|

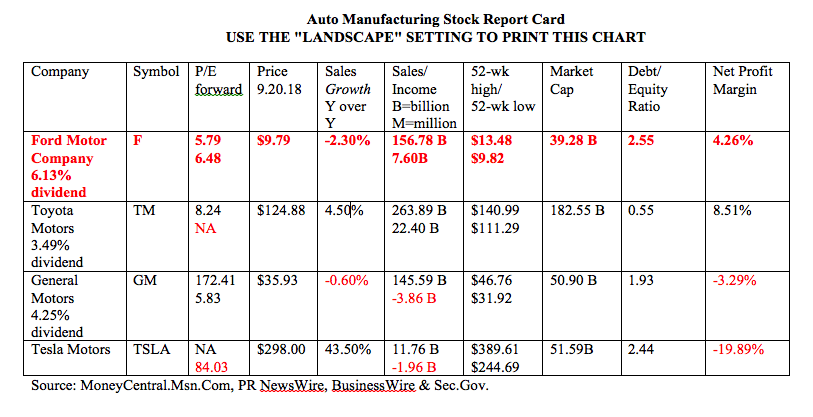

Dear Natalie, I saw the CleanTechnica chart that showed the Tesla 3 becoming the top selling car in the U.S. (by revenue) I have one simple question. Should I invest in Tesla? Signed I.T. Guy Dear IT Guy, Gone are the days that you buy a Blue Chip and hold it to will it to your grandchildren. The Wall Street rollercoaster today is nothing like the days of yore. So, this is not a simple question. However, if your goal is Buy and Forget About It, so you can stay focused on your day job, then investing in any individual company is not a good match for you. Having an Easy-as-a-Pie-Chart Nest Egg Strategy ® that you rebalance once (or more) a year will serve you better. Individual companies require babysitting in today’s world of wild market swings. And in the 10th year of a bull market, every stock can be vulnerable. So, having a defensive strategy is far more important than getting more in the game. However, if you have a little fun money, or if you are passionate about promoting electric cars (with a smaller amount of money), below are a few tips to help you evaluate whether or not investing in Tesla (or any other hot individual company) is right for you. Tesla has promised a spectacular 3rd quarter earnings report, and that often does spark investor buying. The next earnings report should be issued around November 1-2, 2018. Checklist for Investing in Individual Companies Consider The Company’s Potential. Factor in What the General Marketplace Is Likely To Do Are You Willing to Babysit? What’s Your Exit Strategy? And here’s a little more color on each point… Consider The Company’s Potential. You’ll need to do a Stock Report Card ® and Ask the Four Questions ® before you can be sure that you have picked the leader in the industry*. Then you need to apply the rest of the 3-Ingredient Recipe for Cooking Up Profits ® to make sure that you are buying the stock at a bargain*. Never pay retail! Tesla scores very high in revenue growth, and is on the right side of electric vehicles, which are the fastest growing vertical worldwide. No other U.S. car company comes close to Tesla’s growth rate and global expansion plan. So, the only question is price. Today’s price is $299/share. The all-time high was $387/share. Are you willing to purchase near the all-time high, hoping the price goes higher? *The strategies that I used to become a no. 1 stock picker are outlined in my first book, Put Your Money Where Your Heart Is. Factor in What the General Marketplace Is Likely To Do It’s the 10th year of the current bull market, making this the longest bull market in history. So, by the numbers, the market is very high. We should be closer to a correction point than a rally. Are You Willing to Babysit? Last week, CleanTechnica released the news that the Tesla 3 became the top-selling car by revenue. A few days ago, the headlines were about the Justice Department investigating Elon Musks’ personal tweets about the “taking Tesla private” scandal that never played out. In 2019, the Tesla tax credits start phasing out. Will Tesla have to lower its prices to keep sales strong? Additionally, the steel tariffs are predicted to increase the costs of auto manufacturing – further weighing on profitability going forward. The share price has dropped as low as 37% off of its high this year. If you can’t stomach that kind of volatility, and are going to be tempted to trade on every headline, then investing in Tesla is not right for you. What’s Your Exit Strategy? The wiggle room between the 52-week high and low is only about 58%. The wiggle room between today’s price and the high is only 30%. Are you going to capture your gains at 30%? Or are you hoping for an outstanding 3rd quarter earnings report and want to see if the stock shoots the moon? Even great companies are retreating and then rallying on a fairly regular basis this year. So, a smart exit strategy is going to be key to your successful investment. If you’re not sure about any one of these things that I’ve outlined, then your next investment should be in learning how to invest! You wouldn’t bake bread without a recipe, and it’s not a good idea to try and make some dough in stocks without learning my 3-Ingredient Recipe For Cooking Up Profits. We focus on Hot Stocks (and avoiding the Bailouts) for one full day of my 3-day Investor Educational Retreats. Call 310-430-2397 to learn more. Do you have a question for me? Please email [email protected], or post it on my Twitter or Facebook pages. Our team will add your question to my Ask Natalie blog topic list for possible inclusion in this ongoing blog series. Other Blogs of Interest Cryptocurrency Scams Posing as Elon Musk, Your Friends/Family and Government Agencies. Back to School Stock Sales. Should You Buy Tesla Stock? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own shares of Tesla in my investment clubs.

Sterling Harris

22/9/2018 12:32:25 pm

The wiggle room between the 52-week high and low is ONLY about 58%. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed