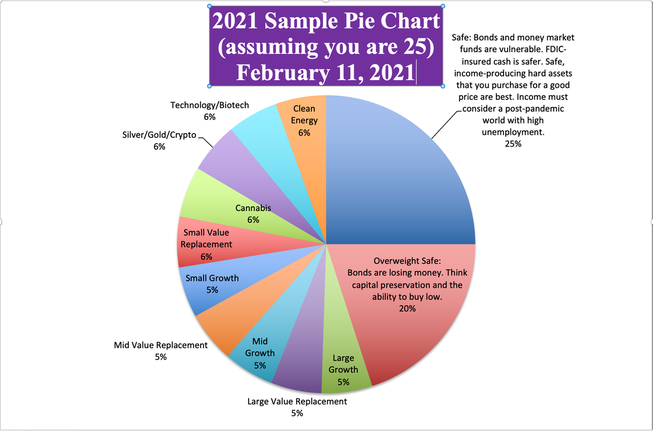

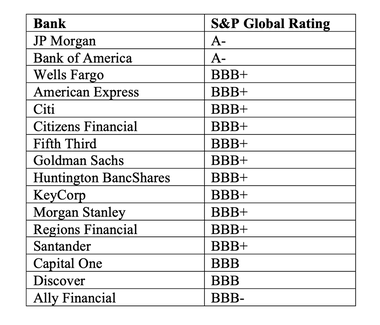

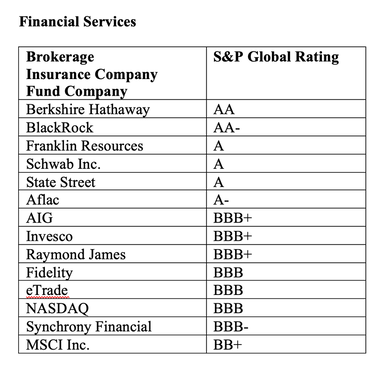

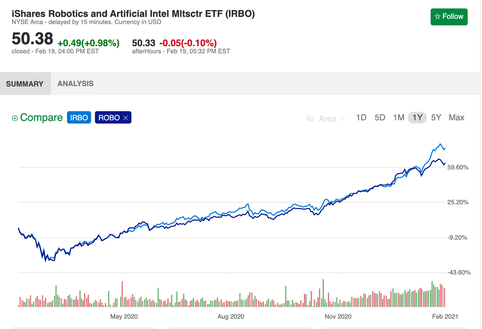

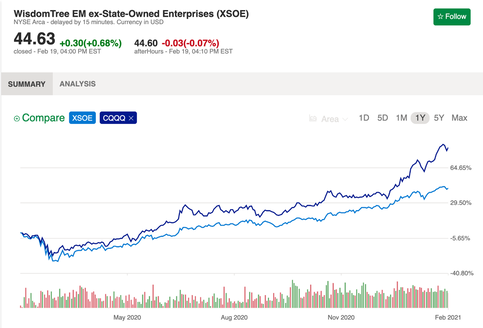

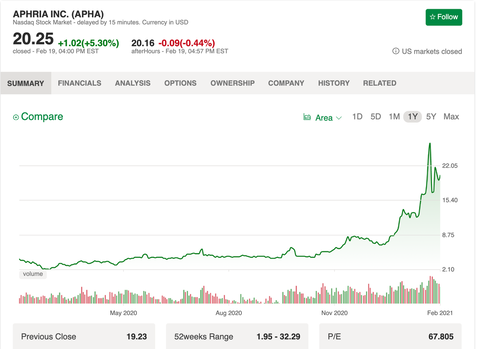

Dear Natalie: I was listening to an “expert” giving a presentation about ETFs. All of the funds he mentioned seem to be up at least 50% since October. I was wondering if the fact that they’re smaller funds translates to liquidity concerns. I noticed one had a trading volume of just 13.1k. Are these really winning ETFs that I should be adding to my nest egg portfolio? Signed: Looks Too Hot to Be True Dear Looks Can Be Deceiving, As you know, our pie chart system includes four hot slices. So, this expert is right in telling you to put performance in your portfolio. Doing so can be very rewarding. Cannabis was a hot we’ve been featuring for a few years. This year our featured company, Aphria, shot the moon, soaring from $2/share in February of 2020 to up to $32/share this year. Silver is up. Technology, particularly FANG and AI, have led the bull market. Biotechnology firms that were focused on the pandemic, such as Vir Biotechnology and Adaptive Biotechnologies (which were featured prominently in our Investor Educational Retreats), are up three and four-fold off their lows. However, picking the right ETF, and just as importantly the right fund company, is essential. The funds this “expert” is mentioning might be more of a marketing ploy than an opportunity. I’m concerned that this presenter could be being compensated on the backend for mentioning these specific funds and companies. (Higher risk funds often pay higher commissions or marketing fees.) So, the first lesson here is to remember to always Grade Your Guru before you listen to anything he says. You want to know if there is any bias or conflict of interest before you even tune into the talk. Is this presenter a “marketing guru” or a Certified Financial Planner? (Both could be paid on the backend.) Oftentimes a simple search on the presenter’s name to see his background for the last 15-20 years will reveal all you need to know in order to invest your time and money elsewhere. All of the funds you sent over are offered by new financial services companies that are not publicly traded (ROBO and EMQQ), or have shown severe signs of distress (WisdomTree and Direxion) over the past year. A safer bet would be to purchase the same type of ETF from a highly rated, highly liquid financial services company. You don’t have to go with unproven companies with liquidity concerns. Liquidity concerns are a big deal today. Over half of the S&P500 is at or near junk bond range, and that includes a lot of financial services companies and banks. Direxion’s hedged ETFs all took a dive – even the gold funds – and haven’t recovered since oil dropped into negative range on April 20, 2020. (Some of the funds you sent over are owned by Direxion.) All of the ETFs that I list below as an alternative choice have a stronger financial foundation and most have performed better to boot. (The superstars listed below, many of which smashed the performance of the ETFs you sent over, are all ETFs and companies we have featured at our Investor Educational Retreats over the past few years.) ROBO underperformed IRBO (owned by BlackRock's iShares). The ROBO fund company has only been around since 2013. ROBO ETFs also own THNQ. HTEC. As an alternative, look at IBB, or the two hot biotechs we discovered in the retreats – Vir Biotechnology and Adaptive Biotechnologies. EMQQ and WisdomTree’s XSOE. Compare with CQQQ, a Chinese Technology ETF. Direxion’s MOON: Compare with Nio (it’s major holding) – a company we first featured in October of 2019, when Nio was trading under $2/share. (Direxion’s fund didn’t even start until Nov. of 2020, missing out on most of Nio’s “shoot the moon” performance from $2 to $60/share.) Direxion comes up with hot sounding names, like (WFH) Work from Home. However, after burning investors with its hedged ETFs, I wouldn’t be very interested in any of their funds. Gold is trading near all-time highs, but look what happened to Direxion’s 3X Gold Bull Fund (which became a 2X Gold Bull Fund when the fund suddenly took a nose dive in March 2020). Investors haven’t come close to recovering their losses, which weren’t prompted by a change in gold prices, but were likely tied to the company’s hedged oil funds. Cannabis One last comment. Sometimes there is a hot industry, like cannabis, where the only fund options are young companies with questionable liquidity, volume and timespan. In that instance, it’s a better choice to just create your own fund, using companies you identify as the leaders of the industry (something you learned on Day 2 of the Investor Educational Retreat). Aphria, the company our team has been interested in since Irwin Simon became the CEO and Walter Robb joined the board, hit $32/share this month after dropping to $1.95 in 2020. Biotechnology With biotech, the two hottest companies we identified – Vir Biotech and Adaptive Biotech – weren’t heavily represented in any of the funds offered at the time. So, here’s another case when leaning into individual companies might be a good option. Again, learning how to evaluate the holdings will make quite a difference in the performance of your hot choices for the nest egg pie chart system. Bottom Line Fund companies are not created equal. It is important to pick funds offered by reputable financial services providers that have been around for at least two decades (not ones that were founded after the Great Recession by professionals who dusted themselves off from the Lehman Bros. bankruptcy or Merrill Lynch implosion to find a new career). However, you can have your cake and eat it, too, when you pick hot industries that are offered by a fund company with a high credit rating and good liquidity. This adds an extra, essential layer of protection to your investment in today’s overleveraged world.  Natalie Pace Financial Empowerment Retreat. Feb. 26-28, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed