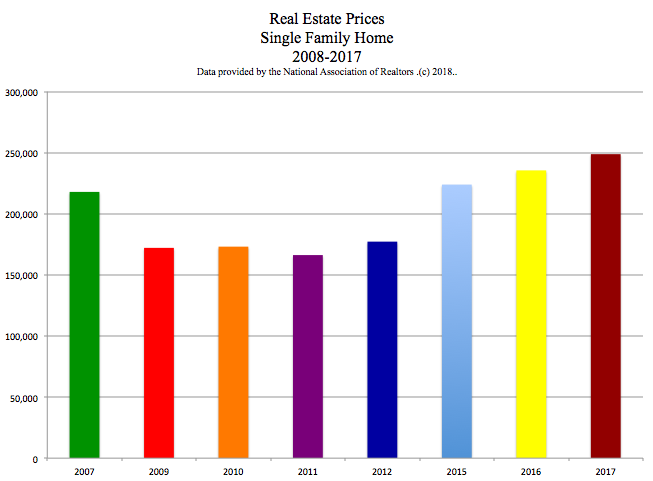

Dear Natalie: I Sold My Facebook and Bought Gold. Signed, What a Waste! Dear What a …! Successful investing is never about looking backwards, and is always about diversification, asset allocation, balance and using data, statistics and time-proven systems to determine what the best return on investment will be going forward. That may sound like a lot, but, it’s actually easy as a pie-chart. You’ll also need to think more like an Olympian. Champions focus on winning. Obstacles are part of the game. Show me an investor who claims to have never been “down,” and I’ll show you Bernie Madoff. It’s what your aggregate overall return is that counts. That and sticking to a winning game plan, using a time-proven system, and not veering off with wild abandon every time there is a move up or down, which happens frequently in today’s volatile market place. If you let your fear (or irrational exuberance) do your trading, you’ll regret it. I was chugging along at 4.5% in Certificates of Deposit for most of 2000 and 2001. I wasn’t interested in buying stocks at the top of an overvalued market. Cash turned out to be the top performing asset in 2000. Then, I almost tripled my money in three short months at the end of 2001. (Yes, right after 9/11.) If you look at your entire investment strategy, you’ve been doing quite well in returns, too. If you have been following the pie chart faithfully since you first came to my Investor Educational Retreat in 2011, then you actually have been invested in Facebook – in your nest egg large cap growth funds. By leaning into technology and NASDAQ (i.e. getting hot and avoiding the bailouts), you have tripled your money in the NASDAQ Composite Index (the exchange where Facebook is traded) since you 2011. The Dow Jones Industrial Average performed well, too, but was completely dusted by the NASDAQ. Here are just a few ways that I would reframe my thinking from “What a Waste” into “What an Opportunity,” “What a Lesson,” and even “Congratulations.” What an Opportunity. If you believe in a company or an asset, and the price goes down, that’s an opportunity to buy low. So, if you were rebalancing your nest egg right now, the massively large slice of your large cap growth stocks is telling you to trim back and sell high. The slimmer slice of gold could be telling you to buy low, unless you believe that gold has had its day and will never come back. What a Lesson. It’s never all or nothing. Market timing just doesn’t work. Hail Mary investments, going all on in what you have been sold as a sure shot, more often crash and burn. In truth, if you were following my pie chart system to a Tee, you have been very invested in Facebook and have benefitted over the last decade from the Facebook run-up safely – in funds, along with over great performers, like Amazon, Google and Nvidia. You have also limited your exposure to gold to just a slice of your portfolio. What a Growth Experience You are now feeling in spades what I’ve been telling you for years. It takes time, experience, wisdom and discipline to get to the point where buying low is your first, and pleasurable, thought. Most people freak out and sell low. You’ll never become a champion investor unless you lean into wisdom and time-proven systems and stop whining about market volatility, which isn’t going away. Exercise your emotional investment muscles! You’ll become a much stronger investor if you do. Celebrate Your Victories. Before the PIIGS bond crises, I talked about safe, income-producing hard assets that you purchase for a good price as holding their value better than bonds. Real estate was still selling near ten-year lows from 2009-2012. You heeded that and purchased a home, which has likely increased in value tremendously. Many homes have doubled in value since the real estate lows in 2009, particularly those along the coasts and other cities with job growth. (The chart below is a nationwide average.) Conversely, between 2005 and 2008, I was screaming from the rooftops not to buy real estate – something that I’m back to bellowing again. Over 10 million homes went to auction in the wake of the Great Recession. Real Estate prices are higher than ever today, and unaffordable to the majority of denizens in many cities. Rising interest rates will limit the buying pool even further. So, home buyer be aware! Counting your victories is important because it helps you to douse the stomach acid and apply reason to whether or not you should be buying more gold at a lower price, waiting for it to increase in value or getting out, even at a loss. There are a few blogs below that might help you to use data, statistics and probability to inform your decision. Work Out and Get Stronger If you expect your investments to increase in value 100% of the time, then you’re setting yourself up for a lot of anger. The markets are volatile. No one is perfect and no one bats a thousand. That’s why you diversify, keep enough safe and rebalance annually in your nest egg, instead of stewing over it all the time. (How many superstar athletes spend a great deal of time complaining and worrying about a loss?) A good plan protects you from downturns, avoids the bailouts, keeps you hot, and earns gains when most people are losing more than half of their retirement. Stick to your game plan, and work out your emotions to become a stronger investor athlete. Let smart discipline be your investment strategy, and you will be a lot more successful than if you succumb to anger, sadness, regret, stomach acid or euphoria, or if you let any hormone color your focus. In the short run, Wall Street is a popularity contest. But in the long run, it’s always back to fundamentals. There is a lot more volatility today, due to the influence of high frequency traders and hedge funds. So, today’s vanquish can turn to tomorrow’s victory more rapidly than you might think. In that scenario, any moment wasted on worry is just that, a waste. Lastly, I want to thank you for volunteering at the retreats so many times. Your presence in the room is always welcome. We love having you there! If you'd like to learn these easy-as-a-pie-chart nest egg strategies, how to protect your assets, earn gains in recessions (like Nilo Bolden did), reduce debt faster than any other fix and even learn to save thousands of dollars every year in our Stop Making the Billionaires Rich at your own expense plan, then call 310-430-2397. We've got two retreats coming up. The sooner you get this information, the faster your life transforms. Click to see Nilo Bolden's testimonial. Click on the flyers below to learn the 15+ things you'll learn, check out pricing and see even more testimonials. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed