|

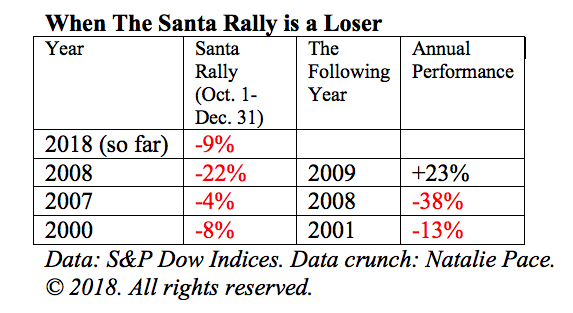

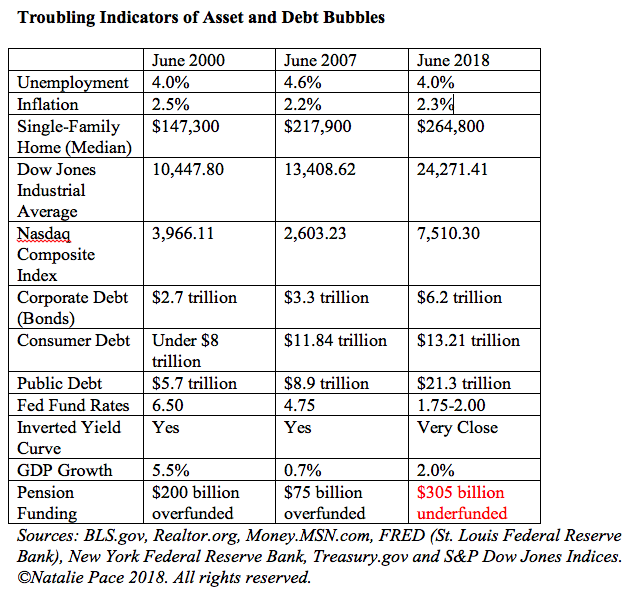

When the Santa Rally is a loser, the next year is a bigger loser, 2/3rds of the time. Below are the last three times that the Santa Rally sucked, along with what happened the following year. Before 2000, you have to go all the way back to 1978 for a bad Santa Rally. The Santa Rally was so reliable before 2000 that you could basically buy at the end of September (the worst performing month on average) and then sell at the end of January (the best performing month) for 50% or more of the annual gains of the year. That strategy hasn’t worked since 2000 (even though there are still “pundits” teaching the “Buy in October, Sell in May” theory). 2000 Dot Coms were in a bubble. Many had been cash negative for more than 4-5 years. The promise of shopping online was dumped every time your dial-up connection dropped. Technology wasn’t developed enough to execute the vision. Stocks dropped 13% in 2001, after losses of 8% in the 2000 Santa Rally. Most people don’t realize that there was a Santa Rally in 2001, after 911! 2002 was another down year for stocks, yet the Santa Rally brought in 8% in gifts. October of 2002 turned out to be the low of the Dot Com Recession. In 2003, the NASDAQ Composite Index earned gains of 50%. 2007 There had been a series of mortgage bank bankruptcies beginning in January 2007, yet the stock market roared on to an all-time high of 1549 for the S&P500 on Halloween. Countrywide Financial, the largest mortgage lender by far, was in deep trouble by September 2007, and announced a layoff of 20% of its staff. By October, Countrywide’s stock was in free fall. Bank of America rescued the mortgage lender (with help from the Feds) on January 11, 2008. Incidentally, Angelo Mozillo, the CEO of Countrywide, first began selling hundreds of millions of stock in April of 2005. So did many other real estate CEOs, including the CEO of KB Home and the C-levels at Toll Brothers. The top dogs and bankers, including H. Paulson, knew real estate was a bubble waiting to pop in 2005. In 2008, the S&P500 lost 23%, after 4% losses in the 2007 Santa Rally. 2008 Bear Stearns stock fell to just $2/share in February. The company was swallowed up by JP Morgan on April 2, 2008. Indymac Bank failed on July 11, 2008. Lehman Bros. declared bankruptcy on 9.15.08. AIG was bailed out on 9.16.18. Banks were bailed out on 10.3.08. Local banks quietly changed signs as the FDIC worked hard to avoid bank runs. If you were without a high school diploma, you had a one in four chance of being unemployed in the U.S. The Santa Rally was a giant loser in 2008, with losses of 22%. The losses for the year were a devastating 38%. So, why was 2009 a winner after the economy melted down? The Dow dropped all the way to 6549 on March 9, 2009. That sparked the U.S. to fire up the printing machine and give a boatload of money to the banks. The banks loaned the money to corporations. That created jobs. Over 10 million jobs were created over the next four years. GM restructured on 6.1.09. Chrysler entered Chapter 11 on 4.30.09. Jobs and pensions were cut, but the auto industry was saved. Sadly, the lending was unequally distributed. 10 million homes also went to auction. As we sit near an all-time high for real estate and stocks, many Americans have forgotten just how horrifying and devastating 2008 was. What’s the Crystal Ball for 2019? Complacency will not be your friend in 2019. As President John F. Kennedy said, “The time to repair the roof is when the sun is shining.” As we enter 2019, most of the issues that were a problem in 2008 are just as problematic now. More so, when you consider that bonds are losing money. That means that the “safe” side of your nest egg won’t save your assets if stocks drop. In the Dot Com and the Great Recessions, bonds earned gains. However, that will not be the case in 2019. There’s just not enough wiggle room in interest rates for the Feds to lower them and spark growth, as you can see in the chart below. As you can see from the chart above, real estate is higher than ever, and unaffordable in many cities. Stocks are higher than ever, with expensive valuations not seen since the Great Depression and the Dot Com Recession. U.S. public debt just hit $21.8 trillion. The economic indicators touted on television, mainly GDP growth and unemployment, are not predictive of recessions today. Asset bubbles are, which is one of the reasons why the Federal Reserve Board is determined to raise interest rates. (Low interest rates create bubbles.) We’ll know how far and how high at the December 19, 2018 meeting. Currently they are on track for a 3.4% Fed Fund rate by 2020. What’s Your Best Move?

A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed