|

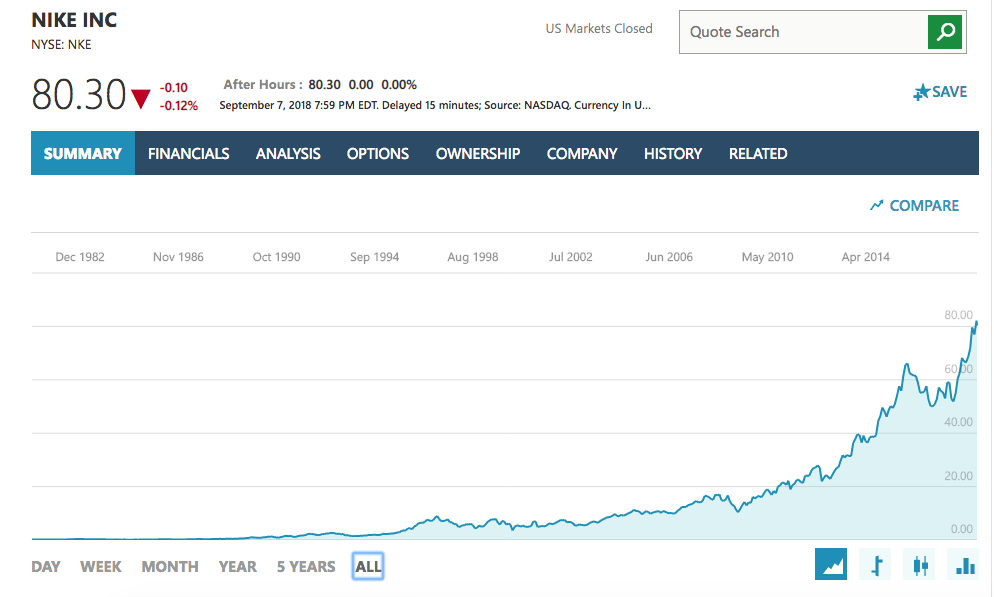

Did Nike Drop From $500 to $80/Share on the Kaepernick Ad? Investors Ask Natalie. Dear Natalie: A friend is suggesting that I buy Nike stock, which he says has fallen from $500 to $80 because of the ad featuring Colin Kaepernick. What do you think? Signed, A Little Help from My Friends Dear Friend, Wow. This is the best example of why you should never act on a hot tip from a friend that I’ve ever seen! As you can see in the chart below, Nike stock is trading at an all-time high at $80/share! I have no idea what your friend’s motivation is in trying to get you to buy Nike right now, but I can tell you that she’s no Warren Buffett! If this was a tip from a financial planner, then she has just tipped her hand that she's a salesman after her own interests above yours. In that situation, it's time to get an unbiased second opinion on your entire financial plan as soon as possible. (Call 310-430-2397 to learn more about how to receive my unbiased second opinion.) On September 4, 2018, Nike stock dropped about $2/share, but it’s still very pricey. I don’t see any compelling reason to jump in at a 68.50 price to earnings ratio, in the 10th year of the bull market. If you like the ad, a better investment would be to support the company’s controversial decision by buying Nike’s shoes and clothes… I’d wait for a truly (not hearsay) better price before buying the stock. If you'd like to learn how to access this simple data, and use the tools for evaluating investments that earned me the ranking of #1 stock picker, join me at one of my Investor Educational Retreats. Call 310-430-2397 to learn more. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed