|

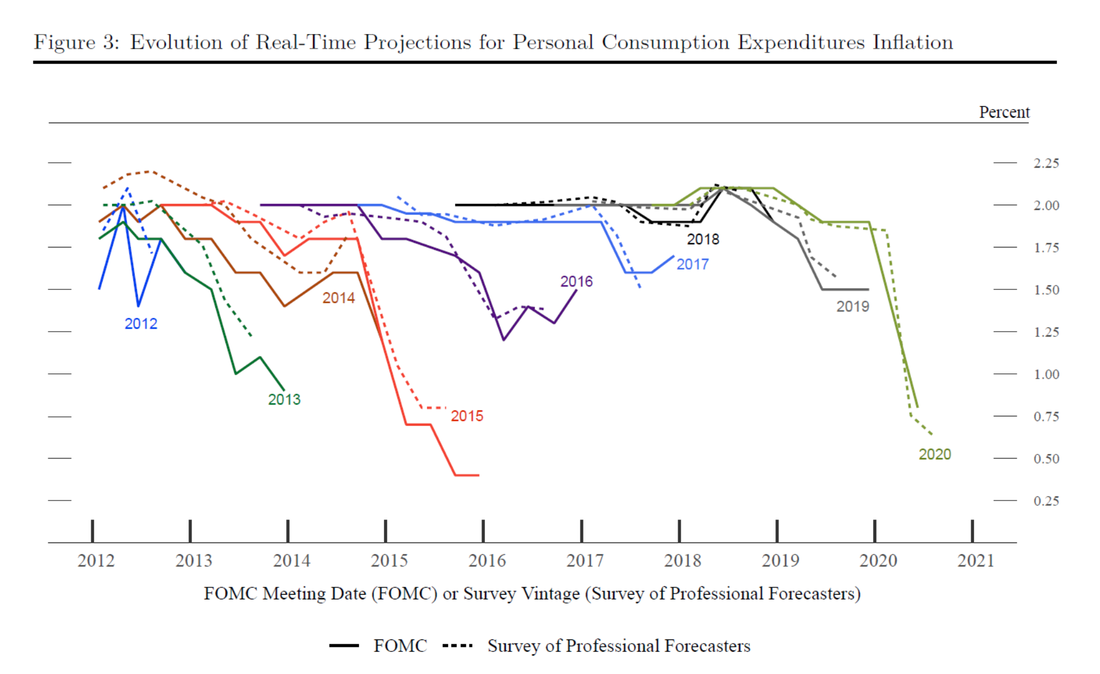

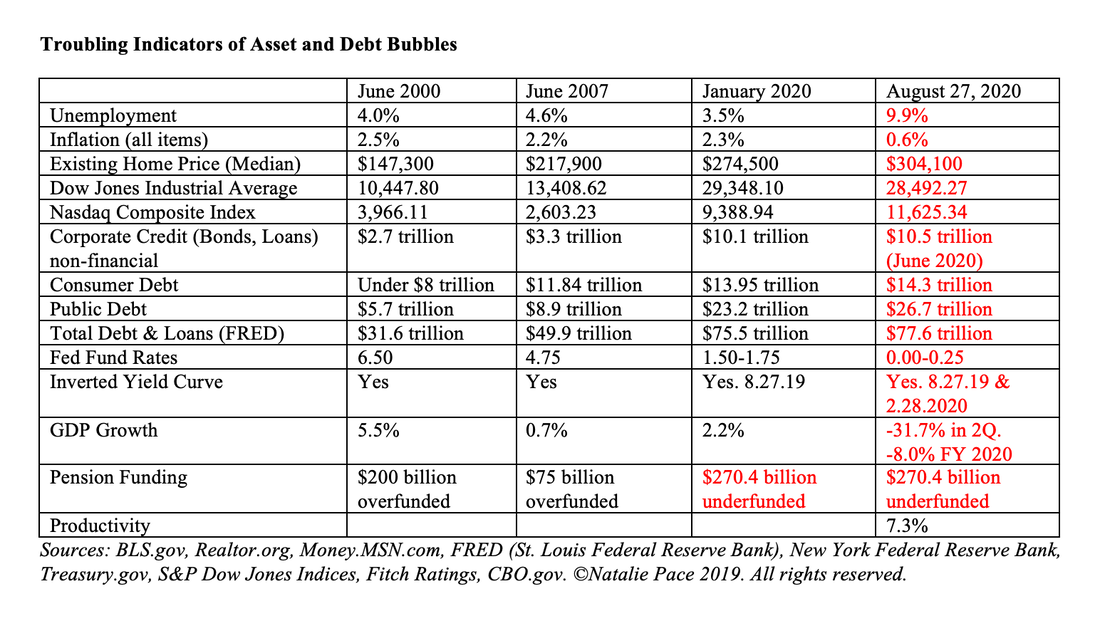

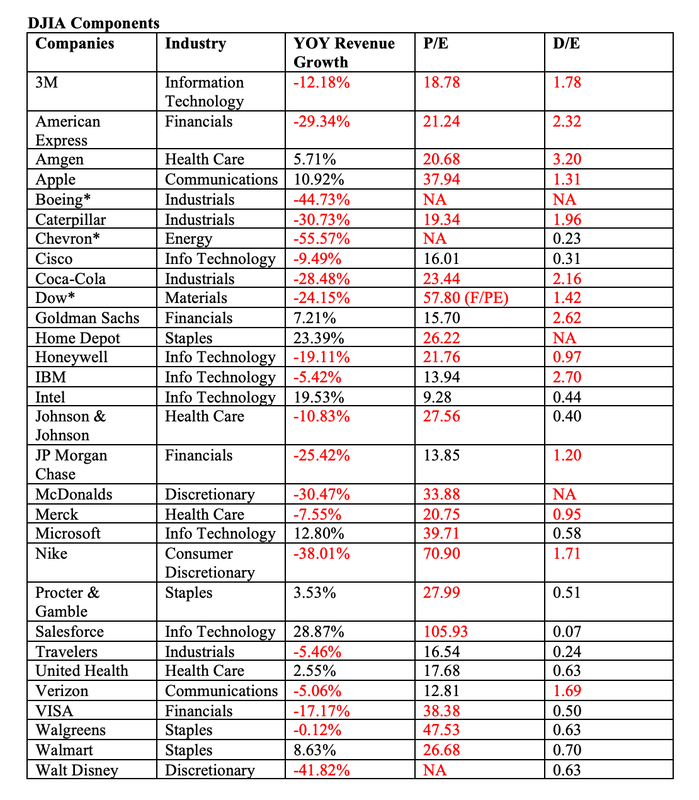

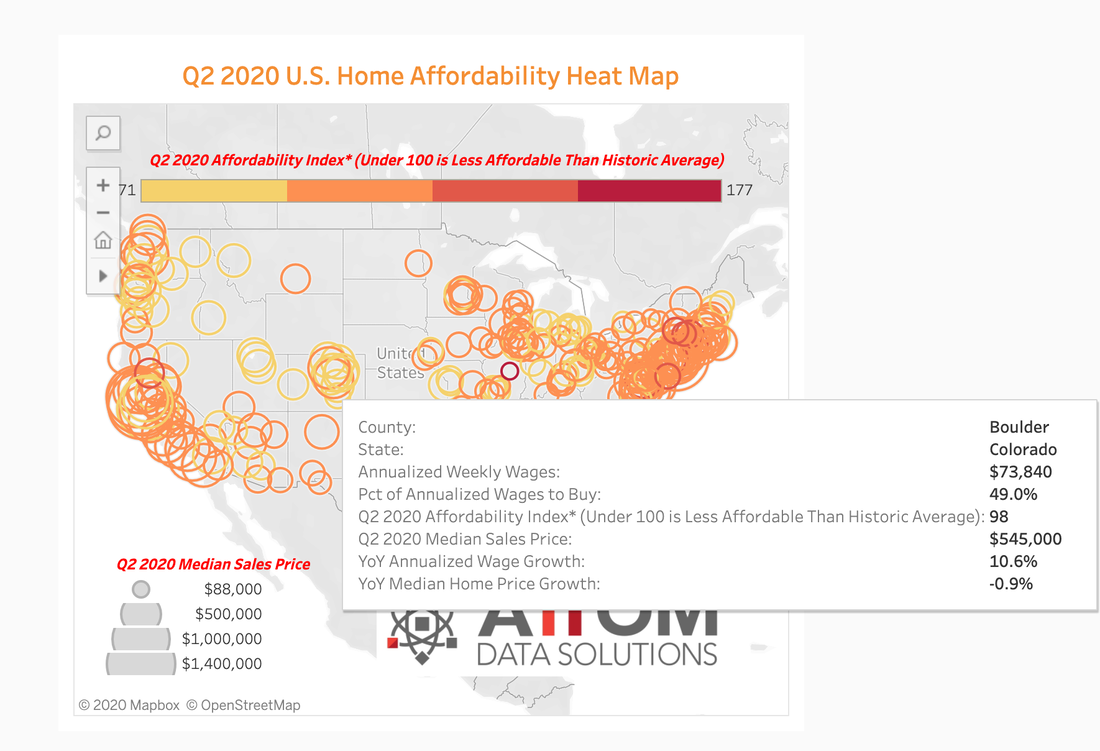

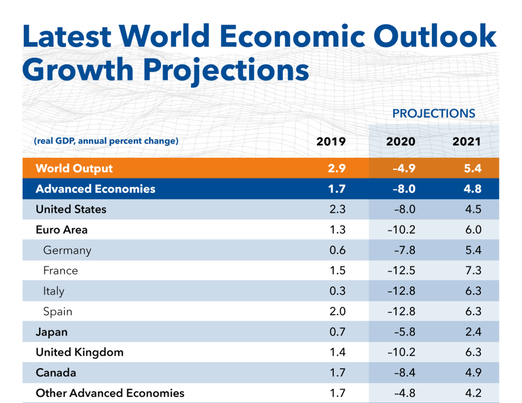

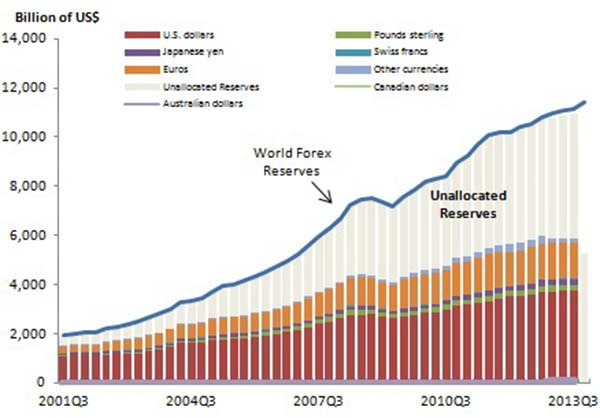

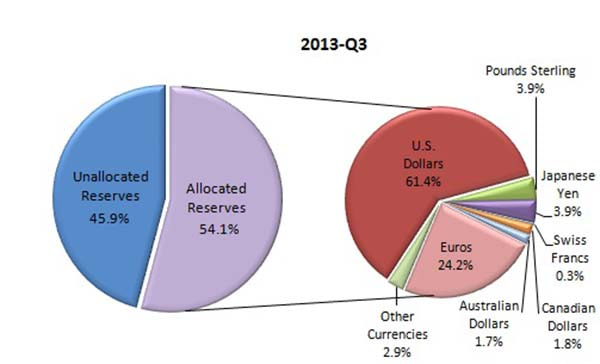

Crystal Ball for the Remainder of 2020. How will the remainder of 2020 play out? Let’s consult the crystal ball of wisdom and data. Don’t Fight the Fed On August 27, 2020, Federal Reserve Board Chairman Jerome Powell announced that the Federal Reserve Board intends to keep interest rates rock bottom, even if inflation starts heating up. According to Jerome Powell, “Longer-term inflation expectations, which we have long seen as an important driver of actual inflation, and global disinflationary pressures may have been holding down inflation more than was generally anticipated.” In other words, the problem continues to be deflation. So, a little kick above 3% might be helpful, in order to move the average closer to 2%. It’s important to recognize that the above chart does not include asset prices, like housing, equities and fixed income. Those are very important caveats. Asset prices are historically high and debt is off the charts. Although the speech acknowledged that interest rates are below their Effective Lower Bound (meaning the Feds have to resort to other tools to kickstart the economy) and the tendency for 21st Century Recessions to end in financial instability is a concern (meaning that the current asset bubbles could be a big problem), the Feds are betting (hoping?) that if corporations can count on low interest rates for years, they will put people back to work. Having a job means consumers can spend again, which should kickstart a recovery. Prior to the COVID-19 Recession, consumer spending made up 68% of GDP. How Will the Fed’s New Policy Work? According to Marc Miles, the former Editor of The Index of Economic Freedom and the former Assistant State Treasurer of New Jersey, the Feds have essentially adopted a Price Rule. The theory, advocated by Henry Calvert Simons (Milton Friedman’s teacher), is that if you just minimize volatility in the short term, everything normalizes over the long term (i.e. a 30 to 40-year period). Therefore, the goal is to keep prices (including asset prices) where they are. When the bond market seizes up, the Feds march in to purchase bonds and bond ETFs, including junk bond ETFs. Same thing for money market funds, Treasury bills and anything that moves. This is exactly what happened in March of 2020. Since that time the offer remains on the table, which has calmed the markets and spurred the NASDAQ and S&P500 to all-time highs. Investors are siding with the Fed. However, the smart money is aware of the underlying crisis, and will move swiftly if there are signs of weakness in any of the asset bubbles (just as they did in mid-February). It is unusual for the Federal Reserve to purchase stocks. However, they crossed the line into equity territory with their purchases of bond ETFs. There is informed speculation that the Feds will resort to purchasing equities, if the stock market dives. Will they let stocks correct 78% as Dot Com stocks did between 2000 and 2002, or 55%, as the Dow Jones Industrial Average lost between October of 2007 and March of 2009? The drop between February 19, 2020, and March 23, 2020, was 35%. Experience teaches us that if you wait for the headlines, it’s too late to protect your wealth. So, you want to have a solid plan in place before the smart money sells. On September, 2, 2020,The CDC announced a moratorium on evictions through Dec. 31, 2020. Last week, HUD announced a moratorium on homeowner evictions for Federal Housing Administration-insured homeowners through the end of the year. This helps anyone who is out of work from becoming out on the street. It also stabilizes rents and home prices – another part of the Price Rule plan. However, what happens to landlords and the banks who loaned money that is not being paid back? In theory, all of the money will still be owed. However, renters and homeowners who couldn’t pay in 2020 could have difficulty catching up in 2021. The current Administration, of course, wants these issues to become crises after the election, not before. These will be quite substantial challenges for the new Administration in 2021. "If tenants are unable to pay their rent, then millions of our nation's housing providers – many of whom are individual landlords and small business owners – will be unable to meet their mortgage obligations, make payroll to their own employees, maintain a safe and healthy living environment for their tenants and pay their state and local government property taxes," said Bob Broeksmit, CEO of the Mortgage Bankers Association. "The result would be a cascading reaction that would only exacerbate the current economic crisis, leading to more job loss, financial pain, and long-lasting economic effects." Will The Feds’ Plan Work? The rally in stocks since March and the continued strength of the real estate market (buoyed up by a flight to the suburbs from overpriced cities and the eviction and mortgage moratoriums) lends support for the efficacy of the Price Rule. However, this doesn’t eliminate the risks of financial instability, particularly in those slow-growth corporations that were caught using their debt to repurchase stocks and pay high dividends. When their revenue plunged in the pandemic, creditors came calling and investors sold. We’ve seen a slew of corporate bankruptcies in 2020 – higher than what occurred in the Great Recession. (When companies declare bankruptcy, their stock traditionally goes to zero.) 2/3rds of the DJIA had a revenue contraction in the 2nd quarter, 73% currently have elevated price/earnings ratios and 57% are carrying very high debt/equity ratios. Investors are betting that, given time, post-pandemic and with the Fed support, those numbers will correct themselves. In 74% of the U.S. cities, real estate is unaffordable to the people who live there. The current moratorium masks this basic problem. The Price Rule exacerbates a crisis that has kept Millennials from purchasing homes, and has many people spending more than 1/3 of their income on housing. A disciplined low-interest rate policy helped the U.S. to cycle out of very high debt levels post World War II. Today, we are also dealing with an aging population, whereas post World War II, the population demographics skewed much younger. In 1940, over 73% of the population was under the age of 45. The average age of death was 64 in men in 1945. Today, almost 44% of the population is over the age of 45. There was also “pent-up demand” from soldiers returning from war in the 1940s, according to Kathy Jones. Today, the U.S. spends 18% of GDP ($3.5 trillion) on health care alone. Part of the problem is obesity in the U.S., which affects 42.4% of the population. Obesity causes a lot of health complications. The other issue is the cost of healthcare itself, which is substantially higher than the rest of the developed world. Over $2 trillion is spent annually on social security, Medicare and Medicaid, accounting for 47% of the U.S. budget. The U.S. budget receipts were $3.5 trillion in 2019, with outlays of $4.4 trillion (a deficit). The U.S. has been running budget deficits since 1960, with the exception of a three-year period under President Clinton and one-year under President Johnson (in 1969). According to Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab, “Powell didn’t mention much about all of the Fed’s facilities/liquidity provisions and the creation of possible asset bubbles; but it’s certainly top of mind for many investors. Longer-term, the question is whether the Fed is inflating asset bubbles, but also setting the stage for financial instability.” Educated investors know that although things feel “normalized,” we are sleeping on an economic volcano. The only question is when and how it will erupt. We are already seeing lava flows (bankruptcies) in various industries that are most susceptible to pandemic-related cultural shift. The problems in housing have been delayed through the end of the year. However, that does not eliminate them. The Risks and Rewards of Low Interest Rates Companies Can Borrow at a Lower Rate By promising low interest rates for years to come, the Feds are encouraging long-term debt over short-term. If corporations can borrow and push out the payback date for decades, then, at least in theory, their net income should benefit from a reduction in the amount the company pays for interest. Marc Miles believes that, based upon the current pandemic-related reduced earnings, along with the interest savings, “The current level of stock prices is likely reasonable going forward.” The problem comes when there is a fundamental shift in the industry, as there has been for oil, commercial real estate, mall REITs, retail, travel & hospitality, auto manufacturing, airlines and other sectors that have seen a dramatic implosion of sales and revenue. Imagine giving the typewriter industry a 30-year loan in 1980, when personal computers were becoming available. Some of these industries were already being replaced, but have been put on the fast-track due to the pandemic. Larger corporations have an easier time rolling over existing debt into long-term bonds. According to Liz Ann Sonders (in an email to me), “Small caps continue to have fundamental profiles that are significantly weaker (in general) than large caps; including weaker balance sheets (more debt), weaker profitability, a higher percentage of 'zombie' companies, etc.” Liz Ann’s team has been overweighting large caps and underweighting small caps on the equity side for the past three years. Should You Own Bonds? On the fixed income side, investors are not being paid for the risk of lending long term. Kathy A. Jones, the Chief Fixed Income Strategist for Charles Schwab, recommends keeping the terms short and the creditworthiness high in both corporate and municipal bonds. Both Kathy Jones and Marc Miles expressed concern for muni bonds. “State and local governments [are] losing tax revenue. They bear a lot of the brunt of the cost of this recovery, particularly with firefighters and hospitals,” according to Kathy Jones. On August 19, 2020, Fitch Ratings downgraded the Rating Outlook for Munis with federal support. (Click to access the list, which includes a lot of mortgage backed securities.) As of April 29, 2020, the five states with the lowest credit ratings were Illinois, New Jersey, Kentucky, Connecticut and Pennsylvania. Santa Rally 2020? So, will stocks continue their rally through the end of 2020? According to S&P Dow Jones Indices’ Senior Index Analyst Howard Silverblatt, there are two things that will determine the fate of the market in the last half of 2020. One is the election (including the aid package and a possible government shutdown) and the second is COVID-19. According to Silverblatt, the market is pricing on the belief that earnings will hit a new high in the 4th quarter of 2021. “If, for any reason, the market needs to change that belief, even if it is just a timing change, it will need to reprice, and given the profits are so concentrated, that could be ugly,” according to Silverblatt. Financial Instability Financial Stability was already a concern before the pandemic. In the November 2019 Financial Stability Report, the Federal Reserve Board noted that asset valuations and debt were both elevated, with debt concentrated in the “riskiest firms amid weak credit standards.” “I’m not surprised Powell didn’t mention asset prices or financial stability. It’s pretty clear that high valuations of asset prices are a trade-off the Fed is willing to make for an improving economy and a lower unemployment rate,” Kathy Jones wrote me in an email on August 27, 2020. I will discuss this in greater detail in my upcoming blog, “Hail Mary Economics.” As you can see in the chart at the top of this blog, all of the things that were a concern in the Great Recession are far more alarming today. The U.S. AAA Credit Rating Fitch Ratings affirmed the U.S. AAA rating on July 31, 2020, but changed the outlook to negative. The problem is “the ongoing deterioration in the U.S. public finances and the absence of a credible fiscal consolidation plan,” according to Fitch’s press release. Fitch acknowledges that the Feds' response to the crisis “prevented a deeper downturn,” but notes that downside risks persist. The International Monetary Fund has predicted a contraction of -8.0% in the U.S. in 2020 (better than Europe, but worse than Russia, Asia, Japan and China.) Will Fitch Downgrade the U.S. Credit? The negative outlook is a massive warning. The U.S. was downgraded by Standard and Poor’s on August 5, 2011. In the wake of that downgrade, gold and silver soared to all-time highs. The rallies were short lived, however. Investors believed the recovery was truly underway, and 2.0% GDP growth in the 3rd quarter of 2011, after the hellacious Great Recession, was enough to prompt faith. The 2Q 2020 GDP was the worst contraction in recorded history (since at least 1947), at -31.7%. As I mentioned above, the IMF is projecting a full-year 2020 contraction of -8.0% for the U.S. Gold recently set new all-time highs of $2,067.15/ounce, and has almost doubled since 2016. Silver had a slower start, but has doubled in price since March 2020, from $14 to $28/ounce. (Click to read my blogs.) Investors are adding a hedge and perceived safety to their portfolios. The continued strength belies that although many investors are maintaining a status quo for now, believing in the Fed policy, few are convinced of a sustained recovery yet. Investor activity and U.S. equity trading volume was double in February and March of this year to what it is now. The attitude appears to be "wait and see," while quietly diversifying and adding in hedge. If worry, doubt and fear set in over any reason at all, volume and VIX could spike and take equities south (at least until the Feds dash in and purchase equities). Banks On August 31, 2020, Fitch Ratings warned that the U.S. federal stimulus is delaying and masking the risk in U.S. banks. The banks have been offering forbearance to their customers, which typically runs out in 90 days, but will, in many instances, now be delayed through the end of 2020. Fitch warns that “Banks with greater exposure to the U.S. consumer are potentially more vulnerable to these downside risks.” Even with forbearance programs, the FHA mortgage delinquency rate just hit the highest it has ever been since the surveys began in 1979, at 15.65%, according to the Mortgage Bankers Association. So far, credit card and car loan delinquencies remain low. However, as Fitch pointed out, this likely has a lot more to do with forbearance than with resilience. Weakness in the banking industry is a risk for stocks and bonds. High unemployment, at 10%, makes it difficult for a highly leveraged population to pay their mortgages, credit cards and car loans. The student loan delinquency rate has been above 20% for years. The Dollar The dollar is expected to weaken, and has already softened against foreign currencies, even though Europe and the U.K. are predicted to have more severe 2020 contractions. Foreigners are holding about $4.145 trillion of the U.S. $26.6 trillion in public debt. However, low interest rates mean that those countries are not being paid to hold our debt, so there may not be a rush to add more. Fortunately, at this time, there isn’t a major challenger to overtake the U.S. as the premiere reserve currency. Most European and many Asian countries increased their holdings of U.S. Treasuries slightly over the past 12 months. China and Japan are still the top foreign holders, at $1.26 trillion and $1.07 trillion, respectively. Saudi Arabia has been divesting its U.S. T-bills. Russia dumped almost all of its U.S. Treasuries in August of 2018, and continues adding to its gold holdings. This may explain the increase in “unallocated” reserves over the past few years. It’s important to note that the U.S. has kept its AAA rating with Fitch Ratings and Moody’s Analytics based upon being a global reserve currency – essentially the fact that the rest of the world likes our dollar. A change in the dollar’s popularity weighs on the rating. Between 2001 and 2013, the biggest challenger to the U.S. currency was “unallocated reserves,” which are “foreign exchange reserves of those countries/territories that currently do not report to COFER but whose total foreign exchange reserves are included in the IFS world table,” according to the IMF. As you can see in the charts below, by the 3rd quarter of 2013, unallocated reserves made up 46% of the global reserves. In the 3rd quarter of 2013, the U.S. dollar made up 61.4% of allocated reserves, but only 1/3 of total reserves – lower than the unallocated reserves (at 46%). Today, the U.S. makes up 57.9% of total reserves and 61.2% of allocated reserves. Unallocated reserves are back to just 6.6%. However, the trend has been increasing over the last 12 months. Bottom Line The recession is global. The trends toward Work from Home are becoming more permanent. This negatively impacts oil, commercial real estate and auto manufacturers, and supports continued strength in technology and e-tail (though that strength is already overpriced into the stocks). Travel and hospitality will remain weak until people are confident that the virus has been contained. Consumer discretionary isn’t expected to recover until jobs recover, and even then sales could remain subdued. How many dresses do you need if you are working at a home office? The only thing propping up the economy right now is the Federal Reserve Board and eviction moratoriums – not economic strength. A select group of economists are saying that the Price Rule will prevent the overprinting of fiat currency from becoming a financial crisis – something that would be a risk if the Feds weren’t buying up any asset that shows signs of illiquidity. (That’s why the Feds raise interest rates in prosperous times – to tighten the money supply. It’s something that was neglected in the most recent expansion.) Another group of economists and industry professionals are very concerned about financial stability and asset bubbles. As one C-level banker put it, “They are referring to the Vincent Price Rule because the economy is being animated with free money like one does a zombie with electricity.” Which school of thought will win? Will the Price Rule smooth things over until peace and prosperity rise over our free land again? Will expensive stocks and bonds become magically affordable in the years to come. (I wouldn’t count on that. Wages have stagnated for decades.) Only time will tell how long the Feds can keep printing more money and buying everything that moves in the wrong direction. In the meantime, however, adopting a plan that works no matter which way stocks and bonds head will put you in the best seat. What’s the price of those episodes of financial instability? Most Main Street investors are risking half or more of their wealth. As Jerome Powell said in his August 27, 2020, speech, “Before the Great Moderation, expansions typically ended in overheating and rising inflation. Since then, prior to the current pandemic-induced downturn, a series of historically long expansions had been more likely to end with episodes of financial instability, prompting essential efforts to substantially increase the strength and resilience of the financial system.” That’s a long way of saying that Buy & Hold is riding a Wall Street rollercoaster in the 21st Century, with most people losing half or more of their wealth in each of the last two recessions. Market timing doesn’t work. However, a properly diversified plan that is rebalanced regularly does. (I teach this strategy at my Investor Educational Retreats, and have written about them in my books, including The ABCs of Money.) As Kathy Jones recommends, “Ask yourself, ‘What made me uncomfortable in March? Do I want to change my allocation, so that I’m more comfortable? Do I really understand how much risk I am taking on?’ Have some cash on hand, so that you are covered if you get laid off or have a problem that needs to get addressed. Now is a great time to do this.” Final Thought "Monetary and fiscal measures are not a substitute for competition and free-market arrangements but a means for attaining greater overall security, stability, and efficiency under such institutions. [Monetary policy] cannot be expected to bring either peace or prosperity out of economic civil war of monopolized industries and pressure groups." Henry Calvert Simons (Milton Friedman's teacher) The above warning came from one of the strongest proponents of the Price Rule. It is an ominous reminder that when everything skews toward saving mega-corporations, at the expense of innovation and competition, the economy is going to have a problem. Should we be saving obsolete industries and executives who used low interest rates to pay high dividends to themselves and their friends, rather than shoring up their companies and creating the products of tomorrow? Or should we be investing in the products and entrepreneurs of tomorrow? These are questions worthy of being answered collectively. In the meantime, protect and diversify your wealth. If you're interested in protecting and diversifying your retirement and investing portfolio, join me at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. The 4th edition, updated to include the COVID-19 Recession, will be released soon. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed