|

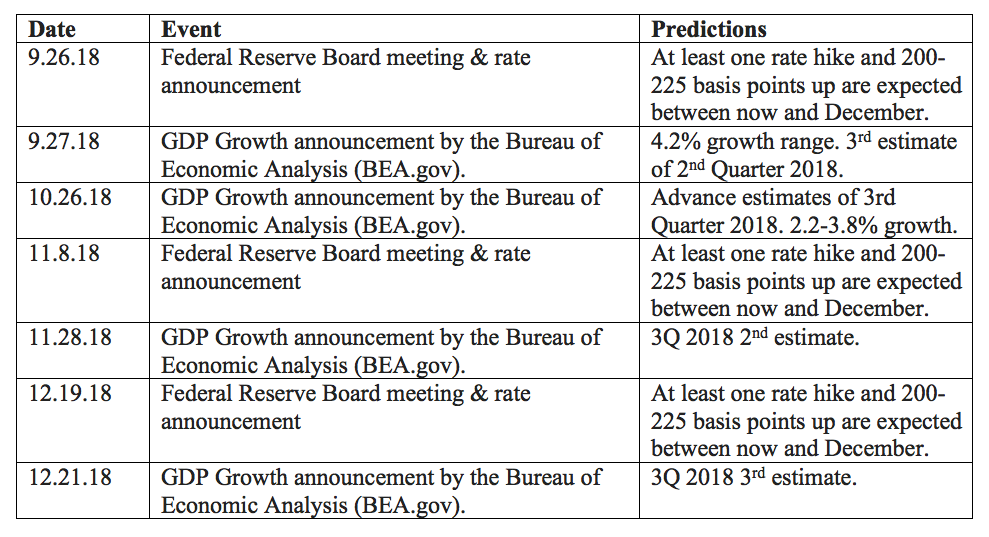

Wall Street is still trading near its all-time high, and gold is near a 9-year low. So, are there any back-to-school stock sales for you to buy before the Santa Rally? Or should you be getting defensive (and getting a second opinion) on your financial plan? I have found a few areas of opportunities that are worth a look, and a few warnings that are worth paying attention to. Here’s What I’ll Cover in this Blog 1. U.S. Stocks 2. Electric Cars 3. Gaming, Artificial Intelligence, Virtual Reality and Autonomous Cars 4. Chinese Technology 5. Gold Miners 6. Lithium 7. Clean Energy (LEDs, solar +) 8. Micro Mobility 9. Facebook, Snap, Weibo and Social Media 10. Red Flag Industries: REITs and Retail And here’s more info on each… Click on the highlighted words to access a longer article on that company or topic. 1. U.S. Stocks U.S. stocks are a tale of two indices. The NASDAQ Composite Index leans toward younger companies with great earnings, that are overpriced. The Dow Jones Industrial Average hosts legacy brands, many of which are weighed down by pension promises, health care costs and debt, but are using financial engineering and cheap, easy, borrowed money to make their earnings look better than they are. They are also overpriced. Companies like Advanced Micro Devices, Facebook, Nvidia have sales growth of 40% or more, with net profit margins of 5%, 39% and 36%, respectively! Turtle Beach’s sales growth was 218% in the last quarter! On the other hand, many of the Dow companies have low or negative growth with high debt and high price to earnings ratios, like American Express (2.67 D/E, 28 P/E), Home Depot (11.60 D/E, 25 P/E) & IBM (2 D/E, 26 P/E). 2. Electric Cars. The Tesla 3 was the #1 selling car in the U.S. in August. Tesla production is expected to double in 3rd quarter over the 2nd quarter. That is great news for Tesla and EVs. The not so good news for Tesla is that the $7500 tax credit per vehicle ends in 2018. How will that impact sales? Will Tesla have to lower its prices next year, and get squeezed on profit margins, just when it is finally making money? The impact of the tax credit won’t start showing up until the 1st quarter 2019 earnings report in late February 2019, however. 3. Gaming, Artificial Intelligence, Virtual Reality, Augmented Reality and Autonomous Cars. Nvidia continues to be a NASDAQ and FAANNG superstar, with 40% sales growth and 36% net profit margin. Turtle Beach keeps revising earnings and profits upward. Nvidia is trading at an all-time high, with a 40 P/E. Turtle Beach’s P/E is 13.55, with a price range of $1.64-$36.50. Today’s price is $22.40. 4. Chinese Technology. Chinese technology is even hotter than U.S. technology, with 68% sales growth & 32% profit margin in Weibo, and 61% growth and 21% profit margins in Alibaba. The issue is the trade war and headlines. Alibaba had $12.2 billion in sales and $1.2 billion in profits in the 2nd quarter of 2018. However, since the net income was half of last year’s, investors gave the stock a beating. Jack Ma announced on Sept. 10, 2018 that he will retire as Alibaba’s chairman in one year, on Sept. 10, 2019 (Alibaba’s 20th anniversary). By the book, Chinese technology is on fire. However, the P/Es reflect their heat, with Alibaba at 50, Weibo at 33 and CTrip at 46. Even with the pullbacks in the share prices of late, many Chinese technology companies are trading near their all-time highs. 5. Gold Miners Gold is trading near a 9-year low. Gold miner ETFs are currently trading at a discount off 70% of their all-time highs. The price of gold is down 37% from its all-time high. Once gold prices start to go up, the miners have more upside potential, due to the sell-off. Gold tends to be a good hedge against a downturn. 6. Lithium With the explosion of electric vehicles, lithium mining companies are doing quite well, which is why FMC is spinning off its lithium division, Livent, into an IPO. Livent’s sales are up 51% year over year in the first 6 months of 2018. Remember that pricing is everything, so don’t buy in just to buy in, without knowing if you are getting a bargain. SQM has a 25 PE, with Albermarle at a 33 PE. 7. Clean Energy. The U.S. solar industry has been heavily impacted by the Chinese tariffs because the silicon ingots and other parts are a global marketplace. It’s something to embrace as a homeowner/consumer if you are living in a sunny state, particularly now when the 30% tax credits are in place. Most homeowners with solar enjoy utility savings of up to 90% on their neighbors. The savings can be even more if you are powering your own EV with solar, and cutting out your gasoline bill. However, as an investor, I’d avoid the solar space for now. LEDs are increasing in popularity, as are electric vehicles. Clean energy ETFs are trading at an all time low. The performance of the solar companies will weigh heavy on the funds, while the growth of LED lighting, lithium and EVs could lift the share prices. 8. Micro Mobility. Companies like Bird and Lime are transforming the last mile in the inner city with electric scooters. Millennials love this easy, affordable solution to expensive parking, cars and gridlock. The companies are still private, but it pays to put this emerging trend on your radar. 9. Facebook, Snap, Weibo and Social Media As I mentioned above, the technology companies in China, like China’s “Twitter” Weibo, have faster sales growth and higher profit margins than the U.S. competition. In the U.S., Facebook (owner of Instagram) is the clear leader. However, even with the Cambridge scandal, the company is still trading near an all-time high. Twitter has finally figured out how to make money ($100 million in the 2nd quarter of 2018), and has sales growth of 24%. But the share price is high (P/E is 95). It was easy to see before Snap Inc.’s IPO that the company hadn’t figured out their product or how to profit from it. (Click to see my blog.) The company lost $3.45 billion in 2017, and just lost a key C-level executive in Imran Khan this week. Facebook and Weibo would be on my Stock Shopping List, waiting for a better bargain. 10. Red Flag Industries: REITs and Retail. Nike is doing great, as are other athleisure brands like Lululemon (but not UnderArmour). However, there have been dozens of retail bankruptcies over the last few years. Unless you are a powerful analyst, retail is a dangerous dark alley to avoid. Most mall owners, like Simon Property, Taubman and Macerich are overleveraged, have expensive share prices, owe a massive amount of money, are losing revenue and many are barely breathing in terms of profits. The mall REITs are keeping investors in with high dividends. However, the adage from Will Rogers is pertinent here: “I’m more concerned about the return of my money, than the return on my money.” Don’t reach for yield! The higher the dividend, the higher the risk. Even a 5% yield is quite risky in today’s world. The over-riding macro sentiment is that stocks are very expensive, and this is the 10th year of the bull market. There are more pressures weighing the macro economy down than there are balloons still lifting stocks. Free, easy, borrowed money, decent (not stellar) GDP reports, low inflation and low unemployment were all present before the Dot Com crash and the Great Recession. What was troubling then were the asset bubbles, which are higher today than ever (and are the reason the Federal Reserve Board is raising interest rates). Earnings support a Santa Rally this year, more in the NASDAQ Composite Index than the Dow Jones Industrial Average, if the interest rate hikes don’t spook investors. There are a lot of ifs in those sentences, so the most important stance for the Santa Rally is a defensive one. Make sure your assets are protected, that you have enough safe and that you know what is safe in a world where bonds are in a bubble. It’s never a matter of jumping all in or all out. My time-proven easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. Call 310-430-2397 or email info @ NataliePace.com to learn how to get safe and protected, and to get a second opinion on your current plan to see exactly where you stand. Most people are far more at risk than they realize. If you lost 1/3 or more in the Great Recession, and you haven’t made any changes, then it would be smart to learn more now. I’ll address the Santa Rally in my October 2018 monthly teleconference. Be sure to tune into that teleconference on Oct. 11, 2018 (Thursday) at 9:00 am PT (noon ET). Click here for the call-in phone number and to listen back 24/7 on demand. If you’d like to listen to further commentary on the Back to School Stock Sales, listen to my September 13, 2018 teleconference at BlogTalkRadio.com/NataliePace. Here’s a calendar of the major events coming up. Other Blogs of Interest

Should You Buy Tesla Stock? from August 9, 2018 Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own some, but not all, of the stocks mentioned in this blog. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed