|

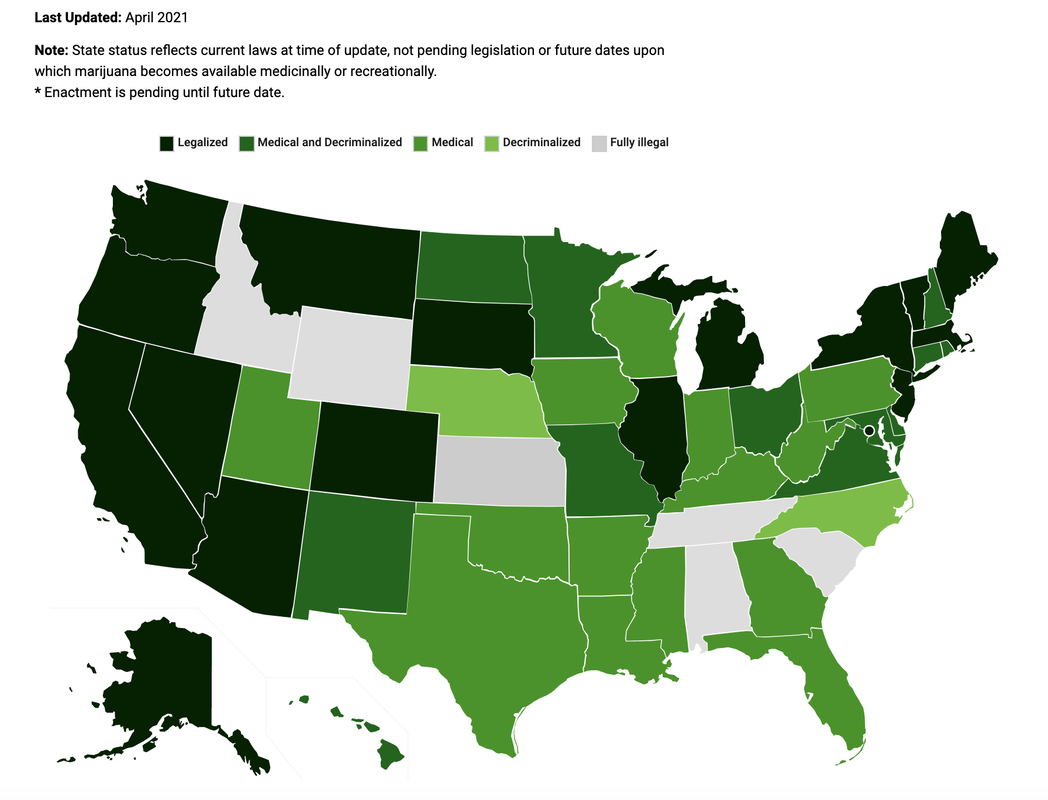

The MORE Act is Reintroduced. The MORE Act to decriminalize cannabis was reintroduced to the U.S. House of Representatives on May 28, 2021. Since then, some cannabis stocks have rallied. Tilray is up 28.6%. New Age Beverages (CBD Products and Tahitian Noni wellness shots) gained 5.5%. Innovative Industrial Properties (a cannabis REIT) is up 4.9%. Cronos is flat. Hexo and Canopy Growth are actually down -1.3%. (All prices are as of June 9, 2021.) The Halo Affect Why isn’t the news adding a halo to all cannabis stocks? The most likely explanation is that Tilray is a meme stock. The company has 3 forums on Reddit, and commands attention on the 10+ million strong WallStreetBets Reddit forum. On February 10, 2021, meme stonk aficionados pushed Tilray to $67/share. Optimistic “Diamond Hand Hodlers” have their sights set on 420. (Tilray’s current share price is $21.43.) While that might sound outlandish, the WallStreetBets traders pushed Gamestop – a company that was on the brink of bankruptcy – from $4/share to $483/share. Tilray’s Team & Products Unlike some other meme stocks, Tilray has an outstanding business model, market-leading products and a best-in-class C-Suite and Board of Directors. On May 3, 2021, Tilray was named to Time Magazine’s 100 Most Innovative Companies. On May 5, 2021, Tilray and Aphria merged. This follows on the heels of Aphria’s purchase of Sweetwater Brewing in December of 2020. Sweetwater Brewing is a popular microbrewery that is uniquely positioned to launch CBD beer. Their 420 Strain G13 IPA has a proprietary hemp-type flavor. According to Aphria’s 3Q 2021 earnings call, SweetWater’s recently launched Hazy, a year-round IPA, is already the No. 1 new craft brew item in the southeast – led by Millennial demand. Sweetwater has been hosting an annual 420 music festival in Atlanta for 15 years. The purchase of this brewery adds lifestyle panache to the Tilray brand and the potential for a CBD beer, in addition to sales. Tilray is now under the leadership of Aphria’s CEO Irwin Simon (the former founder and CEO of Hain Celestial), with Walter Robb (former co-CEO of Whole Foods) and Brendan Kennedy (former CEO of Tilray) on the board of directors. Tilray also boasts of an impressive international advisory council that features government officials from around the world, including Michael Steele (former chairman of the Republican National Committee), Joschka Fischer (the former Vice Chancellor of Germany), and prominent leaders in Canada, Australia, Portugal, New Zealand and France. Will Cannabis Finally be Decriminalized in the U.S.? As you can see in the cannabis map (at the top of this blog), there are only seven states in the U.S. where cannabis is fully illegal. Cannabis is fully legal in 18 states. With a former RNC chairman on the advisory board of Tilray (Michael Steele) and the former Republican Speaker of the House on the board of Acreage Holdings Inc. (John Boehner), alongside a Democrat-controlled House and Senate, there is a good chance that cannabis decriminalization passes. (This is not a guarantee. There is always a chance of a filibuster.) On May 11, 2021, Chuck Schumer, the Senate Majority Leader, promised that he, alongside Senator Cory Booker and Senator Ron Wyden, will be introducing a legalization bill “shortly.” Forward Outlook Last year’s combined revenue of Tilray and Aphria was $685 million – before considering revenue brought in by the Sweetwater Brewing acquisition. Cash burn is still a consideration. Aphria burned through -$361 million in the 3rd quarter of 2021, while Tilray lost $5 million in its most recent quarter. The combined companies held about $530 million in cash and cash equivalents at the end of February 2021. At today’s price, Tilray’s market cap is $9.59 billion. The last time that Aphria and Tilray “shot the moon” as meme stocks (on Feb. 10, 2021), the combined value of the companies was over $20 billion. That only lasted a few hours, and then the stocks crashed down to 1/3 of their value at the top. Cannabis stocks have been quite volatile. However, the world has been normalizing weed as a recreational drug. Amazon just announced that they’ve scuttled their drug testing program. So, when the U.S. does decriminalize, and CBD beverages and edibles come out of the shadows and into stores, the company that offers the most popular brands should be able to increase its value exponentially faster than the less sexy brands in the industry. There are a lot of if’s in that sentence. However, pulling the plug on prohibition and ending the War on Drugs has populist appeal – something many politicians can use to win votes, particularly from Millennials and Gen Z. Bottom Line Tilray is positioning itself to be a leader in the medical cannabis market, in CBD beverages and edibles, and in topicals. According to Tilray CEO Irwin Simon (in his 3rd quarter 2021 Aphria earnings call) the goal is to capture a 30% market share in the $6 billion Canadian market. With popular brands like Sweetwater Brewing (Hazy IPA and Oasis vodka seltzer, with expansion into CBD and higher intensity beverages) and High Park Holdings (Chowie Wowie Gummies) leading the way, and the potential for decriminalization in the U.S., the prospects for this market leader to innovate and expand are quite high. Full disclosure: I own shares of Tilray and New Age Beverages. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick hot funds and companies (like Tilray and our 2021 Company of the Year), and how to incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 13, 2021 (Sunday) to receive the lowest price and a complimentary, private, prosperity coaching session (value $300).  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price and a complimentary private prosperity coaching session (value $300) when you register by Sunday, June 13, 2021. Other Blogs of Interest Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed