|

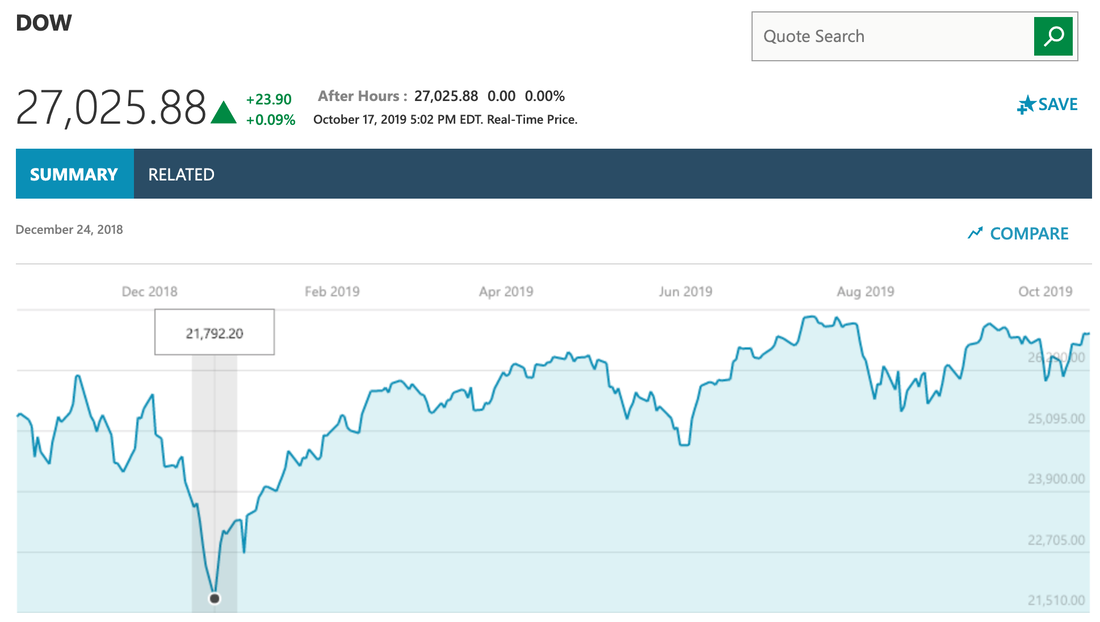

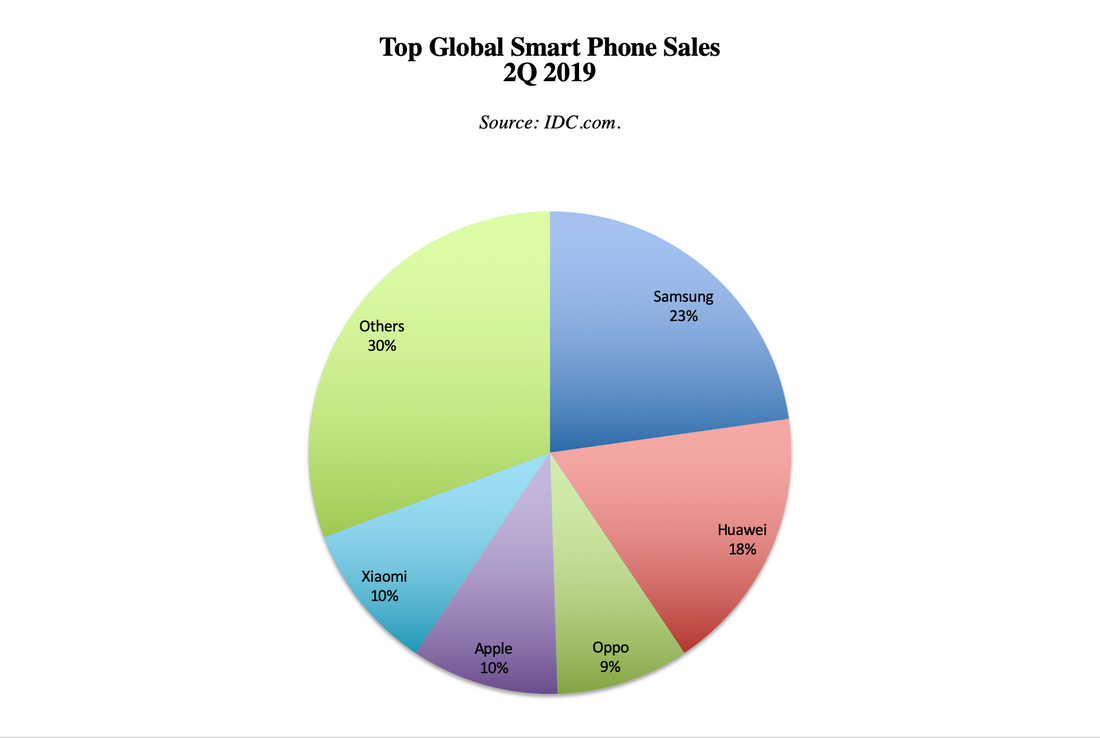

Apple has been the fuel of this bull market for years. Apple’s share repurchases are astonishing. The company bought back $74.2 billion of its own stock in 2018, compared to $34.4 billion in 2017. The closest buyback competitor in 2018 was Oracle, with $29.3 billion in share repurchases. Apple remains on track for another record buyback year, with almost $42 billion repurchased in the first half of 2019. However, rather mysteriously and without any explanation, Apple share repurchases dropped by half in the 4th quarter of 2018 (source: S&P Dow Jones Indices. In the first three quarters of 2018, Apple’s share repurchases averaged $21.4 billion per quarter. In the last quarter of 2018, buybacks abruptly stalled to a mere $10 billion. That was still higher than its peers. However, in a bull market driven by companies buying back their own stock, such a drastic policy shift can quickly impact into the broader market. December 2018 was the worst stocks have seen since the great depression. The S&P500 lost 6.4% in 2018, with losses of 12.31% in the last quarter. Last year’s Santa Rally was coal in the stocking. Most Main Street investors saw losses of 9% or more in their nest eggs, with losses on both the stocks and bonds side of their liquid assets. Performance of the Dow Jones Industrial Average Oct. 2018-Oct. 2019 The real question here is why did Apple stop repurchasing shares in December 2018, when they had plenty of cash on hand, and over $60 billion left in their buyback authorization? Was it simply a matter of price? In October of 2019, Apple stock was trading near its all-time high. Today, Apple’s stock price is even higher, at $241.83. Many companies have rules about pricing with regard to their buyback authorization. There can be other parameters, as well. (Apple hasn’t provided an explanation for the dramatic halt in share buybacks last December.) Another explanation for last year‘s cessation of share repurchases in December at Apple could be in anticipation of a very weak earnings report in January. Companies often have quiet periods before earnings, particularly if the news is not going to be good. We will know Apple’s forward outlook when they report earnings today, after the markets close. (I’ll update this in the comments section of this blog at that time.) In the 2nd quarter of 2019, Apple logged in as the #3 smart phone provider in the world, behind Samsung and Huawei (source: IDC.com). The 3rd quarter results will likely be released tomorrow. The Federal Reserve Fed Fund Rate Wonder why this year’s Santa Rally is more reliant upon Apple than the Federal Reserve’s Board decision? This is largely due to the Effective Lower Bound interest rate, which has already been hit. There comes a point when lower interest rates just can’t inject adrenalin into the late stage of the bull market’s life, even though Wall Street is practically demanding a rate cut today. As Nobel Prize winning economist Robert Shiller explains it, “It’s like your doctor giving you a strong anti-depressant for your mental condition. You think, ‘I must be really mentally ill if he gave me that.’” The economy grew at mere 1.9% in the 3rd quarter of 2019, according to the Bureau of Economic Analysis. Interest rates have been so low for so long that almost everything that can be leveraged responsibly has been. Below are a few examples.

Incidentally, even though interest rates have been falling again and home prices have still been rising, the number of mortgages that are severely underwater has grown this year. This has a lot to do with the recent trend of loan mods that have so many fees and unpaid interest tacked onto the new principle owed. I’ll be looking into this in the coming weeks. If you are a homeowner who is underwater on your home, it’s in your best interest to seek solutions outside of those being offered by the people you owe money to. Reach out to our office at 310-430-2397, or by email at [email protected], with any questions and/or if you are in this position. Bottom Line Apple had almost $100 billion left in its buyback facility as of June 29, 2019. The share price is back near its all-time high, at $241.83 today, vs. an all-time high of $249.75. (The 52-week low of $142/share occurred on January 4, 2019.) Apple is projecting flat to tepid revenue growth of $61-$64 billion, vs. $62.9 billion a year ago. Results will be announced today after the markets close. With Apple’s share price back to an all-time high, if Apple’s forward outlook is weak, we may be looking at the perfect storm that restrains the company from buying back its own stock in the coming months. That was devastating last year. The enlightened investor will take note of the trend, which runs counter to the normal Santa Rally trend, to protect their assets and remain on the right side of the trade. Other Blogs of Interest Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 1/11/2019 06:36:28 am

Great. Iphones always are my passion. I usually buy a new phone whenever Apple launches a new model. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed