|

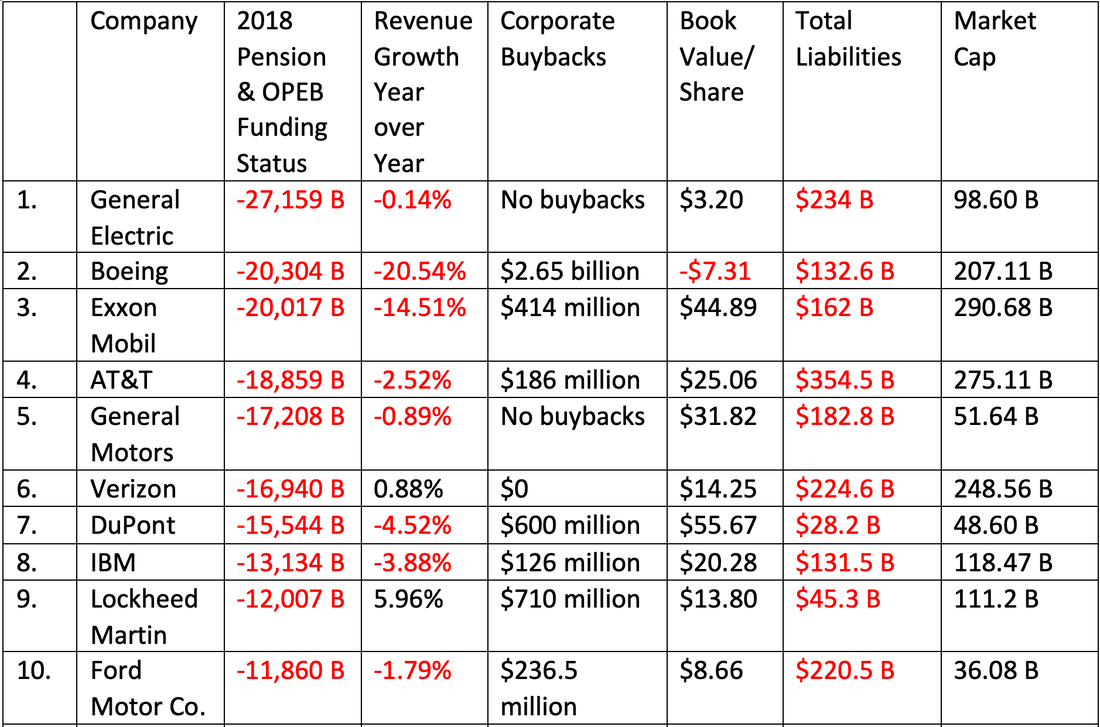

Unicorns Over $100 billion of mythological valuation has ridden off into the sunset on unicorn IPOs this year, including Lyft, Uber, Beyond Meat and the We Co., with post-IPO losses of $26.36 billion, $30.26 billion, $10.1 billion and $39 billion, respectively. The list goes on to include Snap Inc., Dropbox, Pinterest, Blue Apron and more. Many of these losses have hit the wallet of Main Street investors. If you invested in most of these companies at the high, you’ve lost half of your investment. Thankfully, The We Co. IPO imploded before it hit the NASDAQ Stock Exchange. If you were reading my coverage, you knew not to buy even if it did. For years now, most of the IPOs were really insider liquidity events. (Click on the blue highlighted company words for links back to the pre-IPO blogs warning of this.) It was hard to imagine why the so-called smart money, the large institutional buyers, were taking the bait. However, after being burned repeatedly on high valuations that sank on the first day of trading, institutional investors finally said, “No,” at the We Co. road show to a $47 billion valuation. What if we can our CEO? What if we drop the value to $8 billion? “No. No. No.” Reportedly, JP Morgan and Softbank couldn’t find enough buyers even at an $8 billion valuation, which turned out to be the approximate valuation at the time of the Softbank bailout on October 23, 2019. There will be a new top dog at We. Co, a new strategy, a clear path to profitability, far less CEO-centric investment terms and no Main Street dollars burned up on the big boards. Finally, the insiders are taking the same hit on these fairytale unicorn valuations that Main Street investors have been swallowing for years. Altria cut their JUUL valuation by $4.5 billion on Oct. 31, 2019. General Motors wrote down their investment in Lyft in the 3rd Quarter of 2019, taking $291 million in unrealized losses. After the Lyft write-down and the Sept.-Oct. 2019 strike, their revised earnings guidance was lowered by ($2.00) per diluted share, from $6.50-$7.00/share to $4.28-$4.69/share. That’s a 5-year low, with a haircut of -21.3% off of 2018’s earnings per share. To be fair, only a penny of the write-down was attributed to the Lyft losses. Softbank and JP Morgan both had big stakes in The We Co. Softbank was also a major investor in Uber. Softbank’s Vision and Delta Funds division recorded losses (unrealized) in the amount of $4.91 billion (537.9 billion yen) in the results reported on Nov. 6, 2019. Net income was down 50%, to $3.85 billion. That doesn’t fully account for the total losses, however, as the new $8 billion valuation didn’t settle in until Oct. 22, 2019. This will be accounted for in the next earnings report, which is almost guaranteed to be ugly. The full measure of JP Morgan’s involvement in the failed We Co. IPO, and, perhaps more importantly, the personal loans issued to Adam Naumann, in the amount of $597.50 million, has not yet hit the headlines. The loans were secured by WeWork shares and Naumann real estate, which have been severely devalued. (The personal loans were from a group of 3 banks, including JP Morgan, UBS and Credit Suisse.) JP Morgan also led the Lyft IPO. It’s hard to imagine happy times in the C-suite at JP Morgan. JP Morgan may be able to manage the failures better than SoftBank. The loans may not show up as write-downs or losses until/unless Naumann defaults. JP Morgan is notoriously aggressive about getting paid on time, so Adam Naumann is likely seeing a new side to the sycophants who fawned over him when his company boasted the $47 billion valuation and was the darling CEO of the next unicorn IPO. With almost half of the JP Morgan revenue coming from net interest, a terrible showing in the investment banking division could still result in an overall profitable quarter. Leverage The valuation problem is not limited to unicorns and private equity. High valuations on Wall Street and historically high leverage in the most heavily indebted legacy corporations are both issues that economists are watching carefully. As the Federal Reserve Board outlined in their November 2019 Financial Stability Report, “Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards... Hedge fund leverage remains elevated.” The report goes on to warn us that “about half of investment-grade debt outstanding is currently rated in the lowest category of the investment-grade range (triple-B)—near an all-time high.” Below is a list of the Top 10 companies that were behind on their pension and other post-employment benefit obligations. I've also included the amount they've spent on buybacks (while shortchanging the pensioners), the total liabilities and the market value. As you can see, General Electric, AT&T, General Motors, IBM, and Ford all owe more than the company is worth. They don't have the increase in sales to make up the slack. Stocks are trading an all-time high, with near all-time high price to earnings ratios. According to Nobel Prize winning economist Robert Shiller (in an interview from September), “The CAPE ratio is between 28 and 29, or there about. That is high by historical standards. The historical average is about 17... It is a concern.” The two times that CAPE was higher were 1929 (the Great Depression) and 2000 (before the Dot Com Recession). The investment banking division is exactly where Chief Investment Strategist Liz Ann Sonders believes that the cracks in the economy will start to show up first. In my interview with her in August of 2019 she said, “This highly indebted, weak component of the corporate sphere will mark the end of this cycle in some way.” Squeezed Margins Over the past year, banks and brokerages have been having a field day with their net interest income. That party might be nearing sobering up, however. The concern is that the flat yield curve will compress the bank’s ability to earn net interest in the margins between long term rates (which are already very low and getting lower) and short-term borrowings (which are at their effective lower bound and are unable to fall much more). This historically pushes banks into risky behavior – lending to businesses and households that are not credit-worthy, where they can charge a much higher interest rate. That story had a terrible ending in 2008. The Pathway to Profitability “A clear path to profitability” is the phrase du jour on earnings reports. Snap Inc.’s Evan Spiegel used this language in the 3rd quarter earnings press release, which announced another $228 million in net losses for the quarter. Investors sold the following day in a clear signal of “Show me the money.” “Price matters” is the new catch phrase that investors should have on their mind, particularly as we close in on the 1st anniversary of the most devastating December we’ve seen on Wall Street since the Great Depression. Dramatically lower valuations are starting to show up on balance sheets. It will continue to impact earnings, the bulk of which will be reported in the 4th quarter, at the beginning of next year. The “smart money” typically moves in advance, which is why there is no guarantee that this December will be any better than last year’s, which delivered coal in everyone’s stocking. Whether you are dealing with unicorns, legacy corporations or mutual funds with names that you don’t understand, it’s time to know what you own and why you own it. If you’re interested in receiving an unbiased 2nd opinion on your current plan, call 310-430-2397 or email [email protected] for pricing and information. "An investment in knowledge pays the best interest." Benjamin Franklin. Learn the ABCs of Money that we all should have received in high school and watch how fast your life transforms. Other Blogs of Interest Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. This morning, as I prepare for a day when so many of us traditionally count our blessings, I’m filled with awe and amazement for just how much I adore my life. That is not something I say with boastful pride. It is rather an admission that is full of relief, and a bit of amazement. For if you had told me when I was struggling to find my way into my true calling that I would end up in a career that I love so much, and with so many days that I adore living, I don’t know that I would’ve believed you. But it was in those dark moments, where I made sound and brave choices to steer off the well-trodden path, that has led me to this rather astonishing reality of true happiness that I find myself in today. As Mahatma Gandhi said, “Happiness is when what you think, what you say and what you do are in harmony.” So, as I tell you how grateful I am:

There are solutions. There are ways to feel grateful. Gratitude is not something you can force. However, stopping for a day to count your blessings is an important footstep along the path to actually feeling gratitude. This practice points each of us in the right direction. The journey is cumulative. The more you are grateful for the things in your life, the more great things show up mysteriously and magically. I am not sending you this love note of gratitude out of a sense of duty or best practices. I am truly grateful and humbled today for your presence in our community. Whether you are a very active presence in our financial empowerment initiative, or just dipping your toes in the possibility that there is more to learn than what you are being exposed to in the mainstream group think, your presence and patience and interest empowers these central themes.

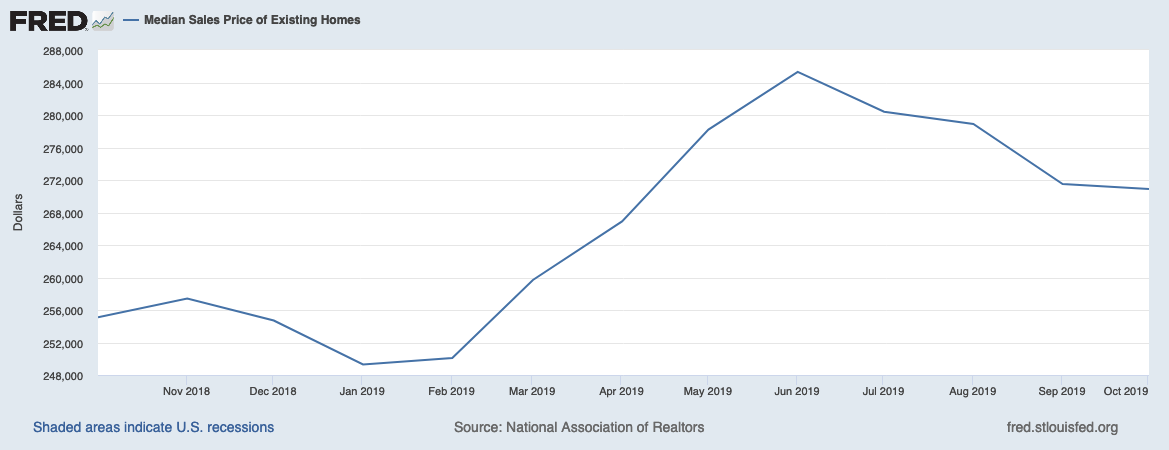

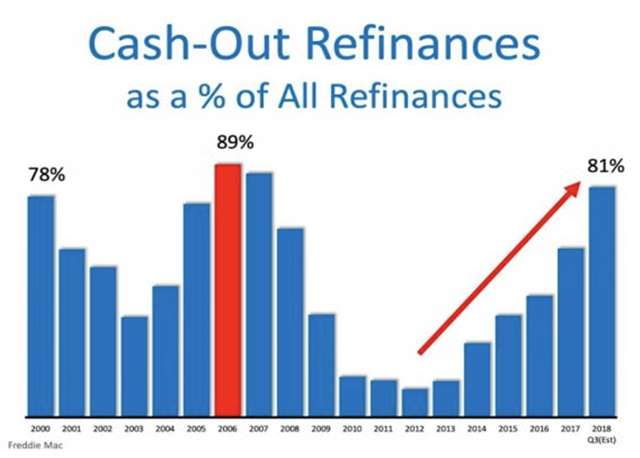

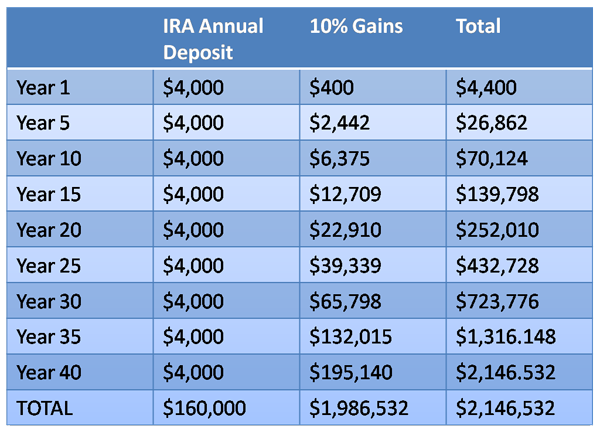

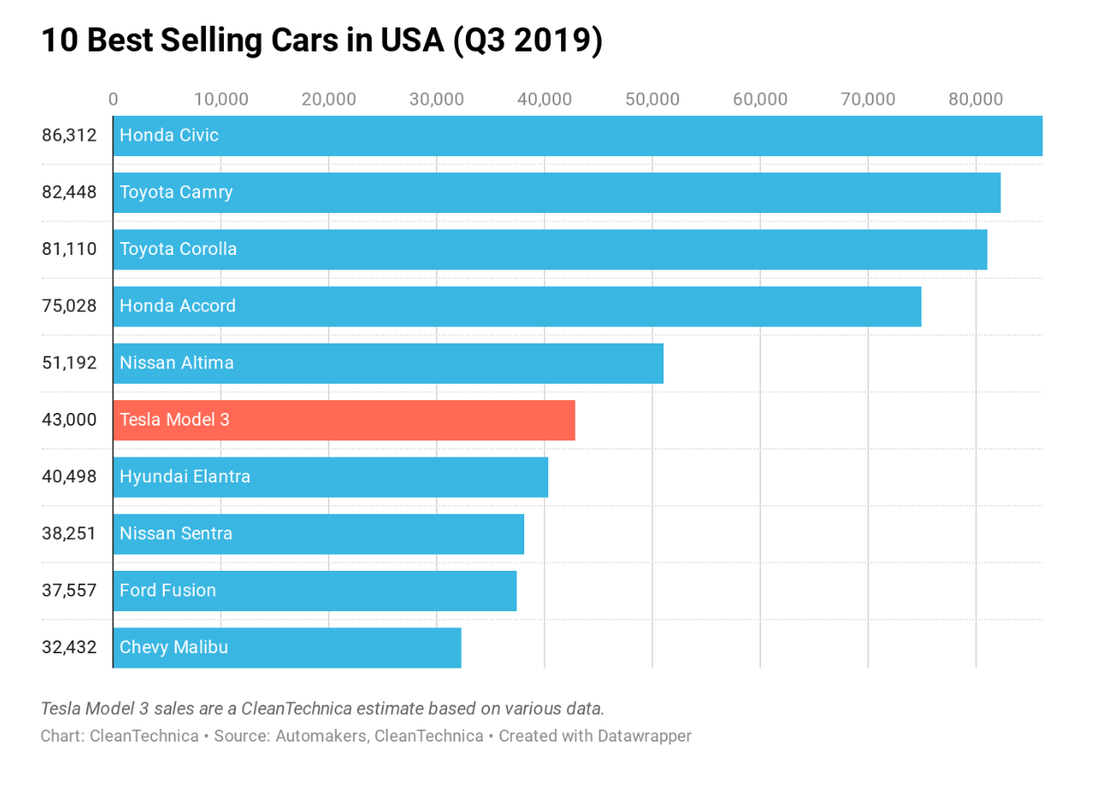

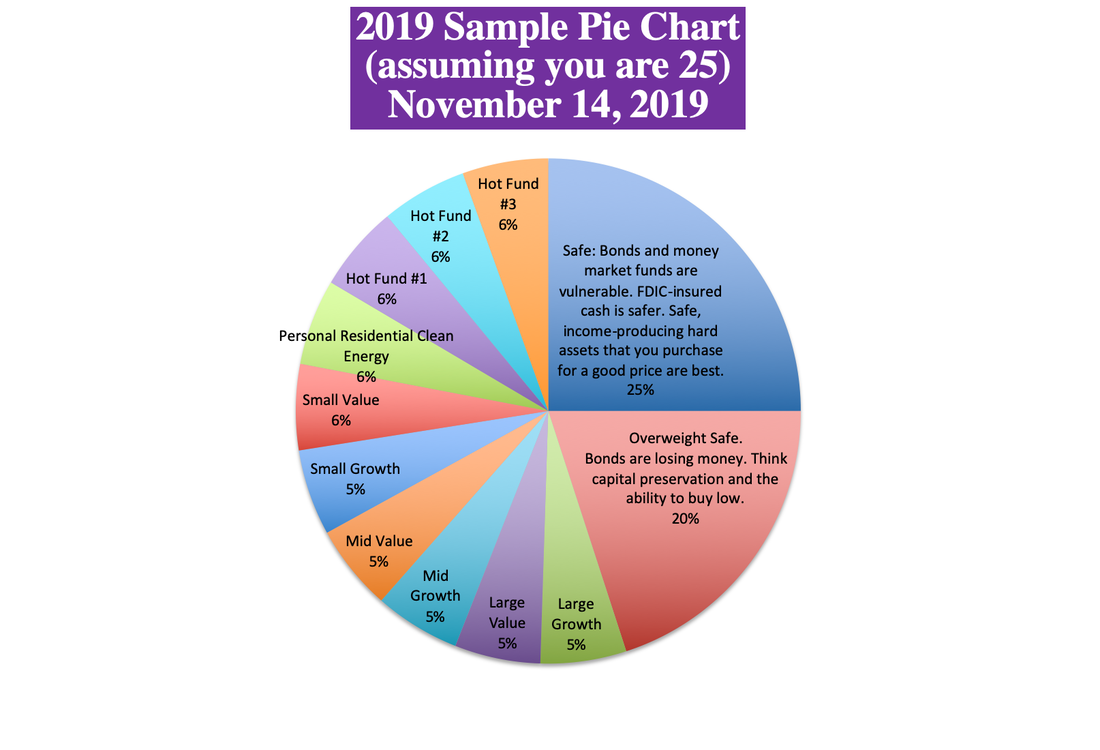

So I do encourage you to count your blessings today. And I am very grateful for your presence in our community. In the words of Stay Strong Project co-founder and kirtan artist David Newman, “Stay strong and keep your faith alive.” Blessed with family and adventure... Always... Other Blogs of Interest Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Real Estate Prices Decline. Includes Strategies for Homeowners and Renters. Home price gains over the past decade have been impressive. In June of 2019, the median sales price of existing homes nationwide hit an all-time high of $285,300. Price appreciation was led by the West (87.7%), the South (52.3%) and the Midwest (47.7%), with the North East witnessing the slowest increase, at 29.9%. However, since June, the median sales price of existing homes has been declining. The decline of the last few months marks the first time in over a decade that home prices have headed south. The average sales price slid to $270,900 between June and October 2019 (source: National Association of Realtors). However, in the Great Recession over 10 million homes were lost. And even today, over a decade later, with real estate prices at all-time highs, 3.2 million mortgages are still 25% or more higher than the value of the home (in other words, the mortgage is underwater). This data is a reminder that buying high, or refinancing high and pulling out the cash, can be a perilous idea. Currently, 74% of U.S. median-priced housing markets are out of reach to average wage earners (source: Attom Data). When buyers become scarce, prices are under pressure. Lawrence Yun, the Chief Economist of the National Association of Realtors, and others in the industry have been calling for more home construction to bring down prices for years. There is a movement toward intergenerational housing. Micro and affordable housing are buzz words. Meanwhile, 34% of renters and 25% of homeowners spend more than 30% of their income on housing (source: Freddie Mac). That is likely the primary reason that consumer debt just hit $14 trillion – the highest it has ever been, and why cash-out refinances are back to pre-recession highs. The Home Equity ATM Machine Red Flag is Back. With Tips on How to Protect Yourself. Have you recently done a refinance on your home, where you pulled the cash out to make ends meet? You are not alone. According to Freddie Mac, the percentage of cash-out refinances as a percentage of all refinances hit an all-time high in the 4th quarter of 2018 – just as it was in 2000 (before the Dot Com Recession) and 2006-2007 (before the Great Recession). The percentage of cash-out refinances was 82% at the end of 2018, 89% in 2006 and 83% in 2000. Freddie Mac is quick to point out that the total amount cashed out this year is far less in dollar terms than 2006, and that the amount of home equity is still very strong. $14.8 billion (inflation adjusted) was cashed out in the 4th quarter of 2018, compared to $104.8 billion in the 2nd quarter of 2006. U.S. households own real estate totaling $25 trillion, with debt of $10 trillion. So, there’s still a lot of equity on the table – $15 trillion – assuming home values remain elevated. If you factor in the $14 trillion of consumer debt, the American consumer is flying a little close to the trees, particularly if home prices continue to abate. More Spending and Debt Can Plunge Consumer Resilience Consumers have been a bright spot in GDP growth, while business and national spending have been declining. The new wealth created in households (largely concentrated in the top 1% of households) may prove to be transitory, however, just as it was in 2007. Why and how? Both real estate and stocks are back to all-time highs. Both assets dropped dramatically in the Great Recession, wiping out personal disposable income, and leaving many homeowners with a financial hangover that took a decade to recover from. When home equity is used as an ATM machine that is a warning sign that the household budget is under distress. Additionally, tariffs and a weakening worldwide economy put pressure on Wall Street. Stocks lost money in 2018, as did corporate bonds. The Number of Homes Seriously Underwater is Still an Issue It’s interesting that at a time when real estate prices are at an all-time high and home lending standards are still considered to be conservative, the number of severely underwater homes is still 3.5 million (source: Attom Data Solutions). That means that 1 in 15 mortgages are seriously underwater, worth 25% more than the value of the home. How is that happening? Here’s the math. A homeowner manages to keep his/her home through the Great Recession, but needs a loan modification in order to afford the payments. The bank has already written the nonperforming loan off. Now the mortgage can be rewritten, with new fees, at a higher principal, with all of the unpaid monthly mortgage payments, penalties and refinance fees tacked onto the total amount owed. The bank then gives a very low interest rate to the homeowner with a payment that is affordable only if you think that paying over a third of your salary to a mortgage that is at least 25% higher than the value of your home is a sound strategy. The homeowner feels strapped and out of options, and knows that this is a short-term solution that leaves them holding the short end of the stick, but signs on the dotted line anyway in order to be able to stay in their home for a little while longer. In that manner, yet another loan modification that puts the homeowner severely underwater slips quietly into the data. International Sales Lead Exodus & Unaffordability A lot of real estate executives point to international buyers whenever they encounter guff from their clients about affordability. However, in 2019, the drop in international purchases of American real estate plunged by 36% (source: The National Association of Realtors). China continued to be the top buyer of U.S. real estate for the 7th consecutive year. However, sales to Chinese home buyers dropped by 56% year over year. What’s Your Best Strategy if You are Borrowing to Make Ends Meet, or if Your Bank is Offering You an Underwater Loan Mod? If your home is underwater now at the top of the market, then the sooner that you acknowledge this, the faster you can adopt a more sustainable budget and recover. The longer you wait, the more stress you will have. You may only be prolonging the inevitable. If prices continue to fall, your situation will only become more dire. Praying and hoping that home prices will continue rising forever is not a sound assumption, especially if they are unaffordable to most of the denizens who live in your community. In short, it’s time to rethink your budget from the ground up. Cutting out café lattes is not going to fix things. Cash-out refinances and underwater loan mods are band-aids that will not stop the cash bleed in your budget. It’s the big-ticket spending that is keeping you hand-to mouth. Housing has become unaffordable, as has transportation, health insurance and many other big-ticket bills. There are solutions, however. Now is the time to address this – while the home prices and stock prices are at all-time highs. It’s a great idea to fix the roof while the sun is still shining. Once the economy weakens, your options could be more limited. The Thrive Budget If you want to fly and thrive, you’ve got to lighten your load. Below are 7 Strategies to Consider. How to Thrive, Instead of Being Buried Alive in Bills 1. Taxes Lower your tax base by contributing to your 401K (pre-tax) and by investing in your retirement funds (where you can typically avoid capital gains taxes). Start learning the difference between earned income, which is taxed at very high rates, and passive income, which is how the wealthy pay lower rates than their executive assistants. This is a way to keep more of your money and to start compounding your gains. 2. Increase Your Passive Income, While Lowering Your Taxes Long-term capital gains can be 0-20%, depending upon your tax bracket. When capital gains occur in your tax-protected retirement account, they are not taxed. When you invest in your individual retirement accounts, you are earning money while you sleep, which is a strategy of the wealthy. (Rich people don’t put their money in jars.) If you invest 10% of your income in tax protected retirement accounts, and that earns a 10% gain, then you’ll have more money in your accounts than you earn in 7 and a half years. Your money will make more than you do in about 25 years. 3. Cut Your Health Insurance Costs If you are healthy and spending an arm and a leg on health insurance, then consider opting for a high deductible and a Health Savings Account. The savings you achieve on your health insurance premiums can go to increase your own wealth in your HSA, instead of just making the health insurance company rich. HSAs are the best long-term health care plan. You will also receive a tax credit. Learn more at IRS.gov. 4. Rethink Housing Intergenerational housing and micro housing are the hottest new trends going. Is it best for each family member to live in an apartment and make the landlord rich, or learn to live together again and keep the money in the family? Only you can be the judge. However, the more you can combine households, the lower the costs for each adult will be. The nuclear family is rapidly becoming a page in history. Millennials who live close to parents may have the added benefit of sharing food costs and lower child care costs. While downsizing might fix your budget, making better use of the space you’re in might be an even better idea. 5. Reduce Your Commute The average person spends $7500 annually on their personal vehicle, including the car payment, insurance, maintenance and gasoline. This increases when gas prices rise, as they are predicted to do, if Saudi Arabia and Russia have their way. Can the family give up one car? Should you move closer to work? Can you take public transportation, ride a bike or purchase an e-scooter, at least for quick trips near your home? The new micro-mobility companies, like Bird, Uber, Lyft and Spin are covering the funding for better bike lanes. If your city or campus has not yet discovered this last-mile solution, it’s worth leading the charge for change. 6. Do an Air-Test on Your Home Are you heating and cooling the outside of your home? Are you a Leaks-R-Us dwelling? Do you still use incandescent bulbs thinking they are cheaper? Are you aware of the savings of a simple counter-top toaster oven for small baking needs? Getting megawatt smart could cut your electric bill in half or more. For most Americans the savings will be in the thousands of dollars. 7. Take Advantage of the 30% Tax Credit for Solar and Energy Efficiency Upgrades If you live in a sunny state, the math for rooftop solar has never been more compelling. There is a 30% tax credit in play through the end of 2019, which drops to 26% in 2020 and 22% in 2021. (So, consider this now.) Click for additional information on the EnergyStar.gov website. Solar panels have never been more affordable. Many homeowners take a $300/month bill down to $30/month. You may be able to borrow from your 401K or Individual Retirement Account (IRA) to cover the purchase costs of purchasing and installing rooftop solar panels and a solar water heater. Be sure to get your megawatt usage down as low as possible before you get your quote. The number of panels that you need is determined by how much electricity you use. Stop Making Everyone Else Rich The goal is to stop making the tax man, banker, landlord, utility company, gasoline station, insurance salesman and more rich at your own expense. Wisdom and innovative thinking, accompanied by bold changes, are the cure when your household budget has you buried alive in bills and struggling to survive. Other Blogs of Interest Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Hong Kong slid into a recession in the 3rd quarter of 2019, according to the government’s advance estimates. The city’s economy shrank 3.2% from the 2nd quarter, while the 2nd quarter slowed -0.5% from the prior quarter. (A recession is defined by two quarters of negative growth.) What’s to blame? The U.S./China Trade War and the Hong Kong protests, according to Reuters. However, in real terms, the decline was sparked by consumers. Instead of spending, Hong Kong citizens were protesting in targeted malls and other areas of commerce. Tourists steered clear of the tension. Shopkeepers lost sales, as did restaurants and any industry or service that is reliant upon tourism spending. China’s economic growth is still faster than the rest of the world, at 3.9% sequentially in the 3rd quarter of 2019 and 6.0% annualized. However, that is down from the astonishing pace that the country has maintained for most of the New Millennium. The U.S. economy slowed to 1.9% in the 3rd quarter, according to advance estimates. The 2019 GDP growth is forecast to come in at 2.2%. In stark contrast to Hong Kong, the U.S. consumer is one of the bright spots of the economy. Personal Consumption Expenditure makes up 62% of the U.S. economy. The increase in August PCE was largely due to car buying and medical care. So, the Hong Kong protests are a stark reminder of the price of political unrest, and just how quickly things can escalate and change. Read my interview with Nobel Prize winning economist Robert Shiller for details on how we can talk ourselves into a recession – or strike ourselves there, as is happening in Hong Kong. Will the Hong Kong Recession Spill Over Into the Rest of the World? The trade war between China and the U.S. has already caused damage to both economies. Companies like General Motors, General Electric and Ford are reporting lower sales and earnings in 2019, and robust cutbacks on their capital expenditures to improve performance. In the 3rd quarter 2019 earnings call on October 29, 2019, GM CEO Mary Barra’s tone was one of resignation that the challenges and costs are here to stay. Barra said, “The team continues to focus on accelerating cost reduction initiatives to improve performance, given the business environment.” In Federal Reserve Board Chair Jerome Powell’s testimony to Congress on November 13, 2019, he noted that “weakness in business investment… is being restrained by sluggish growth abroad and trade developments.” Protecting Yourself from a Global Economic Slowdown Your best protection is to have enough safe in your savings and retirement plans, and to know what’s safe in a world where Ford bonds were just downgraded to junk and over 50% of corporate bonds are at the lowest rung, just above junk bond status. The Cliff Notes on that are that bonds won’t save the day in the next recession. In fact, they might cause it. According to Charles Schwab’s Chief Investment Strategist Liz Ann Sonders, “This highly indebted, weak component of the corporate sphere will mark the end of this cycle in some way.” Another important consideration is that money market funds now have redemption gates and liquidity fees. Many Certificates of Deposit are no longer FDIC-insured. Annuities and life insurance were never FDIC-insured. So, you must read the fine-print on all of your bank, retirement and brokerage products. Personalize Your Pie Chart in Our Free Web Apps. If you’d like to know what a diversified, overweighted safe plan that is personalized for you looks like, click through to our free Easy-as-a-Pie-Chart Nest Egg web app. This pie chart shows you what you should have. The key is learning what you do have, so that you can compare apples to apples. The easiest way to do that is to receive an unbiased 2nd opinion from our office. Call 310-430-2397 for pricing and information. You can also attend an Investor Educational Retreat, where you can learn the ABCs of Money that we all should have received in high school, and implement the time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between. Knowing what you own and why you own it is important to do now before the global economies weaken further. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. General Electric gave no warning before they cut their dividend in half, and their stock dropped by more than 2/3rds. The warnings that Ford bonds were in danger of being downgraded to junk status were fleeting and few. (Click to access my warning in 2018.) If your financial plan is longer than just a few pages, or if you lost more than 30% in the Great Recession, these are red flags. However, even a formerly resilient plan could be vulnerable due to the over-leverage in bonds. Underweight Hong Kong Given the recession in Hong Kong, it’s a sound policy to underweight your exposure there. The iShares Hong Kong ETF EWH is still trading near an all-time high, so now might be an excellent time to consider a different choice. About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She is the co-creator of the Earth Gratitude Project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her easy as a pie chart nest egg strategies earned gains during the last two recessions and have outperformed the bull markets in between. The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 2nd edition of The ABCs of Money was released in 2018. Other Blogs of Interest They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Two of my coaching clients have been having a rough time getting access to their money. Sadly, their story is one that I’ve seen far too often – particularly with regard to Boomers, retirees and anyone who wants to turn over the management of their money to someone else to handle. (Rich people don’t do that. They hold the people who are in charge of their investments accountable, and have regular meetings where the manager has to explain the strategy and the results.) When D&T started asking questions and wanting greater control over their own financial future, their “financial advisor” went radio silent and quit returning calls. They are in the middle of this process. Hopefully, by dotting the I’s and crossing the t’s on their requests, and because we are still riding high on Wall Street, they will get all of their money out of the high-risk investments that they were sold into as safe. Imagine, however, what would be happening during harder financial times, such as the Great Recession… So, many people were caught in these kinds of quagmires, and few escaped without losses. (Lehman bankrupt. GM bankrupt. Chrysler bankrupt. AIG bailed out, but restructured. 20% of the Dow Jones Industrial Average was bailed out or went bankrupt. Washington Mutual bailed out. Countrywide bailed out. Merrill Lynch bailed out. Bear Stearns. All of these bonds and stocks lost a boatload of dough. And that isn’t the end of the list.) As the economy weakens, it’s a very good idea to know exactly what you own and why now, and to be the boss of your money. Specifically, private placement REITs that pay you a high dividend (anything above 4%) are not safe. All of the REITs that I checked into the financials had been losing money for years, with a sea of losses. Annuities are not FDIC-insured. They are backed solely by the insurance company who sells them to you. We would have seen a sea of annuity and life insurance losses if we’d allowed AIG to go bankrupt in 2008. They also have fees and fine print that can dramatically reduce the return that you believe you are receiving. And in some cases with some products, you are at risk of capital loss. (if the company becomes insolvent, you stand to lose most of what you put in.) Here is D&T’s story, in their own words. I met a new financial advisor/money manager, David, at a conference. I wanted to trust someone since my knowledge was lacking in this arena. I had been following Natalie for years and truly liked what she had to say. Finally, I went to my first educational retreat with Natalie. It was all new for me and a bit out of my comfort zone, but I had a deep desire to be in charge of my own money. After all, nobody will care for it like I would. By this time we had hired David. In that first financial educational retreat, I learned that so many things we were invested in were much higher risk than we’d been told. David had put us into a variety of things that were good for him, in that they paid him a high commission! I asked David if he was a fiduciary. He said he was, that everything he did was for us. The thing that truly angers me is what he convinced us to do. I am not a high-risk person, My husband is more so this way, so David manipulated him into investing in private placement REITs. I now know that these are very high risk. Many of these companies have been cash negative for years, borrowing from one investor to pay off another, and paying brokers a high commission to do that. We put in the paperwork last year to cash out of these. Nothing!!! Then we redid the paperwork in August, so we could get the next payout for December. They say that you can only get out of these things twice a year. If you miss the window you have to wait again. We did everything by the book. Once again trusting this would be taken care of. Waiting…waiting…nothing. David, the salesman who put us into these investments, is not even returning our calls!!!! We both have called every week for several weeks now and nothing!!! There is a lot of money in these accounts. It truly matters to us. Now, we’re in the process of writing letters to all parties involved in this world, which includes the broker, the brokerage, another financial firm and the REIT itself. If this does not work, even if it does, we will file complaints with FINRA, the SEC and the FTC on all of those involved. Again, the one that hurts the most is David. If I can impart any wisdom to you, it is to remember that “financial advisors” are sales people. They know how to listen and manipulate to serve their best interests, all the while making you believe that they truly are your friend. I am so angry at this system!!!! I could be angry at myself. However, compassion is what is needed. We did not know that we did not know. They play the game like they care, and they really don’t. It is still hard for me to accept David’s lack of integrity and respect in not responding. My husband has emailed David’s brokerage to report him. Nothing. No response. I am grateful we are now educating ourselves. We have realized through all of this that we truly need to educate ourselves. Studying with Natalie Pace is giving us this opportunity. I wish everyone could take these workshops. It would be great if this was taught in schools. Other Blogs of Interest Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 2019 has been a year of IPOs designed to make insiders rich at new investors’ expense. That was the case in Uber, Lyft and WeWork’s failed IPO attempt. Beyond Meat looked like an outlier to this trend, before last month. Beyond Meat was absolutely delicious at the IPO, soaring from a planned $25 IPO price to a high of $240 in August 2019. However, starting on October 30, 2019, the day that the 180-day lock-up period expired for insiders, Beyond Meat shares took a nose dive down to $76.67. Beyond Meat is different from the other unicorn IPOs of 2019 in that there is a clear path to profitability. The company’s sales increased 250% in the 3rd quarter of 2019, to $92 million. Net income was $4.1 million, proving this young market disruptor company is turning profitable, despite the rapid growth and need for build-out. Beyond Meat has burgers, sausages and even taco meat available at your grocery store, but will also be offered at Dunkin, TGI Fridays, Carl’s Jr., Del Taco, Subway and even in a test for MacDonald’s Canada. Veterans from Tesla, Amazon, Coca-Cola and Nike have jumped on board to help in Beyond Meat’s C-Suite. Beyond Meat’s share price woes have less to do with sales and growth potential, and are more just a valuation concern – and a liquidation event for insiders. Insiders who have had skin in the game for years were itching to turn paper money into profit. Road show investors who thought their shares were worth $25/share, couldn’t resist selling at almost 10 times that amount. Beyond Meat is projecting annual net revenues of $265-$275 million. That is 3 times as much as the net revenues in 2018, at $88 million. However, the estimates indicate that the 4th quarter net revenues might be under $76 million, which would be lower than 3rd quarter’s $92 million. Given the all-stars on the team, the popularity of the product and the growing distribution channels, that’s a puzzling turn of events. Beyond Meat’s CFO Mark Nelson explained in the 3rd quarter 2019 earnings call that the 3rd quarter is Beyond Meat’s seasonally strong quarter due to grilling season. So, is Beyond Meat on sale at $76.67? It’s certainly more affordable than $240/share! Given the growth potential of the $1.4 trillion marketplace of grilled protein, and the team in place, the opportunity should be tasty and juicy going forward. However, as long as insiders continue to sell en masse, the share price will continue to slide. The current price is well beneath most analyst targets, however. And insiders who continue to sell are taking a substantial haircut on the margins they enjoyed last month. There is one caveat, however. This is the late stage of the business cycle. So, if you throw a Beyond Meat patty on the barbie, be sure to watch it closely so that it doesn’t burn. As investors have seen since the company began trading publicly on May 28, 2019, leaving your shares on the grill too long can result in ashes. About Natalie Wynne Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 2nd edition of The ABCs of Money was released in 2018. Other Blogs of Interest Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The funny thing about Wall Street is that when stocks go on sale, nobody is interested, and when the prices are high (as they are today), that’s when folks clamor to buy. When Wall Street reprices, it can happen much faster than you might think, or than you can react to. So, adhering to the old adage of “Buy low, sell high” is as important today as it has ever been. Below are just a few examples of why that’s the case. The Poster Children of the Perils of Purchasing Pricey Investments

And here is a little more color on each lesson learned. Click on the blue-highlighted words to access a blog in the archives on that subject. The Poster Children of the Perils of Purchasing Pricey Investments 1. General Electric. In 2017, General Electric was trading for $32/share and offering a yield of 4.7% to shareholders. Today, GE stock trades for under $11/share and the dividend has been slashed to almost nothing (0.37% yield). There were many signs that GE was borrowing from Main Street to buy back its own stock and pay dividends, which keeps insiders and investors happy, but short-changes workers and the rest of us. I put GE on my Cooling Off Stocks List in 2015. Warren Buffett managed to sell all of his shares a few months before the company slashed its dividend in half, in 2017. On Oct. 8, 2019, GE froze the pension plans of 20,000 workers. The company is underfunded on its pensions and other post-employment benefits by $27.2 billion. Total liabilities for GE top $258 billion. General Electric is just one example of why knowing what you own and learning the basics of investing in stocks is essential in today’s world. 50% of corporate bonds are at the lowest level, just above junk status. Many Wall Street companies are using share repurchases as the financial engineering needed to make their earnings per share look better than it really is, and the price to earnings ratio look lower. 2. WeWork (Uber, Lyft). There were a series of “unicorn” IPOs in 2019 that were really insider liquidation events more than opportunities. The growth at these companies was astonishing (though not as astounding as cannabis). However, so were the losses that had been piling up for more than 4 years. In the case of WeWork, JPMorgan and Softbank were pushing for a $47 billion CEO Adam Naumann personally. Institutional investors balked at the road show, and wouldn’t take the bait even when it was lowered to a $10 billion valuation. The latest bailout deal offered to WeWork by Softbank carries a valuation in the $8 billion realm. Adam Naumann has been stripped of his CEO responsibilities. Thankfully, Main Street investors were protected from this calamity. However, JP Morgan and Softbank had large investments that will have to be written down and protected. So, even Wall Street insiders can drink the wrong Kool-Aid. 3. Ford. In our investor educational retreats, we’ve been using Ford as an illustration for many years, as an example of a highly overleveraged company that was borrowing from Main Street to buy back stock and pay a high dividend, similar to General Electric’s strategy. Ford is a beloved brand, so it was still able to borrow in the bond market, even though when was at the lowest rung of investment grade, offering a mere 5% yield for 30-year bonds. On September 9, 2019, Moody’s downgraded Ford bonds to junk. They had warned of this possibility in 2018. Click to see my blogs on that. 4. Apple. December of 2018 was the worst on Wall Street since the Great Depression. Apple cut its buyback plan in half in October and November, and then stopped buying altogether in December 2018. That’s one of the problems with having the current bull market so reliant on share repurchases. Many corporations have various parameters around their buyback authorization, which can include price. Sometimes the company uses up all of their authorization before the end of the year, and before the board can jumpstart a new round. And, as in the case of GE, Ford, Boeing and other companies, when the debt gets too large, the banks start imposing prohibitions on buybacks when they loan more dough. In Apple’s case, it was a company decision, which has never been explained on record (that I can find). 5. Real Estate. If you purchase real estate too high, your whole life can be ruined. Not only are you at risk of losing your home. Your credit score will be shot. If you stay in your home with an underwater mortgage, you could be stuck there for years, or decades, even if career opportunities or family needs lie in other cities. One thing that you should never do is drain your nest egg to try and stay afloat in an unsustainable lifestyle or an unaffordable home. FYI: banks have recently been offering loan mods that put your mortgage far above the value of your home. If you are in this position, then it’s worth it to seek time-proven solutions, which will never be offered by the entity that you owe money to (i.e. the bank). I have a Debt section in The ABCs of Money that is worth reading. Real estate is back to an all-time high and is unaffordable in many major cities. Buyer beware. 6. Cannabis. Cannabis has been offering highs and hangovers to investors since Canada legalized marijuana in October of 2018. This is a classic example of why price matters. The growth in all of the legitimate cannabis companies that are publicly traded on the Big Boards (excluding the pink sheet penny pot stock scams) is astronomical. The pullback in share prices of late has nothing to do with potential and everything to do with valuation. Today could in fact be a buying opportunity for the hottest pot stocks, particularly those where the annual sales is getting close to the current market capitalization. In addition to growth potential, leadership and the other key factors of identifying the leaders of the industry, you must consider valuation. 7. Gold. Everyone wanted to buy gold in 2011, when it hit $1,895 an ounce. What happened? The banks decided that they would sell off their ETF holdings, which forced American gold investors to take a haircut. Even in an industry like gold, which can go up when stocks go down and is thus a good hedge against weakness on Wall Street, you can’t be all in. Annual rebalancing and proper diversification allow you to get hot in industries like gold, without being over your skis, while having a balanced plan that prompts you to buy low and sell high on auto-pilot once a year. This is taught in my books, emphasized in my unbiased 2nd opinions and covered extensively at my 3-day, life transformational, investor educational retreats. Call 310-430-2397 to learn more. FYI: Most people are still using the outdated Buy & Hope plan, which has cost investors more than half of their equity investments in the last two recessions. It’s time to step off this Wall Street rollercoaster and employ a time-proven plan. 8. Bitcoin. Many gold bugs turned to cryptocurrency in 2017. Just as gold was in 2011-2012, Bitcoin, Ethereum, Litecoin and others were trading high at the end of 2017. If you bought in, you got burned. Bitcoin peaked at $20,000/coin in December of 2017. It’s currently at $9,354. With regard to lesser known crypto projects, buyer beware. There are a lot of sketchy ruse artists offering scams in this space, trying to line their own wallets with gold at your expense. Even Facebook’s Libra has seen many of its partners jump ship, including Paypal, eBay, Visa, Mastercard. 9. CAPE. When I interviewed Nobel Prize winning economist Robert Schiller a few weeks ago, the average price to earnings ratio over the last 10 years was at an all-time high. The only two times it has been higher were before the Dot Com Recession and the Great Depression. We all know how those stories ended. During the Dot Com Recession, NASDAQ stocks lost 78% of their value, and took 15 years to crawl back to even. For most people that means that now is the time to fix the roof while the sun is shining – to actually sell high in your nest egg and trim back to an exposure in equities that is appropriate for your age. Be careful here. You must also learn what’s safe in a world where 50% of corporate bonds are almost junk, and the world is carrying more debt than it has ever seen. The short cautionary flag here is that bonds lost money in 2018 alongside stocks. So, getting safe is trickier than normal. That’s why it’s so important to have a time-proven plan in place at all times, so that you don’t have to worry about “trying to catch a falling knife.” (Wall Street’s metaphor for trying to react to a stock that is repricing overnight.) This may seem like a lot to keep track of. However, once you set up your easy-as-a-pie-chart strategy, all you have to do is to rebalance once a year. That’s less time, money and worry than most people are spending. Otherwise, you’re just riding the Wall Street rollercoaster up and down, never taking advantage of sales, and never selling high when things get overpriced. Again, as I mentioned earlier, annual rebalancing, along with proper diversification (ala our easy-as-a-pie-chart nest egg strategies), is a buy low, sell high system on auto-pilot. That’s why we call it the ABCs of Money that we all should have received in high school. So, as the Feds continue to inject adrenaline into the economy in the form of low interest rates, and as the media and Wall Street insiders try to convince us that things are great, it’s more important to notice what they’re doing behind the scenes and to understand the fundamentals that drive or tank economies. Homeowners and anyone with a nest egg can be certainly happy that stocks and home prices are at an all-time high. However, banking that the rally will continue forever is never the best strategy. (Neither is selling everything before the Apocalypse.) Below are statistics that are very relevant to consider today as almost all assets are back to all-time highs, as is debt.

In the late stage of the business cycle, your best move is to:

Wisdom is the cure. Call 310-430-2397 to learn more about receiving an unbiased 2nd opinion and about attending our next 3-day Investor Educational Retreat. Full Disclosure: I own long positions in cannabis and gold, and short positions in mall real estate. Other Blogs of Interest Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed