|

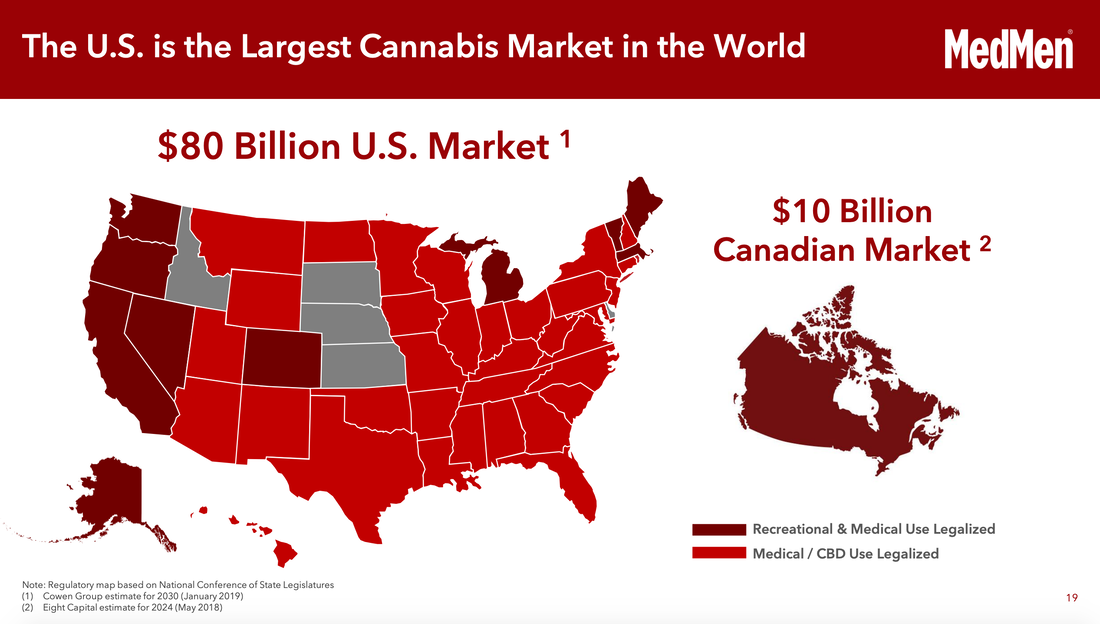

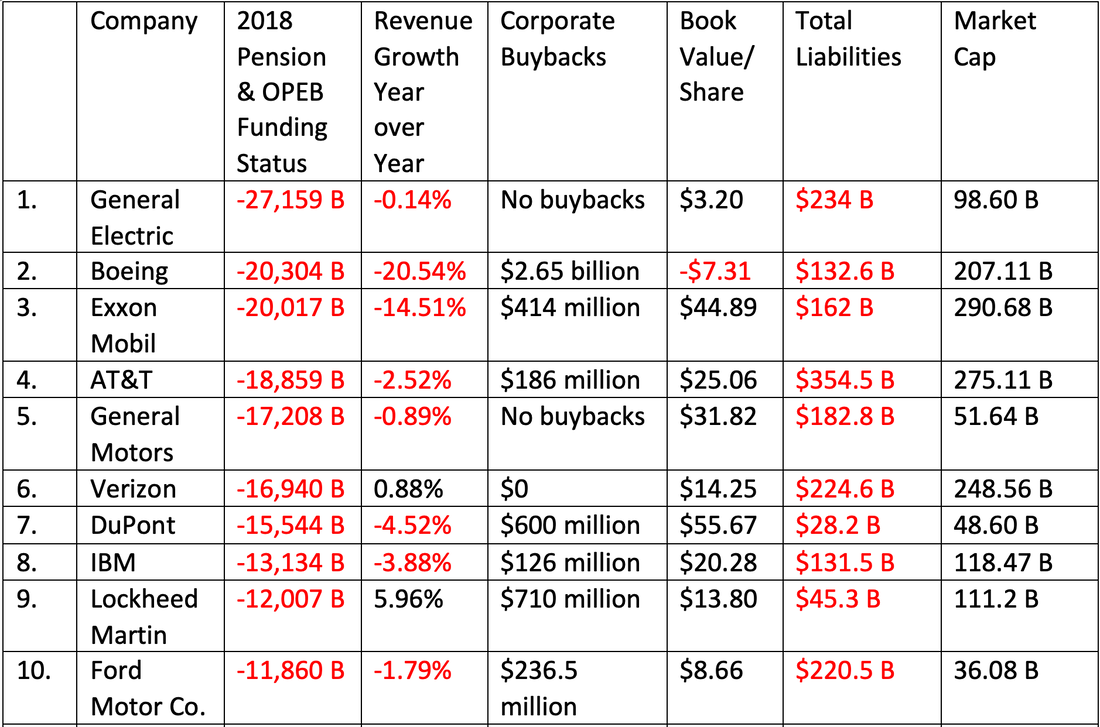

Includes 11 prosperity, abundance and wealth tips for 2020. For additional information on the topics below, listen back to my free teleconference at BlogTalkRadio.com/NataliePace. There is a list of relevant blogs on each subject at the end of this blog. The good news is that only 30-35% of SP Global economists expect a recession in 2020, according to a report released on 12.16.19. On 12.11.19, National Association of Realtors’ economists concurred, pegging the odds of a 2020 recession at 29%. If they are right, and easy money keeps flowing into corporations, so that they can borrow more on the cheap to buy back their own stock, then Main Street has a little time to get their ducks in a row. If the new announcement that Boeing has temporarily halted 737 Max production tips the balance down, then the time frame to make sure that your assets are properly protected and diversified is now. In either scenario, the general theme is: “Fix the roof while the sun is still shining.” If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. You must also know what’s safe in a world where bonds lost money in 2018, money market funds are subject to redemption gates and liquidity fees, insurance companies have high-risk junk bond exposure (and are not FDIC-insured) and many bank products have fine print that reduces their liability and your recovery. I spend one full day on this topic at my Investor Educational Retreats. Call 310-430-2397 to learn more. After extensive research, below are the outlooks on a number of different segments of the economy. Real Estate: There should be continued downward pressure on prices in the U.S. and Canada. In the housing sector, this is largely due to unaffordability. Tighter mortgage standards in Canada are also weighing on home prices. In commercial real estate, this has a lot to do with the Retail Apocalypse.  Photo: Haight Ashbury, San Francisco, USA / Personal picture taken by user Urban, 2004. Wiki Commons license. Used with permission. San Francisco is one of the most unaffordable cities in the U.S. According to Attom Data, the average wage earner cannot afford to buy a home in 74% of U.S. housing markets. Stocks: Volatility, with downward pressure. Stocks lost money in 2018. Since then, corporate buybacks have brought the market back to all-time highs. Borrowing cheaply to buy back stock has been en vogue for years with corporations. When that dries up, the markets head south fast, as we saw in December of last year, when the Dow dropped 12% in just a few weeks. (Click to learn more in my blog on Apple’s suspension of buybacks last December, which resulted in the worst December on Wall Street since the Great Depression.) As a result of all of that corporate borrowing, over 50% of corporate bonds are now at the lowest rung, just above junk status. However, recently, bond managers have been pushing back and demanding covenants and to see a pathway to profitability. The free money faucet is no longer gushing. Without corporate buybacks, the lofty stock evaluations currently rampant could become far less popular. Bonds: Vulnerable. Very vulnerable. Bonds are supposed to be the safe, buoyant side of your nest egg. However, corporate bond funds lost in tandem with stocks in 2018. This is very problematic because this is the side of your nest egg that is not supposed to lose money! Bonds are so leveraged that the Federal Reserve Board is monitoring them. As the Federal Reserve Board outlined in their November 2019 Financial Stability Report, “Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards... Hedge fund leverage remains elevated.” I’ve already mentioned the crowd of bonds at the lowest rung of investment grade. However, junk bonds are all crowded at the bottom rung, too, just above default. According to SP Global, “The number of U.S. issuers that have their credit ratings at ‘B-‘ or below with ratings on a negative outlook or negative credit watch is at 179, portending more downgrades into the ‘CCC’ range and defaults. This is the highest this metric has been in more than a decade.” Energy, retail and consumer products are the most vulnerable. A lot of this risk is packaged into a CLO (Collateralized Loan Obligation) and sold to mutual funds, institutional funds, etc. Since many of the funds have a limit on how much risk they can hold, downgrades run the risk of becoming illiquid and yield payments may have to be halted, according to SP Global. Cannabis: The cannabis industry has the highest sales growth of any industry on Wall Street. Nothing comes close. Companies are borrowing to build out, to meet demand. However, credit has tightened, with managers demanding covenants and a pathway to profitability. This means that companies that are undercapitalized may get into a credit squeeze. There could be bankruptcies and consolidation. This is a new, and normal, phase that every nascent industry goes through. So, if you’re to invest here, you have to know the competitive edge of the company, who is tending the hen house and how much cash and access to capital that the company has. The company that innovates the best product will shoot to the top of the pack, and potentially be worth multiples more than the competition, as happened to Apple when they launched the world’s first smart phone. Gold: Gold is a good hedge against a downturn in stocks and bonds. When stocks go down, gold typically goes up. There is a high correlation with this. There is also a high correlation with high oil prices. Oil prices are fairly low right now. OPEC and Russia want to get prices higher, but U.S. production is moderating that attempt. Higher gold prices are also associated with a weaker dollar. Currently, the dollar is still very strong, which has subdued a jump into gold. I currently have two hot slices in my nest egg pie charts. It's important to remember, however, that politicians, banks and corporations can price-fix this asset. So, you never want to invest the farm on any one asset. In the Great Depression, gold was illegal to own and you had to sell it back to the government. That's how we built up Ft. Knox. A few years ago, some big banks had to pay a fine for price-fixing gold. Small business: Vulnerable. Small business owners, particularly those operating cash negative or with low margins, are vulnerable when the economy turns. There is always a recession. The only question is when. As we enter a period where the global economy is starting to weaken, it’s important to have confidence in your business model and in your ability to withstand a period of weaker revenue. Travel and Hospitality: When economies weaken, industries reliant upon discretionary spending are the canary in the coal mine. Travel and hospitality (including hotels and restaurants) typically are the first to suffer. Retail: Etail wins. Brick and mortar stores have been suffering in the Retail Apocalypse. We’ve seen an unprecedented number of bankruptcies over the last few years. Pensions and Other Post-Employment Benefits: Pensions and other post-employment benefits are underfunded in S&P500 companies by $406 billion. The corporations that are the most severely underfunded tend to be those with the highest debt, which pay the highest dividends to shareholders. Many of the corporations are also buying back their own stock. In other words, the borrowed money is going to shareholders and C-level executives, at the expense of R&D, workers and prior employees. So, what should you do about a weakening, over-leveraged global economy? Strategies to Navigate the Late Stage of the Business Cycle and Heightened Anxiety 1. Intergenerational and micro-housing. Can you better monetize your home? Can you keep the money in the family? 2. Price matters. Challenge: Know what your bottom line is. Are you willing to risk half of that? Assets are at an all-time high. Step off of the Asset Bubble Rollercoaster and step into time-proven strategies. Call 310-430-2397 to register for an upcoming Investor Educational Retreat, where you can learn what works and implement them now. 3. Annual Rebalancing with Proper Diversification. This is a buy low, sell high plan on auto-pilot, which earned gains in the last two recessions and has outperformed the bull markets in between. It also takes the emotions out of investing. For most of Main Street, using a time-proven system and pulling the emotions out of the trade are essential. 4. Bonds, Money Market Funds, Annuities, Insurance and High-Yield Bank Products are not as safe as you have been sold. It’s time to read the fine print and understand what’s safe in a world designed for the banks to be able to do a “bail-in” on your dime. There is an entire section on what’s safe in my book The ABCs of Money. We spend one full day on this at our Investor Educational Retreats. 5. Hard Assets Hold Their Value Better Than Paper Assets in an Over-Leveraged World. There are a few caveats to this, however. 1) Be sure that you are not overleveraged yourself, and that you can afford your asset. 2) Never buy high. 3) Safe, income producing hard assets that you purchase for a good price are key. Every word in that sentence is critically important. 4) Cash could lose buying power, however not as fast as an over-leveraged bond. 5) This period of leverage should have a time-limit. 6) Most people don’t buy low in recessions because they can’t. They’ve lost too much money. So, having cash and being a patient buyer allows you to buy low when others are cycling through a season of pain, stress and losses. 6. The Thrive Budget. Consumer debt just hit an all-time high of $14 trillion. 3.2 million homes are still seriously underwater. Is your budget or your home underwater? It's a good idea to fix this now. Again, "Fix the roof while the sun is still shining." There are solutions. However, you’re not going to get the best strategies for you from the debt collector or the Main Stream Media and group think. If that worked, we wouldn’t have $14 trillion in consumer debt and 3.2 million homes still seriously underwater (even while real estate prices are near an all-time high). 7. The ABCs of Money for College. Get a better degree for half the price. Parents: start the planning and visioning process in kindergarten! $1.5 trillion in student loan debt, with 20% of the loans delinquent are giant red flags of just how important early college planning is. I have a new The ABCs of Money for College ebook being published soon. It will be free for a limited time. Email [email protected] if you would like to be alerted when it is published. 7. Bonds Lost Money Last Year. REIT warning. 50% of Corporate Bonds are at the lowest level, just above junk status. Be careful of the other products that will be sold to you if you tell your financial advisor that you are no longer interested in bonds. These could be even more risky than bonds. (Private placement REITs and annuities offer high commissions to salesmen.) 8. Challenge: What’s Your Bottom Line? How much do you currently have in your nest egg? Are you willing to lose half of it? If not, then now is the time to know what you own and why you own it. It’s time to get safe, protected, hot and diversified. Do not simply “trust” that this is being done for you. That didn’t work out very well for Main Street during the last two recessions. 9. If you wait for the headlines it will be too late to protect yourself. The Feds didn’t admit that the economy was in a meltdown until October of 2008 – after the Lehman Bros. bankruptcy. Stocks had already lost 45% by then. It could take a decade to recover from losses like that. It took The NASDAQ 15 years to make it back to the highs of 2000. In December of 2018, stocks lost 12% before you could even blink. 10. Don’t Leverage Your Life. If you’re having to put basic needs on credit cards to make ends meet, then it’s time to get realistic and adopt a better plan. Yes, there are solutions. No, cutting out café lattes is not going to solve the problem. 11. Low interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, real estate was the nexus, with CDOs (Collateralized Debt Obligations) and SIVs (Structured Investment Vehicles) catapulting the leverage into the stratosphere. This time around, corporate bonds are likely to be the culprit, with CLOs (Collateralized Loan Obligations) as Ground Zero of the downslide. “The current low interest rate environment may limit the ability of monetary policy to support the economy,” Jerome Powell testifying to Congress on November 19, 2019. Credit managers are unwilling to take on risk more than 22-months out. Investors are now demanding a clear path to profitability before buying into IPOs. Bond managers are saying No Thanks to covenant lite bonds and loans. These are all warning signs. The prudent Main Street investor would do well to take the foot off the gas, and look around to know which road you really are on. Are you holding long-term, high-risk bonds that are vulnerable to capital loss – on the safe side of your nest egg? Are you locked into a 401k term date mutual fund? Are you over-leveraged into stocks? There might be more solutions than you are aware of. Wisdom is the cure. The time to find the cure is now. It’s time to know what you own and why you own it. If you’re interested in receiving an unbiased 2nd opinion on your current plan, call 310-430-2397 or email [email protected] for pricing and information. "An investment in knowledge pays the best interest." Benjamin Franklin. Learn the ABCs of Money that we all should have received in high school at one of our Investor Educational Retreats, and watch how fast your life transforms. Other Blogs of Interest The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 26/9/2021 02:39:04 am

Pretty educational material about the state here and hope lots of people get a wear as well. I have found the updates pretty acknowledging and useful as well. Continue to spreading knowledge around and people get educated as well. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed