|

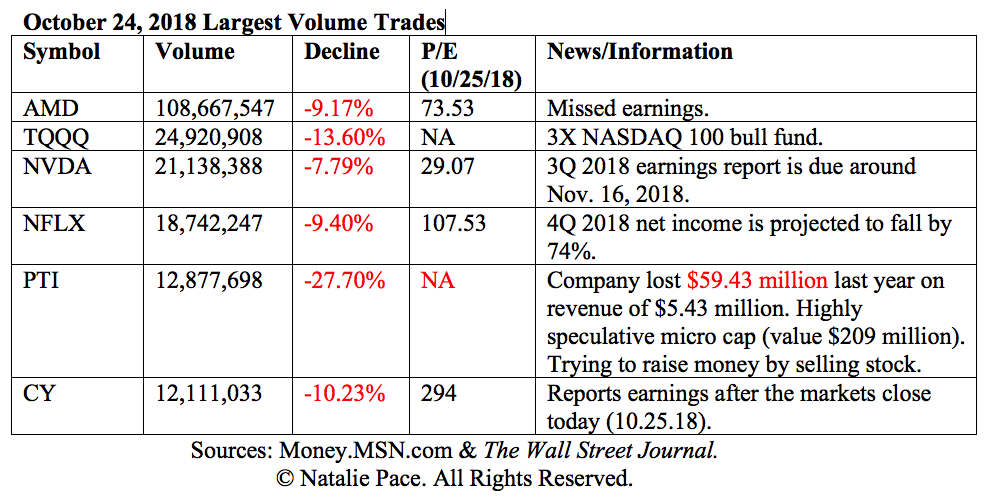

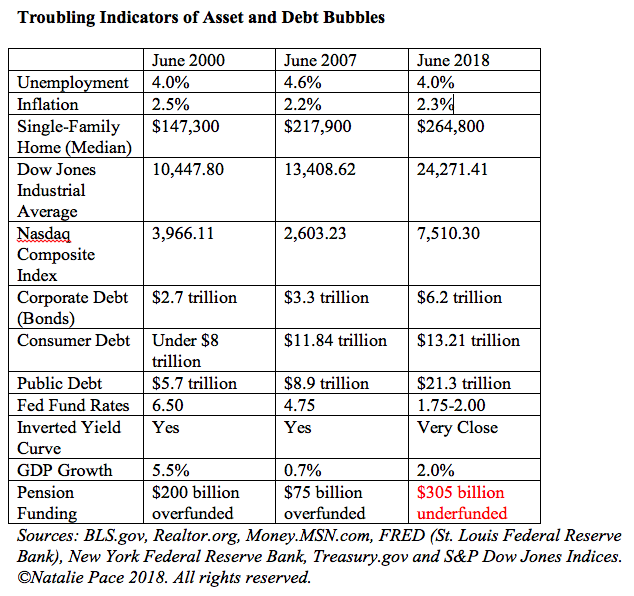

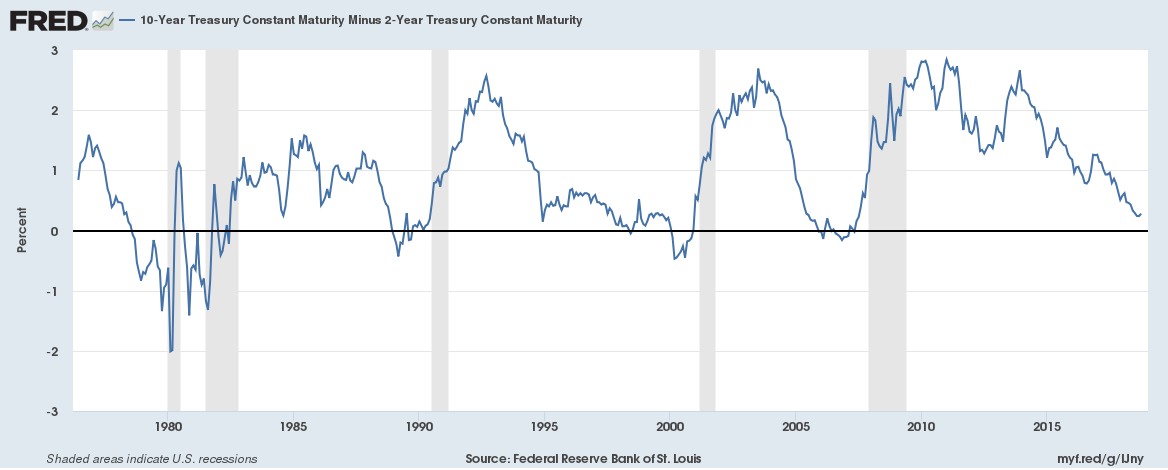

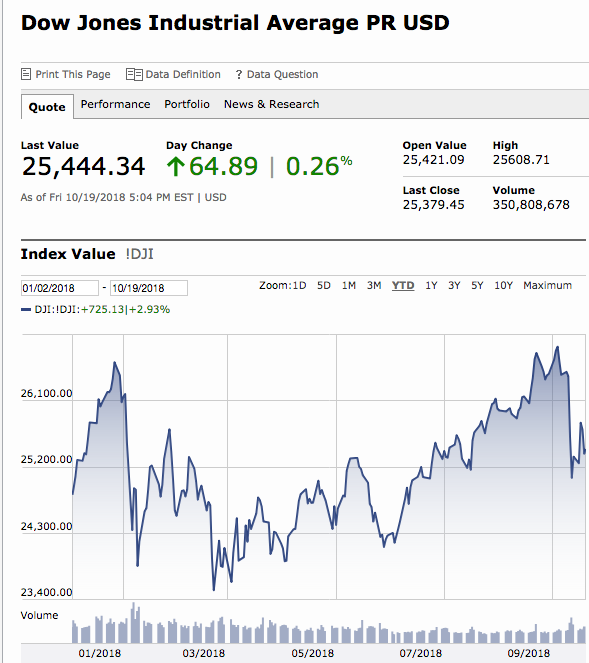

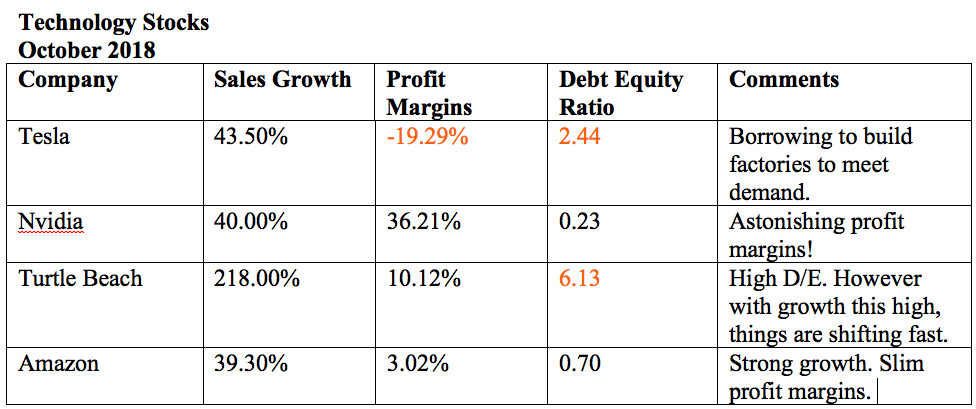

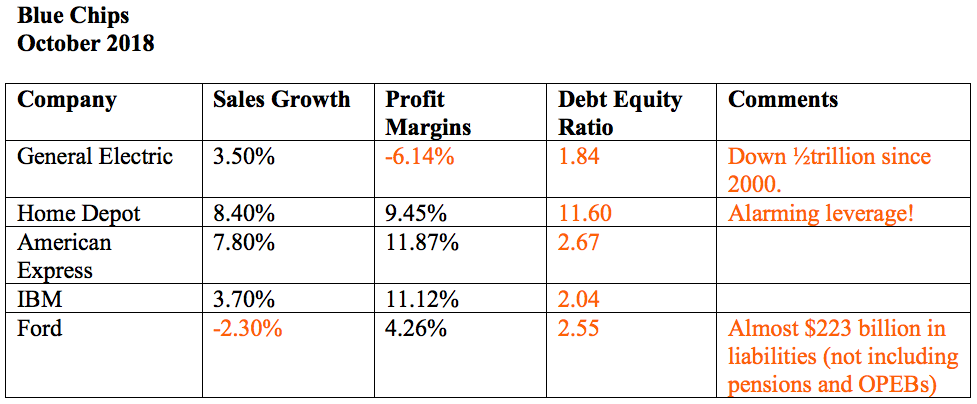

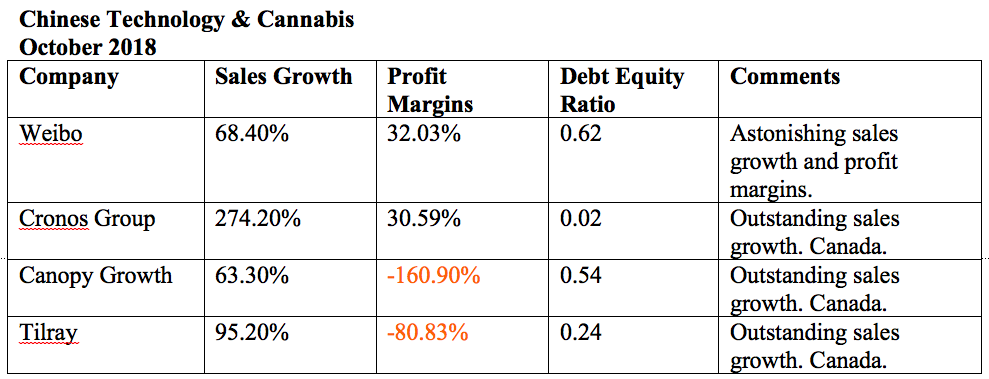

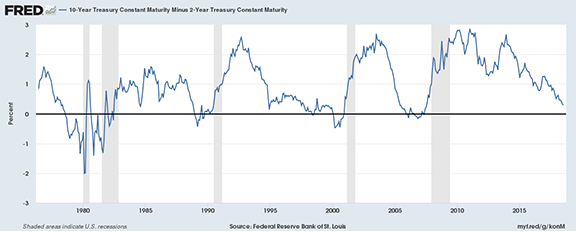

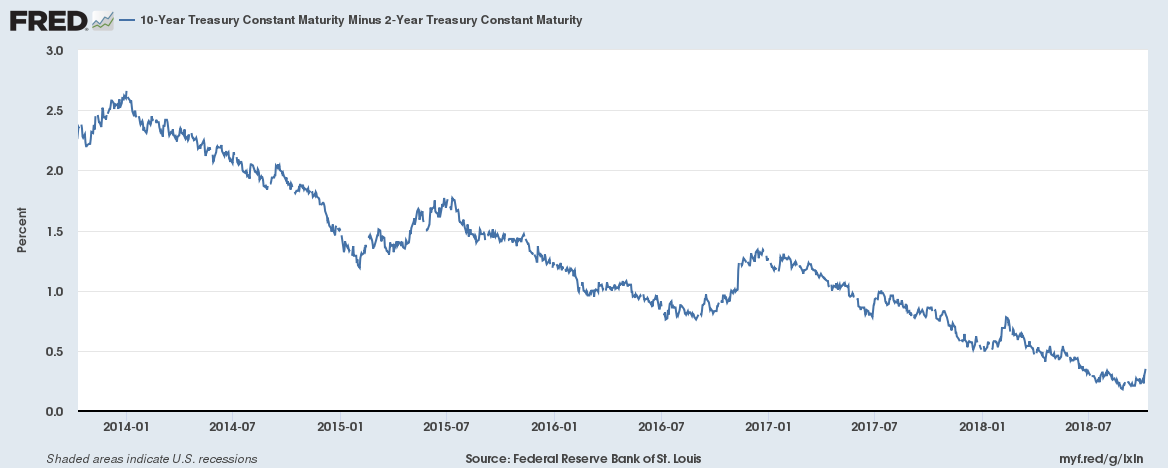

October Spooks Investors. A Tale of Bubbles, Speculation and Greed. On October 24, 2018, stocks wiped out their gains for the year. The NASDAQ Composite Index dropped 4.4%, and the Dow Jones Industrial Average dropped 608 points. What happened was a tale of … Bubbles, Speculation & Greed The average P/E of the S&P500 Index from 1936 to today is about 17.18 (source: S&P Dow Jones Indices). The technology stocks that crashed on October 24, 2018 were all trading at a much higher price to earnings ratio than the average, and most were above 50. Growth stocks can certainly take a higher valuation based upon forward earnings potential. However, when the growth dries up, if valuations are too lofty, then you get rapid corrections such as we saw on Wednesday. In today’s world of high frequency trading and novice options traders and speculators, the correction in a few stocks can trigger a cascade in the larger marketplace. Yesterday, the largest volume trade was Advanced Micro Devices, with a volume of 108.7 million shares (compared to an average volume of 27 million). AMD lost 9.17% in value in advance of earnings. After the markets closed, AMD reported that they had missed their projections. Revenue was down 6% quarter over quarter, and net income was down $14 million from the 2nd quarter 2018. Even with the sell-off, the P/E for AMD is still 73.53. The $34 share price that AMD enjoyed in late September was up three times from the low of $9.04 in April 2018. AMD’s price on October 25, 2018 opened at $17.92. As the NASDAQ began dropping, speculative traders starting abandoning positions. The second largest volume in the NASDAQ was the ProShares 3X Bull NASDAQ fund (symbol: TQQQ), followed by Nvidia, Netflix, Proteostasis Therapeutics and Cypress Semiconductor. Check out the chart below for details. One other lesson of yesterday is that the smart money is tripping the sell button before earnings. Warren Buffett sold all of his General Electric stock a few months before GE cut their dividend in half and before the share price dropped by half. Yesterday, 108.7 million shares of Advanced Micro Devices and 12.1 million shares of Cypress Semiconductor traded before the earnings release. Tomorrow the advance estimates for 3Q 2018 GDP growth in the U.S. will be released. The estimates for what this will be are all over the board, from 2.1%-3.6%. If GDP comes in low, investors will be tempted to sell – largely due to the frothy valuations. If GDP comes in high, then we may have a Santa Rally… There are a lot of ifs in that sentence. Things to keep TOP OF MIND. Asset Bubbles are more problematic today than they were in 2000 or 2008, before the Dot Com Recession and the Great Recession. See the chart below. Learn more in my blog on why interest rates are rising. Quiet Periods Companies have a 2-week quiet period prior to announcing earnings. Since this bull market has been built on buybacks, when companies can’t purchase their own stock, the general marketplace has dropped (early February and again early October). Valuations are frothy – too frothy for weaker revenue and earnings growth. The tax cut boosted EPS (earnings per share) in 2018. However, without the help, 2019 growth should sag. Financial Engineering, particularly in the Blue Chips, has made earnings look stronger and share prices look lower than they really are. As interest rates rise, it will become more expensive for over-leveraged companies to continue this practice. Rising Interest Rates typically stalls out home buying and weighs on real estate. It will also hit highly leveraged companies hard, particularly dividend stocks. The higher the dividend, the higher the risk. Flat Yield Curve. The reason that inverted yield curves are so highly correlated with recessions (100% since 1980) is that banks make their profits on the spread. As short-term Fed Fund interest rates rise, we get closer and closer to an inverted yield curve… In the chart below, the grey areas are recessions. The truth is, as Alan Greenspan warned us on January 31 of this year, stocks and bonds are in a bubble. Bubbles pop. Getting safe is not a matter of market timing, particularly since the “safe” side of most nest eggs is losing money, too. A better strategy is to adopt the time-proven system that earned gains in the last two recessions and has outperformed the bull markets in between. Call 310-430-2397 to get an unbiased second opinion on your current strategy or to learn more. Other Blogs of Interest Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. How Have The Markets Performed This Year? Like a rollercoaster. The S&P500 index is actually up 2.7% on the year. That’s not enough to cover the fees that many financial advisors and mutual funds charge. Additionally, there have been two periods of dramatic dives. In early February and again on October 10-11, 2018, the Dow Jones Industrial Average dropped 5%. Will There Be a Santa Rally? So, will it be smooth sailing from here on out? The short-term economics support a Santa Rally. The long-term economics suggest that this 10-year bull run is near its end. That is why every little event can spark a sell-off, particularly if something occurs right before earnings are released. In early February, stocks headed south when Alan Greenspan appeared on Bloomberg and said that stocks and bonds are in a bubble. In October, the drop was largely due to a little known, behind-the-scenes phenomenon called The Quiet Period. Blue Chips have been borrowing money cheaply and buying back their own stock. However, two weeks before a company releases earnings, during the quiet period, the kibosh is put on buybacks. The volatility in early February was also during a quiet period. The next quiet period will happen in late January/early February. Blue Chips vs. Technology. A Tale of Two Indices. U.S. Stocks U.S. stocks are a tale of two indices. The NASDAQ Composite Index leans toward younger companies with great earnings, that are overpriced. The Dow Jones Industrial Average hosts legacy brands, many of which are weighed down by pension promises, health care costs and debt, but are using financial engineering and cheap, easy, borrowed money to make their earnings look better than they are. They are also overpriced. In the words of Nobel Prize winning economist and Yale professor Robert Shiller, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Companies like Advanced Micro Devices, Facebook, Nvidia have sales growth of 40% or more, with net profit margins of 5%, 39% and 36%, respectively. Turtle Beach’s sales growth was 218% in the last quarter! GE Lost Half a Trillion. Is Your Fave Blue Chip Next? On the other hand, many of the Dow companies have tepid or negative revenue growth with high debt and high price to earnings ratios, like American Express (2.67 DE, 28 PE), Home Depot (11.60 DE, 25 PE) & IBM (2 DE, 26 PE). General Electric has lost 80% of its value since 2000, so the story of overleveraging with financial engineering can be one of woe. Chinese technology and cannabis are on fire with sales growth. Many Chinese technology companies have high double-digit sales growth and profit margins 30% or higher. With Canada legalizing weed, publicly traded cannabis companies are boasting some of the highest sales growth rates seen in this bull market. Santa Rally or True Correction? So, will we have a Santa Rally? Or will the current sell-off continue? The Dow Jones Industrial Average was off 5.2% in just two days as of Oct. 11, 2018, while the NASDAQ was down 5%. Below are the pros and cons… GDP Growth. 4.2% in 2Q 2018. The 4.2% GDP growth in the 2nd quarter is something you’d have to be living under a rock to miss. This was strong – boosted at least 1% by a rush by the Chinese to buy soybeans before the tariffs kick in. Most analysts predict a decent 3rd quarter GDP report, though not as strong as 2Q. (The projections are virtually useless, ranging from 2.1% - 3.9%.) We’ll get the advance estimate on Oct. 26, 2018 (Friday). If the numbers are 3.9% or higher, investors could dance and sing, and we could see a rally. 2.1% growth could silt returns in stocks, even though everyone wants to be happy during the holidays, which often helps Wall Street to rally. A natural, political or terrorist disaster could spoil the fun no matter where the numbers land. Tax Cut and Tariffs Boosted Earnings in the 2nd Quarter 2018 Analysts are optimistic about the 3rd quarter 2018 earnings. According to Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices, “With S&P 500 Q2 2018 EPS being declared a success and setting a new record, attention is now on Q3 2018, which is expected to also set a new record with a 27.8% gain over Q3 2017, as it posts strong earnings and cash-flow, via lower tax rates and stronger sales.” Next year, it will be tougher to show earnings and sales growth, as there will not be a tax slash to boost profits and earnings. What Could Silence the Santa Rally? Tariffs. Tariffs hurt profits. There have been many industries that have warned the White House that their tariffs are going to hurt sales, profitability, growth and potentially cause layoffs in the labor force. Those industries include auto manufacturing, solar, utilities and more. Rate Hikes The Federal Reserve Board has indicated that they intend to keep raising the Fed Fund Rate. The most recent projections from the September meeting suggested that the rate will hit 3.4% by 2020, with one more rate hike at the December 18-19, 2018 Federal Open Market Committee meeting. The “Smart” Money The sell-off on Oct. 10-11, 2018 was not prompted by any communication or action from the Federal Reserve Board. The “Smart” Money has been moving to take profits all year, causing large ripples in the market when they do. This 10-year bull market has been largely fueled by corporate buybacks. Rising interest rates make this a much more expensive proposition. Quiet periods happen every quarter, when corporate buybacks are not allowed. Hedge funds, high-frequency trading and general competitiveness are causing the markets to move at higher speeds and with deeper drops than in the past. Politics The markets don’t like uncertainty. We have that in abundance, not just here in the U.S., but all over the developed and developing world. Act of God Uncertainty is coming from natural causes, too. Every day there is a new report with a dire warning on climate change, or a catastrophic hurricane or other calamity. Real Estate Rising interest rates will limit the buyers, putting downward pressure on prices. If you’re staying in your home, can afford it and aren’t underwater on your mortgage, consider locking in a fixed interest rate now. If you are still underwater on your mortgage, can’t afford your home or can’t lock in a fixed rate, then it’s time to look at options that the debt collector, mortgage broker and bank will not offer you. Cryptocurrency This is still the Wild West for cryptocurrency. The space is rife with scams and shysters. That doesn’t mean that there isn’t a future for blockchain or Bitcoin, Ethereum, Litecoin and more. But it does mean that you should only gamble with a sliver of your money, and only that which you are willing to lose. You also need to grade your guru before you buy into anything. Many slick snake oil salesmen are jumping into this space with MLMs that are designed to line their pockets while draining your bank account. Your best next move is to know what you own, and make sure that you are properly protected from a downturn, with exposure to assets and industries that will hold their value or increase in value if stocks and bonds fall. That requires education and an unbiased second opinion on your current plan. Call 310-430-2397 to learn more now. Market timing rarely works. So, don’t just sell everything, or shift from stocks to bonds, without knowing what you are doing. You need to employ a time-proven strategy that earned gains in the last two recessions and has outperformed the bull markets in between. It’s easy-as-a-pie-chart, which is why I call it the ABCs of Money that we all should have received in high school. Part of that process is understanding that Wall Street has become a Tale of Two Indices. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Know what you own now, while the markets are still very high. Click to listen to my teleconference on the 2018 Santa Rally. If you'd like to learn these time-proven nest egg strategies, join me at an upcoming Investor Educational Retreat. Call 310-430-2397 to learn more. Other Blogs of Interest The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Dow Dropped 832 Points Today. What Really Happened? It was a cascade. Bond rates fell. The yield curve flattened. That spooked investors. Sparking a sell-off. An inverted yield curve has a very high correlation (100%) with recessions, and a flat yield curve is dangerously close to an inverted yield curve. As you can see in the chart below, every recession since 1980 was preceded by an inverted yield curve. Recessions are indicated in grey. When the blue line dips below 0, the yield curve is inverted. As you can see in the chart below, the difference between the yield on the 2-year Treasury bill and the 10-year Treasury bill is negligible at 2.88% and 3.21%, respectively. In other words, the yield curve is flat. Even if you don't know the first thing about yield curves, you can get informed on what is driving today's sell-off, and how to protect yourself. Read more on the yield curve and why the Federal Reserve Board is determined to keep raising interest rates, in my blogs "5 Warning Signs of a Recession" and "Odds of an Interest Rate Hike are Above 90%." It is being reported that everything fell, which isn't true. There was one industry that gained. Since that asset is selling at a bargain right now, it's worthy of consideration as a hedge against further losses. Remember, however, that a healthy nest egg is never all in/all out, but is, rather, based upon time-proven, easy-as-a-pie-chart strategies that earn gains in recessions and outperform the bull markets in between. Wisdom, now more than ever, is the cure! (We teach these at our Investor Educational Retreats. Call 310-430-2397 to learn more.) So, will the problems and issues continue. Or will the markets stabilize? The near-term financial indicators support a Santa Rally. The long-term financial indicators support getting defensive. As I said in my "Back to School Stock Sales?" blog on September 13, 2018: Earnings support a Santa Rally this year, if the interest rate hikes don’t spook investors. There is a big if in that sentence, so the most important stance for the Santa Rally is a defensive one. Make sure your assets are protected, that you have enough safe and that you know what is safe in a world where bonds are in a bubble. It’s never a matter of jumping all in or all out. Today, interest rates spooked investors, pushing up the clock on when you should make sure that you are safe from the next downturn, and that you know what is safe in a world where bonds are losing money, too. Call 310-430-2397 to learn my time-proven, easy-as-a-pie-chart nest egg strategies. They earned gains in the last two recessions and have outperformed the bull markets in between, which is why they are enthusiastically recommended by Nobel Prize winning economist Gary Becker and TD AMERITRADE chairman Joe Moglia. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "I earned gains in the Great Recession. Thank you Natalie for saving my retirement!" Nilo and Bill Bolden Other Blogs of Interest Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Most of us don't know that this year’s time bomb in our retirement plans is hidden on the "safe" side. Why? Mainly due to: Interest Rates to Double in Two Years Bond Values Sink When Interest Rates Soar Hiding in the Shadows Sneaky Names Invested Like Babies And here’s the score on each red flag… Bonds 101: Why the “Safe” Side of Your Nest Egg is in Trouble. Interest Rates to Double in Two Years Interest rates are set to hit 3.4% by 2020. That’s more than double where they started 2018. So, why is that a problem? Because… Bond Values Sink When Interest Rates Soar If you have a 4% 30-year Ford Motor Company bond, and Ford borrows more money at a higher interest rate, then everyone will want the higher interest rate and no one will want your bond. If you have to sell it (for whatever reason), then you’ll have to sell it at a discount to find a buyer. In the worst-case scenario, you won’t be able to sell it, and your bond becomes illiquid, forcing you to hold it for 30 years. You’ll have to just pray that the company will take the bond to term without restructuring debt. Since over ½ of investment grade corporations are BBB (the lowest rung of investment grade before junk bond status), most bond funds are riskier than investors are aware. So, there is both credit risk and interest rate risk preying on the “fixed income” side of your nest egg – which is supposed to be the safe side. The safe side is not supposed to lose money, so you need a better design than bonds to ensure that you keep your dough in 2018 and beyond. For these reasons (and more), keep the duration of your bond terms short and the credit quality high. Do not assume that “investment grade” means safe. Know the composition of your bond fund and know the debt load, profit margins, sales growth and pension funding status of any corporation that you hold bonds on. Hiding in the Shadows Many plans lump bonds on the “fixed income” side, without giving you a lot of details. I’ve been conducting a 2nd opinion on several nest eggs. Across the board, without one exception, I’m finding that almost everyone who thinks that they are safe are actually invested in very risky fixed income strategies, including junk bonds and high-risk mortgage securities – that are already losing money! As interest rates rise (and they are), the risk of capital loss increases. Most of the time it is very tricky getting the details on what you are actually invested in, which is why the second opinion can be so valuable. Sneaky Names A fund might simply call itself Bond Fund A. After clicking around on a wild goose chase, you might finally discover that the bond fund is actually invested in junk bonds – without giving any indication of that in the bond fund name. Another fund was called a Short-Term Income Fund. It was actually high-risk mortgage backed securities, which were already losing principal value. As interest rates rise raising the cost of borrowing, corporations with a lot of debt become more vulnerable than credit-worthy companies (although all bonds lose capital value when interest rates rise). Invested Like Babies Most people are invested like they are half their age. Some are invested like teens or children. You should always keep a percentage equal to your age safe. Overweight 5-20% additional safe in the 10th year of the bull market to protect yourself from the next downturn. That simple strategy earned gains in the last two recessions. That and adding in hot industries, along with annual rebalancing, outperformed the bull markets in between. In a world where stocks and bonds are in a bubble, according to Alan Greenspan, FDIC-insured cash is only the first step of getting safe. There are some excellent choices for preserving your principle that are not found at brokerages and are not paper money. Getting safe is so important, and so tricky in today’s world, that I spend one full day on this at my investor educational retreats. In other words now is the time to understand clearly what you own, and to know what a healthy retirement plan looks like. This is actually easy-as-a-pie-chart, which is why I call it the ABCs of Money that we all should have received in high school. Start with a second opinion. Call our office at 310-430-2397 or email info @ NataliePace.com now to get started. Last week I interviewed the chief fixed income strategist for Schwab, Kathy A. Jones. We discussed the many problems with bonds, rising interest rates, “fixed income” and the “safe” side of the average retirement plan. Check out that blog here. Other Blogs of Interest Interest Rates Set to Jump 70%. Watch out investors and homeowners! Should I Invest in Ford and General Electric? The Tesla 3 Becomes the Top Selling Car in the U.S. Cryptocurrency Scams and Phishers. Back to School Stock Sales. Gold vs. Facebook. Nike Share Price and the Kaepernick Ad. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed