|

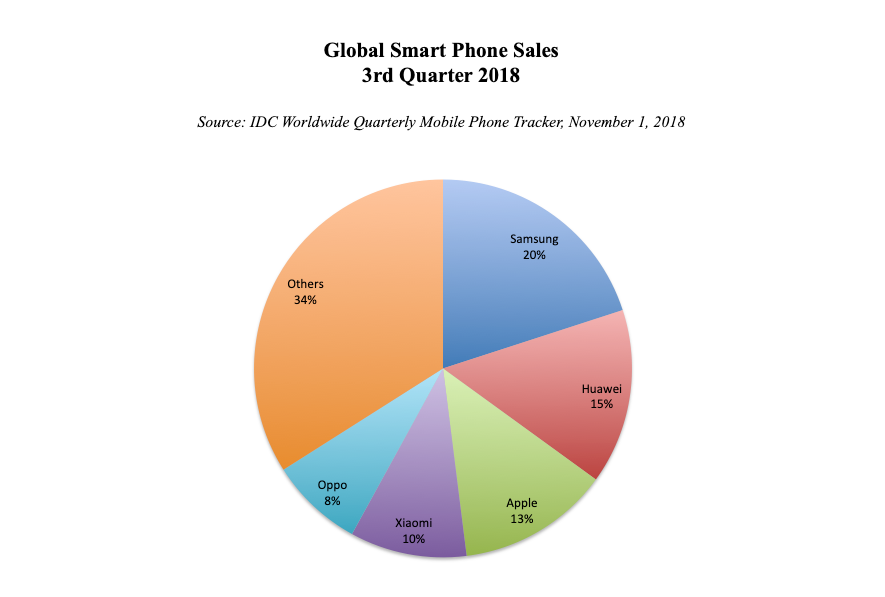

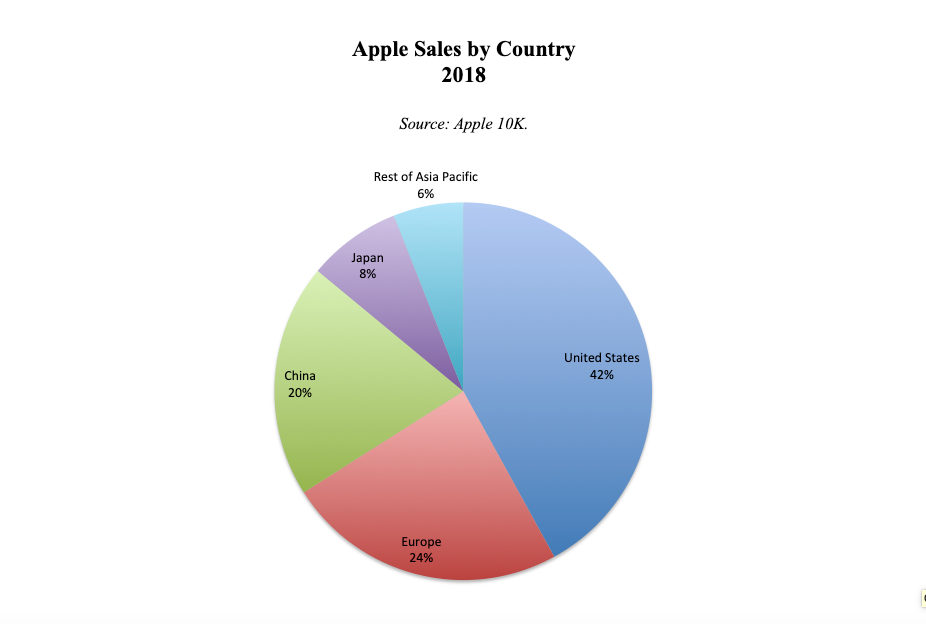

This blog was amended on January 19, 2019. See the end of the blog for details. Yesterday, Apple revised its sales outlook for the 4th quarter (fiscal 1st quarter), claiming revenue will drop in at $84 billion, down from its previous estimate of $89-$93 billion. That caused a fright among investors, and Dow futures are down over 300 points as I write this blog (from Rome, Italy). Put into context, that would represent a drop in sales of 5% year over year. Investors aren't accustomed to weakness in the 1st company to attain trillion dollar value. (The current market value of Apple is $741.73 billion. Share price has been sliding since Oct. 2, 2018.) Tim Cook said that the reason sales will be down by $5-9 billion is basically disappointing iPhone sales in China. He blamed the economic slowdown in China for lower sales, stating on CNBC that “It’s clear that the economy began to slow [in China] during the 2nd half… Trade tensions put additional pressure on their economy.” Traffic in Chinese Apple stores and their channel stores is down as well. While Tim Cook is right about a slowdown in China’s economic growth (to 6.1% predicted in 2019 by Fitch Ratings), that’s not the real reason that Apple sales are down in the world’s largest economy (China). According to IDC, the slowdown in smart phone sales has been going on since the 4th quarter of 2017. The reasons? “Market saturation, increased smartphone penetration rates, and climbing Average Selling Prices,” according to Anthony Scarsella, the research manager with IDC’s Worldwide Quarterly Smart Phone Tracker. The slow down is concentrated in Samsung and Apple, the chief contributors to the pricing problem. The lower-cost Chinese manufacturers Huawei and Xiaomi saw outstanding sales growth year over year. In fact, the 2nd quarter of 2018 welcomed a new leader to the Top 2 in global Smart Phone sales, knocking Apple down to #3. Samsung and Apple have dominated the #1 and #2 position in smart phone sales for a decade. However, Huawei outsold Apple to become the #2 smart phone seller worldwide, with sales of 54.2 million units and 15.8% market share in the 2nd quarter (source: IDC). There are reports that Huawei’s smart phone sales topped 200 million units in 2018. (The final 2018 report from IDC should be available at the end of January.) Here are the most recent numbers from Q3 2018. So, why is Huawei more important than ASP, market saturation and China’s slowing economic growth? Cook is not publicly acknowledging the elephant in the room, although he is smart enough to consider this privately. Huawei is beating Apple in global smart phone sales. The arrest of the Huawei CFO and vice chairwoman Meng Wanzhou is viewed in a negative light – not just by China. Chinese media, other Asian media and many Weibo updates, called the arrest “kidnapping,” referring to the U.S. as a rogue nation. Imagine if Tim Cook were in jail awaiting extradition to China for aiding Tibet in some way. Trade wars don’t just slow economic growth. (The tariffs have actually resulted in a much larger trade deficit with China.) They also tarnish brands. While many Chinese consumers might love their Apple iPhones enough to stay loyal, that becomes increasingly problematic as the U.S. trade policy and the arrest of Huawei’s CFO make headlines in the country. When citizens have to choose between patriotism and a product, it is likely to be the product that suffers. 20% of Apple’s sales come from China, with over 1/3 from Asia Pacific. Tim Cook has his work cut out for him. What can he do to compete with the harsh headlines of a U.S./China trade war and the arrest of a major Chinese competitor’s heir apparent? He must find a way to keep Apple beloved and separate from the actions of the current Administration, while also innovating and reconsidering his aggressive pricing. Will he cut a deal with an Asian carrier, to make his smart phone products more affordable (as he did with AT&T when iPhone first launched). Watch for those headlines to understand how Apple will fare in 2019, which may not be featured as predominantly, or covered as widely, as yesterday’s earnings miss was. *The original blog stated in error that sales growth year over year would be positive. What Should You Do to Protect Yourself From More Wall Street Weakness? A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt, and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, email [email protected]. Happy New Year! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your 2019 to be more enjoyable. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 2 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a discount on your private coaching package (and 2nd opinion), when you register for a retreat. Other Blogs of Interest

2019 Crystal Ball 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Adamo

16/1/2019 02:17:51 pm

Just a quick note to say that I really enjoy reading your intelligently written blog. I appreciate how you sift through some of the complexities of the current markets and provide your well thought out insight and analysis. Fantastic work! Thank you so much for this. 17/1/2019 02:40:42 am

It's my pleasure, Adamo. I love my job! Be sure to join our mailing list if you want to stay tuned into important, ongoing, forensic, proprietary research such as this. 9/3/2020 01:08:47 am

Well, if the S-view flip-flap cover is too much to manage then there is a simpler version of the cover as well. This one is just a back cover without a flap to protect the phone’s screen 26/6/2020 12:03:06 am

This is very appealing, however , it is very important that will mouse click on the connection: Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed