|

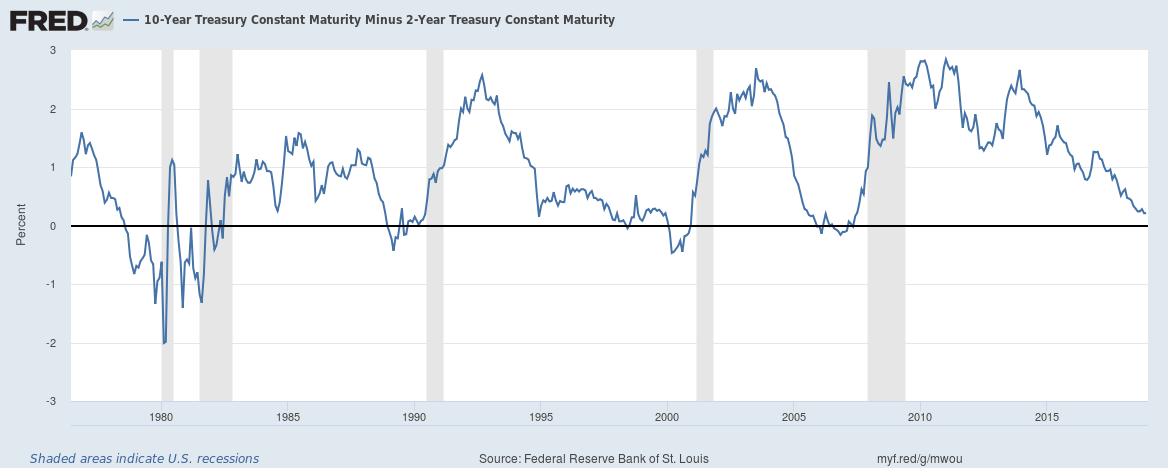

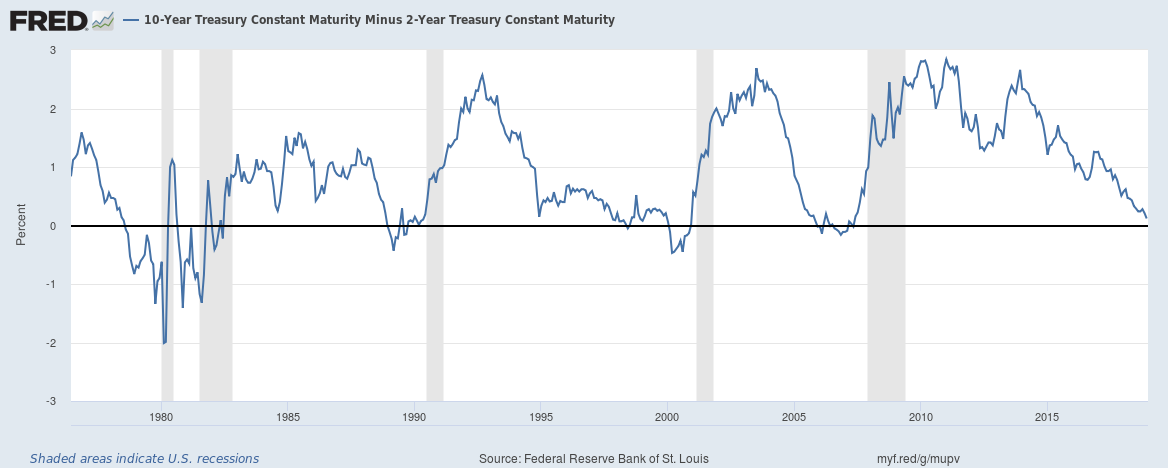

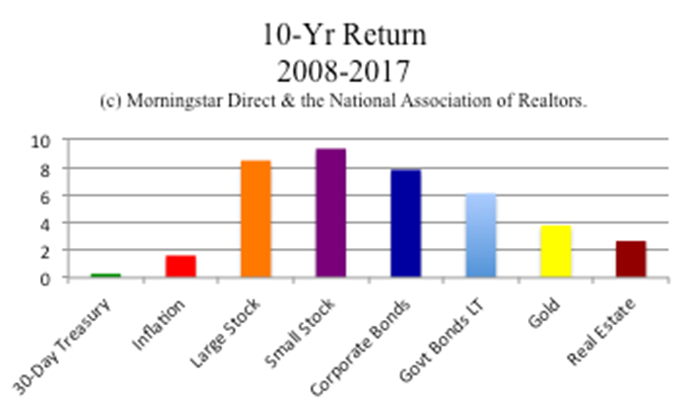

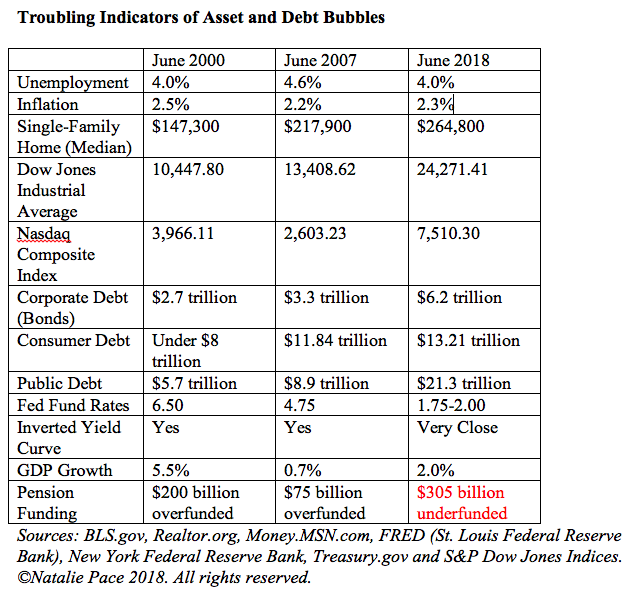

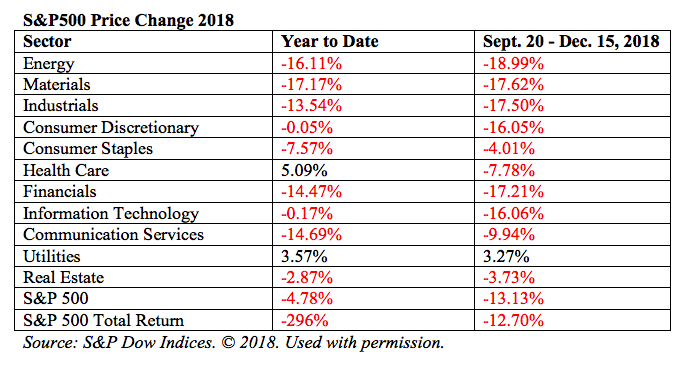

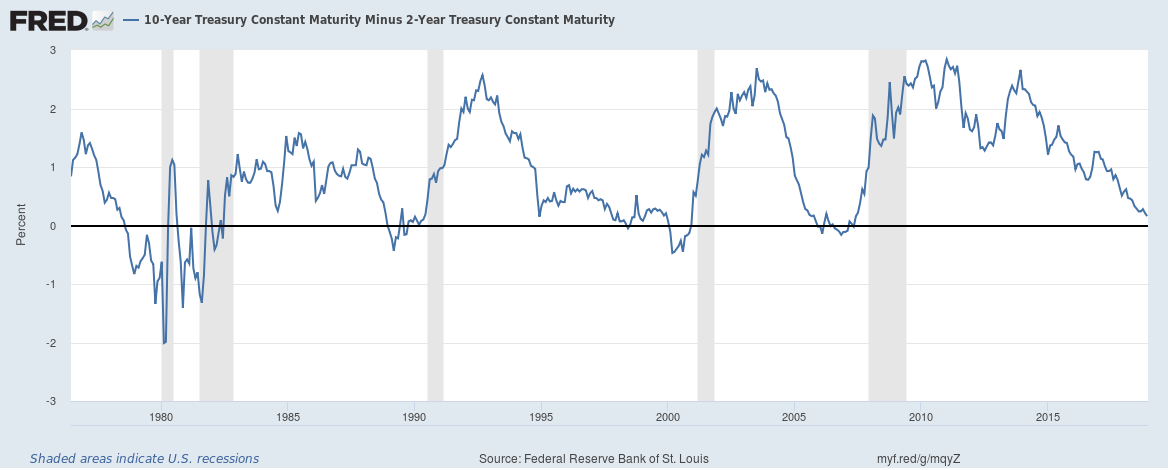

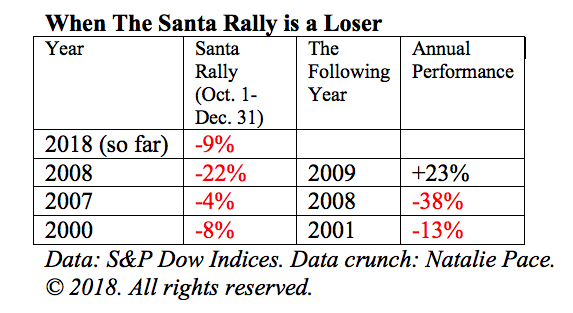

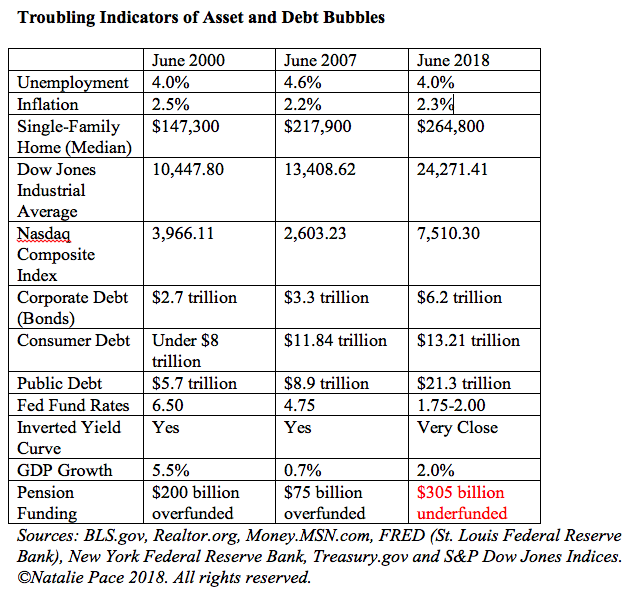

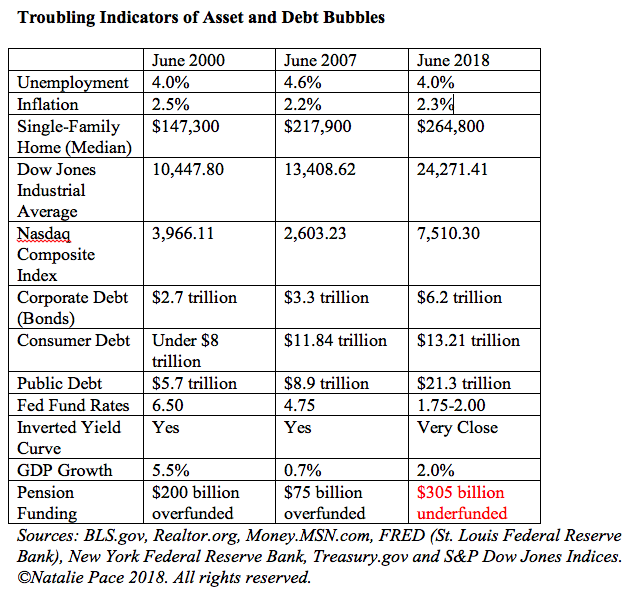

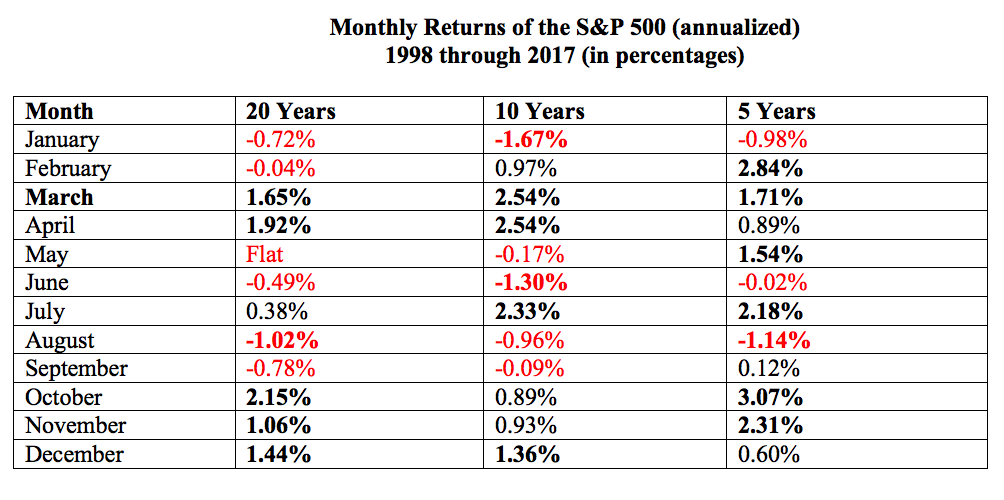

Wonder what 2019 has in store for you, your home, your nest egg, your wallet, your fiscal health and living a rich life? Let’s peer into the facts, data, statistics and correlations to see what the Crystal Ball for 2019 portends for: Stocks Bonds Real Estate Gold Cryptocurrency Cannabis Banks Insurance Companies & Annuities And Beyond Stocks: Bad Santa When the Santa Rally sucks, the next year is even worse 2/3rds of the time. The last two times that October through December offered up coal for Christmas were in 2007 and 2000. 2008 saw losses of 38% in the S&P500, while in 2001, the index dropped 13%. You have to go all the way back to 1978 for a bad Santa Rally before that. As of December 28, 2018, the S&P500 is down -15%, making 2018 the worst December ever. The 2nd place year of the Bad Santa December was 1931, when the index dropped -14.53% (source: S&P Dow Jones Indices). The Bad Santa Rally Phenomenon is merely a symptom of far greater dis-ease in the economic system these days, including massive leverage, asset bubbles, a slow-down in GDP growth, the flat yield curve and other harbingers of recessions. Click on the blue-highlighted words for additional information. I’m also including a list of blogs at the end of this blog, where you can get better informed about what is really going on in the economy. Crystal Ball 2019: Stocks The prognosis for Stocks isn’t good. It usually takes about 18 months for a correction to hit rock bottom. Below are the charts for the Great Recession and the Dot Com Recession. Bad news comes in waves, where the indices drop and then stabilize at a new low, only to be hit again with something worse, until the final recovery can begin. In other words, just at the moment that you are wiped out, fed up and ready to throw in the towel, that’s the point when a prudent investor would be buying low. One final point: everyone knows that buying low and selling high is the key to successful investing. The reason most people can’t buy low is that they’ve suffered too many losses, and must now recover. (You might remember this from 2009.) The reason most people don’t sell high is that they are hopeful the value will go even higher, even when the trend has started to reverse itself. (You might be feeling this way now.) Bonds Rising interest rates mean that current bonds lose value. If you have a short-term bond backed by an income-source that is recession-proof and creditworthy, then odds are decent that you’ll get your yield and the return of your money on redemption day. However, most people are not aware that over half of the companies in the U.S. are at the lowest rung of investment grade, or that many of these highly leveraged companies have been borrowing to buy back their own stock and dividends. The worst examples of what can happen to over-leveraged bonds include: Greece, Stockton, General Motors, the entire airline industry, retail and other industries that have slow growth and have massive pension and other post employment benefit obligations (OPEBs). If you aren’t aware of the interest rate risk and credit risk in bonds, then you can read up on the fate of MF Global, Detroit and GM, or ask any pilot who had a United Airlines pension in 2001 to start your education process. Crystal Ball 2019: Bonds Bonds lost money in 2018. 2019 is expected to see two rate hikes, with one in 2020. That means more bad news for bonds, and that is just the interest rate risk. The credit risk means that we could see some bad news, in the form of restructuring debt, for some of these over-leveraged companies. A bear market in bonds is particularly problematic because the last two recessions benefited from a bull market in bonds. In the Dot Com Recession, bonds were getting up to 25% above their face value, while in the great recession bonds earned 10% on average. This is because interest rates were high enough to be cut before the correction started. That’s not the case today, which is one of the reasons why the Federal Reserve Board continues to hike rates. Getting safe, and understanding what’s safe in a world where bonds are losing money, is so important that I spend one full day on this at my Investor Educational Retreats. Real Estate Real estate is very sensitive to interest rate hikes. When interest rates rise, it squeezes the buyer pool. Owning a home is out-of-reach for the denizens of many cities, particularly folks under 40. Rising interest rates make something that is already unaffordable more expensive. That puts pressure on real estate prices to drop – unless there is a massive amount of new supply coming on the market, or a massive amount of new demand. Real estate is local. So if there is some compelling reason why your particular town or city will buck the national downtrend, pay attention to that. However, knowing the general macro trends will serve you well. Remember that few industries hire in recessions, and many lay-off workers. So, counting on a robust influx of workers next year, in most cases, is not a sound bet. REITs. Private placement Real Estate Investment Trusts have become very popular for broker/salesmen because they pay an outstanding commission. However, many have never recovered from the Great Recession and have been cash negative for years. There are many risks associated with this product that the enlightened investor must learn before writing the check. Here’s an SEC Investor Alert on the topic. The Cliff Notes on REITs are that you are buying stock in a company that owns real estate. You don’t own the real estate yourself. If the company hits trouble, and is forced to restructure their debt and business, your stock in the company becomes toilet paper. Gold Gold should be in a bull market in 2019. Television pundits have begun touting the precious metal, which typically means that the asset’s popularity with Main Street investors soars. Gold soars when stocks or the U.S. dollar swoon. Gold prices go up when oil prices spike. All of those things are could happen in 2019. Of course, once we know that we are in a recession, oil prices will abate again (2020?). Cryptocurrency Cryptocurrency is still the Wild, Wild West. There is promise here, however it is not fully realized. You cannot have Bitcoin valued at $20,000 last December and only $3000 today. That’s not currency. That is speculation. Over 90% of cryptocurrency is speculative trading, trying to get rich quick, rather than it being used as currency. Additionally, there are so many scams in this space that it is absolutely heartbreaking. Be very, very careful that you are not drawn into a cryptocurrency MLM scam. Be sure to read my 12 Red Flags of a Scam blog before investing. Cannabis Cannabis is the booming industry of 2019. The growth rates are off the chart. The interesting thing about cannabis stocks is that the bubble on the pricing has popped. Many are trading near a 52-week low – down by half or more in the last few months. I’m seeing 100% to 400% and more revenue growth year over year in a lot of these companies. Here’s a blog that I wrote on Cannabis in September, the month before Canada legalized recreational use of cannabis products. There are also a lot of scams in this space, and companies trading off the boards with questionable business models and liquidity. So, be sure to read my Penny Pot Stock Scams blog, as well. One more tip on cannabis. It’s a better idea to pick a few winning companies that are publicly traded than to invest in a new cannabis fund that is offered by a company you are unfamiliar with. Banks As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab Inc. explained in my interview that was published on October 22, 2018, “We have taken financials from an outperform down to a neutral. They are only profitable if they can earn the spread between short-term interest rates, which they borrow at, and long-term rates, which they lend at. The reason why the inverted yield curve has almost always brought on a recession is the crush that causes for the financial sector, and the implication that has more broadly.” The yield curve is flat. Each interest rate hike has the potential to take it negative. However, even at a flat yield curve, banks are squeezed. Click to read my blog interview with Liz Ann from October of this year. Insurance Companies and Annuities According to the Financial Stability Report that was released by the Federal Reserve on November 27, 2018, life insurers have been shifting their portfolios toward less liquid assets, weakening their liquidity positions. What That Means. Are you aware that insurance companies are not FDIC-insured and that if the U.S. had not bailed out AIG in 2008 over 50 million policyholders would have been without much of a backstop? Just how safe and protected is your annuity? And Beyond It’s a good idea to harken back to life in 2009, and take steps to make sure that you keep what you have and that you are not over-spending on basic needs or struggling to pay your bills. Most people need to act now to get defensive before the next downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Crystal Ball 2019 was the subject of my free January 2019 Teleconference. Click to listen back 24/7 on demand. If you wish to be notified of an upcoming teleconference, email [email protected] and ask to be added to our email list, or check my home page at NataliePace.com frequently, or follow me on Twitter or Facebook. Other Blogs of Interest

2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Worst December Since The Great Depression is a Wake-Up Call. To date, U.S. stocks have seen the worst December since 1931, with 13.4% lost to date, and counting. In December 1931, the S&P500 dropped -14.53% (source: S&P Dow Jones Indices). I say “and counting” because the government shutdown is not going to instill confidence in investors. The only hope we have of averting another sell-off on Christmas Eve, when the stock market is open until 1 pm ET, is that everyone is out shopping. I know that we’d all rather be shopping and baking cookies. However, closing your eyes while hundreds of thousands (or millions) disappear from your assets is never a good idea. Everything But the Truth Last night, I examined the front pages of the news outlets, to learn what they were reporting about stocks and the economy. An anchor on CNBC actually advised everyone to bake cookies instead of looking at their retirement fund. The headline feature on CNBC.com was that “Strategists are optimistic that stocks will end higher in 2019.” Fox News had nothing about the rout in stocks on the home page. On the economy page, the headline blamed Powell for “investors feeling the hurt from the Fed’s Rate Hike.” On Monday, Cramer was advising everyone to buy into the lower prices. By Friday, he recommended capitalizing on a bull market in gold. Cramer, too, has been blaming the Federal Reserve for the economic issues faced in the U.S. and for the sell-off in stocks (just as he blamed the Feds, rather than the real estate bubble, on the Great Recession). The pundits who blame Jerome Powell for U.S. stocks having the worst December since 1931 are overlooking a few key facts. (See below.) In fact, if the headlines today hadn’t been about the Government Shutdown over the $5 billion border wall, the big news of the day could have been positive. The Bureau of Economic Analysis reported Friday morning that GDP growth came in at 3.4% in the 3rd quarter. That news was buried in the Congressional and White House Budget Blame Game. However, if we had a budget deal and positive economic growth news, Friday might have seen a mini-rally, rather than a 2% drop. (The fundamentals suggest that more perilous drops in prices are on the horizon, so don’t be suckered back in without a strategic plan). What’s Really Going On. 1. Astronomical Public Debt of just short of $22 trillion. 2. GDP Slowdown. GDP is expected to slow down to 2.3% GDP growth in 2019, and 2.0% in 2020. 3. The Trade Deficit. Larger than ever. Tariffs increased the trade deficit! 4. The Trade War (Tariffs). Tariffs typically hurt economies, rather than helping them. 5. Leverage. Astronomical debt abounds in every corner, from U.S. sovereign debt, to personal debt, to corporate and leveraged loans. 6. Financial Engineering. Many corporations have been borrowing to buy back their own stock, making their stock look more desirable and better priced than it really is. Lowe’s Corporation was downgraded by Standard & Poor’s last week for this practice. The trend of downgrades is accelerating. 7. The Gig Economy Doesn’t Add Up. Main Street is still struggling to get ahead. 8. Housing is Unaffordable in many cities. 9. Bubbles: Crypto, Stocks, Bonds, Housing, Cannabis. Low interest rates create bubbles. 10. The Yield Curve. An inverted yield curve is 100% correlated with recessions. As you can see from the chart below, the yield curve is flat. Get additional information on each of these points in the blogs listed at the end of this article. What You Can Do About It Simply put, it is imperative that you get a second opinion on your current plan to be sure that you are safe, protected, diversified and hot, and that you know what is safe in a world where stocks and bonds have lost a lot of money this year. Sadly, even with the losses we’ve seen, this is more likely the tip of the iceberg than the turning point where everything comes up roses and gains again. So, if you are being told to just hang on and wait that is a red flag that you need a 2nd opinion now. Call 310-430-2397 or email [email protected] to secure your session now. Buy and hope doesn’t work. A lot of people point to the recovery after the Great Recession and say, “Look, the markets came back!” That may be true, however, it is very likely that your portfolio hasn’t yet. Do the Math Most investors lost 55% in the Great Recession. If you had a million, it dropped down to $450,000. An 8.5% return on a million is $85,000 (what stocks have done on average over the last decade). However, with only $450,000 now, your return is just $38,250. At that rate, it will take you over 14 years to get back to where you started. It took over 15 years for investors to recover from their losses in the Dot Com Recession (with up to 78% losses on their NASDAQ stocks). So don’t buy into the Sales Pitch that Buy and Hold was a good idea. The pundits are right that market timing is not a good strategy it doesn’t work for many reasons. But that doesn’t mean that you should stick with a losing plan. Modern portfolio theory with annual rebalancing means that you are always safe, protected and hot, and capturing your gains. Annual rebalancing is an auto-pilot Buy Low; Sell High program. When a fund slice fattens up in your pie chart, it’s a signal to trim back and sell some high. When a fund slice has become a sliver, it’s a signal that prices are low and it’s time to beef up a bit. Keeping a percentage equal to your age safe is one of the easiest and most fundamental strategies to earning gains in bull and bear markets (although the 2018 correction is complicated with bonds losing money, too). This year and beyond, you need to know what’s safe in a bubblicious world. So learn The ABCs of Money that we all should have received in high school at the Santa Monica or Colorado Investor Educational Retreats. Bundle your retreat with a second opinion now through Dec. 23, 2018, and you’ll receive up to half off on your 2nd opinion coaching package. Check below for two holiday gifts from me. Two Holiday Gifts That Can Save Your Assets Buy and Hope hasn’t worked since 2000. You need to know what is safe in a world where stocks and bonds are losing money and real estate is completely unaffordable in many cities. This year I have two holiday gifts for you. I updated The ABC’s of Money 2nd edition using 2018 data. It’s exclusively available on Amazon Kindle for just $3.99. Imagine a stocking stuffer gift that can help your friends and family to transform their lives with financial (easy) wisdom! My free 21-day Gratitude Game coaching call series is designed to help you implement the strategies you’ll learn in The ABC’s of Money. The 21-day coaching call series is completely free, and is a great way to start the New Year. All you have to do to claim that gift is reply to this email with the subject “Send me my free gift please!” Remember: when the Santa Rally sucks, the next year is worse at least 2/3rds of the time. Wisdom is what is needed now more than ever. We haven’t seen a December this terrible since 1931, during the Great Depression. So stop listening to the blame game on the partisan media news channels and letting fear or blind faith lead your strategy. Get a time-proven system that scored gains in the last two recessions and has outperformed the bull markets in between. Call 310-430-2397 to learn more. Happy Holy Days! Be sure to claim your free holiday gift from me! Other Blogs of Interest Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. All eyes are on the Federal Reserve today and tomorrow to see if Chairman Jerome Powell and his colleagues will kowtow to Presidential Tweets and pause on the rate hikes, or if they will do what everyone expects them to do and raise the Fed Fund rate another 25 basis points. We’ll know tomorrow at 2:00pm ET, when the FOMC press release will be released, along with a new Summary of Economic Projections. Will the Feds Raise Interest Rates? On September 26, 2018, the FOMC participants projected that 2018 would end with the Fed Fund rate at 2.4%, with 3.1% on tap for 2019 and 3.4% to be the projected target by 2020. On Wednesday, November 28, 2018, Federal Reserve Board chairman Jerome Powell spoke to the Economic Club of New York, saying, “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth.” This was a slight shift in his language, which the markets interpreted to mean that he might slow the interest rate hikes going forward. Few expected that to mean a pause in December, however. Former Federal Reserve Chairman Alan Greenspan said today on CNN that the economy is slowing, which indicates that lowering interest rates is an appropriate path. When asked about the risk of being too late to respond to the changing economy, Greenspan said, “It is a risk that you balance against the risk of being to early.” Either way, Greenspan is confident that the economy will dictate the policy, not White House pressure. Should the Federal Reserve Raise Interest Rates? The complaints from the White House are centered around the stock market volatility. As of yesterday, December’s performance of the S&P500 was -7.27%, the worst since 1931 (-14.53%). However, the dual mandate of the Federal Reserve is to keep inflation low and employment high, both of which are the case right now. As to Greenspan’s point about not being too early or too late, the expectations for economic growth are that the 4th quarter will slow down, but still be positive. Economic Growth The forecasts for 4th quarter 2018 GDP growth range between 2.4 and 2.9%. That’s pretty tepid compared to 3.5% GDP growth in the 3rd quarter and 4.2% in the 2nd quarter (source BEA.gov). However, it is still growth. On December 21, 2018, the 3rd estimate of 3rd quarter GDP growth will be released. It is expected to come in around 3.5%. (The 4th quarter GDP growth advance estimates won’t be available until January 30, 2019.) As long as the Feds can point to an economic reason for raising interest rates, they are likely to for the following three reasons: 1) higher rates are needed to have more room for lowering in the next recession, 2) leverage has become more speculative, and, 3) asset bubbles form when rates are too low for too long. Where The Feds Would Like the Rate to Be As you can see from the chart below, before the last two downturns (which cost stock investors more than half of their assets), the Fed Fund rate was much higher. At just 2.0-2.25%, there isn’t enough wiggle room to help boost economic growth by lowering interest rates. That is why the Feds are raising rates as quickly as they can, while also winding down their own balance sheet. Incidentally, the Federal Reserve reported a cumulative (unrealized) loss on its domestic SOMA securities holdings for October of $66.5 billion, compared to a gain of $80 billion in December of 2017 (page 7). Leverage In the Financial Stability Report that was released on November 28, 2018, the Federal Reserve indicated that they were watching leverage on a number of different fronts, including:

All of that leverage has amounted to losses on the bond side, already. That makes 2018 even more problematic than 2000 and 2008 because during the last two recessions, investors earned gains in bonds (while their equity/stock side lost more than half). Asset Bubbles As I’ve indicated in many blogs over the past two years, low interest rates create bubbles. Stocks, bonds and real estate are all bubblicious. See the chart below. Even with the volatility in the stock market, stocks are still near their all-time high, and many are trading at high multiples. Financial Engineering Financial engineering, largely in the policy of corporate share repurchases, has been used by many corporations to reduce their share count, which in turn makes their EPS look strong, and lowers their price to earnings ratio (by reducing the share count). According to Howard Silverblatt, the senior index analyst at S&P Dow Jones Indices, “[The] first three-quarters of 2018 buybacks rose 52.6% to $583.4 billion from $382.4 billion in 2017, and was 1% shy of the annual record, set in 2007 of $589.1 billion. This policy of borrowing from Peter to buyback stock has resulted in Standard and Poor’s lowering the credit rating of Lowe’s last Wednesday. Since over half of investment-grade corporations are at the lowest rung, if the downgrades continue, this will become very problematic. Corporations will have a more difficult time borrowing from Peter to buyback their own stock, and the price tag will be higher. Without the support of corporate buybacks, stocks could continue to weaken. The Bottom Line It is all speculation of what the Federal Reserve Board will do until tomorrow (Wednesday) at 2:00 p.m. However, based on the numbers, I’d be surprised if there wasn’t a rate hike. The Feds know that the market expects an increase, so there shouldn’t be a rout in stocks based on their decision. And the GDP report that follows on Thursday will make headlines for still being relatively strong. Once the new projections are released, I’ll post those on my social media (Twitter and Facebook). I will offer a report on how that will affect 2019 in my December 27, 2018 teleconference, “Crystal Ball 2019.” A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Dow Jones Industrial Average is down 16% losses on the year from the highs set back in October. The volatility is starting to fray investor nerves. FANG investors who were lured into lofty valuations over the summer have been slammed back to Earth with Netflix stock diving 40% and Nvidia tanking 51%. Those losses are staggering (and heartbreaking). However, this is likely the beginning, not the end, of the trouble. Banks Drag Markets Down. December has been a terrible month for most stocks and bonds. Banks have led in the losses for the year, alongside energy, materials, telecommunications and industrials. See the chart below for an industry breakdown. Energy prices are predicted to rise, since OPEC and non-OPEC countries have agreed to cut production. (Click for more that on that. Goldman Sachs stock is down 40% since March, having lost $35 billion, or 1/3 of its market value. Most banks have lost at least a third of their market cap since March of this year. Morgan Stanley is down $30 billion; Wells Fargo is down $93 billion. JP Morgan is fairing slightly better, with share price losses of 16%. All told, six of the largest U.S. banks have lost more than $372 billion in market values since Spring of this year. Value Funds That’s a problem for value investors as financials were heavily weighted in most large cap value funds, with many carrying higher than 30%. What’s the Problem? The Yield Curve. One of the main issues is the yield curve. An inverted yield curve is associated with recessions, as you can see in the chart below. Currently the yield curve is flat, and on a downtrend. As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab Inc. explained in my interview that was published on October 22, 2018, “We have taken financials from an outperform down to a neutral. They are only profitable if they can earn the spread between short-term interest rates, which they borrow at, and long-term rates which they lend at. The reason why the inverted yield curve has almost always brought on a recession is the crush that causes for the financial sector, and the implications that has more broadly.” Leverage is Another Big Problem According to the Federal Reserve’s Financial Stability Report, “Credit standards for new leveraged loans appear to have deteriorated over the past six months... Lenders have become more willing to extend loans with fewer credit protections to higher-risk borrowers.” Bond Funds More than half of the investment grade corporations in the U.S. are at the lowest rung. That means there are a lot of bond investors who may not realize just how much risk they have taken on. Corporate bond mutual funds are estimated to hold about one-tenth of outstanding corporate bonds. That is likely why the Vanguard Total Bond Market II Index, had the highest outflows with $5.1 billion exiting the fund in October 2018, according to Morningstar. The problem is that a lot of that money is moving over into money market funds, without understanding that those funds can lose money, too, and have liquidity fees and redemption gates. This underscores the need for you to be the boss of your money, and to know exactly what a healthy nest egg looks like in a world where stocks, bonds and real estate are in a bubble, and leverage is way too high. (Call 310-430-2397 to learn more about The ABCs of Money that we all should have received in high school.) This is Just the Beginning As you can read in my coverage on the Federal Reserve’s Financial Stability Report of November 28, 2018, there are many concerns in today’s economy. As I outlined in my blog, Tariffs + Trade + Interest Rates + Quiet Periods + Leverage + Valuation Issues + The Financial Stability Report = the Wall Street Rollercoaster and Losses to Your Nest Egg. January looks even more vulnerable. When the Santa Rally is a loser, the following year is a bigger loser 2/3rds of the time. That’s why it’s important to get safe, diversified and rebalanced before January 2019, i.e. now. If you’ve been following my blog, you know that my warnings that stocks and bonds were in a bubble began last year. I wasn’t alone. Alan Greenspan, Warren Buffett, Robert Shiller and others were screaming from the rooftops as well. Now is the time to do a checkup on what you own, and make sure that you are safe, protected and hot. The last two downturns cost investors more than half of their retirement, and that was with bonds earning gains. This time around, bonds are already losing money, which means that it is even more important to get a time-proven program now than it was in 2000 or 2008. During the Great Recession, the Dow Jones Industrial Average Lost 55%. During the Dot Com Recession, the NASDAQ Composite Index Lost 78% and Too 15 Years to Crawl Back to Even. The banks have the authority to buy back their own stock, which would stabilize the prices. However, the flat yield curve, the leverage and the capital requirements of banks, combined with the lower valuations, may explain why these mega corporations have allowed their stock to sink. If the bank stocks do start to recover, corporate buybacks, rather than strong fundamentals, could be the reason. So, be careful swallowing the bait. Cryptocurrency isn’t the cure. A time-proven system that earned gains in the last two recessions and outperformed the bull markets in between is. Call 310-430-2397 to learn more now. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. When the Santa Rally is a loser, the next year is a bigger loser, 2/3rds of the time. Below are the last three times that the Santa Rally sucked, along with what happened the following year. Before 2000, you have to go all the way back to 1978 for a bad Santa Rally. The Santa Rally was so reliable before 2000 that you could basically buy at the end of September (the worst performing month on average) and then sell at the end of January (the best performing month) for 50% or more of the annual gains of the year. That strategy hasn’t worked since 2000 (even though there are still “pundits” teaching the “Buy in October, Sell in May” theory). 2000 Dot Coms were in a bubble. Many had been cash negative for more than 4-5 years. The promise of shopping online was dumped every time your dial-up connection dropped. Technology wasn’t developed enough to execute the vision. Stocks dropped 13% in 2001, after losses of 8% in the 2000 Santa Rally. Most people don’t realize that there was a Santa Rally in 2001, after 911! 2002 was another down year for stocks, yet the Santa Rally brought in 8% in gifts. October of 2002 turned out to be the low of the Dot Com Recession. In 2003, the NASDAQ Composite Index earned gains of 50%. 2007 There had been a series of mortgage bank bankruptcies beginning in January 2007, yet the stock market roared on to an all-time high of 1549 for the S&P500 on Halloween. Countrywide Financial, the largest mortgage lender by far, was in deep trouble by September 2007, and announced a layoff of 20% of its staff. By October, Countrywide’s stock was in free fall. Bank of America rescued the mortgage lender (with help from the Feds) on January 11, 2008. Incidentally, Angelo Mozillo, the CEO of Countrywide, first began selling hundreds of millions of stock in April of 2005. So did many other real estate CEOs, including the CEO of KB Home and the C-levels at Toll Brothers. The top dogs and bankers, including H. Paulson, knew real estate was a bubble waiting to pop in 2005. In 2008, the S&P500 lost 23%, after 4% losses in the 2007 Santa Rally. 2008 Bear Stearns stock fell to just $2/share in February. The company was swallowed up by JP Morgan on April 2, 2008. Indymac Bank failed on July 11, 2008. Lehman Bros. declared bankruptcy on 9.15.08. AIG was bailed out on 9.16.18. Banks were bailed out on 10.3.08. Local banks quietly changed signs as the FDIC worked hard to avoid bank runs. If you were without a high school diploma, you had a one in four chance of being unemployed in the U.S. The Santa Rally was a giant loser in 2008, with losses of 22%. The losses for the year were a devastating 38%. So, why was 2009 a winner after the economy melted down? The Dow dropped all the way to 6549 on March 9, 2009. That sparked the U.S. to fire up the printing machine and give a boatload of money to the banks. The banks loaned the money to corporations. That created jobs. Over 10 million jobs were created over the next four years. GM restructured on 6.1.09. Chrysler entered Chapter 11 on 4.30.09. Jobs and pensions were cut, but the auto industry was saved. Sadly, the lending was unequally distributed. 10 million homes also went to auction. As we sit near an all-time high for real estate and stocks, many Americans have forgotten just how horrifying and devastating 2008 was. What’s the Crystal Ball for 2019? Complacency will not be your friend in 2019. As President John F. Kennedy said, “The time to repair the roof is when the sun is shining.” As we enter 2019, most of the issues that were a problem in 2008 are just as problematic now. More so, when you consider that bonds are losing money. That means that the “safe” side of your nest egg won’t save your assets if stocks drop. In the Dot Com and the Great Recessions, bonds earned gains. However, that will not be the case in 2019. There’s just not enough wiggle room in interest rates for the Feds to lower them and spark growth, as you can see in the chart below. As you can see from the chart above, real estate is higher than ever, and unaffordable in many cities. Stocks are higher than ever, with expensive valuations not seen since the Great Depression and the Dot Com Recession. U.S. public debt just hit $21.8 trillion. The economic indicators touted on television, mainly GDP growth and unemployment, are not predictive of recessions today. Asset bubbles are, which is one of the reasons why the Federal Reserve Board is determined to raise interest rates. (Low interest rates create bubbles.) We’ll know how far and how high at the December 19, 2018 meeting. Currently they are on track for a 3.4% Fed Fund rate by 2020. What’s Your Best Move?

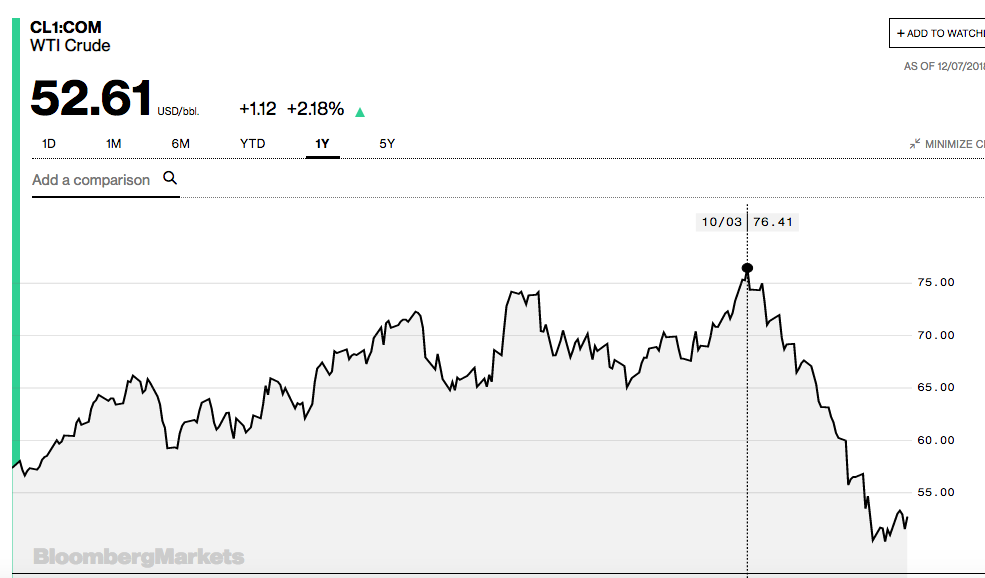

A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. What a busy week. We’ve seen a lot of economic news, most of which is negative for the economy, stocks and bonds. The trade report released on Thursday revealed that the U.S. is on track for a $600+ billion annual trade deficit in goods and services – a high we haven’t seen since President George W. Bush was in office. The arrest of Huawei’s deputy chairwoman and CFO Meng Wangzhou scuttled attempts at a trade truce between China and the U.S. That and more happened by Thursday. And then, on Friday, after the markets closed, we had a flurry of more bad news. 1. OPEC and non-OPEC countries (i.e. Russia) agreed to cut production by 1.2 million barrels/day beginning in January 2019. This is to stabilize the price of oil, which fell from over $75/barrel (WTI Crude) in early October to $50/barrel on November 23, 2018. Winners and Loser of an Increase in Oil Prices Winners

Losers

Other Big News That Dropped Late on Friday, December 7, 2018 1. Iran is exempt from the oil production cuts. In an interview with Bloomberg, HE Alexander Novak, the Russian Minister of Energy, went on record in support of Iran, saying, “Iran and Russia have been partners for a very long time. We support Iran in its urge to further strengthen trade and economic ties with other countries and we will continue doing so.” 2. General Electric announced that the company will cut its dividend to a penny. Last year the dividend was $0.24/share. That was slashed in half in November of 2017. General Electric’s share price has taken a huge hit as a result of the dividend cuts, dropping by 78% from above $31/share in January 2017 to $7.01/share on December 7, 2018. 3. The Mueller Report. The Manafort and Cohen sentencing documents have been headline banter since they became publicly available Friday night (12.7.18). This is not the full Mueller Report. However, it puts political turmoil center stage – something investors rarely stomach well. All of these events are tough on Main Street. The stock futures are pointing lower for next week, and then we have to deal with a Federal Reserve rate hike on Wednesday, Dec. 19, 2018. Even though the rate hike is widely expected, rate hikes have been associated with weakness in equities and fixed income. As I’ve reported previously, bonds have been losing money all year and are predicted to become even more problematic in 2019. (Stocks, too.) The solution, however, is not market timing. Few people get it right when they try to sell everything when they are scared, and back up the truck for stock buys when they feel the market is strong. Emotions operate on a buy high, sell low plan, which is a losing strategy. Everyone wanted to buy Bitcoin in December of 2017, when it soared to a high of $20,000. Those who did are very sorry, as Bitcoin today is worth just $3,370/coin, just one year later (as of December 7, 2018). Stocks are down on the year, with a lot of volatility and could weaken next week further. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest

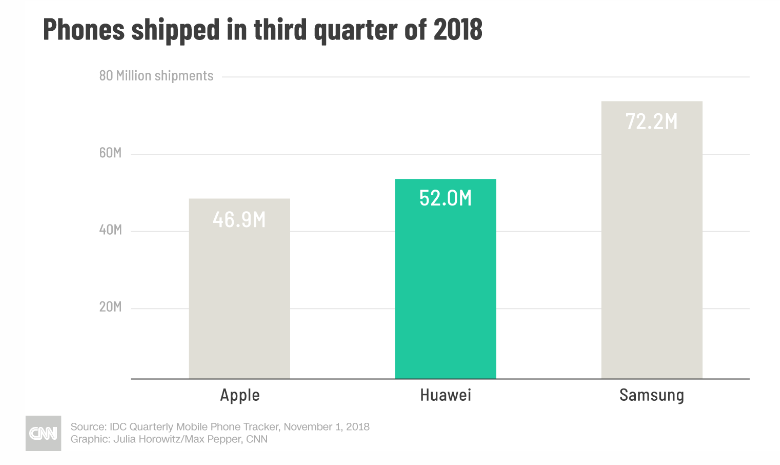

Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Meng Wanzhou (Sabrina Meng) is the deputy chairwoman and CFO of Huawei. She was arrested in Canada on December 5, 2018 and is awaiting extradition to the U.S. Details of the charges are not available at this time, at the request of her legal team. However, many news outlets are reporting that she is accused of Iran sanctions violations. Surviving the Plunge. Stocks dropped over 800 points again yesterday. The Dow Jones Industrial Average survived the plunge, however, settling in for losses of 78 by the end of the trading day (on Thursday, December 6, 2018). That dive exacerbated Tuesday’s Dow drop of 799, which came on the heels of a week-long rally of over 1500 points (between November 23, 2018 and December 3, 2018). If you’re getting a bit dizzy, welcome to the club. Stocks have been on a rollercoaster, and are flat on the year. Bonds have lost money. What’s Going On This Time? The overriding challenges faced by the U.S. economy were outlined in the Financial Stability Report that was released by the Federal Reserve Board on November 28, 2018. Click to access the 12-points of concern that were outlined in that report, which include over-leverage and asset bubbles. In short, there is too much leverage in the world, and low-interest rates create asset bubbles. Rising interest rates will start affecting rate-sensitive industries and assets first, such as corporations with too much debt and real estate. Retail was already in trouble. The California wildfires didn’t help. Tariffs increased costs in an already troubled and over-leveraged U.S. legacy auto industry. This winter, there were a few more challenges that were thrown in the mix. 1. The U.S. trade deficit hit highs not seen since the George W. Bush years, and is the highest ever recorded with China. In October 2018, the U.S. trade deficit in goods and services hit $55.5 billion, and is on track for over $600 billion in deficit for 2018. Tariffs have resulted in a worse trade deficit with China, as you can see by linking to the historical data. 2. Meng Wanzhou, the CFO and vice chairwoman of Huawei, was arrested in Canada, and is expected to be extradited to the U.S. This is huge because Huawei is actually bigger than Apple in terms of global smart phone sales. Imagine China arresting Steve Jobs! (Meng Wanzhou is the daughter of Huawei’s founder and CEO Ren Zhengfei.) Markets around the world dropped the day of her arrest. China has called for her release. Hope of a trade deal between the U.S. and China just evanesced with this arrest. 3. General Motors’ closure of 5 plants continues to make headlines. GM CEO Mary Barra is closing down plants that are underperforming, so that the focus can be on meeting consumer demand – away from sedans and toward SUVs, crossovers and trucks. She’s also doubling engineering resources in electric and autonomous vehicles. The restructuring charges will come in at $3.0 - $3.8 billion. GM’s loss was $3.9 billion in 2017. So, the 2018 restructuring and plant closures are not making investors or Congress very happy, even though the overriding GM vision and business plan appear to be sound, given the challenges the company faces. 4. PG&E and So Cal Edison are being investigated for the November 2018 California fires that wiped out Paradise, California and burned up at least 670 structures in Malibu (including over 400 homes), respectively. PG&E has lost half of its share price value since the fire. How Can You Protect Yourself? At minimum, you need to: 1. Know What You Own. 2. Rebalance at Least Once a Year. 3. Put a Better Plan in Place. Know What You Own. Not one financial plan that I’ve reviewed this year is properly diversified. Most people, even if they have pages and pages of holdings and funds, basically have large caps and bonds. All of them are at risk of losing half of their retirement (or more) – just as they did in the last two recessions. By contrast, the easy-as-a-pie-chart nest egg strategies that I developed in 1999 earned gains in the last two recessions and have outperformed the bull markets in between. Click to access a video of Nilo Bolden talking about just how easy this strategy is. If you start by knowing what you own, then you can compare that to my sample nest egg pie charts to get safe, protected and hot before the next correction. Call 310-430-2397 or email [email protected] to receive links to my free web apps, where you can personalize your own sample nest egg pie chart. If you’d like help knowing what you own, then ask for an unbiased second opinion. We’re here to help. Now is the time to be the boss of your money. Blind faith and hope are not good strategies. Rebalance at Least Once a Year. Annual rebalancing is key! It puts you on an automated buy low/sell high schedule for your diversified nest egg. This works far better than losing more than half every 8-10 years, and then taking the next decade to crawl back to even, which is what Buy and Hope investors are experiencing. How Can You Put a Better Plan in Place? Here’s a To-Do Check List.

The Bottom Line The average person loses money in a flat market, due to the fees. (In other words, you’ve likely lost money this year.) In the last two downturns, most developed world denizens lost more than half of their retirement. So, knowing what you own and understanding how to get safe, diversified, protected and hot now, should be priority one. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Click to read my blog on why you should get safe in December (this month). If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest