|

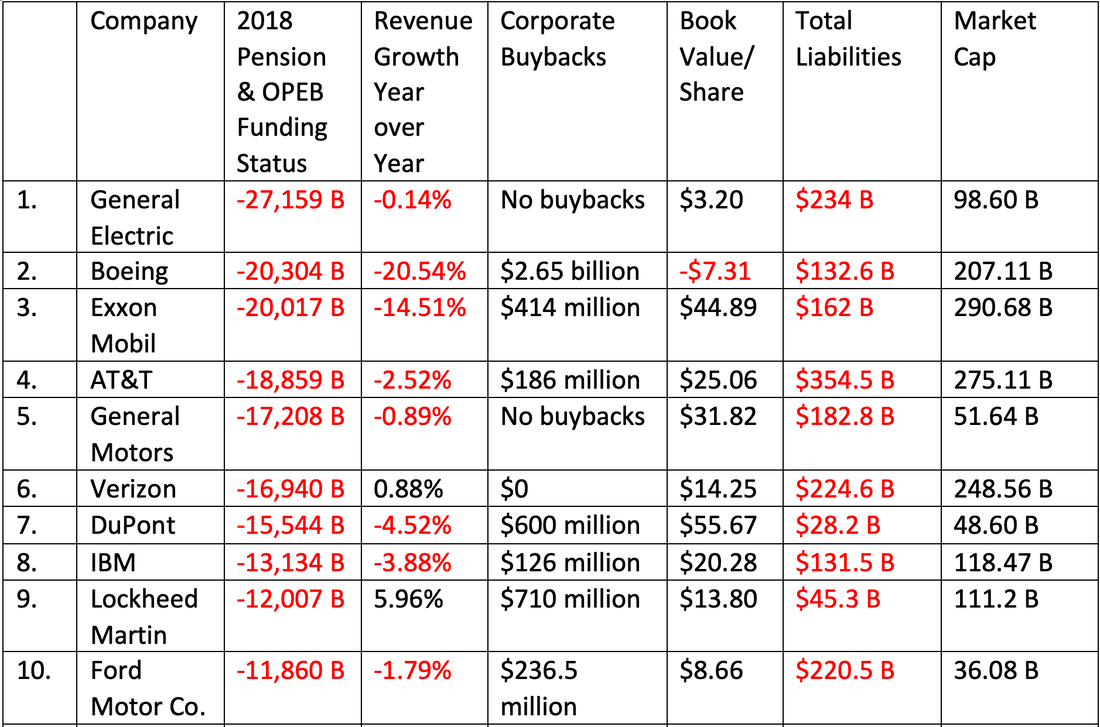

Unicorns Over $100 billion of mythological valuation has ridden off into the sunset on unicorn IPOs this year, including Lyft, Uber, Beyond Meat and the We Co., with post-IPO losses of $26.36 billion, $30.26 billion, $10.1 billion and $39 billion, respectively. The list goes on to include Snap Inc., Dropbox, Pinterest, Blue Apron and more. Many of these losses have hit the wallet of Main Street investors. If you invested in most of these companies at the high, you’ve lost half of your investment. Thankfully, The We Co. IPO imploded before it hit the NASDAQ Stock Exchange. If you were reading my coverage, you knew not to buy even if it did. For years now, most of the IPOs were really insider liquidity events. (Click on the blue highlighted company words for links back to the pre-IPO blogs warning of this.) It was hard to imagine why the so-called smart money, the large institutional buyers, were taking the bait. However, after being burned repeatedly on high valuations that sank on the first day of trading, institutional investors finally said, “No,” at the We Co. road show to a $47 billion valuation. What if we can our CEO? What if we drop the value to $8 billion? “No. No. No.” Reportedly, JP Morgan and Softbank couldn’t find enough buyers even at an $8 billion valuation, which turned out to be the approximate valuation at the time of the Softbank bailout on October 23, 2019. There will be a new top dog at We. Co, a new strategy, a clear path to profitability, far less CEO-centric investment terms and no Main Street dollars burned up on the big boards. Finally, the insiders are taking the same hit on these fairytale unicorn valuations that Main Street investors have been swallowing for years. Altria cut their JUUL valuation by $4.5 billion on Oct. 31, 2019. General Motors wrote down their investment in Lyft in the 3rd Quarter of 2019, taking $291 million in unrealized losses. After the Lyft write-down and the Sept.-Oct. 2019 strike, their revised earnings guidance was lowered by ($2.00) per diluted share, from $6.50-$7.00/share to $4.28-$4.69/share. That’s a 5-year low, with a haircut of -21.3% off of 2018’s earnings per share. To be fair, only a penny of the write-down was attributed to the Lyft losses. Softbank and JP Morgan both had big stakes in The We Co. Softbank was also a major investor in Uber. Softbank’s Vision and Delta Funds division recorded losses (unrealized) in the amount of $4.91 billion (537.9 billion yen) in the results reported on Nov. 6, 2019. Net income was down 50%, to $3.85 billion. That doesn’t fully account for the total losses, however, as the new $8 billion valuation didn’t settle in until Oct. 22, 2019. This will be accounted for in the next earnings report, which is almost guaranteed to be ugly. The full measure of JP Morgan’s involvement in the failed We Co. IPO, and, perhaps more importantly, the personal loans issued to Adam Naumann, in the amount of $597.50 million, has not yet hit the headlines. The loans were secured by WeWork shares and Naumann real estate, which have been severely devalued. (The personal loans were from a group of 3 banks, including JP Morgan, UBS and Credit Suisse.) JP Morgan also led the Lyft IPO. It’s hard to imagine happy times in the C-suite at JP Morgan. JP Morgan may be able to manage the failures better than SoftBank. The loans may not show up as write-downs or losses until/unless Naumann defaults. JP Morgan is notoriously aggressive about getting paid on time, so Adam Naumann is likely seeing a new side to the sycophants who fawned over him when his company boasted the $47 billion valuation and was the darling CEO of the next unicorn IPO. With almost half of the JP Morgan revenue coming from net interest, a terrible showing in the investment banking division could still result in an overall profitable quarter. Leverage The valuation problem is not limited to unicorns and private equity. High valuations on Wall Street and historically high leverage in the most heavily indebted legacy corporations are both issues that economists are watching carefully. As the Federal Reserve Board outlined in their November 2019 Financial Stability Report, “Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards... Hedge fund leverage remains elevated.” The report goes on to warn us that “about half of investment-grade debt outstanding is currently rated in the lowest category of the investment-grade range (triple-B)—near an all-time high.” Below is a list of the Top 10 companies that were behind on their pension and other post-employment benefit obligations. I've also included the amount they've spent on buybacks (while shortchanging the pensioners), the total liabilities and the market value. As you can see, General Electric, AT&T, General Motors, IBM, and Ford all owe more than the company is worth. They don't have the increase in sales to make up the slack. Stocks are trading an all-time high, with near all-time high price to earnings ratios. According to Nobel Prize winning economist Robert Shiller (in an interview from September), “The CAPE ratio is between 28 and 29, or there about. That is high by historical standards. The historical average is about 17... It is a concern.” The two times that CAPE was higher were 1929 (the Great Depression) and 2000 (before the Dot Com Recession). The investment banking division is exactly where Chief Investment Strategist Liz Ann Sonders believes that the cracks in the economy will start to show up first. In my interview with her in August of 2019 she said, “This highly indebted, weak component of the corporate sphere will mark the end of this cycle in some way.” Squeezed Margins Over the past year, banks and brokerages have been having a field day with their net interest income. That party might be nearing sobering up, however. The concern is that the flat yield curve will compress the bank’s ability to earn net interest in the margins between long term rates (which are already very low and getting lower) and short-term borrowings (which are at their effective lower bound and are unable to fall much more). This historically pushes banks into risky behavior – lending to businesses and households that are not credit-worthy, where they can charge a much higher interest rate. That story had a terrible ending in 2008. The Pathway to Profitability “A clear path to profitability” is the phrase du jour on earnings reports. Snap Inc.’s Evan Spiegel used this language in the 3rd quarter earnings press release, which announced another $228 million in net losses for the quarter. Investors sold the following day in a clear signal of “Show me the money.” “Price matters” is the new catch phrase that investors should have on their mind, particularly as we close in on the 1st anniversary of the most devastating December we’ve seen on Wall Street since the Great Depression. Dramatically lower valuations are starting to show up on balance sheets. It will continue to impact earnings, the bulk of which will be reported in the 4th quarter, at the beginning of next year. The “smart money” typically moves in advance, which is why there is no guarantee that this December will be any better than last year’s, which delivered coal in everyone’s stocking. Whether you are dealing with unicorns, legacy corporations or mutual funds with names that you don’t understand, it’s time to know what you own and why you own it. If you’re interested in receiving an unbiased 2nd opinion on your current plan, call 310-430-2397 or email [email protected] for pricing and information. "An investment in knowledge pays the best interest." Benjamin Franklin. Learn the ABCs of Money that we all should have received in high school and watch how fast your life transforms. Other Blogs of Interest Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed