|

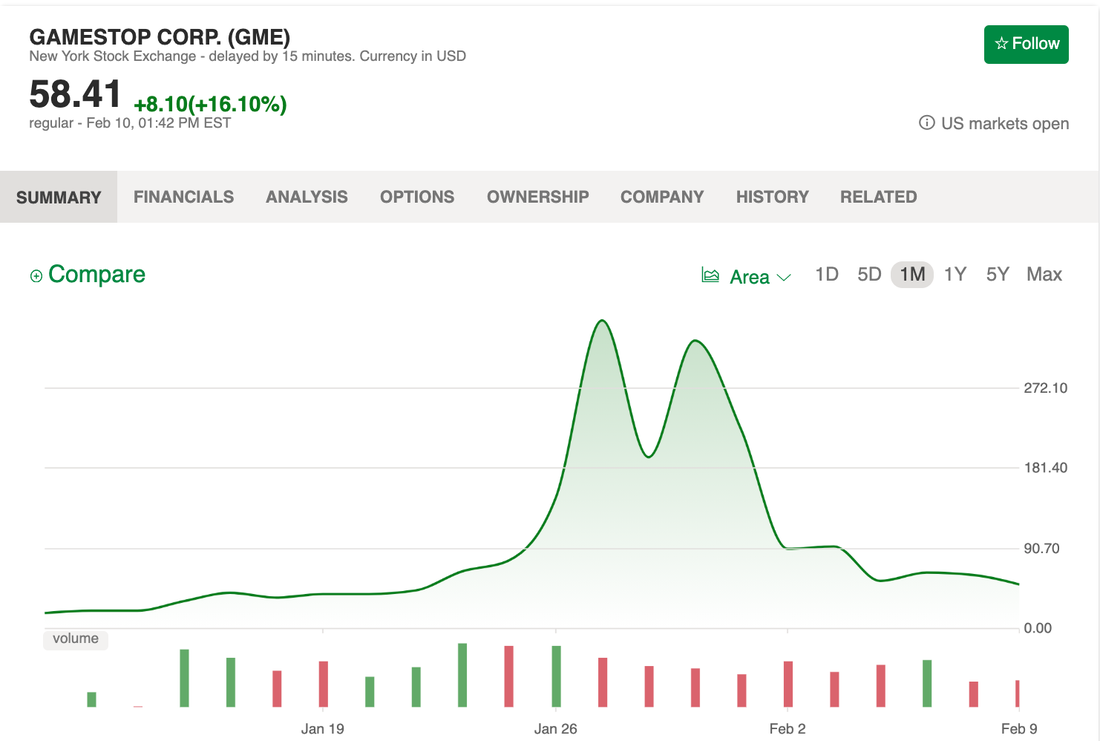

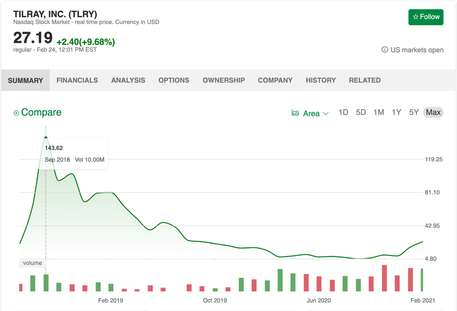

Cannabis companies shot the moon on February 10, 2021, and then fell back to Earth. Is the industry burned out, or smoldering for another moonshot? On February 1, 2021, Senate Majority Leader Chuck Schumer (D-NY) issued a statement with Senator Cory Booker (D-NJ) and Senator Ron Wyden (D-OR) writing, “We are committed to working together to put forward and advance comprehensive cannabis reform legislation that will not only turn the page on this sad chapter in American history, but also undo the devastating consequences of these discriminatory policies.” While not giving an exact timeline, the press release assured Americans that “the Senate will make consideration of these reforms a priority.” Late last year, on December 4, 2020, The House of Representatives passed the MORE Act, which decriminalized cannabis. (Click to learn more.) The legislation was ridiculed by then Senate Majority Leader Mitch McConnell, and never saw even a puff of consideration. As legalization became more popular in the halls of Congress, cannabis companies, like our favorites Aphria and Tilray (who liked each other so much they decided to merge on Dec. 18, 2020), began to gain favor again with investors. After sinking to lows of $1.95/share (Aphria) and $2.43 (Tilray) in March of 2020, both companies tripled by the time of the House Decriminalization in early December. On February 10, 2021, a week after the Senate announced that cannabis decriminalization would be a priority, Aphria and Tilray stocks shot the moon, hitting $32.29 and $67 respectively. They remained airborne only briefly, however. The following day, share prices plunged to $16.88/share and $32/share, respectively, having fallen by half. The February 10th Phenomenon What happened on February 10th and will it happen again? In the wake of the Senate announcement by Senate Majority Leader Chuck Schumer on February 1, 2021, bulletin board discussions of cannabis stocks soared. One of Reddit’s most popular groups, Wall Street Bets, saw a lot of activity related particularly to Aphria and Tilray, their merger, and the purchase of Sweetwater Brewing by Aphria. The chatter fueled the rocket to soaring gains for cannabis on February 10, 2021. So, why were the highs so short-lived? Two reasons really. One is valuation. Aphria and Tilray had agreed to merge with a $5 billion valuation. By February 10, 2021, the combined value of the two companies was over $20 billion. (Today the combined value is in the $11.5 billion range.) The other issue is that, whether by intention or not, Wall Street Bets’ YOLO* meme stocks act like Pump and Dump schemes. Check out the stock performance of other meme stonks below. Will Cannabis Companies Shoot the Moon Again? The fundamentals behind many cannabis companies are strong. Not all cannabis companies are created equal, however. For instance, I have yet to see more than a handful of customers in Medmen’s 5th Avenue store in New York City. (I take daily walks for exercise on 5th Avenue.) There will be some that hope to rise with the tide, and others that are sailing with the wind at their back with seasoned navigators and a mother lode of exceptional goods on board. As I mentioned in my blog of December 5, 2020, after the House decriminalized cannabis, Aphria (combined with Tilray) is in the strongest position, particularly after Aphria’s clever purchase of Sweetwater Brewing. Once we hear a more definitive date for the decriminalization of cannabis in the U.S., you can expect increased investor interest in cannabis. Any rapid rise, however, can be short-lived again, due to profit-taking, the downward pressures of overvaluation and, potentially, general market weakness. (We’re still in the most challenging peacetime economy since the Great Depression.) Valuing Tilray/Aphria/Sweetwater The completion of the reverse acquisition of Tilray (which will look more like Aphria in terms of leadership and power) is expected to happen in the 2nd quarter of 2021. Last year’s combined revenue was $685 million – before considering revenue brought in by the Sweetwater Brewing acquisition. Cash burn is still a consideration. Aphria lost -$120.6 million in the 1st quarter of 2021, with $320 million of pro forma cash on hand. With the expected right-sizing and redundancy trimming that should accompany the merger, the combined cash could be enough to get the company through 2021. However, at the current cash burn, it would be flying a little close to the trees. The 10X Power of Innovation In a nascent industry, the company that comes up with the best product can instantly become 10 times more valuable than the competition. Recently we saw that phenomenon with Zoom Video, which beat out Microsoft’s Skype, Facebook Live and Google Chat to become the videoconferencing software most used and beloved. Investors rewarded the company by sending Zoom’s stock to the moon. All eyes were on CBD Beverages as the next great innovation in the cannabis industry. Sweetwater Brewing has crowned themselves kings of that product line so far with their 420 hemp-based brew… Sweetwater is continuing the trend of name appeal with their limited-release triple-IPA, EFF 2020. There will likely continue to be extreme volatility in the share prices of cannabis companies. At the same time, with decriminalizing cannabis slated for a vote in the Senate this year, there may be one more investor trip to the moon. If things play out like they did when Canada decriminalized cannabis, then the run-up will be fast and robust before the vote, with share prices crash-landing shortly thereafter. Limit orders may be necessary to ensure that you are on the right side of the trade. Tilray hit $300/share in September of 2018, just before Canada decriminalized cannabis (on Oct. 17, 2018). By December of 2018, Tilray had dropped to just $70/share. The company continued to slide to a low of $2.43 in March of 2020. If you'd like to learn how to invest in Shoot the Moon stock picks like Aphria/Tilray, join us for our 3-day Investor Educational Retreat this weekend. Call 310-430-2397 or email [email protected] to learn more. Check out testimonials and discover the 15+ things you'll learn in the flyer below.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed