|

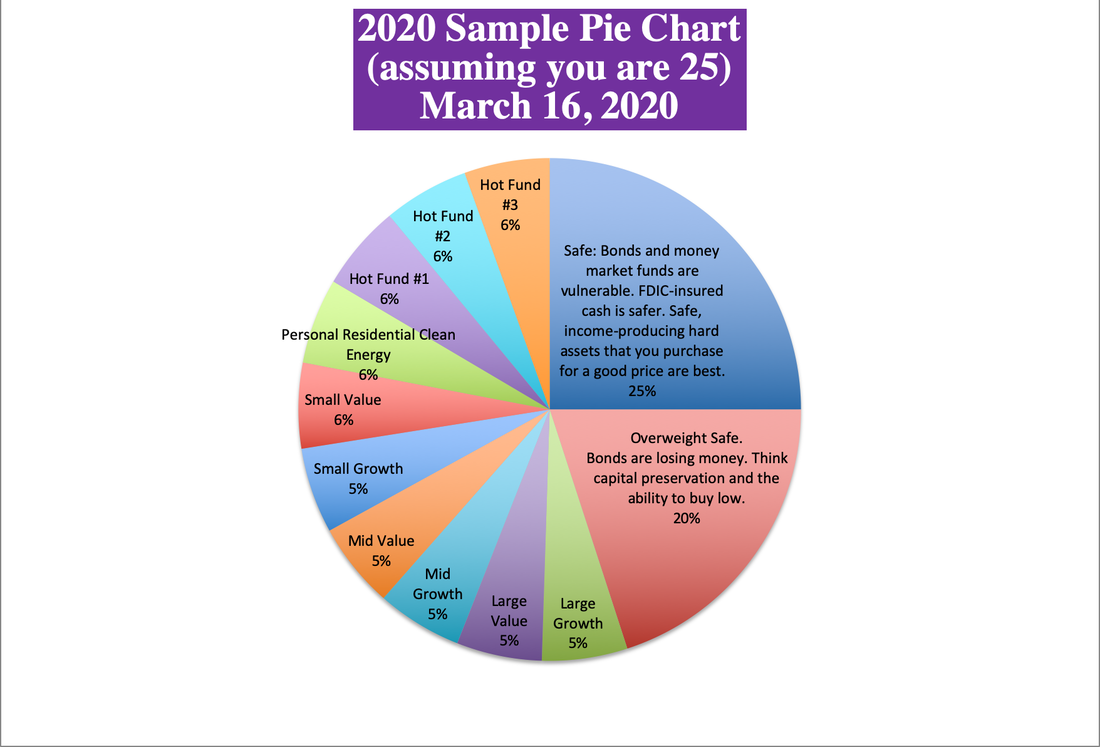

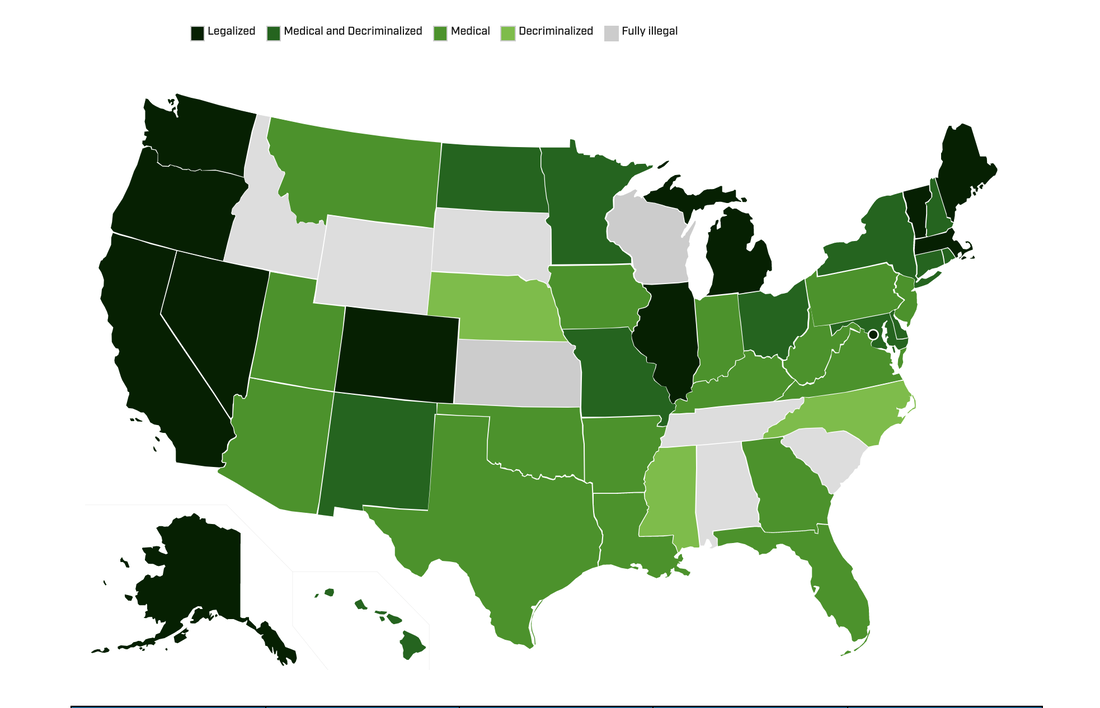

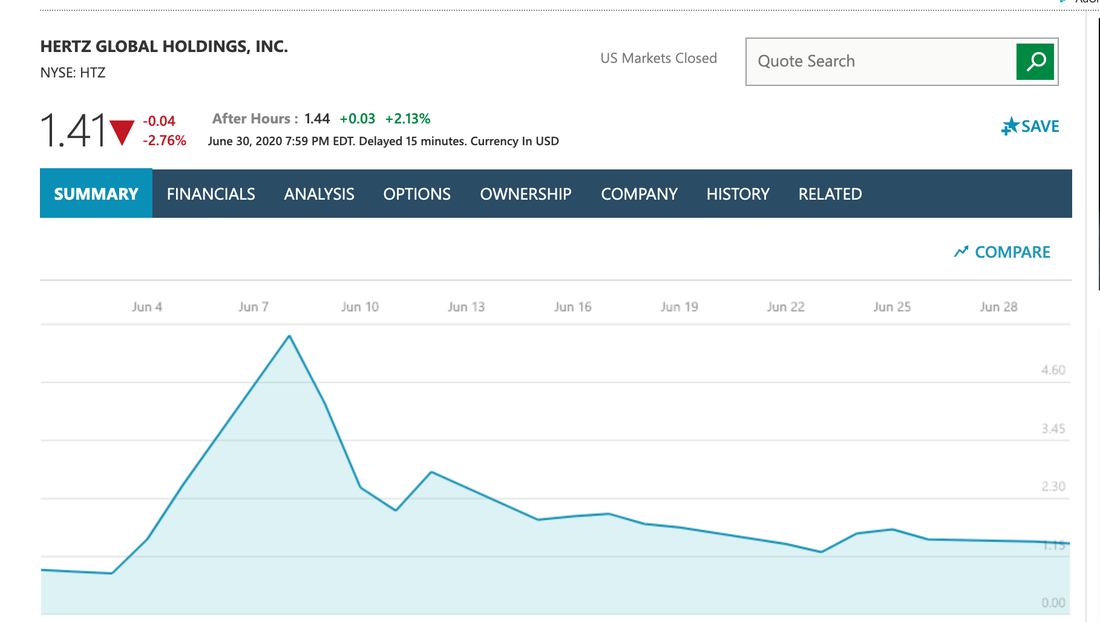

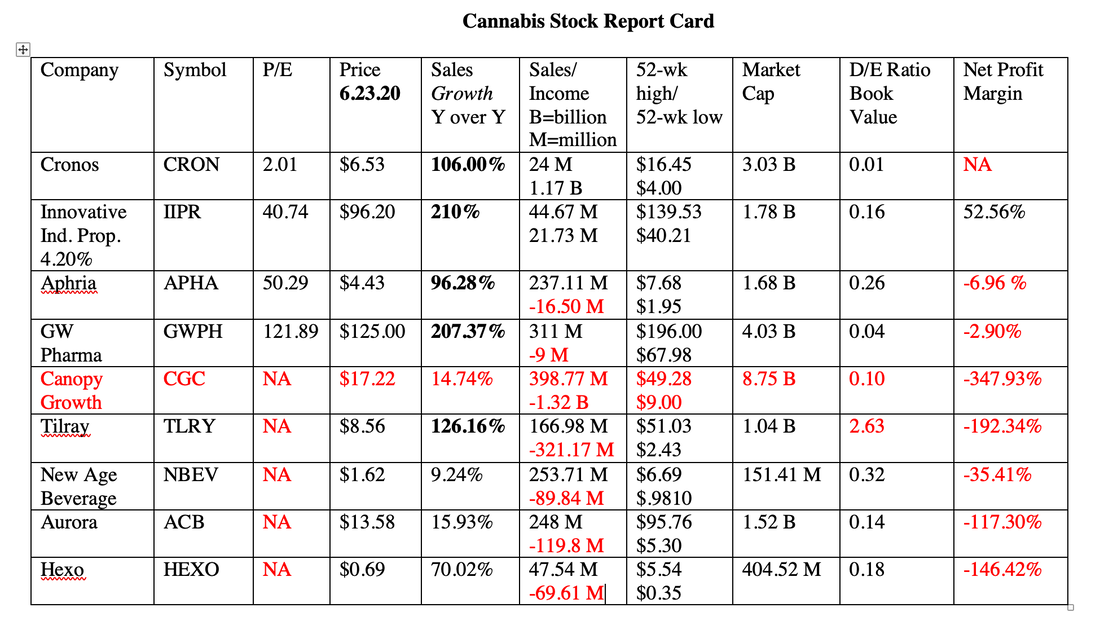

Why Did My Cannabis Stock Go Down? Investors Ask Natalie. The short answer is that cannabis stock went down for the same reason that Hertz stock soared from 40 cents a share to five dollars a share earlier this month, while the company was in bankruptcy. In the short run, things are a popularity contest or just what people do and talk about — herd mentality. In the long run, it always comes back to fundamentals. Some of history’s most cautionary tales are tales of herd mentality – such as what happened to stocks before the Great Depression, to Dot Com stocks before the Dot Com Recession and to stocks and real estate before the Great Recession. This time around, we have to add bonds and money market funds to the madness. The fundamentals on Hertz was that the company was in bankruptcy. So, the time Hertz stock spent at $5/share was limited to just a few hours on June 8th, 2020. Cannabis has been on the chopping block for over a year. If we look at the fundamentals, however, it's clear that customers are still high on the product. Aphria’s revenue in the last quarter was up 98% year-over-year. Tilray’s revenue growth was up 120%. Innovative Properties revenue grew 210%, with GW Pharmaceuticals coming in closely behind at 207% year-over-year growth. Nothing on Wall Street comes close to that kind of year-over-year sales growth. Of all of these companies, Aphria looks to be trading at the most attractive valuation. The company is helmed by the former CEO and founder of Hain Celestial, and boasts having Walter Robb, the former co-CEO of Whole Foods on its board. Tilray is partnered with Anheuser-Busch InBev for developing a CBD beverage. Their 1st product is a CBD tea under the brand Everie. Are You Suffering From Buy High, Sell Low Mentality? During the conversation with this coaching client, I discovered that she had doubled on her cryptocurrency and was up 30% on her large-cap growth and large-cap value stocks. When you are looking at your portfolio during the rebalancing time, you want to make sure that you are looking at everything. If you are focusing solely on the items in the red, then you might be suffering from Buy High, Sell Low mentality. Putting your positions/holdings in to a pie chart takes the emotions out of it, and also prompts you to execute that age-old winning investing strategy of Buy Low, Sell High.  Nest Egg Pie Charts (r) by Natalie Pace. Call 310-430-2397 or email [email protected] for more information. (c) 2020. All rights reserved. It’s easy to be tempted to sell when you think something is losing, and to swoon into the stratosphere when investments are making you money. However, that is a losing strategy when cryptocurrency can drop from $20,000 to $5,000/coin in a matter of months, and stocks can sink by 35% in just a few weeks. On the other hand, we’ve also seen Veritone rally from $2/share to $19/share in less than a month. And the 52-week swing in Tesla’s share price, which is currently at an all-time high, ranges from $200 to $1000/share. Even Elon Musk has tweeted that the share price is too high. Annual Rebalancing with the Nest Egg Pie Chart System is a Buy Low, Sell High Plan on Auto-Pilot When you are rebalancing, put all of your cannabis holdings into the same “slice.” Cryptocurrency would be another slice, even if you have several different types of coins. Separate your funds and other holdings by their size/style. (See the chart above for a sample.) After you know what you own, mock up a pie chart of what you should own. You can personalize your own pie chart using our free web apps. Once you have your sample and your current pies side-by-side, you simply make what you have look like what you should have. A slim slice, like your cannabis, would prompt you to buy more low. Of course, you want to be sure that you are picking the best companies, since there isn’t a well-established cannabis or CBD fund to purchase (and you have to create your own mini-fund). It’s never fun to buy low. However, if you’re right and you do, then you’ll be rewarded well for that bravery. If your cryptocurrency slice is taking up a third of your nest egg, largely because there has been a rally over the past year, then it is prompting you to sell high. If you think cryptocurrency will continue to be strong, then you’ll simply trim back the mega-slice to one or two hot slices. In this manner, you win no matter which way crypto heads. If it implodes, and you still believe in it, then you can buy low. If it rallies, then at your next rebalancing, you can take even more gains. Each Year, What’s Hot and What’s Safe Changes Each year, when you are rebalancing your nest egg, you want to take a closer look at what’s hot and what’s safe. Clean energy was the hottest thing going in 2007, and has been the worst performer on Wall Street ever since. Cryptocurrency was on fire in 2017, and tanked in 2018. On the safe side, money market funds were safe just a few years ago. However, in 2017, companies were allowed to put in redemption gates and liquidity fees. If those are to be enacted, it will happen in a recession, such as we are currently in. In fact, there have been a slew of mutual fund redemption suspensions – mostly concentrated in Europe, so far. Bonds are also a huge problem, due to more than half of the S&P500 being congregated at the lowest rung of investment grade – just above junk bond status. This particular coaching session revealed that this investor was suffering from Buy High, Sell Low mentality. When something goes down she freaks out and wants to sell it. When she’s in the money, she gets greedy and just wants more, more more! That is the way our emotions would have us do things. However, that is the exact opposite of the formula for success. People Don’t Buy Low Because They Can’t Buy Low A year ago, this particular investor had lost a lot on her cryptocurrency. That had her feeling terrible on multiple fronts. Her net worth was down. She couldn’t invest elsewhere because her money was tied up. The only thing she could do was to hope and pray that her crypto recovered. And it did! Investors who were waiting for their Dot Com stocks to recover from that recession had to wait 15 years. People who bought gold at the high in 2011 have been on the losing end of that trade for a decade. It’s important to remember that the reasons people don’t buy low is because…

It’s a reminder that we want to check our emotions at the door when investing. The easiest way to do that is to adopt the time-proven system of the nest egg pie chart strategy, with 1-3 times a year rebalancing. Click to access a blogs with additional information on Buy High, Sell Low mentality and Annual Rebalancing. If you don’t know what you own, or how protected your wealth and retirement are, our Investor Educational Retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more. Click on the banner ad below for additional information on the Oct. 2-4, 2020 Online Financial Empowerment Retreat. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed