|

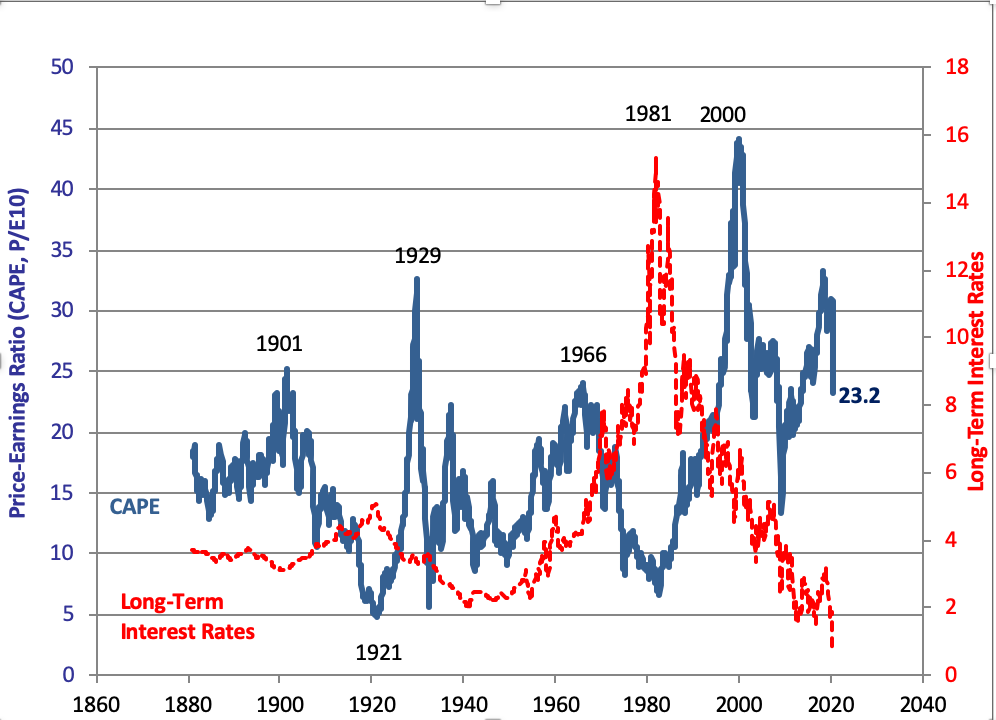

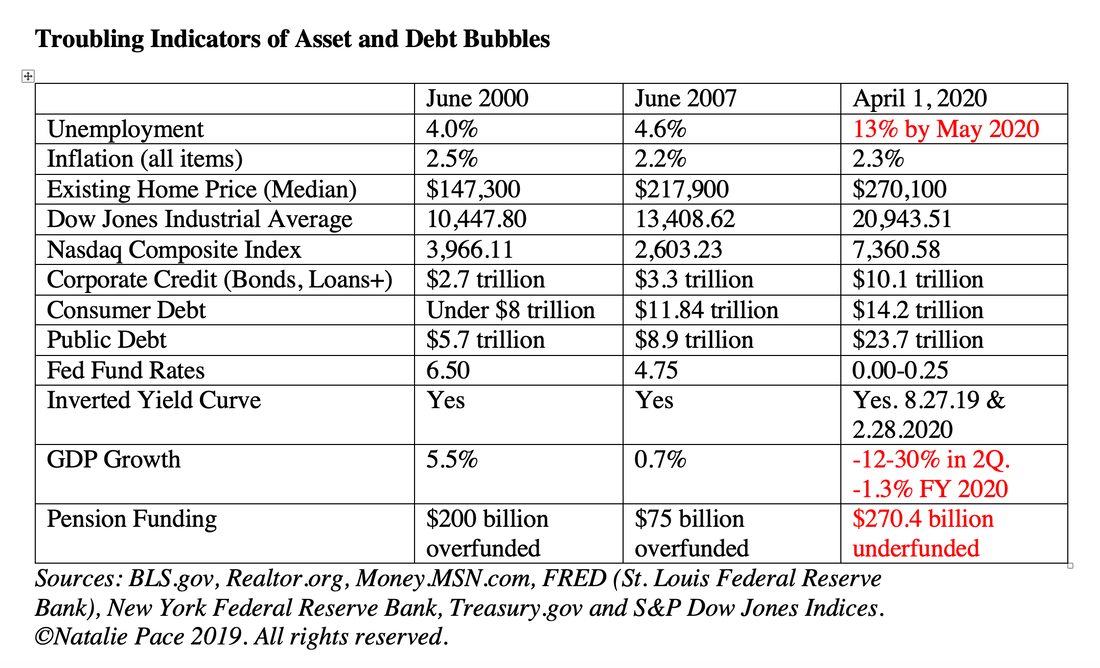

Some of the myths below are outright scams. Others are true in a normal world, but not today. Some are downright deceiving. And one, which sounds like a conspiracy theory, might actually be true. 8 Money Myths, Money Pits and Scams Circulating April 2020 1. Stocks are lower than they have ever been. 2. Are we headed for a recession? 3. This new cryptocurrency, backed by gold, will be the only thing worthwhile in the coming years. 4. Now is a great time to buy dividend stocks. 5. Bonds go up when stocks go down. 6. If you sell now, you’ll be selling low. 7. Once the coronavirus scare is over, everything will rally. 8. The coronavirus is a way to martial law and total control. And here is more information on each one. Money Myths and Scams Circulating April 2020 1. Stocks are lower than they have ever been. This is absolutely false. The most recent low was 6547, hit on February 9, 2009. The all-time high in the Dow Jones Industrial Average was 29,539, set on February 19, 2020. The Dow Jones Industrial Average was down 23% from the all-time high on March 6, 2020. Before the bear market began, most experts were warning that prices were unsustainably high. Robert Shiller, the Nobel Prize winning economist who measures stock prices using a 10-year average of price to earnings ratio, has been warning since 2018 that the only two times in history when his CAPE ratio was higher was before the Great Depression (1929) and before the Dot Com Recession (2000). In the Dot Com Recession, the NASDAQ lost as much as 78% and took 15 years to come back to even. In the Great Recession, the Dow Jones Industrial Average lost 55%. From a CAPE 10-year average price-to-earnings ratio perspective, prices are still historically high from their average. Once the 1st quarter earnings season is announced, with most earnings taking quite a dive, the price to earnings ratio will be pushed higher. So, there is really no measurement that supports this commonly circulated myth. 2. Are we headed for a recession? Informed insiders know that we are already in a recession. However, it won’t be announced until two quarters of contraction are reported – on July 30, 2020. Corporations have pulled their forward earnings guidance. The Federal Reserve Board didn’t publish its customary Supplemental Economic Projections at the emergency March 14-15, 2020 meeting. If you are reading blogs that still speculate about whether or not we’re in a recession, question the source. The writer might be leading you down the wrong path, and encouraging you to do something that might cost you an arm and a leg. There are so many blogs circulating now that lead back to the basic idea that you need to buy more stocks now… with a laundry list of ill-informed reasons why. The smart money wants you to do that, so they have another opportunity to sell high and take their profits on your dime. 3. This new cryptocurrency, backed by gold, will be the only thing worthwhile in the coming years. Whenever there is a lot of fear, doubt and uncertainty in the world, you can expect the snakes and shysters to come slithering out of their holes with a panacea that cures all. Be very careful with these. They promise the world, assure you that they’ve invested their own money, sneak into your email from what looks too be a reliable source or may even come hand-delivered from a friend who fell for the ruse. However, these are all red flags of Ponzi and/or pump-and-dump schemes. As one recent example, the SEC put an emergency stop to the Meta 1 coin on March 20, 2020. This coin had been widely circulated with what appears to be a lie – that the coin was being backed by $2 billion in gold and a $1 billion art collection. In reality, the proceeds were just lining the insiders’ garages with Ferraris. Click to read the SEC complaint. 4. Now is a great time to buy dividend stocks. The U.S. Airlines Organization just signed a letter to Congress promising to suspend share repurchases and dividends until the bailout loans are repaid. The U.K. banks have done the same. Even Jamie Dimon, the CEO and chairman of JP Morgan, noted in his 2019 Annual Shareholder Letter that there might be a “bad recession” combined with “financial stress similar to the global financial crisis of 2008.” In this scenario, he noted that the board of JP Morgan “would likely consider suspending the dividend.” JP Morgan has already stopped their buyback program. In 2019, JP Morgan repurchased $24 billion of their own company stock. Apple was #1 in company share repurchases, with $81.7 billion in buybacks (source S&P Dow Jones Indices). Corporate buybacks and dividends have fueled this bull market since the Great Recession. Highly leveraged companies, like airlines, banks, industrials, real estate and many more dividend-payers, have been borrowing money very cheaply to buy back their own stock and pay dividends (while short-changing pensioners and sometimes even products, as shown by Boeing’s 737 Max plane). This was a risky game that stopped suddenly with the coronavirus crisis. Now, cash-strapped, over-leveraged companies that are seeking a bailout are likely to have covenants to the loans that prevent them from making the insiders rich while looting the company’s future. Bottom lines: If you buy into dividend-paying stocks, you are vulnerable to loss of your capital investment and an abrupt end to the dividends themselves. The higher the dividend, the higher the risk of this. 5. Bonds go up when stocks go down. This is true in a normal world, but not in today’s world. In the Dot Com Recession, bonds were a top-performing asset! In the Great Recession, bonds held strong and earned about 10%. This happens because the Federal Reserve cuts interest rates during recessions to get the economy rolling again. This time around, interest rates are starting out at zero. There’s no room to cut. That is why many bonds and bond funds lost money in December of 2018, when stocks saw their worst sell-off since the Great Depression. Bonds are vulnerable to capital loss and also illiquidity in 2020. Over half of the corporate bonds are congregated at the lowest rung, just above junk bond status. Like Ford, they are vulnerable to being downgraded to speculative. When a company is downgraded to speculative status, you risk that the company will declare Chapter 11, rather than pay you back in full. In the meantime, no one wants to take the investment off your hands. The muni bonds are carrying a lot of risk, too, particularly in the states of Illinois, New Jersey, Kentucky, Connecticut and Pennsylvania. Bottom line: if you have bonds in your portfolio, and you are worried about losing money, then it’s a good idea to examine each position for creditworthiness, term risk and opportunity costs. As I mentioned above (it bears repeating), over half of the corporate bonds are congregated at the lowest rung of investment grade, just above speculative (junk-bond) status. 6. If you sell now, you’ll be selling low. This is one of the age-old, tried and true sales tricks employed by broker-salesmen to get you to Buy & Hold. At the bottom, when you’ve lost half or more (as happened in the two most recent recessions), they are right. However, that is not the case right now. With 23% in equity losses and a smaller loss on the fixed income side, for most Main Street investors, now is likely an excellent time to adopt a strategy that can preserve your wealth. Market timing doesn’t work. It’s never a good idea to just sell everything, or to buy a boatload, based on where you think things are heading. What does work is to, 1) have the right amount safe, 2) know what is safe in a world where bonds, money market funds, annuities and life insurance are vulnerable, 3) be properly diversified in your at-risk portion, and, 4) rebalance your plan 1-3 times a year using our easy-as-a-pie-chart strategy. This plan earned gains in the last two recessions and has outperformed the bull markets in between. Conversely, if you’re using Buy & Hope or market timing, chances are you lost more than half in the last two recessions and spent the bull market crawling back to even. If you lost more than a third in the last recession and you didn’t make any changes, you are more vulnerable today than you were then. It’s time to learn the ABCs of Money that we all should have received in high school. Email info @ NataliePace.com or call 310-430-2397 to learn more about receiving an unbiased 2nd option, or to receive links to our free web apps. 7. Once the coronavirus scare is over, everything will rally. Many analysts are projecting that the world will have a bad 1st quarter, a very bad 2nd quarter and then start a strong rally in the second half of the year. That is certainly what we all want! However, some of the lessons that we learned from the Great Recession are that if you wait for the headlines, it will be too late to protect yourself. Even when the government bails out companies, there will be winners and losers. In 2008-2009, we had a series of unfortunate events before and after the bailouts. Initially, the smaller mortgage providers were allowed to go belly-up. Then Countrywide was bailed out. Indymac had a run on the bank. Many smaller banks changed their name in the Great Recession, while clients continued to bank at the same brick-and-mortar. Bear Stearns was sold at a rounding error of its share price just a few months prior. Lehman Bros. was forced into liquidation, while General Motors and Chrysler were helped to restructure their debt and liabilities. Each one of these milestones hit the stock market hard. There was a steady downturn marked by spectacular drops during these unfortunate events. During the Great Recession it took a year and five months from the top (October 2007) to the bottom (March 9, 2009). The Dot Com Recession experienced a secular decline over a period of two years and seven months, from the top in March of 2000 to the bottom in October of 2002. 8. The coronavirus is a way to martial law and total control. It’s hard to make a case that the coronavirus pandemic was intentional. However, we are seeing serious draconian control measures, which have been introduced to contain the spread and flatten the curve. Some of the control and monitoring measures, which Gary D. Barnett warned about on March 2, 2020, have already become a reality. Movement is being restricted. Quarantines are strongly encouraged (and strictly enforced in some areas of the world). There is talk of a COVID19 passport. Jamie Dimon (and other CEOs) want to have some sort of antibody test so that people with antibodies can return to work (after the all-clear). All of this has drawn attention away from the fact that the economy was overleveraged before this crisis. The printing of money to save the repo market (banking) first went into effect in September of 2019 – well before we ever heard of the coronavirus. There are actually a few lessons to be drawn from this blog. The first is that it cites government data, not just hyperbole. The second is that it isn’t a pitch designed to lead to the panacea, like scam emails will. There is literally no sales-speak as part of this blog by Gary D. Barnett. If you read a lot of hyperbole, that is light on data and statistics from reliable sources, which all point to the one thing that you must do now to save your assets, then chances are you are looking at a marketing pay-to-play email – one that might cost you dearly. You’ll see none of this in Gary’s blog. Gary appears to be sharing wisdom and experience, with links to current policies on government websites, with no agenda other than to inform and enlighten. Those type of blogs are rare. Pay-to-play blogs are prolific. Buyer beware. Bottom Line: A time-proven, well-diversified plan is easy-as-a-pie-chart. It costs less time and money than you are currently spending or have at risk. It protects your assets from losses, and helps your at-risk side stay more buoyant. You’re the boss of your money. It’s important to know these basics so that you can protect your future. It’s not a good idea to have blind faith that someone else is doing this for you. Read D&T’s story for an example of just why that is the case. Call 310-430-2397 or email [email protected] if you'd like an unbiased 2nd opinion on your current budgeting and investing plan, or if you are interested in registering for the Online Investor Educational Retreat April 18-20, 2020. Other Blogs of Interest 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed