|

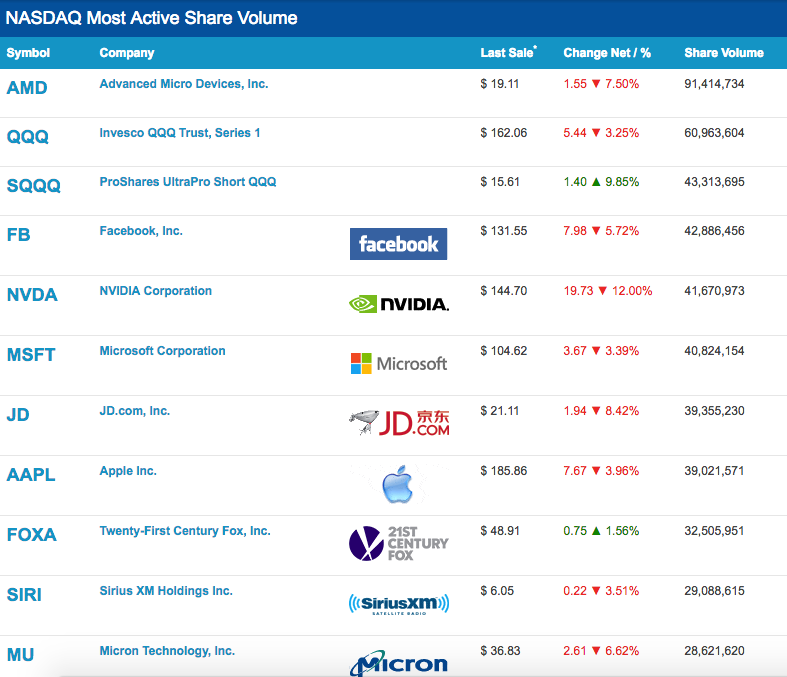

On November 19, 2018, the NASDAQ Composite Index dropped 3.03%. (The Dow Jones Industrial Average lost 1.6%.) Some of the Top 10 sell-off volume leaders were elite members of the coveted FANG*, where the most outstanding returns over the past few years have been. Today, Wall Street dropped again, this time losses were more concentrated in the Dow, with losses of over 2%. What’s going on, and, more importantly, what should you do about it? The simple truth is that stock prices were too high. The big money knows that, and VIP leaders, including former Federal Reserve chairman Alan Greenspan, billionaire Warren Buffett and Nobel Prize winning economist Robert Shiller, have been warning about bubbles for over a year. Here’s where buy low, sell high becomes an emotional game. For the last few years, many folks have wanted to jump into stocks, i.e. buying high, after hearing of the extraordinary gains investors have enjoyed since 2009. Meanwhile, the smart money is looking for every opportunity to sell high and capture gains. That’s why it is so important to use wisdom, information and time proven strategies, and minimize your reliance on headlines, articles, talk shows and salesmen. Below I’ve highlighted some of the data and information you need to be aware of, and below that tips to what is needed for you to get safe, diversified, protected and hot now, before a more severe correction. Here are 10 Key Elements to Wall Street’s Rise and Fall in 2018 1.Price. 2.Earnings. 3.Average P/E. 4.Financial Engineering. (Buybacks, Dividends.) 5.Quiet Periods. 6.Interest Rates. 7.Trading. 8.Deleveraging. 9.Rhetoric and MSM Language. 10.Bubbles. 11.Catastrophic Events. And here is more information on each point… 1. Price. Stock prices are at an all-time high. So are real estate, bonds and debt. The recent weakness doesn’t put things into buying territory, unless 2019 is going to be a gangbuster of a year in terms of earnings growth – something that is not predicted currently. 2. Earnings. Earnings were boosted in 2018 with the Tax Cut. While lower taxes should help companies with their profitability, the one-time boost to earnings growth in 2018 could be hard to match in 2019. The 4th quarter 2018 GDP growth is predicted to just 2.6%, much lower than the 3.5% in the 3rd quarter 2018. 2019 estimates are coming in between 2.4-2.7% (source: Federal Reserve Board). 3. Average P/E. The average P/E for stocks today is 22.19 (as of June 2018). The historical average (since 1936) is 17.18. That’s almost a third higher than normal. The FANG stocks were much pricier. In April of this year, Amazon’s P/E was 227. Netflix’s was 233. Google was 56. And Nvidia’s P/E was 44. These are very lofty prices, even given the outstanding sales growth of these companies, which was 38%, 33%, 24% and 34%, respectively. Today, even with the price pullback on these companies, the P/Es are still much higher than the average, with the exception of Apple with a P/E of 15.60. If earnings soften in 2019, this will increase the P/E, unless prices keep going down. 4. Financial Engineering. Many companies, particularly those with very high debt and pension obligations, have been borrowing money for almost free, and using it to buy back their own stock and to pay dividends. As of Nov. 16, 2018, corporate buybacks are setting an all-time record of almost $200 billion for the 3rd quarter 2018. Apple has been on the largest buyback spree.When a company buys back its own stock, it increases the earnings per share (by reducing the share count), which makes the P/E look lower (by increasing the EPS). All of this keeps investors interested. However, with interest rates rising, and debt rising, the cost of buybacks and dividends is getting to be too high. Too much debt puts a company at risk of a credit downgrade, and rising interest rates make borrowing more costly. Currently over 50% of the investment-grade companies in the U.S. are at the lowest rung before junk bond status. 5. Quiet Periods. Two weeks before a company releases its earnings, the buybacks are suspended. Quiet periods have been associated with the most massive downturns this year, largely because the current bull market has been fueled to a very large extent on corporate buybacks. 6. Interest Rates. The Federal Reserve Board has indicated that they would like to take interest rates to at least 3.4% by 2020. That is double from where rates started 2018. Rising interest rates have meant that bonds have lost value in 2018. Bond funds are losing money. Any company with high debt and high leverage is vulnerable to rising interest rates. 7. Trading. Any big move on Wall Street is subject to high speed due to the amount of high-frequency traders and options traders that are in the market. In the Dot Com Recession, it took NASDAQ 31 months to hit rock bottom, with losses of up to 78%. In the Great Recession, the colossal drop of 55% occurred over a 17-month period. Cryptocurrency has been in a rout for over a year since the high of $20,000 for Bitcoin, with losses of 77%. Is this the beginning of a more severe downturn in stocks, bonds and real estate that will play out in the coming year(s)? It’s better to be safe than sorry… A good plan will allow you to profit from rallies and will protect you from downturns. 8. Deleveraging. The Big Money knows that if they sell all at once, they will end up selling low. Selling a large amount high requires a careful strategy that includes optimizing your sales during market rebounds. That’s why Wall Street looks like a rollercoaster this year (and since 2000). 9. Rhetoric and MSM Language. You’ll hear a lot of pundits in the mainstream media say that stocks have hit “bear” territory. This implies to a lot of less-sophisticated investors that they can buy low now. Broker-salesmen use this kind of language to their advantage, enticing clients to buy into a plan that is not diversified, hot or properly designed for safety. Investor beware. 10. Bubbles. Low interest rates create asset bubbles. Today, we have bubbles in stocks, bonds, real estate and debt. Earlier this year, we had a bubble in cryptocurrency. 11. Catastrophic Events. The wildfires in California were heartbreaking and monumental. The cost of the fires could negatively impact GDP growth. It will also hurt the utilities sector, particularly PG&E and So Cal Edison, which were already struggling under high debt, slow earnings growth and massive liabilities before the fires. Both companies have already experienced a sell-off in stocks, losing more than half their value since the fires began. Recent legislation limits the liabilities of utilities in California. However, it won’t mitigate all of the financial costs of the fires that will have to be borne by these companies. Crystal Ball 2019 Essentially, there are 11 reasons why stocks, bonds and real estate prices are poised to soften in 2019. Which means it’s time for you to get your defensive game on, while keeping some targeted offensive action in play. Solutions The solution to the weakness on Wall Street isn’t to just sell everything. It is to:

You can’t just trust that your broker-salesman is doing this for you when all of the products that they have to sell you are trading near all time highs and are vulnerable to capital losses. It’s time to be the boss of your money and to understand clearly what your exposure is and what a healthy plan looks like. Wisdom is the cure. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. *Facebook, Apple, Amazon, Netflix, Nvidia, Google. *BAT is the Chinese equivalent: Baidu, Alibaba, TenCent Holdings Other Blogs of Interest Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed