|

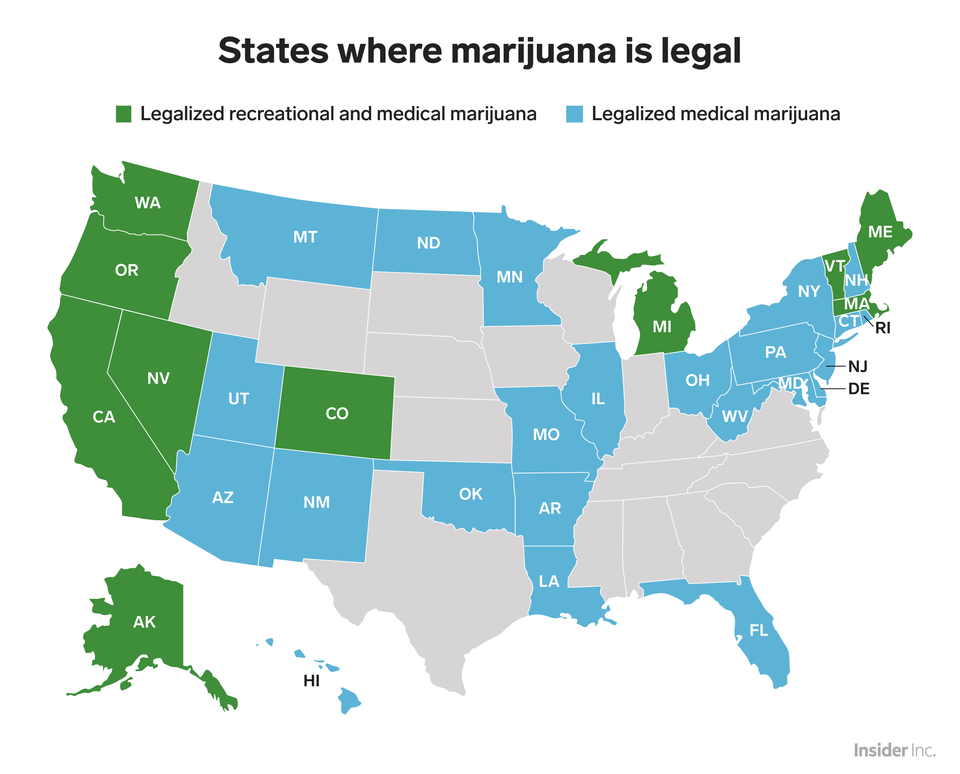

It’s hard to imagine anything that has ever moved through politics faster than the legalization of medical and recreational marijuana, except perhaps the repeal of prohibition almost a century ago. In the past few months, one more state (Michigan) legalized recreational use in the U.S., bringing the total to 10. 33 states now allow medical use of marijuana. I’m seeing CBD Oil for sale over the counter in very conservative states, where being caught with a joint a few years ago could have brought a world of trouble. Customers claim CBD Oil cures virtually everything, and worry about how to sneak it into their luggage as they cross state and country lines. The cannabis industry is attracting very established executives and politicians into their C-suite. Tilray’s new international advisory board includes Governor Howard Dean (Vermont), Joschka Fischer (vice chancellor of Germany), along with senior government officials from Canada, Portugal, Australia and New Zealand. Aphria’s new independent board chairman is Ira Simon, the founder and former CEO and chairman of Hain Celestial. Cronos was just infused with a $2.4 billion investment from Altria (the owner of Marlboro and Philip Morris), giving Altria 45% ownership, with the possibility of taking ownership up to 55% with warrants. Constellation Brands (the owner of Corona, Robert Mondavi and other beer, wine, vodka and whiskey) invested $4 billion in Canopy Growth. MedMen’s board includes former LA Mayor Antonio Villaraigosa. Andrew Modlin, MedMen’s co-founder & President, received the Emerging Leaders Award in 2017 from the American Marketing Association. In short, cannabis is mainstream. Companies are making legitimate deals with Colombian farmers for supply. Most of the publicly traded cannabis companies are Canadian based, with greenhouse grow farms. Gone are the days of gangster movies about weed smuggling. Your grandmother might have even tried one of the products, particularly the CBD Oil. So, it won’t surprise you to learn that cannabis companies are exploding in sales growth. Aurora Cannabis just announced that their revenue for the 2nd quarter (of 2019 fiscal year) will be $50-$55 million, compared to $11.7 million a year ago. This is 68% higher than 1Q 2019 and 327% higher year over year. The company will release their earnings report before the market opens on Feb. 11, 2019. Aphria’s revenue growth exploded with 255% ascension in the most recent quarter. Cronos Group’s revenue rocketed up 186%. Tilray’s growth was an impressive 85.8%. Canopy Growth is the largest and perhaps most well known of the publicly traded cannabis companies. However, Canopy’s year over year revenue growth was only 33% in the last quarter. All of these companies enjoy popularity among investors, trading millions of shares daily, and are listed in the NYSE or NASDAQ stock exchanges. Be careful of cannabis companies that are not traded on the big boards, have very thin trading activity and don’t have governance and financial information that is easily accessible. (MedMen is still trading off the boards in the U.S. with the symbol: MMNFF, and on the Canadian Securities Exchange in Canada, with the symbol: MMEN, putting this early stage company at higher risk than the other companies mentioned in this blog.) The challenge of all of these companies is scaling quickly enough to meet demand, without compromising quality. With the experienced executives that are joining up the companies I mentioned here, these companies should have the talent and experience in place to execute, escalate and start vertically integrating their supply chain. So, when you’re looking for cannabis companies to invest in, be sure to look into who is running the company, along with the board and their qualifications, rather than just blindly investing. There are still plenty of scams out there, and opportunists looking to cash in on the trend. Penny pot stock marketers are still pushing pump and dump schemes, where insiders sell en masse as soon as the ruse attracts enough naïve investors. A few more points:

Full disclosure: I own shares in many of the cannabis companies mentioned in this blog, including Cronos, Aurora and MedMen. Are You Interested in Learning How to Invest in Hot Industries, Like Cannabis? Join No. 1 stock picker Natalie Pace at a 3-day Investor Educational Retreat. Learn the ABCs of Money that we all should have received in high school. Only 2 seats remain available at the Valentine’s Retreat in Santa Monica. Make sure that your financial house is secure enough to withstand the economic storms that are on the horizon. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt, and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, alongside a personalized sample nest egg pie chart, email [email protected]. Other Blogs of Interest Canada Legalizes Marijuana. Penny Pot Stock Scams. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 17/8/2019 12:51:58 am

CBD I think will go hand in hand with the pharmaceutical medicines. This is because CBD can solve the mental health problems like insomnia, anxiety and depression. These problems can not be solved properly from medicines and do have some side-effects as well. I think this is going to be the future of medical field and people should invest in CBD. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed