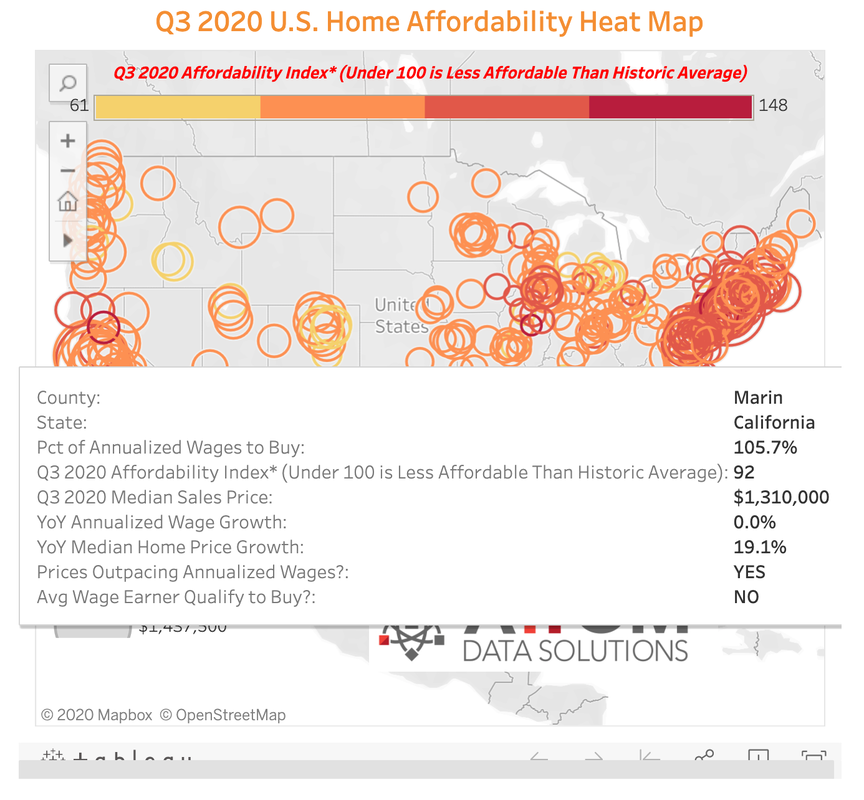

Home prices are skyrocketing. However, so are missed mortgage and rent payments. For answers, I interviewed Mike Fratantoni, the chief economist of the Mortgage Bankers Association. Are you sick of renting? Have you watched real estate prices soar, and rue the day that you didn’t buy? Are you feeling equity-rich, but itching for a move? Are you worried about losing your home or job? Are you underwater on your mortgage? What’s the best plan for real estate in the pandemic and beyond? Signs of Distress In September 2020, 8.5% of renters, 7.1% of homeowners and 40% of student debt borrowers missed a payment (source: Mortgage Bankers Association). Meanwhile, home prices soared to an all-time high of $311,800, up 14.8% year over year (source: National Association of Realtors). How is it that there are so many distressed borrowers (2.82 million rental households, 3.37 million homeowners and 26 million student debt borrowers), and why isn’t that impacting home prices? Should you buy a home now, while mortgage rates are at an all-time low, or hold off until home prices are more affordable? Mike Fratantoni shares his wisdom, research and crystal ball projections for home prices and mortgage interest rates in 2021 and beyond. Natalie Pace: How is it that unemployment is high, concerns about the ongoing pandemic are heightened, missed mortgage and rent payments are elevated, and yet home prices are soaring? Mike Fratantoni: Mortgage rates are very low. The Millennial cohort is getting to peak homebuyer age. There are enough people who have jobs and have not been directly impacted by the shutdown. They are able to maintain their income, and have enough confidence that they are able to maintain that going forward. We are very optimistic about the purchase market in the next couple of years. We’re more worried that there is just not enough inventory on the market. You’re talking only 3 or 4 months of supply at the current pace. There are not enough units on the market. NP: According to AttomData, median-priced homes are unaffordable to the average wage earner in 61% of U.S. counties. Where are prices headed for the rest of the year? Will the pandemic and unaffordability pull prices down? MF: In a situation where we don’t have enough housing stock in the country, prices are going to stay high. Home prices are likely going to keep going up. Even with high unemployment, the mismatch between still strong demand and constrained supply is going to keep home prices increasing even next year, as we exit from this pandemic. NP: There are still 3.5 million homes that are severely underwater on their mortgage. Do you think these homes, and other shadow inventory, might be a factor in subduing home prices going forward? MF: I don’t see that as a large number of households at this point, given that home prices have grown in the last decade and will continue to grow into next year. That is not the same issue as it was in the Great Recession. NP: Unaffordability has become an industry buzz word, yet the situation is only becoming more dire. What can be done to right-size prices for would-be homeowners? MF: We see it as an issue of constrained supply. We need more buildings in cities, suburbs and rural areas. We need it everywhere. NP: Some cities, like Manhattan and San Francisco where the average wage earner is completely priced out of ownership, have seen a dramatic increase in listings and a lowering of prices. According to Zillow, home prices sank 4.2% and 4.9% in 2020 in Manhattan and San Francisco, respectively. Inventory in San Francisco has jumped 96%. MF: You naturally would see Millennials leave the cities and move to the suburbs as they are having children and looking for schools. That was happening any way. With the pandemic and concerns about urban conditions, is this just another reason on the list to move out of the city? Will we see that happening in more and more places? In most parts of the country, it’s tough to tell if this is an additional factor or just the continuation of a new trend. NP: Your data shows that credit is tightening. Will that impact buyers? MF: We’ve seen a jump in delinquencies of FHA loans. That has led many lenders to become more cautious with first-time buyers who might get an FHA loan. So, they’ve put in an overlay requiring a higher minimum credit score. At the other end of the market, for jumbo borrowers, we’ve seen tightening. Banks have so many competing demands that they have tightened up any type of loan that they were going to hold. That includes jumbo loans. However, credit being tight is not impacting overall purchase demand. NP: Where are mortgage interest rates headed? MF: Mortgage rates tend to track the 10-year Treasury rate. Because of the large U.S. deficits and the incredible amount of debt the Treasury is going to have to auction, there will be some upward pressure on 10-year Treasury rates and mortgage rates. Today, we’re closer to 3.0% for a 30-year fixed mortgage rate. We think that will be closer to 3½% next year. It’s not an enormous increase. Prior to this year, that would have been a record low. I would not be surprised if in two or three years, we’re back above 4.0% again. That’s not historically high, but it is higher than we are today. NP: Back to the distressed homeowners and renters who are behind on their payments. What should be done to help them? MF: It’s important either through stimulus payments, or enhanced unemployment insurance, or through direct rental assistance, to help them pay their rent, as opposed to preventing them from being evicted after they don’t pay their rent. An eviction moratorium transfers the problem from a rental household problem to a landlord problem, and kicks the can down the road. The eviction and foreclosure moratoria make sense from a public health standpoint. But it is not correct to think that they are going to solve or mask a problem. It is just delaying and transferring that problem onto another actor. If you’d like to hear my full interview with Mike Fratantoni, including his wisdom on the commercial real estate market, go to YouTube.com/NataliePace. Real estate is an important part of your wealth strategy. However, buying high in real estate can be one of the most expensive lessons you'll ever learn. For that reason, we spend one full day on what's safe and real estate at our Investor Educational Retreats. Register for the Jan. 16-18, 2021 New Year, New You Retreat by Nov. 30, 2020 to receive the best price. Learn more in the retreat flyer. (Click to access). Other Blogs of Interest Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed