|

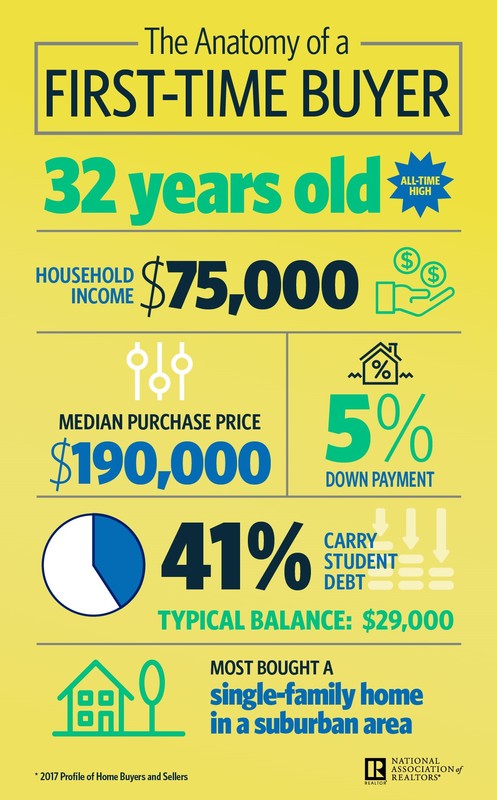

The Senate Passes the Tax Bill. Should be Law By Friday. This blog includes Expert Analysis on How Homeowners Will be Affected, Startling Statistics on the Benefits of the American Dream, and 6 Tips to Successful Home Ownership. The Tax Cut and Jobs Act Passed the House Tuesday, with the Senate voting yes in the wee hours of Wednesday morning. It was a partisan vote, passed narrowly with a simple majority (a few votes actually) by Republicans. The House will have to revote on Wednesday, due to two provisions that had to be changed. The Tax Cut and Jobs Act Bill is expected to be signed into law this week. Just hours before the House passed the Tax Cut and Jobs Act today, Paul Ryan tweeted, “This is going to make such a positive difference in the lives of everyday working Americans from all walks of life." Bernie Sanders suggested that a better name for the bill is, “Trillions 4 Billionaires.” And homeowners everywhere, particularly in the NorthEast, waited for the final markup of the reconciliation of the House and Senate bills to see whether the American Dream of homeownership was on the chopping block. How Will the Tax Bill Affect Real Estate & Homeowners? Dr. Lawrence Yun, the chief economist of The National Association of Realtors was quite clear about the impact the bill will have on real estate. In my interview of December 13, 2017, Dr. Yun stated: In terms of homeownership, the Tax Bill will be negative. Homeowners who feel an extra financial burden might wish to sell. Buyers will want to scale down. They will want a smaller home and a lower price, so they can stay within the mortgage interest deduction and property tax deduction limits. The upper end market will become much softer, while some of the residents living in high property tax states like New Jersey, New York, Connecticut and Illinois, may want to move elsewhere, where there is a lower property tax. If you live in Silicon Valley, Silicon Beach, Seattle, New York City or Denver, the $750,000 mortgage interest deduction cap will trim back some of the mortgage interest that you can deduct on your taxes. For a large number of people living in expensive cities, this tax credit has been a lifeline keeping them afloat. If you live in the Northeast, the $10,000 cap on your property tax deduction could be the straw that breaks the family’s budget. New Jersey is already the state with the most foreclosures, and the changes to the treatment of property taxes are likely to make the situation even more dire (source: ATTOMDATA.com). On the other hand, there are a few changes in the bill to be grateful for. Elizabeth Mendenhall, the president of The National Association of Realtors, issued a statement on December 15, 2017, writing, “We are particularly pleased with the treatment of capital gains on the sale of a home and the preservation of deductions for second homes. We are also grateful that the positive changes for commercial real estate and real estate professionals from the Senate bill have survived.” However, she too was concerned that “the overall structure of this bill poses problems for homeowners and the broader housing market.” Homeownership is one of the most important ways that Americans build wealth. In the 2016 Survey of Consumer Finances, conducted by the Federal Reserve Board, one of the most startling statistics was the difference in median net worth between homeowners and renters. Median inflation-adjusted net worth—the difference between families’ gross assets and their liabilities—was $231,400 for homeowners in 2016 vs. $5,200 for renters. So, how do you ensure that you build wealth, in today’s world, where single-family homes are higher priced than they’ve ever been and the new tax code is limiting the amount of the costs that you can write off? Here are a few tips. 6 Tips for Achieving the $231,400 Homeowner Net Worth Or More (Vs. the $5,200 Renter Net Worth)

The new tax bill limits the deductions that homeowners can take, but it doesn’t eliminate them. Some homeowners are going to be gravely impacted by the caps in mortgage interest rates and property taxes. However, for most Americans, the changes in the Tax Bill are important to note, but minor in actual impact. Consider the many advantages of home ownership, and keep your own American Dream alive, with the sound tips listed directly above. As Lawrence Yun told me last week, “Home ownership is the American Dream. Let’s ensure that home ownership incentives remain in place.” Listen to my complete interview with Dr. Lawrence Yun, the chief economist of The National Association of Realtors at BlogTalkRadio.com/NataliePace. Other Blogs of Interest: Government Shutdown Has Been Avoided. For Two Weeks. Warren Buffett is on the Sidelines. GE Investors Lose Half. If you are interested in learning successful homeownership, investing, protecting your assets, saving thousands each year with smarter choices and other important life math, join me at my Valentine's Financial Empowerment Retreat in the beautiful beach town of Santa Monica, California. This could be the best gift that you give yourself this holiday season. Only 4 seats are still available. Call 310-430-2397 to learn more now! Click below to access testimonials and to discover the 15+ skills you will learn. The Appropriations Bill that was passed last night by the Senate and the House, and signed by the President today, funds the U.S. government for two weeks, through December 22. All assumptions are that Congress will raise the debt limit again. That action should avert a credit downgrade for now. However, in a press release, Fitch Ratings notes that, while not raising the debt limit is the most significant short-term risk to the U.S. AAA Rating, “debt dynamics are also negative, which could put pressure on sovereign creditworthiness over the medium to long term.” (Translation: the astronomical U.S. debt could result in a credit downgrade soon, unless the debt limit shenanigans force a downgrade sooner.) Headlines and the Administration are all pointing to stocks reaching all time highs, 4.1% unemployment and 3.3% GDP growth rate in the 3rd quarter as signs of a healthy economy. In fact, Fitch has raised GDP growth expectations for 2018 to 2.5%. However, touting those gains leaves out a lot of other relevant facts.

Investor sentiment is positive. Everyone is happy with the Wall Street gains. However, this reminds me of the focus groups studies in 2002 that confirmed everyone liked mini vans and Hummers. Once gas prices jumped, all of the sudden everyone loved fuel efficiency. Once a Wall Street correction begins, and corrections happen in relatively predictable patterns, sentiment is likely return to where it was when the Occupy Wall Street movement began, in the wake of the Great Recession. If you are trading on headlines, you’ll always be late to the party and one of the worst casualties of the crash. Vision and foresight are valuable commodities. If you would like to protect your assets now, to reduce debt, adopt a thrive budget, save thousands of dollars every year in your annual budget, live a richer life, and have more money for bucket list vacations, while providing far better for your future, then it is important to learn the ABC’s of Money that we all should’ve received in high school. Our team offers free blogs, free monthly teleconferences, free budgeting and investing web apps, three bestselling books, private prosperity coaching, a second opinion on your current budgeting and investing strategy, and a three day Investor Educational Retreat where you can learn and implement all of this wisdom here and now, before the next downturn. Call 310.430.2397 to get answers to your money questions and to learn real solutions that will transform your life. Receive the best price for the Valentine’s Retreat in the beautiful beach town of Santa Monica, California when you register by Dec. 15, 2017 (during the Early Bird pricing period). Only a few seats remain available, so secure your place now, while you can. Happy holy days. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed