|

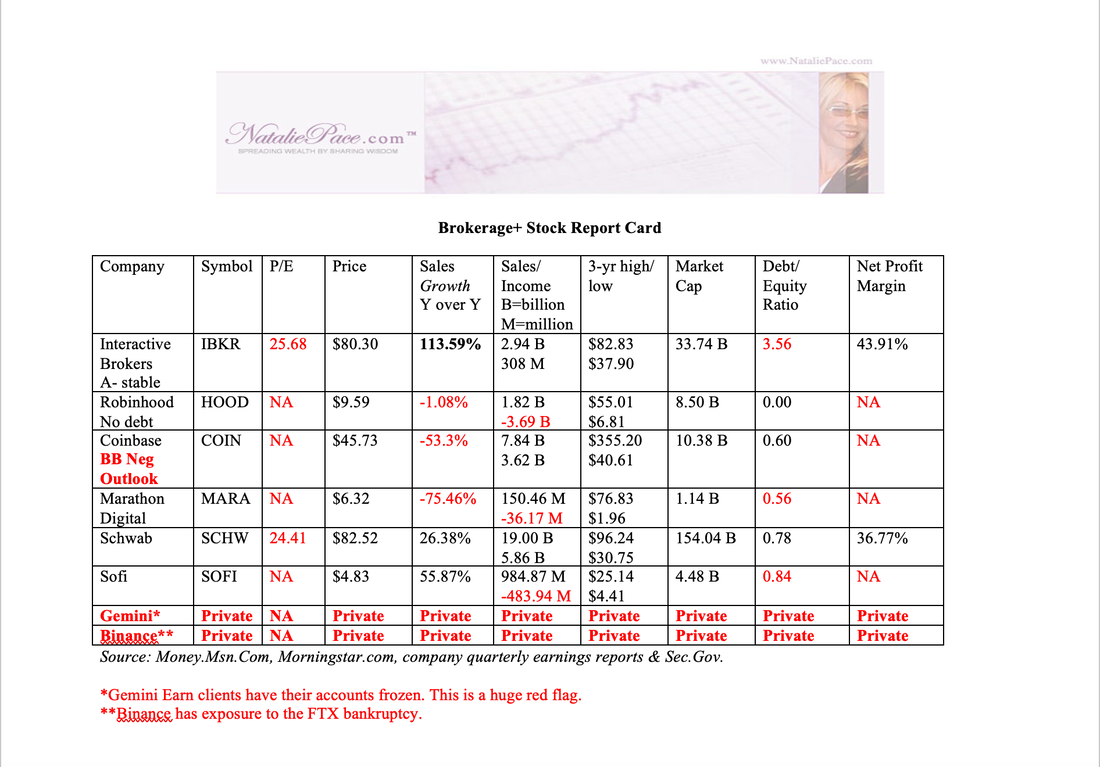

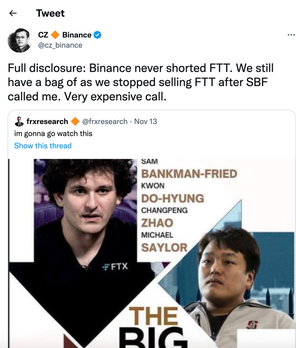

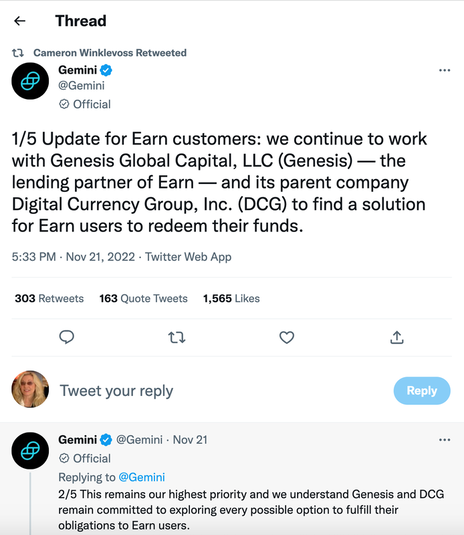

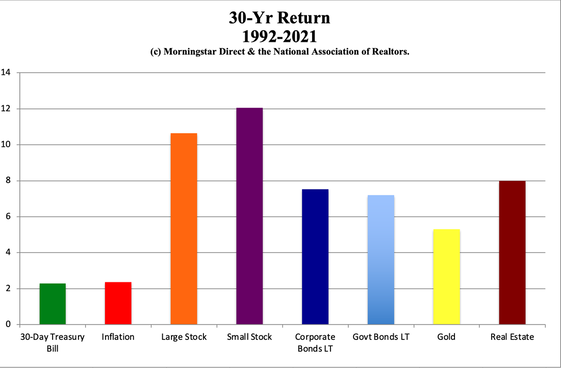

Is Your FDIC-Insured Cash Really Safe? Better Double-Check. Crypto bankruptcies hijacked cash deposits that were promised FDIC protection. Is an FDIC-Insured or CDIC-insured Cash Deposit Safe at any Brokerage? (There are loopholes that we all need to be aware of that apply to all brokerages, even ones that don't deal in crypto.) Which company will be next to fall? Could it be a major crypto exchange or a traditional brokerage? Blockfi, Voyager Digital, FTX and Gemini Earn All Hijacked Customer’s Cash. Blockfi, FTX and Voyager Digital have all declared bankruptcy. In each case, account holders had their assets frozen. Gemini Earn investors have just seen their accounts frozen. Will Gemini be the next crypto company to fall? Voyager Digital told depositors that their cash was FDIC-insured. However, the company has received a Cease & Desist Order from the FDIC on those claims. The implications of a brokerage going belly-up reaches beyond the crypto platforms and into traditional financial services companies, too. Robinhood has a relationship with banks and advertises that depositors are FDIC-insured (as do many other brokerages). Will Robinhood fall into the FDIC loophole, if Robinhood gets into trouble? (Yes, keep reading.) Which brokerages and exchanges are most vulnerable to bankruptcy? What should depositors and traders be wary of? Could the Crypto Winter take down more popular sites, like Coinbase, Robinhood, Gemini and Binance? Below is a look at these questions and more, with particular emphasis on crypto-heavy companies. (Most brokerages don’t support crypto trading yet.) I’ll also address the FDIC pass-through quandary in greater depth in my Dec. 8, 2022 Videoconference. Email [email protected] with VIDEOCON in the subject line, if you’d like to join us live (or watch it back). You can also visit YouTube.com/@NataliePace to watch that and other videoconferences. Before we jump into the nitty-gritty, I want to offer 4 tips to navigate the volatile world of all things coin. This industry is vulnerable to wild swings in value. Betting the farm is never a good idea. Also, the industry is still relatively new, and is rife with ruses, scam artists and poorly-run companies (which have multiple red flags that anyone doing the smallest amount of due diligence can see before the implosion). Start educating yourself on the warning signs by reading my FTX blog. 4 Tips for Crypto Trading 1. Treat crypto as a hot slice or two of your nest egg pie chart system, not as your entire financial plan. (Learn proper diversification and regular rebalancing at our New Year, New You Financial Freedom Retreat.) This is as true of crypto today as it was for meme stocks in 2021, clean energy in 2007 and the Internet in 2000. Hot new industries are volatile. 2. Regular rebalancing will help you to capture gains at the high and add more when prices dip, while the pie chart system itself will keep you from being over-exposed to this volatile asset. Our plan helps to put you on the right side of the trade, and provides a framework for taking on high risk for potentially high reward, without betting the farm. 3. Be wary of claims that your cash deposits are FDIC-insured. (Learn more here and in the FTX Failure blog.) 4. Crypto is an ocean full of whales (large investors) hunting for gains. Trading is active. Crypto is rarely being used as money, outside of the limited world of NFTs. HODL is a myth. The average holding time for Bitcoin & Ethereum is just 4-5 months, and can be much shorter when prices soar and for smaller coins. FDIC-Insurance Loopholes Many brokerages offer FDIC-insurance on their cash deposits through a pass-through relationship that they have with an FDIC-insured bank. What happened at Voyager Digital could happen to many brokerage clients because FDIC-insurance only covers the insolvency of an FDIC-insured bank. Many crypto traders moved from Coinbase to Voyager Digital thinking their money was safer because Voyager assured customers that they were FDIC-insured, while Coinbase spells out the details of how pass-through FDIC insurance actually works. Despite the assurances, Coinbase is still in business, while Voyager clients are panicking. It’s more important to know just how fiscally healthy the firm that holds your dough is. (Getting your paper assets safe is so tricky that we spend one full day on the topic at our Financial Freedom Retreats.) If you’d like to learn more about FDIC policy, FDIC coverage and pass-through loopholes, check out the government agency’s podcast of Nov. 29, 2022. (Click to access.) Below is a Crypto Brokerage Stock Report Card, and more details on the companies themselves. Robinhood Robinhood is a publicly traded brokerage known for gamification, meme stocks, fractional shares, free trading and crypto. All of this initially made the company popular with Millennials and Gen Z, until the GameStop fiasco. This young brokerage lost $3.69 billion in 2021 and is still cash negative. Revenues were down -1% year over year in the most recent quarter with transaction revenues down -22%. As of September 2022, Robinhood reported $6.2 billion in cash and cash equivalents. Robinhood is a young, cash-negative company that has a market cap of $8.5 billion (compared to Schwab’s $154 billion). Brokerages don’t fare well in recessions, particularly smaller, new kids on the block. (Even giants like Merrill Lynch, Bear Stearns, Smith Barney and other brokerages had to be bailed out in 2008.) Coinbase Coinbase is the OG of crypto companies. The company is publicly traded, with a market cap of $10.4 billion. Revenues were down -55% year over year in the most recent quarter. S&P Global rates Coinbase’s debt at BB (junk) with a negative outlook. Having burned through about $2.1 billion in the first nine months of 2022, the company has $5.6 billion in cash + $483 million in crypto. If the weakness in crypto continues, this will be hard on Coinbase. Coinbase rides the cryptocurrency rollercoaster. In 2021, Coinbase made $3.6 billion in net income and had a market value of $80 billion (Nov. 2021). To his credit, Coinbase’s chairman and CEO Brian Armstrong has successfully navigated the company through four boom and bust crypto cycles, since 2012. However, if you have a lot of cash or crypto at Coinbase, it’s a good idea to learn the pie chart system, and consider an FDIC-insured bank for the fiat currency. Binance Binance claims to be the largest crypto exchange by trade volume. In a Special Report issued on June 6, 2022, Reuters accused the company of allowing hackers, fraudsters and drug traffickers to launder at least $2.6 billion between 2017 and 2021 (when the company launched its ICO). There have been multiple reports that the SEC is investigating the BNB IPO and potential money-laundering, while the IRA is looking into tax evasion. Since it is still privately held, financial information is very hard to find. Binance’s CEO Changpeng Zhao says the company has no headquarters. Binance is building a full-service crypto company, with a crypto VISA and ATM withdrawals, in addition to trading and wallets. However, who is going to use crypto as a currency when Bitcoin was worth $69,000 last November and is just $17,000 today (perhaps hackers, fraudsters and drug traffickers)? While stablecoins have potential as payment, they are largely not being used as money. Additionally, LUNA, Blockfi and FTX are reminders that the Crypto Winter can freeze stablecoins, too. The risks to Binance are an extended period of crypto weakness, government scrutiny, regulation and fines, and potential contagion from the other crypto bankruptcies. Binance’s CEO Changpeng Zhao disclosed losses from FTX on Twitter (without providing details). $1.35 billion of crypto assets were withdrawn from Binance on Nov. 12, 2022 after the collapse of FTX, according to CryptoQuant. Binance offers a potentially exciting business model that will have to make it through the Crypto Winter to be viable. However, there are still questions about the shady nature of its clients (which can land the company is severe hot water). Binance’s CEO CZ is a rock star in the industry. Unlike SBF, Zhao had successful ventures prior to Binance. However, despite the efforts of CZ to calm his clients, there is no guarantee that Binance can survive the continued fallout of FTX and crypto. In the event of a Binance bankruptcy, cash deposits will not be FDIC-insured. This is another bank pass-through arrangement. SoFi Sofi is a small, young, cash-negative, publicly-traded financial services company, with a market value of under $5 billion. The company experienced 56% year-over-year revenue growth in the 3rd quarter, largely as a result of a large increase (71%) in personal loans, to $2.8 million. However, the company lost $484 million last year, and only has about $1.26 billion in cash (some restricted). They offer crypto trading with no fees and fractional shares, in addition to many other traditional banking services, including personal loans, student loans, checking and savings. SoFi’s investing web page clearly states that SoFi Invest accounts are not FDIC-insured. (The company offers FDIC-insured checking and savings accounts with 3.25% interest through their bank.) Gemini Founded in 2015 by Cameron and Tyler Winklevoss, Gemini offers an exchange to trade crypto, a credit card, staking, NFTs and a place to store your fiat currency. On Nov. 16, 2022, the company suspended customer redemptions of its “Earn” cash product. This news is buried, so new customers might not even be aware of this. However, if you link to the Tweet below, you’ll see plenty of grief and heat in the responses from harmed depositors, who are still waiting (and praying) to withdraw their money. New Gemini clients are enticed through an affiliate program, where approved affiliates receive a commission for new active customers. So, if you have someone recommending the company, they could well be doing so for their own benefit. Another red flag is the lack of transparency of the company. Finding out who runs and oversees Gemini should be as easy as a few clicks on the company website. Good luck finding out who sits in the Executive Suite with the Winklevoss brothers. Employees voting on Comparably gave the company’s management team a D. The more red flags, the greater the risk. Schwab & Fidelity Currently these brokerages do not allow cryptocurrency trades on their platform, though investors may be able to purchase ETFs with crypto holdings (many of which are put together by young, underfunded, cash negative, small cap fund companies). Schwab is a publicly traded, large cap company, while Fidelity is privately held (FMR LLC). Schwab and FMR both have credit ratings of A- by S&P Global. Both offer FDIC-insured cash deposits through pass-through banking policies. Schwab and Fidelity both have FDIC-insured banks. An inquiry with the FDIC to discover whether or not the brokerage and bank relationship is a pass-through agreement, or if the brokerage is FDIC-insured by nature of the banks owned, yielded a response that the agency doesn’t comment on “open and operating institutions.” During the financial crisis of 2008, Fidelity took TARP money, while Schwab did not. Interactive Brokers Interactive Brokers is a publicly traded, large cap company with a credit rating of A- by S&P Global. Interactive Brokers allows crypto trading in Bitcoin, Ethereum and Litecoin, in addition to the universe of stocks, options, futures and more. Interactive has a much higher debt-equity ratio than Schwab (3.6 compared to 0.78) with a much lower market value (just $34 billion). The company’s FDIC-coverage is another bank pass-through plan. What About Just Holding the Keys to Your Own Hard Wallet? The biggest danger is that you’ll lose your key or have it stolen. If you lose the key, you can’t access your crypto. (This happens.) The other downside is that hard wallets are designed for a long-term HODL, which means that you’re riding the waves of volatility, oscillating between lavish wealth and penury. If you look at the average holding period of your favorite coin, you’re bound to discover that you’re the only one HODLing. The idea that crypto will be the only thing of value when fiat currency is worthless is an effective marketing campaign, but has little probability of happening. If we enter an Apocalypse, it will be easier to rent a room in your home or barter food than to bargain with a hard wallet full of hard-to-access digital coins. Safe havens like crypto today and gold/silver in yesteryear, are highly volatile and tend to underperform assets over the long-term. Bottom Line While this may seem like a lot to keep track of, using the pie chart system with regular rebalancing (1-3 times a year, not more or less), and sticking with well-capitalized, well-run crypto companies with experienced executives who have been successful in business for more than a decade should put you on the right side of the trade and in a seat that is less likely to get frozen in the Crypto Winter. For cash assets, FDIC-insured bank deposits are going to be safer than pass-through brokerages. There are also some creditworthy, rewarding bonds and other nontraditional safe, income-producing investments to consider. Money market funds are vulnerable, TIPS and bond funds are losing value, and bonds are tricky, which is why we spend one full day discussing what’s safe in our Financial Freedom Retreats. New Year, New You Financial Freedom Retreat If you're interested in learning 21st Century time-proven investing strategies for building and protecting your wealth, and managing challenging economic times (from a No. 1 stock picker,) join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details. Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed