|

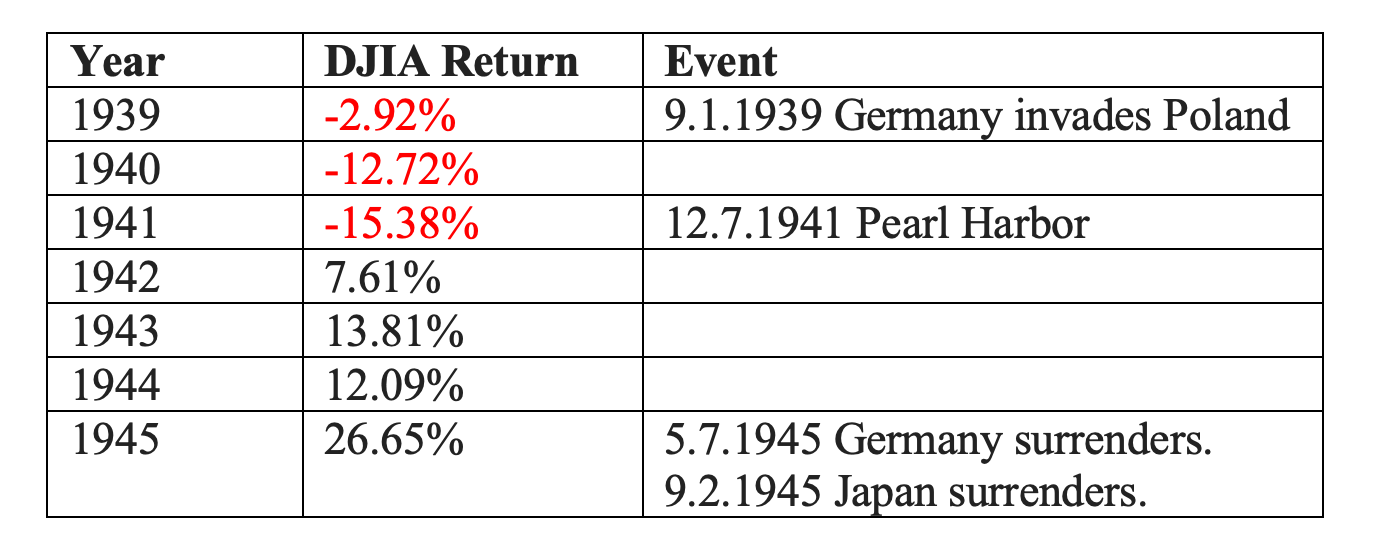

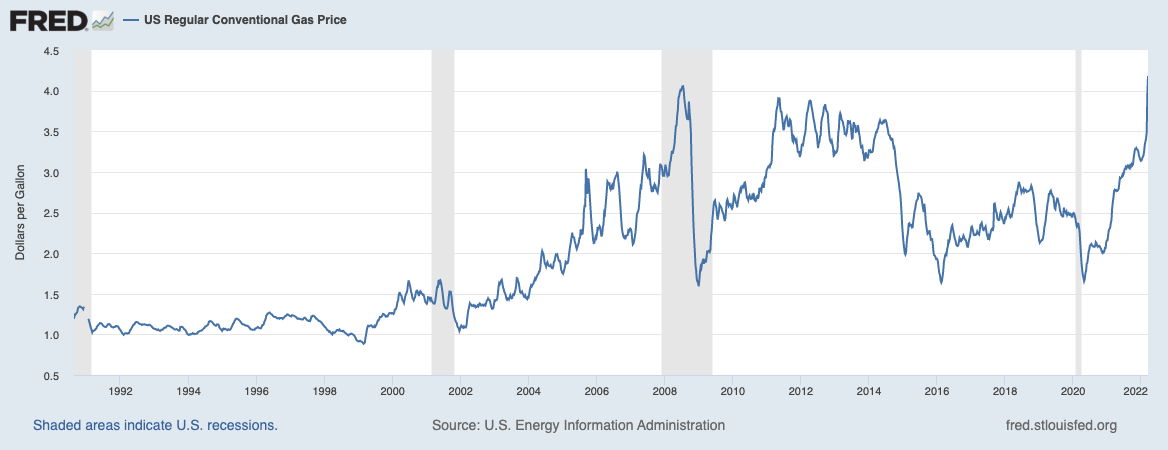

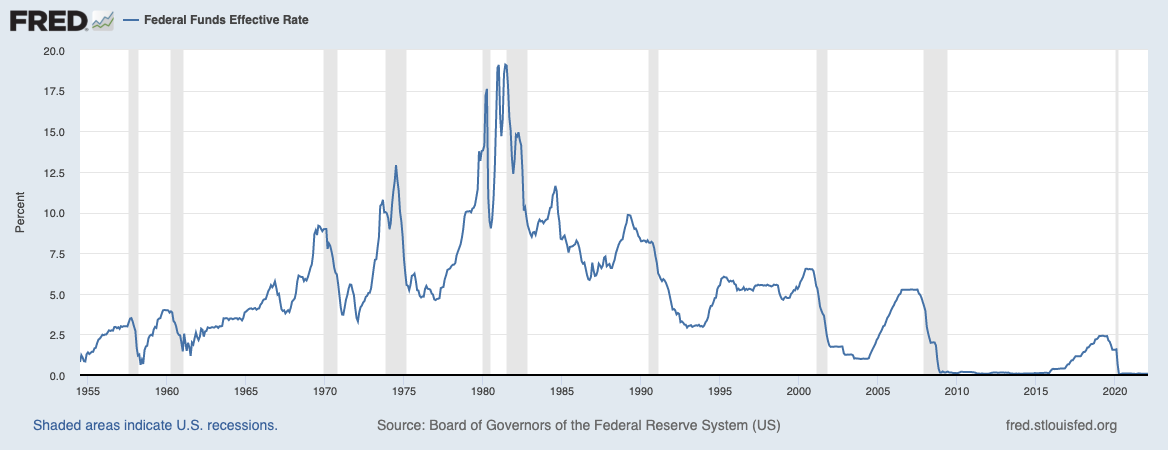

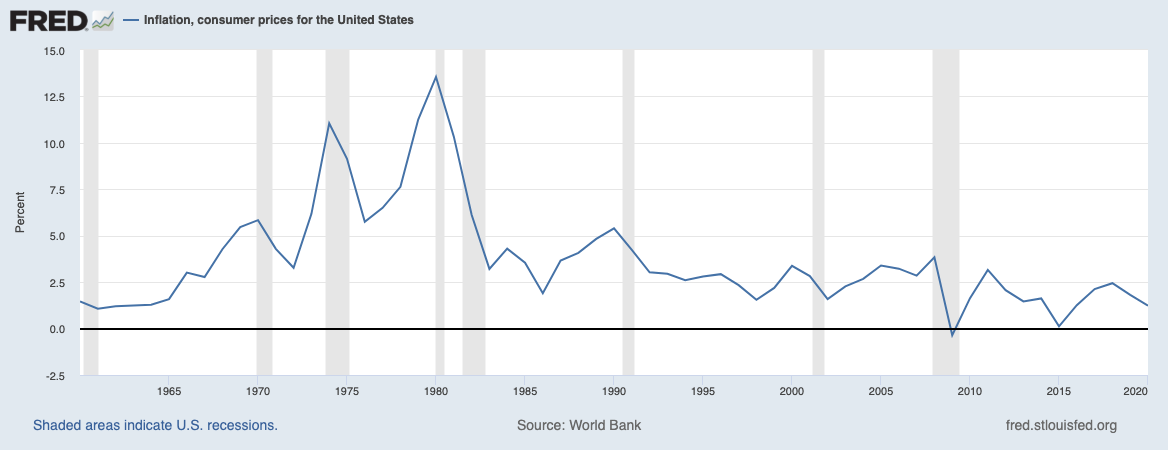

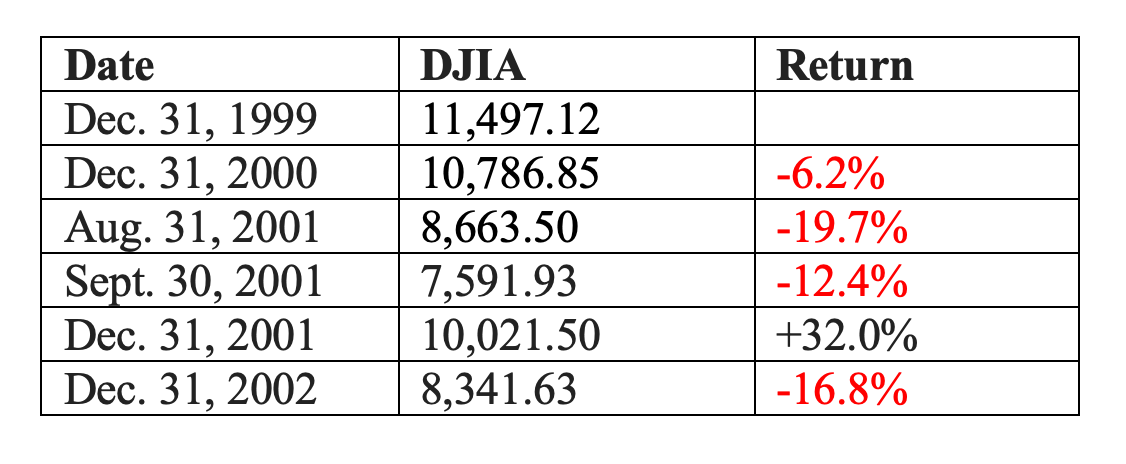

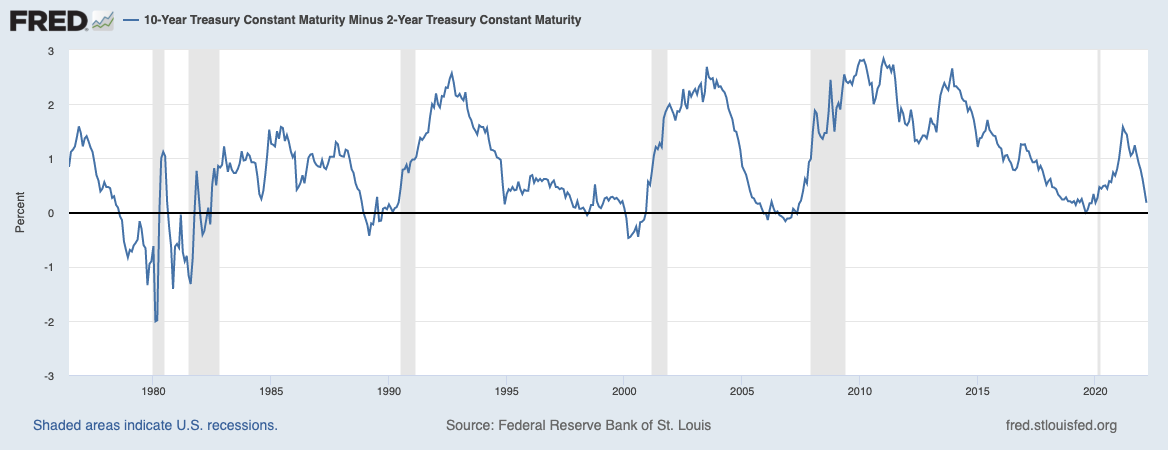

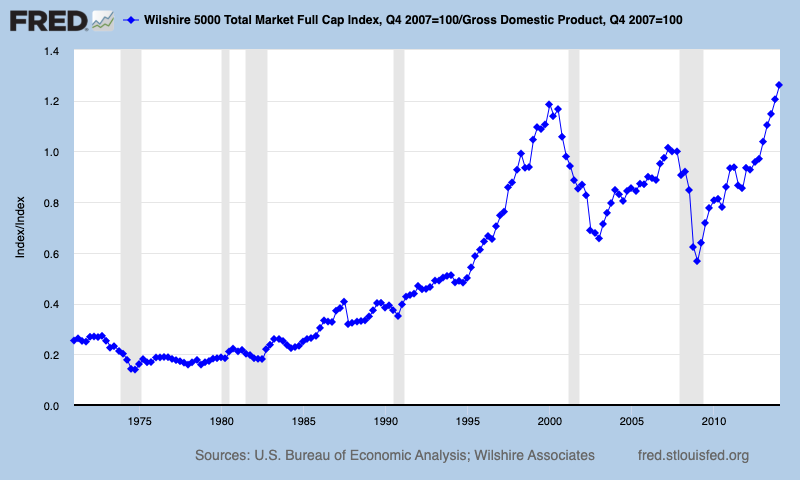

The stock market has been sinking since stocks hit a high on January 4, 2022. The S&P 500 is down 6% since that date. A lot of people are thinking, perhaps hoping and praying, that if they just sit tight everything will resolve itself. However, is that realistic? Below are six charts and six different forces that could drag the economy into a recession over the next year or two. Since 21st Century recessions have been steep and deep, it’s worth it to protect your wealth before the plunge. When you wait for headlines, it’s too late. Making data-driven decisions is far more efficacious. (Continue reading for more details.) High Gas Prices (Recessions are Indicated in Grey) High Gas Prices You don’t need a chart to tell you that gasoline prices are at all-time highs. Russia supplies about 11% of the world’s oil. Boycotts could drive prices higher. (Read my special blog on oil and gas.) The U.S. is in a better seat than most countries since we produce as much oil as we can consume. However, a disruption in the global oil market pushes oil and gasoline prices higher, nonetheless. Companies see their sales and revenue sink when the consumer has to cut back spending in order to make ends meet in the household budget. (This negatively impacts the economy, but is better for the planet.) Since almost 70% of the U.S. economy driven by the American consumer, high oil prices slow economic growth and have a strong correlation with recessions. Rising Interest Rates (Recessions are Indicated in Grey) Rising Interest Rates The Fed Funds rate is predicted to rise to almost 2% this year and plateau at 3% in 2023-2024. That may seem pretty low. However, it’s a long way from zero. As you can see in the chart above, rising interest rates are correlated with recessions. The Federal Reserve Board is going to try to negotiate a “soft landing.” However, if they have to raise rates rapidly to combat inflation, the faster they tighten, the more likely the recession hits. Since over half of the S&P500® companies were at or near junk-bond status before interest rates started rising, that puts enormous pressure on zombie companies that must borrow from Peter to pay Paul to continue operating, and increases borrowing costs, particularly for highly leveraged companies. Those companies tend to be the most vulnerable to share price drops, which further impedes borrowing. You might remember that during the Great Recession, stocks dropped on news of problems at Bear Stearns. The Lehman Brothers bankruptcy and TARP bailouts sparked another big plunge, with the bottom occurring on March 9, 2009, on news that General Motors and Chrysler might declare bankruptcy. Certain industries are certainly going to be more vulnerable than others, like airlines. Rising interest rates are negative for a bond market that is already illiquid and negative-yielding. Inflation Inflation As you can see in the chart above, inflation is highly correlated with recessions. Inflation might peak at 9% this year before it starts abating. Household budgets are already strangled, with consumer debt at an all-time high. The sunset of pandemic support is likely to hurt Millennials and Gen Z. Student loan payments, which were paused during the pandemic, are set to begin again on May 1, 2022. Higher prices will make a tight situation worse. It will also weigh on corporate earnings, as corporations find their profitability strained with supply-chain bottlenecks and high commodity prices. War: 9.11.2001 Before and After War: Pearl Harbor Before and After  War Wars are negative for stocks (and the environment) especially in the first few years. Check out the charts above for market performance in 911 and Pearl Harbor. Click to access my blog and video conference that discuss wars and their effect on the economy in greater detail. Yield Curve Yield Curve Negative yield curves are 100% correlated with recessions. As you can see in the chart above we’re just a hair above zero again. Elevated Asset Prices Elevated Asset Prices Elevated asset prices are very highly correlated with recessions too. The sad news is that the more elevated the stock market becomes, the more severe the plunge. If we’re using the Buffett Indicator (chart above), stocks today are more expensive than they’ve ever been. Using Professor Robert Schiller’s CAPE ratio, before the Dot Com Recession stocks were slightly more expensive than today, with the Great Depression falling into third place. In other words, most financial indicators reflect elevated asset prices, even with the slight pullback in stocks. Bottom Line When six out of six indicators are all pointing to a Recession, it is very important to protect your wealth. Stocks dropped 38% in the 2020 pandemic recession. The Dow Jones Industrial Average sank 55% during the Great Recession, and the NASDAQ Composite Index slid 78% during the Dot Com Recession. When you lose more than half you have to spend a great deal of the bull market just crawling back to even. That’s why having a plan to protect your wealth today its key. Fortunately, there is a time-proven, 21st Century wealth strategy that earned gains in the Great and Dot Com Recessions, and outperformed the bull markets in between. Better yet, it’s easy-as-a-pie-chart. You can read about this respected and efficacious system in The ABCs of Money. You can learn and implement it at our June 10-12, 2022 Financial Freedom Retreat. Or you can start with an unbiased 2nd opinion of your current wealth plan. Email [email protected] or call 310-430-2397 to learn more. If you're interested in sustainability and healing our planet, be sure to check out The Power of 8 Billion: It's Up to Us.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by March 31, 2022 to receive the best price and a complimentary private, prosperity coaching session (value $300). Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.Other Blogs of Interest Other Blogs of Interest High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed