|

People have been emailing me about cannabis for a couple of years now. I’ve been resistant for a few reasons.

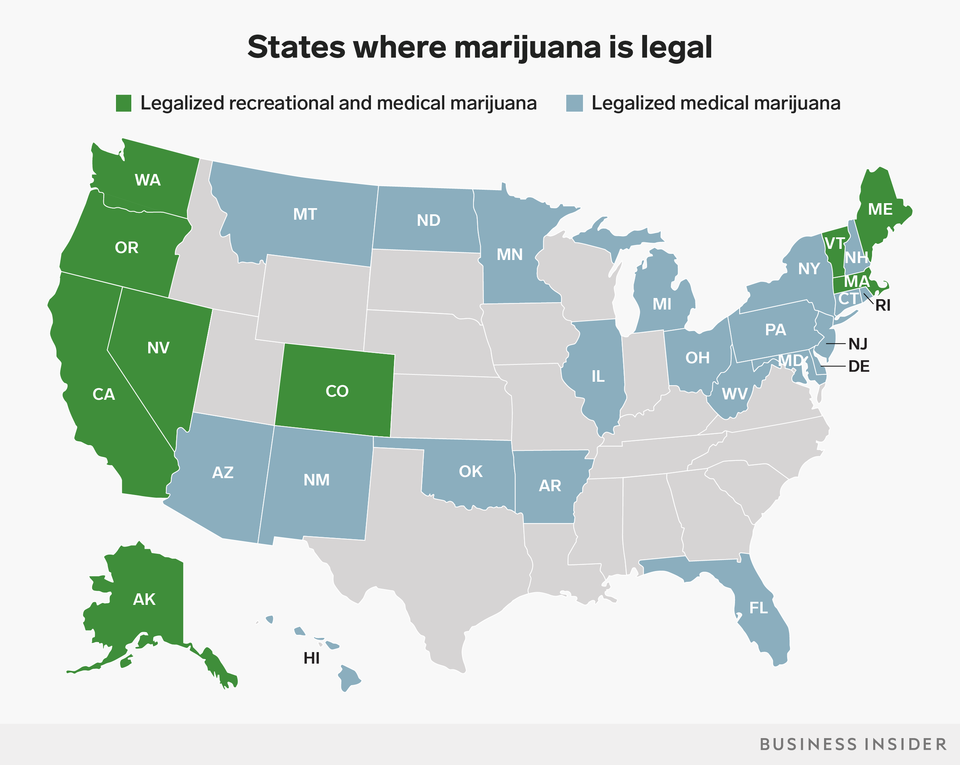

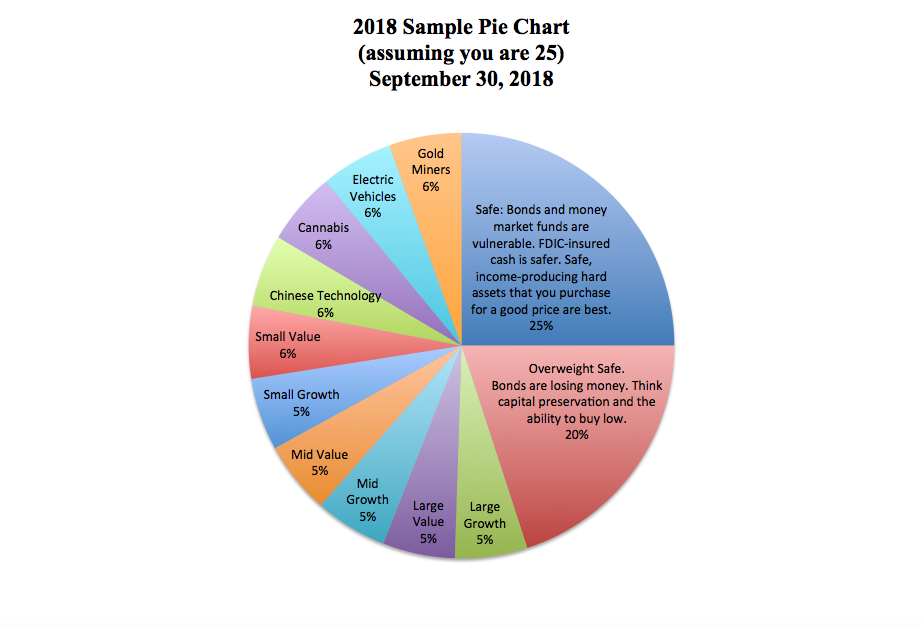

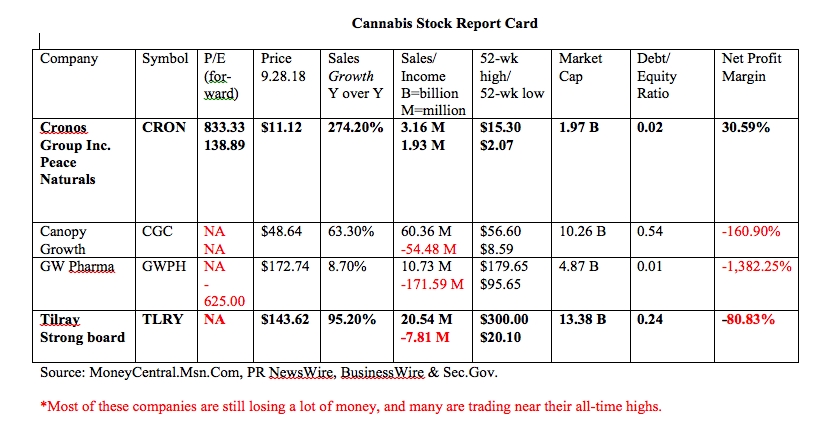

However, with marijuana becoming legal in Canada on October 17, 2018, this is an industry that simply can no longer be ignored (unless you have a moral reason). Here are some very important things to consider before you invest in a marijuana company. 1. The Big Picture 2. Cannabis ETFs 3. Investing in Individual Companies 4. How Much Should You Invest? 5. The 3-Ingredient Recipe for Cooking Up Profits 6. Speculating on New Products and Private Placements 7. Beware of Scam Artists and Social/Email Pump and Dump Schemes 1. The Big Picture It’s important to remember that legal marijuana is a brand new industry – similar to the Internet in the late 90s. (Getting high has been popular for a long time, though criminal.) New industries have a boom period, then a bust, and then a longer period of becoming mainstream. Amazon is worth $2003/share today. However, in between 2000 and 2002, Amazon’s price dropped from $86/share to as low as $6/share. It took almost a decade to crawl back to even. Priceline saw similar price implosions. Many Internet companies, like eToys, disappeared altogether. 2. Cannabis ETFs This is such a new field that your fund choices are very limited. ETF Managers Trust Alternative Harvest Fund (symbol MJ) includes some of the top cannabis companies. However, ETF Manager’s Trust and its CEO Sam Masucci have already seen a slew of lawsuits, which adds to the management costs of the funds. Additionally, Masucci’s last ETF provider, Factor Shares, went belly-up in 2013, when investors were ultimately charged fees of almost 33% (source: Seeking Alpha)! The MJ prospectus includes line items for distribution and service fees and “other” fees, which will be “accrued daily and taken into account for purposes of determining net asset value,” opening the door for unlimited, unexpected costs to own the ETF. Before FactorShares, Masucci was involved in another arbitration and award due to a deal with Bear Stearns in 2000 (source: Bloomberg). So, the top dog at ETF Managers Trust does not have a great track record, which is a huge red flag. 3. Investing in Individual Companies Since the ETF options for cannabis are few and undesirable at this time, you’re left with investing in individual marijuana companies. Most people are not as good at stock-picking as Warren Buffett and should, therefore, limit their gamble to money they are willing to lose. If you do wish to take on the higher risk of investing in a single company, then be sure to learn how to pick a leader, and how to purchase the company for a good price. 4. How Much Should You Invest? For most investors, it is not appropriate to invest any of your retirement in individual companies. You should only invest as much as you are willing to lose (perhaps education or fun money), and never make a Hail Mary gamble. A rule of thumb, if you choose to invest some of your liquid assets, would be to limit your investment to one Hot Slice of your at-risk assets. You can mock up a sample pie chart using my Easy-as-a-Pie-Chart web app (click to access). Here’s a sample pie chart, based upon your age being 25. If your nest egg were $100,000, and you were overweighting 20% safe, then the appropriate hot slice investment would be $5,500. Remember to always keep a percentage equal to your age safe. Overweight up to 20% additional safe due to it being the 10th year of the current bull market. And then divide the remaining at-risk amount by 10. 5. The 3-Ingredient Recipe for Cooking Up Profits 1. Start with what you know. 2. Pick the leader. 3. Buy low and sell high. Learn more about how this recipe works in my first book, Put Your Money Where Your Heart Is. Using a Stock Report Card ® and asking Four Simple Questions ® can help you to determine the winner (both are outlined in detail in my book). Here’s a sample Stock Report Card on a few of the more popular, publicly traded cannabis companies. 6. Speculating on New Products and Private Placements Keith Villa, the brewmaster behind Blue Moon has left MolsonCoors to launch Ceria Beverages, a cannabis-infused, new non-alcoholic brew using the technology of Ebbu. Province Brands, founded by one of the co-founders of Ebbu, is prospecting the cannabis beer space as well. Province Brands just completed a Reverse Takeover, which will allow the company to list on the TSX venture exchange, even though it is only a few months old. http://ceriabeverages.com/ https://www.newswire.ca/news-releases/province-brands-of-canada-announces-reverse-takeover-of-colson-capital-corporation-684565321.html https://realmoney.thestreet.com/articles/07/05/2018/cannabis-beer-giving-investors-fresh-buzz Keith Villa is attributed with creating the fever for craft beer, with Blue Moon. Given the popularity of cannabis and social drinking, Mile-high beer might be the next micro-brewery hit. Still it is very early stage and there will be a lot of startup costs before these companies hit cash-break even. Be sure you’re willing to weather the storms from here to there, and that you aren’t investing in a company that already has too many liabilities to make it. If you don’t understand profit and loss statements, or don’t have access to the financials, then you are investing with blind faith in a very risky endeavor – something that successful venture capitalists would never do. (And you are investing like a VC if you plunk down money in an early-stage, unproven industry.) 7. Beware of Scam Artists There are a lot of bad actors in this space, pretending to be legitimate, who are trying to make a quick buck. It’s important to remember that the titans of the cannabis industry were criminals just a few years ago. Doing your due diligence is key to weeding out the chaff. If the company is not traded on the NASDAQ or New York Stock Exchanges, then it’s a good idea to avoid the investment as a general rule. Pump and Dump schemes abound off the boards. See my Penny Pot Stocks warning of last year for multiple examples of social media scams that were very popular and toxic. If you don’t know how to determine whether or not a company is on the Big Boards, then your next investment should be learning how to invest. (Learn more about my Investor Educational Retreats at NataliePace.com.) Learning how to pick great companies can help you to pick hot industries in your nest egg and avoid the bailouts. As an example, in 2006, I began encouraging investors to overweight the NASDAQ Composite Index and underweight the Dow Jones Industrial Average, particularly overleveraged companies, like General Electric. In the wake of the Great Recession, the NASDAQ doubled the returns of the DJIA. General Electric, which has slashed its dividend in half and lost more than half of its share price in the last year, is not the only overleveraged, problematic Blue Chip. This information is so important that we spend one full day on it at my Investor Educational Retreats. So, if you want to develop your skillset on stock picking, protect your nest egg from the next downturn and even learn how to save thousands annually with smarter choices on your big-ticket bills, then call 310-430-2397 or email info @ NataliePace.com to join me in Arizona Oct. 13-15, 2018 or in Santa Monica, California Feb. 16-18, 2019. Other Blogs of Interest Penny Pot Stocks. Interest Rates Set to Jump 70%. Watch out investors and homeowners! Should I Invest in Ford and General Electric? The Tesla 3 Becomes the Top Selling Car in the U.S. Cryptocurrency Scams and Phishers. Back to School Stock Sales. Gold vs. Facebook. Nike Share Price and the Kaepernick Ad. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Disclosure: I own shares in some cannabis companies. 14/7/2020 10:15:29 pm

In today’s time entrepreneurs have found their passion and determination in building in this filed and they are very much happy to share their experiences with the world as well. Its good that they are setting good examples for others as well who wanted to come in to this filed. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed