|

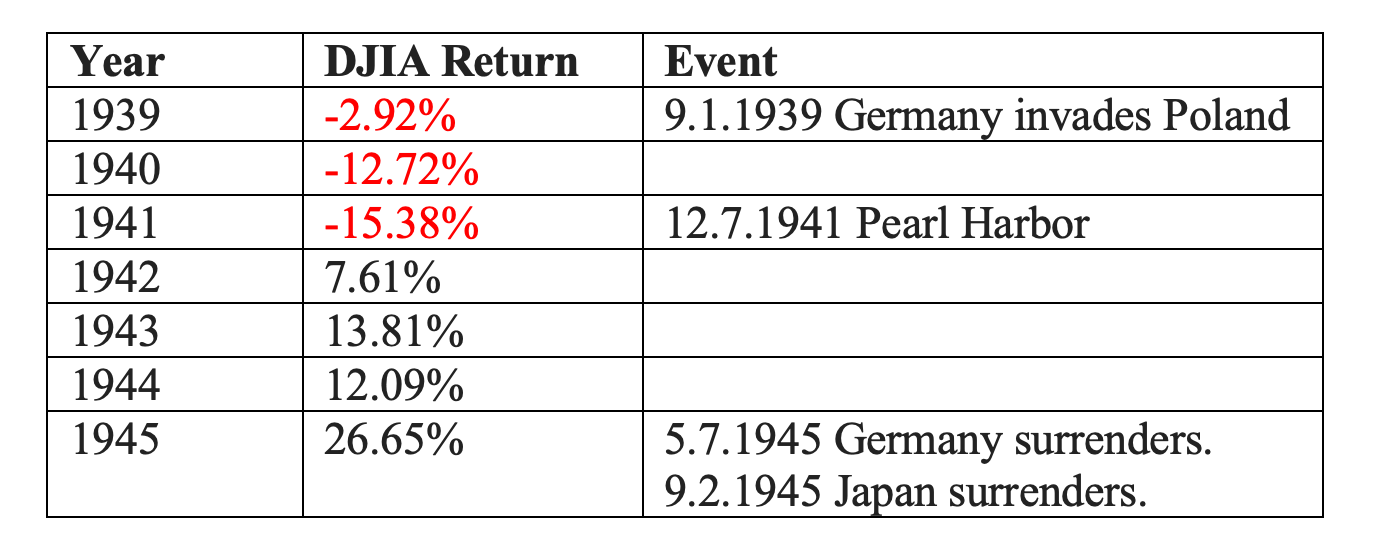

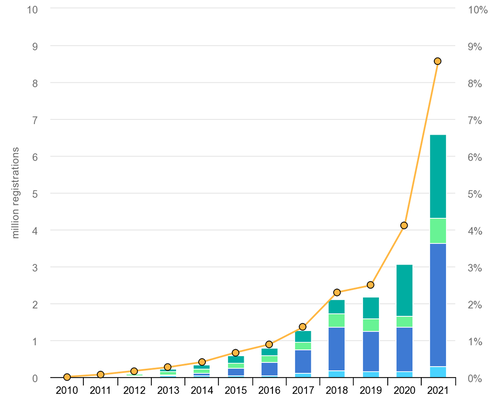

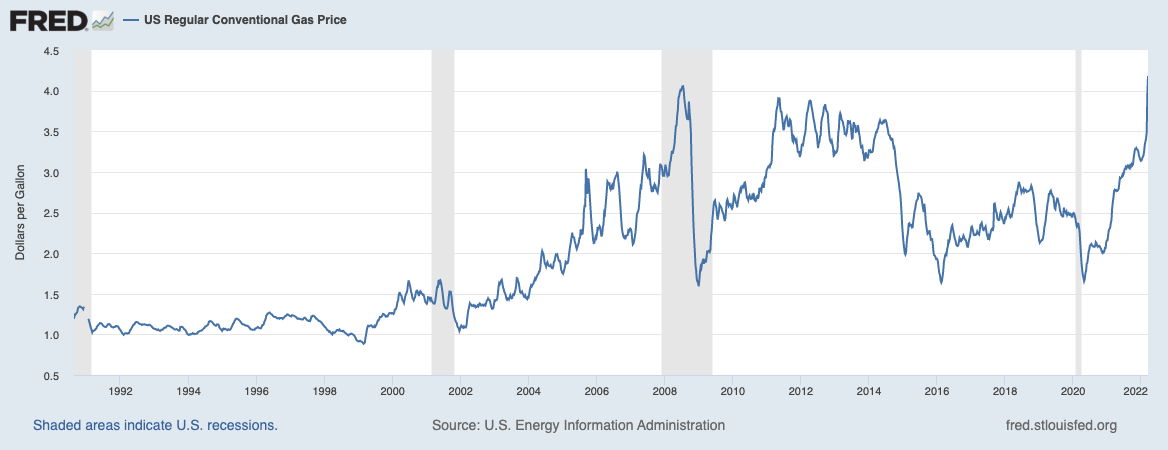

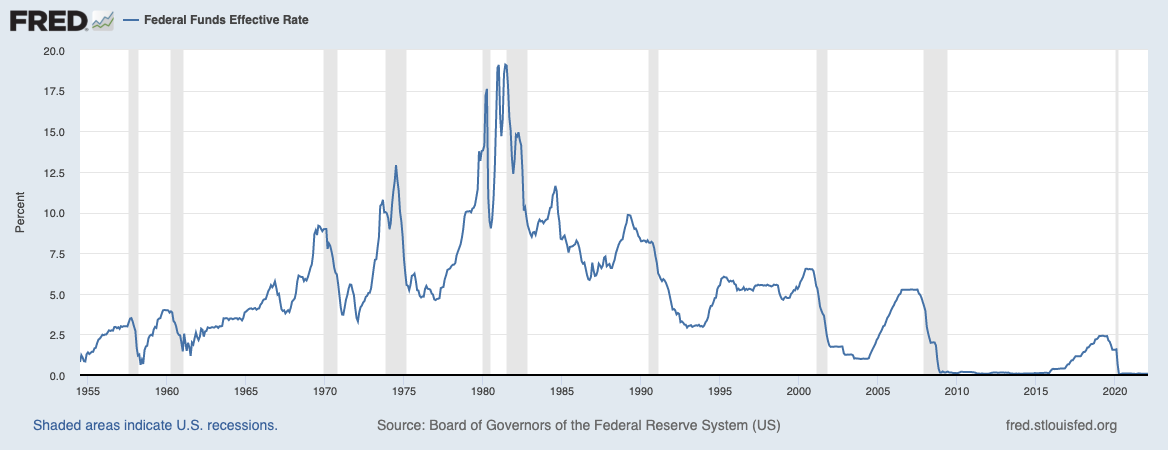

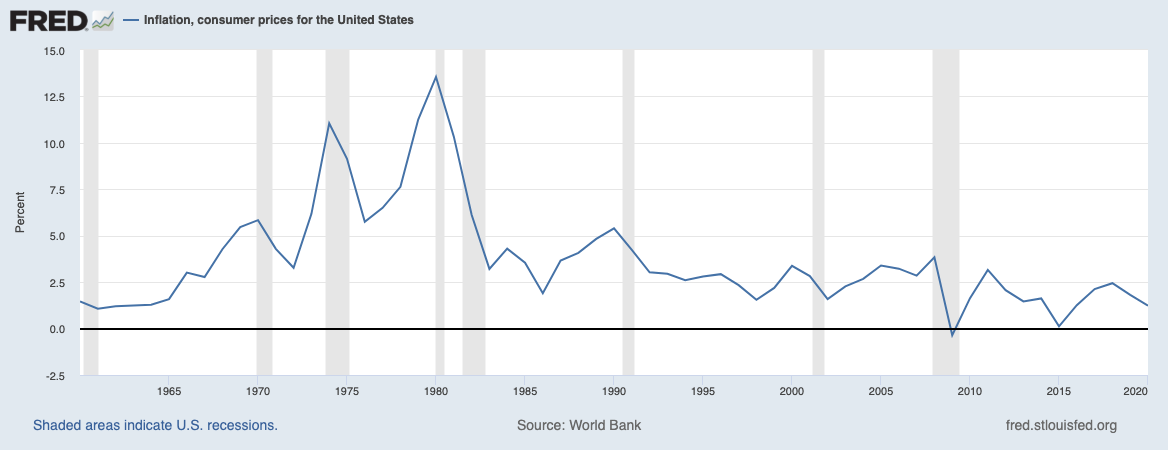

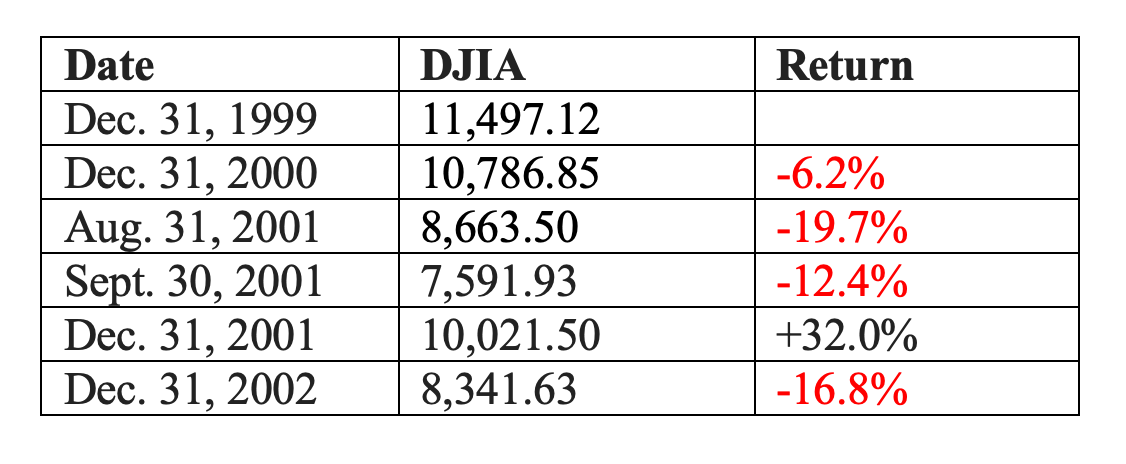

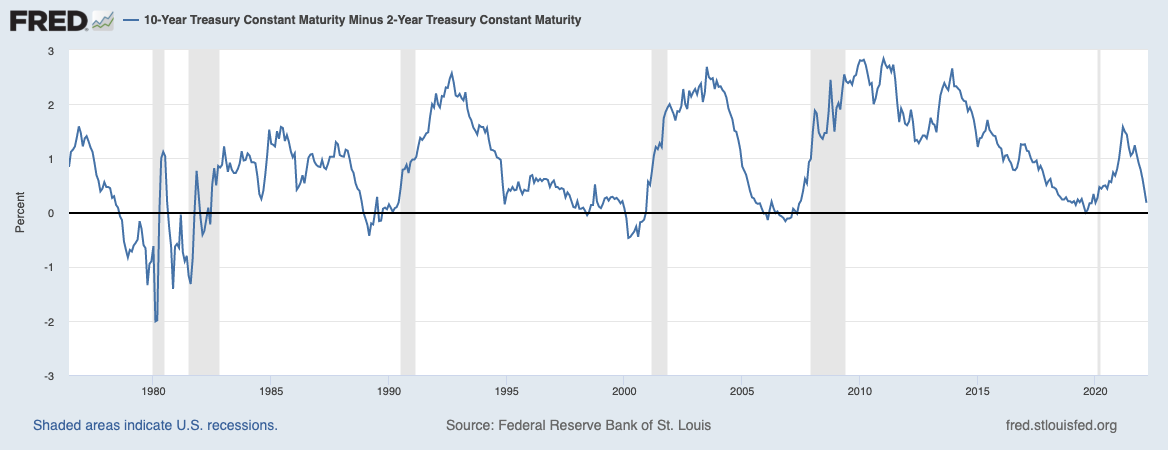

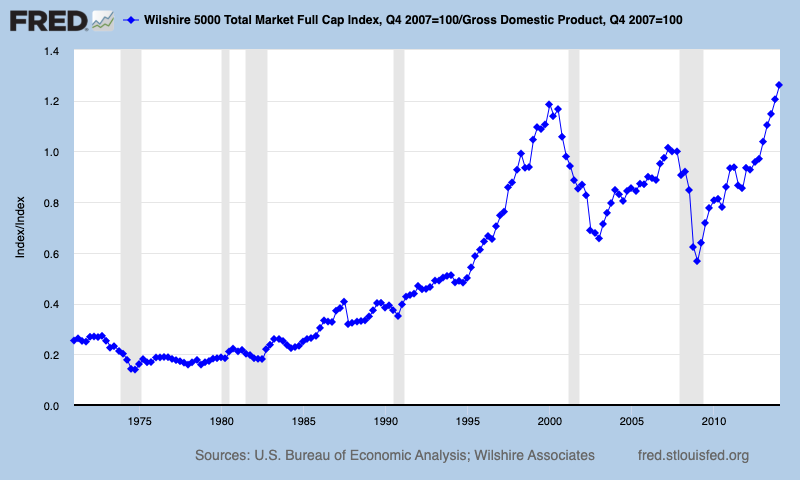

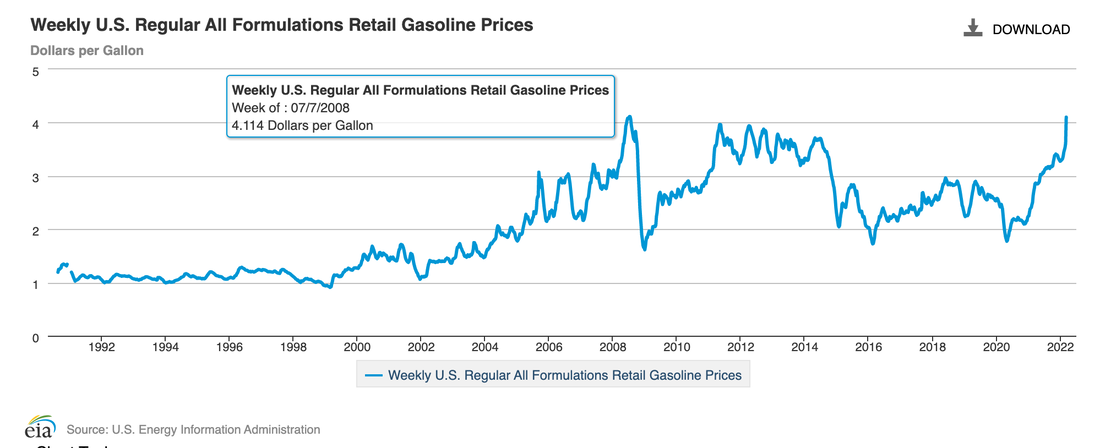

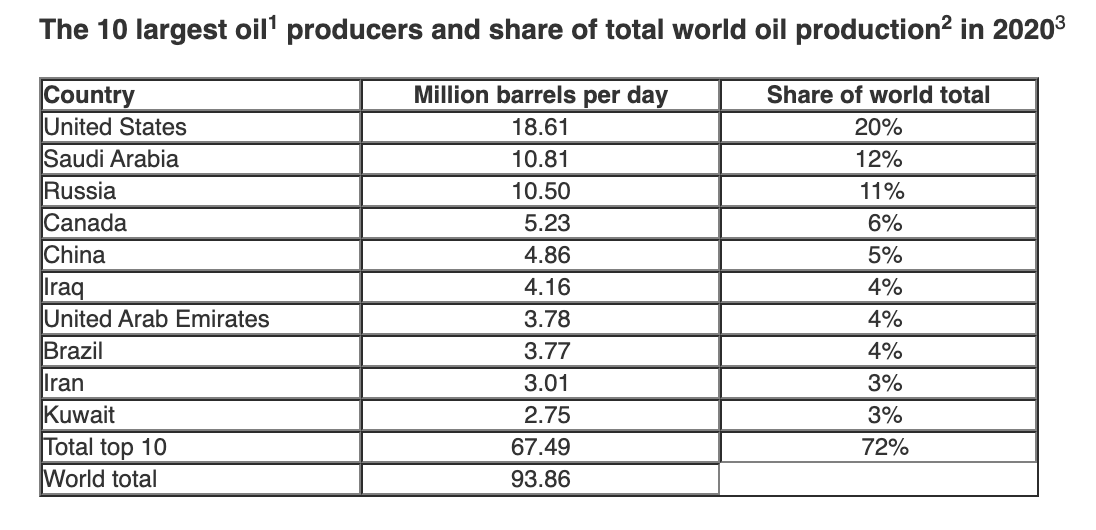

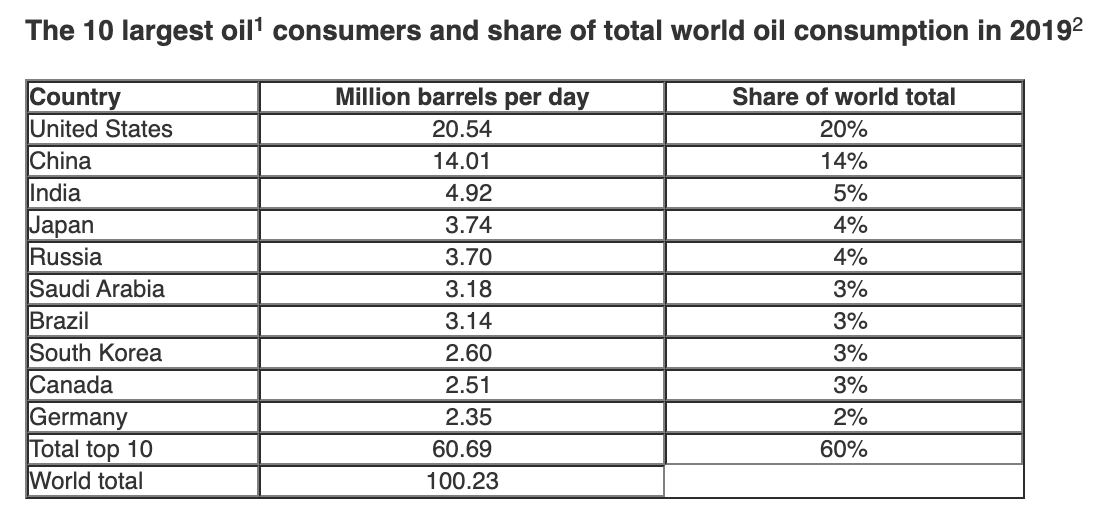

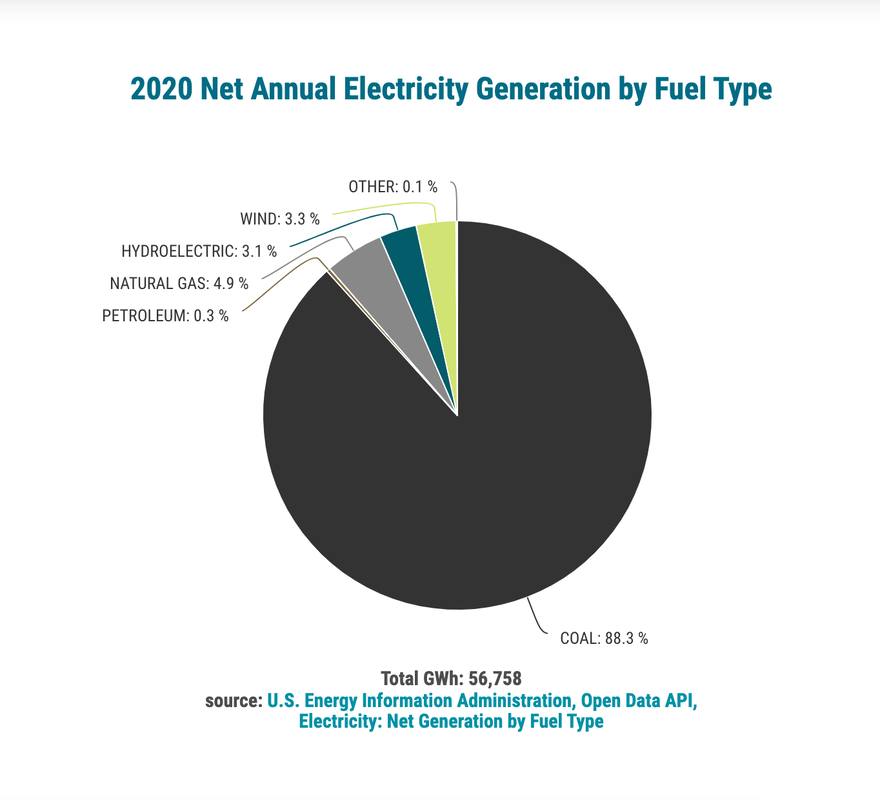

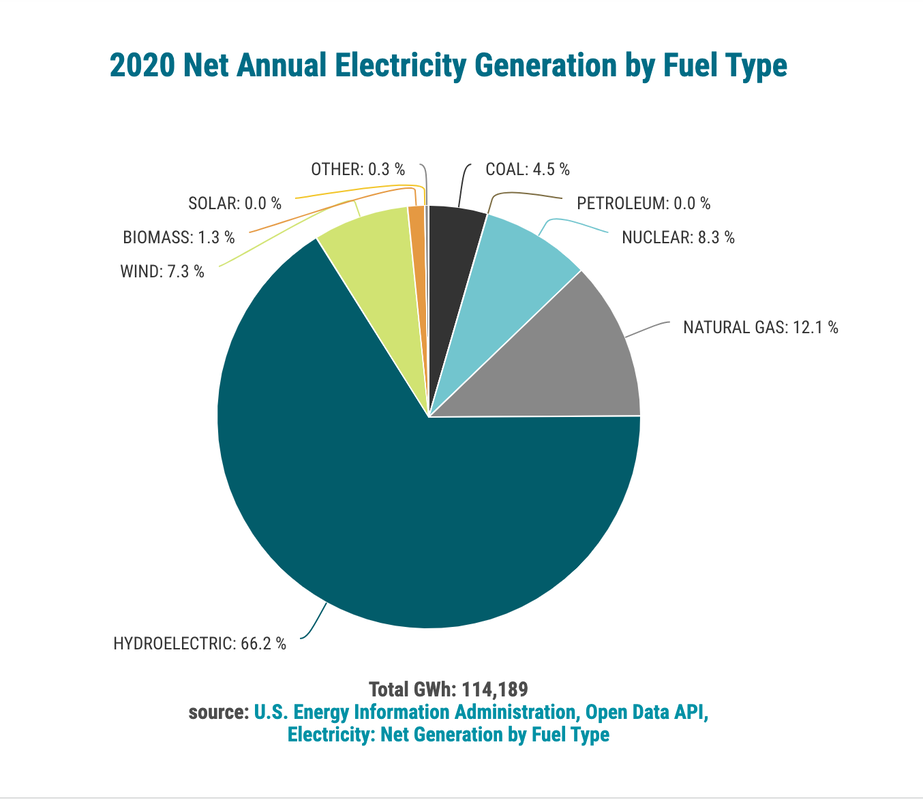

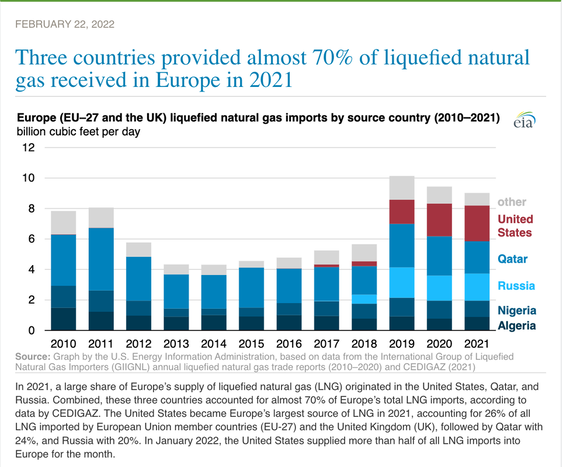

Chinese EV Market Hits 20%. Tesla Hits a Trillion (Again). Sales of electric cars hit 6.6 million in 2021, more than tripling their market share from two years earlier, according to IEA.org. This amounts to 9% of the global market share, up from 2.5% in 2019. China has the fastest EV sales growth, with 3.4 million sold in 2021, for 20% of the nation’s fleet in December – tripling the country’s sales of 2020. In fact, this year’s sales in China are more than all of the EVs sold in the world in 2020. Europe’s 2021 EV sales were 2.3 million, with about half a million EVs sold in the U.S. Germany is the largest EV market in Europe, which is why Tesla just opened a factory in Berlin. Interestingly, however, Norway has the largest EV market share, with 72% of the country’s vehicles, followed by Sweden and the Netherlands, at 45% and 30%, respectively (source: IEA.org). The growth of EVs in China and Europe bodes well for Tesla and the Chinese automakers. Sales have more than doubled for the Chinese car companies, with Tesla at 65% growth year over year. Meanwhile GM sales were down -10.5% year over year in the 4th quarter of 2021, and Ford was up a mere 4.8%. (Email [email protected] with Auto Stock Report Card in the subject line to receive that file.) Tesla sold 936,000 vehicles in 2021, with 480,000 produced in China. The company is expected to sell 1.5 million units in 2022, an increase of 60%. However, even with the wind at the back of EV automakers, that doesn’t mean that everything is smooth sailing. Backlogs, Bottlenecks and High Commodity Prices We are all feeling the pain of inflation, particularly anyone who still drives a gas-powered vehicle. However, so are our businesses. The auto industry has been hurt by rising costs of commodities, including nickel, and supply chain bottlenecks. Tesla favored auto sales at the expense of their solar and battery power businesses in 2021, which helped to keep their EV output robust. The question is, “Will that work in 2022?” Tesla’s net income in the 4th quarter of 2021 was $2.3 billion. We won’t know how much these headwinds will impact Tesla’s revenue and profitability until they report on their quarterly Vehicle Production and Deliveries, likely on or near April 2, 2022, and their 1Q 2022 earnings report, around April 26, 2022. Nio’s February 2022 vehicle deliveries (6,131) were up 9.9% year over year, but were -36% below January’s (9,652). Ford also reported that total vehicle sales in February 2022 were down -20.9% year over year (and were flat in January). The auto companies will report their March and 1Q 2022 production and deliveries tomorrow or Monday. Judging from what has already been released, the news is not predicted to be great, although it’s certainly better for electric vehicle manufacturers than for gas combustion engines. Commodity & Nickel Prices Profits are going to be under pressure for all auto manufacturers due to the increase in commodity prices, and particularly a nickel shortage due to Russian boycotts. On March 13, 2022, Elon Musk warned of this. Indonesia is the largest producer of nickel, followed by the Philippines and Russia. As you can see in the chart below, nickel prices soared when Russia invaded Ukraine. According to S&P Global, about 70% of the world’s nickel production is used in stainless steel, with just 5% used to make batteries – the power behind electric vehicles. However, in order to increase range, more nickel is now being used in batteries, and it is a higher grade (Class 1, 99.8% purity). We’ll know just how pressing the situation is on the manufacturing side in the next day or two, when the vehicle deliveries reports are released by the automakers. Again, we won’t know how dire the pricing is until the earnings reports are released at the end of next month. Which Companies are the Most Vulnerable? Electric vehicles are by far the fastest growing vertical in auto sales. Those newer EV-only companies are enjoying stellar growth. Those older companies that leaned into trucks and SUVs are suffering with sluggish growth and high costs. That competitive disadvantage is compounded by debt, liabilities, Other Post-Employment Benefits (OPEBs), and, in the case of Ford Motor Company, a junk bond rating. Tax Credits EV tax credits have helped Tesla and the Chinese EV automakers to incentivize consumers to buy. Tesla and GM no longer qualify for these credits in the U.S. China is cutting their NEV (new energy vehicle) subsidy by 30% in 2022 and will end the incentives at the end of this year. Click for a list of automobiles and their U.S. tax credits. Valuation Tesla stock is very expensive. The current P/E is 222, while the forward P/E is 104. An average P/E is about 17. Yes, growth stocks can take a slightly higher P/E. However, should a company with $5.5 billion in net income and $54 billion in revenue be worth over a trillion dollars? Are retail investors factoring in price or just following the memes? Bottom Line It’s a risky time to be buying high in auto stocks, even EV auto stocks, particularly given the war, inflation, rising interest rates, negative yield curve and high gas prices – all of which can drag the economy into a recession. While Tesla is trading near its all-time high, some of the Chinese automakers with higher growth are trading near their 52-week lows. So, if there is an April rally, at least some of these can be picked up for a bargain. Full Disclosure: I own shares in a few Chinese EV makers. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth, or how to pick stocks from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by March 31, 2022 to receive the best price and a complimentary private, prosperity coaching session (value $300). Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.Other Blogs of Interest Other Blogs of Interest The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The stock market has been sinking since stocks hit a high on January 4, 2022. The S&P 500 is down 6% since that date. A lot of people are thinking, perhaps hoping and praying, that if they just sit tight everything will resolve itself. However, is that realistic? Below are six charts and six different forces that could drag the economy into a recession over the next year or two. Since 21st Century recessions have been steep and deep, it’s worth it to protect your wealth before the plunge. When you wait for headlines, it’s too late. Making data-driven decisions is far more efficacious. (Continue reading for more details.) High Gas Prices (Recessions are Indicated in Grey) High Gas Prices You don’t need a chart to tell you that gasoline prices are at all-time highs. Russia supplies about 11% of the world’s oil. Boycotts could drive prices higher. (Read my special blog on oil and gas.) The U.S. is in a better seat than most countries since we produce as much oil as we can consume. However, a disruption in the global oil market pushes oil and gasoline prices higher, nonetheless. Companies see their sales and revenue sink when the consumer has to cut back spending in order to make ends meet in the household budget. (This negatively impacts the economy, but is better for the planet.) Since almost 70% of the U.S. economy driven by the American consumer, high oil prices slow economic growth and have a strong correlation with recessions. Rising Interest Rates (Recessions are Indicated in Grey) Rising Interest Rates The Fed Funds rate is predicted to rise to almost 2% this year and plateau at 3% in 2023-2024. That may seem pretty low. However, it’s a long way from zero. As you can see in the chart above, rising interest rates are correlated with recessions. The Federal Reserve Board is going to try to negotiate a “soft landing.” However, if they have to raise rates rapidly to combat inflation, the faster they tighten, the more likely the recession hits. Since over half of the S&P500® companies were at or near junk-bond status before interest rates started rising, that puts enormous pressure on zombie companies that must borrow from Peter to pay Paul to continue operating, and increases borrowing costs, particularly for highly leveraged companies. Those companies tend to be the most vulnerable to share price drops, which further impedes borrowing. You might remember that during the Great Recession, stocks dropped on news of problems at Bear Stearns. The Lehman Brothers bankruptcy and TARP bailouts sparked another big plunge, with the bottom occurring on March 9, 2009, on news that General Motors and Chrysler might declare bankruptcy. Certain industries are certainly going to be more vulnerable than others, like airlines. Rising interest rates are negative for a bond market that is already illiquid and negative-yielding. Inflation Inflation As you can see in the chart above, inflation is highly correlated with recessions. Inflation might peak at 9% this year before it starts abating. Household budgets are already strangled, with consumer debt at an all-time high. The sunset of pandemic support is likely to hurt Millennials and Gen Z. Student loan payments, which were paused during the pandemic, are set to begin again on May 1, 2022. Higher prices will make a tight situation worse. It will also weigh on corporate earnings, as corporations find their profitability strained with supply-chain bottlenecks and high commodity prices. War: 9.11.2001 Before and After War: Pearl Harbor Before and After  War Wars are negative for stocks (and the environment) especially in the first few years. Check out the charts above for market performance in 911 and Pearl Harbor. Click to access my blog and video conference that discuss wars and their effect on the economy in greater detail. Yield Curve Yield Curve Negative yield curves are 100% correlated with recessions. As you can see in the chart above we’re just a hair above zero again. Elevated Asset Prices Elevated Asset Prices Elevated asset prices are very highly correlated with recessions too. The sad news is that the more elevated the stock market becomes, the more severe the plunge. If we’re using the Buffett Indicator (chart above), stocks today are more expensive than they’ve ever been. Using Professor Robert Schiller’s CAPE ratio, before the Dot Com Recession stocks were slightly more expensive than today, with the Great Depression falling into third place. In other words, most financial indicators reflect elevated asset prices, even with the slight pullback in stocks. Bottom Line When six out of six indicators are all pointing to a Recession, it is very important to protect your wealth. Stocks dropped 38% in the 2020 pandemic recession. The Dow Jones Industrial Average sank 55% during the Great Recession, and the NASDAQ Composite Index slid 78% during the Dot Com Recession. When you lose more than half you have to spend a great deal of the bull market just crawling back to even. That’s why having a plan to protect your wealth today its key. Fortunately, there is a time-proven, 21st Century wealth strategy that earned gains in the Great and Dot Com Recessions, and outperformed the bull markets in between. Better yet, it’s easy-as-a-pie-chart. You can read about this respected and efficacious system in The ABCs of Money. You can learn and implement it at our June 10-12, 2022 Financial Freedom Retreat. Or you can start with an unbiased 2nd opinion of your current wealth plan. Email [email protected] or call 310-430-2397 to learn more. If you're interested in sustainability and healing our planet, be sure to check out The Power of 8 Billion: It's Up to Us.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by March 31, 2022 to receive the best price and a complimentary private, prosperity coaching session (value $300). Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.Other Blogs of Interest Other Blogs of Interest High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Gas prices hit a record high this week. As a result of the Russian invasion of Ukraine, followed by worldwide sanctions and boycotts of Russian oil and other goods, prices have soared. Economics 101 tells us that limiting supply without decreasing demand is going to make the prices climb. Economists are also fond of saying that the cure for high prices is high prices. As you can see in the chart below, whenever consumers curtail their driving habits, whether it is due to a pandemic or a recession, gasoline and oil prices plunge. U.S. is Oil Independent The United States is virtually oil independent. We produce about 20% of the world’s oil supply, and we also consume about that amount. In 2020, the U.S. became a “net petroleum exporter” for the first time since at least 1949, according to the Energy Information Association. In reality, there’s a lot more trade that goes on. Russian petroleum imports accounted for 7% of the total imports to the U.S. Prior to the Invasion of Ukraine, supply and demand determined whether U.S. oil stays local, or goes to Mexico or another country. Additionally, when we fight a war in the Middle East or on another continent, we do not ship our oil over to the conflict. Rather, we purchase it locally. According to the former Secretary of the Navy Ray Mabus, oil and war have a price on lives – with one soldier killed or wounded in every 50 convoys of oil during the wars in Afghanistan and Iraq. At face value, you might think that the U.S. is in a position to benefit from a ban on Russian oil. However, many US oil companies have businesses in Russia. The ban means that there could be a material write-down in the 1st quarter earnings report, as well as missing out on a substantial piece of their revenue. One exception to that is Conoco Phillips. Conoco Phillips exited their Russian interests in 2015. I’ll be talking about this more in my videoconference on Thursday, March 10, 2022. If you’d like an Oil Stock Report Card, email [email protected] with Oil Stock Report Card in the subject line. You can also read my blogs on Oil & Gas and other Companies with Business in Russia from earlier this week. The Consumer Has Power Over Prices High gas prices are hitting consumer wallets very hard, just as many are still struggling from the pandemic hangover and high inflation. However, on March 20, 2020, gas prices plunged to their lowest ever, into negative territory (-$37.63/barrel). Oil futures traders were paying buyers to take a delivery of inventory that they simply didn’t want to take. What happened? Production was still high. However, people were locked down and stopped driving. Time and again, we’ve seen that when gasoline prices rise too high, or another shock limits consumer buying power, prices plunge. (Also helps to heal our planet.) The consumer has more power than most know. Work From Home Work from home should have the effect of people driving less. The commute from your bedroom to your home office in your pajamas doesn’t require gassing up. However, there’s at least one other trend that is very reliant upon oil and gas, which might be the reason that demand is still high. Flight to the Suburbs High prices in cities forced a lot of people who wanted to buy a home to look in the suburbs. In the city, it’s easy to walk, take a bus or the subway, or ride a bike to get around. The further you live from basic needs, the more you have to jump in your car for everything, from grabbing a gallon of milk to enjoying a meal at the local café. That is why the most energy efficient suburbanite has a much higher carbon footprint than an energy hog, who lives in the city. 1/3 of CO2 is from Oil, Gas and Coal Driving less is very good for the planet. Over 1/3 of the current CO2 in the atmosphere was put there by just 20 of the largest oil, natural gas and coal companies in the world. Of course, they didn’t put it there on their own. We bought it and used it. The cure for high prices is to drive less, and a big piece of the cure for healing our planet is to do the same. Victory Gardens, Local and Organic Limiting plastic use will also go a long way to lowering gasoline prices. Over half of the barrel of oil is used for making plastics and other petro products. Now is the time to consider having a Victory Garden in your own backyard, at the local school or university, your church and anywhere where you can. If we can grow local organic food and pick it directly from our gardens, without covering it in plastic and then throwing it in a plastic bag, we will limit the amount of oil that has to be drilled and refined to produce plastic, as well as the gasoline used to truck the food to us from far away. Gardens and healthy soil also help to sequester carbon. The Challenge The challenge really is for all of us to be more aware of where oil flows and how our fingerprints are on these high prices. The great news is that if we succeed in this challenge, we will have a lot more money for things we like more than pumping gas and throwing things in plastic bags. We will also be meeting the challenge needed to heal our planet in time to avoid catastrophic consequences from Mother Nature (which we are already seeing and experiencing). Are You Interested in Solar and/or an Electric Vehicle? Should you consider solar panels, if you live in a sunny state? Utility costs are rising, and were already very expensive for many of us. On average, customers saw a bump of 7.6% per MWH on their bills over the past year. Homeowners with solar pay about $30-$40/month on utilities (while also having a very low carbon footprint). For most people that is a savings of at least $70-$80/month. If you live in a sunny state and take advantage of the available tax credits, your payback time on the panels could be 4-7 years. Thereafter, it’s like having a bond that pays you a yield of 5% or higher (much higher if you are powering your own electric vehicle with your solar). The U.S. is still offering a 26% tax credit in 2022. If you are interested in solar for your home, there are many things to consider before you get the quote. I’d suggest that you read the chapter “How to Save Thousands Annually With Smarter Energy Choices” of the 5th edition of The ABCs of Money. If you live in a cold or cloudy state, you can still insulate and incorporate a few energy-saving tricks to cut your heating and cooling by 90% or more. Fueling an EV is Half the Cost (or More) of a Gas Guzzler Should you drive an electric vehicle? With gasoline prices at $4.10 (nationwide average), much higher in some areas (like California) and a little lower in others, the cost of an electric vehicle just got much more affordable. The Department of Energy advises that on average fuel costs are half for EV owners. You can also save on maintenance, as there is no engine (only batteries). Some states are greener than others. Driving an EV on the West Coast can be very planet-friendly, while driving an EV in the Gulf States and West Virginia can be 80% or higher powered by fossil fuels. Bottom Line The cure for high prices is high prices. If we want lower gas prices and to heal the home planet, we need to spread the word that driving less, eating local and organic, and kicking our plastic obsession are all ways to reduce demand. FYI: I’m going to be hosting a videoconference today about Stocks in Wartime. If you’d like to join us live, email [email protected] with VIDEOCON in the subject line. If you’d like to watch it back, go to YouTube.com/NataliePace.  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details. Other Blogs of Interest How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. On February 24, 2022, Russia invaded Ukraine. Since then, some corporations, like BP, have moved fast to denounce the aggression and to divest themselves of Russian investments. Apple, Ikea, American Express, Mastercard, VISA, TJ Max, Nike and more announced they will suspend their businesses in Russia. The list grows each day. National Grid and Unison Energy in the United Kingdom are refusing to unload Russian liquified natural gas (LNG) when it arrives in dock. Airbnb.org acted swiftly to assist housing refugees from Ukraine. On March 5, 2022, Russia blocked Facebook in the country. (Myanmar did the same thing to silence dissent during their coup in 2021.) YouTube is reportedly still available in Russia, even though the platform has blocked access to Russian state-controlled media. On the other hand, JP Morgan Chase, Morgan Stanley and many of the more than 3000 multinationals with business in the land of the aggressors have been radio silent about their exposure to Russian businesses and customers. Boycotts of McDonald’s, Pepsi and Estee Lauder, who do business in Russia, are making headlines because so far these companies appear to be continuing operations as usual. On Friday, Shell purchased “heavily discounted” oil from Russia, promising to donate the profits to humanitarian aid in Ukraine. There aren’t any sanctions on Russian oil and gas, so the purchase was legal, though not without ample criticism. Oil and Gas are Still Flowing In an interview with Bloomberg TV on February 28, 2022, Jamie Dimon, the CEO of J.P. Morgan, acknowledged that banks are working with government officials to implement sanctions, but warned that there were workarounds for SWIFT and that there could be unintended consequences for sanctions. One of those potentially damaging consequences is the need for Russian oil and gas in Europe and Ukraine. About 1/3 of Russia’s economy is linked to oil and gas, and their top customers are Europe and Ukraine. While the Nord Stream 2 pipeline has been scuttled, Russian gas flows through three other pipelines, through the Ukraine to Europe. Infrastructure damage to these pipelines would disrupt the gas market, and prices could spike. Of course, that would be Russia shooting itself in one of the few revenue streams available, which is likely why those pipelines are being spared from the shelling. J.P. Morgan and other banks appear to be assisting in the work-around for the Russian oil and gas industry. J.P. Morgan’s research team issued an update on the industry on March 4, 2022, writing, “The west has taken careful steps to ensure that current SWIFT (Society for Worldwide Interbank Financial Telecommunication) and Russian bank sanctions do not prove to be an obstacle for Russian natural gas exports to Europe.” Bank reports are difficult enough to parse, much less understand how much of their revenue flows in from any particular country or client. However, there are reports that J.P. Morgan is the main U.S. banker for Gazprom – Russia’s largest publicly traded gas company by revenue. J.P. Morgan is also Rosneft’s bank, a Russian oil company. Oil Prices are Surging Even with help from banks and an exclusion of oil and gas from the sanctions, oil prices are already at $115/barrel. Prices could surge to $120/barrel if the Ukrainian conflict continues and the sanctions widen to include an outright ban on Russian oil products, unless Iranian oil is infused into the market. The all-time high for OK WTI crude hit $142.52/barrel on July 4, 2008. Incidentally, the U.S. imports about 600-800 kbd (thousand barrels per day) of Russian oil, according to the J.P. Morgan report, mainly consisting of fuel oil feedstocks and some crude. (Plastic is made from oil feedstocks.) Will the Russian Boycott Damage the Earnings of NATO Companies? So, how much damage can a Russian boycott create for multinational companies? Is that why McDonald’s, J.P. Morgan and others have not issued a press release outlining their position? Gazprom was the largest publicly listed gas company in the world in 2019. However, its share price began sinking on February 16, 2022, and tanked after the invasion. It’s now worth about 15% of what it was valued at in January of 2022. BP announced it would take a “material non-cash charge” for divesting itself of its Rosneft ownership. However, the move will also hit BP’s revenue. In 2021, Rosneft was responsible for an RC (replacement cost) profit of $2.4 billion. McDonald’s reported their 2021 full-year earnings on February 2, 2022. In that report, the company noted that 53% of their revenue comes from the “international operated marketplace,” driven largely by the U.K., France and Russia. Yes, you read that right: more than half. The New York Times is reporting that Russia makes up 9% of the company’s total revenues. If McDonald’s announces a suspension of operations, savvy investors are going to be worried about the next earnings report. Since McDonald’s is a Dow Jones Industrial Average component (one of just 30 companies), that would affect the index, which is broadly considered as a gauge of the “stock market.” The Cost of War First and foremost, our hearts and prayers go out to the Ukrainian people who have had their country invaded, and are suffering unimaginable harm from the killing, bombs, infrastructure disruption, lack of food, cold temperatures and loss of life and home. May there be peace, no more bloodshed, accountability and rebuilding. As I indicated in my blog on the Russian Invasion on February 24, 2022, war is expensive and costly – far beyond the horrific loss of life, the devastating destruction of homes and land and the hostile tensions. The worldwide ramifications ripple far beyond the hotspot. We live in a very interconnected global economy. Russia and Ukraine will be hit the hardest economically, but the damage will not be limited to those nations. The invasion of Ukraine is compounded by the already fragile economic condition that the pandemic left the world in. The ever-alarming reports of the catastrophic effects and costs of climate change continue. In plain words, the situation isn’t good for investors. There can be a substantial loss of personal wealth that can take a decade to recover, if ever. Email our office at [email protected] if you’d like a Bank or Fast Food Stock Report Card, or if you are having any difficulty accessing our report on the Russian invasion. Call 310-430-2397 or email [email protected] if you’re interested in a time-proven, 21st Century wealth protection plan that is easy-as-a-pie-chart. Yes, this works for retirement plans, too. We’ll be teaching this plan at the March 18-20, 2022 online Investor Educational Retreat.  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details. Other Blogs of Interest Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed