|

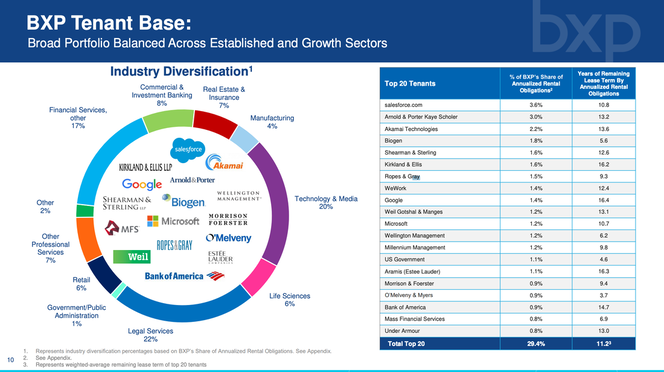

California Reopens. For Tourists. Office Buildings are Still Ghost Towns. Open for Tourists On June 15, 2021, California reopened. I’m saying “for tourists” because although offices were open for business, too, nobody showed up (continue reading for details). California Governor Gavin Newsom made the announcement at Universal Studios in Hollywood, CA, surrounded by minions and a troll. I visited Fisherman’s Wharf in San Francisco on June 14, 2021. Happy travelers were everywhere, laughing at sea lions and posing for pictures. The restaurants, like Fog Harbor Fish Company, had a wait list. If you’re headed to Disneyland and you are vaccinated, you don’t even need to wear a mask. Offices are Still Ghost Towns Since I was in San Francisco, I headed over to the Salesforce Tower to see who would show up for work at the office, and how long the lines to get into the building would be. When you have these towers that reach 1000 feet or more into the sky, combined with social distancing protocol, the elevator commute time alone can be prohibitive. Less than a handful of people entered the Salesforce building at 8 a.m., flashing their health approvals on their mobile phones. The gondola leading up to the public park was empty, but still running. (Fortunately, someone turned it off by the time I came back about an hour later.) Almost all of the local restaurants that support the office workers were closed. The sole food option was an Acai Bowl food truck. There was nobody in line. I walked over to Embarcadero for breakfast. There things were moving. Dozens of Millennial joggers, with their cell phones secured to an arm band or designer activewear, loped along the shore. At 8:45, the ferry let off a boatload of passengers, most of which appeared to be essential workers. I decided to see if the 9 a.m. start time might yield more staff to enter buildings. At 8:55 am, I followed the only professional on the street, a prematurely balding banker-type, who carried his lunch in a brown bag in one hand and a cold brew in the other. He hustled to make it to the Google building by 8:58. I waited for a few minutes to see who else might show up. Another 9 people entered One Market Plaza. Back at Salesforce, a dozen young tech workers entered the building between 9:15 and 9:25. In the public park on the roof of the Salesforce Transit Center (70 feet in the sky), three small groups of professionals were having Walk and Talk meetings (by small I mean 2-3 people in each group). It was easy to distinguish these groups from the smattering of mothers, fathers and grandparents pushing toddlers to the Toddler Tuesday song and dance event scheduled for 10 am. On Monday, June 7, 2021, Salesforce CEO Marc Benioff announced on CNBC that more than half of his staff (50-60%) will work from home – up from about 20% before the pandemic. According to Benioff, “The past is gone. We’ve created a whole new world, a new digital future.” In a study by Citrix, 90% of Millennial and Gen Z workers do not want to return to the office full-time, and over half wish to work from home full-time. In the press release, Citrix concludes, “As the data makes clear, today’s business leaders are clearly disconnected from what the Born Digital [Millennials and Gen Z] really want from work.” Work-from-Home clearly creates challenges for the commercial real estate industry, which has more than recovered in share price from the pandemic, but still faces serious fiscal challenges and heightened vacancies in their buildings (even when the space is still under lease). While corporate C-levels are upbeat on their earnings calls, focusing on the long-term lease commitments and their market-leading capabilities, many are quietly selling stock. Recent C-Suite, board and institutional insider stock sales include Cushman & Wakefield, CBRE, Boston Properties, Colliers and Hudson Pacific. Most of these companies, with the exception of Hudson Pacific, have share prices that are trading at all-time highs (above pre-pandemic levels). In this industry, the share prices are high, price-to-earnings ratios are outlandish, revenue is down, debt is heightened, the business model is suffering a structural blow, and credit ratings are at the lowest rung of investment grade (BBB). Cushman & Wakefield was downgraded to B+ (junk) by S&P Global on March 23, 2021. What Will Happen to All of The Empty Office Buildings? While CRE CEOs are reporting to shareholders that their mostly empty office buildings have tenants that are “waiting to see” what the future holds, many CEOs, like Benioff, Jack Dorsey (Square and Twitter) and Mark Zuckerberg (Facebook), are clear that Work-from-Home has become a permanent part of life. A bank C-level located in New York City anonymously reported that his company negotiated to reduce the office space to a third of what it was pre-pandemic, adopting a new Work-From-Home and desk-share model. Meanwhile Doug Linde, the president of Boston Properties reported in the 1Q 2021 shareholder earnings call that “the office tenants are deep into planning for their return to the physical in-person work environment as we approach the back half of 2021.” Companies looking to get rid of office space are driving rents down. Sublease availability increased 61.7% year-over-year in New York City during Q1 of 2021, higher than it has been in 3 decades, according to a Savills report released on March 31, 2021. Some building owners have plunged their properties into remodeling. Others are focusing on biotechnology and health care (which now has an emerging Teledoc option). Not every empty mall or building can become a data center or Amazon warehouse. Boston Properties president Doug Linde admits that there is a lot of subleasing activity, saying, “There is a lot of sublet space on the market, but a large portion of it is not accessible because of short term, unworkable existing conditions or, quite frankly, the user discomfort with the lessors’ profile.” Salesforce is Boston Properties’ #1 client, with WeWork as its #8 client. Companies entered into decades-long lease agreements before the pandemic changed the way we all do business. This was the fundamental problem that squashed the WeWork IPO in August of 2019. Sophisticated investors thought that The We Co.’s business model of taking on long-term leases, with only short-term commitments from entrepreneurs and startups, was going to be a problem in the late stage of the business cycle. Those long-term leases provide some support for the CREs in the short-term. Interest rates are low. Stocks are high. Terms are relatively easy. Only a portion of their leases will come up for renewal in 2021 or 2022. Extricating from a long-term lease is a strategic maneuver for any company looking to downsize their office space. However, if Activision Blizzard is any example, the companies are in trouble once the leases do come up. Activision abandoned their Boston Properties campus in Santa Monica on March 26, 2021. What Could Possibly Go Wrong for the Building Owners? Tenant bankruptcies, high levels of sub-leasing and interest rates are the biggest risks to CREs in the near and mid-term. (Over the long-term, office buildings will have to revise their business model for a post-pandemic world, if they manage to survive on reduced rent revenue without declaring bankruptcy.) Low interest rates, mortgage-backed securities purchases by the Feds and the Secondary Market Corporate Credit Facility kept these debt-laden commercial real estate companies off of the ropes during the pandemic. (All of the companies I examined were rated in the BBBs or lower.) When interest rates rise, it will make borrowing more expensive and difficult – which is one of the primary reasons that Jerome Powell assured everyone today that interest rates could remain low until 2023 (inflation and pandemic permitting). The Feds announced on June 2, 2021 that they will begin selling off their SMFFC holdings. According to the press release, “SMCCF portfolio sales will be gradual and orderly, and will aim to minimize the potential for any adverse impact on market functioning by taking into account daily liquidity and trading conditions for exchange traded funds and corporate bonds.” Vornado and Boston Properties’ bonds are part of the portfolio that will be sold. The Higher the Dividend, the Higher the Risk REITs are a risky move in a post-pandemic world. Most companies are heavily indebted, are trading at unsustainably high multiples and have slow or negative revenue growth. They pay high dividends and commissions to keep investors and brokers interested, respectively. Many are unaware of the risks they are taking on, particularly since the structural shift to Work-from-Home is being under-reported. Those companies that have a competitive advantage (such as outdoor space for relaxed social meetings and LEED status) and fiscal husbandry should fare better than companies with older energy-hog buildings with higher debt. Figuring out what to do with the empty buildings and how to negotiate with their tenant customers will take a few years to sort out. Are the CRE CEOs clueless or simply reassuring investors until they have good news about an innovative transition plan to report? Bottom Line If you are working from home, enjoy only having to dress waist up for your work week! If you are investing in REITs, it’s best to factor in the impact that the Work-from-Home trend is having on office buildings. If you’ve been hearing that Zoom and Teladoc meeting software are going to be irrelevant as people head back to work, that’s not what is what is showing up in the data or what I’m seeing in my boots-on-the-ground research. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 13, 2021 (Sunday) to receive the lowest price and a complimentary, private, prosperity coaching session (value $300).  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.

Ms Webb

27/6/2021 10:57:10 pm

HIRE A PROFESSIONAL HACKER TODAY FROM CONTRACT HACKERS! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed