|

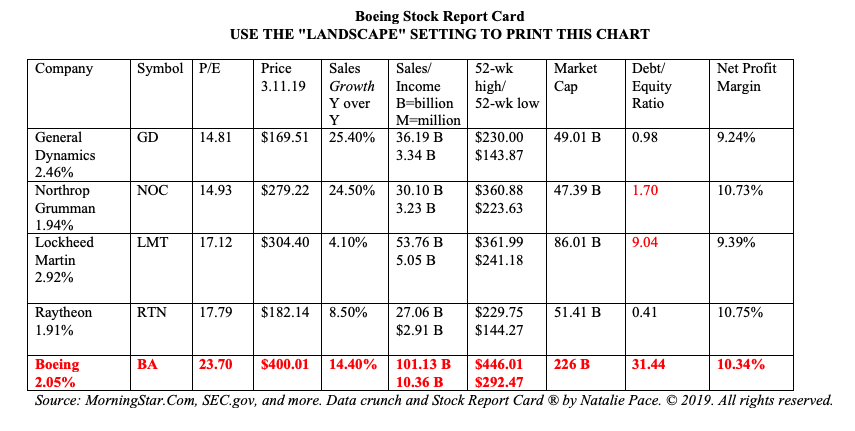

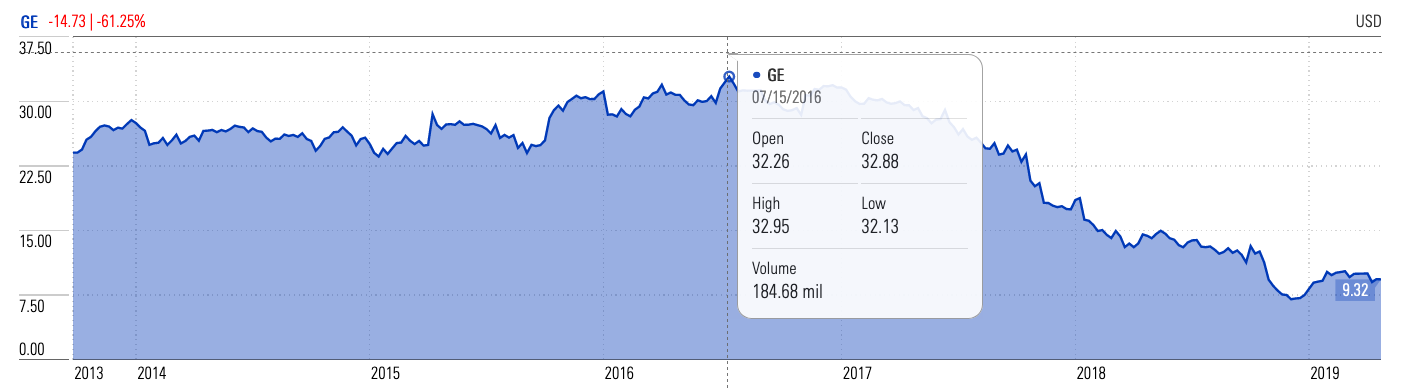

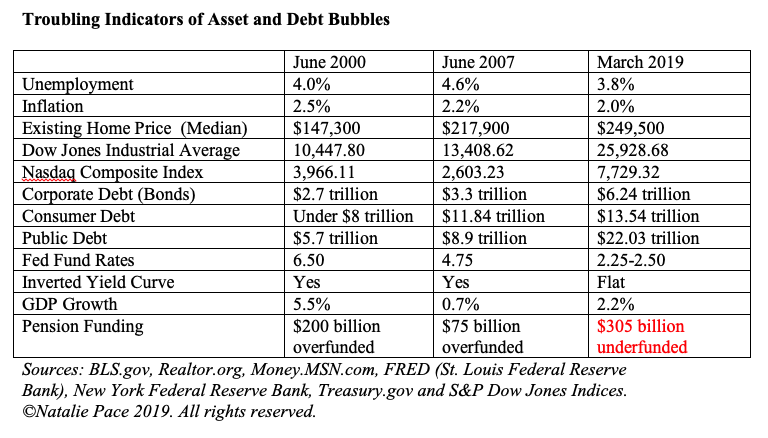

On Friday morning, April 26, 2019, at 8:30 am ET, the Bureau of Economic Analysis will release the 1st quarter 2019 GDP growth advance estimate. 2019 is predicted to slow worldwide, and the U.S. is not immune to that. U.S. GDP growth in 2019 is predicted to slow to 2.1%, as the affects of the tax cut wear off and the problems of tariffs, BREXIT and the late stage in the economic cycle kick in. Estimates for the 1st quarter GDP growth range from 1.4%-2.8%. On the low end, investors will likely take a defensive stand, and stocks could sink. If growth hits 2.8%, sophisticated managers will know that is largely as a result of financial engineering, as the rally in stocks is largely a result of corporate buybacks. So, there is no guarantee than an upside surprise near 3% growth would spark more buying. Financial Engineering is Not Real Growth. Boeing has borrowed money to buyback its own stock, rather than hire ample staff to do the job right. This rewards shareholders in the short term. However it harms regular folks and the company itself in the medium and long-term. There is no greater tragedy than the loss of 346 innocent travelers. Boeing is trying to buy their way through this crisis, as they work to get the software safety upgrade for the 737 approved and the airplanes delivered. So far Boeing stock has been very buoyant, still trading near an all-time high of $375.46/share, as of April 24, 2019. However, how long can the company borrow to buyback stock? Boeing’s debt/equity ratio is the highest in the industry at 31.44. The company has warned that they will have to restate their 2019 financial guidance at “a later date.” 1Q 2019 revenue was down 2% due to the canceled and delayed aircraft deliveries. (The Ethiopian Airlines crash was on March 10, 2019, so the cancellations and issues will show up more in the next earnings report.) Boeing’s net earnings were down 13%, while the earnings per share took a 10% haircut year over year. Boeing spent $2.3 billion on share repurchases and $1.2 billion on dividends (a 20% increase) in the 1st quarter. This is about $1.4 billion more than the company earned. General Electric was another company that kept raising their dividends and buying back their own stock, on an unsustainable path to where they are now – with a share price worth less than 2/3rds of what it was a few years ago, and almost no dividend. Buybacks Hit An All-Time High, Just Like 2007 All Over Again According to S&P Dow Jones indices senior index analyst Howard Silverblatt, corporate buybacks are at an all-time high, running a whopping 68.6% above last year. Apple spent $88 billion in 2018 on stock repurchases and dividends. The company’s net income was $59.53 billion. Oracle spent $32.75 billion on buybacks, with $3.82 billion in net income. Banks were in the top ten spenders, led by Wells Fargo, with $29.153 billion spent on buybacks and dividends and $20.69 billion in net income. Amgen, Microsoft and Facebook were also big buyback spenders. Amgen’s spending topped its net income by $13 billion, while Microsoft spent almost $14 billion more than it made. Buybacks Were the Fuel Before the Great Recession, Too The cost of buying into a financially engineered asset bubble is enormous. Stocks dropped by more than half in the last two corrections. Real estate dropped by half or more in many cities (around the world) during the Great Recession, such as Stockton, California, Detroit, Michigan, Las Vegas, Nevada, Miami, Florida and Phoenix, Arizona (to name a few). Low Interest Rates Create Bubbles Low interest rates create bubbles. As you can see in the chart below, asset bubbles were the rocket fuel of the last two recessions – and the leading indicators of the correction. Inflation and unemployment were both low in 2007 and 2000. The asset bubbles today are even more troubling, particularly when you look at debt and underfunded pensions. Bonds are in trouble this time around due to the amount of credit risk (debt) in the world. Over half of the investment grade corporate bonds are rated at the lowest level. One canceled order or customer could take the company into junk bond status. Also, the Feds don’t have enough room to lower rates and help the economy went it hits troubled waters, as it inevitably does. If the Federal Reserve Board is not able to raise interest rates before the next correction, the correction itself could be longer, deeper and more harrowing. Business cycles are cyclical. This is the late stage of the current expansion by most measurements. Asset bubbles have made real estate and stocks unaffordable for many Americans. (If you’re not aware of the high price to earnings ratio in stocks, it will pay to get educated on this.) According to Robert Shiller, a Nobel Prize winning economist and Yale’s professor of economics, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000.We are at a high level, and its concerning. People should be cautious now.” Retiring Boomers are putting pressure on the entitlement expenditure. BREXIT and tariffs will affect the U.S. economy negatively. (Tariffs have increased our trade deficit and taken it to an all-time high.) As former Federal Reserve chairman Alan Greenspan noted in an interview on CNBC on April 12, 2019, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized [as inflation].” So, what do you do when you see financial storms brewing on the horizon? You fix the roof while the sun is still shining, relying upon time-proven systems that work. Buy and Hope has been riding the Wall Street rollercoaster up and down, losing more than half in each Recession, and then barely crawling back to even again before the next financial crash. You can’t afford those kind of losses this time around, particularly when the solutions are so simple. Wisdom is the cure. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. I'm also be hosting a Real Estate Master Class in Denver on April 26, 2019 and an Investor Educational Retreat April 27-29, 2019. (You'll have to act fast to join me there!) Click on the flyer links below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more and to register now. Other Blogs of Interest The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 20/2/2022 10:36:18 pm

Thanks for sharing this useful information! Hope that you will continue with the kind of stuff you are doing. 21/2/2022 10:16:07 am

Hi Cody, 9/9/2022 02:29:46 am

Thanks Lexynne. This blog is from 2019. You can get more updated information in our more current blogs and books. Visit the home page to access links. https://www.nataliepace.com/ 23/5/2024 05:57:24 am

Well written article, I always love to read your articles thanks for sharing. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed