|

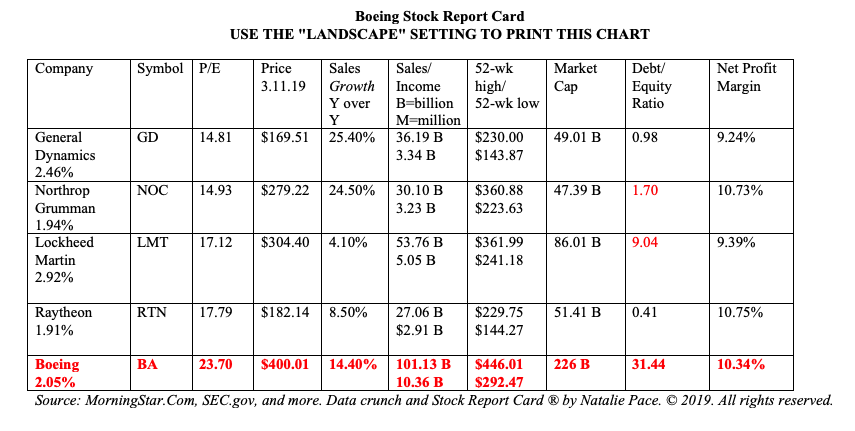

On Friday, April 5, 2019, after the markets closed (companies like to release bad news this way), Boeing announced that the company would cut production of its 737 airplanes from 52 per month to 42 per month. According to Boeing’s CEO Dennis Muilenberg, “We're adjusting the 737 production system temporarily to accommodate the pause in MAX deliveries, allowing us to prioritize additional resources to focus on software certification and returning the MAX to flight.” In the same press release, the company admitted that the 737 aircraft's “MCAS function” was a “link” in a chain of events that caused the Lion Air Flight 610 and Ethiopian Airlines Flight 302 accidents. Boeing is working on a software update “that will prevent accidents like these from ever happening again.” As might be expected, investors responded by selling off the stock in after-hours trading on Friday, continuing the sell-off today. The stock is trading at $374.61, down 16% from the all-time high of $446.01 on March 1, 2019. The all-time high occurred just 10 days before the Ethiopian Airlines fatal (and heartbreaking) crash on March 10, 2019. Since then, more and more bad news for Boeing has unfolded. But the stock has stayed fairly resilient. How’s that the case? Buybacks In short, buybacks. The 737 production is not the only thing that Boeing will have to cut. Boeing has one of the biggest buyback programs on Wall Street. On the Boeing investor’s home page, the company boasts that it has given out $50 billion over the last five years in buybacks and dividends. Link The problem with excessive spending on buybacks and dividends is that, at least in 2018, the amount given back was more than the company made. In other words, like many dividend-paying, debt-laden Blue Chips, Boeing has been using buybacks to prop up their own stock, which makes their earnings look stronger than they really are, and lowers the price-to-earnings ratio (by reducing the share count). In 2018, Boeing repurchased $9.3 billion in shares and paid out $4.6 billion in dividends, for a total cost to the company of $13.9 billion. Since the net income of 2018 was only $10.45 billion, Boeing paid out $3.45 billion more than it earned. At the end of 2018, Boeing’s cash was down to just $7.6 billion, from $11.7 billion in 2014. That’s flying a little too close to the trees, considering the production cutback. So, it’s likely that Boeing will be borrowing as quickly as possible. That would trigger a rating for the debt issuance, which will be negatively impacted from the production cut and the grounding of Boeing’s largest revenue generator, the 737. This doesn’t mean an automatic downgrade, but it will be included in the analysis. The 737 accounted for 70% of the planes delivered in 2018, at 580 out of 806. The company may wish to postpone raising debt until they get the all-clear on delivering the 737 again. In this scenario, they may have to preserve capital and postpone share repurchases, allowing the stock to trade freely on investors’ whims. As you can see from the attached Stock Report Card, Boeing already has an astronomical debt/equity ratio and the highest price to earnings ratio of its peers. So, given the amount of debt that Boeing already has, combined with all of the lawsuits over the plane crashes and a worldwide grounding of the 737, Boeing may find their loan or bond covenants with strings attached – such as the money can’t be spent on buybacks or dividends. The last company to make headlines for paying out more in buybacks and dividends than it earned in income was General Electric. General Electric’s dividend has been slashed to 4 cents, and the share price has dropped by more than 70% from where it was in 2017. Boeing’s capital situation, and a pause in the company’s share repurchases, could affect the share price as much or more than the 20% reduction in 737 production. Boeing is authorized to repurchase up to $20 billion of its own stock. However, the math doesn’t add up on executing that at this time. Boeing executives and staff will be working around the clock to get the software fixes needed to get the 737 back in the skies as quickly as possible. Boeing is a stalwart brand (until these latest tragedies) with products that are very much needed in today’s world. There are a slew of government insiders on the Boeing board to help facilitate a fast approval once the 737 is ready to fly. However, whenever that occurs, which could be within a few short months, the prudent investor will be looking at the balance sheet to determine whether or not that 2.10% dividend is worth gambling your principal on at this time. The production slowdown will impact earnings for at least a few quarters going forward. Boeing is not the only debt-laden blue chip that is spending a lot more propping up its stock and paying out dividends than it is earning in net income. Stay tuned to my blog at NataliePace.com/Blog for a more complete report later this week. As the economic landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 14/5/2019 06:51:03 pm

The 2nd quarter 2019 earnings report should be issued around July 24, 2019. It won't be pretty... However, the corporate buybacks, and the fact that our Acting Secretary of the Defense is a former Boeing executive (who is currently under investigation for improperly advocating for Boeing while in office). Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed