|

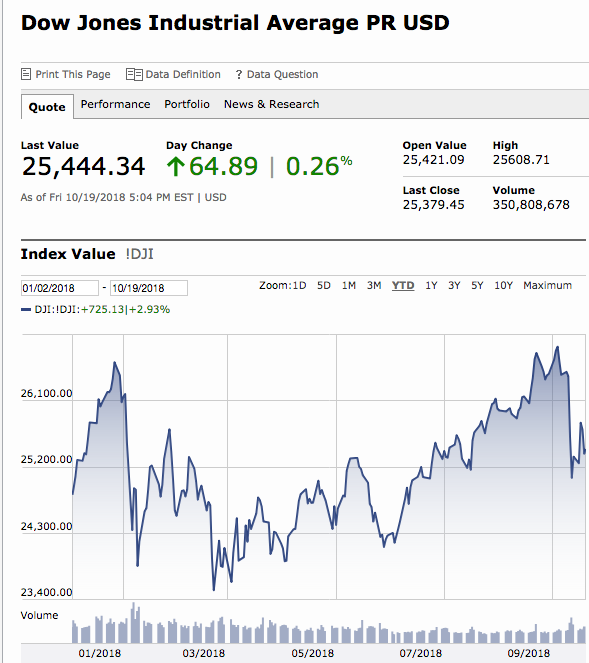

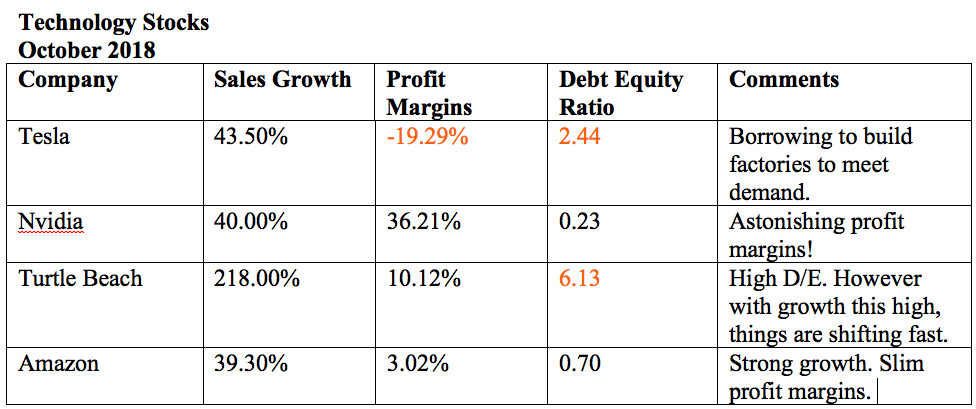

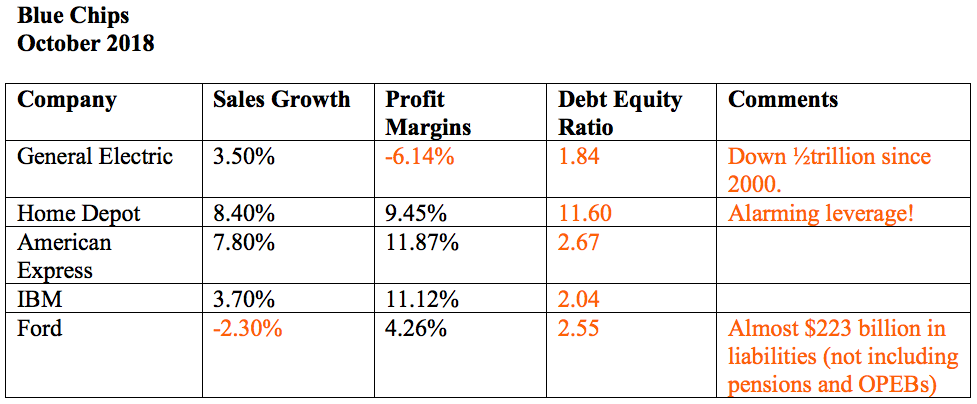

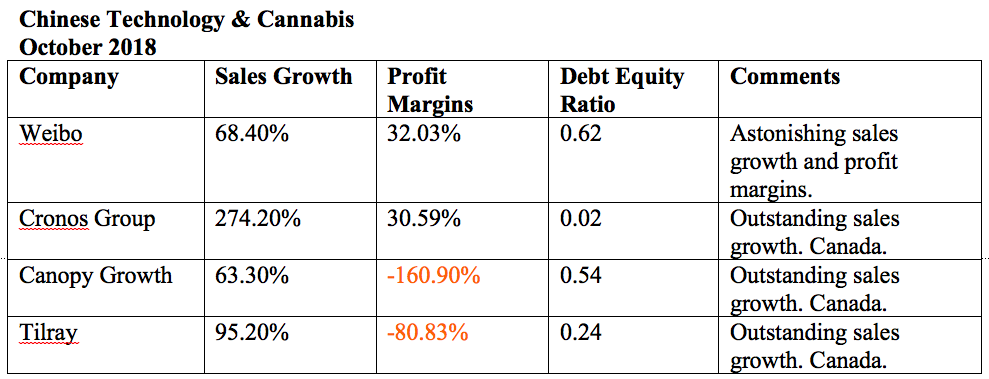

How Have The Markets Performed This Year? Like a rollercoaster. The S&P500 index is actually up 2.7% on the year. That’s not enough to cover the fees that many financial advisors and mutual funds charge. Additionally, there have been two periods of dramatic dives. In early February and again on October 10-11, 2018, the Dow Jones Industrial Average dropped 5%. Will There Be a Santa Rally? So, will it be smooth sailing from here on out? The short-term economics support a Santa Rally. The long-term economics suggest that this 10-year bull run is near its end. That is why every little event can spark a sell-off, particularly if something occurs right before earnings are released. In early February, stocks headed south when Alan Greenspan appeared on Bloomberg and said that stocks and bonds are in a bubble. In October, the drop was largely due to a little known, behind-the-scenes phenomenon called The Quiet Period. Blue Chips have been borrowing money cheaply and buying back their own stock. However, two weeks before a company releases earnings, during the quiet period, the kibosh is put on buybacks. The volatility in early February was also during a quiet period. The next quiet period will happen in late January/early February. Blue Chips vs. Technology. A Tale of Two Indices. U.S. Stocks U.S. stocks are a tale of two indices. The NASDAQ Composite Index leans toward younger companies with great earnings, that are overpriced. The Dow Jones Industrial Average hosts legacy brands, many of which are weighed down by pension promises, health care costs and debt, but are using financial engineering and cheap, easy, borrowed money to make their earnings look better than they are. They are also overpriced. In the words of Nobel Prize winning economist and Yale professor Robert Shiller, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Companies like Advanced Micro Devices, Facebook, Nvidia have sales growth of 40% or more, with net profit margins of 5%, 39% and 36%, respectively. Turtle Beach’s sales growth was 218% in the last quarter! GE Lost Half a Trillion. Is Your Fave Blue Chip Next? On the other hand, many of the Dow companies have tepid or negative revenue growth with high debt and high price to earnings ratios, like American Express (2.67 DE, 28 PE), Home Depot (11.60 DE, 25 PE) & IBM (2 DE, 26 PE). General Electric has lost 80% of its value since 2000, so the story of overleveraging with financial engineering can be one of woe. Chinese technology and cannabis are on fire with sales growth. Many Chinese technology companies have high double-digit sales growth and profit margins 30% or higher. With Canada legalizing weed, publicly traded cannabis companies are boasting some of the highest sales growth rates seen in this bull market. Santa Rally or True Correction? So, will we have a Santa Rally? Or will the current sell-off continue? The Dow Jones Industrial Average was off 5.2% in just two days as of Oct. 11, 2018, while the NASDAQ was down 5%. Below are the pros and cons… GDP Growth. 4.2% in 2Q 2018. The 4.2% GDP growth in the 2nd quarter is something you’d have to be living under a rock to miss. This was strong – boosted at least 1% by a rush by the Chinese to buy soybeans before the tariffs kick in. Most analysts predict a decent 3rd quarter GDP report, though not as strong as 2Q. (The projections are virtually useless, ranging from 2.1% - 3.9%.) We’ll get the advance estimate on Oct. 26, 2018 (Friday). If the numbers are 3.9% or higher, investors could dance and sing, and we could see a rally. 2.1% growth could silt returns in stocks, even though everyone wants to be happy during the holidays, which often helps Wall Street to rally. A natural, political or terrorist disaster could spoil the fun no matter where the numbers land. Tax Cut and Tariffs Boosted Earnings in the 2nd Quarter 2018 Analysts are optimistic about the 3rd quarter 2018 earnings. According to Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices, “With S&P 500 Q2 2018 EPS being declared a success and setting a new record, attention is now on Q3 2018, which is expected to also set a new record with a 27.8% gain over Q3 2017, as it posts strong earnings and cash-flow, via lower tax rates and stronger sales.” Next year, it will be tougher to show earnings and sales growth, as there will not be a tax slash to boost profits and earnings. What Could Silence the Santa Rally? Tariffs. Tariffs hurt profits. There have been many industries that have warned the White House that their tariffs are going to hurt sales, profitability, growth and potentially cause layoffs in the labor force. Those industries include auto manufacturing, solar, utilities and more. Rate Hikes The Federal Reserve Board has indicated that they intend to keep raising the Fed Fund Rate. The most recent projections from the September meeting suggested that the rate will hit 3.4% by 2020, with one more rate hike at the December 18-19, 2018 Federal Open Market Committee meeting. The “Smart” Money The sell-off on Oct. 10-11, 2018 was not prompted by any communication or action from the Federal Reserve Board. The “Smart” Money has been moving to take profits all year, causing large ripples in the market when they do. This 10-year bull market has been largely fueled by corporate buybacks. Rising interest rates make this a much more expensive proposition. Quiet periods happen every quarter, when corporate buybacks are not allowed. Hedge funds, high-frequency trading and general competitiveness are causing the markets to move at higher speeds and with deeper drops than in the past. Politics The markets don’t like uncertainty. We have that in abundance, not just here in the U.S., but all over the developed and developing world. Act of God Uncertainty is coming from natural causes, too. Every day there is a new report with a dire warning on climate change, or a catastrophic hurricane or other calamity. Real Estate Rising interest rates will limit the buyers, putting downward pressure on prices. If you’re staying in your home, can afford it and aren’t underwater on your mortgage, consider locking in a fixed interest rate now. If you are still underwater on your mortgage, can’t afford your home or can’t lock in a fixed rate, then it’s time to look at options that the debt collector, mortgage broker and bank will not offer you. Cryptocurrency This is still the Wild West for cryptocurrency. The space is rife with scams and shysters. That doesn’t mean that there isn’t a future for blockchain or Bitcoin, Ethereum, Litecoin and more. But it does mean that you should only gamble with a sliver of your money, and only that which you are willing to lose. You also need to grade your guru before you buy into anything. Many slick snake oil salesmen are jumping into this space with MLMs that are designed to line their pockets while draining your bank account. Your best next move is to know what you own, and make sure that you are properly protected from a downturn, with exposure to assets and industries that will hold their value or increase in value if stocks and bonds fall. That requires education and an unbiased second opinion on your current plan. Call 310-430-2397 to learn more now. Market timing rarely works. So, don’t just sell everything, or shift from stocks to bonds, without knowing what you are doing. You need to employ a time-proven strategy that earned gains in the last two recessions and has outperformed the bull markets in between. It’s easy-as-a-pie-chart, which is why I call it the ABCs of Money that we all should have received in high school. Part of that process is understanding that Wall Street has become a Tale of Two Indices. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Know what you own now, while the markets are still very high. Click to listen to my teleconference on the 2018 Santa Rally. If you'd like to learn these time-proven nest egg strategies, join me at an upcoming Investor Educational Retreat. Call 310-430-2397 to learn more. Other Blogs of Interest The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed