|

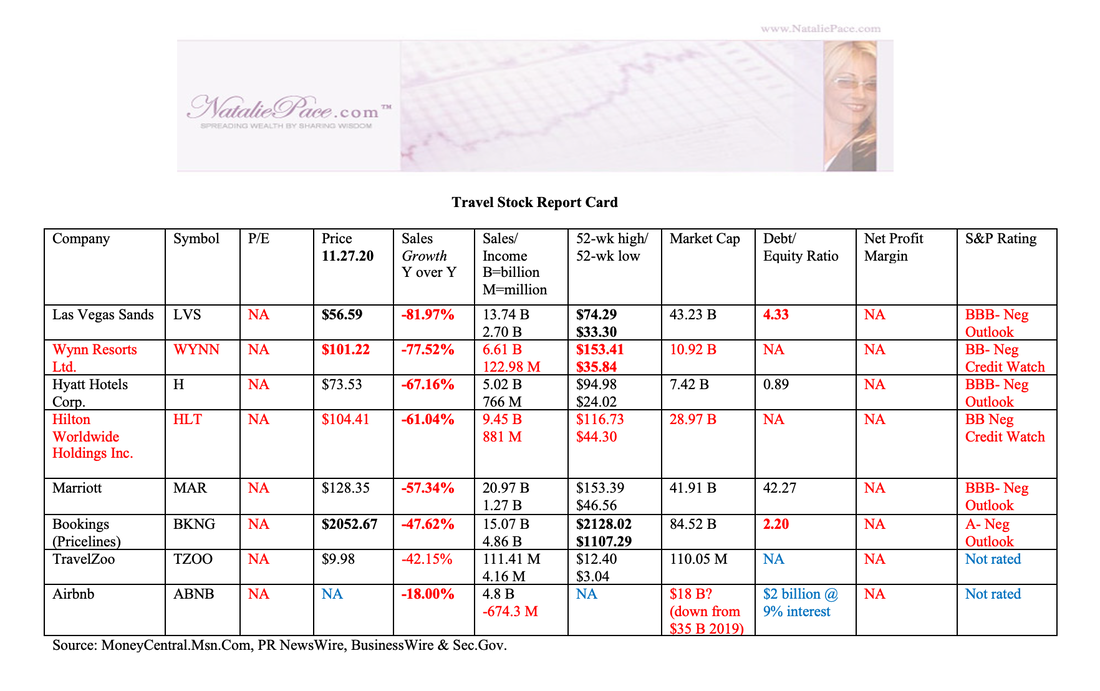

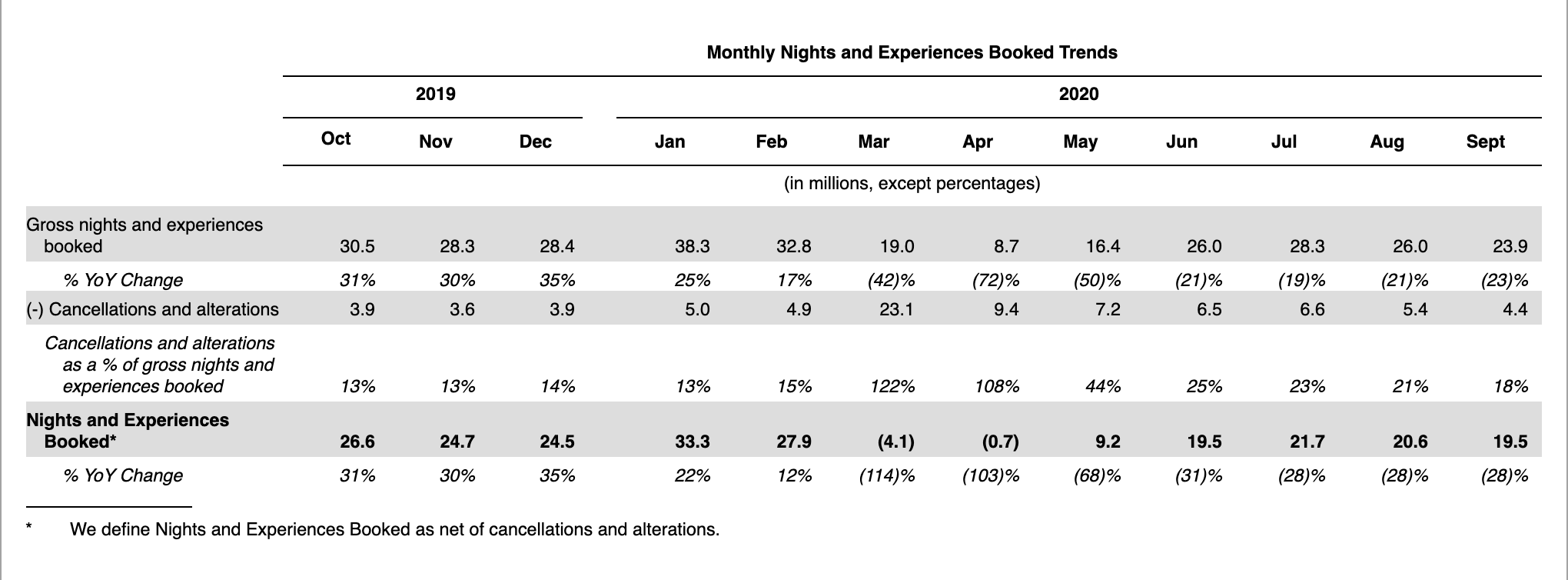

Airbnb Courts Hosts to Invest in the IPO. 6 Issues to Consider Before Riding this Unicorn Why is Airbnb racing to the big boards before the end of 2020? The money raised (estimated to be $3 billion) could be essential to continuing operations, as the 2020 net loss will be “substantial,” according to the company’s S-1 filing. However, another big piece of the equation is that Airbnb’s IPO – like many of the 2019 IPOs including Lyft and WeWork’s failed attempt – is a liquidity event to turn paper profits into cash for the insiders before options expire or there is further devaluation of the company. (Click to read our warnings on those 2019 IPOs.) The Sharing Economy Airbnb started in 2007 with an idea that many thought was crazy at the time – that strangers would stay in the spare room, or even on an airbed in the living room, at private homes. Now there are 4 million Airbnb hosts worldwide. The business model is compelling, particularly when you consider that 4 million hosts today grew from just two (the founders) in 2007. Millennials have enough money troubles with all of the student loan debt they are juggling. If they want any travel in their lives (post-pandemic), it might have to include a bit of couchsurfing. It’s unlikely the sharing economy is going away. Airbnb is Faring Much Better Than Hotels As you can see in the Travel Stock Report Card below, the third quarter year-over-year revenue plunged for hotels – after an equally terrible 2nd quarter in 2020. With a surge in COVID-19 infections, fall 2020 bookings are expected to implode again for Airbnb, hotels, casinos and other travel companies (including Bookings, Expedia, Trip.com and TravelZoo). The 3rd quarter was actually a period of recovery for many industries, with the U.S. GDP growth rebounding 33.1%, after sinking -31.4% in the 2nd quarter and -5.0% in the 1st quarter. That indicates that there are structural changes in the travel space – something that investors and lenders should account for. Meetings and conferences moved into Zoom rooms, rather than trying to navigate the in-person meeting restrictions posed by the pandemic. The Airbnb founders believed their market potential was $1.5 trillion in January of this year. In truth, it’s difficult to guess what the serviceable market of Airbnb will be in a post-pandemic world. Things changed overnight in a few short weeks in March 2020 for the company, when cancellations meant that the year-over-year bookings fell 114%. In September of this year, bookings were still down 28% year over year. At least half of Airbnb hosts use their home-sharing revenue to help pay their own rent or mortgage, according to an internal Airbnb survey conducted in 2019. So, the need for people to share their homes is still high, with home and rent prices hitting all-time highs, and housing being unaffordable in two-thirds of U.S. cities. The question is, “Will guests want or need to travel as much in a post-pandemic world?” Is business changed for the foreseeable future, or forever? Should Hosts Invest in the IPO? U.S. Airbnb hosts have been invited to participate in the IPO through a Directed Share Program at the IPO listing price. As a customer who has used Airbnb around the world, I’m a huge fan of the product. However, there are six issues with regard to the finances that would prevent me from wanting to be an investor at this time. 6 Issues with the Airbnb IPO Insider Liquidity Event It’s a very good idea for Airbnb to squirrel up as much cash as they can to weather the economic storms caused by the pandemic. Since they raised $2 billion in bonds under less-than-favorable terms in April of this year, including a severe haircut on valuation, it’s understandable that they would turn to the IPO equity marketplace. However, another motive is clearly to turn paper profits into cash for insiders and early investors. No Lock-Up for 15-25% of Shares. The policy to reward insiders and VCs is underscored by the fact that there is no lock-up window. Airbnb is allowing up to 15% of the stock to be sold by insiders on Day 1, with potentially up to 25% of shares able to be dumped on Day 2. Typically, there is a 6-month lock-up period where no insider selling occurs. Institutional investors might balk at this condition, whereas many hosts might not even read the S-1 filing. September Bookings Down 28%. Gross Booking Value Down 17%. Airbnb’s 3rd quarter 2020 revenue showing was the best in the hospitality space, with gross booking value down only -17%. Given the challenges of today, that’s pretty impressive. (Las Vegas Sands reported a year-over-year drop in revenue of 82%.) However, it is still a drop, and the 4th quarter this year is likely to be much worse. By comparison, Zoom’s revenue was up 355% in the 3rd quarter. Net Losses Since Inception Airbnb has had net losses since the inception of the company. The company was expanding to keep up with demand, which is understandable for a fast growing, early stage company. However, in 13 years of operations, Airbnb has never turned a net profit. In the S-1, Airbnb admitted that they’ll have to use a “significant” portion of their cash to support 2020 operations. Most companies today must make a strong case about their clear path to profitability in order to borrow money. This became essential to raising money last year, before the pandemic. This is likely why Airbnb had to borrow $2 billion in April of this year at 9-11.5% interest rates, with a valuation that had been slashed by almost half of its 2019 value of $35 billion, to a reported $18 billion in April of 2020 (per CNBC). In the S-1 filing, Airbnb underscored multiple times that they may not be able to achieve profitability. So, in addition to the problem of cash-burn, there could be an issue raising more capital going forward. Valuation: $18 billion? $30 billion? (Down from $35 Billion in 2019) The Wall Street Journal is reporting that Airbnb’s value today could ring in at $30 billion. Airbnb’s revenue was $4.8 billion in 2019. In the first 9 months of this year, Airbnb has only taken in $2.5 billion so far in revenue, with a -$697 million net loss, compared to a -$323 net loss in the same period of 2019. When considering valuation, it’s important to remember how much the value dropped in April. If you invest, and the share price drops as much as it did then, you’ll lose almost half of your capital. Outlawed in NYC, Santa Monica, Hawaii and Other Places Hotels have fought hard to keep Airbnb out of their pockets. Short-term rentals have been banned in many cities, including New York City, Santa Monica, California and some cities in Hawaii. On September 3, 2020, Santa Monica extended their Airbnb ban to include any rental under a year. (Previously the ban had been only on short-term rentals under 30 days.) Airbnb is fighting back and winning a few battles. Airbnb recently successfully negotiated with Honolulu and Kauai County to open the short-term rental market back up to Airbnb hosts. With hotels hit so hard by the pandemic and in serious funding trouble, you can expect even more government pressure on the company. (Wynn and Hilton are already in junk bond territory, with Marriott, Hyatt and Las Vegas Sands at the lowest rung of investment grade with a negative outlook.) Bottom Line Investors are forward-thinking and Airbnb has proven that travelers are more than willing to shack up with strangers in a foreign land. This business should remain popular, once we are able to travel again. The bigger issues are cash-burn, structural shifts in travel trends and the ability to turn a profit. Since these challenges will be at the forefront for months, and perhaps even years, it is very possible that the share price will be volatile. You can bet that Airbnb and its investment bankers are going to give it everything they’ve got to get this IPO off the ground, including having Airbnb hosts pre-purchase shares. Most of the hosts are not as sophisticated as the institutional investors that companies typically court in their IPO roadshows. IPOs used to be exciting before chronically cash-negative companies raced to the Big Boards just to make the insiders rich. I quite love Airbnb as a customer, and will consider investing once we understand what life looks like after a vaccine, and once the Airbnb profit model makes more sense, and cash. Now is the right time to make sure that you have battened down the hatches on your wealth. Call 310-430-2397 or email [email protected] to learn about our Jan. 16-18, 2021 Online Investor Educational Retreat, or to receive information on my unbiased 2nd opinion of your financial plan. Register for the Jan. 2021 retreat by November 30, 2020 to receive the best price. Register with a group of friends and family to save hundreds per person! Other Blogs of Interest Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 10/12/2020 06:06:46 am

If you are planning to move into a new house because you are fed up with it, you can consult professional house remodeling companies for changing it. They'll convert your entire home into something unique and different, and saves a lot of your investment. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed