|

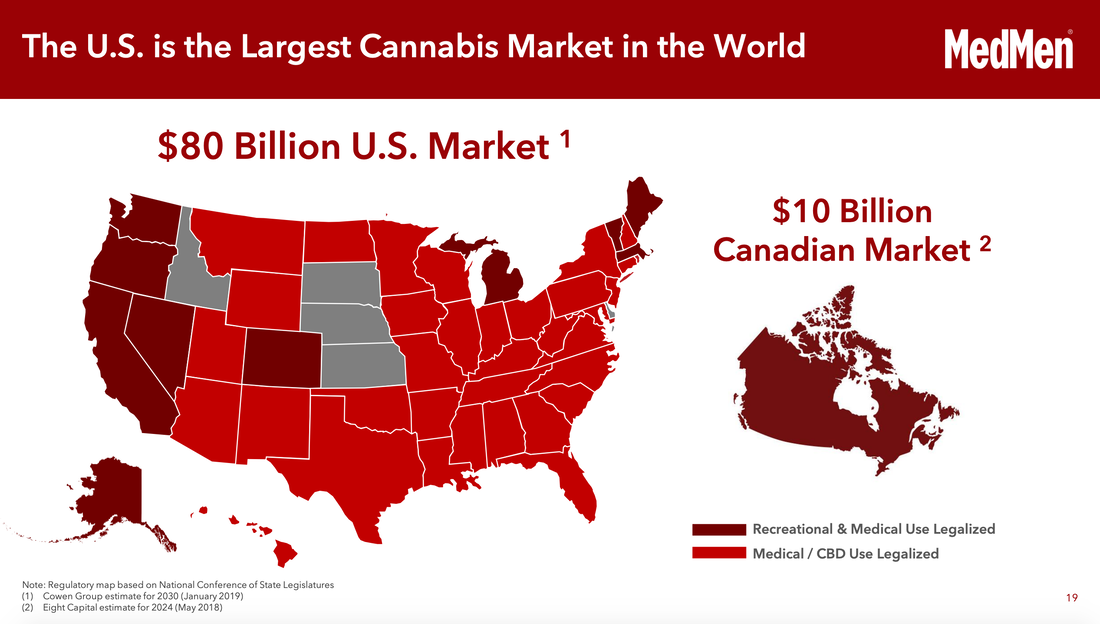

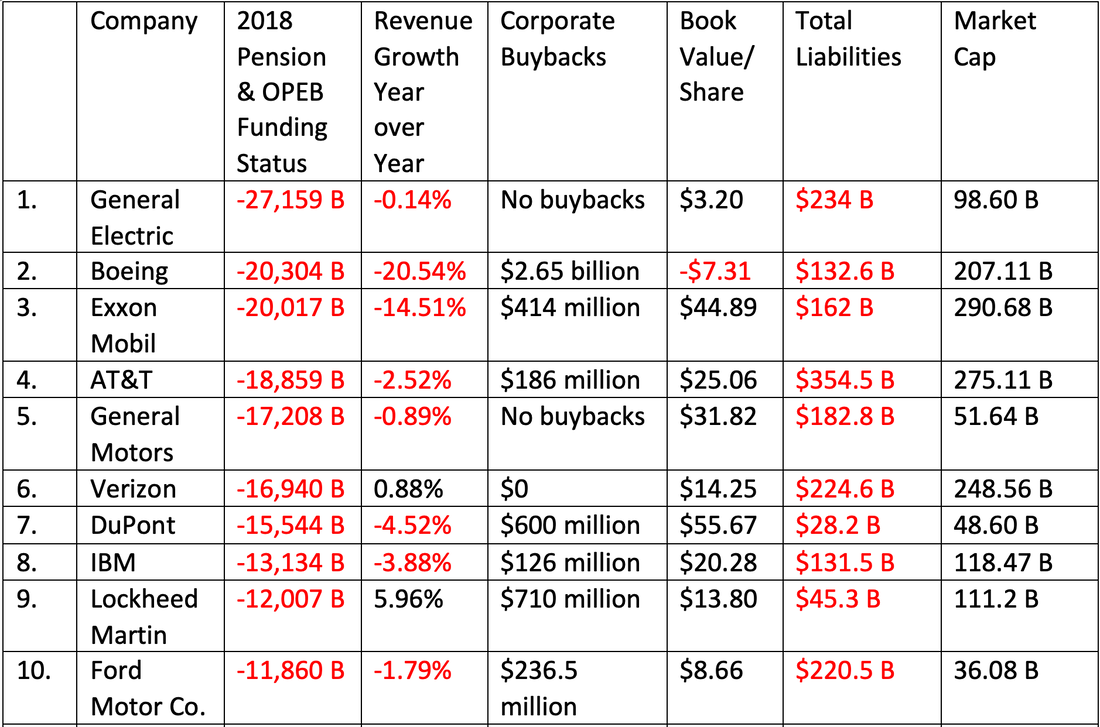

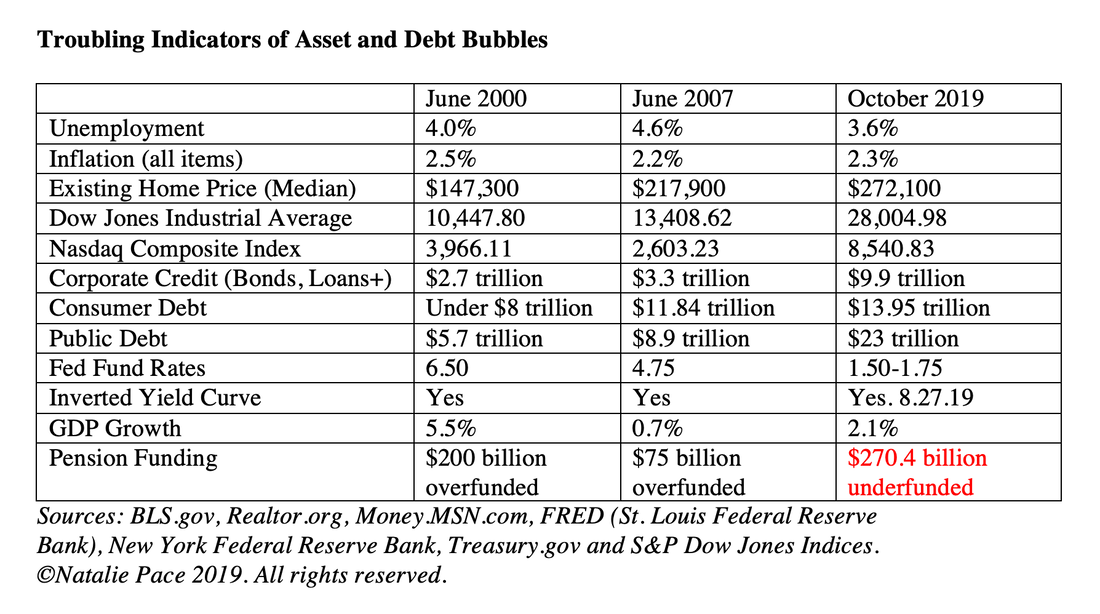

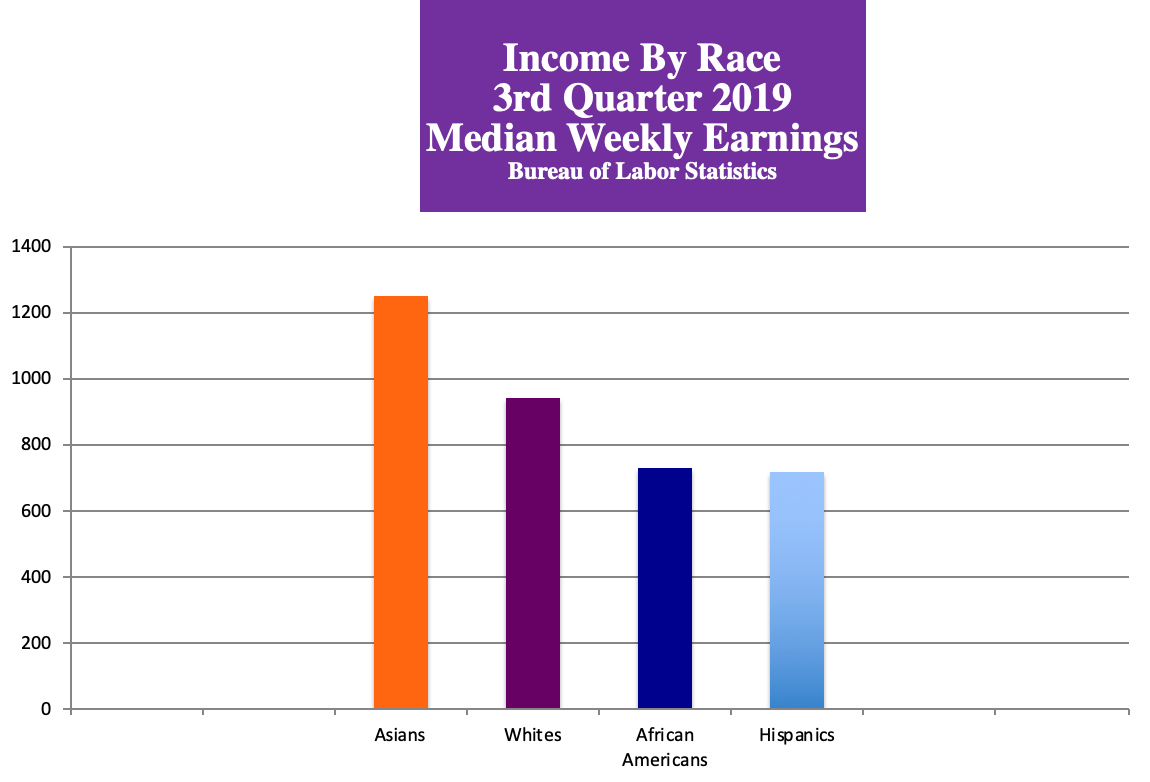

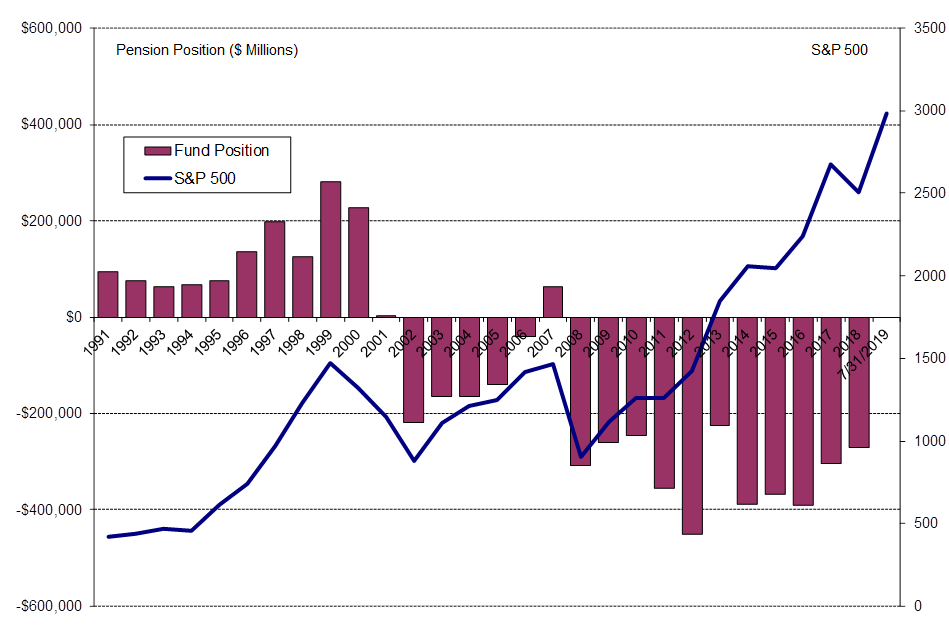

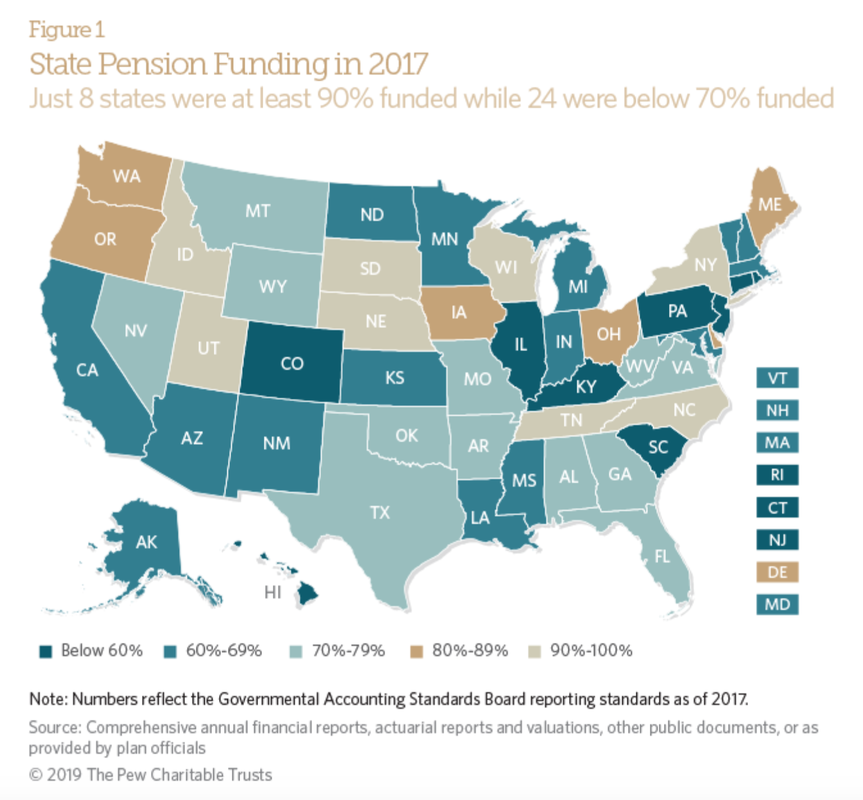

Includes 11 prosperity, abundance and wealth tips for 2020. For additional information on the topics below, listen back to my free teleconference at BlogTalkRadio.com/NataliePace. There is a list of relevant blogs on each subject at the end of this blog. The good news is that only 30-35% of SP Global economists expect a recession in 2020, according to a report released on 12.16.19. On 12.11.19, National Association of Realtors’ economists concurred, pegging the odds of a 2020 recession at 29%. If they are right, and easy money keeps flowing into corporations, so that they can borrow more on the cheap to buy back their own stock, then Main Street has a little time to get their ducks in a row. If the new announcement that Boeing has temporarily halted 737 Max production tips the balance down, then the time frame to make sure that your assets are properly protected and diversified is now. In either scenario, the general theme is: “Fix the roof while the sun is still shining.” If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. You must also know what’s safe in a world where bonds lost money in 2018, money market funds are subject to redemption gates and liquidity fees, insurance companies have high-risk junk bond exposure (and are not FDIC-insured) and many bank products have fine print that reduces their liability and your recovery. I spend one full day on this topic at my Investor Educational Retreats. Call 310-430-2397 to learn more. After extensive research, below are the outlooks on a number of different segments of the economy. Real Estate: There should be continued downward pressure on prices in the U.S. and Canada. In the housing sector, this is largely due to unaffordability. Tighter mortgage standards in Canada are also weighing on home prices. In commercial real estate, this has a lot to do with the Retail Apocalypse.  Photo: Haight Ashbury, San Francisco, USA / Personal picture taken by user Urban, 2004. Wiki Commons license. Used with permission. San Francisco is one of the most unaffordable cities in the U.S. According to Attom Data, the average wage earner cannot afford to buy a home in 74% of U.S. housing markets. Stocks: Volatility, with downward pressure. Stocks lost money in 2018. Since then, corporate buybacks have brought the market back to all-time highs. Borrowing cheaply to buy back stock has been en vogue for years with corporations. When that dries up, the markets head south fast, as we saw in December of last year, when the Dow dropped 12% in just a few weeks. (Click to learn more in my blog on Apple’s suspension of buybacks last December, which resulted in the worst December on Wall Street since the Great Depression.) As a result of all of that corporate borrowing, over 50% of corporate bonds are now at the lowest rung, just above junk status. However, recently, bond managers have been pushing back and demanding covenants and to see a pathway to profitability. The free money faucet is no longer gushing. Without corporate buybacks, the lofty stock evaluations currently rampant could become far less popular. Bonds: Vulnerable. Very vulnerable. Bonds are supposed to be the safe, buoyant side of your nest egg. However, corporate bond funds lost in tandem with stocks in 2018. This is very problematic because this is the side of your nest egg that is not supposed to lose money! Bonds are so leveraged that the Federal Reserve Board is monitoring them. As the Federal Reserve Board outlined in their November 2019 Financial Stability Report, “Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards... Hedge fund leverage remains elevated.” I’ve already mentioned the crowd of bonds at the lowest rung of investment grade. However, junk bonds are all crowded at the bottom rung, too, just above default. According to SP Global, “The number of U.S. issuers that have their credit ratings at ‘B-‘ or below with ratings on a negative outlook or negative credit watch is at 179, portending more downgrades into the ‘CCC’ range and defaults. This is the highest this metric has been in more than a decade.” Energy, retail and consumer products are the most vulnerable. A lot of this risk is packaged into a CLO (Collateralized Loan Obligation) and sold to mutual funds, institutional funds, etc. Since many of the funds have a limit on how much risk they can hold, downgrades run the risk of becoming illiquid and yield payments may have to be halted, according to SP Global. Cannabis: The cannabis industry has the highest sales growth of any industry on Wall Street. Nothing comes close. Companies are borrowing to build out, to meet demand. However, credit has tightened, with managers demanding covenants and a pathway to profitability. This means that companies that are undercapitalized may get into a credit squeeze. There could be bankruptcies and consolidation. This is a new, and normal, phase that every nascent industry goes through. So, if you’re to invest here, you have to know the competitive edge of the company, who is tending the hen house and how much cash and access to capital that the company has. The company that innovates the best product will shoot to the top of the pack, and potentially be worth multiples more than the competition, as happened to Apple when they launched the world’s first smart phone. Gold: Gold is a good hedge against a downturn in stocks and bonds. When stocks go down, gold typically goes up. There is a high correlation with this. There is also a high correlation with high oil prices. Oil prices are fairly low right now. OPEC and Russia want to get prices higher, but U.S. production is moderating that attempt. Higher gold prices are also associated with a weaker dollar. Currently, the dollar is still very strong, which has subdued a jump into gold. I currently have two hot slices in my nest egg pie charts. It's important to remember, however, that politicians, banks and corporations can price-fix this asset. So, you never want to invest the farm on any one asset. In the Great Depression, gold was illegal to own and you had to sell it back to the government. That's how we built up Ft. Knox. A few years ago, some big banks had to pay a fine for price-fixing gold. Small business: Vulnerable. Small business owners, particularly those operating cash negative or with low margins, are vulnerable when the economy turns. There is always a recession. The only question is when. As we enter a period where the global economy is starting to weaken, it’s important to have confidence in your business model and in your ability to withstand a period of weaker revenue. Travel and Hospitality: When economies weaken, industries reliant upon discretionary spending are the canary in the coal mine. Travel and hospitality (including hotels and restaurants) typically are the first to suffer. Retail: Etail wins. Brick and mortar stores have been suffering in the Retail Apocalypse. We’ve seen an unprecedented number of bankruptcies over the last few years. Pensions and Other Post-Employment Benefits: Pensions and other post-employment benefits are underfunded in S&P500 companies by $406 billion. The corporations that are the most severely underfunded tend to be those with the highest debt, which pay the highest dividends to shareholders. Many of the corporations are also buying back their own stock. In other words, the borrowed money is going to shareholders and C-level executives, at the expense of R&D, workers and prior employees. So, what should you do about a weakening, over-leveraged global economy? Strategies to Navigate the Late Stage of the Business Cycle and Heightened Anxiety 1. Intergenerational and micro-housing. Can you better monetize your home? Can you keep the money in the family? 2. Price matters. Challenge: Know what your bottom line is. Are you willing to risk half of that? Assets are at an all-time high. Step off of the Asset Bubble Rollercoaster and step into time-proven strategies. Call 310-430-2397 to register for an upcoming Investor Educational Retreat, where you can learn what works and implement them now. 3. Annual Rebalancing with Proper Diversification. This is a buy low, sell high plan on auto-pilot, which earned gains in the last two recessions and has outperformed the bull markets in between. It also takes the emotions out of investing. For most of Main Street, using a time-proven system and pulling the emotions out of the trade are essential. 4. Bonds, Money Market Funds, Annuities, Insurance and High-Yield Bank Products are not as safe as you have been sold. It’s time to read the fine print and understand what’s safe in a world designed for the banks to be able to do a “bail-in” on your dime. There is an entire section on what’s safe in my book The ABCs of Money. We spend one full day on this at our Investor Educational Retreats. 5. Hard Assets Hold Their Value Better Than Paper Assets in an Over-Leveraged World. There are a few caveats to this, however. 1) Be sure that you are not overleveraged yourself, and that you can afford your asset. 2) Never buy high. 3) Safe, income producing hard assets that you purchase for a good price are key. Every word in that sentence is critically important. 4) Cash could lose buying power, however not as fast as an over-leveraged bond. 5) This period of leverage should have a time-limit. 6) Most people don’t buy low in recessions because they can’t. They’ve lost too much money. So, having cash and being a patient buyer allows you to buy low when others are cycling through a season of pain, stress and losses. 6. The Thrive Budget. Consumer debt just hit an all-time high of $14 trillion. 3.2 million homes are still seriously underwater. Is your budget or your home underwater? It's a good idea to fix this now. Again, "Fix the roof while the sun is still shining." There are solutions. However, you’re not going to get the best strategies for you from the debt collector or the Main Stream Media and group think. If that worked, we wouldn’t have $14 trillion in consumer debt and 3.2 million homes still seriously underwater (even while real estate prices are near an all-time high). 7. The ABCs of Money for College. Get a better degree for half the price. Parents: start the planning and visioning process in kindergarten! $1.5 trillion in student loan debt, with 20% of the loans delinquent are giant red flags of just how important early college planning is. I have a new The ABCs of Money for College ebook being published soon. It will be free for a limited time. Email [email protected] if you would like to be alerted when it is published. 7. Bonds Lost Money Last Year. REIT warning. 50% of Corporate Bonds are at the lowest level, just above junk status. Be careful of the other products that will be sold to you if you tell your financial advisor that you are no longer interested in bonds. These could be even more risky than bonds. (Private placement REITs and annuities offer high commissions to salesmen.) 8. Challenge: What’s Your Bottom Line? How much do you currently have in your nest egg? Are you willing to lose half of it? If not, then now is the time to know what you own and why you own it. It’s time to get safe, protected, hot and diversified. Do not simply “trust” that this is being done for you. That didn’t work out very well for Main Street during the last two recessions. 9. If you wait for the headlines it will be too late to protect yourself. The Feds didn’t admit that the economy was in a meltdown until October of 2008 – after the Lehman Bros. bankruptcy. Stocks had already lost 45% by then. It could take a decade to recover from losses like that. It took The NASDAQ 15 years to make it back to the highs of 2000. In December of 2018, stocks lost 12% before you could even blink. 10. Don’t Leverage Your Life. If you’re having to put basic needs on credit cards to make ends meet, then it’s time to get realistic and adopt a better plan. Yes, there are solutions. No, cutting out café lattes is not going to solve the problem. 11. Low interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, real estate was the nexus, with CDOs (Collateralized Debt Obligations) and SIVs (Structured Investment Vehicles) catapulting the leverage into the stratosphere. This time around, corporate bonds are likely to be the culprit, with CLOs (Collateralized Loan Obligations) as Ground Zero of the downslide. “The current low interest rate environment may limit the ability of monetary policy to support the economy,” Jerome Powell testifying to Congress on November 19, 2019. Credit managers are unwilling to take on risk more than 22-months out. Investors are now demanding a clear path to profitability before buying into IPOs. Bond managers are saying No Thanks to covenant lite bonds and loans. These are all warning signs. The prudent Main Street investor would do well to take the foot off the gas, and look around to know which road you really are on. Are you holding long-term, high-risk bonds that are vulnerable to capital loss – on the safe side of your nest egg? Are you locked into a 401k term date mutual fund? Are you over-leveraged into stocks? There might be more solutions than you are aware of. Wisdom is the cure. The time to find the cure is now. It’s time to know what you own and why you own it. If you’re interested in receiving an unbiased 2nd opinion on your current plan, call 310-430-2397 or email [email protected] for pricing and information. "An investment in knowledge pays the best interest." Benjamin Franklin. Learn the ABCs of Money that we all should have received in high school at one of our Investor Educational Retreats, and watch how fast your life transforms. Other Blogs of Interest The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Nature’s Prince and His Twin Eco Cities. The benefits (body, mind, spirit) of greening your life. While some CEOs stand accused of financing the burning of the Amazon Rain Forests, and other Presidents strip back environmental protections of our planet, there is one leader who has been advocating for more than four decades for greater Harmony between mankind and the planet that nurtures and sustains us. He’s H.R.H. The Prince of Wales and Heir Apparent to Her Majesty The Queen. Those who work closely with him affectionately refer to him as “The Boss.” He is also Nature’s Prince and the author of the book Harmony, placing sustainability at the heart of all he does. The Prince of Wales leads by example. His Home Farm is organic and has been since 1985. (You can have champagne tea and visit the Highgrove Gardens.) He drives an electric car. The Duke of Cambridge (Prince William) founded Active for Wildlife, bringing together a collaboration of conservation organizations to protect natural resources, promote environmental education and stop illegal trafficking of ivory products. The Duke of Sussex (Prince Harry) is the President of African Parks, a nonprofit conservation organization in Malawi. He also advocated for recycling during his military days. Reaching beyond his immediate family, The Prince of Wales and the Duchy of Cornwall are creating mixed use communities that make it easier for those who live there to enjoy the body/mind/soul benefits of living green. Poundbury, Dorset Poundbury, Dorset In October of 1993, The Prince of Wales and famed urban designer Leon Krier set out to create a sustainable community on the outskirts of Dorchester, called Poundbury. The streets were created to promote walking and biking, particularly for day trips to the market, employing Krier’s famous bike and pedestrian friendly traffic calming strategies. Most everything is recycled in Poundbury, including food waste (which accounts for approximately 22% of waste in most communities, according to EPA.gov). The heat is powered by anaerobic digestion. The main food market, Waitrose, has eliminated plastic carryout bags, and carries organic food and products. The Brace of Butchers offers local meat, produce and milk for sale, which are available in bulk, i.e. not wrapped in plastic. The Potting Shed features organic fare, wines and prosecco. While staying in Poundbury in December of this year, I had the good fortune of being hosted by a couple who commute by bicycle daily, 16-24 miles round trip. This happens even in winter. Sometimes if the weather forecast calls for rain on the ride home, they’ll opt for driving. However, biking is “play” and driving is a bit of a grudge for them. According to Li Watkins, “You see the birds and butterflies. It’s such a different world than listening to the radio, with your foot on the gas pedal.” Li and her husband Jonathan purchased a 2nd home in Poundbury (their 1st home is in Bridport), partially to be able to do a bike commute, and also so that their daughter could attend the local school. Katie and Pete Smith used to commute two hours daily to work. Poole is about 30 miles from Poundbury. However, afternoon school traffic during the return trip home can turn the route into a stop and go nightmare of an hour and a half. The couple found similar jobs in food service in Poundbury, and now walk to work. “It’s lovely. Now we leave the house and we’re here in five minutes,” Katie told me. “We used to come home so stressed.” They also save over $4,000 per year that used to be spent on gasoline. The additional savings on wear and tear to the car makes the money that can now be spent on other things they enjoy more, such as their children and weekends off, even higher. Over 50% of the children at Damers First School in Poundbury commute by bike or scooter. Under the aegis of Head Teacher Catherine Smith, and with the tireless campaigning of Damers eco warrior Edd Moore, the Damers school children have also led an award-winning no plastic campaign in Poundbury and Dorchester. They started by convincing the school authorities to deliver their fruit and produce without plastic wrapping. They then developed a Waxtastic No Plastic cling film, which they sell to the locals. The Damers Eco Club members, with Edd Moore at the helm, challenge local businesses to nix plastic wrapped food, plastic carryout bags and plastic straws. (Click to learn more about Damers First School.) Their recycling program has helped to fund outdoor classrooms, gardens, chickens, turtles, a pond, and other hands-on learning opportunities that make school fun. In 2019, Damers First School in Poundbury was named the Eco-School of the Year (a national achievement) and was crowned the Surfers Against Sewage (SAS) Plastic Free Schools’ Champion. Learn more about Eco-Schools, a global green curriculum for all school ages, at https://www.ecoschools.global. There is more to be done in the ongoing efforts to green Poundbury. There are far too many commuters zipping down city centers that were designed for mixed use. Some folks, out of habit, still drive a few blocks for groceries or to the local pub. However, as we can see with Catherine Smith, Edd Moore, Li and Jonathan Watkins, Katie and Pete Smith, Fran Leaper and many more Poundbury denizens and leaders, sustainability initiatives are now being led by the community members themselves. That has freed up the Duchy of Cornwall team to turn their efforts to a twin eco-city that some are calling Poundbury by the Shore – Nansladen, Cornwall. Nansladen (Nansladen is Cornish for broad valley) Nansladen is in Cornwall, near the famous surfing beach town of Newquay – a popular seaside tourist attraction. The area is more affordable than Poundbury (at least for now), with a pastel aesthetic and Cornish culture at the heart of the community. The street names are in Cornish. (Try pronouncing Chi Myghtern Lewdh Kresennik Pennfenten.) Like Poundbury, there is a focus on sustainability, green space, play areas and creating a walking/biking mixed use community. Nansladen’s construction materials and labor are sourced locally. At least 10% of the new homes will feature “in roof” solar power, and this number is set to grow alongside the electric vehicle chargers being installed in some of the public squares and residential garages, according to project manager Peter James. There is also great attention paid to insulation, which reduces energy use dramatically, no matter where it is sourced from. According to Peter, it’s important to “reduce the need for heat and electric. Don’t just waste it because it’s green.” 30% of the housing in Nansladen will be affordable. As in Poundbury, Nansladen uses a “pepper pot” approach to integrating affordable housing, rather than creating lower-income ghettos. Yes, the marquee homes will be bigger. However, as you walk down the street, you’d be hard-pressed to identify which apartments were “affordable” and which are where the posh, grand home fires burn. Nansladen is still in the early stages. However, the community has already begun attracting Londoners who can telecommute to work, thanks to fiber, and prefer a rural setting for raising their family. Home sales are prebooked through June of 2020. I drove into Nansladen under a full rainbow and magically, a few days later as I drove away back toward Poundbury, that same full rainbow arched for me again. Just as the first Poundbury residents enjoy the capital pleasures of being early adopters (some have seen the value of their home double), will the early Nansladen denizens have fate shine on their vision? One thing is for sure. When you create a sustainable community, people who are interested in living in greater harmony with nature will want to come. And when you make it easy and affordable for them to come, they queue up. About Natalie Pace Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback). Her new book The ABCs of Money for College will be out soon. Other Blogs of Interest The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Does Your Financial Planner Really Like You? Are they trustworthy? Is your 401K allocation properly diversified? How to tell what is really going on. Recently, a couple reached out to me. They had always believed that their financial planner was a good friend. However, when they started poking around, and discovered that what they’d been sold into were high-risk REITs (Real Estate Investment Trusts), and opted to exit, their “friend” quit returning their calls. (Click to read their story.) That was a year ago, and they are still trying to get their money back. They had been sold into those REITs as safe, and offering a good income. In reality, many high-yielding private placement REITs pay the broker-salesman a high commission, which is why these risky assets land in your portfolio. If the safe money is less than 3%, and you’re being offer 5% or higher, then whatever you are being sold into has risk involved. The higher the dividend or yield, the higher the risk. So, how do you know if your CFP is really your friend, rather than a salesman who might be paid a higher commission to sell you into things that are high-risk? Below are a few tips. How to Tell if Your CFP Likes You as Much as She Says She Does It’s in Her KISS (Keep it Simple, Stupid). She Listens. She Speaks Respectfully. She Sets a Time for Annual Rebalancing. She is Trustworthy. How to Tell if Your Plan is as Special as Your CFP Says it Is It Holds Up in Bad Times as Well as Good Times. It is based upon MFP with AB, rather than B&H. (See below for the meaning.) The Proof is in the Pudding Challenges: 1. Request and receive a graph outlining the performance of your portfolio, compared to the S&P500 since 2007. 2. Look at the amount that you currently have, and ask yourself if you are willing to lose the same amount that you lost between October of 2007 (the high before the real estate bubble popped) and March of 2009 (the low of the Great Recession). And here is a little more color on each point. How to Tell if Your CFP Likes You as Much as She Says She Does It’s in Her KISS (Keep it Simple, Stupid). A well-diversified plan only needs to be a few pages long. If you have pages and pages of holdings this is actually a red flag that you are not as well-diversified as you should be, and the brokerage may be making a killing on fees. More pages and more holdings do not add up to greater diversification if the holdings are essentially the same size and style over and over again, which is usually the case. She Listens. If your questions are brushed aside with sales-speak, that’s a red flag. She Speaks Respectfully. Anytime you hear the phrase, “You wouldn’t perform surgery on yourself, so why are you trying to manage your own money,” run. It’s your money. You’re the boss. The CFP should treat you with respect, answer your questions in words you can easily understand and provide data, graphs and proof of what they are claiming. She Sets a Time for Annual Rebalancing. Annual rebalancing, with proper diversification, is one of the most important ways that Main Street has been able to protect and grow their money over the last 20 years. It is a buy low, sell high plan on auto-pilot that can protect your assets from losses, while also allowing you to stay invested during the bull markets. She is Trustworthy. This is very different from having a lot of letters behind your name, or in having a fancy title. Bernie Madoff was the president of NASDAQ. Jon Corzine, who blew up MF Global, was a former New Jersey governor and co-chairman at Goldman Sachs. The Nobel Prize winning economist who wrote the book on options trading had one of the largest hedge fund bailouts in the 1990s. Trustworthy people don’t mind transparency, and are happy to provide you with the reports and oversight that every boss should require. When people want to hide things, it is usually for a reason. How to Tell if Your Plan is as Special as Your CFP Says it Is It Holds Up in Bad Times as Well as Good Times. If your net worth is doing great now, but struck rock bottom in 2009, then you are riding a Wall Street rollercoaster. A well-designed plan protects you from losses, while keeping you invested so that you can capitalize on bull markets. Our easy-as-a-pie-chart nest egg strategies earned gains and have outperformed the bull markets since 1999, at a time when most people are losing more than half in every recession. Click to access Nilo Bolden’s video testimonial. It Uses MFP with AB, rather than B&H. Buy and Hope doesn’t work in today’s high debt, slow growth world. Modern Portfolio Theory with Annual Rebalancing is an easy strategy that does work. Be careful, however, as a good salesman will tell you that they use Modern Portfolio Theory, even if they really don’t. They will sometimes even provide you with a chart that makes it look like you are diversified, when in fact you are invested in one fund that acts more like a big blob of “everything and the kitchen sink” rather than a truly diversified plan. This is also a problem with target date funds in your 401K, which are also based on the outdated Buy & Hope plan. Buy and Hope has been losing more than half in the last two recessions. Do you really want to risk that much in losses? Are you confident that the economy is stronger today than it was before the last two downturns? (See the Asset Bubble Chart below for a comparison.) The Proof is in the Pudding Challenges: 1. Request and receive a graph outlining the performance of your portfolio, compared to the S&P500 since 2007. Most people are shadowing the performance of the S&P500, but actually performing worse by a couple of percentage points, due to fees. If this is what your performance chart looks like, you’re going to be in trouble when the next correction happens, and you probably lost money in 2018. 2. Look at the amount that you currently have, and ask yourself if you are willing to lose the same amount that you lost between October of 2007 (the high before the real estate bubble popped) and March of 2009 (the low of the Great Recession). Downturns and recessions are a part of life. A well-designed plan, with annual rebalancing, will protect you, while allowing you to profit. It’s a good idea to make sure your plan is properly protected and diversified now, while everything is nice and high, rather than wait and rue the day. Complacency is never your friend. Neither are emotions; happiness now, or fear at the bottom of a recession, both work against you, prompting you to buy high and sell low – the opposite of what successful investors do. Many employers offer a self-directed option for your 401K. Even if they don’t, there are still ways to diversify better, and start gaining greater freedom and control over your future. These strategies often offer other wealth accumulating benefits, as well. Anything is better than risking half or more in losses. Nobody cares about your money more than you do, not the broker-salesman who claims to be your friend, or the HR person who harps on about your limited plan options. It’s important that you are the boss of your money. If you don’t know where to start, begin by learning the ABCs of Money that we all should have received in high school. Wisdom is the cure! Other Blogs of Interest What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. A conversation with Kevin Murphy, winner of the MacArthur “Genius” Award and professor of economics at The University of Chicago Booth School of Business, on upward mobility, college loan debt, staggering health care costs, climate change and immigration. When we think of wealth, we think of money. How rich are you? How many homes, cars and things do you own? How many vacations can you afford to take, and where do you stay? Kevin Murphy, the recipient of the Macarthur “Genius” Award and a professor at the University of Chicago Booth School of Business, encourages us to think of wealth in a much more holistic way. He stresses the importance of the family and K-12 education to prepare students to succeed in college and trade school. Murphy quantifies how providing opportunities for the underserved add up to greater prosperity for all of us. He makes a case for the immigrant as a driver of American economic prowess – both high-skilled and low-skilled. He offers guidance on how to spark conservatives to action on climate change. At a time when upward mobility is backsliding, college loan debt just hit $1.5 trillion, immigrants are under attack and U.S. climate initiatives have been scaled back, a fresh perspective on how to get America back on track, from the expert who studies these things, is something each of us can benefit from. Economists take the politics out of the debate, and focus, rather, on what the historical data tells us about what works and what doesn’t. Check out highlights from our conversation below. Natalie Pace: Let’s start with the basics. Why is upward mobility stagnating in America? Kevin Murphy: In recent decades, the rate of progress has slowed. Most people start their lives with very little in terms of financial wealth. The way that people have done better than their parents is that they were able to achieve more career-wise, in the labor market, than their parents did. NP: Education is fundamental to getting a better job, right? KM: Education and skills are more important today than they have ever been. NP: We have more people entering college than ever. However, only 60% are graduating, and college debt just hit $1.5 trillion. Is this where upward mobility is stalling out? KM: If you watch late night TV, it’s no longer kitchen gadgets that I remember when I used to watch late night TV. It’s now “Sign up with the University of Phoenix, with Arizona State, with New Hampshire, with the local tech college.” People are going to school. People are trying to get training. However, if you’re not well-prepared, if you didn’t get a lot of quality education and other skills when you were young, it’s very hard to be successful in college. If you want to think about economic mobility, don’t just think about financial wealth. Think about what people inherit from their parents more on the human capital side. NP: That seems to be a key lesson that is missing from the college admissions scandal. You can’t cheat on tests to gain the skills you need to be successful in life. KM: Education is a cumulative process. You build on what you already have. When you go to the 2nd grade, you build upon what you learned in the 1st grade. It keeps going on from there. Your success in 1st grade depends a lot upon what you did when you were three, four and five years old because that was the foundation. A lot of people wonder what we’re doing wrong at the college level. I think it’s more about what we are doing wrong before that. Why aren’t students prepared? If they are not prepared, the stakes are high. If they don’t succeed, they’re going to end up dropping out. They are not going to get the skills. And they’re going to end up with a pile of debt. We have to look earlier for the solutions. We’re not doing such a great job of educating a major fraction of our labor force. We also have problems with deterioration of the family. NP: What role does altruism play in helping the community? Some neighborhoods can easily raise money to fill in the gaps of public education, or send their children to private schools. What does the research show about the commonwealth benefits of helping children in underserved neighborhoods, who are not getting the education in K-12 that they need to succeed in college and trade school? KM: Our nation got as far as we’ve come by extending opportunities to a broader segment of the underserved population. We wouldn’t have gotten as far as we did, had we not done that. We’re not going to get as far as we could go, if we don’t continue to do that. When some kids in the community start out with poor quality schooling, and have relatively low levels of investment in them, that puts them behind the 8-ball. When they get behind in high school and try to go to college, it is very difficult because they just haven’t developed the skills and foundation they need to succeed. We need to expand the opportunity for the underserved in our neighborhoods, like we have in the past. NP: We’ve seen Asians rise to the top of the income-earning demographic in America. In the 19th century, Asians were immigrating to build our railroads at the lowest wages in America, and were even prohibited from immigrating for a decade (in the Chinese Exclusion Act of 1882). Does the rise in income status to the top of the USA say a lot about their commitment to family and their investment in children? KM: This does point to the value of the family. You see that same thing among many Hispanic families. Many Hispanics come here and they are very focused on investing in their children. Immigrants are a very big asset. Attracting high-skilled immigrants is a no-brainer. However, low-skilled immigrants are also a great asset because immigrants bring with them a focus on the future. Why would you go to a place where people don’t like you unless you are focused on the future? It’s not a lot of fun to leave your family and friends and go to a place where you are on the outside, where you don’t fit in so well, and maybe you don’t even know the language. People do that because they are focused on improving themselves and the lives of their children. Those are the kinds of people you want. NP: Immigrants get blamed for taking jobs, but also for draining our health care system and other social benefits. Can we talk a little about health care in America? We spend more on health care than any nation in the world, at $3.5 trillion annually and 18% of GDP. Is this really something we can blame on immigrants, or is there also something fundamentally wrong at play here that is driving up costs? KM: Life expectancy went up 30 years in the 20th century, which is an enormous improvement, but it has come at an increasing cost. Ultimately, cost containment comes down to having the buyer of the service worry about saving money. We don’t worry about people not having the incentive to build more cost-effective washing machines or toasters or computers. There, where people are spending their own money, there is an emphasis on building things better, but also a strong emphasis on making things cheaper. When people go to the store, they look for a price/quality trade-off. They say, “Well, this TV is $500 and this other TV is better, but it is $3000. I’ll have to go with the $500 TV.” That creates the incentive to make the $500 TV, rather than just make the greatest $3000 TV that you can make. The markets for plastic surgery look nothing like the markets for other health care. They actually tell you before you go in what the price is. There is a range of prices. You can buy the high-end price, or pay the low-end price. It looks much more like all of the other markets that we’re used to. Why? Because people are spending their own money. When consumers are spending their own money, the markets respond. That’s part of what we have to move toward – a system where there is more focus on the cost effectiveness of the treatments themselves. This is where the foreign models are not the answer. A lot of those just pay less to providers and suppliers. NP: Anyone reading this will wonder how consumers can ever pay for their own health care when a trip to the hospital can bankrupt you. That is why so many Americans are paying an arm and a leg on low-deductible health insurance. There are already health savings accounts available that would move toward the consumer weighing in on choice and costs. However, they are not well-known, and health insurance companies have no incentive to sell them, when their own premiums will be cut so dramatically. (Yes folks, you could be saving thousands on your health insurance premiums annually, particularly if you are healthy.) KM: I think more people would take it if they knew about it. Don’t give up! People have a lot on their minds. They don’t always respond, but just keep pressing. It may take 10 years for people to switch how they run their lives. But, we have to do that. We don’t want to get to a point where we spend 35% of GDP on health care. We need to make these products as attractive as possible to people. The benefits that I’m talking about require people taking it in numbers. If we have a marketplace where more people are weighing in on the price, the supply side of that marketplace will respond. NP: If more people knew just how underfunded their pensions and other post-employment benefits are at these legacy corporations, they’d be very interested in the Health Savings Accounts. It’s the top of the market. Pensions and benefits are historically overfunded at this stage of the business cycle. KM: If you think the corporate systems are terrifying, you should look at the state and public systems. They are terrifying squared. People don’t do such a good job of taking care of other people. We have to recognize that. That’s just how people work. NP: That sounds like the perfect lead-in, sadly, to talk about climate change. How can we, at long last, provide the economic incentives for consumers to reduce their carbon footprint, for corporations to stop offering single-use everything, for the electric grid to be powered with clean energy and for plastics to be replaced with something that doesn’t pollute our oceans? KM: Ultimately, people have to be incentivized through the prices they pay. You have to raise the price of carbon. If the buyers can cheaply use less, they’ll do it. If the suppliers can cheaply use less, they’ll do it. The bad news behind a carbon tax is that for every dollar of climate benefit that it would generate, it generates a lot of tax dollars. A conservative estimate might be $20 in taxes for every dollar of climate benefit. So now, think about the battle lines in climate change. Does it look like a battle between people who care about their children and people who don’t care about their children? Or does it look like a battle between people who would like a bigger government versus people who want a smaller government? It looks like the second one, not the first one. People don’t look at this as a choice of climate versus not climate. They look at it as a choice between big government versus small government. If we close the gap politically, we’ll have a much greater chance of success. That’s why I think the Green New Deal is politically a tough way to go. That’s going to run into more resistance than you need to tackle the climate problem. The question is, “How do we deal with it without pitting the bigger government and smaller government forces against each other?” In principle, you should be able to do that.  About Kevin M. Murphy Kevin Murphy is the George J. Stigler Distinguished Service Professor Economics at the University of Chicago Booth School of Business. He is the first professor at a business school to be chosen as a MacArthur Fellow. He was selected for "revealing economic forces shaping vital social phenomena such as wage inequality, unemployment, addiction, medical research, and economic growth." In addition to his position at the University of Chicago, Murphy works as a faculty research associate for the National Bureau of Economic Research. He primarily studies the empirical analysis of inequality, unemployment, and relative wages as well as the economics of growth and development and the economic value of improvements in health and longevity. Other Blogs of Interest Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed