|

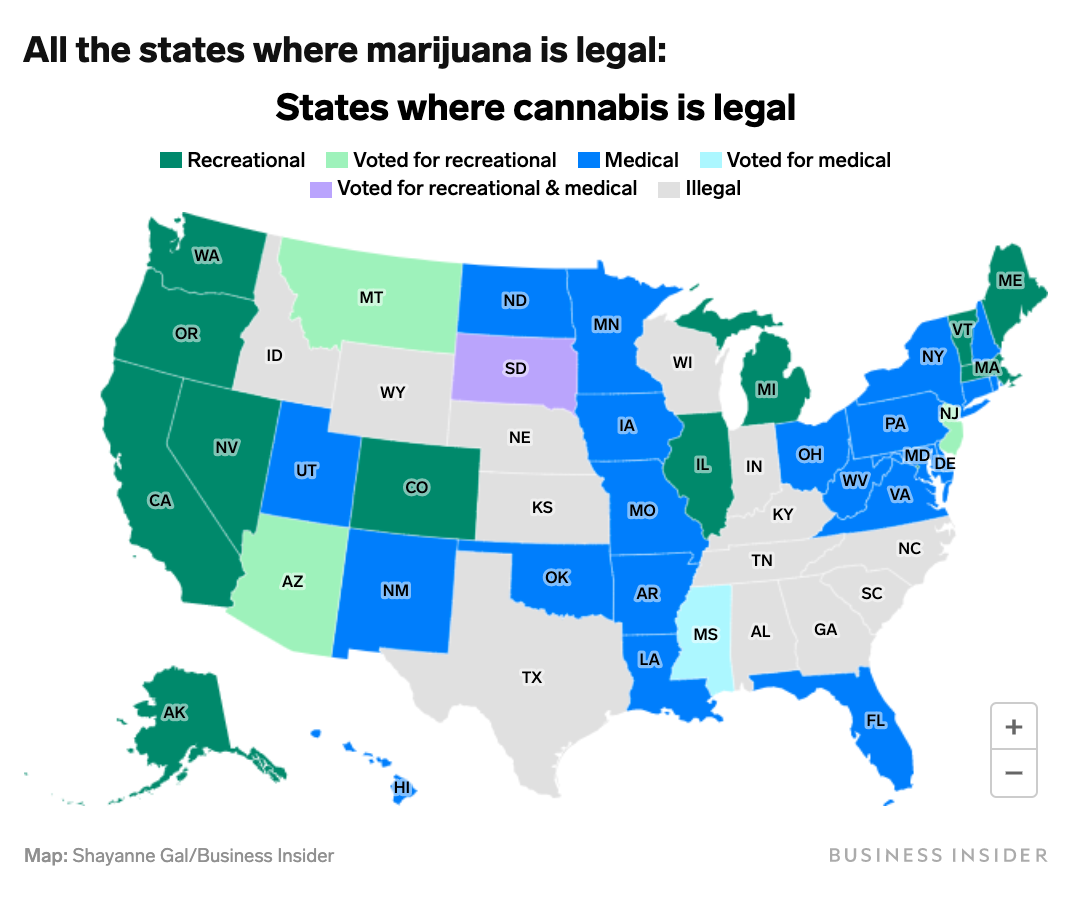

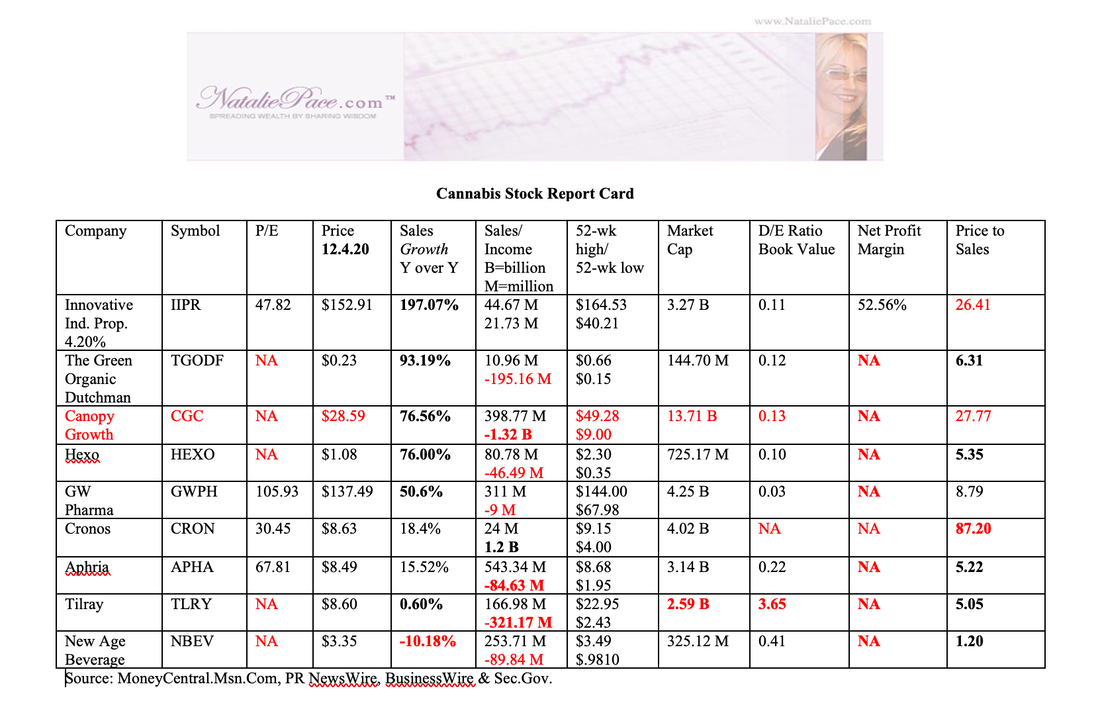

On December 4, 2020, the U.S. House of Representatives voted to decriminalize marijuana and to lay the groundwork for legalization. The Senate GOP remains resistant to the MORE Act (H.R. 3884), with the Senate Majority Leader belittling the vote. On the Senate Floor on December 3, 2020, Mitch McConnell (R: KY) opined sarcastically, "The House of Representatives is spending this week on pressing issues like marijuana. Marijuana. You know, serious and important legislation, befitting the national crisis." According to the Pew Research Center, 2/3rds of Americans want cannabis to be legal. The only real chance for a vote in the Senate lies in the Georgia Senate run-off election, scheduled for January 2, 2021. If Democrats win both seats, then the Senate would have a 50/50 Democrat/Republican split, with control and the deciding vote going to the Democrats. If Chuck Schumer becomes the Senate Majority Leader, there will likely be a swift vote and approval. There are a lot of ifs in that speculation. However, the reality of red (nope) and blue (yup) will become clear quite soon. In the meantime, investors have voted with their dollars, sending many cannabis companies, including Aphria, Innovative Industrial Properties, Canopy Growth and Tilray, into triple-digit gains off of their lows in March of 2020. Will the popularity continue? Do the fundamentals support an investment in an industry that might become legal nationwide in the U.S.? Many U.S. states have already legalized pot. Uruguay was the first country to legalize weed, with Canada following suit in October of 2018. Mexico’s Senate voted to legalize on November 19, 2020, which could put them on the map soon. Innovation Leads to Explosion In explosive new industries, the company that produces the hottest new product could become ten times more valuable overnight. The most recent example of this is Zoom Video. Zoom is not the only video product available. Facebook has Portal and Facetime. Google has Google Chat. Microsoft has Skype and Teams. However, Zoom’s product was superior to the point that videoconferencing is often called “Zooming.” Zoom’s revenue was up 367% in the 3rd quarter of 2020. Zoom’s share price has soared up to 9.5 times since last year’s IPO. Technology has been on fire. However, no other company comes close to Zoom’s meteoric rise in valuation. Which cannabis company will be the Zoom of the industry? Many of them are placing their bets on cannabis beer-like beverages. Aphria Aphria purchased Sweetwater Brewing Company (based in Atlanta) in December of 2020. Sweetwater’s 420 Strain G13 IPA became the #1 bestselling new craft beer of 2019 (according to the company). Currently the brew includes terpenes and hemp flavors. However, it’s easy to see that the branding and flavors position the company as a leader for a cannabis-legal world (and are doing quite well even now). The acquisition price was $300 million and should add at least $67 million annually to the revenue of Aphria. Sweetwater sells at Walgreens and Duane Reade in Manhattan, at Walmart and Winn Dixie in Miami and even at gas stations in Atlanta. Aphria’s CEO is Irwin Simon, the founder and former CEO and chairman of Hain Celestial. Walter Robb, the former co-CEO of Whole Foods, is on the Aphria board. Don’t be surprised if you see Sweetwater Beverages in a Whole Foods store near you soon. Tilray Tilray owns Chowie Wowie edibles and Fluent Beverages, which is a joint venture with Labatt breweries. Fluent’s first beverage was a CBD tea, with plans to launch sparkling beverages. Tilray has joint ventures with Anheuser-Busch Inbev and with Sandoz. There has been no news this year on that magic 420 beer that everyone has been banking on since the AB Inbev deal was announced in October of 2019. Tilray spent the 3rd quarter right-sizing operations, including shuttering their Ontario-based cannabis greenhouse. That helped to reduce their net loss dramatically in the 3rd quarter of 2020 (to $2.3 million, from $36.4 million a year ago). The company has $155.2 million cash-on-hand. Tilray has strong leadership, with executives from Molson Coors, Revlon, Goldman Sachs and Mattel. The Green Organic Dutchman The Green Organic Dutchman specializes in certified organic cannabis, grown in LEED-rated buildings and sold in recyclable packaging. Not surprisingly, sales have almost doubled year over year, to $11 million. The company’s products are sold in Canada, Poland and Germany. Interestingly, the current CFO and interim CEO comes from the oil and gas industry, as does the chairman of the board. The company also has executives hailing from Novartis and Bristol-Myers Squibb, indicating there could be a focus on medical cannabis. The Green Organic Dutchman is a penny stock, trading off the boards in the U.S. (TGOD is the symbol on the TSE.) This makes it a much higher risk investment than the other companies mentioned in this blog. There isn’t a food product innovator at The Green Organic Dutchman who can compete with the Hain Celestial/Whole Foods team at Aphria, although the certified organic promise could be a competitive advantage with certain customers. Innovative Industrial Properties Innovative Industrial Properties had explosive growth in the 3rd quarter of 197% year over year. However, the good news appears to be more than priced in. The company has one of the highest price to sales ratios on the Stock Report Card, with sales of just $45 million compared to a market cap of $3.27 billion. One concern is that the company purchases retail and industrial property and then leases the space back to the companies they purchase from. With ongoing purchases at a time when real estate at an all-time high and considered to be unaffordable in many major cities, Innovative Industrial could be buying their assets at a very high price. That’s never a good idea, even if the asset is generating revenue. Price Matters Cannabis is still an early-stage industry. Companies are investing in growth, and are cash-negative, with the exception of Innovative Industrial (symbol: IIPR), which earned almost $22 million in net income last year on $45 million revenue. When you can’t rely upon price-earnings ratios to determine a company’s valuation, it’s helpful to look at the price-sales ratio. As you can see in the Stock Report Card below, there are three companies that still have very high valuations when comparing their share price to their sales – Innovative Industrial, Canopy Growth and Cronos. Bottom Line Cannabis remains popular. States in the U.S. and countries around the world have moved with unprecedented speed to decriminalize CBD, medical marijuana and hemp and even to legalize recreational cannabis use. Cannabis companies have experienced extreme volatility in their share prices. Tilray’s high in 2018 was $300/share, while Canopy Growth traded above $50/share and Aphria hit $12/share. There could still be some runway in the current rally – particularly if Georgia goes blue in the Senate and the MORE Act is signed into law. While the rising tide of cannabis can lift all ships, it will favor those companies with the best products and valuations. Would you like to learn how to construct your own Stock Report Card and pick stocks like a No. 1 stock picker? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed