|

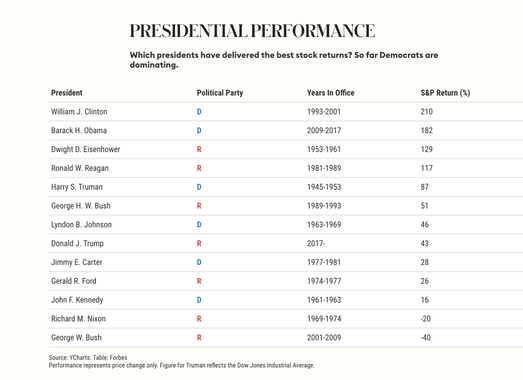

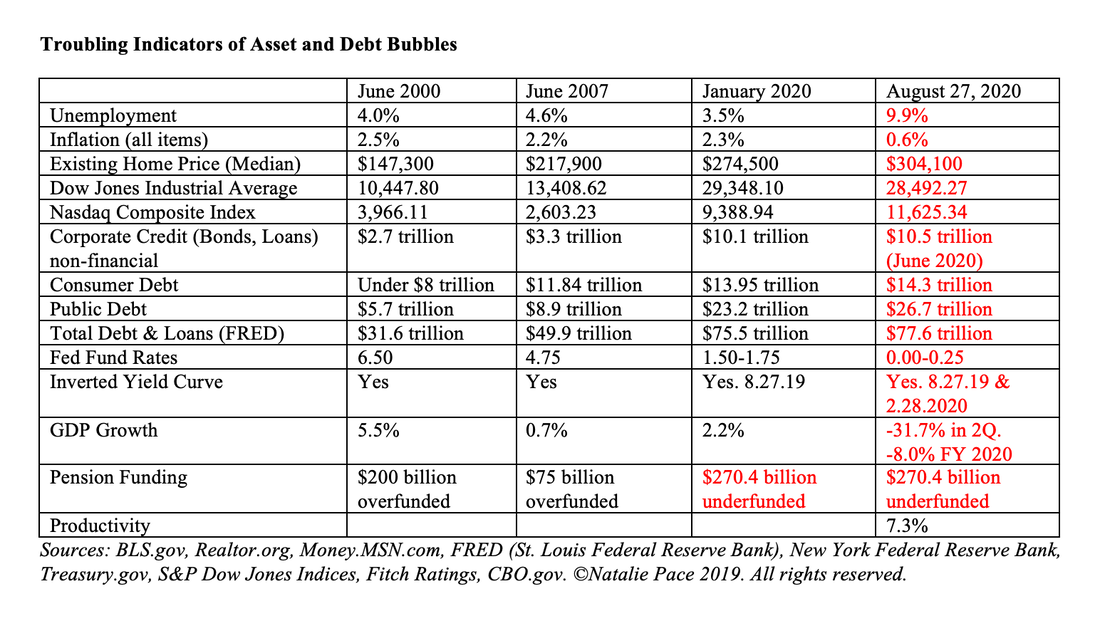

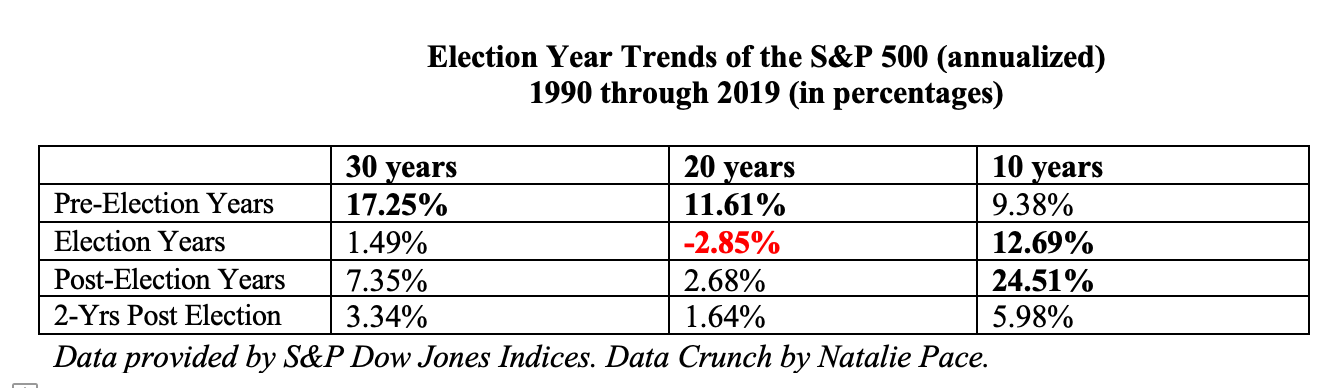

Will the Stock Market Fare Better Under Biden or Trump? The statistics might surprise you. Stock Market Performance by President As you can see from the charts below, Democrats have a better track record for the stock market than Republicans. This is something that Wall Street insiders are all aware of. According to Jeremy Siegel, the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania, in his book Stocks for the Long Run, “Bull markets and bear markets come and go, and it’s more to do with business cycles than Presidents.” 21st Century Wall Street Rollercoaster It’s important to note, however, that 21st Century business cycles have fundamentally changed – with the contractions becoming crises. As Jerome Powell noted in his infamous Jackson Hole speech on August 27, 2020, “Before the Great Moderation, expansions typically ended in overheating and rising inflation. Since then, prior to the current pandemic-induced downturn, a series of historically long expansions had been more likely to end with episodes of financial instability, prompting essential efforts to substantially increase the strength and resilience of the financial system.” Powell is referring to the 78% NASDAQ losses in the Dot Com Recession, the 55% Dow Jones Industrial Average losses (and bank meltdown) of the Great Recession and the 35% knife drop that happened between February 19, 2020, and March 23, 2020. We have clawed back some losses, but that doesn’t mean we are out of the woods. For more background on what’s going on and what the rest of 2020 will look like, read my “Crystal Ball for the 2nd Half 2020” blog. Part of the problem is political gridlock, where there is no backbone to address the spending challenges of today. Raising taxes or cutting spending can cost you your seat in Washington. Economists will tell you that lower taxes are an effective way to stimulate growth. However, when you fail to cut spending to allow for the reduced tax income, which happened under the Administrations of #45, #43, #41 and #40, then you create financial imbalances. It’s easy for the financial imbalances and instability, which Jerome Powell is referring to, to build up when you have less income combined with as much or more spending. If it happened in your household, you’d be in trouble pretty fast, as you can’t print up more fiat currency to try and bridge your way to a better tomorrow. Pretty soon, you’ll have to borrow at very high interest rates, or on a credit card. You won’t have your debt bailed out by the Federal Reserve, as major, heavily indebted U.S. corporations did this year. The U.S. has been running budget deficits since 1960, with the exception of a three-year period under President Clinton and one-year under President Johnson (in 1969). (Click to see the data.) The U.S. public debt is now an eyepopping $26.7 trillion. We have added over $3.3 trillion to the U.S. public debt since February. However, prior to that, the toll was ticking up by over a trillion a year (including under the current Administration). Bipartisan Solutions The only way that we get back to spending within our means, and paying off a Mt. Everest of debt, is for both sides of the aisle to work together. When the issues are politicized and people are polarized, the necessary reforms are not addressed with transparency and solutions are not achieved. We all want the same thing: greater prosperity and opportunity, and a fair playing ground to achieve that. We differ on the process to get there. The risks of continuing the way we have, with slow growth, unsustainable debt and devastating recessions, are too great to continue The Blame Game of procrastination. Are Election Years Super Performers? It used to be that election years were great – the 2nd best performers in the 4-year cycle (led by pre-election years). As you can see in the Election Year Chart below, election years are now all over the map. The Dot Com and the Great Recessions show up in the 20-year data, but not the 10-year data. In those recessions, the election years were devastating. 2000 saw a -10% drop in the S&P500. 2008 saw a -38.5% correction. Will There Be a Santa Rally in 2020? In 2008 (the Great Recession), September, October and November sank like a rock, with losses of -9.08%, -16.94% and -7.49%, respectively This was after a fairly calm July and August. December tried to offer a gift lift of 0.78%. In 2000 (the Dot Com Recession), September dropped -5.35%, October leveled out at -0.49% losses, November tanked with an -8.01% correction and December tried to put a gift of 0.41% in the stocking. This was after robust gains in August of 2000 of 6.07%. So, having a good summer actually presaged disaster in those recessions. We are in a recession, with unemployment, debt, leverage and other economic data that looks worse than the Great Depression. The historic data on how markets perform in recessions isn’t encouraging. As Howard Silverblatt, the senior index analyst of the S&P Dow Jones Indices, wrote in an email on July 31, 2020, this market rally has been built on “fear of losing out by individuals, the need to make the numbers by money managers, and the universal need to believe... As for doomsayers and (shocked) short-sellers, eventually they will be right, but when?” Buy & Hope Doesn’t Work Buy & Hope is a strategy that worked during the Great Moderation (last century), but has cost investors up to half, or more, of their wealth in the last three recessions. Proper diversification and annual rebalancing is a time-proven 21st Century strategy. In today’s world, with so much debt, it is important to know what is safe. Bonds can become illiquid and lose principal. Money market funds have redemption gates and liquidity fees. (It’s listed in the fine print. This was a new rule implemented in 2017 to prevent a run on the banks.) Read my blog and watch my videoconference with Kathy A. Jones, the Chief Fixed Income Strategist of Charles Schwab, to learn more. You can read about our time-proven, easy-as-a-pie-chart nest egg strategies, in my book The ABCs of Money. You can learn these transformational tools at our Oct. 3-5, 2020 Investor Educational Retreat. You can call or email our office for pricing and information on an unbiased 2nd opinion of your current plan, which comes with a roadmap for safety and diversification. Call 310-430-2397 or email [email protected]. Other Blogs of Interest Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. The 4th edition, updated to include the COVID-19 Recession, will be released soon. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed