|

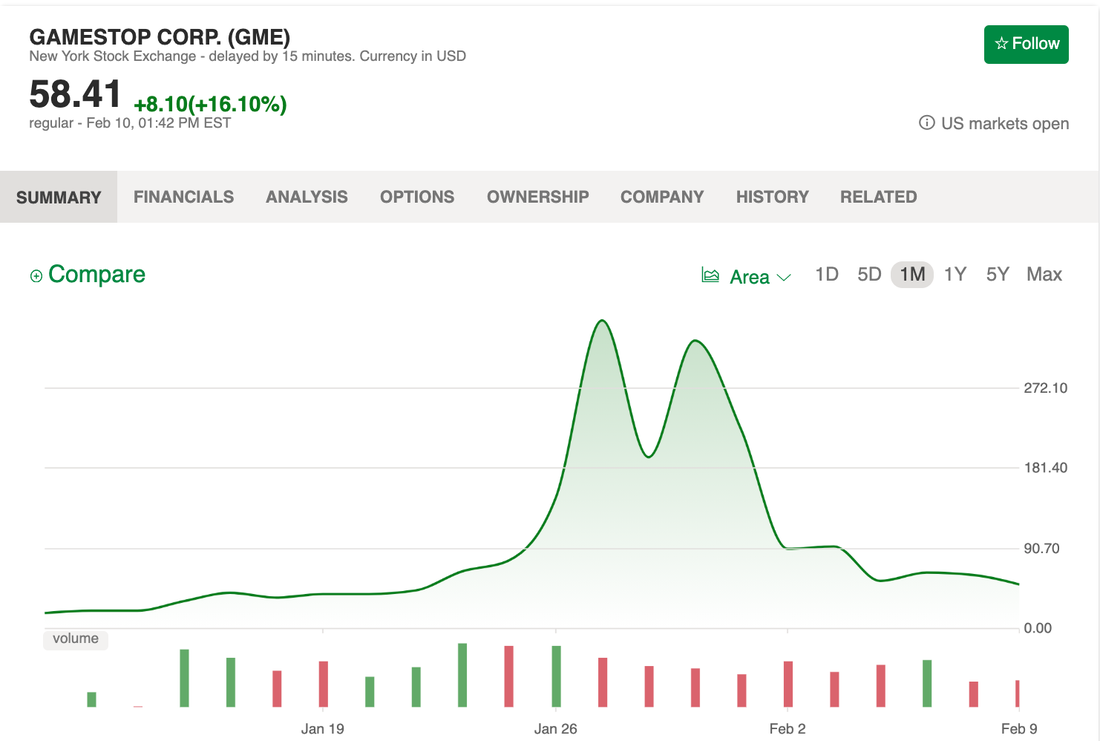

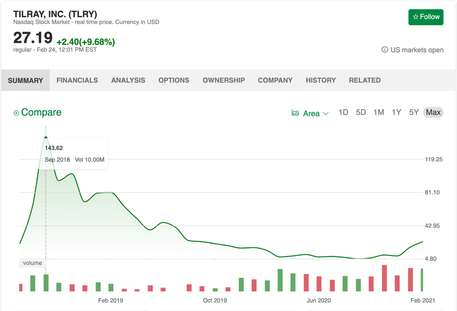

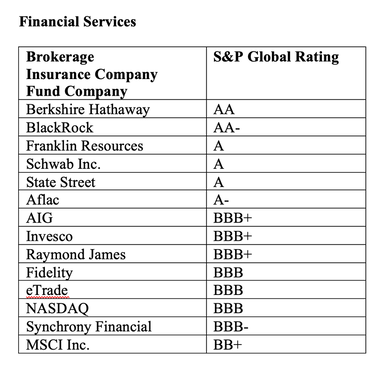

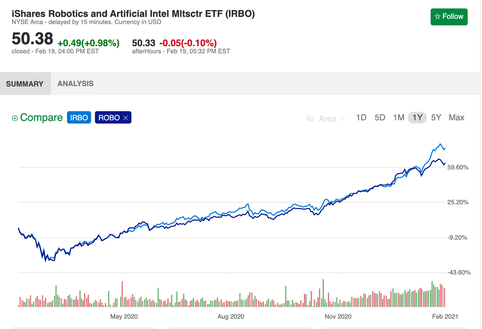

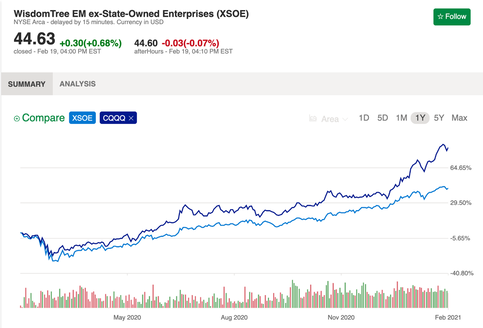

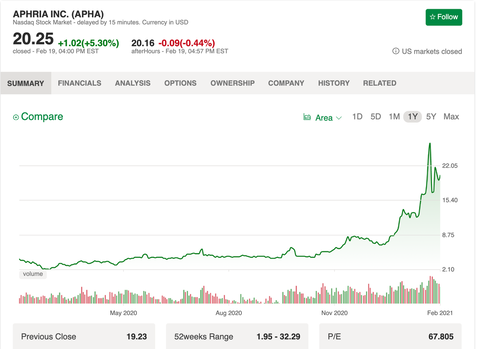

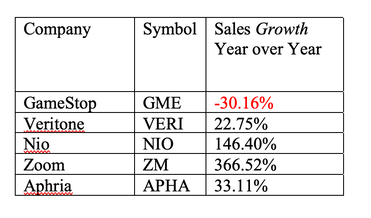

Cannabis companies shot the moon on February 10, 2021, and then fell back to Earth. Is the industry burned out, or smoldering for another moonshot? On February 1, 2021, Senate Majority Leader Chuck Schumer (D-NY) issued a statement with Senator Cory Booker (D-NJ) and Senator Ron Wyden (D-OR) writing, “We are committed to working together to put forward and advance comprehensive cannabis reform legislation that will not only turn the page on this sad chapter in American history, but also undo the devastating consequences of these discriminatory policies.” While not giving an exact timeline, the press release assured Americans that “the Senate will make consideration of these reforms a priority.” Late last year, on December 4, 2020, The House of Representatives passed the MORE Act, which decriminalized cannabis. (Click to learn more.) The legislation was ridiculed by then Senate Majority Leader Mitch McConnell, and never saw even a puff of consideration. As legalization became more popular in the halls of Congress, cannabis companies, like our favorites Aphria and Tilray (who liked each other so much they decided to merge on Dec. 18, 2020), began to gain favor again with investors. After sinking to lows of $1.95/share (Aphria) and $2.43 (Tilray) in March of 2020, both companies tripled by the time of the House Decriminalization in early December. On February 10, 2021, a week after the Senate announced that cannabis decriminalization would be a priority, Aphria and Tilray stocks shot the moon, hitting $32.29 and $67 respectively. They remained airborne only briefly, however. The following day, share prices plunged to $16.88/share and $32/share, respectively, having fallen by half. The February 10th Phenomenon What happened on February 10th and will it happen again? In the wake of the Senate announcement by Senate Majority Leader Chuck Schumer on February 1, 2021, bulletin board discussions of cannabis stocks soared. One of Reddit’s most popular groups, Wall Street Bets, saw a lot of activity related particularly to Aphria and Tilray, their merger, and the purchase of Sweetwater Brewing by Aphria. The chatter fueled the rocket to soaring gains for cannabis on February 10, 2021. So, why were the highs so short-lived? Two reasons really. One is valuation. Aphria and Tilray had agreed to merge with a $5 billion valuation. By February 10, 2021, the combined value of the two companies was over $20 billion. (Today the combined value is in the $11.5 billion range.) The other issue is that, whether by intention or not, Wall Street Bets’ YOLO* meme stocks act like Pump and Dump schemes. Check out the stock performance of other meme stonks below. Will Cannabis Companies Shoot the Moon Again? The fundamentals behind many cannabis companies are strong. Not all cannabis companies are created equal, however. For instance, I have yet to see more than a handful of customers in Medmen’s 5th Avenue store in New York City. (I take daily walks for exercise on 5th Avenue.) There will be some that hope to rise with the tide, and others that are sailing with the wind at their back with seasoned navigators and a mother lode of exceptional goods on board. As I mentioned in my blog of December 5, 2020, after the House decriminalized cannabis, Aphria (combined with Tilray) is in the strongest position, particularly after Aphria’s clever purchase of Sweetwater Brewing. Once we hear a more definitive date for the decriminalization of cannabis in the U.S., you can expect increased investor interest in cannabis. Any rapid rise, however, can be short-lived again, due to profit-taking, the downward pressures of overvaluation and, potentially, general market weakness. (We’re still in the most challenging peacetime economy since the Great Depression.) Valuing Tilray/Aphria/Sweetwater The completion of the reverse acquisition of Tilray (which will look more like Aphria in terms of leadership and power) is expected to happen in the 2nd quarter of 2021. Last year’s combined revenue was $685 million – before considering revenue brought in by the Sweetwater Brewing acquisition. Cash burn is still a consideration. Aphria lost -$120.6 million in the 1st quarter of 2021, with $320 million of pro forma cash on hand. With the expected right-sizing and redundancy trimming that should accompany the merger, the combined cash could be enough to get the company through 2021. However, at the current cash burn, it would be flying a little close to the trees. The 10X Power of Innovation In a nascent industry, the company that comes up with the best product can instantly become 10 times more valuable than the competition. Recently we saw that phenomenon with Zoom Video, which beat out Microsoft’s Skype, Facebook Live and Google Chat to become the videoconferencing software most used and beloved. Investors rewarded the company by sending Zoom’s stock to the moon. All eyes were on CBD Beverages as the next great innovation in the cannabis industry. Sweetwater Brewing has crowned themselves kings of that product line so far with their 420 hemp-based brew… Sweetwater is continuing the trend of name appeal with their limited-release triple-IPA, EFF 2020. There will likely continue to be extreme volatility in the share prices of cannabis companies. At the same time, with decriminalizing cannabis slated for a vote in the Senate this year, there may be one more investor trip to the moon. If things play out like they did when Canada decriminalized cannabis, then the run-up will be fast and robust before the vote, with share prices crash-landing shortly thereafter. Limit orders may be necessary to ensure that you are on the right side of the trade. Tilray hit $300/share in September of 2018, just before Canada decriminalized cannabis (on Oct. 17, 2018). By December of 2018, Tilray had dropped to just $70/share. The company continued to slide to a low of $2.43 in March of 2020. If you'd like to learn how to invest in Shoot the Moon stock picks like Aphria/Tilray, join us for our 3-day Investor Educational Retreat this weekend. Call 310-430-2397 or email [email protected] to learn more. Check out testimonials and discover the 15+ things you'll learn in the flyer below.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.  Dear Natalie: I was listening to an “expert” giving a presentation about ETFs. All of the funds he mentioned seem to be up at least 50% since October. I was wondering if the fact that they’re smaller funds translates to liquidity concerns. I noticed one had a trading volume of just 13.1k. Are these really winning ETFs that I should be adding to my nest egg portfolio? Signed: Looks Too Hot to Be True Dear Looks Can Be Deceiving, As you know, our pie chart system includes four hot slices. So, this expert is right in telling you to put performance in your portfolio. Doing so can be very rewarding. Cannabis was a hot we’ve been featuring for a few years. This year our featured company, Aphria, shot the moon, soaring from $2/share in February of 2020 to up to $32/share this year. Silver is up. Technology, particularly FANG and AI, have led the bull market. Biotechnology firms that were focused on the pandemic, such as Vir Biotechnology and Adaptive Biotechnologies (which were featured prominently in our Investor Educational Retreats), are up three and four-fold off their lows. However, picking the right ETF, and just as importantly the right fund company, is essential. The funds this “expert” is mentioning might be more of a marketing ploy than an opportunity. I’m concerned that this presenter could be being compensated on the backend for mentioning these specific funds and companies. (Higher risk funds often pay higher commissions or marketing fees.) So, the first lesson here is to remember to always Grade Your Guru before you listen to anything he says. You want to know if there is any bias or conflict of interest before you even tune into the talk. Is this presenter a “marketing guru” or a Certified Financial Planner? (Both could be paid on the backend.) Oftentimes a simple search on the presenter’s name to see his background for the last 15-20 years will reveal all you need to know in order to invest your time and money elsewhere. All of the funds you sent over are offered by new financial services companies that are not publicly traded (ROBO and EMQQ), or have shown severe signs of distress (WisdomTree and Direxion) over the past year. A safer bet would be to purchase the same type of ETF from a highly rated, highly liquid financial services company. You don’t have to go with unproven companies with liquidity concerns. Liquidity concerns are a big deal today. Over half of the S&P500 is at or near junk bond range, and that includes a lot of financial services companies and banks. Direxion’s hedged ETFs all took a dive – even the gold funds – and haven’t recovered since oil dropped into negative range on April 20, 2020. (Some of the funds you sent over are owned by Direxion.) All of the ETFs that I list below as an alternative choice have a stronger financial foundation and most have performed better to boot. (The superstars listed below, many of which smashed the performance of the ETFs you sent over, are all ETFs and companies we have featured at our Investor Educational Retreats over the past few years.) ROBO underperformed IRBO (owned by BlackRock's iShares). The ROBO fund company has only been around since 2013. ROBO ETFs also own THNQ. HTEC. As an alternative, look at IBB, or the two hot biotechs we discovered in the retreats – Vir Biotechnology and Adaptive Biotechnologies. EMQQ and WisdomTree’s XSOE. Compare with CQQQ, a Chinese Technology ETF. Direxion’s MOON: Compare with Nio (it’s major holding) – a company we first featured in October of 2019, when Nio was trading under $2/share. (Direxion’s fund didn’t even start until Nov. of 2020, missing out on most of Nio’s “shoot the moon” performance from $2 to $60/share.) Direxion comes up with hot sounding names, like (WFH) Work from Home. However, after burning investors with its hedged ETFs, I wouldn’t be very interested in any of their funds. Gold is trading near all-time highs, but look what happened to Direxion’s 3X Gold Bull Fund (which became a 2X Gold Bull Fund when the fund suddenly took a nose dive in March 2020). Investors haven’t come close to recovering their losses, which weren’t prompted by a change in gold prices, but were likely tied to the company’s hedged oil funds. Cannabis One last comment. Sometimes there is a hot industry, like cannabis, where the only fund options are young companies with questionable liquidity, volume and timespan. In that instance, it’s a better choice to just create your own fund, using companies you identify as the leaders of the industry (something you learned on Day 2 of the Investor Educational Retreat). Aphria, the company our team has been interested in since Irwin Simon became the CEO and Walter Robb joined the board, hit $32/share this month after dropping to $1.95 in 2020. Biotechnology With biotech, the two hottest companies we identified – Vir Biotech and Adaptive Biotech – weren’t heavily represented in any of the funds offered at the time. So, here’s another case when leaning into individual companies might be a good option. Again, learning how to evaluate the holdings will make quite a difference in the performance of your hot choices for the nest egg pie chart system. Bottom Line Fund companies are not created equal. It is important to pick funds offered by reputable financial services providers that have been around for at least two decades (not ones that were founded after the Great Recession by professionals who dusted themselves off from the Lehman Bros. bankruptcy or Merrill Lynch implosion to find a new career). However, you can have your cake and eat it, too, when you pick hot industries that are offered by a fund company with a high credit rating and good liquidity. This adds an extra, essential layer of protection to your investment in today’s overleveraged world.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Are you an Einstein in investing? A complete novice? Check your Investor IQ with the 26 questions below. If you score 21 correct answers or higher, then you’re in great shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (So, consider joining us at our next Investor Educational Retreat.)

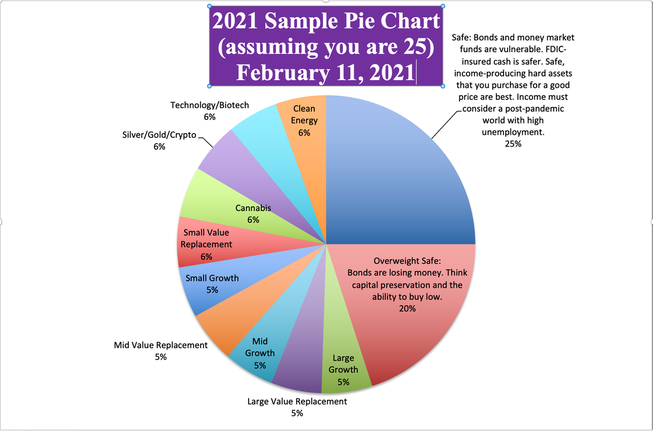

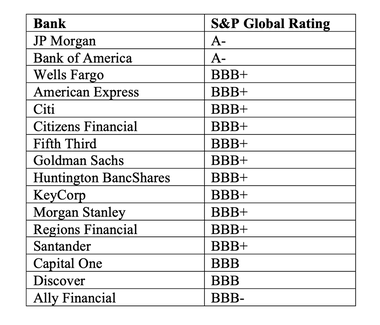

Answers are listed in the article "Investor IQ Test Answers 2021" in my blog at NataliePace.com. https://www.nataliepace.com/blog/ Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven investing, budgeting, debt reduction, home buying solutions that will transform your life.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. If you score 21 correct answers or higher, then you’re in great shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (So consider joining us at our next Investor Educational Retreat.) 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question is, "A percentage equal to your age.” As we are currently in the most challenging economic environment since the Great Depression, it would be even better if s/he adds, “But given the pandemic and problematic economy, we should consider overweighting even more safe." If they just sidestep this question and redirect you to a risk tolerance questionnaire, that is a red flag. One more important thing. Bonds are highly leveraged, subject to credit risk, vulnerable to capital loss and are illiquid to boot. So, you need to understand what’s safe, rather than just relying upon bonds to keep you safe. Now is the time to clearly know exactly what you own and why. Consider getting an unbiased 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and details. 2. What are 3 red flags that your financial plan is in on a Wall Street rollercoaster and at risk of losing half or more of its value?

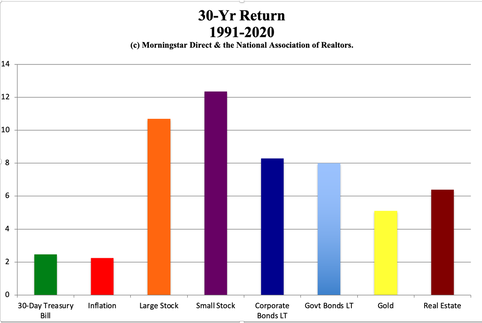

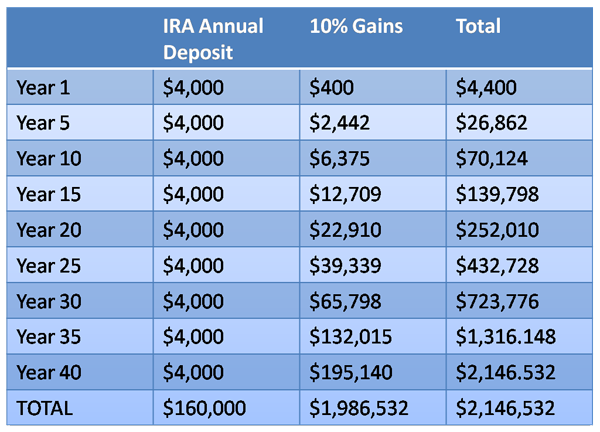

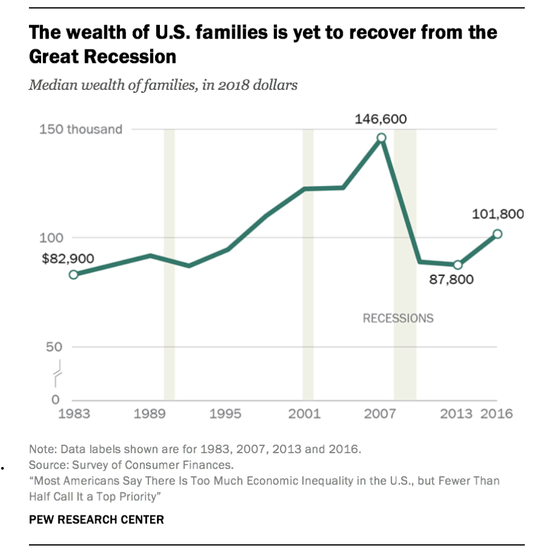

Remember: Your nest egg recovered in the pandemic because the wind has been at your back. The economic storms are still on the horizon. When/if the tides turn, losses can incur quite swiftly. (The 35% plunge between February 19, 2020 and March 23, 2020 was the fastest that any bull market had ever about-faced into a bear.) Wisdom and time-proven systems are the cure. (Our easy-as-a-pie-chart nest egg strategies, with annual rebalancing, earned gains in the last 3 recessions and have outperformed the bull markets in between.) 3. How much of your nest egg should you keep safe? A percentage equal to your age. Consider overweighting more safe when the economy is stumbling or in a pandemic. In today’s world, it is important to know what’s safe. Bonds are losing money and are illiquid, which makes them substantially riskier than most investors realize. Money market funds have redemption gates and liquidity fees. 4. What's safe? Hard assets will outperform paper assets in a world where there is too much paper money, financial inequality and broken promises floating around. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” You have to also consider what will safely produce income in a post-pandemic world. Real estate is at an all-time high in the U.S., so it’s difficult to purchase for a good price in 2021. You don’t want to be all in on hard assets because you also need liquidity and cash flow. That is why some of the best hard asset investments are those that reduce your monthly expenses (for life). I spend one full day on What’s Safe at the Investor Educational Retreats. Educate yourself now on the best income-producing hard assets that are right for you now, so that when prices are more attractive, you know what you want and have the means to take action and close the deal. Call 310-430-2397 to learn more. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 13.0% annualized over the last decade and 10.7% over the 30-year period. Small cap stocks performed at 10.09% and 12.35%, respectively. (Asset performance graphs, and more, are available to Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 2.05% annualized over the 10-year period and 5.1% over the last 30 years. Gold mining stocks doubled in 2016, dropped by 75% in 2017 and are currently worth double their 2017 lows again. The all-time high for gold of $2,067.15 was hit on August 6, 2020. The last high of $1,895/ounce in gold occurred in September of 2011, the month after S&P Global Ratings stripped the U.S. of its AAA credit rating. Fitch Ratings currently has the U.S. on a negative outlook, meaning the AAA rating from Fitch could be downgraded this year. (Moody’s still has a stable outlook for the U.S., as of February 17, 2021.) 7. What is the average return of real estate over the last 10 and 30 years? Over the last decade, real estate has performed at 7.90% annualized. (The devastating losses of the Great Recession are no longer included in this statistic.) Over a 30-year period, real estate increase 6.4% annualized. Real estate prices are higher today than they were before the Great Recession – meaning real estate is largely unaffordable to many Americans. According to AttomData, average income-earners are unable to purchase in their community in 55% of U.S. cities. 3.2 million U.S. homes are still underwater – even with prices higher than ever. (This is largely due to loan mods.) This creates a little opportunity in the shadow inventory. There is nothing worse than buying high in real estate, and watching the value of your home sink below the amount that you owe on it! It can ruin your life for years, if not decades. 8. What was the top performing investment in 2020? Bitcoin gained 346% in 2020. The NASDAQ Composite Index scored 43.6% gains, with gold polishing up a performance of 22.3%. Oil prices were the biggest losers of 2020. In April of 2020, oil prices went negative. Oil companies were overstocked and had to pay to have oil taken off of their hands. Bonds performed pretty poorly as well, with negative yields and illiquidity issues. 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 ½ years. This is based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets have done over the 30-year period, from 1991-2020. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did from 1991-2020. 11. What’s the safest investment in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. Pouring everything into real estate can be vulnerable, as you still need liquidity. It’s not a good idea to just put everything into cash and real estate. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. Market timing doesn’t work. Most, but not all, hard assets are overpriced right now. If you are equity-rich, you still want to do the analysis to make sure that remains the case if real estate asset prices decline in value, as they did in the Great Recession. (Click for a blog that will help you to do this.) There are some excellent hard assets that are worth considering now, which is why I spend one full day on this topic at the Investor Education Retreats. Value capital preservation more than reaching for yield. It will allow you to buy low when things are on sale. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by All ETFs, Germany, the International Monetary Fund, Italy, France, Russia and China (source: Gold.org). China and Russia have been on a gold buying spree since 2008. Reports are that they will start trading oil and other commodities using their own currency backed by gold, in an effort to break free from the dollar. (Click to read my report on Russia and Gold.) There were multiple reports between 2011 and 2017 that the U.S. banks and brokerages were selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Recessions are hard on insurance companies, so we may see some troubled insurance companies (as we did in the Great Recession). Getting on the other side of the most challenging economic environment since the Great Depression will take time. Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. You can be a better steward of your wealth than any insurance company. It’s time to be the boss of your money. 14. What were the top performing and the worst months for stocks over the past five years? November, April, July and January performed best over the 5-year period (in that order), on average. February, March and October were negative months. Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email info @ NataliePace.com. 15. What was the top performing quarter for stocks over the past twenty years? October through December – the Santa Rally – performed the best over the 20-year period, but saw greater volatility in the 5-year trend. October saw negative returns of -1.48% over the 5-year period. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally that year. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. I spend one full day on what’s hot, teaching you how to identify the best investments of the year, in my Investor Educational Retreats. 16. What was the worst investment in 2020, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis, oil or real estate? Oil was by far the worst investment in 2020, offering negative returns on the oil price of -23% on the year. Bonds were pretty poor performers, offering limp returns and very low liquidity. The Dow Jones Industrial Average was another underperformer. While the NASDAQ scored 43.6% gains, the Dow limped along at just 7.2% gains. Last year’s loser, cannabis, was up more 1000% in February of 2021 on news that the U.S. might decriminalize cannabis, and fueled by Reddit bulletin boards and Robinhood investors. Stay tuned into my blogs and videoconferences for ongoing news, analysis and vital investor information. Email [email protected] with VIDEOCON in the subject line to receive the logon information for the next monthly videoconference. 17. Which year is expected to perform better, 2021 or 2022, based upon historical returns of election years? 2021 is a post-election year. Over the last 10-30 years, post-election years post gains in double-digits, while the second year of the new Administration averages in the low single-digits. Economic forecasts from the Federal Reserve Board support this trend as well. 2021 is projected to have 4.2% GDP growth, while 2022 could be just 3.2%. Historically, election years were strong performers, with pre-election years earning the highest score of the entire Presidential Cycle. However, the 10 and 20-year election returns were wiped out due to the 2008 Great Recession (losses of 55%) and the 2000 Dot Com Recession (losses of up to 78% in the NASDAQ). 2020, another election year, saw a plunge of 35% in stocks between February 19, 2020 and March 23, 2020, due to the pandemic. Stocks recovered for 2020 gains of 16.26% in the S&P500! This has made stocks in 2021 quite pricey, which could mute gain possibilities this year. 18. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. And many are carrying far more debt than the value of the company. Leverage has begun to concern economists. Over 50% of the corporate bonds are at the lowest rung, just above junk bond status. This includes a lot of banks. Ford Motor Company was downgraded to junk bond status in September of 2019. (We've been warning of this in our retreats and books for over a decade.) If you don’t understand how much debt corporations are holding, it’s time to learn The ABCs of Money that we all should have received in high school. General Electric isn’t the only blue chip that had to slash its dividend and lost substantial market value as a result. Debt and leverage, along with subdued sales, are the main reasons why the DJIA has underperformed the NASDAQ Composite Index in the 21st Century. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 19. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. New Chips, like Apple, Google, Amazon, Facebook, Nvidia and Netflix, are far safer, and higher performing, than Blue Chips, both in terms of growth, but also in terms of the fiscal health of their balance sheets. You’ve probably heard the acronym FANG. Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Since the Great Recession, the NASDAQ Composite Index has offered far superior returns than the Dow Jones Industrial Average, even factoring in dividends. In fact, the higher the dividend, the higher the risk (read the chapter of the same name in The ABCs of Money for additional information. 20. Which index has performed better since the COVID-19 pandemic hit in February of 2020, the Dow Jones Industrial Average or the NASDAQ Composite Index? The NASDAQ scored 43.6% gains in 2020, with the DJIA limping along at 7.2%. 21. How much did investors lose between February 19, 2020 and March 23, 2020? The Dow Jones Industrial Average dropped 35%, while the NASDAQ Composite Index sank 35%. Many of the hottest stocks, including Nvidia (-38%), lost even more. 22. How much did investors lose during the Great Recession and the Dot Com Recession? The Dow Jones Industrial Average lost 55% in the Great Recession. The Dot Com Recession saw a drop in the NASDAQ Composite Index of up to 78%. It took the NASDAQ 15 years to crawl back to even. Investors haven’t fully recovered from these routs. According to Pew Research, most Americans are worth less today than they were in 1995. Investors haven’t fully recovered from these routs. According to Pew Research, most Americans are worth less today than they were in 1995. You can’t afford to lose more than half every 8-10 years, crawl back to even, only to lose more than half again. It’s time to step off of the Wall Street Rollercoaster and into time-proven, easy systems that work. Buy & Hope is a last century plan that hasn’t worked in the New Millennium and will not work going forward. The quick pandemic recovery in 2020 is an anomaly that is not supported by the economic conditions. 23. Does Buy & Hope work? If not, what does? Buy & Hope lost more than half in 2000 and 2008 and up to 35% between February and March of 2020. Due to the amount of debt and leverage, and the slow rate of growth, Buy and Hold will not work going forward (until those problems are dealt with and cycled through). That is why Buy & Hope investors are worth less today than they were worth in 1995. Our easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. Working off of the pie charts, instead of the brokerage statement, allows you to take the emotions out of the plan, and rely, instead, upon a time-proven system. This pie chart system, with annual rebalancing, is a buy low, sell high plan on auto-pilot – prompting you to do what you should be doing each year. Email [email protected] or call 310-430-2397, if you’d like to customiz your own sample pie chart. 24. Why is it that so many investors are unable to Buy Low and Sell High? Buy low, sell high is a mantra that everyone knows. So, why do so few investors do it? There are a few reasons…

25. What is the 3-Ingredient Recipe for Cooking up Profits? 1. Start with what you know and love 2. Pick the Leader 3. Buy low; sell high (easy to say; hard to do) This recipe, along with my Stock Report Card, Four Questions, market strategies and data drilling, is how I earned the ranking of number one stock picker. The recipe is easy. Learning how to use these tools requires practice. You must begin by locating and analyzing data, which is actually less time and far more informative than reading articles, which have a fraction of the information and might be written by a novice. Come to my next Stock Master Class and Investor Educational Retreat to learn firsthand (from me) how easy and effective this strategy is, and why it has worked through bull and bear markets for more two decades now, while most strategies have bankrupted investors. Call 310-430-2397 or email [email protected] to learn more. 26. What are the Four Questions for Picking Winning Stocks? The Four Questions for Picking Winning Stocks. 1. What’s the product? 2. Who’s the customer? 3. Can the company continue to make a superior product going forward and get it to their customer at the best price before the competition? 4. Who’s the CEO and can s/he motivate the employees to make the best product faster, better and cheaper than the competition? As you can see, three out of four questions can be answered by being a good customer of the company. The 3rd question will benefit from you completing a Stock Report Card, and understanding how to use the data. So, the more you know about a company (ingredient #1 of the recipe for Cooking Up Profits), the easier it is to pick the leader. In Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback), I used these questions and tools to compare two companies. Google scored an A (in 2006, when it had only been publicly traded for 2 years). The Wall Street Blue Chip that I gave a D- to went on to declare bankruptcy (General Motors). FYI: Using the Stock Report Card and 4 Questions, I identified both of these trends years before these major events occurred. The book was written in 2006, three years before GM went bankrupt. In fact, I applauded Google on national television before its IPO, when most pundits pooh-poohed it. This is the power of asking the right questions, rather than just listening to the mainstream media. So, are you an Einstein in investing? A complete novice? If you scored 20 correct answers or higher, then you’re in great shape! If you scored 18 right, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (So, consider joining us at our next Investor Educational Retreat.) Call 310-430-2397 or email [email protected] to learn now.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Are you an Einstein in investing? A complete novice? Check your Investor IQ with the 26 questions below. If you score 21 correct answers or higher, then you’re in great shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (So, consider joining us at our next Investor Educational Retreat.)