies that I cover in my books and retreats. If you want to read about them, call 310-40-2397 or email [email protected] and ask for the links to the most recent editions. If you wish to learn and implement the strategies as soon as possible, before the next recession, join me at my next retreat in Arizona Oct. 19-21, 2019. Call 310-430-2397 for additional information and to register now. Click on the retreat banner ad below to access the 15+ things you’ll learn and master and to read testimonials. Teens and college students may attend the Arizona Retreat for half off the regular individual price. I am also offering a 2nd opinion on your current budgeting and investing strategy. So, if you wish to know what you own, and just how safe, protected, diversified and hot you really are, call our office for pricing and information on the 2nd opinion. Wisdom is the cure. You must be the boss of your money. If you relinquish your power and give it to a “financial advisor” and that advisor loses your money, it is you who loses. No amount of gnashing of teeth will bring the losses back. It took 15 years for the NASDAQ to crawl back to its 2000 highs, and 6 years for the Dow Jones Industrial Average to claw back to its 2007 peak. In the meantime, your credit will be shot, and many people risk losing their homes. There are time-proven solutions. Now is the time to learn them. Other Blogs of Interest China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. In the 2nd quarter of 2019, Apple sank to the 4th position in global smartphone sales, behind Samsung (75.1 million shipments), Huawei (58.7 million) and Oppo (36.2 million). Apple’s sales/shipments were 35.3 million for the quarter (source: IHS Markit). According to Jusy Hong, IHS Markit’s research and analysis director, “Huawei was able to replace falling international shipments with increased sales in China. However, the full effects of the ban likely will be felt by Huawei’s international business in the third quarter of this year.” Actually, Huawei’s sales are strong in both China and Europe – costing Apple market share in both regions. (The ban is in the U.S., Australia and Japan.) According to Apple’s 2Q 2019 earnings report, net Apple sales in Greater China and Europe fell in the 2nd quarter year over year, by -4% and -2%, respectively. Sales in the Americas were also down 1%, while the rest of Asia Pacific and Japan increased 13% and 5.6%, respectively. Apple is projecting flat revenue growth of $61-$64 billion for the next quarter (its fiscal 4th quarter). What is perhaps just as relevant as slipping to 4th in smartphone sales is that Apple’s diluted earnings per share actually dropped 7%, despite a massive buyback attack from Apple of $17 billion in share repurchases. Apple has the largest corporate share buyback plan in the U.S. by far, having repurchased $74.2 billion in shares in 2018 and $41 billion already in the first half of this year. The current buyback program authorizes up to $75 billion in share repurchases. The company has $94 billion in cash and marketable securities, and $135 billion in total current assets. So, is Apple’s new strategy to wage war on Huawei through the White House, while repurchasing its own shares to keep investor interest piqued? Or will there be a new exciting product launch on the horizon? In the 3rd quarter 2019 earnings press release Apple CEO Tim Cook promised, “The balance of calendar 2019 will be an exciting period, with major launches on all of our platforms, new services and several new products.” However, since Steve Jobs transitioned, the business strategy has been built more on political warfare and financial engineering than innovation. Apple’s Chief Design Officer Sir Jonathan Ive, the creative technological mind behind the Mac and the iPhone, left the company to launch his own on June 27, 2019. However, Apple will remain one of the new company’s primary clients, according to both Jony Ives and Tim Cook. With 17% of Apple’s revenue coming from Greater China and 22% coming from Europe, Apple can’t afford to continue to lose market share in these countries. The tariffs and trade wars exacerbate the problem in these regions, while the Huawei ban should help Apple sales in Japan, the U.S. and Australia. A weaker yuan and stronger dollar mean that Apple’s already pricey products become unaffordable in China and Europe – even more so when compared to the prices of Huawei and Oppo. A general anti-White House sentiment in China doesn’t help. Tariffs and trade wars, and the fallout of this strategy, are problems that the White House can’t blame on the Federal Reserve. Apple can afford to keep its share price afloat with share repurchases this year. However, declining sales will send a message to Wall Street that could taint investor appetite, particularly if Apple misses its revenue target in the fiscal 4th quarter of this year. That report won’t be released until the first week of November… If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Register for the Florida Feb. 8-10, 2020 Retreat by Sept. 30, 2019 to receive the best price and a complimentary private prosperity coaching session (value $300). Call 310-430-2397 or email [email protected] to learn more now. I'm also offering an unbiased 2nd opinion on your current retirement plan. If you're worried that you have too much Apple in your portfolio, or would like to be sure that you are safe and properly diversified, then call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed