|

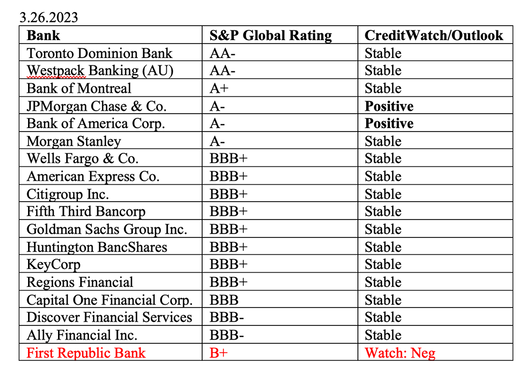

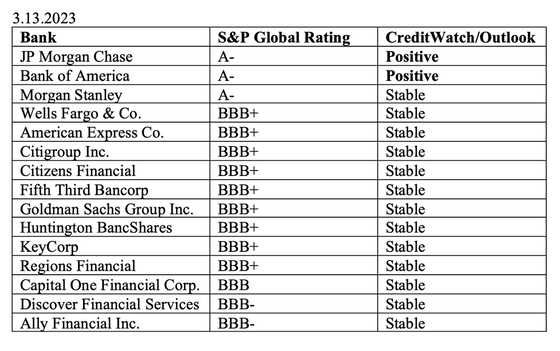

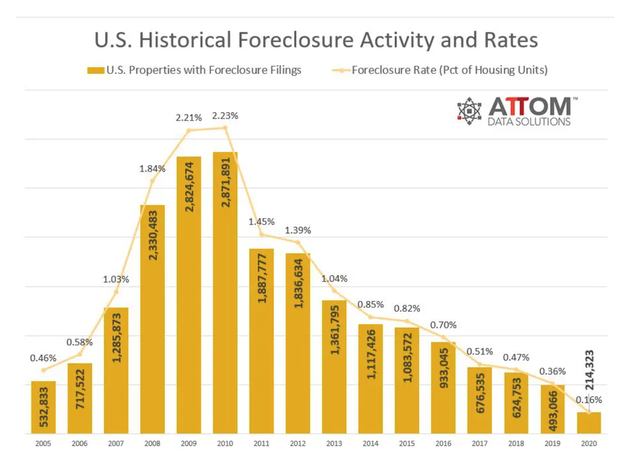

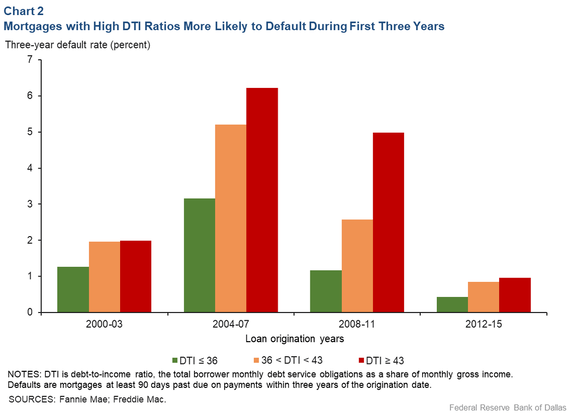

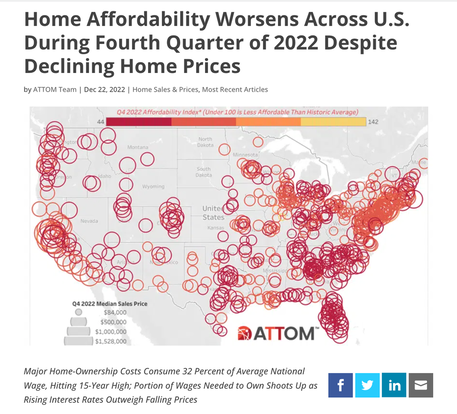

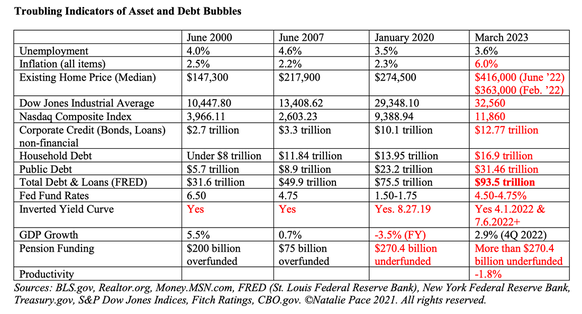

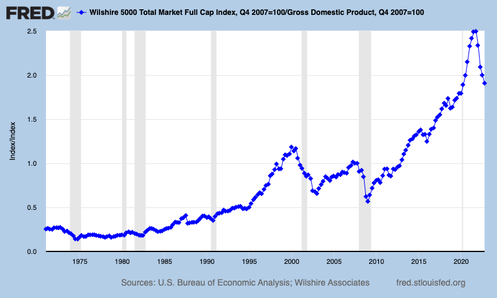

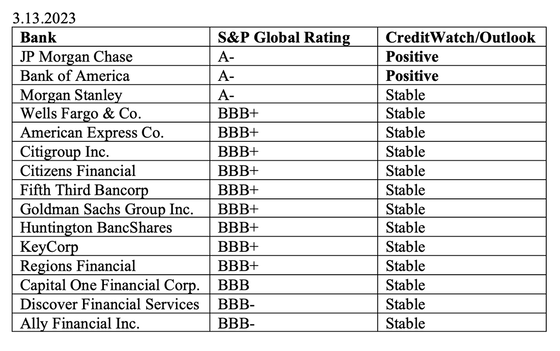

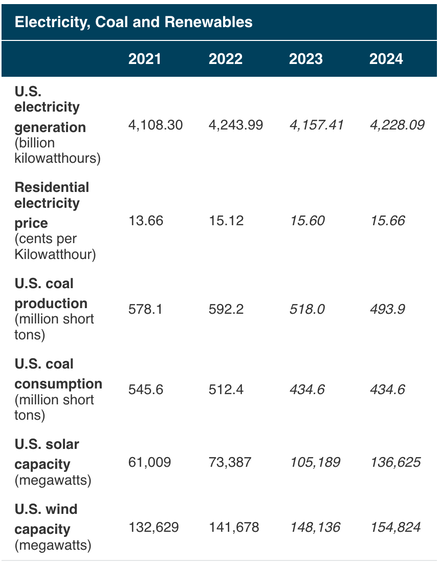

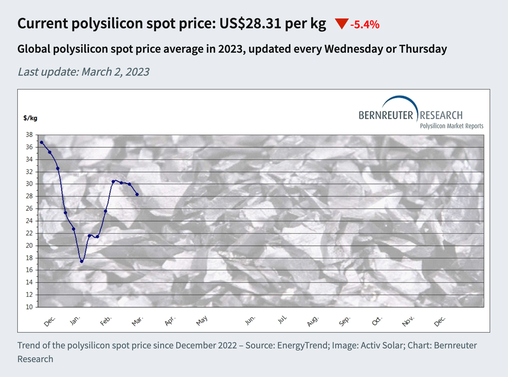

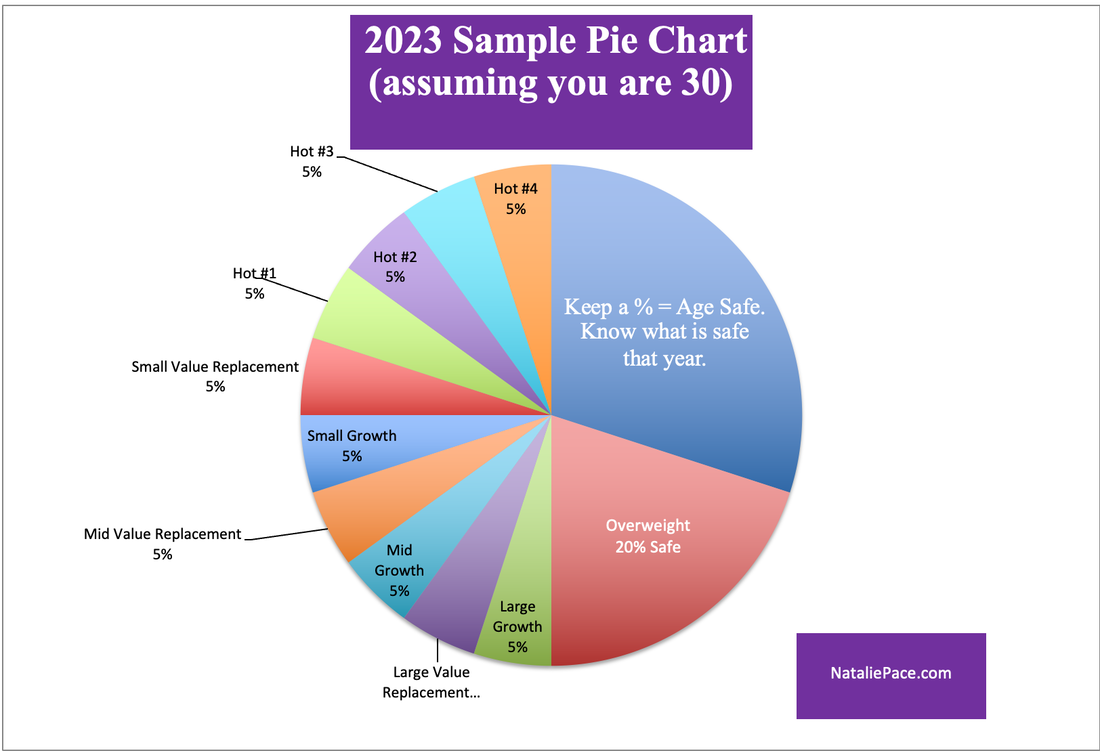

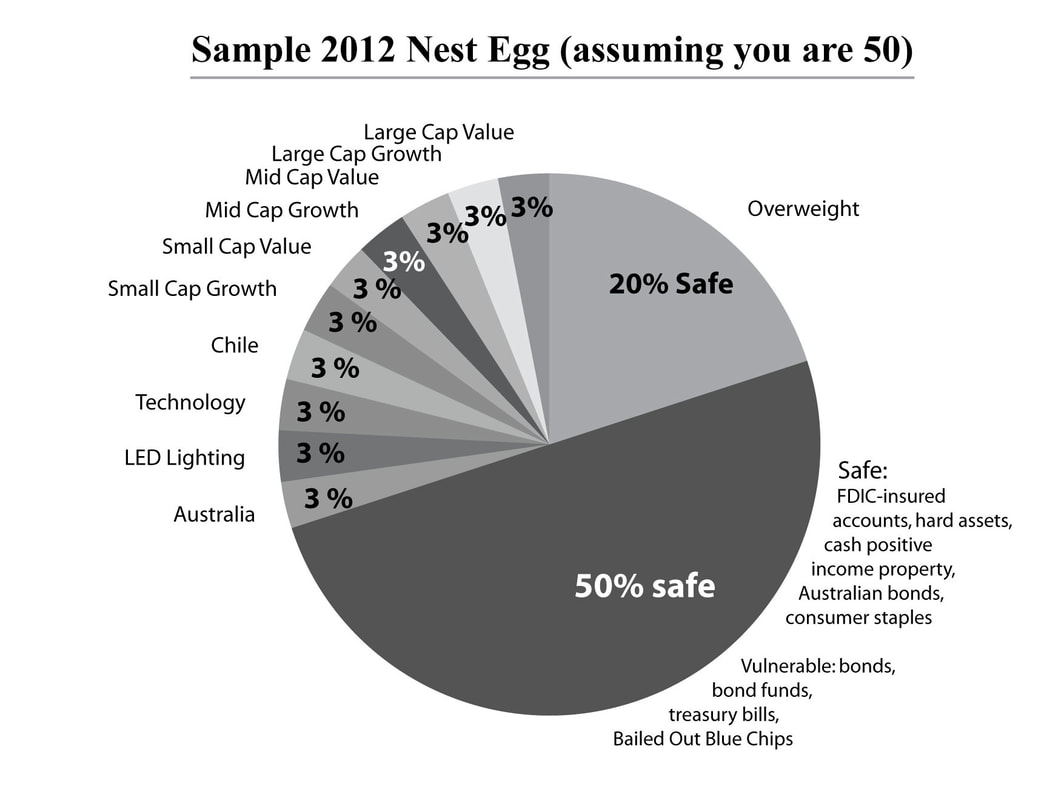

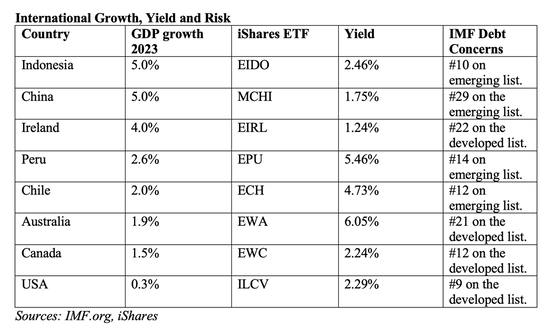

Are There Any Safe Green Banks? Investors Ask Natalie. Dear Natalie, In my coaching session, we discussed choosing a bank that is FDIC-insured, has an A or higher credit rating, and one that offers interest on my savings. I was considering transferring to Chase or Bank of America. However, a friend brought to my attention that these banks are heavily invested in fossil fuels. She told me to check out green banks. Do you have recommendations for a bank that meets the solvency and interest requirements that is also environmentally friendly? Thank you! Signed, Green Saver Dear Green Saver, I firmly believe that we should be putting our money where our heart is. I also believe that we should be able to keep our money, and not have it overly at risk or worrying us, as has happened for depositors over the past few weeks. Bank Failures Small, regional banks (like the ones listed on the Green Banks List you provided) are more susceptible to bank failures than the big banks. With the failures of Silicon Valley Bank and Signature bank, solvency is a serious concern. To put this into perspective, 489 banks failed during and after the Great Recession, between 2008 and 2013. They were all regional banks. The big banks were bailed out. Jerome Powell, the Federal Reserve Board, the Treasury Department and the FDIC are all saying that even uninsured depositors are safe if a bank fails. However, the FDIC-insured limit is still just $250,000. There is some fine print in the Silicon Valley Bank FDIC notification that indicates uninsured depositors may not have immediate access to all of their money. (Click to read the FDIC press release.) Green Washing & False Advertising It’s tempting to look at a list of green banks and just want to put our money there. However, we’ve seen time and time again how labels can be very deceiving. ESG funds are missing the E (environment) and actually have 20% or more polluters in the index. (Click to read that blog.) The fund companies that claim to be socially conscious often invest in fossil fuels, big pharma, fast food and other companies that have a big CO2 or waste footprint. (We will discuss this in the Financial Empowerment Retreat April 22-24, 2023.) Whenever there is a beautiful carrot dangling in front of us, a lot of times there is trouble, green washing, false advertising or outright scams lying on the other side of the bait. So, just using the criteria, green or divested of fossil fuels to select our bank could be very perilous to our financial health, and not actually help to wean us off of oil addiction. Who is Running the Company, and Who is in Charge of Oversight Yes, there are some new, very small banks that claim not to be invested in fossil fuels. However, we’re going to have to do a forensic analysis of who runs the bank, how long they have been running the bank, how much experience they have, how much control and oversight they have, how many shares they personally own, and whether or not they have problems in their background. My spot check revealed business practices that were far too lax for me to feel comfortable in giving any of these banks my money. The banks on the list are so young that each one I checked didn’t have a credit rating. One was only a year old, with less than 20 employees! Another had no board listed on its website. CrunchBase showed only two employees and one adviser/board member employed at the bank – i.e. no oversight or accountability. The Bank for Good vetting process doesn’t appear to include much in the way of making sure that the people running the bank are doing so in a professional manner – something that is KEY when you’re thinking about stowing your life’s fortunes in their hands. Are Big Banks Invested in Fossil Fuels? Yes. However, so are most investors, most workers, all taxpayers, and anyone with a life insurance policy or annuity. According to CU200, Fidelity, Dimensional, Blackrock, Vanguard, State Street, Life Insurance Corp. of India and Capital Group (American Funds) are among the 10 investors with the most influence over the world’s fossil fuels. The Rainforest Action Network cites JPMorgan Chase, Citi, Wells Fargo, and Bank of America as being responsible for one quarter of all fossil fuel financing identified over the last six years. According to RAN, “RBC is Canada’s worst banker of fossil fuels, with Barclays as the worst in Europe and MUFG as the worst in Japan.” Below are the current credit ratings of a few U.S., Australia and Canadian banks. Consumption and Fossil Fuels (Oil, Gas, Plastic, Polyester…) We drive. We use plastic. We wear polyester. A vast majority of us have a single-use problem. Over half of each barrel of oil goes for petrochemical products, like plastic, polyester, rubber, asphalt, etc. Therefore, if we really want to reduce CO2 and convince banks and other investors to stop profiting from polluters, we’re going to have to change our awareness and habits to stop voting for fossil fuels with our purchasing dollars. That would do a lot to stop banks and the financial services industry from investing in fossil fuels. If there aren’t any profits to be made, they won’t invest. I strongly encourage each of us to read The Power of 8 Billion: It’s Up to Us, and to commit to reducing our personal CO2 footprint by 30% this year. Going Green with Our Green Does that mean we should throw our hands up in defeat and turn our accounts over to the big banks that are destroying our planet? No. We can do a lot better with our investments, our life insurance, our annuities, our bank deposits, and as importantly, our consumption choices. Going green with our bank deposits, while also protecting our wealth is tricky because the most highly rated U.S. banks (Bank of America and JPMorgan Chase) are the worst about investing in fossil fuel companies and projects. It’s also important to remember that most investors, taxpayers and anyone with a retirement account (particularly those target date funds) are invested in fossil fuels. Greening our investments is something that we teach at our Financial Empowerment Retreats. (You’re attending in April and will learn important ways to do this then/there.) Putting Our Money Where Our Heart Is Activism can and should include putting pressure on the banks and fund companies to divest from fossil fuels, to stop using fossil fuels ourselves, and to limit the business that we do with the worst offenders. Since banking green is so tricky and fossil fuels are so pervasive in all of our lives, I’ll offer a few examples of how we might do this in my Green Banks videoconference on Thursday, April 6, 2023. If you’re not already registered to receive the logon instructions, just email [email protected] with VIDEOCON in the subject line to join us live. I will also be hosting a videoconference this Thursday on Where to Stash Your Cash that will include 7 things to do to protect our wealth and future. You can watch this on YouTube.com/NataliePace, or listen on my Apple or Spotify podcasts. Bottom Line Divesting our lives of fossil fuels has to go farther than just selecting a green bank. The money and investments that we don’t think about, particularly those in our retirement accounts, need to be confronted just as much as the banks that host our ATM cards. Educating ourselves on the power we hold as consumers, changing our habits, and learning how to put our money where our heart is will offer the tipping point we’re looking for. Excluding some of those things could keep things at the status quo. Once we learn this essential life math (that we all should have received in high school), it becomes the way life is, and gives us each a shot at healing our home planet and conserving the flora, fauna and animals that live here with us. It will also save most of us thousands of dollars annually, when we learn how to rethink our big-ticket spending, particularly on energy. I’ll see you in April at our investor empowerment retreat, Green Saver. (Invite your friend to learn how to bank and invest green, too!) In 3 life-transformational days, you’ll learn a whole lot more of how you can achieve what you are looking for with a carefully crafted plan, and by taking a hard look at the woman in the mirror and asking her to change her ways. Most of us need an energy audit. Few of us, particularly Americans, Canadians, Australians and anyone living in the Middle East, have a low carbon footprint. (Europeans have a footprint about 2/3rds lower than Americans, Canadians and Australians. Africans have the lowest CO2 footprint, with the highest impact of climate change. The Middle East has the highest CO2 footprint per capita by far. All this and more is outlined in The Power of 8 Billion: It’s Up to Us.) Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Feds Meet Today. 8 Fires They Need to Put Out. At 2 pm ET, the FOMC will release their statement advising the world whether or not they have raised interest rates by another 25 basis points. Before the Silicon Valley Bank crash, Wall Street expected this. Since then, some economists, including Sheila Bair (former FDIC chairman), are calling for a pause. It is unlikely that the Feds will cut rates. Here’s why. If they cut, they will be perceived as flip-flopping or being too soft on inflation. The February Consumer Price Index was still running too hot – at 6% year over year. Worse, if inflation catches fire, it could be far more difficult to put out without employing Volcker moves. (For an informative economics lesson, Google how Paul Volcker handled inflation in the late 1970s and 1980s.) This means there will be a lot of pressure to keep raising rates this year, even if they pause tomorrow, with almost no upside to cutting rates until inflation is “well-anchored” at 2% or below. Larry Summers and Mohamed El-Erian, the chief economic adviser at Allianz, believe the inflation fight isn’t over yet, and rates should continue to rise. What Will The Federal Reserve Board Do About… Weakness in the Banking Industry. Inflation. Bond Losses. Rising Interest Rates. Depleted Savings. Stalled Out Housing Market. Recession? Debt Ceiling… First Republic Bank is still in trouble, even with $30 billion of support from J.P. Morgan Chase, Wells Fargo, Bank of America, Citigroup and more. The company’s stock dropped from $115/share on March 8, 2023 to just $16 today. Over half of the S&P500 is at or near junk bond status. Keeping interest rates too low for so long encouraged companies to borrow lots of money at very low interest rates. Silicon Valley Bank was one of those companies. However, it is not the only bank with a BBB rating. 8 Fires The Feds Need to Put Out. With ways that we can protect our wealth now before the next unpleasant event. Bank Failures: Win and Defend Like Giannis Bank Stress Test Results Announced End of June Debt Ceiling End of May Inflation & Quantitative Tightening Rising Interest Rates. Bond Losses, Bank Failures and the Fed’s New Funding Facility Housing & Depleted Savings Recession? And here is more color on each point… Bank Failures: Win and Defend Like Giannis It has been reported that the star player of the Milwaukee bucks, Giannis Antetokounmpo, at one time had been putting his money in 50 banks, with no single account holding more than $250,000, to ensure that all of his cash was FDIC-insured. You’re going to start seeing a lot of pundits prognosticating that there’s no need for that, as the Feds, Treasury and FDIC are going to bail everyone out, even uninsured depositors. However, the FDIC limit remains $250,000, and if you read the FDIC statement from when the Silicon Valley Bank failed, you’ll see that there can be restrictions placed on withdrawing amounts that are above the FDIC-insured limit. It specifically reads that “Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds.” While the government agencies are promising that all depositors will get their SVB money back, there is a question of when they might have access to all of the funds. On March 13, 2023, I outlined seven strategies to enact now to protect your cash, so that you can win and defend like Giannis, instead of hoping for access to your money or counting on the FDIC to change the rules or raise the limit. Click to access that blog. Bank Stress Test Results Announced End of June Banks are currently conducting their stress tests. As I mentioned above, the Federal Reserve Board is offering a funding facility that should make it much easier for the mega banks to pass this stress test, even though most of them are at the lowest rung of investment grade. If a bank does not pass, they may be required to cut their dividend, as Wells Fargo had to do in the pandemic. The financial industry slowed their share repurchases in 2022, dropping from $62 billion in Q3 2021 to $23 billion in Q3 2022. $22.5 billion worth of shares were repurchased by the financial industry in the 4th quarter of 2022. The financial industry (not just banks) is vulnerable to continued weakness. We’ve been underweighting this industry for over a year, with the most recent blog warning against banks on Feb. 10, 2023 – one month before the SVB Bank failure. The stress tests apply to the largest banks, and are not required from the regional and smaller banks, like Silicon Valley and Signature banks, or from insurance companies or those involved in shadow banking. As I mentioned in my blog on the Silicon Valley Bank failure, Silicon Valley Bank was rated at BBB two days before it failed. Creditworthiness counts. Not only do we want to do a forensic review of the banks, brokerages, credit unions and insurance companies that we do business with, we must also be mindful of the loopholes of brokerages that claim our cash is FDIC-insured. It’s very important to be completely cognizant of the fine print now. (Our team can help with an unbiased 2nd opinion. Email [email protected] for pricing and information.) Debt Ceiling The collapse of Silicon Valley Bank, Signature Bank, and Credit Suisse Bank have captured the headlines. Few people are remembering that Congress is still wrangling over when and how to raise the Debt Ceiling, and that we are currently using extraordinary measures to pay our bills. X date, when we can no longer pay our bills, is expected in early June. So this important Act of Congress is going to start making headlines again in April, and could become a crisis if it’s not resolved before the end of May. Waiting until the last minute to strike a deal, which is what is expected to happen, will prevent a default, but could still have negative consequences. It is important to remember that waiting until the last minute cost the US its AAA rating with S&P Global on August 5, 2011. After that downgrade, gold and silver soared to their all-time highs. When investors lose faith in stocks and the dollar, safe havens become very popular. Bitcoin was selling for $19,500 before the SVB failure, and is currently at $28,202, up 42.6%. Silver has rallied 12% since March 10, 2023, while gold is up 6.6%. Inflation, Quantitative Tightening Inflation is still well above the 2% target of the Federal Reserve Board. At Jerome Powell‘s testimony to Congress on March 7, 2023, he indicated that rates are going to have to go higher than expected. Powell said, “The process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy. As I mentioned, the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” We will know more about where interest rates and economic indicators stand on Wednesday after the meeting. However, persistent inflation creates a strong need for interest rate hikes and quantitative tightening to continue. It’s a delicate dance. Rising Interest Rates Low interest rates are intended to boost economic growth when recessions occur. However, the U.S. has had a low interest-rate policy since 2008. While this did help the economy rise out of the Great Recession and prevented a crisis during the COVID19 pandemic, it is also well known to cause inflation and asset bubbles, which are the bugaboos the economy now has to deal with. (The PBS Frontline documentary Age of Easy Money explains this well.) Low interest rates promote speculation and leverage, widen the gap between the rich and the poor, reward risk-takers and punish the prudent and the savers. “He’s your guy when stocks are high, but beware when they start to descend,” from “Diamonds are a Girl’s Best Friend.” To prevent a further crisis in shelter inflation and other US basic living essentials, the Federal Reserve is in a position of being forced to raise interest rates. They could surprise us on Wednesday and decide to pause the rate hike. However, given the pressures to abate inflation, any pause is likely to be temporary. Bond Losses, Bank Failures and the Fed’s New Funding Facility We’ve been warning about mid- and long-term bonds since at least 2012. They’ve been losing money and have had severe liquidity problems. Even the U.S. Central Bank began losing money in September 2022. Last year long-term government bonds lost -26%, which is more than the S&P500. So, it’s a very good idea to take a look at our portfolio and know exactly what we own and why, rather than having blind faith that someone is protecting our wealth, or throwing our hands up and thinking there is nothing we can do with our retirement plans (there are options). The SVB, Signature and Credit Suisse bank failures illuminate that even the professionals are having troubles with bonds. I’ll be addressing where to stash your cash in my video conference on March 30, 2023. If you’re not already signed up to receive the logon information, email [email protected] with VIDEOCON in the subject line. As I mentioned above, the Feds have set up a new funding facility for “eligible” banks, which will allow some to receive funds in exchange for their bond portfolio, where the collateral is valued at par. This is going to be very helpful for banks that qualify. However, there are a number of corporations and nonbank financial services that are also very heavily indebted and are exposed to bonds that are losing value, which are going to have more difficulty borrowing in a higher interest-rate environment than they did when money was free and easy. So, we may experience a more challenging recession this year than Wall Street has been factoring in, and there are likely to be more corporations in crisis. Housing & Depleted Savings The housing market has been a bright spot since the Great Recession, so even those who lost a home or two in the Great Recession are having trouble remembering just how bad it was then. Over 20 million homes were foreclosed on. However, with savings depleted, interest rates at a much higher level and real estate prices still very close to their all-time highs, very few people qualify for a mortgage at this time. Also a new hurdle has emerged that was previously suspended. The Consumer Financial Protection Bureau has a rule that borrowers of qualified mortgages cannot have a debt to income ratio above 43%. This rule was suspended during the pandemic, but it is now back into play for any loans that are guaranteed by Fannie Mae or Freddie Mac. DTIs have been running hot of late, as you can see in the chart below. High DTI ratios are correlated with recessions and outsized drops in values of real estate. Anyone who purchased a home between 2009 and 2013 has seen the value of their home double or, in some places, even triple or quadruple. However, it’s important not to confuse a bull market with wisdom. The factors that determine what happens tomorrow include all of the things listed above and more. One of the other headwinds against home price increases is that 99% of counties in the U.S. are unaffordable to the people who live there (source: AttomData). If you own a home that you can afford, in a place you want to live for the next decade, that you purchased before 2016, you should be in a good seat. If any one of those factors is missing, it’s a good idea to conduct a review of your housing plan. There is an entire section of Real Estate in The ABCs of Money 5th edition. Read that, or email [email protected] if you’d like an unbiased 2nd opinion with important data and information to factor into your decision-making. Home prices have started to slide. Nationwide, prices are down by -13% percent since the highs in June of 2022, from a median price of $416,000 then to $363,000 in January of 2023 (source: The National Association of Realtors). The places that went up the fastest are the ones that are dropping the most: Idaho, Arizona, Nevada, Washington and Oregon. Recession 2023? The U.S. defied economic expectations in 2022 with GDP rising 2.1%, but it had a lot to do with a one-off inventory increase. The first quarter of 2023 is expected to do pretty well, too. GDPNow predicts the economy will expand at 3.2%, while the more skeptical Conference Board is even forecasting 1% growth. The US economy is predicted to contract for three consecutive quarters starting in the second quarter of 2023. We will know how the economy fared for the first quarter of 2023 on April 27, 2023, when the advance numbers are released. Again, this could be a decent showing, with things starting to look more bleak over the summer, with the 2nd quarter reported on July 27, 2023. Bottom Line The world has never seen this much debt. Stocks have never been this expensive, even with the pullback in 2022. Many banks have allowed their credit rating to fall to the lowest run of investment grade. We must read the fine print. We must know the risks. We must understand how to protect our wealth and our future. There are ways to do all of this by taking a holistic approach to our budget, our investments, our cash, and our bills. It’s time to be the boss of our money and to have a plan that can navigate the previously unchartered risk that is currently present. Our easy-as-a-pie-chart nest egg strategies and Thrive Budget earned gains during the Dot Com and the Great Recessions. This is just the life math that we all should have received in high school. You can read about this system in our bestselling books. You can learn and implement the strategies in our 3-day life transformational retreats. The next one is April 22-24, 2023 online, so you can attend in your pajamas. Or you can reach out to me for an unbiased second opinion, where you will know exactly what you currently own. You will be provided with a pie chart of what a better plan looks like, and you will receive step-by-step instructions on how to better diversify your wealth and protect your future. For busy professionals, this is a very good first step toward being the boss of our money, rather than having blind faith that a broker/salesman is protecting our future for us. Email [email protected] for pricing and information. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 7 Ways to Stash Your Cash Now The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Lessons from the Silicon Valley Bank Failure Since the failure of Silicon Valley Bank was announced after the market close on Friday, today could be a very volatile day on Wall Street. The stock futures are looking positive, based upon Federal Reserve support for certain banks (not all). However, if there is strength this week, it’s still a very good idea to implement the below-listed strategies – to be properly diversified with a system for rebalancing and protecting your wealth. Join us at the April 22-24, 2023 Retreat to learn very important systems and strategies to protect our wealth, and to transform our relationship with money. Don’t panic. Prepare. Below are 7 things we should know and do now. 1. Which Banks are Most at Risk? 2. What Happens to the People and Companies Who Have More than the FDIC Limit of Cash Held at Silicon Valley Bank? 3. What Can We Do to Protect Our Cash? 4. Be Wary of Emails and Social Media Ads in All Caps 5. Money Market Funds and Non-FDIC-Insured Bank Products, including Certificates of Deposit 6. Annuity and Life Insurance 7. Know What We Own in Our Retirement Plan and Brokerage Accounts Now And here are more details on each point. 1. Which Banks are Most at Risk? Below are a few banks and their current S&P Global credit rating. The bank stress tests are being conducted now and the results will be released at the end of June. Check the credit rating of the bank you do business with at SPGlobal.com. With so many banks at or near junk bond status, underweighting financials is a beneficial strategy. Silicon Valley Bank was still investment grade (BBB) with a stable rating as of November 10, 2022. S&P Global downgraded SVB to BBB- on March 9, 2023 (still investment grade). On March 10, 2023, the FDIC established receivership of the bank. In one of my February blogs, I outlined why banks are risky at this time. (click to access). We go into detail on how we can underweight financials in the funds we hold in our retirement and brokerage accounts at our April 22-24, 2023 Financial Empowerment Retreat. Email [email protected] to learn more and register now. 2. What Happens to the People and Companies Who Have More than the FDIC Limit of Cash Held at Silicon Valley Bank? While the FDIC, the Treasury Department and the Federal Reserve Bank issued a joint statement assuring depositors at SVB that they “will have access to all of their money starting Monday, March 13,” the statement by the FDIC clarified that insured depositors have all access, while “uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds.” If you bank at SVB and have cash levels above the FDIC-insured limit (or just general interest), you can read the full FDIC statement at FDIC.gov. . 3. What Can We Do to Protect Our Cash? Check the cash levels that we are currently holding at various banks that we do business with. Consider having more than one bank holding our cash, particularly if our cash levels are well above the FDIC-insured limit of $250,000. Know the current credit rating of the banks. If we have our cash at a brokerage that is promising FDIC-insured coverage, know the limits on that claim. (Click to read my blog on the FTX and Voyager Digital failures, when FDIC-insured claims were null and void.) In that blog, I also discuss the credit ratings of a few brokerages. I would consider having more than one bank even if my current bank has a bank sweep program. It’s unlikely that SVB and Signature Bank are the only ones that are going to have serious trouble. Even the central bank is losing money at this time, due to the plunge in value of long-term bonds. According to the Sept. 21, 2022 minutes of the FOMC meeting, “Federal Reserve net income turned negative in September.” Net income is not expected to turn positive for a few years. Creditworthiness counts. 4. Be Wary of Emails and Social Media Ads in All Caps We’re already seeing rallies in crypto, gold and silver (the safe haven plays). We’re going to start seeing a lot of emails and social media ads warning of a central bank failure, and advising investors that these safe havens are the only solution. Is that the case? No. However, it is definitely a good idea to consider having a hot slice or two of a safe haven hedge against a downturn in stocks. (Learn our nest egg pie chart system at the April 22-24, 2023 online Financial Freedom Retreat.) Crypto investors will be thrilled if the SVB failure ends their horrific crypto winter, and gold/silver investors will be ecstatic if the decade-long doldrums finally snaps. However, even with safe haven plays, it’s important to understand the cycles and to never confuse a bull market or a rally with wisdom. Why shouldn’t you put all of your money into crypto, gold or silver? The first reason is volatility. If you use the pie chart system and are rebalancing regularly, then you have a way of capturing gains and buying low. Otherwise, your net worth and credit score could spend decades underwater. However, another very real risk is that the ruse you’re being offered is an outright scam – even if it is being promoted by a celebrity or well-known book author. Read my blog on the failure of FTX and SBF to learn more about avoiding these money pits. 5. Money Market Funds and Non-FDIC-Insured Bank Products, including Certificates of Deposit Money market funds, all insurance products (including annuities) and some CDs are not FDIC-insured. Money market funds can impose redemption gates and liquidity fees. Now is the time to look forensically at the holdings in your brokerage and retirement accounts and to become familiar with the fine print – what happens in times of distress. Clearly, this is no longer a theoretical warning. The shareholders and certain unsecured debt holders of Silicon Valley and Signature Banks are not being bailed out. Learn more in my blog on MMFs, FDIC and SIPC, and in What’s Safe? Section of The ABCs of Money, 5th edition. 6. Annuities and Life Insurance All financial services companies are at risk in recessions, particularly the current one, due to their exposure to long-term bonds and other high-risk, high-leverage products. Since annuities and life insurance are only guaranteed by the company that issues the product (and the state guaranty funds), it’s important to, at minimum, know the credit rating of the company that is making a promise to you. It’s also important to know how much debt, leverage and risk that the company is taking on through a qualified outside source (not just relying upon the company’s claims). We wouldn’t have many insurance companies if they weren’t bailed out in the Great Recession. This time around, taxpayers are not expected to be forced to shoulder that burden. We educate you more about annuities and life insurance in the Financial Freedom Retreat (where we spend one full day on what’s safe) and in The ABCs of Money, 5th edition. 7. Know What We Own in Our Retirement Plan and Brokerage Accounts Now It’s not a good idea to have blind faith that someone else is protecting our future for us, or to avoid looking at our retirement funds because we believe that we can’t really make changes or that we should just ride things out. Stocks have a history of dropping by more than half in the 21st Century recessions. In 2022, long-term government bonds dropped by -26%. So, even the “safe” side of our wealth plan is at risk. Most managed brokerage and retirement accounts shadow the performance of the general marketplace. Our easy-as-a-pie-chart diversification and rebalancing strategy earned gains in the Dot Com and Great Recessions and have outperformed the bull markets in between. Now is the time to be the boss of your money. Bottom Line Whether you learn our time-proven 21st century strategies in our bestselling books, receive an unbiased 2nd opinion personally from me (email [email protected] for pricing and details), or learn and implement these strategies after attending our April 22-24, 2023 Retreat, now is the time to protect our wealth. Email [email protected] for pricing and information, or visit the home page of NataliePace.com, where you’ll find links to our books, the April Retreat and much more. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The 2 Best Solar Stocks Includes a warning about a former revenue darling that has seen its revenue and margins plunge. As you can see in the chart below, solar power is predicted to increase by 86% over the next two years. Solar companies are enjoying robust revenue growth – the best they’ve seen in awhile, and this is expected to continue well into 2024, as more individuals and governments wean themselves off of fossil fuels. (Europeans have endured an expensive winter due to their reliance on Russian natural gas for heat and cooking.) Do a quick search on solar companies to invest in and you’ll see First Solar, SolarEdge and Enphase mentioned pretty much across the board. Not surprisingly, these companies are trading at their 3-year highs and at very lofty price-earnings ratios. However, are they the best companies to invest in? Are there any that have great potential that are trading at an attractive price? Bargain vs. Buzz Enphase and SolarEdge both boast of year-over-year revenue growth of 76% and 61%, respectively. Although very impressive, this is not the highest growth on the Solar Report Card, where companies like JinkoSolar and Daqo are more than doubling in revenue annually. (Email [email protected] with Solar Stock Report Card in the subject line to receive your copy.) Additionally, with price-earnings ratios of 77 and 195, the ENPH and SEDG stocks are very expensive, even if the growth continues apace in 2023. First Solar is a laggard on the Solar Stock Report Card, with and net losses of $44 million in 2022. Revenue was down in 2022, to $2.62 billion, from $2.92 billion. Although First Solar is losing money, its stock is trading at a 15-year high, largely thanks to Motley Fool and Jim Cramer. Daqo Interestingly, one of the companies with the highest growth of the Stock Report Card (last year) has a P/E of just 2 – something that is rarely seen with a company that is increasing revenue to the tune of 118% year over year. Daqo Energy supplies polysilicon. Demand was hot and supply was short last year, so prices soared, inflating Daqo’s revenue and net profit margins. Despite that treasure trove, the U.S. scrutiny and threat of delisting Chinese companies caused Daqo’s share price to sink. This year more polysilicon is coming to market. Revenue is expected to plunge for Daqo, starting as soon as the 1st quarter. Daqo is forecasting that 1Q 2023 revenue could be short -37% from the 1st quarter of 2022. Polysilicon prices plunged below $18/kg in January of 2023, but have rebounded back to above $28/kg. The average selling price (ASP) was $37.41/kg in Q4 2022, compared to $36.44/kg in Q3 2022, and $21.76 in 2021. With more polysilicon available in 2023, BloombergNEF is forecasting that the price could drop to $10-$15/kg this year. Daqo enjoyed profit margins as high as 60% in 2022. However, the lower price structure will challenge their margins, and could cause net losses. The company has $4.65 billion in cash and cash equivalents, and is expanding production. According to Longgen Zhang, CEO of Daqo New Energy, Daqo expects to “produce approximately 190,000~195,000 MT of polysilicon in 2023, 42% to 46% more than in 2022.” However, the new price structure will be a stunning reversal of fortune for the company. Forbes recently included Daqo in its 8 Best Solar Power Stocks of 2023 article. Yahoo and Investopedia also featured the company in their recent Best Of lists. While Daqo was one of our favorites in 2021 and 2022, it’s now one that we would underweight. 1Q 2023 results should be released around April 21, 2023. Sunpower Sunpower offers solar and storage solutions. In fall of 2022, the company partnered with General Motors, KB Homes and Ikea to promote residential rooftop solar. GM has selected Sunpower as its exclusive solar provider and preferred EV charger installer, and will tout the bidirectional charging capabilities of the system and GMs cars to “provide whole home backup during a grid outage” (something that has made headlines of late, particularly in Texas and California). Ikea launched Sunpower Home Solar in their California stores in Fall of 2022, with plans to expand in the future. KB Homes, in conjunction with Sunpower, the University of California, Irvine, Schneider Electric, and Southern California Edison, are building an Energy-Smart Connected Community in Menifee, California with 200 all-electric, solar-powered homes connected to a micro-grid with battery storage. Sunpower’s revenue annual growth was 37.8% in the 4th quarter of 2022. The company is forecasting adjusted EBITDA growth of up to 63% in 2023. Sunpower has yet to make major headlines. It’s share price is trading at a discount of 71% off of its Jan. 2021 high of $54.00/share. JinkoSolar JinkoSolar had the highest year-over-year sales growth on the Solar Stock Report Card, with 128% revenue growth. JinkoSolar has global operations and $11 billion in revenue. The company will announce its 4Q and full year 2022 earnings on March 10, 2023 at 7:30 am ET. The company won the Ernst & Young “Sustainability Awards 2022 Outstanding Enterprise” award. The margins are tight at Jinko. Last year’s net income was only $150 million, on $6.4 billion in revenue. With such a low EPS, the price-earnings ratio looks elevated. However, Jinko has the lowest price/sales ratio of the companies we examined (by far). According to the preliminary report, this year’s net income could be closer to $382 million. (We’ll know on March 10th.) At minimum, the company is one to consider putting on a Stock Shopping List. Clean Energy Funds The easiest way to get exposure to clean energy without having to babysit a lot of individual stocks is to purchase a clean energy fund. Be wary of ESG funds. They are typically missing the E (environment), exclude solar companies and justify having 20% or more fossil fuel companies through the S&G portion of their mandate. (Learn more in my ESG: Missing the E blog.) ETFs to consider include ishares ICLN and Invesco’s PBD and PBW. Since Blackrock (owner of ishares) has an AA- rating, compared to Invesco’s BBB+, we’ve been leaning into ICLN at our retreats. Utility Prices Residential utility costs increased by almost 11% in 2022 and are expected to rise in the coming years. This should be positive for rooftop solar companies, like Sunpower. As more homeowners, particularly those in sunny states, are encouraged to do the math, and as the clean energy tax credit of 30% remains in effect for the next decade, rooftop solar offers a lot of benefits to anyone looking to save thousands annually on their utility bill. Macro Concerns Solar energy is a bright spot in a sluggish U.S. economy that is expected to see at least a mild recession in 2023. Homeowners could be pushed by high utility bills to seek budget-saving solutions that have an added benefit of being planet-friendly. This is all positive for the industry. However, it’s important to remember that, while a rising tide lifts all ships, a sinking tide can ground even great companies. If stocks head south, the centrifugal force could pull all share prices down the drain. For that reason, we’re adopting a dollar-cost-averaging approach. Bottom Line A clean energy ETF should be a good addition to the hot slice of our nest egg. Be sure to keep everything in balance, to consider overweighting safe, to rebalance regularly, and to consider dollar-cost-averaging into your slice. All of this is outlined forensically at our Financial Freedom Retreat. Join us April 22-24, 2023. Email [email protected] to learn more. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Which Countries Offer the Highest Yield for the Lowest Risk? In today’s global economy, it’s fairly easy for Main Street investors to choose funds that specialize in countries around the world. The benefits of country diversification include: exposure to different economies and their growth potential, mitigation (somewhat) of risk, and higher yield. Each year, we line up GDP growth expectations, debt to GDP and other factors to determine which countries offer the best risk/reward. See below for 5 countries that are ranking at the top of the pack, one that has fallen off of our radar and two that are higher risk than most of us realize. 2 Countries With More Risk Than Investors Realize: the U.S. & Canada Since the pandemic and the aftermath of escalating inflation, almost all countries have increased their debt and are now having to raise interest rates. That can be a problem, particularly if there is a lot of corporate debt in the country. The IMF issued an alert on Jan. 31, 2023, writing, “[The] build-up of risk in the corporate sector and a doubling of funding costs for even the safest issuers could pose serious problems for many economies and their financial systems.” The U.S. was listed as #9 of the developed world countries that were at risk, behind Portugal, Norway, Greece, Spain, Iceland, New Zealand, Austria and Italy. Canada was #12 on that list. In my country analysis this year, I included financial instability risk rankings from the IMF report. (If you’d like that graph, email [email protected] with Country GDP Debt Graph in the subject line.) It’s important to remember that we are a global economy. A ripple in the developed world can become a tidal wave in the developing world. In other words, all equity-based investments are at risk. High leverage and rising interest rates create a great deal of problems for fixed income products, too. For these reasons, we are overweighting an additional 20% safe in our sample pie charts (limiting exposure to equities) and underweighting mid- and long-term bonds. (We’ve been suggesting that Main Street investors have limited exposure to low-yielding mid- and long-term bonds for a decade now.) You can personalize your own sample pie chart using our free web apps. Email [email protected] with FREE WEB APPS in the subject line. Fixed income investors are finally being rewarded for their risk, but navigating between the new opportunities and the legacy debt (which is plummeting in value) is tricky. I address this in my 2023 Bond Strategy blog. (Click to access.) 5 Countries With Attractive Risk/Reward Scenarios Australia Ireland Peru Indonesia China FYI: Chile is No Longer on Our Hot Country List And here is more color on each country. 5 Countries With Interesting Risk/Reward Scenarios The U.S. has a lot to offer investors in terms of leading multinational companies. Canada is rich in natural resources, including oil sands. I’m not suggesting that we jettison Apple, Google, Amazon and other large multi-national companies from our investing plan. These trillion-dollar companies offer a solid foundation. For most of us, however, almost all of our exposure is in one or both of these countries, and in only very large corporations. Additionally, there is a great deal of difference between high-growth, low-debt companies, and the high-debt, slow-growth companies that are concentrated in value funds. Many U.S. large-cap growth companies are still experiencing very high valuations. Legacy value companies have a great deal of leverage. Over half of the S&P500 is at or near junk bond status. What we’re offering in this blog is a way to diversify away from the low-yielding value funds and into international equities, many of which offer double or triple the yield. Australia Australia is a country that is rich in natural resources. After the Great Recession, Australian equities more than doubled in value in under two years. (It took the Dow Jones Industrial Average over six years to crawl back to even.) The post-recession building boom typically puts natural resources in high demand. While 2023 could see Australia’s economy slow to 1.9% GDP growth, if there is an economic recovery in 2024, Australian companies could soar again. In the initial stages of economic weakness, almost all international equities will go down before the decoupling occurs. The U.S. is expected to experience at least a mild recession, so stocks worldwide could be under pressure. For that reason, if we don’t already have exposure to an Australian ETF, it’s a better idea to dollar-cost average into the holding, rather than to just slam-dunk a purchase to fill up a slice of the pie chart. In addition to the capital upside, many Australian ETFs offer a far more attractive yield than their U.S. and Canadian counterparts. As you can see in the chart below, the iShares Australian ETF (symbol: EWA) is currently offering a yield of 6.05%, compared to 2.3% in the U.S. and Canada. According to the IMF, Australia has a much lower risk of financial instability than Canada and the U.S., as well. Ireland Ireland is benefitting from being the European tax haven for a lot of technology companies, including Google and Apple. The country was in dire straits during the Great Recession. It required IMF assistance and a bank bailout. However, since then, it has risen to having one of the highest GDP per capita in the world, at $107,000 per person, compared to $78,000 in the U.S. and $60,000 in Canada. Ireland’s GDP growth was a whopping 14% in 2021, 9% in 2022, and is expected to be one of the highest in the world, at 4.0% in 2023. The yield on the iShares ETF (symbol: EIRL) is only 1.24%. However, this is a country that is carrying lower risk than most of the developed world. Again, if we don’t already own this ETF, it’s a better idea to dollar-cost average into the holding, rather than to just purchase the slice all at once. Peru Copper has been coined as “the new oil” by Goldman Sachs because the metal is essential in the transition to a new energy economy. Peru is the 2nd largest producer of copper in the world, behind Chile. The country also has some unique food/nutrition products that are desired around the world, including quinoa, camu camu, maca and cacao. There is political unrest in Peru that could spill over and impact the economy. However, at this time, Peru is expected to have 2.6% GDP growth in 2023 and 3.2% in 2024. When copper is hot, as it was in 2021, Peru’s GDP catches fire, too. In 2021, Peru’s economy grew by almost 14%. Investors are receiving a yield of 5.46% for investing in the iShares Peru ETF (symbol: EPU). Indonesia Indonesia benefits from the growth of China, and is also energized from the higher prices of oil and gas. The country is the #1 producer of nickel – a rare metal that is central to lithium ion batteries and other clean energy products. Indonesia’s GDP is expected to grow at 5.0% in 2023. FYI: Vietnam’s economy is predicted to grow 6.2% in 2023. It’s difficult to invest in a Vietnam-based ETF, which is why the country is not included here. China China was heavily impacted by COVID in 2022, but is expected to have a stronger 2023, with 5.0% GDP growth. The country agreed to U.S. audits of its publicly-traded companies. So, in addition to having a strong economy, investors could benefit from buying into equities that were oversold last year. FYI: Chile is No Longer on Our Hot Country List Chile’s GDP growth was lower than Peru’s in 2022, at 2%. The country’s GDP is projected to contract -1% in 2023. There is a higher risk of financial instability in Chile than Peru. Those are a few of the reasons why we are leaning into Peru, and away from Chile in our Hot Country analysis this year. Bottom Line Adding in foreign countries can bring higher dividends, potentially higher performance, greater diversification and lower risk to our equity investments. While we aren’t suggesting that we get rid of all of our U.S. or Canadian investments, there is room in the pie for diversification by country, in addition to size and style. Each year, we line up the numbers to identify a few countries that might offer the best risk/reward scenario. Not surprisingly, most of the countries featured here are rich in natural resources, or based in Asia. As many developed world countries are expected to have weak GDP growth in 2023, all equity prices could be under pressure. For that reason, we’re encouraging a dollar-cost averaging approach to adding these holdings to our portfolio, and to overweighting up to 20% additional safe. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |