|

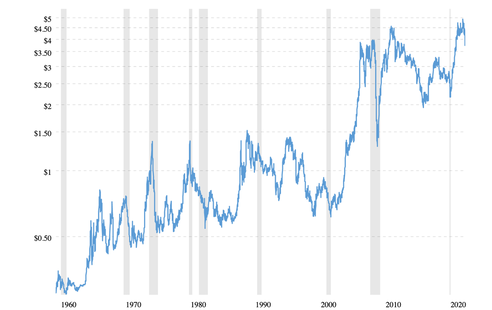

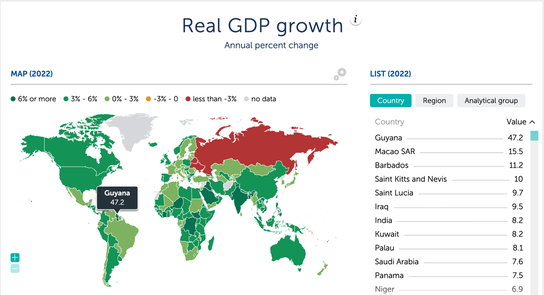

Copper Entered a Bear Market Last Week Copper prices have plunged from a high of $4.80/pound in early March 2022 To $3.85 on June 29, 2022. That’s a drop of 20%, which puts copper into an official bear market (alongside stocks). As you can see from the chart below, $3.85 is still pretty high. However, the concern is that a recession could pull prices down further, as often happens. For instance, in January of 2020, copper prices were at $2.85. By March 23, 2020 (at the bottom of the pandemic), the cost sank to a low of $2.10/pound. Prices didn’t stay there long and were back to $3.00 by September. However, the Pandemic Recession was the shortest contraction in history. In December of 2008 during the Great Recession, copper prices plunged to $1.30/pound. They didn’t return to $3.00 until September of 2009. How will Chile and Peru (the #1 and #2 copper producers in the world) fare in 2022? What about the world’s copper producers, including Freeport-McMoran? Goldman Sachs: “Copper is the New Oil” On May 4, 2022, Goldman Sachs issued a report, writing, “As the most cost-effective conductive material, copper sits at the heart of capturing, storing and transporting these new sources of energy. In fact, discussions of peak oil demand overlook the fact that without a surge in the use of copper and other key metals, the substitution of renewables for oil will not happen.” If the world is moving toward net-zero and clean energy – and away from fossil fuels and oil – why aren’t copper prices surging? As we’ve seen in past contractions, it’s the fear of a recession where consumers and businesses are forced to rein in their spending. Recessions Drag Everything Down A recession is already happening in Russia, Belarus and Ukraine. The rest of the world isn’t in a recession yet. However, the U.S. economy contracted in the 1st quarter by -1.6%, and full-year GDP estimates have dropped to 1.7%. Few economists forecast a recession before it happens. However, former Treasury Secretary Lawrence Summers has gone on record with a bold prediction that “a recession is almost inevitable” within the next two years and likely sooner rather than later (source: Bloomberg TV on June 24, 2022). Jerome Powell’s new definition of a soft landing (which skirts the mention of avoiding a recession) is as close as the Feds are going to get with a recession prediction before it shows up. As we see in the chart above, in the early stages of a contracting economy, copper can go down, as can other safe haven strategies, like gold, silver and even cryptocurrency. (Crypto tanked with stocks in the early days of the pandemic.) However, as the world rebuilds, copper is key. So, just as in previous recessions, near-term, downtrending volatility can be replaced by a Shoot the Moon trajectory. 2023 Should Look Better Than This Year The need for copper in a cleaner world should ultimately play in the favor of the world’s number one and two copper producers: Chile and Peru. However, in 2022 with a 21% reduction in copper prices, both countries may struggle to recover from the pandemic overhang, and the social unrest that is inherent in the region. Bloomberg reported earlier this year that Chile is on a path to nationalizing its copper and lithium mines. GDP expectations in 2022 are only 2.5% for Peru – down from 13.3% last year. Chile’s GDP predictions are a mere 1.5% in 2022 (down from 11.7% in 2021). While expectations were outstanding for both countries in 2021, this year, we’re taking Chile off the hot country list (due to the potential for nationalization) and underweighting Peru. Copper Companies Freeport Mc-Moran reported an increase in revenue of 73% in the 1st quarter of 2022. Freeport 1Q 2022 revenues were $6.6 billion with an average price of $4.66/pound. The comps for the 2nd quarter, which should be announced around July 21, 2022, will likely be flat year over year, and could be down. The outlook for copper is ultimately bright and shiny, but could be tarnished in the near term, which is why FCX stock is down -43% off of its 52-week high. McEwen Mining is a junior mining company with a large copper project in development in Argentina. The company is still in the preliminary economic assessment phase, with plans for an Oct. 2022-June 2023 drilling season and an IPO for McEwen Copper (which is 81% owned by McEwen Mining) in the first half of 2023. This is a company that has flown under the radar of investor attention for quite a number of years. However, once copper heats up again, investors should become more interested in a small company with such large copper resources. Bottom Line Copper is essential to our modern lives, and to a cleaner, greener world. However, as the world’s economies slow down and contract, demand for essential metals, like copper, drop, along with prices. These tend to be the first to recover, and robustly, once rebuilding begins. Protecting and diversifying assets, with an eye on the horizon, is the most rewarding strategy in uncertain and volatile times. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price and a free 4-part Protect Your Wealth Now webinar that will get you started immediately when you register before July 15, 2022.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Hottest and Coldest Countries in the World. The 1 Commodity Most Impacting Global GDP & the Dark Shadows Looming Over the World. The Hottest Countries Guyana‘s GDP is predicted to be the highest in the world at 47%. (Keep reading for the event that sparked such a leap.) Columbia will lead Latin America in GDP, at an estimated 5.8% in 2022. Indonesia’s 5.4% 2022 GDP growth projection is one of the strongest in Asia. That compares to a predicted 1.7% in the U.S., 3.3% in China and a recession in Russia and Belarus. What do the hot countries have in common, in a world where economies are posting much slower growth this year than last? They all export energy products. 3.2 billion barrels of oil was found off the coast of Guyana in 2018. The country began exporting in 2020. In 2021, Colombia was South America’s largest coal producer and second-largest petroleum and other liquids producer, after Brazil (source: EIA.gov). Last year, Indonesia was the world's largest exporter of coal by weight and the seventh-largest exporter of liquefied natural gas (LNG). The country also exports petroleum, and is the world’s largest supplier of nickel. (Watch my webinar on nickel-producing countries.) Russia is the 3rd largest producer of petroleum in the world (behind the U.S. and Saudi Arabia) and the 2nd largest producer of natural gas (behind the U.S.). However, the Russian economy is expected to contract by -7.8% in 2022, due to the worldwide boycotts, as a result of the country’s invasion of Ukraine (source: Reuters). The paradox is that had Russia not invaded Ukraine, it is unlikely that oil prices would have shot up to $110/barrel. 2021 ended the year at under $70/barrel (still high). Columbia and Indonesia ETFs With persistently elevated oil prices, why did the share price of the iShares MSCI Columbia ETF (symbol: ICOL) drop -26% this month? Even strong funds and companies can get drug down in a bear market. Another factor for Colombia was that the country just elected Gustavo Petro, the mayor of Bogota and a former leftwing guerilla fighter. He’s Colombia’s 1st socialist President. President Petro is promising pension reforms that could result in a 3% lowering of GDP for Colombia in 2022, if they materialize. While political reform can be glacial, the kneejerk reaction of investors rarely is. Is the country oversold? As one of the global leaders of GDP in 2022, is Colombia ripe for buying? While many investors are focusing on oil companies to capitalize on very high oil prices, if you are interested in energy, another play is to add some of these energy exporting emerging economies. There’s always heightened risk when you’re dealing with emerging countries. There can also be greater rewards. The Indonesia iShares MSCI ETF (EIDO) is down about 10% from its 52-week high. Will Energy Prices Remain So High? The big question is, “Will oil prices continue to be above $100 a barrel?” Oil prices are highly correlated with war. It takes a lot of oil and gas to fly planes, fuel tanks and truck soldiers to the battlefields. Another key factor to high prices is that Europe remains very dependent upon Russian oil and gas. Demand is high, and Russian boycotts create less supply, and higher prices. On the other hand, when consumers work-from-home, buy electric vehicles or trim back their travel because gas prices are too high, the plunge can be swift and steep – as we saw in the pandemic. The pandemic lockdowns in March of 2020 were the first time that oil prices were negative – when traders were paying others to take delivery of products they had no way of storing. Inflation and Interest Rates Politicians are keen to reduce oil prices as soon as possible to help out their consumers. Central bank governors are jacking up interest rates to battle inflation (of which energy is the biggest driver). When Will the War End? Another interesting development is that Western intelligence officials believe that Russia will exhaust their combat capabilities in a few months. Will this end the war in Ukraine? Bottom Line For now, there seems no end in sight for high oil prices. However, it’s always best to be forward-thinking when investing, and to be mindful of pricing in our entrance and exit strategies. It is certainly in most of our best interests to lower oil and gas prices, stamp-out inflation, and promote and sustain a more peaceful and productive world. If high energy prices persist, then Columbia, Indonesia, Guyana and other energy exporters (including companies) will benefit. If the war in Ukraine ends or if energy prices abate, what’s good for humanity and the healing of our planet might be very hard on investors’ wallets – particularly if you’ve purchased Chevron, Exxon Mobil or another oil company at an all-time high. The markets remain volatile, and the risk of a recession is real and heightened. The best approach in times of volatility and uncertainty is to be properly protected and diversified – and to rebalance regularly – particularly if a stock or fund has had a nice run (like both ICOL and EIDO did this year, before the June weakness. Personally, I'm bracing for a potentially hellish summer. However, it's never a matter of being all in or all out. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price and a free 4-part Protect Your Wealth Now webinar that will get you started immediately when you register before July 15, 2022.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. “Lies, Damn Lies and Statistics” Mark Twain. Debunking the economic nonsense and noise that abound. When the markets head south, in the initial days of a bear market, broker/salesmen scramble for their sales-speak playbook. Frantic calls pour in, and many are placated with some of the lines listed below – unless the plunge deepens and the losses become unbearable (which sadly has happened in three of the last three recessions). The pandemic recession was the blink of an eye and came roaring back, so many have forgotten that the stock market dropped almost 40% in just a month. Don’t cling to the hope that the next recession will act the same. In Federal Reserve Chairman Jerome Powell’s words (from a May 2022 interview), “The process of getting inflation down to 2% will include some pain.” So, with the S&P500 officially in a bear market, with losses since the high of -24%, should we be placated or should we get more defensive? Should we rely upon what we’re hearing in the mainstream media and from our financial advisor? What can protect Main Street investors from stock market losses? (There are 21st Century, time-proven solutions. Keep reading.) Below are 10 of the nonsense and noise (lies, damn lies and statistics) that are being bantered about in the media – even as the wealthiest investors continue to send the markets south, as they hunker down for the economic hurricane on the horizon. (Wall Street insiders are always the first to sell, and the first to buy back in at the bottom.) 10 Misleading and Potentially Catastrophic Sound Bites 1. People are being forced to sell low to take their mandatory distributions. 2. The statistics tell us we are not in a recession. 3. The economy is strong and corporations have a lot of cash. 4. We can move you to bonds to get you safer. 5. The Treasury Series I bonds are paying over 9%. 6. If you make changes now, you’ll just be selling low. 7. Turning off the news is a good idea. 8. Buy and Hold is a strategy that Warren Buffett uses. 9. You have to invest to keep up with inflation. 10. You should buy a house now before interest rates go up anymore. Here is a little more color on each one of these time-worn sales pitches, alongside a better, time-proven, 21st-century plan. 1. People are being forced to sell low to take their mandatory distributions. If you have to sell anything right now to take a mandatory distribution, you weren’t properly protected to begin with. Liquidity is an important part of any wealth strategy. 2. The statistics tell us we are not in a recession. Kevin O’Leary, Shark Tank’s Mr. Wonderful, came out with a video today saying that he doesn’t see a recession, even though that’s what a lot of economists and experts are forecasting. The economy contracted in the first quarter. Two consecutive quarters of economic decline marks the start of a recession. So, all eyes are on July 28, 2022, when the 2nd quarter GDP will be announced. If it is negative, we’re in a recession. Jerome Powell revealed that the economy picked up in the 2nd quarter in his press release on June 15, 2022. That could mean that we avert a recession for now, which is often what happens in the early stages of a bear market. However, it is also common for the stock market to start its decline well before the official recession announcement. The last two recessions are prime examples of that. The S&P500 had already dropped almost 40% before most people even knew we were in a pandemic in March of 2020. By the time the White House and Treasury Department admitted that we were in a deep recession in October 2008, the Dow Jones Industrial Average had already dropped about 45%. So, if you wait for the headline that we’re in a recession, it will be too late to protect your wealth. The bottom in the Great Recession was 55% losses. At that point many people thought we were in an Apocalypse because: * Lehman brothers got liquidated, * The entire banking system had to be billed out, * Mortgage banks and brokerages had to be rescued * Insurance companies, like AIG, were bailed out, and, * General Motors and Chrysler declared bankruptcy. Your plan should protect you from the recession before it arrives. Fortunately, that plan is easy-as-a-pie-chart with regular rebalancing. In fact, if your losses to date are more than 10%, that is a red flag that your current plan is not well-designed. 3. The economy is strong and corporations have a lot of cash. There is still a lot of cash in some of the corporations. Interest rates were near zero for a very long time, and corporations could borrow very cheaply, let their own credit score fall to the lowest rung of investment grade and receive no penalty for that kind of behavior. Now, we have over half of the S&P 500 at or near junk-bond status, including a lot of banks, brokerages and insurance companies. Saying that the corporations have a lot of cash, and ignoring the mountains of debt, is a perilously dangerous premise. I’ve mentioned that the U.S. economy contracted in the 1st quarter, and is one quarter away from being declared to be in a recession. 2022 full-year GDP keeps getting revised down, with the most recent estimate being 1.7%. The Feds never predict a recession before it arrives. And, of course, when it finally does arrive, it’s always due to some crazy circumstance like war, runaway inflation or some other uncontrollable event. Few ever admit that persistently low interest rates create asset bubbles and dangerously high leverage. Most just try to enjoy the ride as long as it lasts. 4. We can move you to bonds to get you safer. Bonds are illiquid and negative yielding. They are vulnerable to interest-rate risk, credit risk, duration risk, and they have no term premium. In a normal world, bonds would be a way to get safe because the Federal Reserve Board would be cutting interest rates, not jacking them up at lightning speed. (There is an inverse relationship between interest rates and bond values.) So, in today’s Debt World, you really need to know what’s safe. Otherwise, you could get locked into a long-term investment that borrows your money well beyond your own expiration date (those 30-45 year bonds), pays you very, very little and is impossible to liquidate. Prospective bond investors should receive a much better interest-rate with lower credit risk as early as next year, and certainly by 2024. If you jump in now, particularly into long-term bonds, you could be left holding the bag on an illiquid, negative-yielding, long-term, money-losing investment. 5. The Treasury Series I bonds are paying over 9%. The Series 1 savings bond is currently paying a 9.62% composite rate. That is astonishingly high in today’s world, where junk bonds are only paying 5%. However, that rate is only good for six months. The new composite rate will be announced on November 1. The fixed rate is zero on the bond. The other piece of the equation is attached to inflation, which is currently high. Inflation could still be high in November. However, if the FOMC‘s projections turn out to be accurate, next year inflation is going to drop by almost half. Since the fixed rate is zero on the bond, this could take the interest rate below 5%. If inflation falls further than that the interest-rate will be lower. If deflation occurs, then you could be getting no interest at all, while others are receiving a much higher rate in their savings accounts. You must hold the Series 1 savings bond for one year. If you exit before five years then you’re going to give up three months of your interest. This could still be worth it. However, it is unlikely that this bond will pay 9.62% for longer than the first six month period – unless inflation remains stubbornly high. 6. If you make changes now, you’ll just be selling low. The S&P earned about 27% last year, and is down about -24% already this year. So, we’ve given back most of the 2021 gains. However, we’ve been in a secular bull market since 2009. So, we’re still fairly high up the buy low, sell high continuum, particularly if we were well diversified and leaning into technology and growth over the past decade. If you are being told that you are selling low, it’s a sales tactic that’s intended to manipulate your emotions to keep you from making any changes. This is a hallmark of the last-century Buy & Hope strategy. What’s true? The sooner that we adopt a time-proven 21st Century strategy, the more of our wealth that we can protect. If we wait and the coming recession is as problematic as the Great Recession or the Dot Com Recession, we could be risking more than half of our wealth. This imposes serious financial hardship on our family. It wipes out our credit score. When we ride the Dow Jones Industrial Average all the way to its trough (which was 6547 on March 9, 2009), we then have to spend much of the bull market making up losses. (It took 15 years for the NASDAQ Composite Index to recover from the Dot Com Recession.) Sadly, after steep losses, many people are tempted to sell low and get out of everything altogether. Clinging to a money-losing proposition doesn’t work and neither does market timing. Having blind faith that someone else is protecting your wealth, when a simple 15-year performance chart could reveal that you are at risk of riding a Wall Street roller coaster much lower than it is right now, can be perilous to your fiscal health. 7. Turning off the news is a good idea. Turning off the noise is actually a good idea, but only if you have a time proven 21st-century plan in place. Acting on headlines almost always put you on the wrong side of the trade. If your plan is not properly protected and diversified, and you are not rebalancing it regularly to capture your gains, then whoever is telling you to stop watching the news is motivated to control you into adopting their plan. If things worsen, you’re not going to be able to stop worrying because you’ll quite clearly see the losses in your accounts. It’s much easier to manage your emotions when your plan protects you from extreme losses. 8. Buy and Hold is a strategy that Warren Buffett uses. Warren Buffett quite famously sold all of his General Electric stock just weeks before the company announced that they were cutting their dividend in half. (The stock dropped by half when the announcement was made.) Buffett used to live and die by Wells Fargo Bank stock. This is a holding that he didn’t get out of in time. He also quite famously bought into airlines at the low in the pandemic, only to sell them at a loss just a few weeks later. There’s a Wall Street saying, “Stick to your knitting.” Adopt a strategy that actually works in the 21st-century, and then don’t allow yourself to be distracted by the noise and nonsense that blusters nonstop. Warren Buffett, like other institutional investors, employs a team of analysts and managers who are active in their trading. When there’s a material event that changes the game or if they made the wrong call (as with the airlines), they are the first to get out. Fortunately, Main Street investors don’t have to jump into active trading. We just need to keep enough safe, be properly diversified and rebalance regularly (1-3 times a year). 9. You have to invest to keep up with inflation. This is a very common sales tactic. It’s used to get you to buy something – sometimes so that the broker/salesman makes an outstanding commission (6-7% or more, which equates to $6,000-$7,000 on every $100,000 invested). You’ll almost always be told that that investment is going to be safe, even if it’s not. Many investments today, including the ones that would normally be used for safety, like bonds and money market funds, are vulnerable to loss of your principal and have other risks. Getting safe in a rising-interest rate, high-inflation environment is a two-step process. I spend one full day on this topic at our Investor Empowerment Retreat. I have an entire section devoted to “What’s Safe?” in The ABCs of Money 5th edition. I also have a free podcast and webinar that you can listen to and watch. 10. You should buy a house now before interest rates go up anymore. Buying a house at an all-time high is a risky proposition that could ruin your life for a decade or longer. There are many things you want to consider before buying a house. However, buying high and having the value of the home drop below the mortgage can be one of the worst investments you’ll ever make. Real estate is an illiquid investment, which means that you might have trouble getting yourself unencumbered from it. I have a webinar and podcast on this topic that it’s important to listen to before buying a home in 2022. If you purchased a home or a vacation home within the last few years, it’s a very good idea to make sure that you:

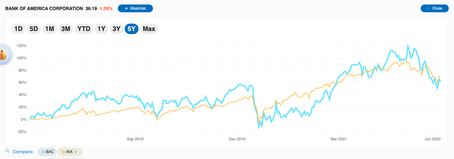

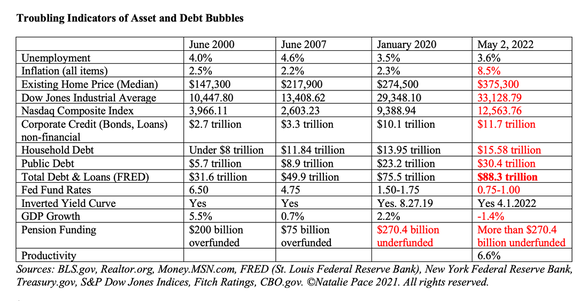

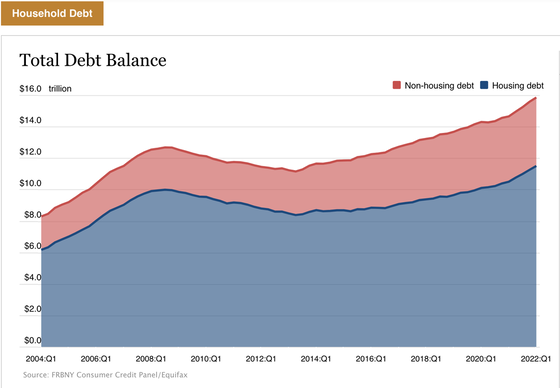

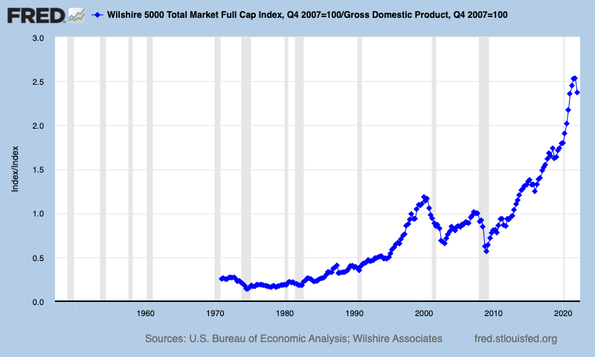

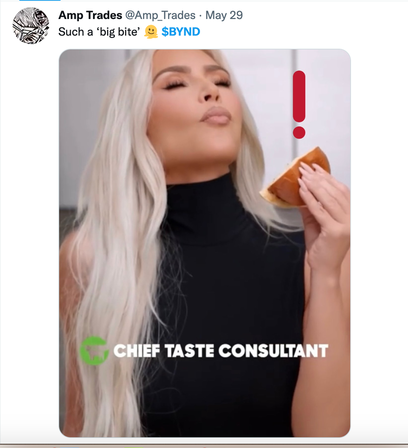

Bottom Line We learned during the Pandemic Recession that there are things we can’t live without no matter what is happening, like technology, toilet paper and hand sanitizer. What will be the industries that remain more buoyant in the next recession? While technology stocks have actually gotten hammered in 2022, we still need WIFI, smart phones and a lot of the AI that has become imbedded in our lives. The world is still committed to healing our planet and promoting cleaner and greener energy, food and companies. Most of us pay our utility bills, even when we tighten our budgetary belts. The U.S. is a country of innovators that produces a lot of what the rest of the world needs for existence. We tend to attract the top talent from around the world. (Many of our breakthroughs come from immigrants, like Sergey Brin, the co-founder of Google, who is Russian.) The stock market has never gone to zero in over a century – through many times of war and even the Great Depression. Market timing doesn’t work. That is one of the market aphorisms being bantered about that is absolutely true. However, having the appropriate amount safe, being properly diversified, knowing what is safe in a world where bonds and money market funds are vulnerable, and rebalancing at least once a year is a time-proven plan that has successfully navigated through each of the 21st century recessions (which are very different than last-century recessions). This might sound complicated, but it is actually easy-as-a-pie-chart – much easier than you might imagine. That’s why we call it the life math that we should have received in high school and college. The sooner you get a 21st-century, time-proven plan, the better off you’re going to be. It’s time to turn off the noise, sales-speak and the nonsense, and trust results. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the downturn from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price and a free 4-part Protect Your Wealth Now webinar that will get you started immediately when you register before July 15, 2022.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Investors Ask Natalie: Why Are Bank Stocks Going Down? Shouldn’t They Rise With Interest Rates? While you might think it’s logical that when interest rates rise, banks make “bank,” there’s actually a high correlation with rate hikes and recessions, especially when the rate hikes are unexpected and aggressive. Last week, Jamie Dimon warned that there is an economic “hurricane” on the horizon. We just don’t know how devastating it will be yet. Share price plunges typically precede the actual recession, and bank stocks are no exception to the rout. If you do a chart comparison of major banks compared to the S&P500, they look like shadows. It’s important to remember that stocks dropped 55% in The Great Recession and took almost 6 years to crawl back to even. The NASDAQ drop was even more dramatic (-78%) and prolonged (15 years) during the Dot Com Recession. Since asset valuations were even higher in 2022 than they were in the Dot Com Bubble, comforting ourselves with the false hope that “it always comes back,” isn’t a great plan. As researchers Pascal Paul and Simon W. Zhu noted in their report for the Federal Reserve Bank of San Francisco, “What matters for banks is not the level per se but the margin between different interest rates.” When short-term (bank borrowing rates) rise too rapidly, the banks are exposed to interest-rate risk without the buffer of a term premium. The profit margins are just too slim. Combine slim margins with having so many mortgages locked into fixed interest rates at historic lows – about 95% of new and refinanced mortgages have been fixed over the past two years (source: Mortgage Bankers Association) – and a predicted loss of mortgage origination revenue to the tune of a -37% decline from last year, and you’ve got a recipe for a great deal of stress in the financial services industry. In the Great Recession, if the Treasury and Federal Reserve Board hadn’t bailed out the banks, few would still be in business. Many brokerages (Bear Stearns, Merrill Lynch, Smith Barney, etc.) were absorbed into the banks to prevent them from going belly-up. Investors still lost the majority of their equity investment, and if they were invested in Lehman Bros., they lost all of it. A complete meltdown is not expected to happen this time because analysts point out that credit quality is good and unemployment is at historic lows. However, “pain” can be very broadly spread in a declining market. Losing money in a retirement plan takes down your assets to debt ratio, and your credit score along with it. I’ll give you a brief tutorial below on some of the issues happening today that are putting bank stocks under pressure. If you’d like to receive our Bank or Brokerage Stock Report Card, simply email [email protected] with the name of the Stock Report Card that you are interested in. Here are some of the stress points in the economy and banking sector Inverted Yield Curve Massive Debt & Leverage High Valuations Money Market Fund Risk Russian Exposure And here is additional Information on Each Point.. Inverted Yield Curve The yield curve inverted again on April 4, 2022. Inverted yield curves are almost 100% associated with recessions. It indicates that the bank’s net interest margin is squeezed or negative. In 2020, Paul and Zhu wrote, “Banks’ net interest margins have been falling at the same time as compensation for taking on duration risk has declined over the past three decades.” That scenario is negative for banking revenue and net income. Massive Debt & Leverage Low or negative-yielding, high-risk, long-term bonds are a much bigger issue than many fixed-income investors are aware of. Banks have means for managing a lot of this risk, through CLOs and by selling bonds to investors. However, it doesn’t wipe the slate clean, particularly when over half of the S&P500 is at or near junk bond status (including a lot of banks and brokerages). A peak at the Asset Bubble chart below gives you the stark reality of debt and leverage in the U.S. today. Consumer debt is higher than it has ever been, as are corporate and public debt and loans. Additionally, 25-40-year-olds are spending between 35-50% of their income on housing. The Feds are attempting to contain inflation while keeping the job market strong. However, if layoffs start occurring, consumer debt and leverage could become a big problem for people, products and anyone who loaned money to them. High Valuations: Low Interest Rates Create Asset Bubbles The S&P500 is down -15% from its January 2022 high of 4818. However, as you can see from the chart below, stock prices are still very expensive – even higher than they were in the Dot Com Recession, when the NASDAQ Composite Index dropped 78%. Banks are vulnerable to equity losses. According to the Federal Reserve Financial Stability Report released in May of 2022, “With valuations at high levels, house prices could be particularly sensitive to shocks.” No one is predicting a Great Recession type calamity. However, if you purchased your home recently, it’s worth it to make sure that you haven’t stretched the budget too thinly. It’s equally important to be aware that there are still 1.3 million homes that are severely underwater – even with home prices at all-time highs. Even if everyone pays their mortgage on time, the slowdown in mortgage originations will have a negative impact on mortgage revenues. Money Market Fund Risk Money Market Funds have seen their assets decline since 2020. Since these funds are “runnable,” they are a “structural vulnerability.” This is something that the Federal Reserve Board has been watching closely. They have a Repo Facility in place to help, which is getting tapped at unprecedented levels (click to see). Many investors are not aware that money market funds can lose money, and that they have redemption gates and liquidity fees. MMFs were a pretty big problem in the Great Recession, and could be a major issue if the current equity downtrend continues. If you’d like to know more about the risks in money market funds, be sure to read the “What’s Safe” section of The ABCs of Money. Russian Exposure JP Morgan Chase was often thought of as the bank that raised capital for Russian companies. JPMorgan and Goldman Sachs stated in March 2022 that they were going to exit the country. That means that the 2nd quarter earnings could start reflecting the exit. Citigroup has a bank in Russia. Citi warned that their exposure to Russia amounted to about $10 billion (source: Reuters). Citi’s stock is down 36% -- having plunged more than twice as far as the general market and the company’s banking competitors. Insurance Companies, Mortgage Banks and Hedge Funds Most of the issues discussed for the mega, multinational banks are even more problematic for the independent mortgage banks, insurance companies and hedge funds. Mortgage banks are losing revenue and having their profit margins squeezed. Insurance companies (do you have an annuity?) and hedge funds have a high amount of leverage and are very vulnerable to stock market plunges. Bottom Line In bear markets, bank stocks are as vulnerable as other equities, as is their dividend. If they don’t pass the Federal Reserve Stress Tests, they are required to cut dividends and suspend share buybacks. (Wells Fargo had this happen in the Pandemic Recession.) When dividends are cut, share prices plunge. Also, the higher the dividend, the higher the risk. Wells Fargo and Citigroup pay the highest dividends in the banking industry right now, and that’s a mere 2.0% and 3.77%, respectively. Now that you know bank stocks can lose as much as other stocks, what’s your best game plan? Proper diversification with regular rebalancing (something we teach at our Financial Freedom Retreats). You can read about it in The ABCs of Money. You can join us for the June 10-12, 2022 Online Retreat. Or you can email [email protected], if you’d like help understanding exactly what you own, how much you are at risk of losing, and what a better plan looks like. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the downturn from a No. 1 stock picker, join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Beyond Meat is trading near an all-time low of $25/share (after soaring to $240/share during the pandemic). Kim Kardashian, yes the influencer with 314 million followers on Instagram, just signed on to be the Chief Taste Consultant. So, is this a rare opportunity to buy into the plant-based protein of tomorrow, or is Beyond Meat done? Kim Kardashian Kim Kardashian is reinventing herself yet again. She is taking advantage of opportunities like hosting Saturday Night Live, dating Pete Davidson and Keeping Up With the Kardashians’ constant headline-grabbing drama to capitalize on one of her passions – a “non-strict” vegetarian diet. Click to watch her Beyond Meat promo, which has already received 1.2 million likes and over 18,700 comments (not all good). Is this all that Beyond Meat needs to find itself back in the freezers of fans and stock portfolios of investors? Beef, Pork & Chicken Prices Are Rising In the early days of the pandemic, there was a supply disruption of meat. Beyond Meat products flew off the shelf. By October of 2020, the BYND share price soared to $200/share, from a low of $36/share in March (at the market bottom). In 2022, the USDA is projecting that meat prices could jump 9-10%, with pork up 6-7%. We’ve seen the shift away from meat before during the pandemic. Will inflation price out traditional meat and welcome plant-based protein back into kitchens? It’s a question worth asking before you sell your shares. 2022 Outlook This year, supply chain disruptions, labor shortages, a lockdown in China and inflation are all impacting Beyond Meat, as well as the other plant-based protein and traditional protein competitors. These factors make forecasting highly uncertain. However, Beyond Meat is projecting a double-digit increase in revenues this year, to $560-$620 million (+21-33%). After subtracting the 1st quarter 2022 revenue of $109.5 million, that parcels out to revenue of $150-$180 million per quarter for the coming three quarters. Last year, the 2nd quarter revenue was $149.4 million. So, 2Q 2022 revenue growth may not be impressive. (Expect the 2Q 2022 earnings report in the 2nd week of August.) However, if the chips start falling in Beyond Meat’s favor or if Kim K’s influence attracts more home cooks, the second half of 2022 could bring more exciting quarterly comparables. The third and fourth quarters of 2021 were $106.4 million and $100.7 million, respectively. At the high-end, the year-over-year revenue growth would be about 70% -- something that should spark investor excitement. If fans love what Kim Kardashian eats as much as they enjoy how she looks, then all bets are off. Her SKIMs clothing line just hit a valuation of $3.2 billion – doubling in value since April of 2021. Forbes estimates that Kim K. is a billionaire. Her endorsement is a major coup for Beyond Meat – despite the snarky comments by trolls and the yammering of bloggers featuring the negative publicity. Competition (The Very Good Food Company & Oatly) Very Good Food Company The Very Good Food Company announced their 1Q 2022 earnings on May 17, 2022. Revenue decreased -24% YOY to $2 million from $2.64 million a year ago. The 4th Quarter 2021 revenue was $4.3 million, making 1Q look dismal indeed. Investors are throwing in the towel on this company. However, the company’s new interim CEO isn’t. The company recently hired former Nestle executive Matthew Hall as the interim CEO. According to the 1Q 2022 earnings press release, Hall believes that the Very Good Food Company has a good shot at being the plant-based food’s “thought leader.” He stated, “We have a great brand, fantastic products, engaged customers, and some very dedicated and talented people.” So, why isn’t that very good product selling and why did the first quarter revenue implode? VGFC stopped their eCommerce marketing spend, largely because the coffers were bare. The company has only $3.3 million in cash, with current liabilities of $6.7 million. If they don't raise money in the next 30 days, it could be restructuring time. That bad news was another grenade to their share price. While there are no guarantees that VGFC will be able to continue without restructuring, having a seasoned executive at the helm improves the odds measurably. Oatly Oatly is also trading down -86% from its 3-year high of $29.00/share, despite increasing revenue almost 19% in the 1st quarter of 2022. Oatly expects to increase revenue by 37-43% in 2022, to $880-$920 million. It was the staggering net loss of -$87.5 million in the 1st quarter that put the company out of favor with its shareholders. With only $219 million cash on hand, combined with higher interest rates, a resurgence of COVID in China and the tightening of money supply, Oatly is starting to fly too close to the trees. If Oatly manages to increase operating margins, raise more cash and meet or exceed projections, investors should become interested again. However, having been burned so badly by VGFC, Beyond Meat and Oatly, plant-based protein investors have become stunned and disgusted. While YOLO and Shoot the Moon memes were plentiful for Oatly, VGFC and Beyond Meat in the past, there is a lot more DD (due diligence) going on, including valuation. Valuation The traditional food companies like Tyson, Kellogg and Conagra have lower valuations. However, they also have lower revenue growth. Many of the plant-based protein companies are younger with much higher growth potential. The companies featured in this blog are all still operating cash-negative, and are reinvesting their cash in new production to meet high demand. Using a price-sales ratio, Beyond Meat, Oatly and The Very Good Food Company valuations are higher than the traditional food companies. However, if these companies can get through the near-term rough patch and start living up to their potential, now could prove to be a great time to pick up more Oatly, Very Good Food Company and Beyond Meat – unless the overall economy takes a deep dive south. Recession? Are we in a recession? That is the topic of my webinar to be held on Wednesday, June 1, 2022 at 5 pm PT. The podcast will be available on my Spotify page, while the webinar itself can be found on YouTube.com/NataliePace. Given that the 1Q 2022 GDP was a contraction, it’s a good idea to get informed on what the future has in store for investors. This is key for trading, as well as protecting your wealth and retirement plans. Bottom Line The projections for the growth of plant-based food range wildly from a tepid 3% CAGR to an eye popping 33.6% annualized. Meatless Mondays are becoming de rigueur. As we’ve seen over the past three years, the pandemic, war, economic uncertainty and general mayhem have the ability to upend even the most sound data projections. As we’ve also seen, when meat runs expensive or scarce, plant-based protein has a golden moment. The volatility of companies like Beyond Meat, The Very Good Food Company, Oatly and many others is one of the reasons why regular rebalancing is a key part of any investing strategy (something we emphasize repeatedly at our Investor Educational Retreats and in my books). It’s difficult to want to buy low when a company’s stock tanks, or to sell high when it soars. On the one hand, you’re worried it might stay low forever (or go out of business), and when the party rages, FOMO (Fear of Missing Out) keeps you dancing and drinking in your dreams of gains long after they evanesce… Rebalancing, particularly within our nest egg pie chart system, takes the emotions out of it and prompts you to stay on the right side of the trade. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the downturn from a No. 1 stock picker, join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed