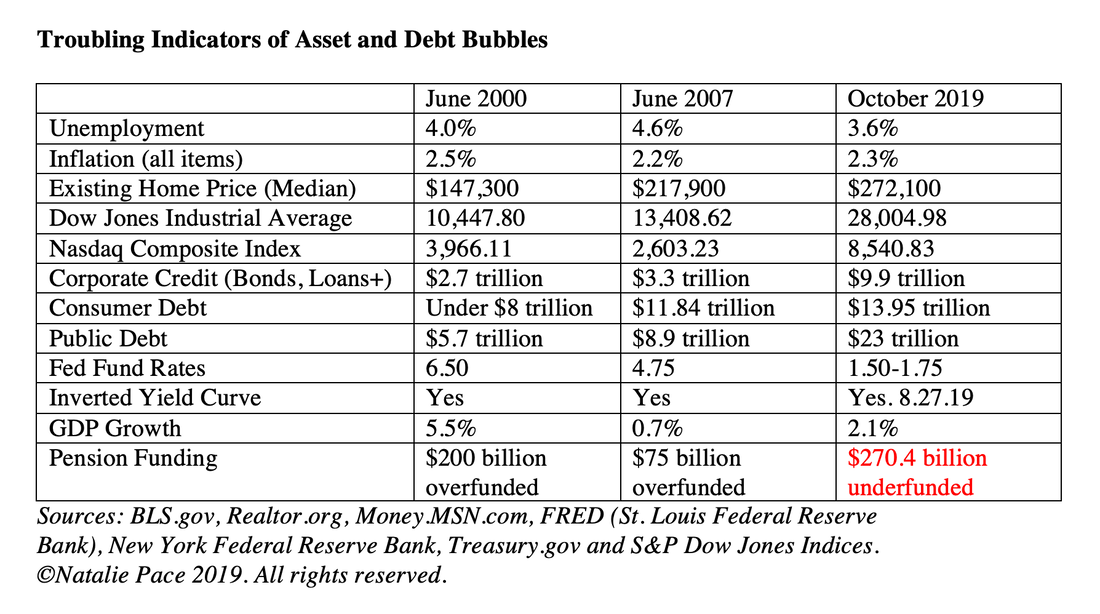

Does Your Financial Planner Really Like You? Are they trustworthy? Is your 401K allocation properly diversified? How to tell what is really going on. Recently, a couple reached out to me. They had always believed that their financial planner was a good friend. However, when they started poking around, and discovered that what they’d been sold into were high-risk REITs (Real Estate Investment Trusts), and opted to exit, their “friend” quit returning their calls. (Click to read their story.) That was a year ago, and they are still trying to get their money back. They had been sold into those REITs as safe, and offering a good income. In reality, many high-yielding private placement REITs pay the broker-salesman a high commission, which is why these risky assets land in your portfolio. If the safe money is less than 3%, and you’re being offer 5% or higher, then whatever you are being sold into has risk involved. The higher the dividend or yield, the higher the risk. So, how do you know if your CFP is really your friend, rather than a salesman who might be paid a higher commission to sell you into things that are high-risk? Below are a few tips. How to Tell if Your CFP Likes You as Much as She Says She Does It’s in Her KISS (Keep it Simple, Stupid). She Listens. She Speaks Respectfully. She Sets a Time for Annual Rebalancing. She is Trustworthy. How to Tell if Your Plan is as Special as Your CFP Says it Is It Holds Up in Bad Times as Well as Good Times. It is based upon MFP with AB, rather than B&H. (See below for the meaning.) The Proof is in the Pudding Challenges: 1. Request and receive a graph outlining the performance of your portfolio, compared to the S&P500 since 2007. 2. Look at the amount that you currently have, and ask yourself if you are willing to lose the same amount that you lost between October of 2007 (the high before the real estate bubble popped) and March of 2009 (the low of the Great Recession). And here is a little more color on each point. How to Tell if Your CFP Likes You as Much as She Says She Does It’s in Her KISS (Keep it Simple, Stupid). A well-diversified plan only needs to be a few pages long. If you have pages and pages of holdings this is actually a red flag that you are not as well-diversified as you should be, and the brokerage may be making a killing on fees. More pages and more holdings do not add up to greater diversification if the holdings are essentially the same size and style over and over again, which is usually the case. She Listens. If your questions are brushed aside with sales-speak, that’s a red flag. She Speaks Respectfully. Anytime you hear the phrase, “You wouldn’t perform surgery on yourself, so why are you trying to manage your own money,” run. It’s your money. You’re the boss. The CFP should treat you with respect, answer your questions in words you can easily understand and provide data, graphs and proof of what they are claiming. She Sets a Time for Annual Rebalancing. Annual rebalancing, with proper diversification, is one of the most important ways that Main Street has been able to protect and grow their money over the last 20 years. It is a buy low, sell high plan on auto-pilot that can protect your assets from losses, while also allowing you to stay invested during the bull markets. She is Trustworthy. This is very different from having a lot of letters behind your name, or in having a fancy title. Bernie Madoff was the president of NASDAQ. Jon Corzine, who blew up MF Global, was a former New Jersey governor and co-chairman at Goldman Sachs. The Nobel Prize winning economist who wrote the book on options trading had one of the largest hedge fund bailouts in the 1990s. Trustworthy people don’t mind transparency, and are happy to provide you with the reports and oversight that every boss should require. When people want to hide things, it is usually for a reason. How to Tell if Your Plan is as Special as Your CFP Says it Is It Holds Up in Bad Times as Well as Good Times. If your net worth is doing great now, but struck rock bottom in 2009, then you are riding a Wall Street rollercoaster. A well-designed plan protects you from losses, while keeping you invested so that you can capitalize on bull markets. Our easy-as-a-pie-chart nest egg strategies earned gains and have outperformed the bull markets since 1999, at a time when most people are losing more than half in every recession. Click to access Nilo Bolden’s video testimonial. It Uses MFP with AB, rather than B&H. Buy and Hope doesn’t work in today’s high debt, slow growth world. Modern Portfolio Theory with Annual Rebalancing is an easy strategy that does work. Be careful, however, as a good salesman will tell you that they use Modern Portfolio Theory, even if they really don’t. They will sometimes even provide you with a chart that makes it look like you are diversified, when in fact you are invested in one fund that acts more like a big blob of “everything and the kitchen sink” rather than a truly diversified plan. This is also a problem with target date funds in your 401K, which are also based on the outdated Buy & Hope plan. Buy and Hope has been losing more than half in the last two recessions. Do you really want to risk that much in losses? Are you confident that the economy is stronger today than it was before the last two downturns? (See the Asset Bubble Chart below for a comparison.) The Proof is in the Pudding Challenges: 1. Request and receive a graph outlining the performance of your portfolio, compared to the S&P500 since 2007. Most people are shadowing the performance of the S&P500, but actually performing worse by a couple of percentage points, due to fees. If this is what your performance chart looks like, you’re going to be in trouble when the next correction happens, and you probably lost money in 2018. 2. Look at the amount that you currently have, and ask yourself if you are willing to lose the same amount that you lost between October of 2007 (the high before the real estate bubble popped) and March of 2009 (the low of the Great Recession). Downturns and recessions are a part of life. A well-designed plan, with annual rebalancing, will protect you, while allowing you to profit. It’s a good idea to make sure your plan is properly protected and diversified now, while everything is nice and high, rather than wait and rue the day. Complacency is never your friend. Neither are emotions; happiness now, or fear at the bottom of a recession, both work against you, prompting you to buy high and sell low – the opposite of what successful investors do. Many employers offer a self-directed option for your 401K. Even if they don’t, there are still ways to diversify better, and start gaining greater freedom and control over your future. These strategies often offer other wealth accumulating benefits, as well. Anything is better than risking half or more in losses. Nobody cares about your money more than you do, not the broker-salesman who claims to be your friend, or the HR person who harps on about your limited plan options. It’s important that you are the boss of your money. If you don’t know where to start, begin by learning the ABCs of Money that we all should have received in high school. Wisdom is the cure! Other Blogs of Interest What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed