|

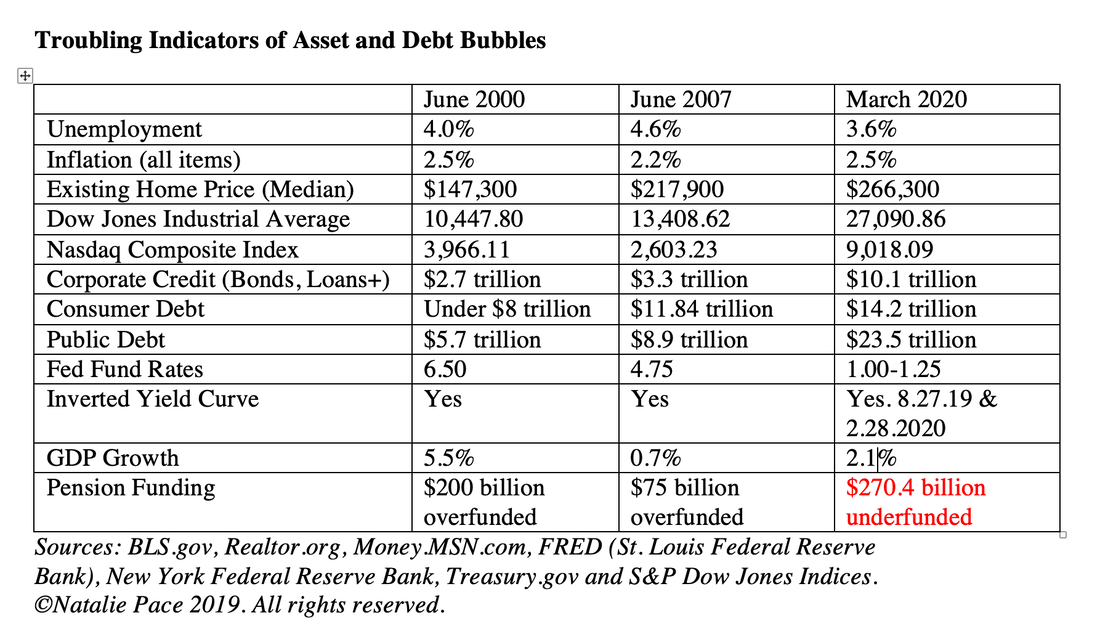

Price matters. Stock Prices are Still Too High. Dow futures are pointing to another down day. It's hard to know who to trust. Trust results that include the Great Recession. If you’re looking at your gains in the bull market, then you are not properly prepared for what your plan will do (and has done) in bear markets. Buy & Hope lost more than half in the last two recessions. Our easy-as-a-pie-chart nest egg strategies, with annual rebalancing earned gains in the last 2 recessions, when most investors lost more than half, and have outperformed the bull markets in between. Market timing doesn't work either. In fact, this time around, the safe (fixed income) side is as vulnerable as the equity side. Annuity providers and insurance companies are going to be hit hard by lower interest rates and by the stock decline. These products are not FDIC-insured. Money market funds have redemption gates and liquidity fees. Bonds are overleveraged. (Click for additional information on each blue highlighted word.) Time-Proven Strategies Work "Thank you Natalie for saving my retirement!" Nilo Bolden. Watch Nilo Bolden discuss this in her video testimonial at the link below. https://www.youtube.com/watch?v=gMmsuT84S7E "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital. "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Price Matters. They are Still Too High. You’re going to start hearing a lot of pundits and economists talking about the price of stocks. That is because price matters, and prices are still too high – even with a 20% correction. If you’ve been following my news you know that I’ve been reporting on this for a while. (Click to see my blog on the topic.) If you’re a data lover, here’s the rub: historical price to earnings ratios are 16-17. Today, even with the correction, they are at 26. Once earnings are reported in the 1st quarter, which is predicted to be very ugly, the earnings side goes down, which makes the P/E ratio higher. The gist of that is that stock prices were very high historically when earnings were strong – way too high. Earnings weakness, combined with weakness in consumer spending and supply chain disruptions, make the market very vulnerable to a continued correction. In Nobel Prize winning economist Robert Shiller’s words, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000. We are at a high level, and it’s concerning. People should be cautious now.” I’ve had this warning in my blogs for over a year. Click to read my interview with Professor Shiller from a few months ago. How Can You Protect Yourself? What can you do to protect yourself? If you’ve been following my work for a few decades you know that my strategies have been saving homes and nest eggs since 1999. There are very few strategies that achieved that. Easy-as-a-pie-chart nest egg strategies with annual rebalancing are actually quite simple. The Thrive budget is simple in theory, but requires brave, innovative and bold choices to increase your income and reduce your expenses. So, you have to get educated now, and it’s a good idea to do that quickly, so that you can protect your wealth now, before the situation gets worse. That is why I’m offering a 2nd opinion on your current plan. You’ll receive a pie chart of what you currently have, a pie chart of a better plan and my commentary on the areas of strength and weakness in your budgeting and investing strategy. That provides you with an action plan. You’re the boss of your money. I’m not a broker. I don’t sell financial products. My business is financial wisdom and time-proven systems, so that you truly know what you own and can make strong, sound choices to protect your wealth and live a rich, sustainable life. I have included a list of my blogs below. If there’s anything that is of interest to you just click on that blog. Chances are I’ve already written about the things you are most concerned about. If you have other questions, or are interested in a 2nd opinion or in attending my next retreat, call 310-430-2397 or email our office at [email protected]. I’d love to see you at the June Retreat in Santa Monica, or the October Retreat in Arizona. However, I would not wait that long to get your assets safe, protected and properly diversified, if I were you. “Riding it out” is not a time-proven plan. Buy and Hold has been losing more than half in the last two corrections. Proper diversification with annual rebalancing protects you from downturns and allows you to profit from bull markets and strength (instead of praying and hoping to gain back the losses you endured by riding it out). In today’s world you have to know what is safe because there are a lot of historically safe products that are vulnerable to capital loss this time around. Consider getting a second opinion on your current plan now. Call 310-430-2397 or email info @ NataliePace.com to learn more. Other Blogs of Interest Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed