|

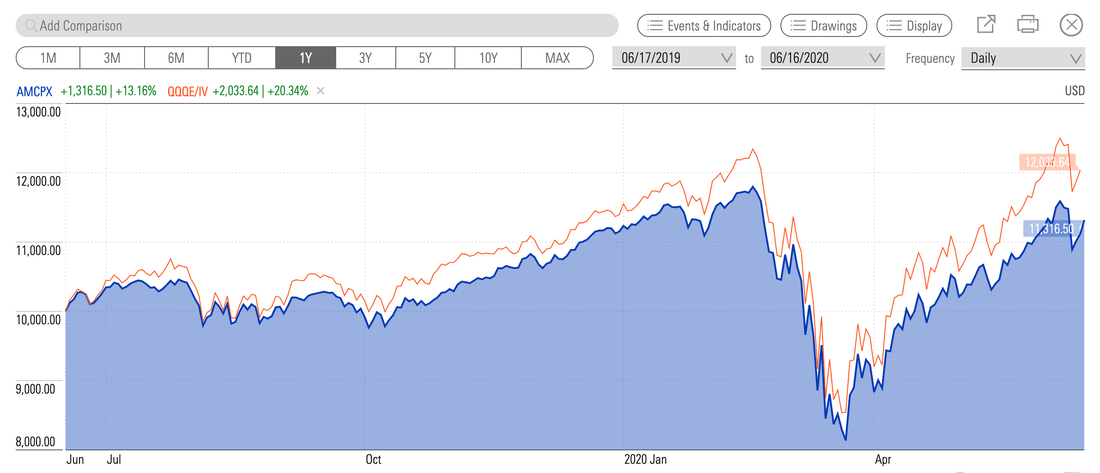

Is Your Financial Advisor Good at Navigating Stormy Seas? 5 New Questions to Ask your Financial Advisor. Are you looking for someone to help you manage your money? Are you wondering if the financial advisor you have is good at navigating tough times? It’s easy for anyone to make money in a bull market. However, how well can your financial plan hold up in a recession? The last two recessions cost most Main Street investors more than half of their wealth. (The recession was announced on June 8, 2020 by the National Bureau of Economic Research.) Never confuse a bull market with wisdom or a well-designed strategy. Here are 5 questions to ask your financial planner to determine just how well s/he can handle the challenging economic environment that lies ahead. The answers reveal whether or not your CFP spends her day selling products to clients, or if she spends her day actually looking for the data and statistics needed to create a well-balanced and well-protected portfolio. We are in an unprecedented time, which will require a lot more skill to navigate successfully. 1. What’s the current unemployment rate? The wrong answer: 13.3%. The right answer: 16.3% with over 25 million Americans unemployed. Learn more in my blog “$10 Avocados. Lies. Damn Lies and Statistics.” 2. How much of my money should I keep safe? The Buy & Hope answer: That depends upon your risk tolerance. But the markets always come back, so don’t worry about short term fluctuations. The 21st Century truth. Buy & Hope investors have been riding a Wall Street rollercoaster losing more than half of their wealth in each of the last 2 recessions (the Dot Com Recession and the Great Recession). This cost many people their homes as well. Learn more in my Recession blog. Take steps to protect your home and wealth with the strategies outlined in my Recession-Proof Your Life blog. The right answer: Always keep a percentage equal to your age safe. Overweight safe in recessions, or in the late stage of the business cycle, to protect yourself. In today’s world, with so much leverage in the bond market, you also need to know what is safe. Learn more in my Bond blog. 3. What is safe? Ford was downgraded to junk in 2019. I’ve been seeing reports that over half of the S&P 500 is at the lowest rung just above junk bond status. The wrong answer: If you just keep your money in a savings account, you’ll be losing money because of inflation. At least in a bond, you will be making some income. The right answer: When companies are downgraded to junk bond status, the value of the bond itself goes down, your income is at risk of being canceled and if the company has to declare bankruptcy, then you are going to lose some of your principal investment. If you need to sell your bond, you may not be able to do it because no one will want to buy it. If you’re going to hold bonds you have to keep the credit worthiness at the highest rung and the terms short. Bond funds carry more risk because they can often include up to 20% junk bonds in the holdings. We are in an unprecedented recession. Only the most creditworthy companies were able to raise money before the bail-out in March 2020, and the hard times are not over yet. Also, we are in a period of deflation, not inflation. Learn more in my Bond blog. 4. What other products are safe for me to protect my principal, while also earning an income? The wrong answers: Money market funds, annuities or real estate investment trusts. You can earn an income with these products. (What you are not being told is that the higher risk products offer a higher commission.) The right answer. Money market funds now have redemption gates and liquidity fees, meaning that you could be denied access to your money or have to pay a fee to access your money. Rates are typically very high risk, with most of the companies showing cash negative gains over the past years, even while real estate prices rose to all-time highs. Read my blogs on real estate and work from home, FDIC-insured cash and what happened to a retired couple who were told that their REIT was guaranteed by real estate. (Click on the blue highlights to access these blogs.) So, what is safe in a world where bonds are overleveraged, and REITs are very high risk? Getting safe is a two-step process. The first step is to keep your money. The second step is to purchase safe, income-producing hard assets that you purchase for a good price, considering a post-pandemic world. There actually are a few of those products available today. We spend one full day on this at our investor educational retreat. The next retreat is in October 2-4, 2020. You can also read about What’s Safe in the 3rd Edition of The ABCs of Money. FYI: If you register for the Oct. 2020 Retreat by June 30, 2020, you receive the lowest price and a complimentary private, prosperity coaching session (value $300). Click on the retreat flyer to learn more and to read testimonials. 5. Are stocks too high? I’m getting dizzy from the rollercoaster ride. In March, I thought I’d lost so much, and now I’m wondering if I should take some money off the table, so that I don’t lose it again. Wrong answer: The stock market can fluctuate. But if you just hang on for the long term, everything will be OK. The right answer: Stocks are very close to an all-time high. In fact, the only two times in history that the price-earnings ratios were this high were in 1929, before the Great Depression, and in 2000 before the Dot Com Recession. We all know what happened in the Great Depression. In the Dot Com Recession, the NASDAQ Composite Index lost 78% of its value, and took 15 years to crawl back to its March 2000 highs. Learn more about pricing in my interview with the senior index analyst of the S&P500®, Howard Silverblatt and in my blog “$10 Avocados.” Bottom Line: If your financial advisor is consistently giving you the wrong answer or the fast, inaccurate data, then you are dealing with a salesman. If you want to verify just how much your plan is at risk, ask your current advisor for a chart of your portfolio performance for the last 15 years, compared to the S&P500®. Most plans are just riding up and down, losing more than half in each recession, and using the bull markets to earn back losses, instead of amassing gains. Additionally, most managed plans are performing about 2% below the index, due to fees. (See the chart below for an example.) The worst is not over. Many of the emergency funds that were authorized expire on September 30, 2020. The 2nd Quarter 2020 GDP Report that will be announced on July 30, 2020 is expected to be the worst on record. In 2020, GDP is projected to contract by -6.5% (source: Federal Reserve.gov). The last two recessions have taught us that when repricing occurs, most people lose more than half of their wealth. From the top to the bottom in stocks typically takes about 18 to 24 months. The high in real estate was in 2007, and the low bottomed out in 2011. It’s not a good idea to try to market time these things. Our easy-as-a-pie-chart system with annual rebalancing protects you and can earn gains safely. It’s less time, less money and a whole lot less worry. Simply rebalancing your nest egg annually allows you to capture gains and remain properly safe and diversified, if you use the pie charts as your guide. This is a Buy Low, Sell High plan on auto-pilot. So, whether you learn how to protect your wealth and diversify your investments by reading the 3rd Edition of The ABCs of Money, or by receiving an unbiased 2nd opinion on your current plan for me, or by attending our October 2020 Investor Educational Retreat, wisdom and time-proven systems are the cure, and the time is now. Having a strong financial house can protect your future from the financial storms on the horizon. You want to hire, assess and furlough your financial advisor like your life depends upon it because your lifestyle and future does. Blind faith, free advice and Buy & Hope have been very expensive strategies in the last two recessions of the 21st Century. They are unlikely to be a good strategy in the days ahead. If you don’t know what you own, or how protected your wealth and retirement are, the retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more now. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 1/7/2020 10:08:07 pm

For many people, debt is a way of life. Don't allow yourself to feel discouraged if you have to search for options for credit card debt relief - you are not alone. There are millions of others out there in the same situation. It usually starts with someone getting behind on a couple of payments and before they know it, the interest rates and late fees are blown out of control. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed