|

Editorial Update: On March 17, 2021, the Federal Reserve Board increased 2021 GDP projections for the U.S. to 6.5%, from 4.2% projections in December of 2020. This is positive for the Spring Rally. However, there are a few events coming up over the summer that could burn up the Spring green, including the Debt Ceiling (July 31, 2021), Fitch's Negative Outlook on the AAA U.S. Sovereign credit rating and massive leverage in weak industries. Learn more in the Spring Rally and Stimulus Party Like It's 1999 blogs. (Click to access.) After this week’s pullback, you might be hoping for a Spring Rally. The NASDAQ Composite Index is down 6.4% since March 1, 2021. However, many of the fundamentals behind the rout of this week are going to remain a factor in all asset prices this year. In short, we have to whirl the effects of hope, hot air, handouts, the vaccine, pandemic hangover, inflation, asset bubbles and financial instability into our crystal ball, and see what materializes. As MIT professor Andrew Lo has famously said, “Physics has three laws that explain 99% of the phenomena, and economics has 99 laws that explain 3% of the phenomena.” (Lo is the author of many books on the financial markets and leads the MIT Laboratory for Financial Engineering.) Will:

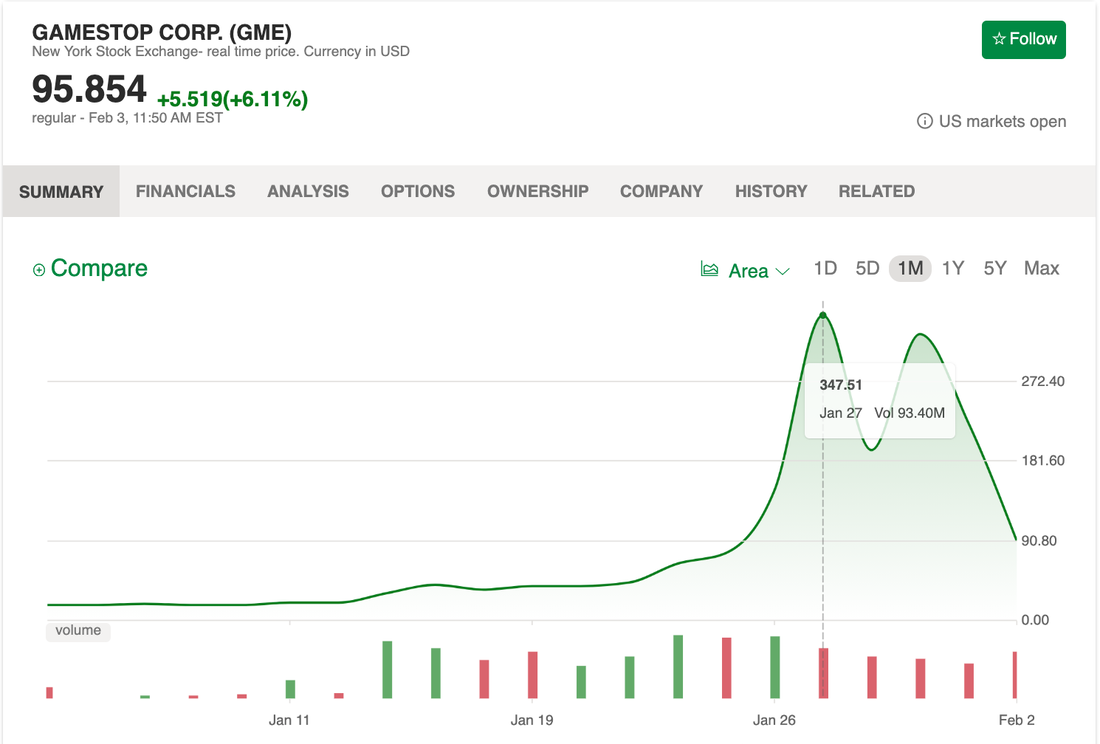

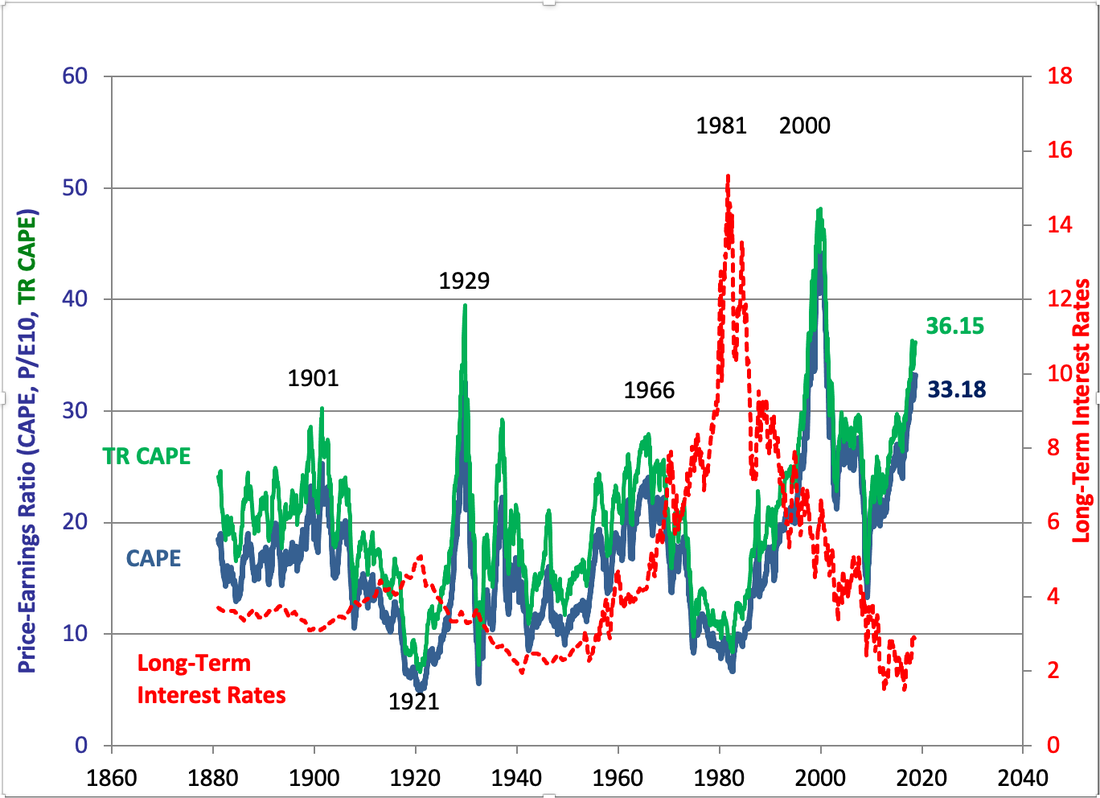

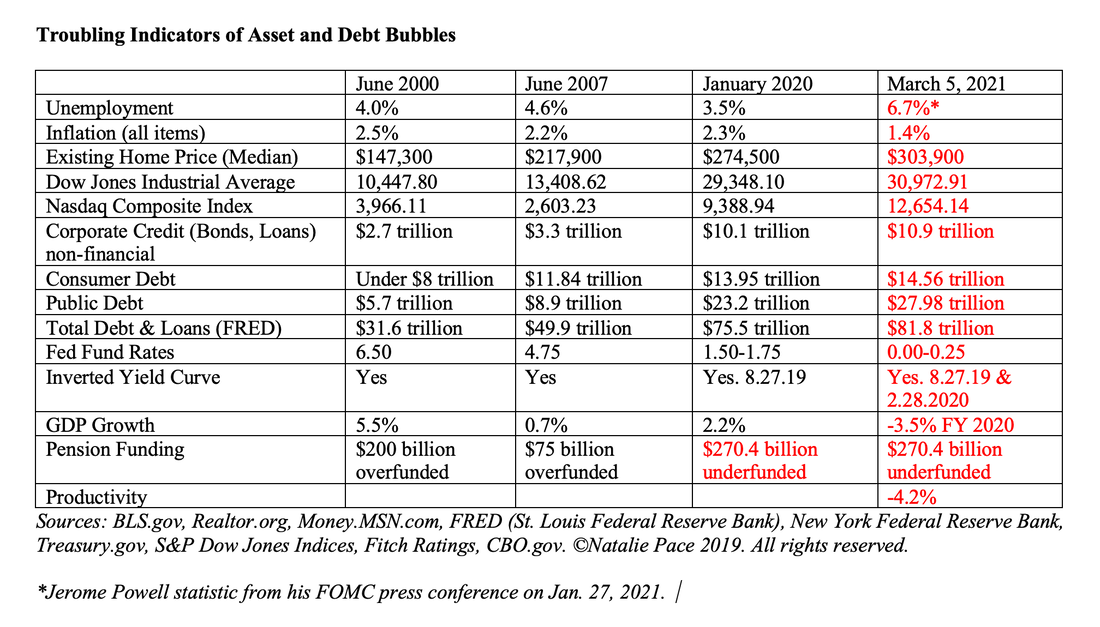

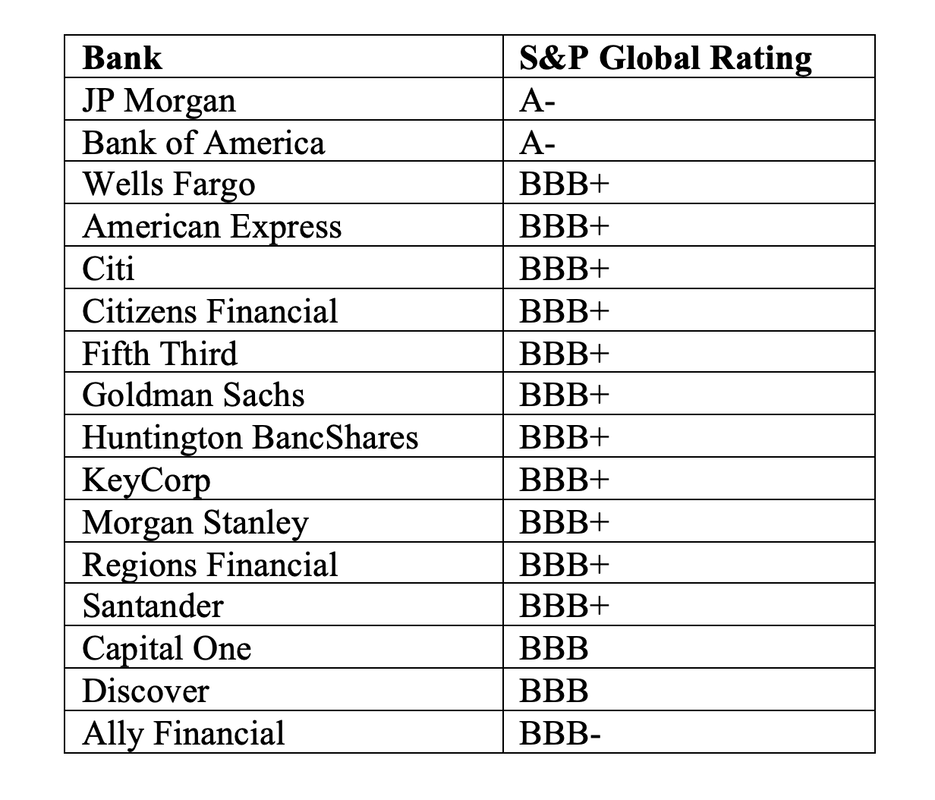

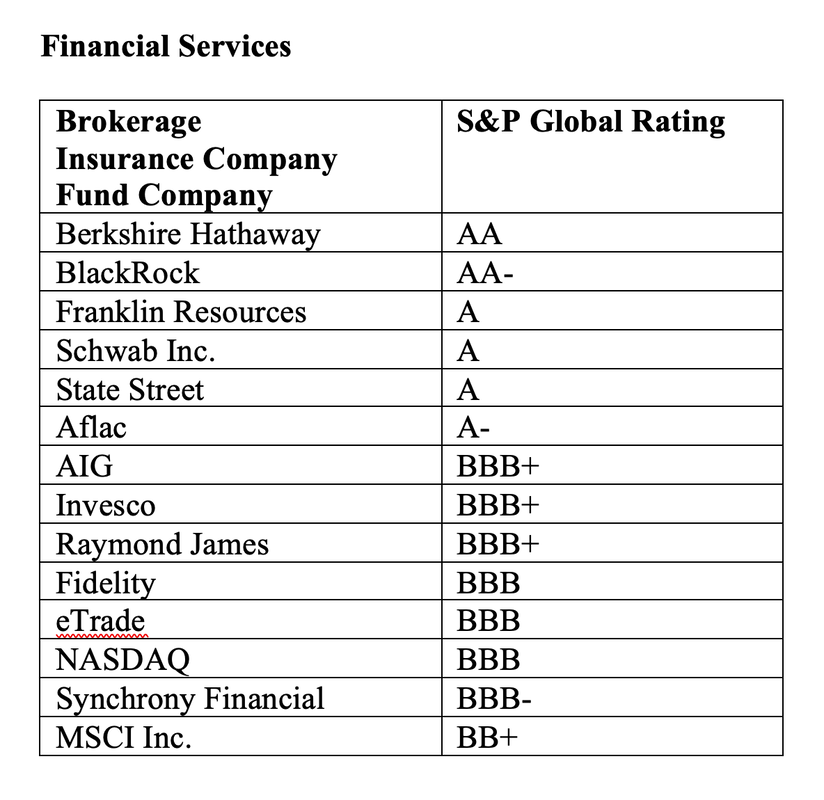

Add up to a Spring Rally? Everyone is hoping that the economy will strengthen and stocks will soar. But has the good news already been priced in? How high can equities fly? What might crash land them? Below are eight things we must consider when thinking about a Spring Rally, and making projections about just when our lives will return to normal. It’s probably better to think about this as a New Normal of a Post-Pandemic World. 8 Factors that Could Prompt or Pop a Rally in Stocks Hope Hot Air Handouts The Vaccine Pandemic Hangover Inflation Asset Bubbles Financial Instability And here is a little more color on each issue. Hope People just want a happy ending. We’ve been living in a nightmarish time warp, where long, sequestered days of repetitive hibernation has us all stir-crazy. Perhaps it is always darkest before the dawn? Maybe we’ll walk outside in Spring and the sun will shine again. Our wealth will do what it usually does in the Spring Rally – increase. There’s at least one dark cloud in the sky of this Eden – the specter of last March, when the Dow Jones Industrial lost 35% before most of us knew we were in a pandemic. (The WHO declared COVID-19 was a pandemic on March 11, 2020. The low on Wall Street was March 23, 2020.) Hot Air Hope and optimism has brought in a new type of investor – one who wants to shoot the moon and become an instant millionaire. There are plenty of predators waiting in the wings to pounce on this prey. Reddit bulletin boards and Robinhood investors have been piling into troubled companies like GameStop, AMC, Bed, Bath & Beyond and Blackberry, sending their share prices soaring. Sadly, the zenith flashes and crashes typically within a few short minutes. Check out the share price trajectory of these stocks over the last month. As you can see, they look more like Pump & Dump Schemes than opportunities. Memes stocks and other marketing and promotional campaigns have wiped out newbie investors, who get gassed up on the promise of becoming rich overnight. Reading these marketing blogs can be a little intoxicating. However, a quick look at the trajectories of past meme stocks is sobering. So be cautious, particularly if you are trading on margin. Handouts The $1400/person check that the Biden Administration is close to handing out should help the economy. Prior to the pandemic, consumer spending made up 70% of GDP in the U.S., with $13.3 trillion spent. In 2020, that figure dropped by half a trillion to $12.5 trillion. The Brookings Institute predicts that it will take until 2022 for consumer spending to return to 2019 levels. For those sectors most hard hit, such as hospitality, hotels, casinos, travel and health care (non-COVID-19 related), the full recovery may not occur until 2023 or 2024, according to Brookings. Will stocks soar on increased consumer spending in 2021? Many companies already have the recovery priced in. As you can see in the average P/E chart below, which is provided by Robert Shiller, Yale professor of economics, the average price to earnings ratio is very high. In fact, the only two times in history when P/Es were higher was in 2000 and 1929. The Vaccine The COVID-19 vaccine might be distributed to all of American adults by early summer. Will that mean an opening up of the economy, a rebound in spending, travel and eating out and La Vie en Rose again? On one hand, as Federal Reserve Board Chairman Jerome Powell has been pointing out repeatedly: a return to normal is unlikely until people feel safe congregating again. I’m in Manhattan now and what I’m seeing is that there are places where people are fine mingling and other places where they are not. While this is still early in the vaccine distribution, the trends reflect some biases that stem from self-interest. Airplanes. I recently had to fly to Arizona for a memorial service. The plane was at or near 100% capacity. There was no social distancing, although everyone was required to wear a mask. Grocery stores try to limit the amount of people inside and encourage everyone to social distance. However, if someone stands too long in front of the organic tangerines, she’s going to attract a crowd around her, reaching in to grab and go. In other words, when you have to sit or stand next to someone for something essential, people are already doing it. The Office. Now that we know how easy it is to host meetings online in our yoga pants (with appropriate looking business attire on top) will we want to go back to the office? How many of us want to add a daily commute back into our lives? For New Yorkers, San Franciscans and other city dwellers, the commute might be the queue at the elevator. Elevators are one place that people are still social distancing – at least in Manhattan. This impedes a return to the office, if it’s located on the 63rd floor. The office building is still a question mark in the pandemic recovery. Do we really need two places, or can we live and work at home? Now that businesses know we can be productive from home, will reducing the office space be low-hanging fruit to make up some of the financial challenges of 2020? Has there been a structural shift in the way we work? Many technology companies say, “Yes.” Of course, there will always be businesses and services that require having a shop. Travel & Entertainment. Hotels, events, cruise ships and casinos saw their revenue drop by up to 90% in 2020. How fast will the vacationers and conventioneers return? Has there been a structural shift in how we host conferences and launch events? Will the convention business come back? Many businesses have been forced to conserve capital due to revenue losses, while taking on more debt to survive the pandemic. Hosting meetings and conventions online is a lot more cost-effective than travel, airfare, per diems and hotels. Over 19 million Americans are taking some form of unemployment (compared to 2 million a year ago). This could also put a damper on discretionary spending. Even those with a job might be more discerning and conservative about when and how they have fun, preferring to save for a rainy day. Pandemic Hangover. The vaccine should make it possible to visit foreign countries again. Cabin fever has us all ready to hop on a plane for a week in the Caribbean. However, astronomical personal debt, a fragile economy, a volatile stock market, unaffordable housing, high unemployment, and all of the budget nightmares that go along with this pandemic hangover may slap down our dreams. Just how much of a factor will excessive debt play in the recovery of countries, cities and businesses that are heavily reliant upon travel and tourism? Real estate prices are at all-time highs and stocks are near their apex. However, so is debt on every level, consumer, corporate, municipal and sovereign. Fitch Ratings has a negative outlook on the U.S. AAA credit rating. If Fitch decides to downgrade the U.S., they may do it over the summer, as Standard and Poor’s did in 2011. Inflation. The Dow Jones Industrial Average dropped 346 points on March 4, 2021 after Jerome Powell affirmed that the Federal Reserve will keep interest rates low, even if inflation starts creeping in. Powell said, “We expect that as the economy reopens and hopefully picks up, we will see inflation move up... That could create some upward pressure on prices.” Gold and silver prices tumbled in tandem with stocks on the news. Cannabis and Tesla were some of the hardest hit. Asset Bubbles. The last two recessions, pre-COVID-19, were characterized by financial instability and asset bubbles. Today, the prices are even higher, while the debt has entered the intergalactic realms. See the Asset Bubble Chart below. Should a company like Tesla that makes less than half $1 billion in net income be valued at almost $900 billion, as Tesla was in January of 2021? Investors are enthusiastic with Tesla’s growth (at 45.5% year over year) and potential. However, experience tells them that getting out over your skis too early can be deadly. Pricing today for tomorrow’s (or next decade’s) potential can be an expensive lesson. Almost every company on Wall Street was trading at half the price (or lower) on March 23, 2020 than it is today. Tesla traded at $70/share, compared to $621/share on March 4, 2021. Tesla’s share price is down 31% since the January 2021 highs. Nvidia’s share price is off 19.5%. Amazon is down 16%. Apple, a company which repurchased $24.8 billion of its stock in the last quarter of 2020, has lost 17% of its value. Even with those price corrections, the P/Es of these companies are 74, 72 and 33, respectively. The average P/E is 16-17. Overvalued Commercial Real Estate Implodes According to Bloomberg, Jared Kushner’s Times Square building was valued at $470 million in 2016. It sank to $92.5 million in 2020 and is currently in the process of foreclosure, with over $370 million in arrears. We’ve seen asset prices implode with unprecedented speed in today’s world. Financial Instability Over half of the S&P500 is at or near junk bond status. That includes a lot of banks and financial services companies. Many of these companies have exposure to the weakness in commercial real estate. Margin debt just hit an all-time high. Speculation is rampant on Wall Street. If investors get into trouble, the brokerages might as well. Financial instability increases the likelihood of a more severe and extended drop in asset prices, as occurred in the two previous recessions (Dot Com and the Great Recession). Talk on the Street We’re hearing a lot of pundits talk about the strength in stocks, the sizzling and spectacular returns of cryptocurrency, and the specter of inflation. Does that mean that technology is weak? Nope! It’s simply means that people are taking profits in what they perceive to be an overheated market. It’s hard to imagine a future without a smart phone, gaming, Whole Foods, movie streaming and ordering everything you need online. That’s why the pie chart system works better than trying to jump in and out (market timing). Will Bitcoin be the only currency when the dollar disappears? Unlikely. If someone is telling you that, beware. There are a lot of crypto-criminals and fraud in this space. Cryptocurrency is currently a trader’s delight. You can’t have a currency that is worth $20,000 one month, and drops to under $5,000 just a few months later. Yes, Bitcoin just hit $57,489 earlier this month, for some of the best returns to be had. Here again is an example of how having a slice of Bitcoin is a better strategy than going all in. Knife-Like Drops Debt, leverage, valuations and financial instability are all a concern. The pandemic recession has been characterized by knife-life corrections (such as in the Times Square building mentioned above). February 19, 2020 to March 23, 2020 was the swiftest that a bull market had ever become a bear – with losses of 35%. Yes, we’ve seen a robust recovery. However, financial instability was already a concern before the pandemic and has only become more problematic. In the words of Jerome Powell from the FOMC press conference of December 16, 2020, “The current economic downturn is the most severe of our lifetimes. It will take a while to get back to the levels of economic activity and employment that prevailed at the beginning of [2020].” Bottom Line Asset prices are inflated. The Spring Rally and vaccine are already overpriced in. Add in inflation and a move to a perceived stronger bond market (it’s not), and you’ve got a potential for a nasty surprise. Hot air is taking meme stocks to the moon, only to see them crash land in a matter of minutes. Few pundits are featuring leverage, debt and financial instability, which were the sinkholes of the two previous recessions. Most Americans are worth less today than they were worth in 1995. Your best strategy, is a diversified plan that factors in what is safe in a world full of financial instability. Market timing doesn’t work. Overweighting safe, underweighting leverage, leaning into hot industries (including technology), and reading the fine print on anything you think is safe (but probably isn’t) will afford you the grace and gains of rising above the Wall Street rollercoaster. Buy & Hope cost investors half or more of their wealth in the two previous recessions, and then they must hope and pray to recover losses in the bull markets. It took 15 years to recover from the Dot Com losses and seven and a half years to come back from the Great Recession. So, if you’re banking on a Spring Rally to keep sending stocks to the moon, and you’re not properly protected in case this March looks a lot like last year, then you are gambling. A properly diversified and protected plan protects your wealth from downturns, and allows you to build wealth in the bull markets. You lean into areas of strength and hot industries, so that when rallies occur, your wealth grows at twice the speed. You rebalance regularly, so that you keep your gains instead of watching them evanesce in the next downturn. This is a buy low, sell high plan on auto-pilot for your nest egg, which is the soundest strategy in the late stage of a secular, overpriced bull market, in the middle of the most challenging economy of our lifetime. This is something we teach at my financial empowerment retreat. The next one is April 24-26, 2021. It’s online so you can join us from anywhere.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by March 15, 2021. Other Blogs of Interest Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed