|

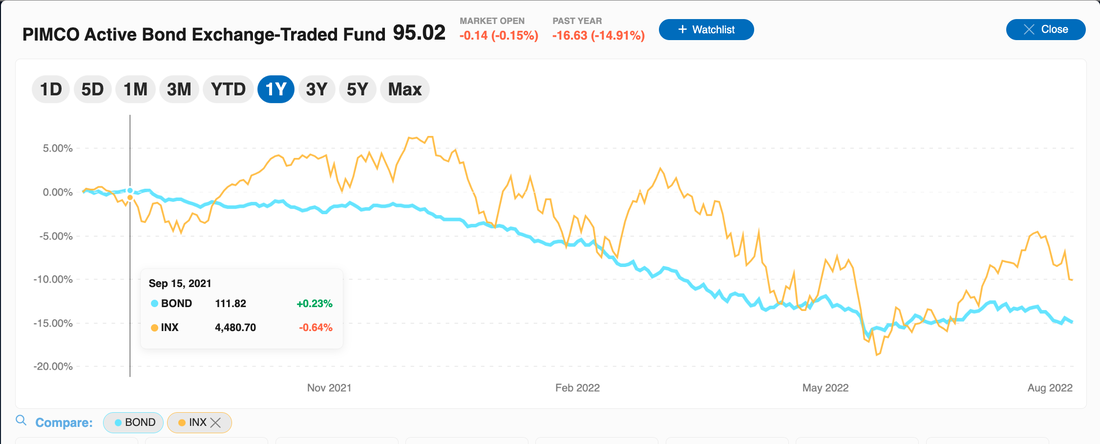

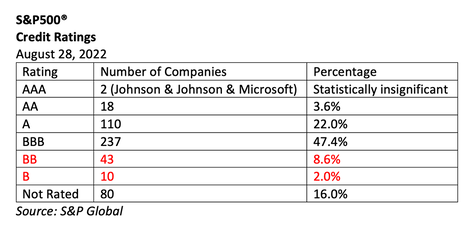

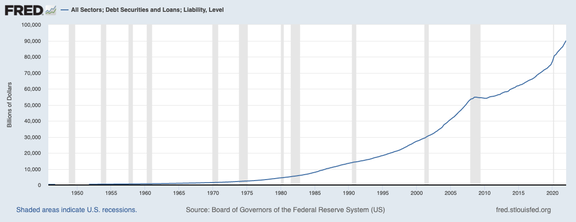

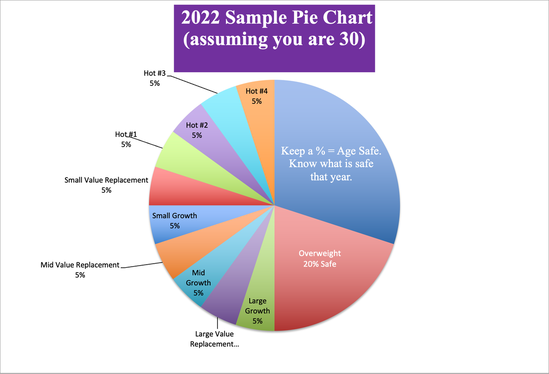

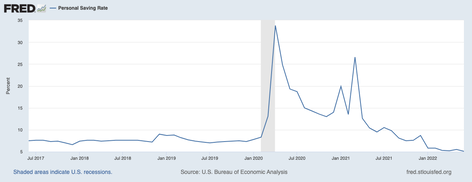

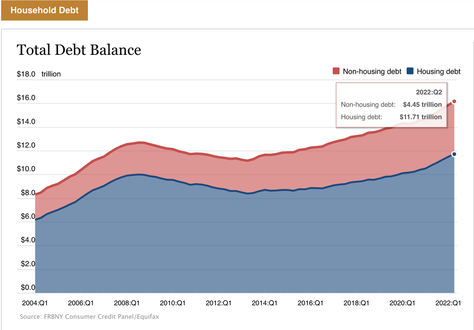

What’s Safe in a Debt World? Not Bonds. “I’m more concerned with the return of my money than the return on my money,” Will Rogers. Bond funds reported their biggest weekly outflow in eight weeks last week, according to Reuters. The Pimco Active Bond exchange-traded fund (Symbol: BOND) is down 15.2% over the last year, with losses in tandem with the S&P500®. The safe side of our portfolio is supposed to protect our wealth – something that really isn’t happening with bonds or bond funds these days. Why? There is too much risk in the world – both credit risk and interest rate risk. Bonds have an inverse relationship with interest rates. As interest rates rise the value of your bond decreases. There is also a great problem with leverage and debt. We’ve never seen these levels in the United States. Ever. Over half of the S&P500® companies are at or near junk bond status. This is not a statistic investors are seeing in the headlines. Here's another bit of news that rarely makes the news cycle. There is over $9 trillion in debt loans outstanding in the U.S. As you can see from the graph below, this is off the charts in terms of historical leverage. Below are 12 essential strategies to protect your wealth from the economic storms on the horizon. Multiple economists are now in consensus that the US will experience a recession in 2022. We may already be in a recession now. (Click to learn more.) According to The Conference Board, “Economic weakness will intensify and spread more broadly throughout the US economy in the second half of 2022. [We expect] a recession to begin before the end of the year.” 12 Essential Strategies for Protecting Wealth in 2022 1. Bonds are Illiquid and Negative Yielding. Underweight bonds. Keep the terms short and the creditworthiness high. Traditionally bonds are considered the area of safety. These are what broker-salesmen offer anyone with a low risk tolerance for losses. However, clearly, that is not what is happening. As mentioned above, Pimco’s bond fund has been losing money in tandem with the stock market. Lack of liquidity is a big problem because if we wish or need to sell the bond, there might not be any buyers, or we may have to drop the price (lose money). Some people are purchasing bonds that will last longer than they will live. (Are you a senior purchasing a 40-year bond?) As mentioned above, over half of the S&P500® is at or near junk bond status. There aren’t a lot of creditworthy companies asking for money. 2. Money Market Funds Can Lose Money, and Have Redemption Gates and Liquidity Fees. Money market funds are another traditionally safe asset. In many 401(k)s, this is one of the few options for safety that we can select. However, money market funds are funds, and they can lose value just like every other fund can. Additionally, if the fund company itself has liquidity problems, or too many people want redemptions at the same time, there are policies in place that allow the fund company to stem that flow by imposing a redemption gate or a liquidity fee. That means that you may have to pay to have access to your money, or you may not be allowed access at all for a period of time. These funds are quite a bit riskier than most people realize. Additionally, when you factor in the expenses, the yield they offer for that risk is rather anemic. 3. Annuities have Surrender Fees, Hidden Fees and Are Not FDIC-Insured. One of the most highly leveraged industries in the U.S. is the insurance industry. According to the Federal Reserve Board’s Financial Stability Report, which was released in May, “Leverage at life insurers remained near its highest level of the past two decades. Life insurers continued to invest heavily in corporate bonds, collateralized loan obligations (CLOs), and CRE debt, which leaves their capital positions vulnerable to sudden drops in the value of these risky assets.” Annuities are not FDIC-insured. Many times they have hidden fees. And they are one of few investments that loses 9-10% the minute you purchase them (those surrender fees). If you want or need access to your money over the next decade, you’re going to take a big haircut. It’s also important to remember that AIG would’ve gone bankrupt if the US had not bailed the company out in 2008. AIG is the biggest annuity provider. Many companies with different names are actually owned by AIG. If you are going to own an annuity, it would be important to know the company’s credit rating, as well as to look deep into the fine print to make sure that you’re not being eaten alive by fees. Broker-salesmen make a good commission (up to 10% annually) for selling individuals into annuities. 4. Dividends Don’t Pay When Your Principal Plunges. I was recently on stage with someone at a major conference who “specializes” in high-yield stocks for the income. He said that the share price always sorts itself out, if you just buy and hold. That’s simply not the case. Warren Buffett famously sold all of his General Electric stock just a few months before the company cut its dividends. The stock market is still trading close to an all-time high. However, GE is still down over 2/3 from its $243 highs of late 2016. It’s never a good idea to lose principal in the hopes of earning a small amount of “income.” The higher the dividend, the higher the risk. 5. Capital Preservation. A lot of people are being sold into risky, money-losing assets as “safe” with the sales pitch that if you don’t try to earn some income, your money is losing buying power, and you’re not keeping up with inflation. What they’re not telling you is that you are at risk of losing money in addition to buying power, and are not getting much of a return to take on that risk. It is important to preserve your capital in recessions. When you lose too much money, your credit score plunges, your lifestyle changes, your relationships suffer and you might have to take on a 2nd job or delay retirement. 6. Liquidity Affords Us the Opportunity to Buy Low. Most people don’t buy low because they can’t. When we lose too much money in a recession, we have to hope and pray that our investments crawl back to even, rather than being one of the few who preserve their capital and can go on a buying spree at a very reduced price. So rather than get sold into risky, money-losing assets with the fear of inflation hanging over our heads, our mantra should be to preserve our capital because it affords us the ability to buy low. (There are tricks to reducing the impact that inflation has on our lives. Learn more in the Thrive Budget section of the 5th edition of The ABCs of Money.) 7. Keep a Percentage Equal to Our age Safe. I do a lot of unbiased 2nd opinions. There is not one that I’ve done where people have the appropriate amount safe. The standard rule is to keep a percent equal to your age safe. The closer we get to retirement, the less time we have to recover from losses. This is another reason why it’s important to know what safe in a Debt World. When bonds are losing money, or annuities are reducing in value due to the hidden fees, we need to have a different plan for the safe side of our portfolio. That is why we spend one full day on What’s Safe in our Financial Empowerment Retreats. Email [email protected] with Retreat in the subject line to learn more. 8. Overweight Safe During Times of Economic Hardship. We are overweighting 20% safe in our sample pie charts due to the risk of recession. This one simple trick is how people earned gains in the Great Recession and the Dot Com Recession. If you’re 50 and you’ve overweighted 20% safe, if the stock market loses half, your losses are only about 15%. The bonds earned gains in the Great Recession and the Dot Com Recession, making up for the losses on the equity side. It is more difficult to get safe this time around. However, liquidity is one of the essential elements of weathering the economic storms on the horizon. 9. Keep the Money in the Family. One thing that separates very wealthy families from the rest of us, is that they tend to think multi-generational. They plan 100 years in advance. They educate their children in financial matters. They don’t spend a lot of family money on rent and landlords. I am sure that Millennials and Gen Z are very sick of living with their parents, and vice versa. However, there are many solutions to consider when you think outside the box, and make keeping the money in the family a top priority. Check out our real estate blogs, podcasts and videoconferences, as well as the Real Estate section of the fifth edition of The ABCs of Money. 10. Safe Income Producing Hard Assets That You Purchase for a Good Price. One area of safety is to purchase safe, income-producing hard assets that you purchase for a good price. When we first introduced this mantra in 2011 (when real estate was at a decades-low price), only those with liquidity (money) could take advantage of it. Most of those people have seen the value of their investments more than double. Now, with real estate at an all-time high, it’s difficult to purchase anything for a good price. However, there are other low hanging fruit. If you live in a sunny state, then solar panels can save thousands annually. The payback time can be as low as 4-7 years. Be sure to get your megawatt usage down as low as possible before you get the quote. (Learn more in The ABCs of Money.) If you don’t live in a sunny state, then insulating better and using LED lighting can also save thousand annually. Energy efficiency upgrades offer tax credits up to 26% in 2022. Also, think about how you can reduce the amount you spend on gasoline. Can you ride a bike, walk or take public transportation more? Should you consider moving closer to work? The average person spends almost $8000 a year owning a car, when you factor in the car payments, car insurance, maintenance, parking, tickets and gasoline. What kind of investment can you make to lower that CO2 footprint, which can also give you more room in the budget for things you like more than gas stations? Would a solar-powered electric vehicle be right for you? There are tax incentives of up to $7,500 to purchase certain qualifying models. (Click to access information.) 11. Proper Diversification. Proper diversification is really important. Most people don’t have much diversification at all. We have the same type of holding over and over again. Even if we have 18 pages of individual stocks, we might be concentrated only in large-cap stocks, with just a smattering of diversity. Our sample pie charts have 10 funds: small, medium, large, value and growth, and four hot slices. The hot slices allow you to get invested in things that can remain more buoyant in recessions, such as consumer staples or utilities, or might even be good hedging tools that could increase in value. We spend one full day on the nest egg pie chart strategy in our Investor Educational Retreats. Our next one is October 8-10, 2022 online. (You can attend from anywhere, in the comfort of your own office or living room.) Register now and receive a free 4-part webinar on how to get safe, which you can enact now, before the retreat. 12. Regular Rebalancing. Regular rebalancing is essential for protecting our wealth. If we are not rebalancing at least once a year, then we are at risk of riding a Wall Street rollercoaster. During the Dot Com Recession, the NASDAQ Composite Index lost 78%, and took 15 years to recover. That means that a million dollars sank to just $220,000. Everyone who was partying on their AOL gains in 1999, were in big trouble at the bottom in 2002 – except those of us who rebalanced at least once a year. During the Great Recession, the Dow Jones Industrial Average lost 55% and took about 7 1/2 years to recover. We don’t want to use bull markets to make up losses. Simple rebalancing is one of our best tools to prevent that, along with keeping the right amount safe, diversifying and knowing what is safe in a Debt World. Bottom Line It’s important to know what is safe in a debt world. This basic financial literacy allows us to be the boss of our money, rather than having blind faith that someone else is doing this for us. It’s time to employ a time-proven, 21st Century system (listed above) to protect our wealth now. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. For most of the 21st Century, the U.S. has been hot on China – hosting IPOs left and right. Baidu (China’s search engine) went public on the NASDAQ Stock Exchange on August 5, 2005. Alibaba listed on the NYSE on Sept. 19, 2014. “As of March 31, 2022, there were 261 Chinese companies listed on the U.S. stock exchanges with a total market capitalization of $1.3 trillion,” according to the U.S.-China Economic and Security Review Commission. Chinese companies saw their shares fall out of favor with American investors beginning in February of 2021. On August 3, 2022, a bombshell was dropped. The U.S. SEC issued a rather stark Investor Bulletin, warning investors that, “You should be aware that the securities of a Commission-identified issuer will be subject to a trading prohibition in the United States if the company is so identified for three consecutive years. This could result in the securities becoming illiquid and potentially losing value significantly.” While the current law requires that foreign companies (mostly Chinese) must comply with the SEC’s audit requirements by 2024, SEC’s Chair Gary Gensler wants a deal in place this year, as Congress is trying to move up the deadline for audit compliance to 2023. Money & Politics Why would the SEC want U.S. investors to pull financial support away from Chinese companies? While Congress and the SEC claim that it is all about proper auditing, could it have anything to do with politics? With Russia’s invasion of Ukraine and China staging war games in Taiwan, is the U.S. employing financial saber-rattling? Are they serious about delisting Alibaba and other popular Chinese equity investments? Or are they forcing financial hardship on these firms (and the American investors who bought into them) as an aggressive wooing and reminder of how the U.S. consumers and investors have helped China’s rise to become the strongest economic power in the developing world? It’s important to remember that the U.S. and Europe are two of China’s biggest customers and investors. At the same time, China and Russia have grown closer over the past few years. China and Russia will be conducting joint military exercises from August 30 to Sept. 5 (just as they did last year). China’s Ministry of Defense issued a statement that the participation “is unrelated to the current international and regional situation.” China appears to have taken a neutral stance in the invasion of Ukraine (so far). 2022 & 2023 are Critical Many analysts are confident that the 3-year time frame allows ample time to resolve these issues. (H.R.6285, the new bill that proposes to push up compliance to 2023, was referred to the House Committee on Financial Services on Dec. 14, 2021.) They are telling their clients that China is serious about resolving these issues and that the talks are continuing. Charlie Munger & the Daily Journal Corporation still had $34 million invested in Alibaba as of the last 13F report on July 6, 2022. In his speech on July 27, 2022, the SEC’s Gary Gensler affirmed that, “The SEC and the PCAOB have been negotiating with Chinese authorities on a Statement of Protocol to govern inspections and investigations of registered public accounting firms on the ground in China and Hong Kong.” However, Gensler also said that the Statement should be completed this year, since Congress wants to accelerate the timeline for compliance from three years down to two years. His message to The Chinese authorities was firm: “I look forward to ensuring key investor protections in our markets — with China-based issuers, if the law is followed; or without China-based issuers, if it is not.” Which Companies are on the HFCAA List? Since March 30, 2022, the SEC has been adding Chinese based companies to their HFCAA list (Holding Foreign Company Accountable Act). (Click to see if your company is there.) There are over 150 companies listed on the SEC’s HFCAA webpage – the majority of the 261 Chinese companies publicly listed in the U.S. If you own a Chinese equity, chances are your company is on the list, including the name brands, like Alibaba, Nio, Xpeng, Li Auto, and a few surprises, like Canadian Solar. Alibaba Alibaba was added to the “provisional” HFCAA list on July 29, 2022. The company responded by issuing a statement to the Hong Kong bourse, writing "Alibaba will continue to monitor market developments, comply with applicable laws and regulations and strive to maintain its listing status on both the NYSE and the Hong Kong Stock Exchange." On August 4, 2022, the company added two new independent directors, with expertise in finance and auditing. Irene Yun-Lien Lee is the chairman of Hysan Development Company Limited and the independent non-executive chairman of Hang Seng Bank Limited. Albert Kong Ping Ng is the former chairman of Ernst & Young China. Are There Any Reasons to Invest in China? China’s economy has slowed, but is still growing. Goldman Sachs is projecting 3% GDP growth for 2022, compared to the Federal Reserve Board projection of 1.7% GDP growth in the U.S. The U.S. economy contracted for the first half of 2022, which is commonly assumed to mean that the country is in a recession. The NBER has not yet made that announcement, however. Chinese companies have seen their revenue growth slow, as well. Weibo’s year-over-year growth was only about 5.6% in the 2nd quarter, while Baidu and Alibaba were flat. Profit margins are also lower. It wasn’t uncommon for Chinese companies to have double digit profit margins that were above 20 or 25% last year. Today Alibaba and Baidu’s profit margins are modest at 3.84% and 6.1%, respectively. However, the 2nd quarter included a two-month lockdown in China. So, brighter days may lie ahead – though dimmer than the halcyon days of yore. Share prices for companies like Alibaba and Weibo are at all-time lows that have not been seen since their IPOs. If there are signs that China is moving to a more friendly stance with the West, or if these Chinese companies start allowing audits, their share prices could recover very rapidly. Alternatively, if China invades Taiwan, you’re likely to see investments in Chinese companies plunge. The stock market reacts quickly to political vicissitudes, and especially to war. U.S. investors in Chinese equities could either have a fantastic Santa Rally or a lump of coal in the stocking… Daqo The exception to the slower trend would definitely be Daqo. Daqo is a polysilicon provider for the solar industry. The year-over-year sales growth is 182%. Profit margins are 51%. The P/E is only 3. It’s truly rare to see a company that is so much in demand with its customers, which is so out of favor with investors. Daqo is also on the HFCAA list. Unlike Alibaba, which made it clear that they will try to keep their NYSE listing, Daqo’s press release was more ambiguous. The company wrote, “The Company has been actively exploring possible solutions to best protect the interest of its stakeholders.” At this point, Daqo has until 2024 to get its books audited (unless the deadline is moved up to 2023). Learn more about Daqo in my July 10, 2022 blog. Bottom Line Investing in Chinese equities got a lot riskier in 2022. We have removed Chinese funds from our Hot Country list, as there is just too much political heat and pressure for most passive investors to handle. However, if Chinese and American relations improve or if these Chinese companies allow auditing access, investors should get very excited about these companies again. The ones that will recover the fastest are the ones that are the most undervalued, and are showing the most promising revenue growth. Daqo is the poster child of that. If you choose to take on higher risk for potentially higher gain, you can’t just buy and hold. Investing in Chinese equities requires that you stay plugged into developments on the SEC’s auditing demands – particularly toward the end of this year. Investors must babysit their Chinese equities, know when their exit strategy is going to be, and pay close attention to whether or not hundreds of Chinese companies are going to be delisted in 2024 – or possibly earlier, in 2023, if H.R. 6285 passes Congress. Taking profits early and often is never a bad plan in volatile markets. Regular rebalancing (1-3 times a year) is a critical component of our time-proven, 21st Century wealth plan. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 75% of New Homeowners Have Buyer’s Remorse. Real Estate Prices Drop as Sales Plunge. Should you buy, sell, hold or wait? Learn where interest rates and home prices are headed over the next few years. According to Zillow, 75% of new home owners are regretting their purchase. Some are facing more maintenance, upkeep and remodel costs than they anticipated. Others wish they’d taken more time to weigh their options. Home sales dropped 20% year over year in July, and prices were down 3% from June’s high of $416,000, to a median existing home sales price of $403,800. Those who were already regretting their purchase are experiencing heightened stress now. If you’re thinking about purchasing a home, be sure to read the information below before you throw your hat in the ring. (It’s a realtor/broker/salesman’s job to sell you a home and get the commission – not to weigh all of the budget, market, investment and lifestyle consequences of your purchase.) If you’re wondering whether or not you have overextended yourself and should be exiting your recent purchase, consider the points below, read the case studies outlined in the Real Estate section of the 5th edition of The ABCs of Money, and join me on Thursday, August 25, 2022 for my free videoconference and podcast. I host a short Q&A at the end of each webinar. One of the most painful lessons any of us can endure is to buy real estate at the top of the market or to purchase more home than we can afford. That can create hardship for a very long time, while also tanking our credit rating. The sooner we face the facts, the better off we’ll be. Buyers are Backing Out D.R. Horton, an American homebuilder, reported that 24% of buyers were backing out in the 2nd quarter, using inspections and other escrow loopholes to back out of the deal. Some weren’t able to move forward due to higher interest rates. They no longer qualified for a loan. Many new homeowners are stretching above what their budget can really bear. The unaffordability of housing has drained the savings of many Americans. The pandemic support is already gone, while consumer debt (including mortgage debt) rang up to an all-time high of $16.15 trillion in the 2nd quarter of 2022. This is an indicator that Americans are burning through savings and taking on debt to make ends meet. Interest Rates Are Rising This won’t affect fixed rate mortgages. One bit of good news is that the vast majority of mortgages and refinances over the last few years were fixed rates. That will help to prevent a real estate meltdown such as occurred in 2008. There were just too many ARMs (Adjustable Rate Mortgages) then. When the monthly payment jumped, there were too many people who couldn’t pay. There was also a great deal of speculation in the Great Recession. This time around lending standards were higher, with the majority of new homeowners having prime credit scores, according to the Federal Reserve. Most people were buying a home they were intending to live in. Just 14% of purchasers were investors or 2nd home buyers in July of 2022, according to the National Association of Realtors. The real concern is that there is a great deal of people who are spending most of their income on housing, particularly between the ages of 25 and 40. According to the National Association of Realtors, millennials and Gen Z are spending 23% of their income on a mortgage and 50% or more on rent. This may seem like an obvious reason to buy a home, and is the fuel that fed the fire of home price jumps during the pandemic. However, it’s important to remember that buying high in real estate does not go well if prices weaken, which is already happening. The Federal Reserve Board is counting on homeowners to “weather the storm” if a recession brings home prices down. However, distressed homeowners who are already spending too much on housing will be cash-strapped and trapped, with a credit score that plunges and wipes out the option to borrow until better times return. Living through an underwater mortgage is a difficult financial burden that can elevate stress, health and relationship problems. The 4 D’s of Real Estate If you are itching to buy or sell a home right now, then it’s a good idea to learn more about the 4 D’s of real estate: divorce, death, depression and disaster. When any one of the 4 D’s occur, homeowners might be forced to sell. There are far fewer buyers today, and we’re entering a seasonally slower season for real estate. So, if a homeowner is desperate to sell, the price has to drop. That works to the advantage of the patient buyer. Shopping in the shadow inventory means you might find deals that are 35% or more off the retail price. This is something we’ll discuss in great detail at my upcoming Real Estate Master Class, to be held online on Oct. 15, 2022. (Click to learn more.) What About Interest Rates? Rising interest rates make buying a home more difficult and expensive. The Fed Funds rate is predicted to rise to 3.4% this year, 3.8% in 2023 and then retreat back to 3.4% in 2024. The longer run expectation is 2.5%. If the economy hits a recession and prices weaken, the Federal Reserve Board will cut rates. This isn’t expected to happen until 2024. However, economic and inflation indicators will determine the policy. Right now interest rates on a 30-year fixed mortgage are 5.13%, up 88% from a low of 2.73% in January of 2021. Home Builders, Mortgage Companies & REITs We are underweighting real estate in our sample pie charts. Commercial real estate is suffering from the Work From Home trend. There are high vacancies in many office buildings and malls. It's important to remember that the higher the dividend, the higher the risk of losing your principal. Storage, data centers and industrial real estate are still holding strong. However the strength is already built into the share prices. Email [email protected] if you would like a Home Builders and Mortgage stock report card. Both industries are seeing sales/revenue slump as buyers dry up. Incidentally, the distress in real estate in the Great Recession started with bankruptcies in the mortgage banking sector as early as April of 2007. The stock market kept rising through October, before plunging throughout 2008 and landed at a bottom on September 9, 2009. On that date, the Dow Jones Industrial Average hit 6,547 (-80% from today’s range of 33,705). The recent median low price for homes was $166,100 in 2009 (down -60% from the June 2022 high and -25% from the 2006 high of $221,900). Incidentally, almost 20 million homes were lost to foreclosure between 2006 and 2019 (19.6 million). No one is predicting that kind of implosion. However, it is common for stocks and real estate prices to plunge far and fast in 21st Century recessions. It’s important to protect our wealth before the bad headlines – which is why we are also overweighting 20% additional safe in our Sample Pie Charts. You can learn our time-proven 21st Century wealth strategies at the Oct. 8-10, 2022 Online Financial Empowerment Retreat. Register now and receive a free 4-part webinar on how to protect your wealth from a downturn and your budget from inflation. Bottom Line If you’re itching to buy, it’s a great idea to take your foot off the gas and start evaluating real estate with a different lens than the sales speak offered by your realtor broker-salesman. There’s an entire section on real estate in The ABCs of Money 5th edition. The book includes a checklist of considerations that every prospective homeowner should consider before buying a house. If you’re thinking about selling, there are also many considerations to evaluate before you sell. Real estate can be a great way to hold wealth, particularly during a time when paper assets and fiat currency are losing value, and especially if you can find a way to gain some income out of it. There are multiple real-life case studies outlined in the Real Estate section of The ABCs of Money 5th edition that will help you to expand and broaden your vision so that you won’t be one of the 75% of new homeowners who have buyer’s remorse. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast.

Watch videoconferences and webinars on Youtube. Other Blogs of Interest Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Solar is shining and clean energy is fired up. July’s Wall Street Rally was a robust 9.11%. Some of the companies mentioned in the blog below, like Sunpower, have already soared up to 46% over that same period. Part of this was increased anticipation for the Inflation Reduction Act. However, sales were on fire for many companies, even before the passage of the Act in the U.S. Senate today. Learn more below. Is the Inflation Reduction Act of 2022 Law Yet? The Senate just passed the Inflation Reduction Act, which includes a great deal of incentives for clean energy and climate action. According to the Congressional Budget Office, it also includes a “net decrease in the deficit totaling $102 billion over the 2022-2031 period.” H.R. 5376 is expected to pass The U.S. House of Representatives and be signed into law, which means blue skies and smooth sailing for a lot of clean energy companies (once it happens). So which of the following segments and companies will benefit most? Solar The word solar is mentioned 36 times throughout the text of the Inflation Reduction Act. There are a lot of incentives for homeowners, apartment buildings and commercial buildings to power with solar, wind and hydro, and become more energy-efficient. This could really benefit companies like Sunpower that focus on rooftop solar, and Renesolar that focuses on medium-sized grid solar projects. Sunpower’s sales have already soared, with a 60% increase year over year. According to Sunpower’s CEO Peter Faricy, homeowners are buying rooftop solar for three reasons: to save on their utility bill, to be a part of the climate solution, and for peace of mind, if the grid fails. There is a 26% federal tax credit available for residential solar in 2022. One of Sunpower’s most popular new products is their Sunvault energy storage system. Renesolar’s projects are expecting to start showing up in revenue in the 2nd half of 2022. A renewed worldwide focus on solar will also benefit Daqo, a Chinese based polysilicon provider (a key raw material in the solar photovoltaic supply chain). (Click to learn what other global clean energy initiatives are gaining momentum.) Daqo saw revenue growth of 182% in the most recent quarter. With silicon prices elevated, Daqo’s Forward Outlook is extremely good. The company just increased their guidance, and is expecting annual production volume to increase to 129,000 to 132,000 MT from 86,587 MT in 2021. That’s a jump of 52% on the upper side of the guidance. In 2Q 2022, the average selling price for polysilicon was about $33.08 per kilogram. According to BernReuter.com, today’s prices are $38.86/kg. With increased production and higher prices, robust revenue growth should continue for Daqo. What’s even more amazing is that Daqo’s bright future is not baked into the share price. The company is currently trading at a price earnings ratio of just three, according to MSN’s money site. It’s very rare to see such an amazing growth story with such an affordable price – and this key inflection point rarely lasts for long. SunPower and Renesolar were cash negative in 2021. Both companies have a higher price to sales ratio than Daqo. If you’d like to see the Solar Stock Report Card, just email [email protected] with Solar SRC in the subject line. Wind The turbine industry benefits from investments in onshore and offshore wind. This should play to the strengths of American Superconductor (symbol: AMSC) and TPI Composites (symbol: TPIC). The wind business at AMSC accounts for just 13% of total revenues. However, their revenues in the wind unit increased 49% in the most recent quarter, without the help of the IRA 2022 bill. TPI Composites shut down its Ohio factory late last year, and advises that it could take a minimum of 6 to 9 months to restart the factory to serve US based contracts. AMSC’s 2nd quarter revenue was down -10.67%, while TPI Composites reported a drop of -1.41%. Both companies are projecting continued weakness in the coming quarter. However, AMSC’s CEO is excited about the “tailwinds” for his business. His team should start translating their backlog, which increased by 30% in the quarter, into revenue toward the end of 2022. International wind companies include Gamesa and Vestas based out of Denmark. Vestas is trading off the boards in the US. Gamesa is a division of Siemens Energy, a German company. Regenerative Agriculture and Healthy Soil The IRA 2022 Bill is focused on reducing waste, while sequestering carbon. The IRA 2022 Bill provides funding for following the science for forest, crop cover and soil solutions. Farmers are incentivized to plant cover crops. There are also funds for farmers transitioning to organic production. There is money for planting trees in urban communities. Energy Efficiency There is a big push in the bill for energy efficiency. This impacts everything from energy auditing, home energy smart systems, retrofits, insulation and much more. Google and Amazon both have smart home energy systems. ITron does this for cities and utilities. Itron is having serious supply chain issues that are impacting the company’s ability to translate a $4.1 billion backlog into revenue. The company expects to have flat year-over-year revenue in 2022. The good news for homeowners and business owners, and even school principals and CEOs, is that simple, affordable energy efficiency fixes can result in substantial savings on power bills. So filling out the paperwork for federal funding is a step towards fiscal health, in addition to being part of the solution for healing our planet. Clean Energy Funds Most people are going to be better served by investing in a clean energy ETF, than by gambling on an individual company. Individual companies require babysitting, particularly in a contracting economy, with a recession on the horizon. I would steer clear of E.S.G. funds. Most are missing the E. They have no solar, wind or EV companies, and include a lot of oil, gas, plastic and other petrochemical providers. I would also want to be assured that the fund company itself is creditworthy (as many financial services companies are at the lowest rung of investment quality). One of my favorite clean energy funds is the iShares Global Clean Energy Fund, with the symbol ICLN. Climate Action Governments around the world are leaning into clean energy, both as needed for healing the planet, and also to become energy independent and less reliant on hostile regimes. However, as we discovered at COP26, the commitments made are not enough to prevent a climate disaster. Individuals must be the change we wish to see. So, please read, share, like and comment on The Power of 8 Billion: It’s Up to Us. In this book’s pages, you’ll find the how-to guide for reducing our personal CO2 footprint and healing our planet. The good news is that it is a quadruple win of healthy planet, healthy budget, healthy body and happy life. The challenge is for each of us to reduce our personal CO2 by 30% this year, next year and every year until we’re back on track for a healthy Earth. In the meantime, each one of us can save thousands of dollars on things we like a lot more than the utility bill, the gas station and car insurance. Bottom Line We have one to two slices of clean energy in our sample pie charts these days, as one of the bright spots of a challenging economy. Remember that your best strategy against a bear market is proper diversification, regular rebalancing, overweighting safe, and knowing what is safe in a world where over half of the S&P500® is at or near junk bond status. You can read about these time-proven, 21st Century, wealth strategies in my bestselling book The ABCs of Money fifth edition. You can learn and implement these strategies at our online investor educational retreat. You can also call our office for pricing and information on receiving an unbiased second opinion and a step-by-step blueprint that protects your wealth from recessions, while outperforming the bull markets in between. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed