|

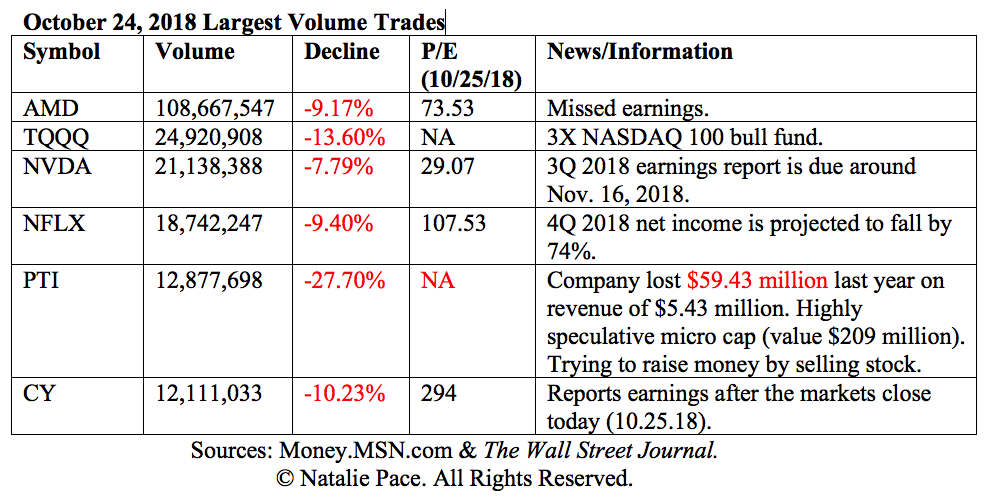

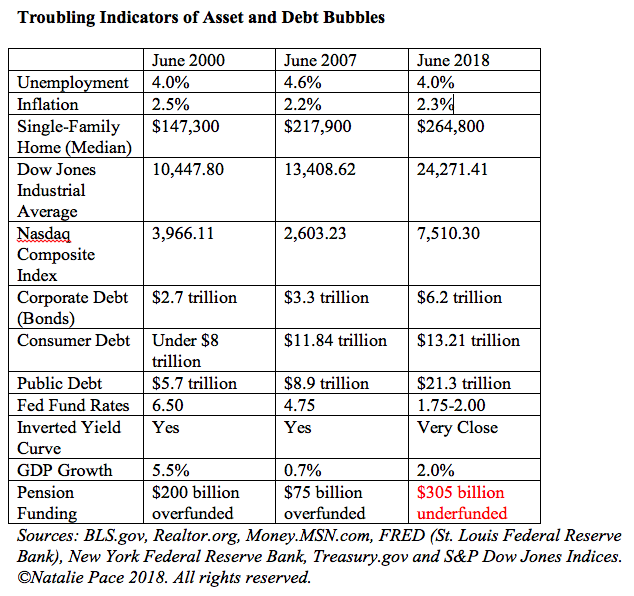

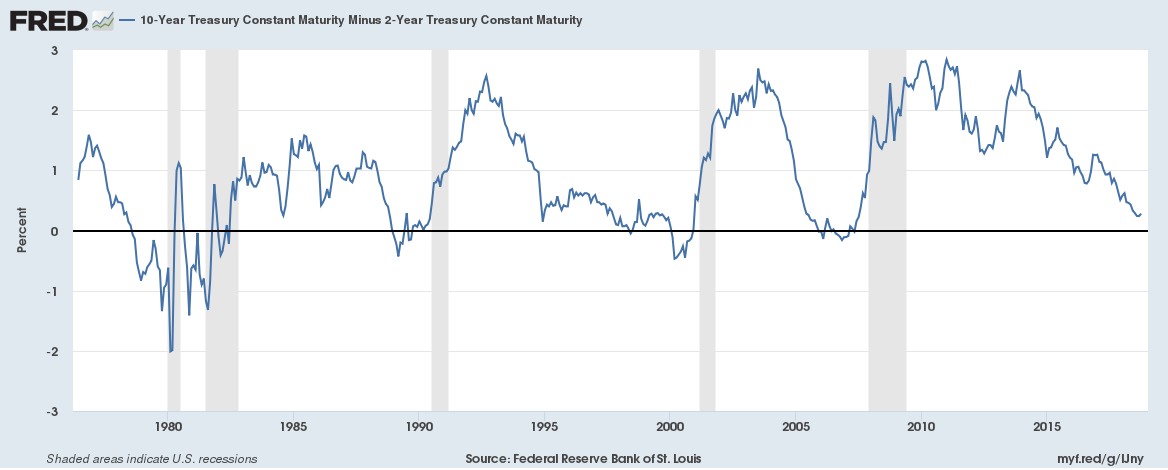

October Spooks Investors. A Tale of Bubbles, Speculation and Greed. On October 24, 2018, stocks wiped out their gains for the year. The NASDAQ Composite Index dropped 4.4%, and the Dow Jones Industrial Average dropped 608 points. What happened was a tale of … Bubbles, Speculation & Greed The average P/E of the S&P500 Index from 1936 to today is about 17.18 (source: S&P Dow Jones Indices). The technology stocks that crashed on October 24, 2018 were all trading at a much higher price to earnings ratio than the average, and most were above 50. Growth stocks can certainly take a higher valuation based upon forward earnings potential. However, when the growth dries up, if valuations are too lofty, then you get rapid corrections such as we saw on Wednesday. In today’s world of high frequency trading and novice options traders and speculators, the correction in a few stocks can trigger a cascade in the larger marketplace. Yesterday, the largest volume trade was Advanced Micro Devices, with a volume of 108.7 million shares (compared to an average volume of 27 million). AMD lost 9.17% in value in advance of earnings. After the markets closed, AMD reported that they had missed their projections. Revenue was down 6% quarter over quarter, and net income was down $14 million from the 2nd quarter 2018. Even with the sell-off, the P/E for AMD is still 73.53. The $34 share price that AMD enjoyed in late September was up three times from the low of $9.04 in April 2018. AMD’s price on October 25, 2018 opened at $17.92. As the NASDAQ began dropping, speculative traders starting abandoning positions. The second largest volume in the NASDAQ was the ProShares 3X Bull NASDAQ fund (symbol: TQQQ), followed by Nvidia, Netflix, Proteostasis Therapeutics and Cypress Semiconductor. Check out the chart below for details. One other lesson of yesterday is that the smart money is tripping the sell button before earnings. Warren Buffett sold all of his General Electric stock a few months before GE cut their dividend in half and before the share price dropped by half. Yesterday, 108.7 million shares of Advanced Micro Devices and 12.1 million shares of Cypress Semiconductor traded before the earnings release. Tomorrow the advance estimates for 3Q 2018 GDP growth in the U.S. will be released. The estimates for what this will be are all over the board, from 2.1%-3.6%. If GDP comes in low, investors will be tempted to sell – largely due to the frothy valuations. If GDP comes in high, then we may have a Santa Rally… There are a lot of ifs in that sentence. Things to keep TOP OF MIND. Asset Bubbles are more problematic today than they were in 2000 or 2008, before the Dot Com Recession and the Great Recession. See the chart below. Learn more in my blog on why interest rates are rising. Quiet Periods Companies have a 2-week quiet period prior to announcing earnings. Since this bull market has been built on buybacks, when companies can’t purchase their own stock, the general marketplace has dropped (early February and again early October). Valuations are frothy – too frothy for weaker revenue and earnings growth. The tax cut boosted EPS (earnings per share) in 2018. However, without the help, 2019 growth should sag. Financial Engineering, particularly in the Blue Chips, has made earnings look stronger and share prices look lower than they really are. As interest rates rise, it will become more expensive for over-leveraged companies to continue this practice. Rising Interest Rates typically stalls out home buying and weighs on real estate. It will also hit highly leveraged companies hard, particularly dividend stocks. The higher the dividend, the higher the risk. Flat Yield Curve. The reason that inverted yield curves are so highly correlated with recessions (100% since 1980) is that banks make their profits on the spread. As short-term Fed Fund interest rates rise, we get closer and closer to an inverted yield curve… In the chart below, the grey areas are recessions. The truth is, as Alan Greenspan warned us on January 31 of this year, stocks and bonds are in a bubble. Bubbles pop. Getting safe is not a matter of market timing, particularly since the “safe” side of most nest eggs is losing money, too. A better strategy is to adopt the time-proven system that earned gains in the last two recessions and has outperformed the bull markets in between. Call 310-430-2397 to get an unbiased second opinion on your current strategy or to learn more. Other Blogs of Interest Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed