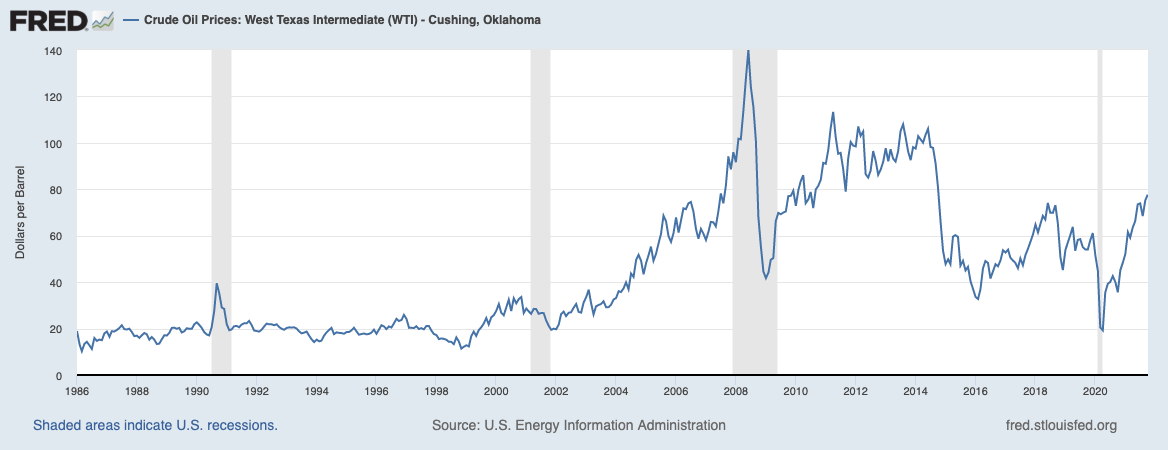

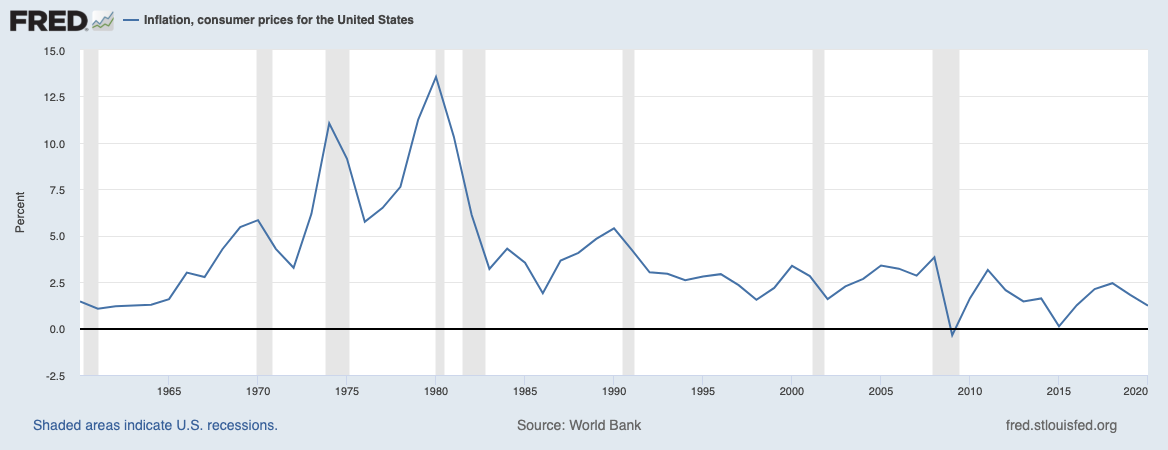

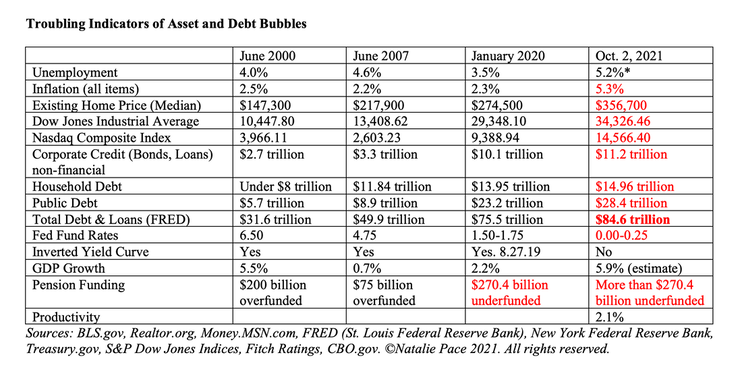

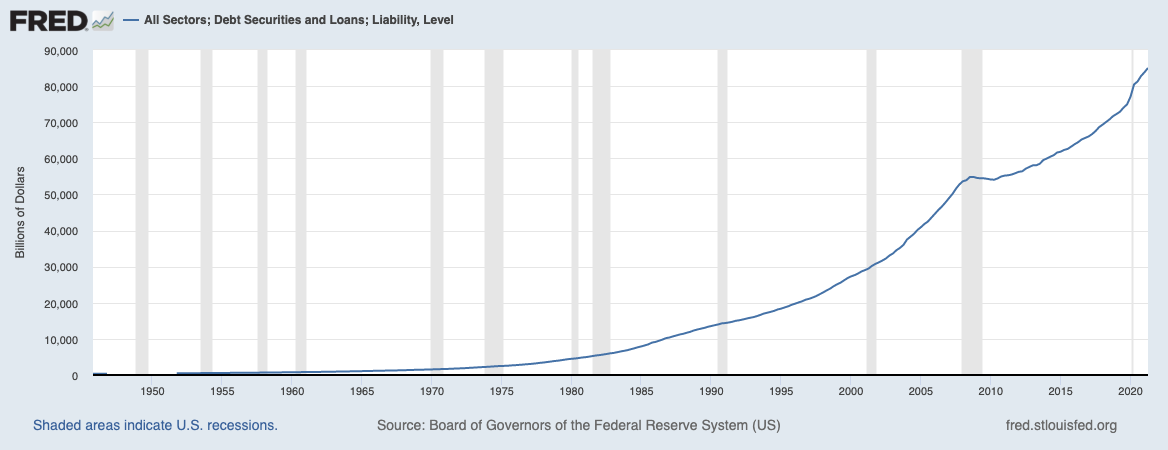

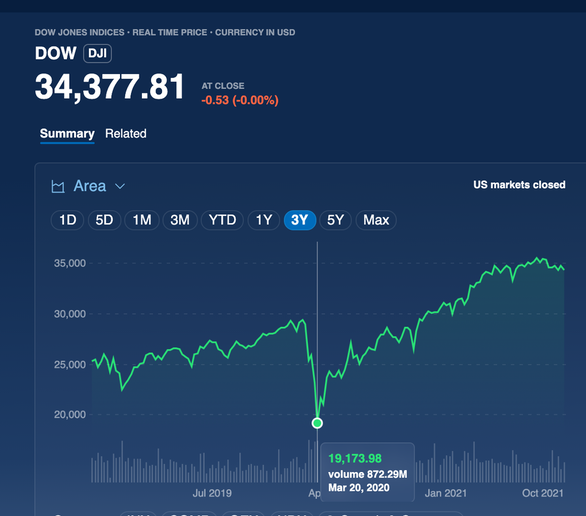

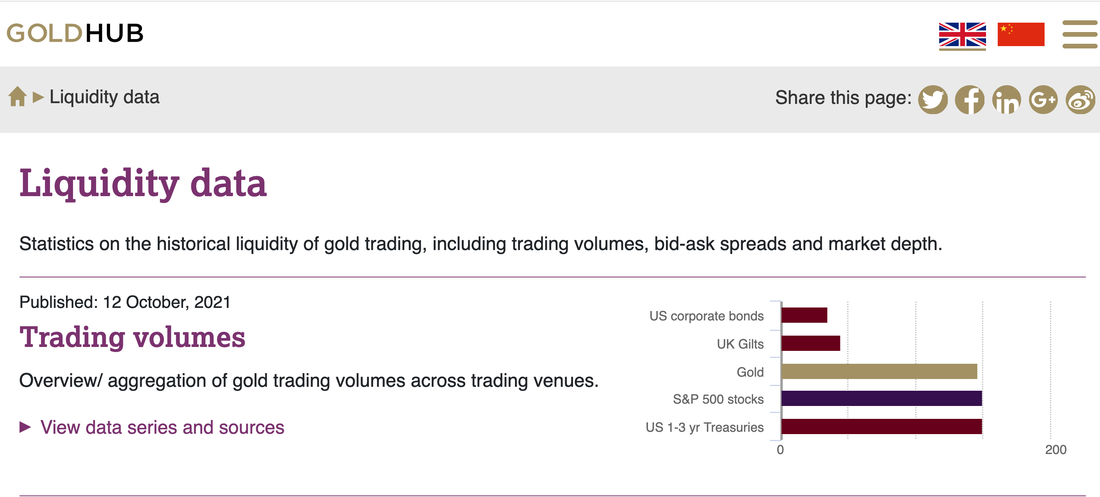

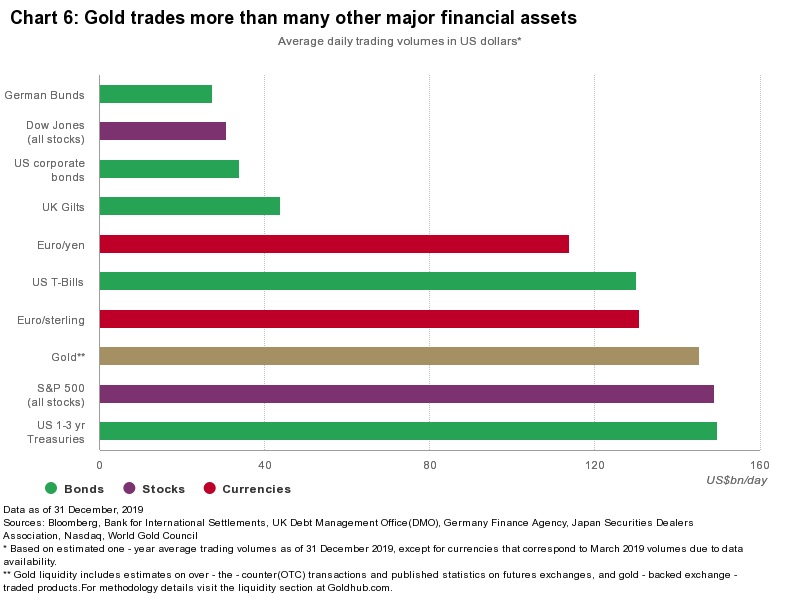

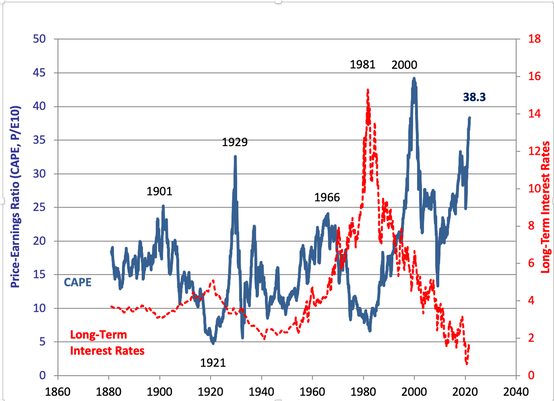

Dark clouds of smoke and fire emerge as oil burns during a controlled fire in the Gulf of Mexico, May 6, 2010. The U.S. Coast Guard, working with BP, local residents and other federal agencies, conducted the burn to help prevent the spread of oil following the explosion on Deepwater Horizon, an offshore drilling unit. Photo by the U.S. Dept. of Defense. Public Domain. Wiki Commons. High oil and gasoline prices are highly correlated with recessions. So is inflation. Check out the charts below. (The shaded areas are recession years.) The highest gasoline prices in the U.S. occurred right before the Great Recession, when a barrel of oil was trading at $141 and retail gasoline prices jumped to $4.11 a gallon. Today’s prices are $80.50 per barrel for oil, and $3.30/gallon at the pump. That’s lower than 2008, but much higher than normal (and what folks can afford). Inflation On Oct. 13, 2021, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (all items) rose 5.4% in September compared to September 2020. The “food and shelter” indices accounted for more than half of the increase (housing, food and gasoline). According to the National Association of Realtors, “Due to high home prices, 4.8 million fewer households can buy a residence versus two years ago, even though mortgage rates are lower than in 2019.” Additionally, this is the first time since 1972 that inflation is higher than the average rate on a 30-year mortgage, according to NAR’s senior economist and director of forecasting Nadia Evangelou. Consumer Spending and GDP Growth Consumer spending makes up about 70% of the US GDP growth each year. When consumers have to spend a lot more on gasoline and other basic needs (inflation), they have less to spend on other goods and services. When inflation-imposed belt tightening in the budget coincides with other household challenges, like high unemployment, a downturn in real estate or stock prices, or bond market gyrations, then the economy can experience a period of financial instability. The last such periods were in 2020 during the pandemic, in 2008 during the Great Recession, and in 2000-2002 when Dot Coms busted out. Before the Great Recession, real estate was overleveraged and equities were at an all-time high. Both assets tanked in tandem. Today, real estate prices are back to all-time highs, as are equities. Leverage Many of us are aware of the amount of public debt ($28.4 trillion). Fewer of us are aware of consumer and corporate debt. Over half of the S&P 500 is at or near junk-bond status. Consumer debt is higher than ever. Margin trading is also at an all-time high. 2/3 of millennials who purchased a home recently have buyer's remorse and worry that they purchased it at too high of a price. According to the St. Louis Federal Reserve Bank, the total amount of loans and debt in the U.S. is an eye-watering $85 trillion. The Federal Reserve Board has warned that risk appetite is elevated. According to their Financial Stability Report that was released in May of 2021, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” Financial Instability and Sudden Market Drops Low interest rates create asset bubbles. When asset prices get too lofty, the correction can look like a falling knife. During the pandemic, between February 19 and March 23, 2020, we saw the fastest switchback from a bull market to a bear, when the S&P 500 dropped 38% in about a month. 2021 GDP for the U.S. The U.S., China and world GDP growth rates have been revised downward. 5.9% in the U.S. and 8.1% in China are still impressive. However, it’s a good thing to remember that this is a bounce off a terrible year in 2020 for the world. In 2020, most of the world experienced an unprecedented economic contraction, due to the COVID-19 pandemic. (2020 is represented in red below; 2021 in green.) The resurgence of the Delta Variant of COVID-19 was responsible for a weaker than expected 3rd quarter. The 1Q and 2Q 2021 U.S. GDP growth were 6.3% and 6.7%, respectively. However, the 3Q 2021 growth is predicted to come in at under 4%. Since institutional investors and hedge funds are forward-thinking, a stock sell-off might happen before the data is released on the morning of Oct. 28th. This could be part of the reason that stocks dropped by 5% in September. Asset Prices are Elevated Wall Street analysts and economists are aware that stock prices are high, and bonds are illiquid and negative yielding. Below is the current liquidity data on bonds compared to gold and the S&P 500. The chart from December of 2019 (below) reveals that bonds were weak even before the pandemic. Dow Jones stocks had almost as much of a problem finding buyers as bonds in late 2019. The Dow Jones Industrial Average has a greater concentration of the legacy, indebted companies, while the NASDAQ Composite Index tends toward younger, low-debt, high-growth companies. (The S&P500 is a compilation of companies from both indices.) During the pandemic, the Federal Reserve Board printed up a lot of money and became a lender of last resort to a lot of slow-growth, debt-laden companies, including “fallen angels” such as Ford Motor Company, which is now rated BB+ with a negative outlook (speculative status). Very High Stock Prices As you can see in the CAPE chart below, the Great Depression has now fallen to the third highest period of stock speculation. The highest was before the Dot Com Recession, when the NASDAQ Composite Index lost up to 78% of its value between March 2000 and October 2002. Today is the second highest period of pricey equity valuations, per Professor Robert Shiller’s CAPE ratio, which is a 10-year average of price-earnings ratios. What Do You Do? Incorporating a time-proven, 21st Century system is your best strategy, rather than market timing or trying to outsmart policymakers, the Federal Reserve and the Treasury Department. A lot of U.S. publicly-traded companies provide things that the world relies upon daily for our interconnected world and technology-driven lives. March of 2020 afforded investors a rare opportunity to purchase many of our favorite FANG* stocks at a 50-75% discount off the prices being traded today. The pandemic showed us that even during the worst economic challenges we’ve seen in our lifetime, we still use (and pay for) technology, biotechnology, communications, Wi-Fi, utilities and even toilet paper (consumer staples). A Time-Proven 21st Century Strategy Our easy-as-a-pie-chart nest egg strategies with regular rebalancing are time-proven in the 21st Century, at a time when Buy & Hope is like riding a Wall Street rollercoaster. Research by Pew indicates that most Americans are worth less today than they were in the late 1990s. This has a lot to do with the severity of recessions in today’s world. Younger investors might be mistaken to think that recessions can last only two months and then everything goes back to normal. However, that has not been the case. The NASDAQ Composite Index took 15 years to come back to even from its losses in 2002. The Dow Jones Industrial Average took five years to recover from over 55% losses in the Great Recession. Using bull markets to make up losses is not an efficacious wealth strategy. When your wealth drops by half, your credit score plunges, your liquidity is constrained and you might have to take on another job to pay your bills. Our nest egg pie chart system protects you from losses by keeping the proper amount safe. You might far outperform the general market with hot industries. You’ll have the liquidity to buy low when stocks are trading cheap. Regular rebalancing is a buy low, sell high system on auto-pilot that takes the emotions out of investing. Most people do not buy low because they can’t. If you don’t have enough cash on hand, you can’t buy low. Another barrier to bargain prices on Wall Street is that when prices decline so far, people become afraid to invest. Bottom Line Inflation, political uncertainty, high unemployment, high gas prices, leverage, debt and financial instability continue to plague the world’s economies, even in a stellar recovery year, like 2021. Market timing won’t help you. A diversified plan that is regularly rebalanced will. You can read about it in The ABCs of Money and Put Your Money Where Your Heart Is. You can learn and implement it at our 3-day Investor Educational Retreats. You can secure an unbiased 2nd opinion on your current plan that includes a blueprint to better wealth protection and asset optimization. Email [email protected] with 2nd Opinion in the subject line for pricing and information. *FANG: Facebook, Apple, Amazon, Netflix, Nvidia, Google.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed