|

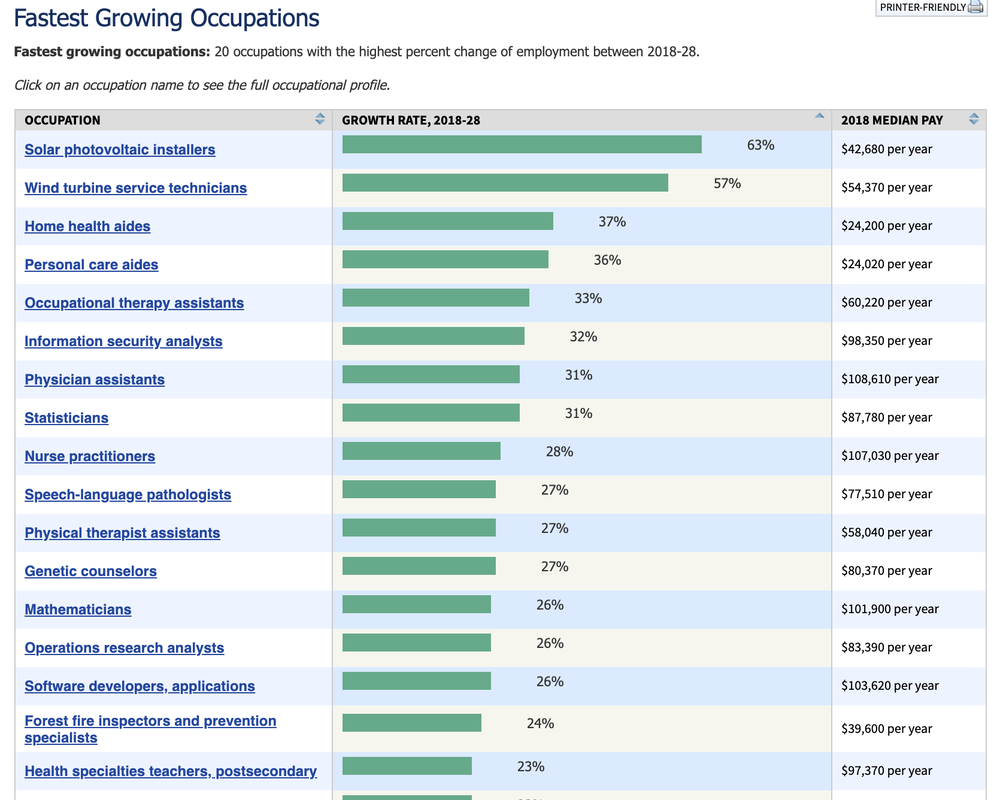

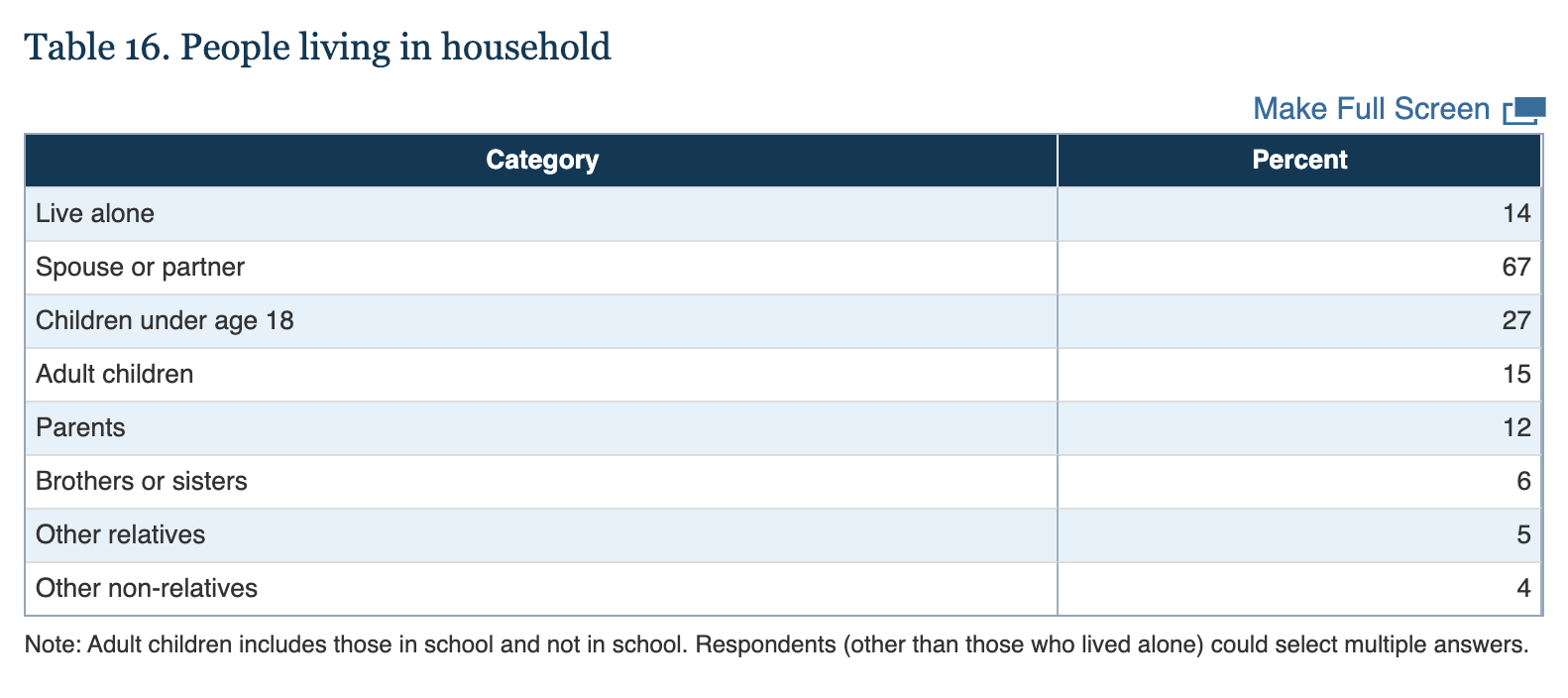

With $1.54 trillion in student loan debt and a graduation rate of just 60%, it's clear that parents and teens need to have a better game plan for higher education. So, start with the 10 questions below to get on the right track for an extraordinary college experience that should result in you getting a better degree for half of the cost. That’s going to add up to a lot less student loan debt, and an increased chance at real opportunity once you graduate. 10 Questions to Put You on the Path for College and Career Success 1. What is your ideal college experience? 2. What are you naturally good at? (Talent) 3. What do you love to create? (Passion) 4. What is the best university to get a degree in that area of study? 5. Should you consider a Gap Year? 6. Where would you like to be in six years and what is the best route to get there? 7. How are you going to earn money while you are in college? 8. In addition to scholarships and grants, are there other ways for you to earn passive income? 9. Is trade school more appropriate for you? 10. What is the student feedback on your school of choice? Here is a little bit more color on each point. 1. What is your ideal college experience? If you are going to college to get away from your parents or to party, then you need a Gap Year. Period. College is far too expensive and demanding to enroll for the wrong reasons. This is the primary reason that the drop-out rates are so high. Flunking out with a $50,000/annual price tag is the ultimate buzz kill. If you are motivated to learn and achieve, scored high on your SAT and received a scholarship to the university of your dreams, good for you. For most of us, that will not be the case. We will need to design a plan to make sure that we get the degree we want, which will result in a great lifetime career without drowning in debt. (There are ways!) 2. What are you naturally good at? (Talent) It takes hard work and dedication to rise to the top of your field. There are careers that you will naturally excel in, and others that you might never master. An extraordinary athlete might not make an outstanding astrophysicist. An inspiring artist may not rise to the top of dental school. So, what comes easy for you? How can those gifts and talents be parlayed into income? 3. What do you love to create? (Passion) When you put your heart into something, then time flies. You won’t even notice how long you’ve dropped down the rabbit hole of higher learning on the subject. As Buddha said, “Your work is to discover your world and then with all your heart give yourself to it.” 4. What is the best university to get a degree in that area of study? If astronomy and starships are your passion and talent, then you might be surprised to learn that the University of Arizona is one of the top-ranked schools. So, if your ultimate goal is to graduate from Berkeley, Harvard or Princeton, and you are an Arizona resident, should you start at U of A and transfer into the Ivy League as a Junior? If you kill it at U of A, could you qualify for grants and scholarships to an Ivy League School that might otherwise be out of reach? 5. Should you consider a Gap Year? A Gap Year is highly correlated with success in college. There are many reasons for that. If you do your Gap Year in a foreign country and become fluent in a second language, you’ll have an easy A in one of your classes. If you take an internship or apprenticeship in your field of interest, then you’ll have real world experience that gives you a competitive edge in your book learning. If you sow your wild oats and get away from your parents, you might appreciate the value of education more, and hunker down to study. In Europe, the Gap Year is rather de rigueur. 6. Where would you like to be in 6 years and what is the best route to get there? Rather than a plan that focuses on what university will have you, how can you design a game plan so that you can actually attend your dream come true university? When you set your sites for where you want to be post-graduation, you’re more likely to get there. Part of that 6-year vision should include designing a college plan that will not drown you in debt when you graduate. 7. How are you going to earn money while you are in college? Do you have enough funding from your college savings plan or from your parents to attend without having to work? (Teens/tweens: start your college fund now, with or without your parents!) Grants are typically available, but only cover a small portion of the costs. Scholarships are available, but are very competitive, and often only cover a small portion of the costs. Taking your general education coursework at a local junior college not only cuts your costs dramatically, but might be your springboard to an even better university than you could attract as a freshman. Due to the high drop-out rates, there is more room for juniors. If you’ve excelled at the junior college level, then you might qualify for some lucrative academic-based scholarships. (That is how I was able to attend the University of Southern California!) 8. In addition to scholarships and grants, are there other ways for you to earn passive income? If your money has earned money and compounded gains in a college savings plan, can you purchase a home (with your parents) and rent out the spare rooms to other college students for passive income? Wouldn’t that be a better job than working at the local fast food joint? The more that you can eliminate basic needs bills, and accumulate passive income, the more time you can devote to studying and rising to the top of the class. 9. Is trade school more appropriate for you? If you’re not academically inclined, there are many trades that are in high demand. In fact, solar PV installers and wind turbine technicians are at the top of the Jobs of Tomorrow. In many instances, getting an apprenticeship will pay you to learn and earn your certification, which is a better bargain than a for-profit university with a high drop-out rate. Go to Apprenticeship.gov to learn more about government-based programs. Ask around locally, and within family and friends, for a master tradesman who might be willing to take you under her wing for training and certification. 10. What is the student feedback on your school of choice? If you search for reviews and ratings by students, faculty and alumni, then you should get the inside scoop on whether the university you’re being courted by is really worth the dime. Those for-profit universities with very low graduation rates are also ranking very low in customer satisfaction. It’s a good idea to learn why before you fall into the same trap. Nonprofit private universities, like Ivy League Schools, have very high graduation rates and receive very high praise from students, faculty and alumni. Having everything turn up roses for you might start with separating the 2-3 stars from the 5-star reviews. College success is highly correlated with the type of university you go to. Public universities and private non-profit institutions have graduation rates of 60% and 66% respectively, while private for-profit colleges have a graduation rate of just 21%! Females are graduating in greater numbers than males in most halls of higher learning. Once you graduate, you want to be sure that your career of choice pays you well enough to afford your basic needs and your college loan debt. That equation is so out of whack that 15% of adult children are living with their parents. Millennials are delaying purchasing their first home for up to seven years longer than their parents did. This is all attributed to the very high cost of paying back student loans. So, figuring out a course of action that eliminates this possibility is essential to loving your College Experience after you graduate. Regardless of where you came from, you can step on the path to the career of your dreams. I’m living proof of that, having grown up in quite modest means and going on to graduate summa cum laude from The University of Southern California. While we may think that some universities are out of reach, designing a careful route can yield results that might surprise you. That certainly was the case for me. (I discuss this in greater detail in my College Videoconference.) For additional information on how you can design a college game plan that leads to the career of your dreams, with less than half of the student loan debt of your colleagues, be sure to read The ABCs of Money for College. Watch my College Success videoconference on YouTube.com/NataliePace. Don’t miss my next college videoconference where we’ll discuss the mistakes parents make when preparing their kids for college. Email [email protected] with VIDEOCON in the subject line to be sure that you receive the login instructions, along with the date and time. Investing smart in your college savings plan can compound gains. If you'd like to learn the ABCs of Money that we all should have received in high school, to up your investing game, join me at my next Investor Educational Retreat. Students receive a large discount. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy. Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed