|

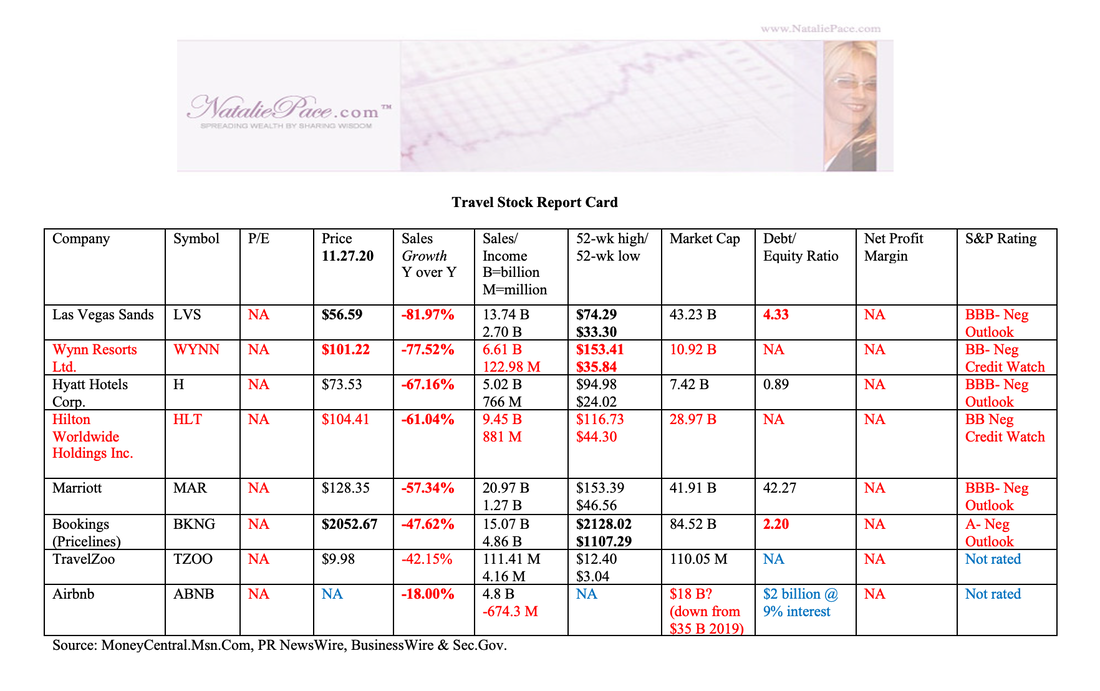

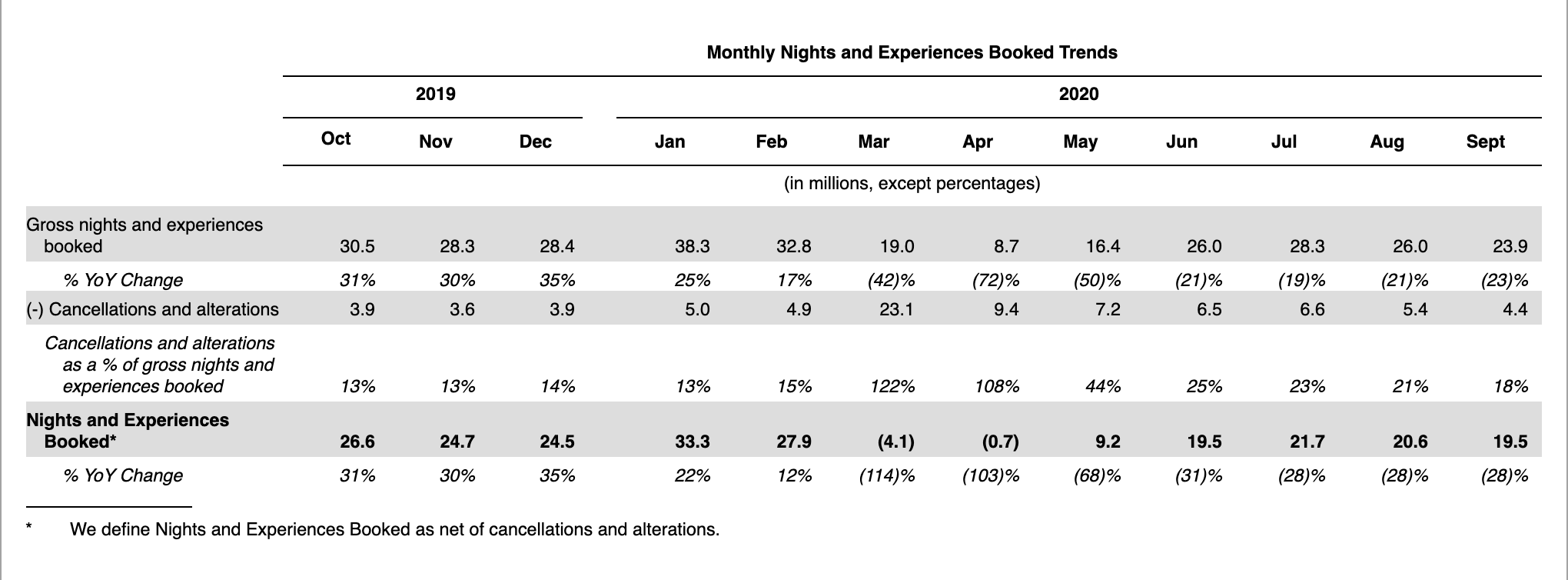

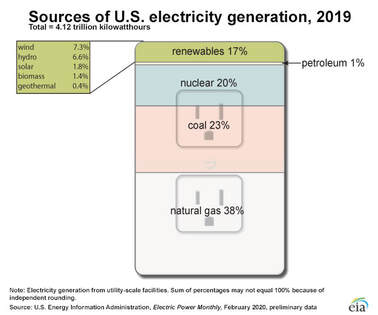

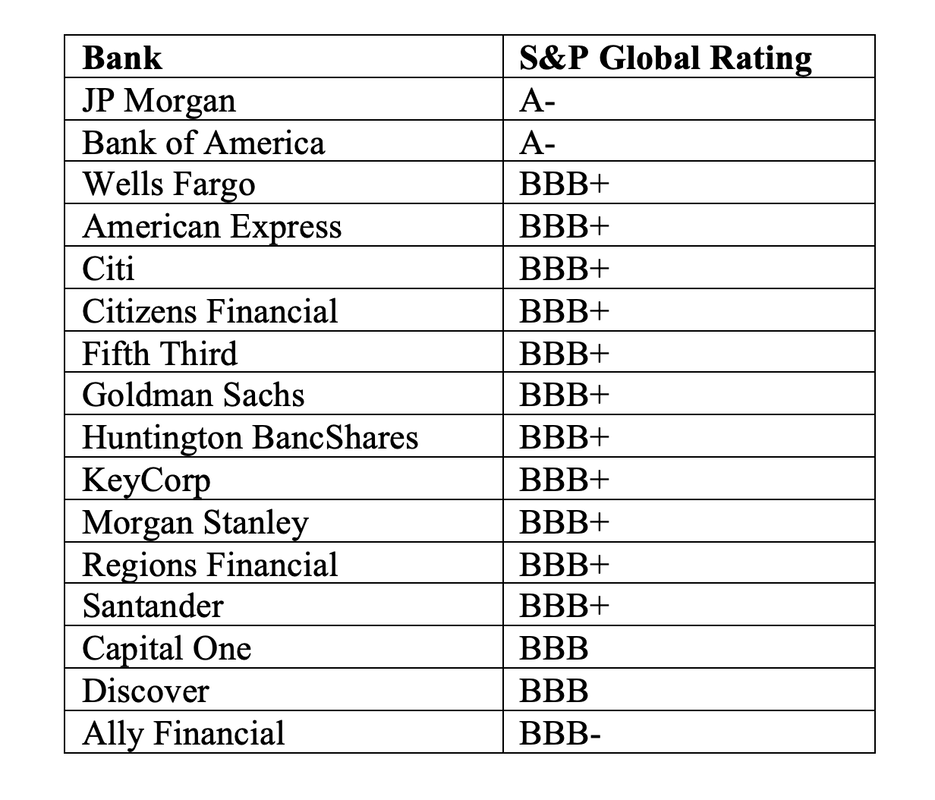

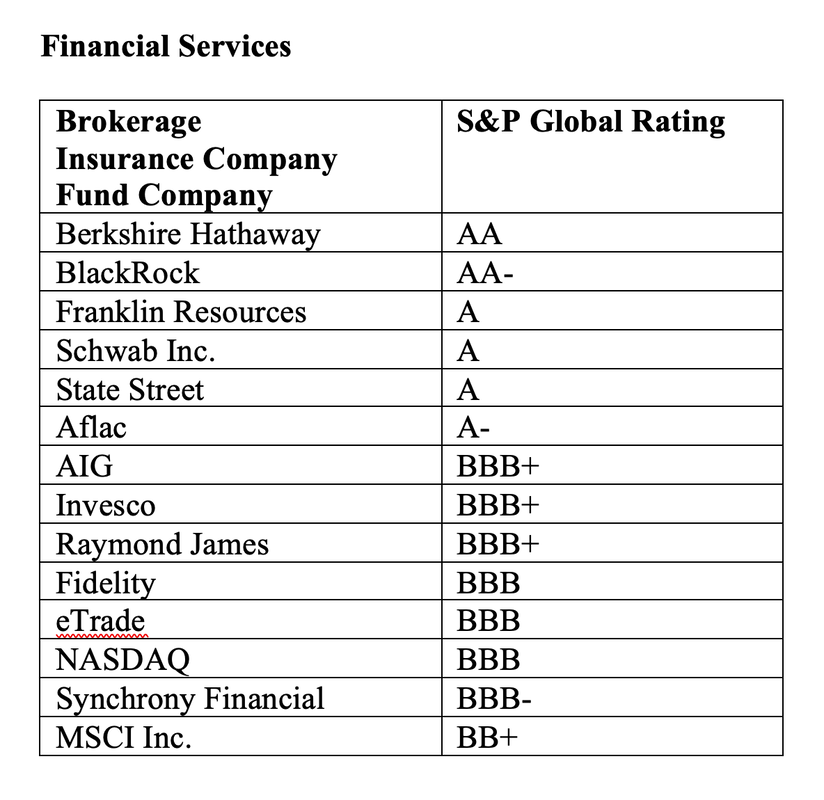

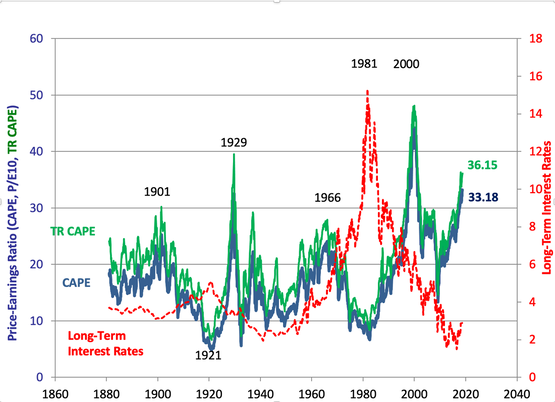

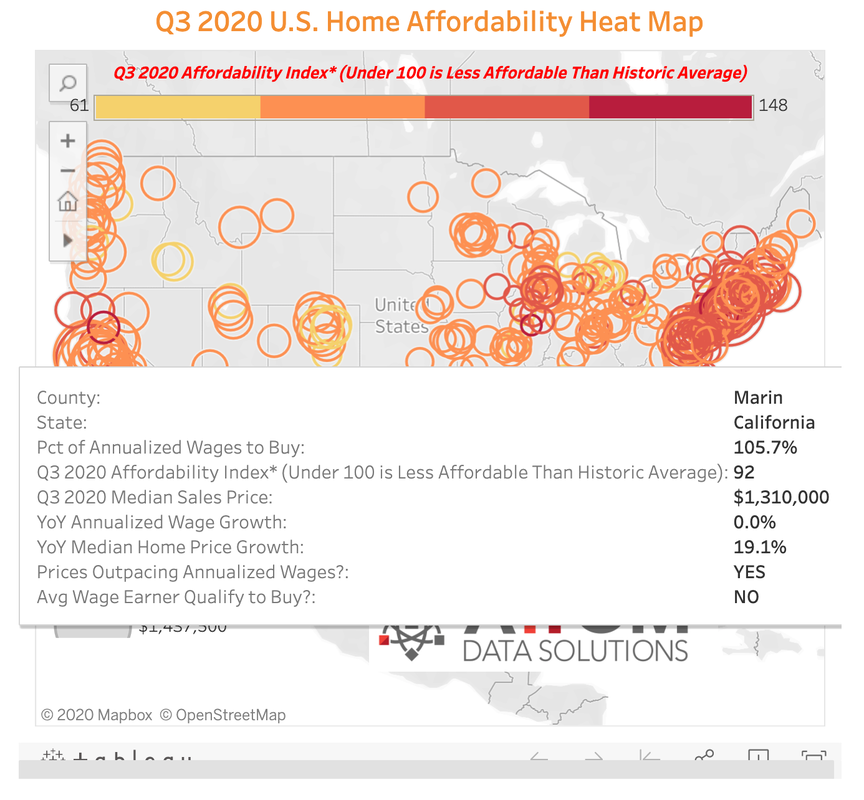

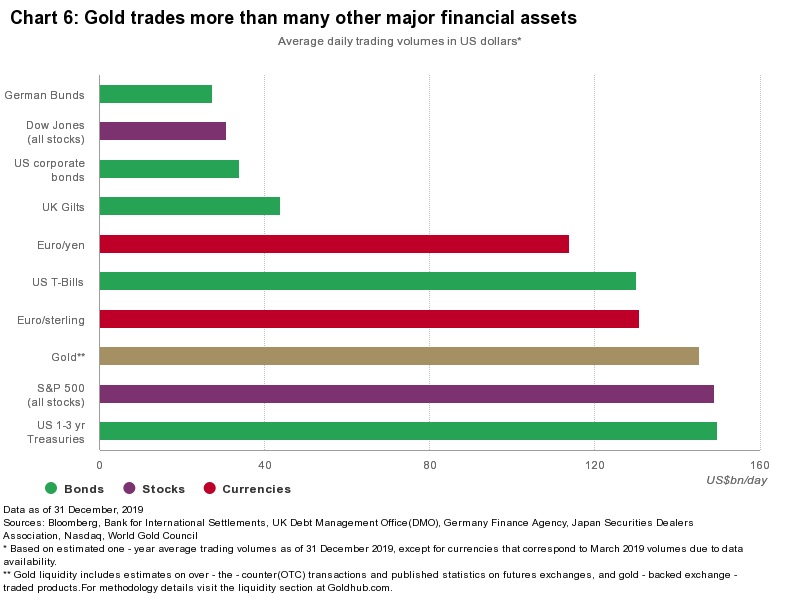

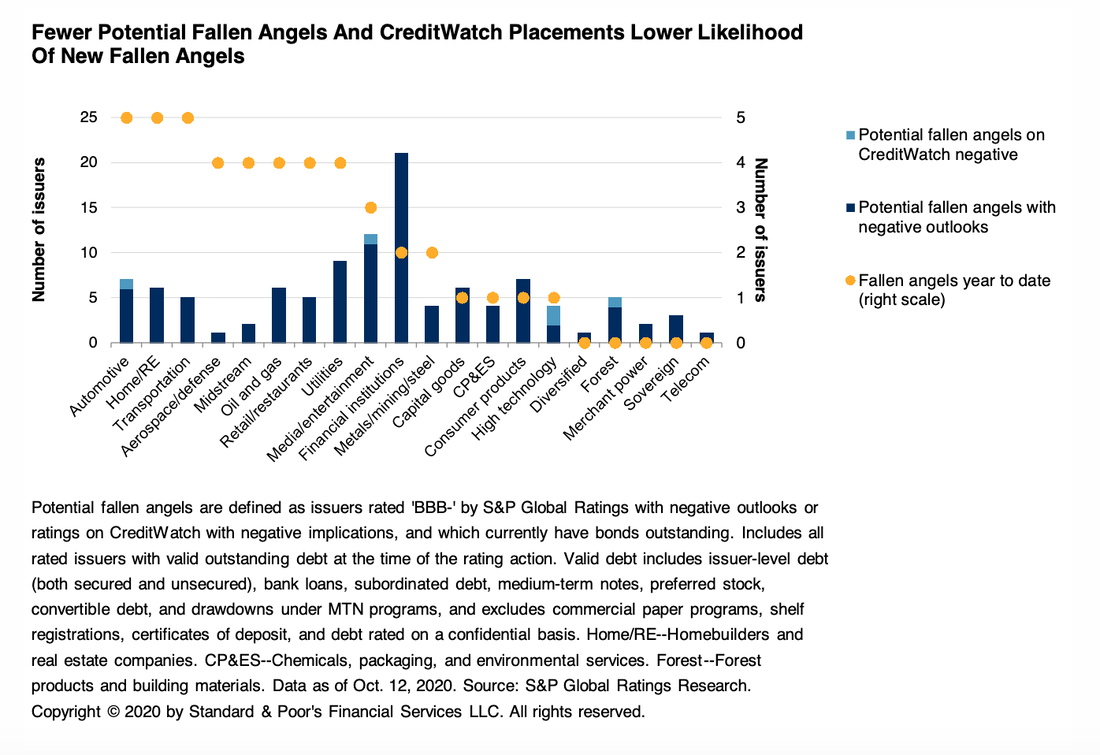

Airbnb Courts Hosts to Invest in the IPO. 6 Issues to Consider Before Riding this Unicorn Why is Airbnb racing to the big boards before the end of 2020? The money raised (estimated to be $3 billion) could be essential to continuing operations, as the 2020 net loss will be “substantial,” according to the company’s S-1 filing. However, another big piece of the equation is that Airbnb’s IPO – like many of the 2019 IPOs including Lyft and WeWork’s failed attempt – is a liquidity event to turn paper profits into cash for the insiders before options expire or there is further devaluation of the company. (Click to read our warnings on those 2019 IPOs.) The Sharing Economy Airbnb started in 2007 with an idea that many thought was crazy at the time – that strangers would stay in the spare room, or even on an airbed in the living room, at private homes. Now there are 4 million Airbnb hosts worldwide. The business model is compelling, particularly when you consider that 4 million hosts today grew from just two (the founders) in 2007. Millennials have enough money troubles with all of the student loan debt they are juggling. If they want any travel in their lives (post-pandemic), it might have to include a bit of couchsurfing. It’s unlikely the sharing economy is going away. Airbnb is Faring Much Better Than Hotels As you can see in the Travel Stock Report Card below, the third quarter year-over-year revenue plunged for hotels – after an equally terrible 2nd quarter in 2020. With a surge in COVID-19 infections, fall 2020 bookings are expected to implode again for Airbnb, hotels, casinos and other travel companies (including Bookings, Expedia, Trip.com and TravelZoo). The 3rd quarter was actually a period of recovery for many industries, with the U.S. GDP growth rebounding 33.1%, after sinking -31.4% in the 2nd quarter and -5.0% in the 1st quarter. That indicates that there are structural changes in the travel space – something that investors and lenders should account for. Meetings and conferences moved into Zoom rooms, rather than trying to navigate the in-person meeting restrictions posed by the pandemic. The Airbnb founders believed their market potential was $1.5 trillion in January of this year. In truth, it’s difficult to guess what the serviceable market of Airbnb will be in a post-pandemic world. Things changed overnight in a few short weeks in March 2020 for the company, when cancellations meant that the year-over-year bookings fell 114%. In September of this year, bookings were still down 28% year over year. At least half of Airbnb hosts use their home-sharing revenue to help pay their own rent or mortgage, according to an internal Airbnb survey conducted in 2019. So, the need for people to share their homes is still high, with home and rent prices hitting all-time highs, and housing being unaffordable in two-thirds of U.S. cities. The question is, “Will guests want or need to travel as much in a post-pandemic world?” Is business changed for the foreseeable future, or forever? Should Hosts Invest in the IPO? U.S. Airbnb hosts have been invited to participate in the IPO through a Directed Share Program at the IPO listing price. As a customer who has used Airbnb around the world, I’m a huge fan of the product. However, there are six issues with regard to the finances that would prevent me from wanting to be an investor at this time. 6 Issues with the Airbnb IPO Insider Liquidity Event It’s a very good idea for Airbnb to squirrel up as much cash as they can to weather the economic storms caused by the pandemic. Since they raised $2 billion in bonds under less-than-favorable terms in April of this year, including a severe haircut on valuation, it’s understandable that they would turn to the IPO equity marketplace. However, another motive is clearly to turn paper profits into cash for insiders and early investors. No Lock-Up for 15-25% of Shares. The policy to reward insiders and VCs is underscored by the fact that there is no lock-up window. Airbnb is allowing up to 15% of the stock to be sold by insiders on Day 1, with potentially up to 25% of shares able to be dumped on Day 2. Typically, there is a 6-month lock-up period where no insider selling occurs. Institutional investors might balk at this condition, whereas many hosts might not even read the S-1 filing. September Bookings Down 28%. Gross Booking Value Down 17%. Airbnb’s 3rd quarter 2020 revenue showing was the best in the hospitality space, with gross booking value down only -17%. Given the challenges of today, that’s pretty impressive. (Las Vegas Sands reported a year-over-year drop in revenue of 82%.) However, it is still a drop, and the 4th quarter this year is likely to be much worse. By comparison, Zoom’s revenue was up 355% in the 3rd quarter. Net Losses Since Inception Airbnb has had net losses since the inception of the company. The company was expanding to keep up with demand, which is understandable for a fast growing, early stage company. However, in 13 years of operations, Airbnb has never turned a net profit. In the S-1, Airbnb admitted that they’ll have to use a “significant” portion of their cash to support 2020 operations. Most companies today must make a strong case about their clear path to profitability in order to borrow money. This became essential to raising money last year, before the pandemic. This is likely why Airbnb had to borrow $2 billion in April of this year at 9-11.5% interest rates, with a valuation that had been slashed by almost half of its 2019 value of $35 billion, to a reported $18 billion in April of 2020 (per CNBC). In the S-1 filing, Airbnb underscored multiple times that they may not be able to achieve profitability. So, in addition to the problem of cash-burn, there could be an issue raising more capital going forward. Valuation: $18 billion? $30 billion? (Down from $35 Billion in 2019) The Wall Street Journal is reporting that Airbnb’s value today could ring in at $30 billion. Airbnb’s revenue was $4.8 billion in 2019. In the first 9 months of this year, Airbnb has only taken in $2.5 billion so far in revenue, with a -$697 million net loss, compared to a -$323 net loss in the same period of 2019. When considering valuation, it’s important to remember how much the value dropped in April. If you invest, and the share price drops as much as it did then, you’ll lose almost half of your capital. Outlawed in NYC, Santa Monica, Hawaii and Other Places Hotels have fought hard to keep Airbnb out of their pockets. Short-term rentals have been banned in many cities, including New York City, Santa Monica, California and some cities in Hawaii. On September 3, 2020, Santa Monica extended their Airbnb ban to include any rental under a year. (Previously the ban had been only on short-term rentals under 30 days.) Airbnb is fighting back and winning a few battles. Airbnb recently successfully negotiated with Honolulu and Kauai County to open the short-term rental market back up to Airbnb hosts. With hotels hit so hard by the pandemic and in serious funding trouble, you can expect even more government pressure on the company. (Wynn and Hilton are already in junk bond territory, with Marriott, Hyatt and Las Vegas Sands at the lowest rung of investment grade with a negative outlook.) Bottom Line Investors are forward-thinking and Airbnb has proven that travelers are more than willing to shack up with strangers in a foreign land. This business should remain popular, once we are able to travel again. The bigger issues are cash-burn, structural shifts in travel trends and the ability to turn a profit. Since these challenges will be at the forefront for months, and perhaps even years, it is very possible that the share price will be volatile. You can bet that Airbnb and its investment bankers are going to give it everything they’ve got to get this IPO off the ground, including having Airbnb hosts pre-purchase shares. Most of the hosts are not as sophisticated as the institutional investors that companies typically court in their IPO roadshows. IPOs used to be exciting before chronically cash-negative companies raced to the Big Boards just to make the insiders rich. I quite love Airbnb as a customer, and will consider investing once we understand what life looks like after a vaccine, and once the Airbnb profit model makes more sense, and cash. Now is the right time to make sure that you have battened down the hatches on your wealth. Call 310-430-2397 or email [email protected] to learn about our Jan. 16-18, 2021 Online Investor Educational Retreat, or to receive information on my unbiased 2nd opinion of your financial plan. Register for the Jan. 2021 retreat by November 30, 2020 to receive the best price. Register with a group of friends and family to save hundreds per person! Other Blogs of Interest Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The 2020 Holiday Season is unique for many reasons. We may be far from family, and we might be concerned about conserving capital – forcing us to be more frugal in our holiday spending. Fortunately, below are a few thoughtful gifts that show your loved ones you care, with very little cash outlay. Check out the free and under $5 stock stuffers, or to choose to invest in incredible deals that ensure 2021 and beyond are great years for you and your family. Free Burnout to Brilliant Health Conference Featuring a Special Message from His Holiness The Dalai Lama and and an Important Discussion with Natalie Pace Learn how to have amazing energy and optimal health no matter how busy or stressed out you are. Starts on Nov. 30, 2020. Free 21 Days of Prosperity Coaching. Imagine what replacing fear, worry, doubt and debt consciousness with confidence, time-proven strategies and life-transformational tools can do toward making 2021 a prosperous year. Enjoy 21 days of video coaching from Natalie Pace that will break down the walls that keep you stuck in a rut. Place time-proven, easy-to-implement systems as the foundation for your financial home. Learn how to earn money while you sleep safely, save thousands annually in your budget with smarter big-ticket choices and protect your wealth from the pandemic. These solutions have transformed the lives of many. "Just following the 21 days changed my mindset so much that my business went from just barely profitable to reaching record sales and profits 2 months later! I have now played The Gratitude Game a second time and intend to play it at least once a year! Thank you, Natalie!" Suzie Under $5 The ABCs of Money offers the life math that we all should have received in high school. The sooner you learn this vital information, the faster you create a richer life. "College students need the information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, chairman, TD AMERITRADE “Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided in this book. This is why I recommend it with enthusiasm.” Professor Gary S. Becker. Gary Becker won the 1992 Nobel prize in economics. The ABCs of Money for College teaches your tween or teen how to get a better degree for up to half the cost. Student loan debt is a crisis in the U.S., with 40% of loans in forbearance. Parents: start the process of college planning when your kids are young, and the entire family will enjoy a fruitful journey creating the career path of your dreams. This guide also includes the Jobs of Tomorrow, from trade positions to Ph.D.s, and the unique trajectory that is appropriate for each individual. "There are many strategies in Natalie Pace's book, The ABCs of Money for College, that prepare families - remember education is a family journey - to uplift and educate their children. Natalie also shares strategies for students who are not well-supported at home to create their own pathway to success. Given the central role that investments in the human capital of our children will play in the success of our children and our country, Natalie's book could not be more timely or important." Kevin M. Murphy, McArthur “Genius” Award winner, and George J. Stigler Distinguished Service Professor of Economics, Department of Economics, The University of Chicago Booth School of Business Each ebook is under $5, and makes a great stocking stuffer for loved ones. Receive a Free Gift Valued at $300* Register for the Jan. 16-18, 2021 New Year, New You Financial Empowerment Retreat by November 30, 2020 to receive the best price and a complimentary private prosperity coaching session (value $300). Groups of 5 Pay Just $368.80/Person* Ensure that everyone you love has the financial foundation necessary to successfully navigate a post-pandemic world by registering for the Jan. 16-18, 2021 Retreat as a family. We’ll help you achieve that goal by giving you an unbelievable price. The individual rate to attend (in the Early Bird pricing period) is $695. (An in-person retreat would cost $995-$1650/person, so this is already incredible savings.) A group of 5 will pay just $368.80/person** – cutting the individual price almost in half. You must register by Nov. 30, 2020 to receive these dramatic cost savings. Real Estate Master Class. January 23, 2021 Interested in buying or selling your home? Want to purchase an income-producing hard asset? There are VERY important considerations and unique opportunities in a post-pandemic world. The math is not simple. However, the proper tools make this fundamental life choice one that you can evaluate properly and embrace. Real estate is one of the largest commitments you'll make in life. Yes, you want to stop making the landlord rich and purchase a home for your family. This is key to building wealth. At the same time, buying more than you can truly afford, or at an all-time high (and largely unaffordable) price will be hell. There are opportunities in the shadow inventory that your broker isn't sharing with you. Learn this and more inside secrets at this Master Class! Receive the Best Price when you register by Cyber Monday, Nov. 30, 2020. Click here to learn more. "I am so grateful to have this opportunity and knowledge that allows me to feel empowered rather than paralyzed and fearful. Thanks to you, Natalie!" SM "I met a new financial advisor/money manager, David, at a conference. I wanted to trust someone since my knowledge was lacking in this arena. I asked David if he was a fiduciary. He said he was, that everything he did was for us. David had put us into a variety of high-risk investments that were good for him, in that they paid him a high commission! Many of these companies have been cash negative for years, borrowing from one investor to pay off another, and paying brokers a high commission to do that. We put in the paperwork last year to cash out of these. Nothing!!! Then we redid the paperwork in August. We did everything by the book. Waiting… waiting… nothing. David, the salesman who put us into these investments, is not even returning our calls!!!! Now, we’re in the process of filing complaints with FINRA, the SEC and the FTC on all of those involved. If I can impart any wisdom to you, it is to remember that “financial advisors” are sales people. They know how to listen and manipulate to serve their best interests, all the while making you believe that they truly are your friend. I am so angry at this system!!!! It is still hard for me to accept David’s lack of integrity and respect in not responding. I am grateful we are now educating ourselves. Studying with Natalie Pace is giving us this opportunity. I wish everyone could take these workshops. It would be great if this was taught in schools." D&T, Indiana 2nd Opinion on Your Current Wealth Strategy If you were worried about your strategy in March, or missed the opportunity to enjoy Dow hitting 30,000 in November, consider getting an unbiased 2nd opinion on your current wealth strategy from Natalie Pace now. A good plan protects you from downturns, while allowing you to profit in the bull markets. It also has you leaning into the hottest areas, while avoiding the money pits. Whether you are thinking of purchasing (or selling) a home, wondering which boxes to check off in your retirement plan, worried about how to protect your wealth from another downturn or sick of making everyone else rich with the high cost of everything in your life, Natalie Pace’s life math blueprint offers you a time-proven, 21st Century action plan. Testimonials "We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We are finally able to take control of our money. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. It's been a summer of miracles. Natalie contributed greatly to this. She added sanity and peace to my life. I am forever grateful." AC & AM Other Blogs of Interest Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Thanksgiving 2020 may find us far from our families, or connecting with them on videoconference. That's something to be thankful for -- the ability to connect with loved ones around the world face-to-face, on our phones, for a decent price. Ask a Boomer what long-distance phone calls used to cost. Each will have a horror story to tell, perhaps of a tween making a trans-Atlantic phone call to a friend from a hotel room to the tune of hundreds of dollars. The pandemic has limited our lives in many ways that we hope will be behind us soon, perhaps with a vaccine. However, there are a few blessings, too. The skies have never been bluer or cleaner in my lifetime. So, before we return to "normal," my prayer this Thanksgiving is that we will take a look at some of the forced lifestyle changes that we want to embrace by choice once COVID-19 is behind us. I launched a strong “personal net zero” trajectory on Earth Day 2010, which was the year that the BP Oil Spill gushed at least 210 million gallons of oil into the Gulf of Mexico. I knew then that oil companies were drilling a mile beneath the ocean with unproven recovery equipment to feed my oil addiction. It was not easy reducing my driving at that time -- before micro mobility came to our cities. However, a few years ago, I got rid of my car completely. Today, most of my to-do list can be done by walking (something that keeps me healthy), riding a bike, taking public transportation or catching a Lyft. Occasionally, I'll rent a fuel-efficient car for a road trip home to visit the family. Li and Jonathan Watkins ride their bikes to work every day in Southern England – even when it rains. Katie and Pete Smith can hardly imagine how they ever afforded their commute before they got jobs in Poundbury, where they live. Rush hour traffic would often turn a 30-mile drive into a two-hour commute. The gasoline budget savings are welcome and useful. However, the time and stress of the commute are also something that Katie is grateful she no longer endures. Many cities offer very affordable bike-share programs and have expanded bike lanes, making them more visible and customary. Locals are encouraged to take the friendlier road – to share in a kinder, more compassionate way. Single occupancy vehicles have long been the bane of city planners, who received near-constant complaints of gridlock traffic. Every bike or e-scooter makes the commute easier for drivers, taking cars off the road. And of course, when we all stop driving, as we did in the pandemic, then we breathe cleaner air and can see farther out on the horizon. Since the U.S. grid is still powered by 62 percent fossil fuels (and 20% nuclear), I do my work in sunlit rooms and regulate temperature by opening and closing windows and with layered clothing. Well-insulated homes can heat using body heat. I know many smart handymen, contractors, electrical engineers and architects who have reduced their electrical usage and energy bills by 90 percent with smart energy choices, and no change in lifestyle. You've probably noticed how much you are saving from not having to commute to work. All told getting smarter about your big-ticket bills, including curbing the car, insulating your home, LED lighting and putting a timer on your water heater, can add up to savings of thousands of dollars every year. Imagine the bucket list vacations you can take (once the pandemic is over) with that kind of money. My prayer this Thanksgiving is that blue skies, clean water, wildlife and healthy oceans will be the gifts we endow to the centuries of humans and animals to come. I invite/encourage you to try at least one hour of personal net zero this Thanksgiving weekend (without technology, too). Get tips of what you might try at http://EarthGratitude.org/ in the free Future Earth and Clean Living ebooks (click to download). You can also watch a 4-minute film about a brave young family who made a bold pro-planet choice for their young son on the Earth Gratitude home page. One last thing: If you haven't already claimed your 21 Days of Prosperity Coaching, which is my Free Holiday Gift to you this year, simply email [email protected] with the subject I Want My Free Holiday Gift. Happy Thanksgiving! Natalie Pace Other Blogs of Interest Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.  On November 19, 2020, Treasury Secretary Steven Mnuchin sent a letter to Federal Reserve Board Chairman Jerome Powell reminding him that the “current [CARES Act] facilities are set to expire at year end.” He is recommending that the Board of Governors approve a 90-day extension of the Commercial Paper Lending Facility, the Money Market Mutual Fund Liquidity Facility, the Primary Dealer Credit Facility (banks) and the Paycheck Protection Program Liquidity Facility. That means the bond, bond fund and the Main Street Lending Programs will expire on Dec. 31, 2020. This is problematic because more than 1000 bonds have been purchased, along with quite a lot of bond funds. Over the past few weeks, another 100 bonds were purchased. Every Dow component, including Microsoft and Apple, has received financial support. 58.8% of the S&P500 companies are at or near speculative status (source: S&P Global). 11.8% of the index is already in junk bond territory, including most of the airlines. A disturbing number of banks and financial services companies are in BBB territory. (AAA is the highest rating. BBB is the lowest investment grade rating, with BB in speculative territory.) The liquidity facilities and purchasing programs have kept junk bonds and funds artificially high, and have also provided liquidity for everything from investment grade bonds, money markets and even Treasury Bills – all of which had a crisis in March of 2020. Jerome Powell confirmed the policy in a letter to Mnuchin on Nov. 20, 2020, writing, “You have indicated that the limits on your authority do not permit the CARES Act facilities to make new loans or purchase new assets after December 31, 2020, and you have requested that we return Treasury's excess capital in the CARES Act facilities. We will work out arrangements with you for returning the unused portions of the funds allocated to the CARES Act facilities in connection with their year-end termination.” Can We Keep Printing Money Like There’s No Tomorrow? Since the pandemic hit, we’ve added $4 trillion to the public debt, which now rings up to $27.254 trillion. (#45 started his Administration with $20 trillion in debt.) We can keep printing until the end of July 2021. However, on August 1, 2020, we’ll hit the Debt Ceiling again. You’ll start hearing more about this in late Spring of 2021. However, with the bond purchasing programs expiring at the end of this year, Congress will have to approve another bailout package to rescue those companies that are still distressed. What Makes a Strong Economy? It’s easier to understand what it takes to create a strong economy if you think about what it takes to build and maintain a thriving small business. Successful entrepreneurs create or build a product that people want to buy. They compete with others to make the best version of it, and then sell their wares for a price that people can afford to pay. Selling oil and gas to the world made the Middle East and Russia rich. With the pandemic, these areas will suffer because travel and the personal commute are both down dramatically. Technology has become central to our lives, benefitting the U.S. and China. So, what can we do to invent and build the products of tomorrow that the rest of the world needs? What will be useful in a post-pandemic world? Will the planet’s denizens focus on climate action? Will clean energy products fare well? Is Borrowing the Right Answer? Borrowing is always a temporary solution. If there are businesses that are not as relevant in a post-pandemic world, they need to right-size their operations. As Jerome Powell has stated repeatedly, “Many borrowers will benefit from these programs, as will the overall economy, but for others, a loan that could be difficult to repay might not be the answer. In these cases, direct fiscal support may be needed.” As taxpayers funding these programs, we also need to ask ourselves which products and services we want to invest in – the products of yesteryear or the products of tomorrow. In 1992, during a period of very high debt, the Clinton Administration invested quite heavily in the Internet. History has rewarded our country for that policy. If we had not invested in the technology industry during that time, we’d be in a lot more trouble right now. Technology revenue has buoyed up the American economy through the 2020 pandemic. President Clinton presided over the best stock market in history. (Guess which President has the distinction for the second best.) So, what is the Internet of tomorrow? That’s the question we want to ask going forward. Don’t Fight the Fed There definitely is a great deal of power in our U.S. Federal Reserve Board. However, it is our tax dollars that the Fed is using. The Fed’s Emergency Authority is intended to be temporary. There are deadlines, such as the programs that will expire at the end of 2020. The propping up of an ailing industry is not intended to be forever. At some point, the industry has to support itself, right-size to a new and lower demand, or become obsolete. It’s key to remember this when you think of the industries you want to support. You wouldn’t want your investing or tax dollars to support the typewriter or the horse and buggy, so apply the same logic to the products that are becoming less relevant in today’s world. Be cautious right now. It’s very easy to be tempted into purchasing risky investment products at the top of the market because you see everybody else making money and you want to join the party. However, ignoring what happened in March could be a very expensive lesson. Here are a few other deadlines to be aware of. Remember that investors and markets are forward-thinking. If you wait for the headlines, it will be too late to protect your wealth. Debt Limit Must Be Raised Before August 1, 2021 The current debt ceiling has been suspended through July 31, 2021. It will have to be raised before then. You’ll start hearing about this in late Spring of 2021. U.S. Sovereign Rating Has a Negative Outlook from Fitch Ratings The U.S. has the highest government debt of any AAA-rated country. Fitch has us on a negative outlook, which gives up to 12-18 months to fix the issue. That means that anytime between now and the end of 2021, we could start hearing signs that we’ll lose our AAA rating with Fitch. Canada was downgraded to AA+ on June 24, 2020. What’s Your Best Strategy? The right answer is not sitting on the sidelines, and it is not buying high. In fact, our easy-as-a-pie-chart system with annual rebalancing is a buy low, sell high plan on auto-pilot. It: * Protects you from the downturns * Profits from bull markets * Prompts you to buy more when the markets drop (at a lower price) * Reminds you to sell high when the party rages (to capture gains) In the 21st Century, you’re riding a Wall Street rollercoaster with a Buy & Hope plan. As Jerome Powell warned on August 27, 2020, expansions now end with “episodes of financial instability.” Those episodes have cost investors more than half of their wealth in the two last major recessions, and up to -35% in March. This crisis is not over, even though stock and real estate prices are higher than ever. The pie chart plan with annual rebalancing is time-proven. It’s time to replace blind faith and last-century strategies that don’t work with financial wisdom. Learning the ABCs of Money that we all should have received in high school is vital to your fiscal health. Now is the right time to make sure that you have battened down the hatches on your wealth. Call 310-430-2397 or email [email protected] to learn about our Jan. 16-18, 2021 Online Investor Educational Retreat, or to receive information on my unbiased 2nd opinion of your financial plan. Register for the Jan. 2021 retreat by November 30, 2020 to receive the best price. Register with a group of friends and family to save hundreds per person! Other Blogs of Interest Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Includes 8 Ways to Protect Against Recessions, Pandemics and Other Wealth Viruses Have you ever been stressed out about money? (I know this is a rhetorical question.) Financial empowerment is personal to me because I lost a close friend to suicide. She was inconsolably distressed after her accountant convinced her to borrow against her home equity and invest in an income-producing REIT that went bankrupt. She had other losses from temporarily loaning money to a friend who didn’t return it as promised. I had warned her, but she believed that her "financial advisor" had her best interests at heart. (She didn't know that he earned a substantial commission for selling her into these risky propositions.) Watching what she went through, and then narrowly avoiding the same traps myself, prompted me to spend my life's work on financial literacy and sustainability. Money is one of the biggest stresses in modern life. It can lead to burnout, unhappiness and disease. Most of us don't talk about money. However, wealthy people do educate their families in financial matters -- not just how to balance a checkbook or helping them pay for college. You might have excellent mindfulness, visualization and meditation skills. However, these are band-aids if you wake up each day to the same fiscal ailments. So, embracing a lifestyle that supports our prosperity and abundance can go a long way to reducing stress and creating health and joy in our lives. It's easy to believe that our finances are in order when the markets are high and home prices keep going up. However, I’ve watched bubbles pop three times. You’re confident and exuberant when stocks and real estate prices are high, and devastated/destroyed when the bubbles burst. A better plan protects you from losses, while allowing you to grow your wealth in the good times. With 40% of students skipping out on their college loan payments, and over 6 million homeowners and renters missing a payment in September of 2020 (in the U.S.), there are clear signs of distress in the economy. According to Nobel Prize winning economist Robert Shiller, the only two times that stock prices were higher than they are today was in 2000 (before the Dot Com Recession brought losses of up to 78% in the NASDAQ Composite Index) and in 1929, before the Great Depression. Home prices are unaffordable in 63% of the U.S. cities, and 3.5 million homeowners are still underwater on their mortgages. If you wait for the headlines, it’s too late to protect your wealth. Now is the time to make sure that your financial home is strong enough to protect you from the economic storms that are on the horizon. The solutions are rather simple. However, they require making brave choices and blocking out the onslaught of constant news, hot tips and sales-speak. 8 Ways to Ensure That You are Protected Against Recessions, Pandemics and Other Wealth Viruses  You can watch me discuss these 8 Strategies in the free Burnout to Brilliant Global Conference Nov. 30, 2020, with Vanessa Bartlett. 8 Ways to Protect Against Recessions, Pandemics and Other Wealth Viruses

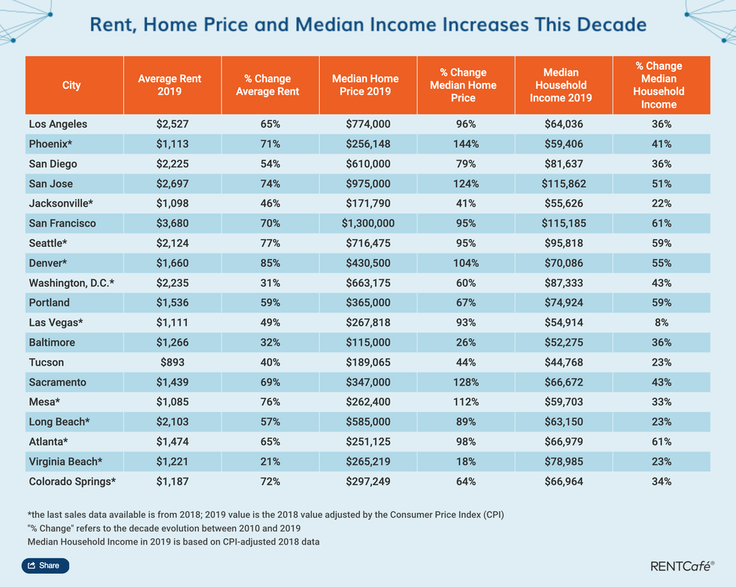

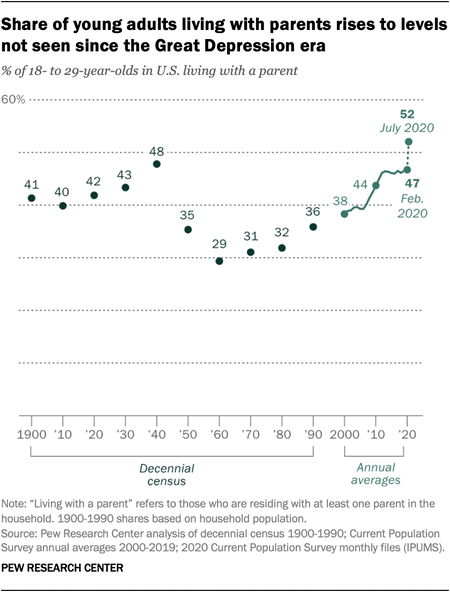

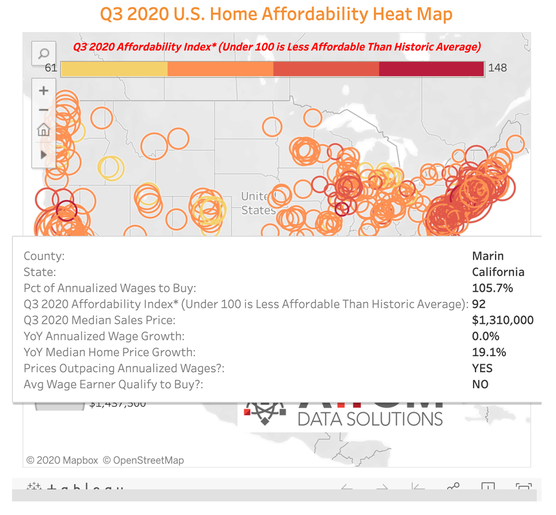

And here is more color on each point. 1. Adopt a Thrive Budget When you allocate 50% of your income to thrive and 50% to survive that assures that you have enough in your budget to:

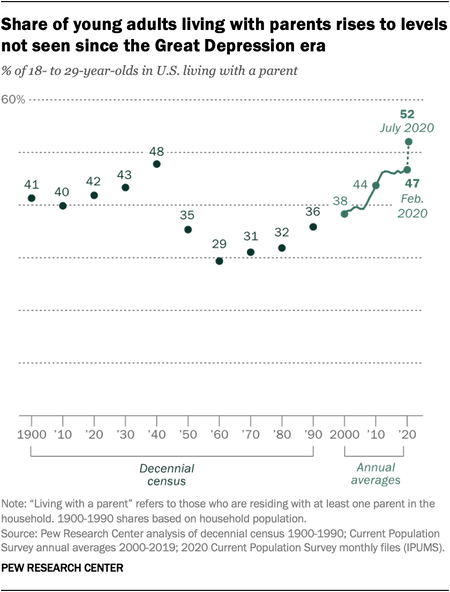

How do you get there? You have to adopt the secrets of the wealthy. Rich people pay less in taxes, for medical insurance, and for a boatload of other big-ticket bills, including housing. When you are buried alive in bills and struggling to survive, it is impossible to thrive. This kind of existence is very hard on your health and relationships. Discover a better plan in The ABCs of Money and learn them at our Investor Educational Retreat. (I can’t pack 350 pages and 3 days of teachings into one short blog.) 2. Apply Modern Portfolio Theory to Your Nest Egg Buy & Hope is a last-century strategy that has been costing investors half or more of their wealth in the last two 21st Century recessions. They then spend most of the bull markets crawling back to even. That’s not a financial plan. That’s a Wall Street rollercoaster. Incidentally, most financial advisors will tell you that they use modern Portfolio Theory. I’ve been doing 2nd opinions, and I have yet to find one managed plan that was properly protected and diversified. Our easy-as-a-pie-chart system costs less time and money, and earned gains in the last two recessions, while outperforming the bull markets in between. (Again, most people lost more than half of their wealth in the last two recessions on the Buy & Hope plan.) You can read about these time-proven strategies in The ABCs of Money and learn them at our Investor Educational Retreat. If you were concerned about your investments in March of 2020, that’s a red flag that your plan is flawed. 3. Keep the Money in the Family Intergenerational housing is higher today than it was in the Great Recession. While it was born of necessity, it’s one way to stop making everyone else rich and keep more money in the family. Princes don’t buy their own castles. Wealthy people think a century in advance when they do their financial planning, and include provisions, including housing, for all of the kids. Think rich to become financially free. 4. Save Thousands Annually with Smarter Big-Ticket Budget Choices Housing is unaffordable in 65% of U.S. cities. The solution isn’t biting the bullet and paying more than half of your income on a place to sleep. We must get creative about housing, transportation, medical insurance, utilities, gasoline, taxes and other big-ticket bills. Billionaires like Warren Buffett and Bill Gates pay a tax rate that is half or lower to what their executive assistants pay. Passive income (money while you sleep) can protect your wealth from capital gains taxes if you set up tax-protected retirement plans. You can also save tens of thousands annually with smarter choices in your health insurance, utilities and transportation. Wisdom is the cure. This is another major theme in The ABCs of Money and our Investor Educational Retreat. 5. Learn the ABCs of Money That We All Should Have Received in High School When someone says, "Let me do it for you," you’ve just given up your power. When someone says, "Let me teach you how," you are setting the stage for personal freedom. There is nothing more expensive than free financial advice or having blind faith that someone else is managing your money for you. (As I mentioned at the top of this blog, it cost a close friend her life.) Learn the ABCs of Money that we all should have received in high school and watch how fast your life transforms. It’s time to take ownership of your wealth and future, and to be the boss of your money. 6. Take the 21-day Gratitude Game Challenge Wealth consciousness and vision, alongside a time-proven plan, are required to set the stage for your prosperity and abundance. We need the right mindset, toolkit and skillset. The 21-day Gratitude Game Challenge gives you a daily wealth mantra and an action plan. 21 days are needed to jettison the vices and establish new habits. This holiday season, I’ll be offering a free gift of the first seven days of the 21-day challenge outlined in The Gratitude Game. Simply email [email protected] with the subject I WANT MY FREE GIFT! to receive the links to the daily videos. 7. Put Your Money Where Your Heart Is Once you become financially literate and start building your own personal wealth, you can start fine-tuning your strategy to make sure that you are profiting from the things you believe in. There are many benefits to this, including financial benefits. When you remain uninformed about where your money is invested – whether that is through your tax dollars, your 401K, your managed brokerage account, your insurance plan, your annuity, or another financial vehicle – you are often profiting from the very companies that you picket. If you wish to stop supporting polluters, then learn how to put your money where your heart is and profit. 8. Start Preparing for College When Your Kids are ChildrenIt can feel overwhelming to be a parent these days. Life doesn’t add up. We’re in a pandemic. You might worry about your parents as much as your kids. So, it’s understandable that so many parents just follow the rote path for college and let their teens fall into the student loan debt trap. Student loan debt has reached a crisis, with a grand total of $1.55 trillion in student loan debt and 26 million borrowers who missed a payment in September. This is a crisis for Millennials and will become a toxic trap for Gen Z, too, unless we become more mindful of how to get a better, more employable degree for up to half the cost. There are many strategies with that goal in mind in The ABCs of Money for College. If you wait until your kids are in high school, it might be too late to put them on the right path. (By that time, they’re not listening to you as much as they listen to their friends.) However, when your family sows the seed of college planning when your kids are children, it becomes the way life is. Bottom Line You might feel great about your home equity and your stock portfolio right now. However, that doesn’t mean that your finances are in order. It just means that we’re in a bull market. Since we are also in a pandemic and an unprecedented recession, with many renters, homeowners and industries in extreme distress, now is the right time to make sure that you have battened down the hatches on your wealth. Call 310-430-2397 or email [email protected] to learn about our Jan. 16-18, 2021 Online Investor Educational Retreat, or to receive information on my unbiased 2nd opinion of your financial plan. Other Blogs of Interest Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Including an 8-Point checklist for would-be home buyers. Join me for my Real Estate Videoconference on November 12, 2020 at 5 pm PT. Email [email protected] for the logon instructions. Watch it back at YouTube.com/NataliePace. Recently there have been a lot of people itching to buy a home. Maybe it’s the low mortgage interest rates. Perhaps it is the pandemic. With rents so high, it feels like you are just flushing money down the toilet. You’ve watched your homeowner friends brag about how much equity they now have. And now that you can work from pretty much anywhere, maybe you’re thinking of exiting city-life for the more affordable suburb. What is not tempting is the home price itself. Home and rent prices have skyrocketed over the past decade, particularly in the West. Meanwhile, wages have not kept apace. One of my coaching clients is looking to settle down with his fiancée. His annual salary averages about $75,000/year. He qualifies for a $500,000-$600,000 loan. However, in Los Angeles, where he lives, he’s priced out of many neighborhoods. A $600,000 mortgage (over $30,000 annually) would take up 40% of his income – far higher than is recommended for housing costs. However, if he doesn’t buy, his rent could easily cost just as much. It’s easy to understand why he wants to bite the bullet and just buy something – anything. However, buying high and having your home value drop significantly below your mortgage can be hell for years. So can being property rich and cash poor. There is often some unexpected, big-ticket repair that has to be fixed every 7-10 years – whether it is plumbing, a new roof or a tree falling on your car. If you’re overleveraged on the mortgage, you might have to put emergencies on a credit card. It’s hard to be a patient buyer when prices for rent and homeownership keep going up. (It doesn’t make sense, given the negative economic impact of the pandemic and recession, until you factor in the moratoria on evictions and foreclosures. More on that later.) Industry experts predict the rising price trend to continue in 2021 due to a housing shortage. (Click to read my interview with Mike Fratantoni, the chief economist of the Mortgage Bankers Association.) However, once you own the home, it is yours – for better or for worse. So, you simply must do the math on affordability and on price, and create your own opportunity, in a world were none of this adds up. Getting creative is the only process that will get you there. When you take the time and apply the necessary tools to get it right, you’ll come out on the other side with a sanctuary home that you love and can afford, without breaking the family budget. Check out 7 Case Studies in the Real Estate section of The ABCs of Money for real-world examples of navigating home and income-property ownership. There you will find stories of real people who have overcome challenges, seized opportunities and made brave choices to create the home and life of their dreams. Click to watch Alvin and Jada’s story in their 4-minute film on EarthGratitude.org. 8-Point Checklist for Home Buyers. Sanctuary Home The Thrive Budget Intergenerational Housing The 3-Ingredient Recipe for Cooking Up Profits Shopping in the Shadow Inventory Safe, Income-Producing Hard Assets that You Purchase for a Good Price Will Real Estate Ever Be Affordable Again? Climate Change And here is more color on each point. Sanctuary Home Your home is ultimately the place where you renew your spirit and nourish your dreams. You will thrive if you find a city and neighborhood that reflect your values, where the people get you. Factor in all that you love doing and the little things that make you smile when considering where you want to live. When you think that this is going to be your home for the next decade or more, you’ll be glad you picked a place where you enjoy living. The Thrive Budget Overspending on housing creates stress and could put you into unsustainable debt, particularly when the other big-ticket items, like transportation, health insurance, food, cable, phone, utilities, student loan debt, taxes and WIFI can bury you in bills. There are ways, through smarter choices on your big-ticket items, to keep these expenses down. (Read the Thrive Budget section of The ABCs of Money for details.) The target is 50% to survive and 50% to thrive. If you’re spending more than 1/3 of your income on housing costs, you might start resenting rather than loving your home. Credit card debt could start amassing and compounding, putting you in the hole. Many cities are unaffordable at this time. That’s one of the reasons why intergenerational housing has become de rigueur. Intergenerational Housing 52% of young adults aged 18-29 are living with at least one parent. This is higher than in the Great Depression, which should tell you something about the challenges we face today – that includes, but is not limited to, unaffordable housing. Thinking about this as an opportunity might actually be a blessing in disguise. Having everyone in the family overspending on housing makes others rich. You can keep more of the wealth in the family, and beef up your liquidity to prepare for better housing opportunities, if you look at housing from an intergenerational perspective. The 3-Ingredient Recipe for Cooking Up Profits The recipe is simple. The devil is in the details. In most markets, you’re going to have to shop in the shadow inventory to get the 3rd ingredient right.