|

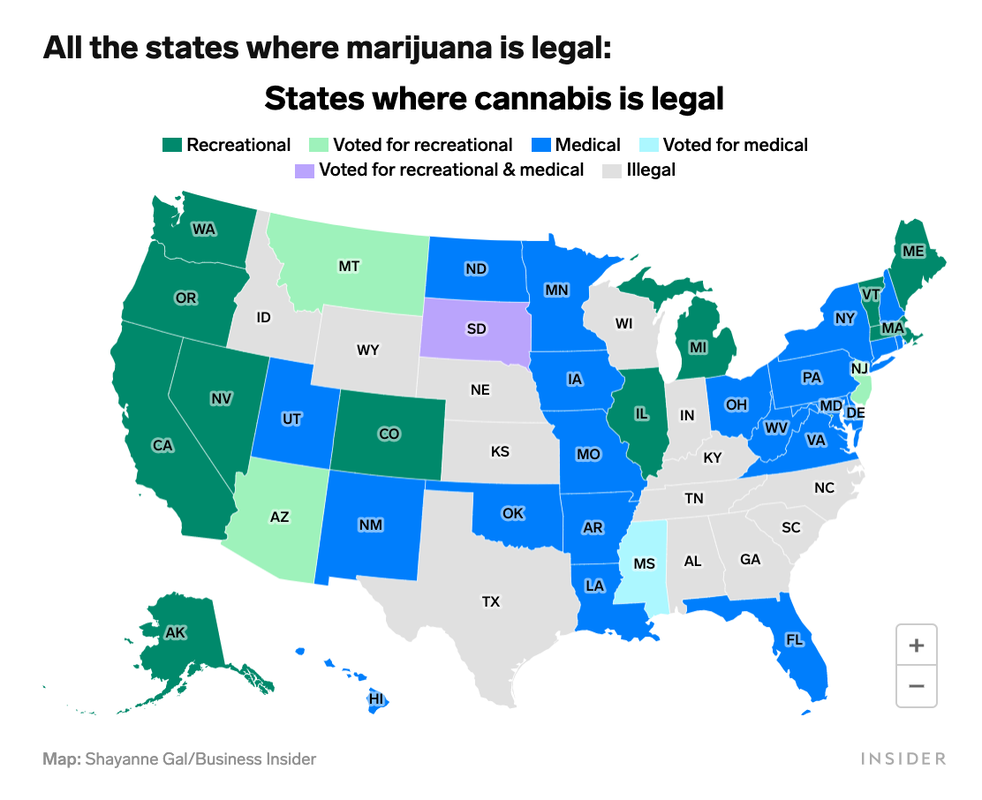

Over the past few weeks, there has been a flurry of activity at MedMen corporate. The beleaguered cannabis retailer, which was attempting to become profitable after ousting its founders and CEO in January of 2020, has been navigating employment lawsuits, executive exodus and boardroom in-fighting, with a dollop of weak sales and pandemic protocol on top. The interim CEO Tom Lynch, who was appointed on March 30, 2020, began beefing up the board with A-list members from Whole Foods, the Coffee Bean and Tea Leaf and Salesforce. In the 1st Quarter (fiscal) 2020 earnings report that was released on December 7, 2020, Tom Lynch assured investors, writing, “With the strength of our team and support of our capital partners, we are ahead of schedule with respect to our turnaround plan. As we get closer to achieving company-wide profitability, we remain committed to growing the MedMen brand and maintaining our position as the leading cannabis retailer in the U.S.” While that statement sounds pretty exciting, there are quite a number of red flags that seem to be pointing in the opposite direction, including executive exodus, weak sales, flying pretty close to the trees (low cash) and a painfully weak share price (under 14 cents today). Executive Exodus On December 18, 2020, CFO Zeeshan Hyder was replaced by Reece Fulgham as Interim Chief Financial Officer. What does Fulgham have that Hyder doesn’t? Restructuring experience. It takes a certain type of skillset (and stomach) for a contentious battle with founders, shareholders, creditors and bondholders. It’s also possible that Hyder just wanted out – to put the whole debacle behind him. Additionally, both Lynch and Fulgham have SierraConstellation Partners as their main gig. SCP is the firm engaged by MedMen to turn the company around. Lynch offered praise to former CFO Hyder, writing, “His steady hand and deep industry knowledge were vital during our turnaround.” On December 16, 2020, two days before Hyder was replaced, Tom Lynch was elected as the MedMen Chairman of the Board. Ben Rosehas resigned as the chairman and from the board effective immediately. In addition to being the former executive chairman of MedMen, Ben Rose is the Chief Investment Officer of Wicklow Capital, a capital investor in MedMen. The abrupt departure signals discord behind the scenes. Did Hyder resign out of loyalty to Rose? Andrew Modlin (a MedMen co-founder) lost his Class A super voting shares on Christmas Eve (12.24.2020). Executive exodus is a red flag, particularly when the CFO and COB depart at the same time. 1Q 2021 (Fiscal) Revenue In the quarter ending September 26, 2020, MedMen revenue was up 35.1% sequentially, but down 10.13% on the year. Revenue was $35.6 million for the quarter ending September 26, 2020, compared to $39.7 million for the same period in 2019. How will the last quarter of 2020 fare? The pandemic came roaring back this fall. While many stores remained open, with social distancing and mask-wearing policies in place, there just wasn’t a lot of customer traffic. I made repeated visits to the “flagship” 5th Avenue MedMen store in Manhattan in December and the Venice, California stores in October and November. In every case, the stores were bereft of customers, with no delivery bikes in sight. Weak cash-flow could present a problem for an out-of-court turnaround. Cash MedMen had $10.3 million in cash and cash equivalents as of September 26, 2020. The net loss in the most recent quarter was -$30.2 million compared to a net loss of -$83.4 million in the same period last year. While this was an improvement, perpetual fundraising is an expensive proposition, particularly when your share price is in penny stock range ($0.139 USD). The U.S. House of Representatives Decriminalized Cannabis Cannabis is becoming more legal in the U.S. The U.S. House of Representatives decriminalized cannabis on December 4, 2020. It’s not law yet, however, because the U.S. Senate hasn’t voted. The House approval sent shares in cannabis companies like Aphria soaring up to 3-fold off of their March lows. (Read my Dec. 5, 2020 Cannabis blog for additional information.) By contrast, MedMen shares have stayed stubbornly close to their all-time low. Is Restructuring Imminent? Because cannabis is still a problem in most countries – with the exception of Canada, Uruguay and a handful of others – whenever a cannabis company wants to borrow money, they must pay a higher interest rate. Since the terms and conditions of previous fundraising efforts have been disastrous for MedMen capital investors (including Wicklow Capital and Gotham Green Partners), Lynch and Fulgham have their work cut out for them. Skirting bankruptcy, even with these financial engineering masters at the helm, might be impossible. Remember: you won’t get prior notice. If MedMen does indeed declare Chapter 11, the already low share price will likely gap down overnight, before you can sell. (Bad news of this nature is typically announced after the markets close.) Are you interested in learning how to pick great stocks and avoid the losers, or in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 13/8/2021 04:40:00 am

Well to have the interesting material on your forum that would empower people to improve their knowledge about. Thank you so much for the stuff here that would be recommending to all. Thumbs up and please continue to bring such updates on your forum. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed