|

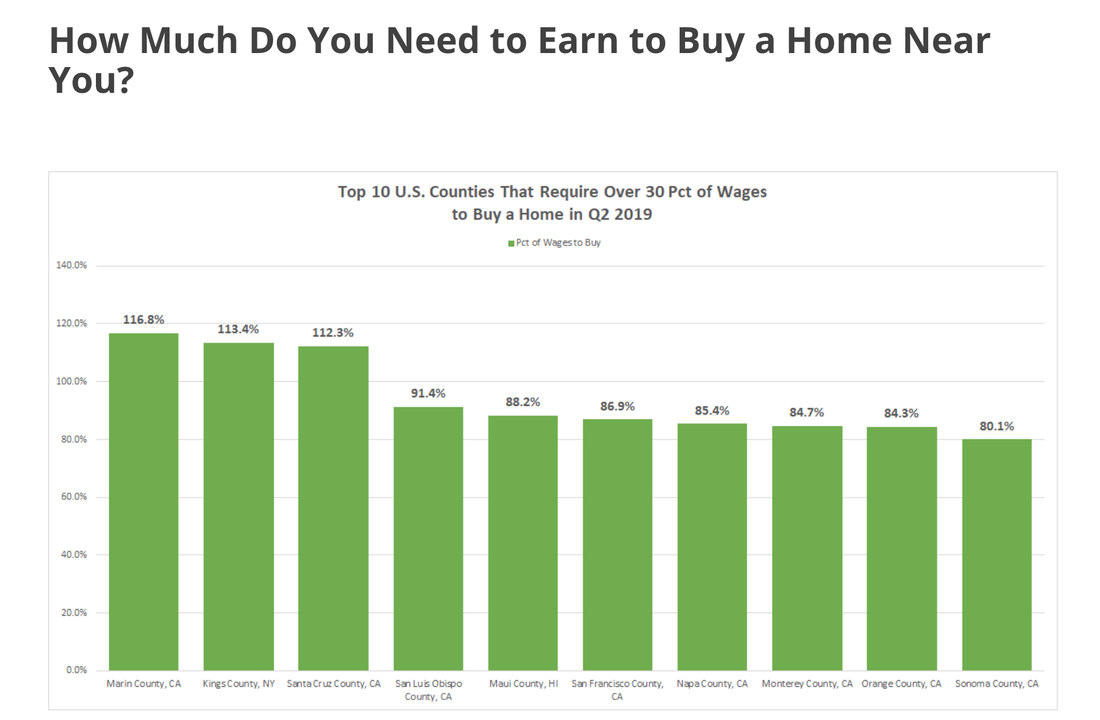

Housing is Unaffordable in 74% of the U.S. On Thursday, AttomData.com released a report outlining the stark reality of today – that the average wage earner cannot afford to buy a home in 74% of U.S. housing markets. The most unaffordable markets are in California (8 of the Top 10), with Maui, HI and Kings County, NY (Brooklyn) rounding out the Top 10. Cook County, IL (Chicago) and Maricopa County, AZ (Phoenix) were also near the top of the list. Meanwhile, if you want to live in Houston, Detroit, Cleveland or Columbus, you’re likely to find something that you can afford. Essentially, if you live in a place that’s teaming with jobs and cutting-edge technology, you might have to live in your car. What’s almost as astonishing and heartbreaking as unaffordability, given that real estate prices are at an all-time high, is that there are still 5.2 million U.S. properties that are seriously underwater. This number is up from last year, even while real estate prices have continued to increase. How is that even possible? Well, the banks have taken to giving loan mods where a ton of interest and penalties are tacked on. They then give the homeowner a payment they can afford and a low, often fixed, interest rate, with a total amount due (not including the interest earned over the decades) that is above the price of the home. For some reason, the homeowner thinks this is a good idea, even though they now owe 25% or more than the home is worth. If you are one of the unlucky ones who owe more than the value of your home, it’s time to look into a few options that are not going to be offered by your bank. If you are locked into a low-interest rate loan that is far above the value of your home, particularly if you are struggling to make the payments, it’s time to get a new plan. Even if the loan mod puts payment within reach, it is likely a terrible idea to accept the deal of paying more for your home than it is worth, when markets are at an all-time high. If real estate values drop, then you’ll be even more locked in and more seriously underwater, with few options on how to sell, move or escape. (Call our office at 310-430-2397 for resources.) Will Housing Unaffordability Tear Down the Economy? The crystal ball on the economy, provided by the Federal Reserve Board, forecasts that GDP growth will slide down to 2.1% growth in 2019, from the 3.1% growth we enjoyed in the 1st quarter. We should start seeing that slowdown in the 2nd quarter 2019 GDP. The advance report will be released on July 26, 2019 at 8:30 am ET by the Bureau of Economic Analysis (BEA.gov). High real estate prices affect everything. It makes it harder for mom-and-pop shops to stay in business, weighs down a retail sector that is already struggling to catch up to Amazon (and from financial predators who take advantage of their need to access debt) and gobbles up most of the budget of the Middle class. If you want to buy a home in Marin County, you’d need to hand over more than you earn (on average). Of course, this is impossible and you’d never qualify for a mortgage, which is why the PHSI is down 3.1% year over year in the West and the MidWest, where home prices tend to be more affordable, has become the market leader. The high cost of housing has contributed to consumer debt soaring to an all-time high – above where it was before the Great Recession. Household debt is now $13.67 trillion. Public debt is $22 trillion. As Alan Greenspan warned in an interview in April of this year, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized.” How Unaffordability is Already Impacting the Economy

What Does This Mean For Home Owners, Sellers and Would Be Buyers? Should You Buy? Should You Sell? Should You Hold? See my check-list below for a blueprint by which to analyze your options. A Boomer couple, who are close to retirement, just purchased an 800 square foot fixer-upper in South Central Los Angeles for $450,000. There are a million ways that this can go wrong for them, and only a couple of ways that it can go right (mainly if they are able to fix and flip before the next downturn starts to snowball)… 12-Point Check List for Homeowners, Home Buyers and Renters 1. The Mortgage Interest Deduction. 2. Buy What You Can Afford. 3. Have a 10-Year Or Longer Vision. 4. Lock-in a Fixed. 5. If You’re Underwater on Your Mortgage, Get a Second Opinion. 6. Align Your Mortgage Pay-Off Date With Your Retirement Date. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. 9. Interested in Buying a Home Abroad? Read my blog. 10. Consider the Shadow Inventory. 11. Never Buy High. 12. Keep the Money in the Family. And here is additional information on each point. 1. The Mortgage Interest Deduction is one of the best ways to lower your tax bill and stop making Uncle Sam rich. You can write-off the cost of financing your home, or a second home, up to a cap of $1,000,000, and your HELOC up to $100,000. If you are getting killed in taxes, this is a great solution. However, it is never a good idea to buy high. By itself, this is not a good reason to purchase today. 2. Buy What You Can Afford. The Thrive Budget works like a charm when you limit your basic needs to 50% of your gross income. When you overspend on your home and become property rich and cash poor, you risk losing your home and ruining your credit score, and ensure sleepless nights and stress. If your city is unaffordable, there are creative solutions to your problem that are worth considering. Call our office for a private coaching session to discover some ideas that might work out great for you. Buying more than you can afford or at the top of the business cycle can easily create a decade’s long nightmare for you. 3. Have a 10-Year Or Longer Vision. In 2019, when real estate prices are back to an all-time high, it is not the time to buy and flip. If prices weaken, you could be locked into your home for a much longer period than you anticipate. So, be sure to cast your vision out over a 10-year horizon, or longer, and know what you’ll do with your home if you receive a great career opportunity in another city, or if real estate values plunge, or if your family expands beyond the capacity of your current living space. 4. Lock-in a Fixed. Interest rates are still at a historic low. Locking in a fixed rate now could save you tens of thousands (or more) in the coming months and years (assuming you haven’t already done this). Don’t fret that the banks aren’t loaning. See what the mortgage lending specialists are offering, and if it’s competitive, consider it. Don’t do this, however, if it means a big increase to your debt to assets ratio, or if it means your mortgage will be underwater. 5. If You’re Still Underwater, Get an Unbiased Second Opinion. Not from your bank. If your mortgage is still severely underwater, as it is for over 5.2 million Americans, then it’s time to seek the counsel of a professional who is not in the banking industry. Paying a million dollars for a home that is only worth $700,000 or less makes the bank rich. In the meantime, your credit score remains in the toilet due to your debt being so much higher than your assets. There might be solutions that you haven’t thought of. In this scenario, it is also exceedingly important to keep squirreling money away in your tax protected retirement accounts and health savings account. Being a slave to the mortgage, at the expense of your own retirement and future, is making the banksters rich at your own expense. 6. Align Your Mortgage Pay-Off Date With Your Retirement Date. One of the best things you can do to plan for retirement is to align your mortgage pay-off date with your retirement date. Once you retire, life will be much easier if you’ve reduced your expenses dramatically. Since housing is one of the biggest expenses in the budget, having no mortgage will help tremendously. If you haven’t done this by the time you retire, but you have a lot of equity, your current home might be a great way to earn income by renting it out while you downsize to a more affordable home. Do the math and make sure that the income is well above all of your expenses, and makes it worth the trouble. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. Stocks and bonds are in a bubble, and are highly leveraged at this time. Even though real estate can also lose value in a downturn, you can still live in your home or rent it out. When a company restructures their debt, the stock becomes toilet paper and your bonds could lose all or most of their value. Being a property owner could be the best way to retain wealth in the challenging years ahead. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. With stocks and bonds in a bubble, one of the best areas of “safety” is to consider safe, income-producing hard assets that you purchase for a good price. Every word in that sentence matters, which takes real estate off the table, for now, in most cities. There are other options that are not well-publicized, however, that are a great price, and offer 25% or more Return On Investment. Curious? Attend my next Investor Educational Retreat! Call 310-430-2397 to learn more. 9. Interested in Buying a Home Abroad? Read my blog that includes a 10-Point Ex-Pat Check List. 10. Consider the Shadow Inventory. With 5.2 million homes underwater, that means there are lot of distressed homeowners, many of who are late on their payments. There are also homes being sold at auction, and others that are bank-owned. If you shop in the shadow inventory, you might achieve savings of 1/3 or more off of the multiple-listing service. 11. Never Buy High. Buying high in real estate creates far more problems than just being locked into your home and loan for an extended period of time. Be sure to buy only what you can afford and to find a home that is not overpriced. In most American cities, that will mean waiting patiently until prices down, or getting creative about how you might transform an undervalued asset into income-producing housing. 12. Keep the Money in the Family. Keep this mantra forefront as much as possible. Whenever you and your family benefit, rather than a stranger landlord, the money can remain part of the family estate. This is something to think about in housing throughout the arc of life, from college to retirement and to what to do with aging parents. Owning your own home has many advantages. However, buying real estate high can be a nightmare that drains you dry for years. Over 10 million homes went to auction in the wake of the Great Recession. That stress is soul-killing and difficult to endure. It prevents you from investing in other opportunities that will make your life easier and ruins your credit-score – even if you keep making payments. So, being an astute buyer, instead of being sold into something now by a clever broker-salesman, is key to success in home-buying and investing in income-producing property. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed