|

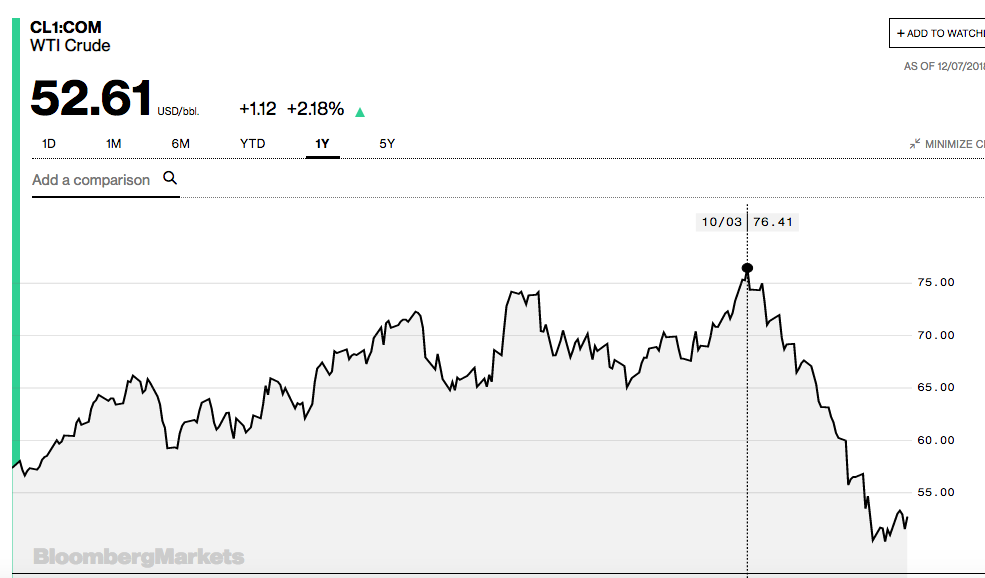

What a busy week. We’ve seen a lot of economic news, most of which is negative for the economy, stocks and bonds. The trade report released on Thursday revealed that the U.S. is on track for a $600+ billion annual trade deficit in goods and services – a high we haven’t seen since President George W. Bush was in office. The arrest of Huawei’s deputy chairwoman and CFO Meng Wangzhou scuttled attempts at a trade truce between China and the U.S. That and more happened by Thursday. And then, on Friday, after the markets closed, we had a flurry of more bad news. 1. OPEC and non-OPEC countries (i.e. Russia) agreed to cut production by 1.2 million barrels/day beginning in January 2019. This is to stabilize the price of oil, which fell from over $75/barrel (WTI Crude) in early October to $50/barrel on November 23, 2018. Winners and Loser of an Increase in Oil Prices Winners

Losers

Other Big News That Dropped Late on Friday, December 7, 2018 1. Iran is exempt from the oil production cuts. In an interview with Bloomberg, HE Alexander Novak, the Russian Minister of Energy, went on record in support of Iran, saying, “Iran and Russia have been partners for a very long time. We support Iran in its urge to further strengthen trade and economic ties with other countries and we will continue doing so.” 2. General Electric announced that the company will cut its dividend to a penny. Last year the dividend was $0.24/share. That was slashed in half in November of 2017. General Electric’s share price has taken a huge hit as a result of the dividend cuts, dropping by 78% from above $31/share in January 2017 to $7.01/share on December 7, 2018. 3. The Mueller Report. The Manafort and Cohen sentencing documents have been headline banter since they became publicly available Friday night (12.7.18). This is not the full Mueller Report. However, it puts political turmoil center stage – something investors rarely stomach well. All of these events are tough on Main Street. The stock futures are pointing lower for next week, and then we have to deal with a Federal Reserve rate hike on Wednesday, Dec. 19, 2018. Even though the rate hike is widely expected, rate hikes have been associated with weakness in equities and fixed income. As I’ve reported previously, bonds have been losing money all year and are predicted to become even more problematic in 2019. (Stocks, too.) The solution, however, is not market timing. Few people get it right when they try to sell everything when they are scared, and back up the truck for stock buys when they feel the market is strong. Emotions operate on a buy high, sell low plan, which is a losing strategy. Everyone wanted to buy Bitcoin in December of 2017, when it soared to a high of $20,000. Those who did are very sorry, as Bitcoin today is worth just $3,370/coin, just one year later (as of December 7, 2018). Stocks are down on the year, with a lot of volatility and could weaken next week further. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest

Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed